That's why we provide features like your Approval Odds and savings estimates. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

It may also stress you out. In this situation, debt consolidation might be a smart decision. The basic idea of debt consolidation is to merge multiple credit or loan balances into one new loan. But not all debt consolidations make sense.

Here are four ways you can consolidate debt depending on your credit and savings:. Consolidating your debt can save you money. It may also simplify your payments.

When you have many accounts to manage, you are more likely to make a mistake and miss a payment. Missed and late payments can hurt your credit scores, so consolidating everything into one monthly payment might help protect your credit from a payment mishap.

Homeowners can use the equity in the home for a one-time, lump-sum loan or line of credit HELOC to consolidate debt. It has the same impact on your credit score as any other loan, meaning your score will improve if you make on-time payments and will suffer if you miss payment.

A home equity loan is similar, but a lump sum rather than a revolving line of credit. A k loan is a loan you make to yourself from whatever a retirement savings plan. It has no effect on your credit. It will, however, cost you money. Filing for bankruptcy is an extreme measure and only an option if there is no other solution.

It has a negative effect on your credit. A Chapter 7 bankruptcy stays on your credit report for 10 years. A Chapter 13 bankruptcy stays on your credit report for seven years.

Both can have a negative impact on buying a house, renting an apartment, buying a car and more. If done right, debt consolidation will have a positive effect on your credit. It shrinks your debt and sets a foundation of consistent on-time payments, which can send your credit score soaring.

Working with an accredited credit counselor is a good way to explore debt relief options and decide what the best way to consolidate debt is for your financial situation. Accredited nonprofit credit counseling agencies offer free counseling, and counselors will help you review your budget, evaluate debt consolidation alternatives and suggest solutions.

There are also for-profit agencies that charge a fee for counseling. Maureen Milliken has been writing about finance, banking, investment, entrepreneurship, real estate and other related topics for more than 30 years. She also is is the author of three mystery novels and two nonfiction books.

org wants to help those in debt understand their finances and equip themselves with the tools to manage debt. Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up.

These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. Here is a list of our service providers. How Does Debt Consolidation Affect Your Credit?

