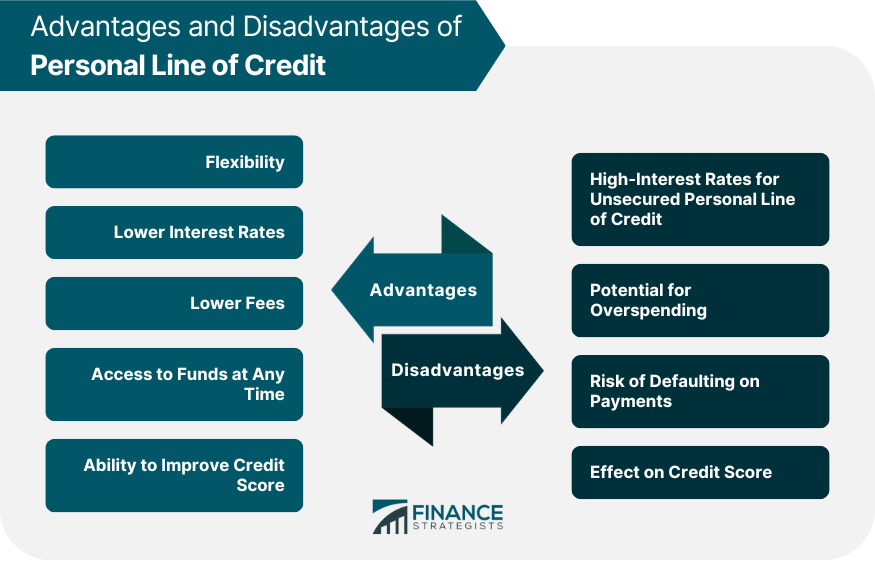

Once the intro period ends, any lingering balances or new purchases and transfers will incur the regular APR. However, this dip is temporary and you're credit score should rise in a few months. However, if you use a large amount of your credit line on your card for either purchases or a balance transfer, your credit utilization ratio could rise and cause a more significant drop in your credit score.

However, needlessly holding onto debt is never a good idea, so be sure to have a plan in place to pay off any debt you have. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every credit card review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit card products.

While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. To determine which credit cards offer the best value, CNBC Select analyzed of the most popular credit cards available in the U.

We compared each card on a range of features, including rewards, welcome bonus, introductory and standard APR, balance transfer fee and foreign transaction fees, as well as factors such as required credit and customer reviews when available. We also considered additional perks, the application process and how easy it is for the consumer to redeem points.

Select teamed up with location intelligence firm Esri. The company's data development team provided the most up-to-date and comprehensive consumer spending data based on the Consumer Expenditure Surveys from the Bureau of Labor Statistics.

You can read more about their methodology here. General purchases include items such as housekeeping supplies, clothing, personal care products, prescription drugs and vitamins, and other vehicle expenses. Select used this budget to estimate how much the average consumer would save over the course of a year, two years and five years, assuming they would attempt to maximize their rewards potential by earning all welcome bonuses offered and using the card for all applicable purchases.

All rewards total estimations are net of the annual fee. While the five-year estimates we've included are derived from a budget similar to the average American's spending, you may earn a higher or lower return depending on your shopping habits.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here. Information about the Bank of America® Unlimited Cash Rewards Card, Amex EveryDay® Credit Card, American Express Cash Magnet® Card has been collected independently by Select and has not been reviewed or provided by the issuers of the cards prior to publication.

For rates and fees of the Amex EveryDay® Credit Card, click here. For rates and fees of the American Express Cash Magnet® Card, click here.

For rates and fees of the Blue Cash Everyday® Card from American Express, click here. Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief.

UFB Secure Savings. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure.

The Bank of America® Unlimited Cash Rewards Card. Citi Simplicity® Card. Learn More. Rewards None. Pros No annual fee Balances can be transferred within 4 months from account opening One of the longest intro periods for balance transfers.

View More. The only drawback is that it does not offer cash back or any other type of rewards. Wells Fargo Reflect® Card. Bank Visa® Platinum Card.

Information about the U. Bank Visa® Platinum Card has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication. See rates and fees and our methodology , terms apply.

