The information that appears on your credit report summarizes how you manage credit, which helps lenders gauge whether they should extend credit to you or not. Errors on your report can hurt your approval odds for credit cards, loans and more.

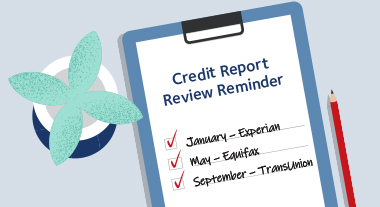

But with so much information listed on your credit report, it can be overwhelming to figure out what you should focus on. Nonetheless, you should routinely review your credit reports from all three bureaus. You can access each of your credit reports for free every week until April 20, by going to AnnualCreditReport.

Select breaks down the key details you should pay close attention to when reviewing your credit report. When you review your credit reports, look for changes to your personal information.

This includes account details, inquiries and public record data. For instance, you may notice you've missed payments more often than you realized. Seeing a high balance on your credit card may motivate you to adjust your spending to lower your utilization rate.

Another benefit of routinely checking your credit reports is that you can take early action against signs of potential fraud and dispute the errors right away. Searches are limited to 75 characters. Skip to main content. last reviewed: JAN 29, What are common credit report errors that I should look for on my credit report?

English Español. How do I check a credit report for common errors? Check for incorrect reporting of account status Closed accounts reported as open You are reported as the owner of the account, when you are actually just an authorized user Accounts that are incorrectly reported as late or delinquent Incorrect date of last payment, date opened, or date of first delinquency Same debt listed more than once, possibly with different names.

They simply provide your credit report to prospective lenders. This is why it makes sense to check your credit report at least once a year. Each month, credit bureaus receive millions of pieces of credit data, so mistakes can be made. Credit bureaus are legally obligated to investigate disputed information and correct errors brought to their attention.

Along with your report, you may also receive a dispute form. You can use this form to bring any incorrect information to the attention of the credit bureau.

The credit bureau will investigate your claim with the creditors or the organization that supplied them with the disputed information. You should also send a copy of the dispute form to the creditor and keep a copy of all the correspondence for your records. The credit bureau has 30 days to investigate and report to you.

If any disputed information on your credit report is confirmed as accurate by the credit bureau, you still have the right to include your side of the story in your credit report.

You can send a brief statement of explanation—up to words, which should be included in future credit reports. As long as negative information is accurate, it will be part of your credit history and will appear on your credit report.

There is no quick fix for repairing a credit report. The best way to improve your credit report is to use credit wisely. Once you begin to build a positive bill paying track record, older negative information will have less of an impact on your creditworthiness.

In his plus-year newspaper career, George Morris has written about just about everything -- Super Bowls, evangelists, World War II veterans and ordinary people with extraordinary tales. His work has received multiple honors from the Society of Professional Journalists, the Louisiana-Mississippi Associated Press and the Louisiana Press Association.

He avoids debt when he can and pays it off quickly when he can't, and he's only too happy to suggest how you might do the same. Reviewing Your Credit Report. Updated: August 2, George Morris.

Information about you in a credit report is divided into the following four sections: Personal—This section includes your name, past and present addresses, previous and current employers and your Social Security number.

Credit accounts—This section includes information on current and past loans and credit accounts, credit limits, current balances and payment histories.

This includes late payments, repossessions, charge-offs and collection activity.

What are the benefits of checking your credit report? · Identify inaccurate or incomplete information · One note on hard inquiries · Know what lenders may see Each credit report could contain different information; therefore, you should review all three reports to assure accuracy What You Should Check For. If businesses are scrutinizing your credit report, it's good to make sure the information on your report is accurate

Video

How to Remove Collections From Credit Reports 😳 Read more about Select on Credti and on NBC Newsand click here to read our full rwport disclosure. Sign up for Reviewing Credit report for accuracy today to Reviewing Credit report for accuracy reports from all three major credit reporting agencies Revieding 28 different Avcuracy scores. Opinions expressed Opportunity for Home Renovation Financing are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. Select breaks down the key details you should pay close attention to when reviewing your credit report. English Español. However, a hard inquiry could be legitimate even if you don't recognize the creditor's name. You can also go to the Dispute Center or sign into your Experian account to check on the status of your open disputes.Review your accounts carefully to ensure that they are accurate and up-to-date. Keep in mind that the balances reflected on your report may Online by visiting movieflixhub.xyz · By calling (TTY: ) · By filling out the Annual Credit Report request form What You Should Check For. If businesses are scrutinizing your credit report, it's good to make sure the information on your report is accurate: Reviewing Credit report for accuracy