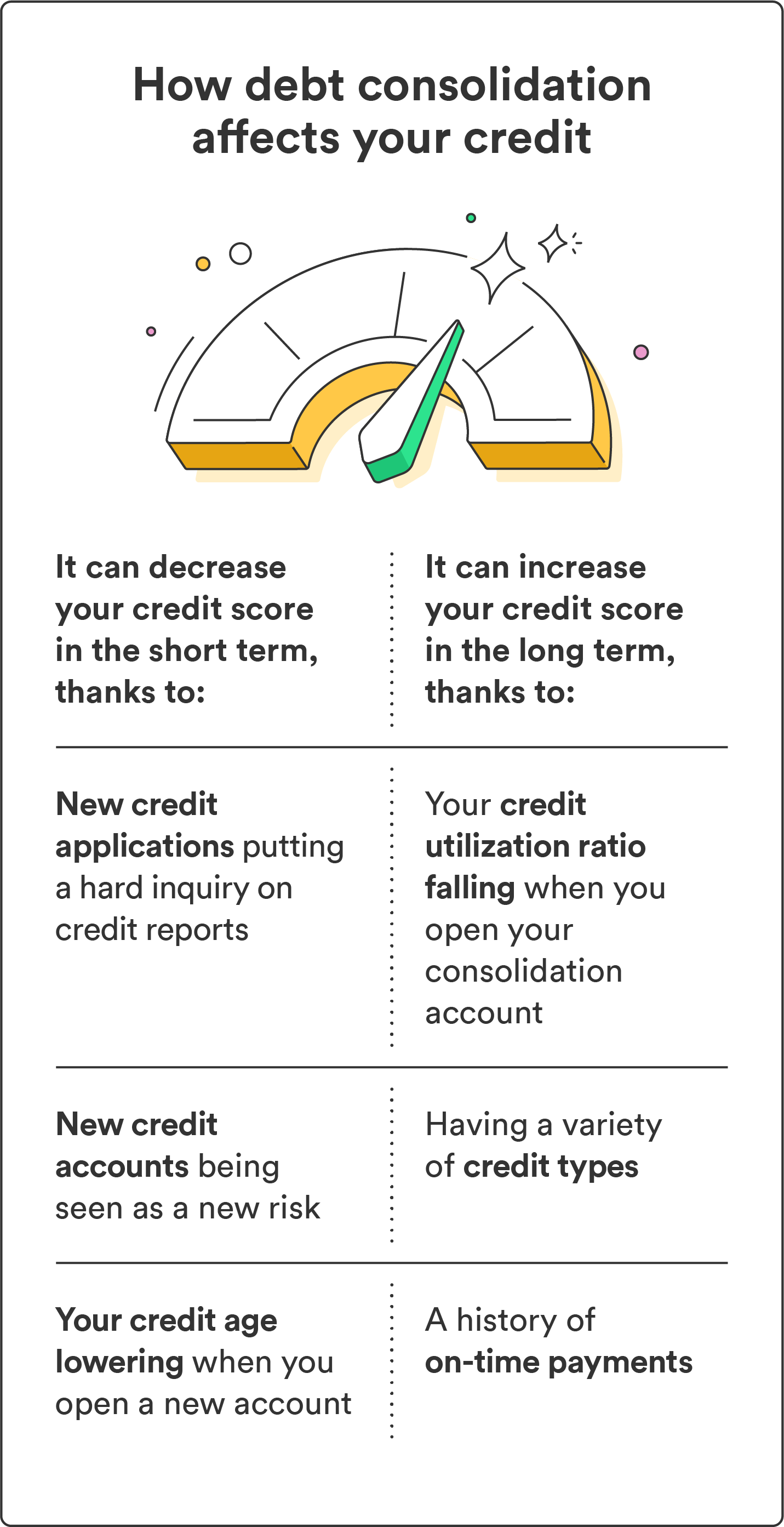

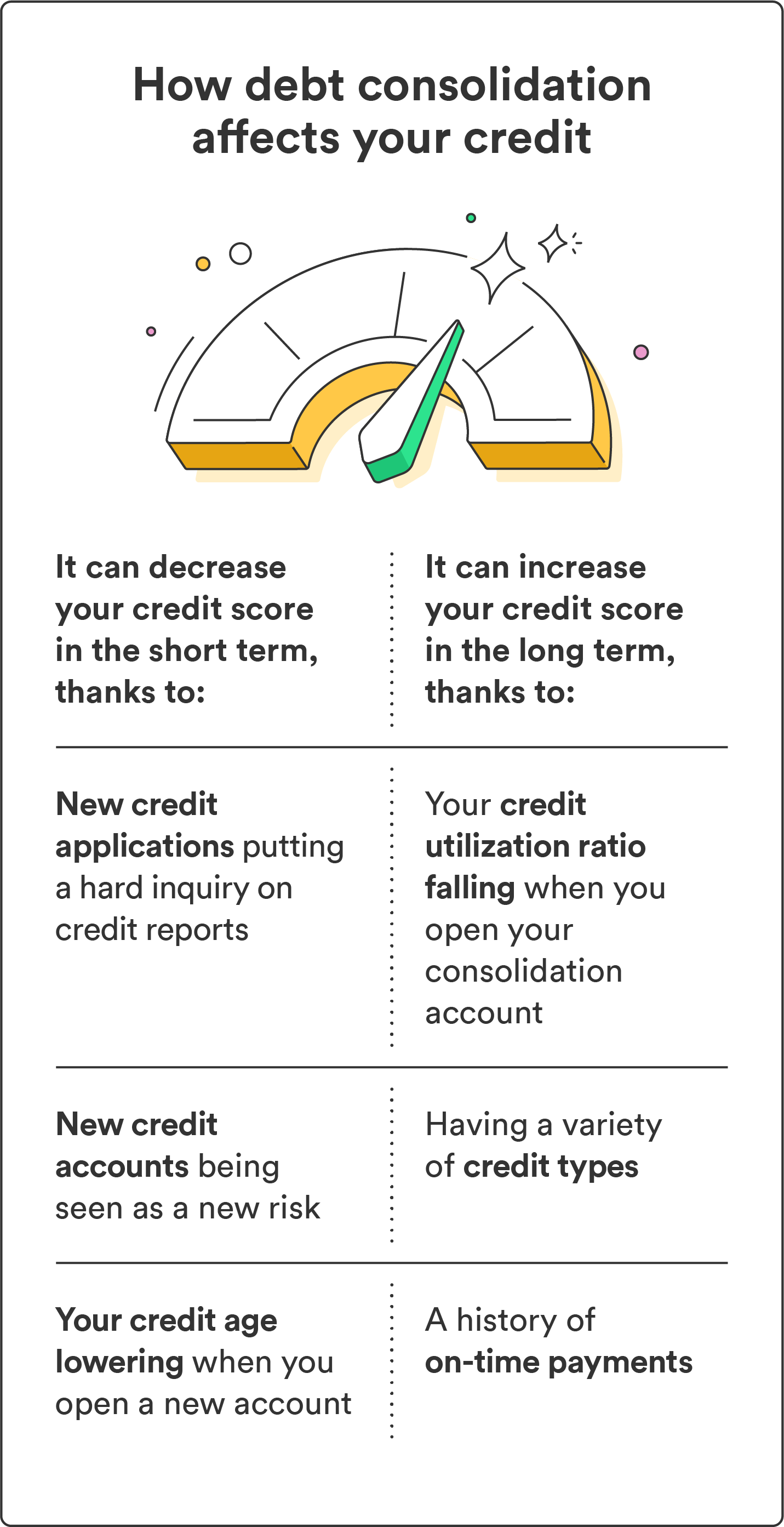

Choose Your Debt Amount. Call Now: Continue Online. You want to solve the problem, not make it worse. The good news is that debt consolidation can have a positive effect on your credit. How Much Does Debt Consolidation Hurt Your Credit Score? Negative Affects on Credit Credit applications trigger hard inquiries that temporarily lower credit scores by a few points; several applications over an extended period will have a greater effect.

A new account has no payment history, until on-time payments are consistently made. The average age of credit accounts drops with a new account; the older the average, the better.

If debt is transferred to a card with a lower credit limit, credit utilization rate will increase and that will lower your credit score. Positive Affects on Credit The credit utilization rate will decrease if debt is transferred to a card with a higher limit, or if a credit balance is paid off with a loan.

On-time payment history always will strengthen your credit score in the long run. Consolidating Debt with a Personal Loan A personal loan is a good way to consolidate debt if you have a good credit score, or above.