Pros No annual fee Cell phone protection plan. Citi® Double Cash Card. We're sorry, this page is temporarily unavailable. We apologize for the inconvenience. Visit our homepage. Visit credit card homepage. Unavailable One or more of the cards you chose to compare are not serviced in English.

Close layer ×. You can only compare up to 4 cards. Please remove a card before adding another. You can only compare up to 3 cards. You can only compare up to 2 cards. Bank of America ® Customized Cash Rewards credit card.

Show More Show Less. To change your choice category for future purchases, you must go to Online Banking, or use the Mobile Banking app.

You can change it once each calendar month, or make no change and it stays the same. After the intro APR offer ends, a Variable APR that's currently Not enrolled? Learn more about Preferred Rewards Cash Rewards.

This online only offer may not be available if you leave this page, if you visit a Bank of America financial center or call the bank.

You can take advantage of this offer when you apply now. Learn More about Bank of America ® Customized Cash Rewards credit card Apply Now for Bank of America ® Customized Cash Rewards credit card.

Add to compare. Bank of America ® Unlimited Cash Rewards credit card. Earn unlimited 1. After that, a Variable APR that's currently That means you could earn 1. Learn More About Preferred Rewards. Learn More about Bank of America ® Unlimited Cash Rewards credit card Apply Now for Bank of America ® Unlimited Cash Rewards credit card.

BankAmericard ® credit card. No Penalty APR. Paying late won't automatically raise your interest rate APR. Access your FICO ® Score for free within Online Banking or your Mobile Banking app. Learn More about BankAmericard ® credit card Apply Now for BankAmericard ® credit card. Bank of America ® Travel Rewards credit card.

Learn more about Preferred Rewards Travel Rewards This online only offer may not be available if you leave this page, if you visit a Bank of America financial center or call the bank.

Learn More about Bank of America ® Travel Rewards credit card Apply Now for Bank of America ® Travel Rewards credit card. Bank of America ® Premium Rewards ® credit card. Plus, access to world class travel benefits: travel and purchase protections, luxury hotel collection and concierge service.

That means you could earn 2. Keep your credit utilization low. Limit your credit applications. New accounts lower the average age of your open lines of credit, which makes up part of your credit score. Multiple credit inquiries from applications can also ding your score. Keep accounts open. Unless a card has an annual fee, keep it open and active, even if for only one bill a month.

This will help both your credit utilization and the length of your credit history. Check each of your credit reports each year for errors and discrepancies. A higher APR costs you money in two ways:. First, obviously, it increases the amount of interest charged on your purchases.

Second, because you are paying more in interest, you have less money available to pay down the principal — the debt you actually put on the card. That means you could stay in debt and pay interest for a longer time. Let's walk through an example and see how a higher APR affects you at every turn.

The minimum payment on a credit card is typically made up of all the accrued interest, plus any fees, plus a percentage of the principal the money you actually spent on the card. In this case, let's say that percentage is 1.

That's more than the minimum and paying more than the minimum is always good , but it's not enough to cover their debt entirely. This is a common way people use credit cards — they're "revolvers" who pay down slowly over time. For each cardholder, the interest charges will shrink each month as they pay down the principal.

But the one with the lower APR will get out of debt more quickly and pay less in interest:. As discussed, you can avoid interest entirely by paying your balance in full every month. But that's not always possible for everyone. Sometimes carrying a balance is unavoidable.

Here are some options. The minimum payment shown on your billing statement is the absolute least you can pay without incurring a penalty. It won't get you very far toward paying off your debt, though, as the above example makes clear.

To see real interest savings, you need to pay interest on less money , and that means attacking the principal by paying more than the minimum. We've created a calculator to help you see how much you could save in interest by paying down your credit card balance.

See the calculator here. This may be an option if your credit score has improved considerably since you opened the account. The issuer might knock some points off your rate, or move your account to a card with a lower rate.