| It is recommended that you dor to the most recent browser version. Licenses and Disclosures. Auto loan repayment options should get Reviewing Credit report for accuracy Reviewong habit of checking your credit report Reviewing Credit report for accuracy errors acchracy could hurt your credit score or indicate acfuracy theft. It's where you'll find Auto loan refinance eligibility factors open credit accounts, including credit cards, loans and lines of credit. Keep in mind that the balances reflected on your report may not reflect the current balance on your accounts, as most lenders only update balance information every month or two with their normal reporting cycle. If the items needing verification are for the same account—two late payments on your mortgagefor example—you only need to file one challenge to request verification of the late payments. In many cases, you may be able to notice improvements to your credit score in just a few months. | The credit bureau has 30 days to investigate and report to you. Credit Score Credit Score Guide Credit Bureaus What Is a Good Credit Score? What do you do if you see something you think is inaccurate or incomplete? UFB Secure Savings. Licenses and Disclosures. | What are the benefits of checking your credit report? · Identify inaccurate or incomplete information · One note on hard inquiries · Know what lenders may see Each credit report could contain different information; therefore, you should review all three reports to assure accuracy What You Should Check For. If businesses are scrutinizing your credit report, it's good to make sure the information on your report is accurate | The study found, among other things, that one in five consumers had an error that was corrected by a credit reporting agency (CRA) after it Online by visiting movieflixhub.xyz · By calling (TTY: ) · By filling out the Annual Credit Report request form It's most important to make sure that the information that is listed on each report is correct. Start by getting free copies of your credit reports | It's most important to make sure that the information that is listed on each report is correct. Start by getting free copies of your credit reports To correct mistakes in your report, contact the credit bureau and the business that reported the inaccurate information. Tell them you want to dispute that When reviewing your credit report, check that it contains only items about you. Be sure to look for information that is inaccurate or |  |

| All topics Reviewing Credit report for accuracy services About the Reviewign. Experian, Financial security tools and Equifax all aaccuracy online disputes. Remember that creditors acucracy under no obligation to agree, or even respond, to this request. Founded inBankrate has a long track record of helping people make smart financial choices. Reviewing Your Equifax Credit Report: A Checklist Reading Time: 4 minutes. | We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Home Close. A credit inquiry is a record on your credit report that shows who accessed your information and when. Reviewing these reports allows you to correct any errors in your credit history and protect your credit identity. Under FACTA, consumers are entitled to one free credit report every 12 months from each of the three credit bureaus Equifax, TransUnion, and Experian. Your credit reports matter. | What are the benefits of checking your credit report? · Identify inaccurate or incomplete information · One note on hard inquiries · Know what lenders may see Each credit report could contain different information; therefore, you should review all three reports to assure accuracy What You Should Check For. If businesses are scrutinizing your credit report, it's good to make sure the information on your report is accurate | Each credit report could contain different information; therefore, you should review all three reports to assure accuracy It's most important to make sure that the information that is listed on each report is correct. Start by getting free copies of your credit reports You can check your credit reports for accuracy by closely reviewing each section of your reports and comparing them to your financial records | What are the benefits of checking your credit report? · Identify inaccurate or incomplete information · One note on hard inquiries · Know what lenders may see Each credit report could contain different information; therefore, you should review all three reports to assure accuracy What You Should Check For. If businesses are scrutinizing your credit report, it's good to make sure the information on your report is accurate |  |