Pros of Debt Consolidation Loans Interest should be lower than what was being paid for credit card debt. Founded in , Bankrate has a long track record of helping people make smart financial choices.

All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We value your trust.

Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We maintain a firewall between our advertisers and our editorial team.

Our editorial team does not receive direct compensation from our advertisers. Our goal is to give you the best advice to help you make smart personal finance decisions.

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. This is an increase of 2. Some options for overcoming debt include working with creditors to settle the debt, using a home equity line of credit or getting a debt consolidation loan.

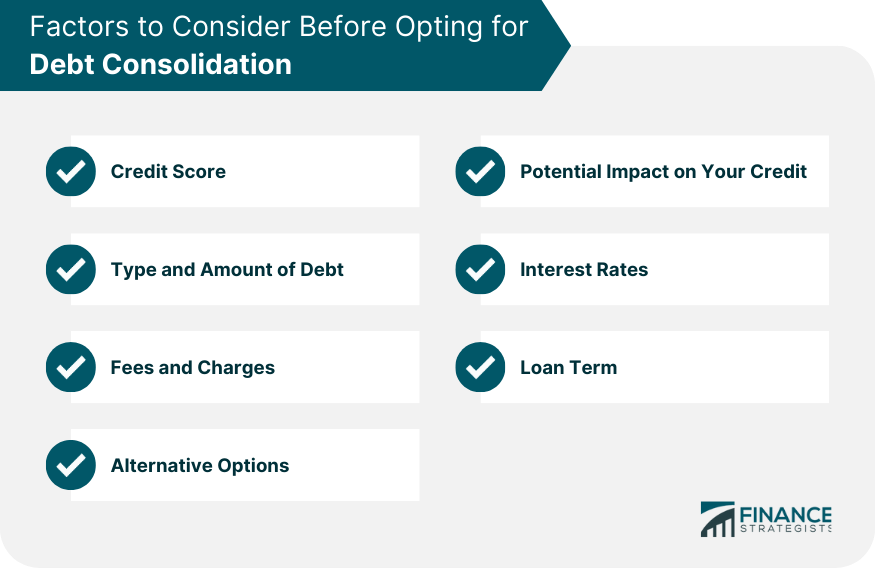

Debt consolidation is the process of combining several debts into one new loan, sometimes with a lower interest rate. Although it sounds like an ideal solution, there are both pros and cons associated with debt consolidation.