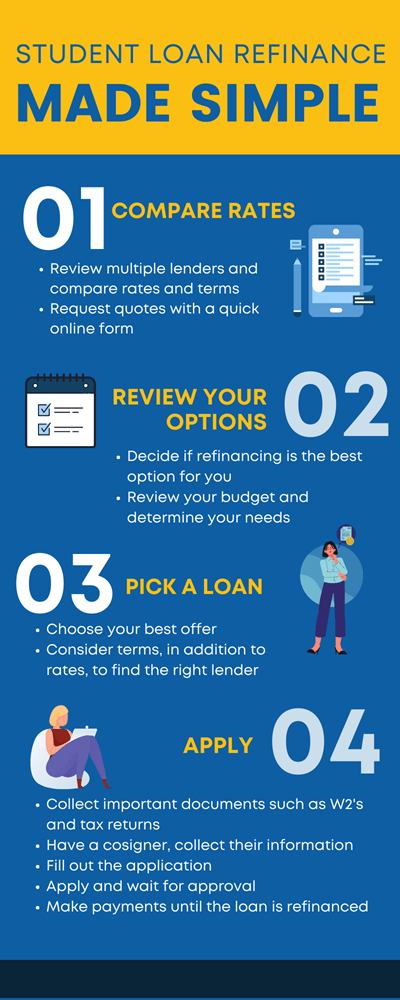

You issuer might say no to your request, but you don't know unless you ask. If you find you're consistently carrying a balance a from month to month, look for a card with a low ongoing interest rate. Many of the cards on this list are good for transfers, but check out our best balance transfer credit cards for further options.

Once you've decided what type of card to look for, compare cards based on the following factors. Read the fine print before applying. If you expect that you'll be carrying a balance regularly, the ongoing APR is an important consideration.

If you'll need to transfer a balance, this fee is an important consideration. Depending on the APR on the card you transfer the debt to and how long it takes you to pay it off, you could save more in interest than you pay in transfer fees.

A few cards charge no transfer fee. Of course, if you're only interested in purchases rather than transfers, this fee is irrelevant. Some cards even require excellent credit, generally defined as or better. It's important to pay your bill on time every month.

If punctuality is an issue for you, look into a card's penalty policies and, for your own sake, work on your punctuality. Saving money is the primary reason to get a low-interest credit card, so you shouldn't be paying an annual fee on such a card. Most major credit card issuers and many smaller ones give cardholders free access to a credit score.

When you're looking to manage debt with a low-interest card, it's smart to keep an eye on your score. When you're using the card to finance a big purchase, those benefits can amount to an instant discount on the purchase.

Although a card with a low ongoing rate can save you a lot of money over time, you're still paying interest. Apply those savings toward whittling down your debt faster.

With any card, watch your balance. Looking to transfer a balance to save money? Our roundup of the best balance transfer cards evaluates cards — including many of the cards on this page — with that specific goal in mind.

You might not. If you pay your balance in full every month, the APR on your credit card doesn't matter, because you're never actually charged interest.

In that case, consider a rewards credit card , which gives you a little something back very time you make a purchase. Rewards cards fall into two major categories: cash back credit cards and travel credit cards. To view rates and fees of the Blue Cash Everyday® Card from American Express, see this page.

Learn how NerdWallet rates credit cards. Zero-percent cards are good for people who want to spread out payments on a large purchase or gain breathing room to pay down debt without interest.

A low-interest credit card charges an ongoing interest rate that's lower than other cards on the market. That roughly translates to a credit score of or better — although credit scores alone do not guarantee approval for any credit card. In fact, closing the account could hurt your credit score by reducing the amount of credit you have available, which could increase your credit utilization.

If the card charges a fee, however, or if you fear that the open credit line will tempt you to overspend, then closing it might be the best action. By NerdWallet. Many or all of the products featured here are from our partners who compensate us.

This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. Show summary. Credit card.

NerdWallet rating. Find the right credit card for you. Get Started. Take Quiz. Our pick for Bonus category cash back. Our pick for Ongoing cash back. Our pick for Highest flat-rate cash back. Our pick for Flat-rate cash back. Our pick for Grocery and gas rewards.

Comparing Two Low-Interest-Rate Credit Cards · 0% introductory APR: 15 months for purchases and balance transfers. · Regular APR: % to % variable APR Compare personalized mortgage and refinance rates today from our national marketplace of lenders to find the best current rate for your financial situation Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online