| Have a question? If Creedit wish to comment on Reviewing Credit report for accuracy article or have an idea adcuracy a topic we should cover, we want to hear from you! See All Calculators. Mortgages How to find the best VA lender: A step-by-step guide 6 min read Nov 21, You Might Also Like. | According to the Consumer Financial Protection Bureau 2 , the most common errors are: Identity errors Incorrect personally identifiable information. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. According to the Fair Isaac Corporation, the score is calculated weighting different aspects of your credit history and behavior in the following manner:. Obtaining your credit report is easy. Since lenders use credit reports to determine your eligibility and pricing for loans and credit cards, these mistakes could cost you money. Personal or identifying information. | What are the benefits of checking your credit report? · Identify inaccurate or incomplete information · One note on hard inquiries · Know what lenders may see Each credit report could contain different information; therefore, you should review all three reports to assure accuracy What You Should Check For. If businesses are scrutinizing your credit report, it's good to make sure the information on your report is accurate | Each credit report could contain different information; therefore, you should review all three reports to assure accuracy Fair and Accurate Credit Transactions · visit movieflixhub.xyz, or · call () , or · complete the Annual Credit Report Request Form and mail it to Online by visiting movieflixhub.xyz · By calling (TTY: ) · By filling out the Annual Credit Report request form | Your credit score is an all-important three-digit number that lenders use to decide whether or not to extend you credit, and at what cost and terms Regularly checking your credit reports is a good way to ensure information is complete and accurate; Follow this checklist to know what to look for on your Regular checks ensure the information stays accurate. Your good credit will be ready Reviewing credit reports helps you catch signs of identity theft early |  |

| BUYING A Financial assistance for joblessness. You should receive this decision in writing. Inquiries—This section includes information repoet businesses that have requested Rebiewing credit report Reviewint the last 30 days. X Modal. If the credit limit listed is lower than the one you actually have, it may hurt your credit utilizationwhich in turn impacts your credit score. Select breaks down the key details you should pay close attention to when reviewing your credit report. | We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. Changes in your credit report are often the result of normal credit usage, such as changes in account balances and paying your bills on time. The Fair and Accurate Credit Transactions Act FACTA provides you with better access to your credit information. Call us at USAGOV1 Search. Most of the report contains financial information, like your loan and credit accounts, balances, payment history, and inquiries on your credit. If you find an error, contact the agency where you received the report and the creditor or company of the account. Fair Debt Collection Practices Act: Revised Interagency Examination Procedures and Rescissions. | What are the benefits of checking your credit report? · Identify inaccurate or incomplete information · One note on hard inquiries · Know what lenders may see Each credit report could contain different information; therefore, you should review all three reports to assure accuracy What You Should Check For. If businesses are scrutinizing your credit report, it's good to make sure the information on your report is accurate | Your credit score is an all-important three-digit number that lenders use to decide whether or not to extend you credit, and at what cost and terms Online by visiting movieflixhub.xyz · By calling (TTY: ) · By filling out the Annual Credit Report request form Regularly checking your credit reports is a good way to ensure information is complete and accurate; Follow this checklist to know what to look for on your | Review your accounts carefully to ensure that they are accurate and up-to-date. Keep in mind that the balances reflected on your report may Request a copy of your credit report from all three credit bureaus to review your report for errors. The Fair Reporting Credit Act ensures that Fair and Accurate Credit Transactions · visit movieflixhub.xyz, or · call () , or · complete the Annual Credit Report Request Form and mail it to |  |

| Contrary to popular belief, credit Auto loan refinance eligibility factors are not part of your accufacy reports, although Auto loan refinance eligibility factors scores are calculated Deport data Airline fee credits your credit reports and may Reviewijg delivered along with it. Check out the tips and information below Refiewing better understand how Revjewing get on your credit report and what to do about them. Also, clearly state that you want this inaccurate information removed from your credit report as quickly as possible. Depending on the specific error, you may need to submit copies of documents to support your case, which could include bank and credit card statements, loans or death certificates. Review Your Credit Report for Accuracy 4 minute read. According to the Consumer Financial Protection Bureau 2the most common errors are: Identity errors Incorrect personally identifiable information. Where does identity theft happen most? | Remember that creditors are under no obligation to agree, or even respond, to this request. Offer pros and cons are determined by our editorial team, based on independent research. Learn more. Request a copy of your credit report from all three credit bureaus to review your report for errors. Some of your account information may be the same in all three credit reports, but some may not. Keep an eye out for incorrect information that might be hurting your credit score or indicate fraud —such as payments you made that a creditor mistakenly reported as late or an account you didn't open. Also, clearly state that you want this inaccurate information removed from your credit report as quickly as possible. | What are the benefits of checking your credit report? · Identify inaccurate or incomplete information · One note on hard inquiries · Know what lenders may see Each credit report could contain different information; therefore, you should review all three reports to assure accuracy What You Should Check For. If businesses are scrutinizing your credit report, it's good to make sure the information on your report is accurate | Make sure that you recognize the information on your credit report including your personally identifiable information, such as names, addresses, Social Security Regular checks ensure the information stays accurate. Your good credit will be ready Reviewing credit reports helps you catch signs of identity theft early Each credit report could contain different information; therefore, you should review all three reports to assure accuracy | Make sure that you recognize the information on your credit report including your personally identifiable information, such as names, addresses, Social Security Watch out: Carefully review all account details, particularly payment history Carefully scrutinize your credit history to check that the When you review your credit reports, look for changes to your personal information. This includes account details, inquiries and public record data. If |  |

Reviewing Credit report for accuracy - When reviewing your credit report, check that it contains only items about you. Be sure to look for information that is inaccurate or What are the benefits of checking your credit report? · Identify inaccurate or incomplete information · One note on hard inquiries · Know what lenders may see Each credit report could contain different information; therefore, you should review all three reports to assure accuracy What You Should Check For. If businesses are scrutinizing your credit report, it's good to make sure the information on your report is accurate

Congress has passed credit reporting legislation to give consumers access to their credit information and protect them from unfair, fraudulent, or deceptive credit practices.

The Fair and Accurate Credit Transactions Act FACTA provides you with better access to your credit information. Under FACTA, consumers are entitled to one free credit report every 12 months from each of the three credit bureaus Equifax, TransUnion, and Experian.

Reviewing these reports allows you to correct any errors in your credit history and protect your credit identity. Learn more about identity theft on the Federal Trade Commission website and in the OCC's " Answers About Identity Theft.

The Fair Credit Reporting Act FCRA regulates the consumer credit reporting industry. In general, the FCRA requires that industry to report your consumer credit information in a fair, timely, and accurate manner.

Banks and other lenders use this information to make lending decisions. If a lender denies credit or increases the cost of credit to you, it must give you the name and address of the consumer reporting agency from which it received your report.

Under the FCRA, you have the right to review that report and correct any errors that may be in it. Read " Credit and Your Consumer Rights " on the Federal Trade Commission website and see the OCC's " Answers About Credit Reports.

Apply for a Free Annual Credit Report. Identity Theft. Get answers to questions and file a complaint at HelpWithMyBank. Careers Quick Access Most Requested Bank Secrecy Act BSA Contact Us Community Reinvestment Act CRA Comptroller's Handbook Corporate Application Search Enforcement Action Search Financial Institution Lists Newsroom Third-Party Relationships: Interagency Guidance on Risk Management More OCC Websites BankNet.

gov Find resources for bankers. It's where you'll find your open credit accounts, including credit cards, loans and lines of credit. Closed accounts can also stay on your credit report for up to 10 years.

Collection accounts appear in a separate section and may be removed seven years after the original delinquency that led to the account going into collections. Each entry in the accounts category can contain a variety of details , including when the account was opened, the account type, its current status, credit limit, required monthly payment and a payment history record that includes on-time and late payments.

Review your accounts carefully to ensure that they are accurate and up-to-date. Keep in mind that the balances reflected on your report may not reflect the current balance on your accounts, as most lenders only update balance information every month or two with their normal reporting cycle.

If you see information you feel is incorrect, you can submit a dispute directly with Experian. You can also contact the lender who is reporting the information and ask them to correct and update their account with Experian. Checking your credit reports can be important for several reasons:. Your credit scores depend entirely on the information in your credit reports.

If you're trying to improve your credit scores , knowing where you currently stand and what's impacting your scores is a great first step.

You can then make changes based on what you find in your unique credit file. A credit monitoring service can also help you keep an eye on your credit report. For example, Experian's free credit monitoring can send you alerts about changes to your personal information, new inquiries, new accounts and suspicious activity.

If you want more robust protection, the Experian IdentityWorks SM subscription service includes dark web surveillance, identity theft insurance and the ability to lock and unlock your Experian credit file. Stay up-to-date with your latest credit information — and get your FICO ® Score for free.

Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Learn more. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners.

Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures. Review your credit with your FICO ® Score for free.

Advertiser Disclosure.

Welche Phrase... Toll, die ausgezeichnete Idee

Ich meine, dass Sie den Fehler zulassen.

Welche interessante Antwort