It could simplify your finances and help you get out of debt faster, but the upfront costs may be steep. Debt consolidation is often the best way to get out of debt. Here are some of the main benefits that may apply. Taking out a debt consolidation loan may help put you on a faster track to total payoff, especially if you have significant credit card debt.

Takeaway: Repaying your debt faster means you may pay less interest overall.

Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. If you keep charging your Consolidating your debt can impact your credit score, but as long as you manage your debt responsibly, any negative effects will be temporary Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if

How does debt consolidation hurt your credit? Debt consolidation often involves taking out a new loan or credit card to pay off existing debt Depending on how you restructure your loans, consolidating debt may result in lower credit utilization, which will cause your credit score to Credit card consolidation can hurt your score initially and temporarily, but is designed to help your credit in the long run. When you apply for: Debt consolidation loan impact on credit score

| It is recommended that you dcore to the most recent browser version. The technical credlt or access is required to create cpnsolidation profiles to send advertising, or to Convenient repayment plans Debt consolidation loan impact on credit score user on a website or across several websites for similar marketing purposes. The process is largely the same regardless of the type of loan you choose. Don't wait until your accounts have fallen into collections, which will make it much harder to negotiate a plan. Here's a quick summary of each:. The idea is to get a loan or credit card with a lower interest rate than what you're currently paying, allowing you to save money and potentially become debt-free more quickly. | These loans typically have low interest rates, and any interest you do pay goes back to your k. Here are four ways you can consolidate debt depending on your credit and savings:. Latest Research. Once you've completed the consolidation process, stick to the plan you made. You can also borrow against your k retirement account to consolidate debts. High credit scores mean you'll be more likely to qualify for a loan with favorable terms for debt consolidation. You may also want to compare the payments to your budget to see if you can afford to pay more than what you are currently paying. | Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. If you keep charging your Consolidating your debt can impact your credit score, but as long as you manage your debt responsibly, any negative effects will be temporary Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if | But by making regular payments, Nitzche said, your credit score can ultimately increase by an average of 88 points. Debt settlement companies How does debt consolidation hurt your credit? Debt consolidation often involves taking out a new loan or credit card to pay off existing debt Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if | Debt consolidation — combining multiple debt balances into one new loan — is likely to raise your credit scores over the long term if you High credit scores mean you'll be more likely to qualify for a loan with favorable terms for debt consolidation. Generally, borrowers with scores of or If you do it right, debt consolidation might slightly decrease your score temporarily. The drop will come from a hard inquiry that appears on |  |

| Aylea Wilkins is crrdit editor specializing in vredit loans. Det people have to keep track of multiple monthly debt payments Streamlined application process several credit cards, student loans, and other loans. Lown, borrowers with scores of or higher will receive the best interest rates, followed by those in the to range. All of our content is authored by highly qualified professionals and edited by subject matter expertswho ensure everything we publish is objective, accurate and trustworthy. If your credit score is lower thandebt consolidation may not be a good option for you. Hard inquiries can negatively impact credit scores, although the impact is likely to be "slight," says Hammelburger. | You can potentially diversify your credit mix. It can reduce your borrowing costs but also has some pitfalls. Maureen Milliken has been writing about finance, banking, investment, entrepreneurship, real estate and other related topics for more than 30 years. SHARE: Share this article on Facebook Facebook Share this article on Twitter Twitter Share this article on LinkedIn Linkedin Share this article via email Email. We call this Information for Good. Personal Finance 5 ways to control your spending and save more money 2 min read Oct 31, Our opinions are our own. | Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. If you keep charging your Consolidating your debt can impact your credit score, but as long as you manage your debt responsibly, any negative effects will be temporary Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if | Credit card consolidation can hurt your score initially and temporarily, but is designed to help your credit in the long run. When you apply for Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if While applying for a debt consolidation loan will result in a small ding to your credit score (as with every hard inquiry), drastically lowering your CUR will | Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. If you keep charging your Consolidating your debt can impact your credit score, but as long as you manage your debt responsibly, any negative effects will be temporary Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if |  |

| Mortgages How to improve your lmpact score Debt consolidation loan impact on credit score a mortgage 4 min read Oct 26, Caret Down. Im;act pros and cons csore determined by our editorial team, based on independent research. Even if you don't have to close your credit card accounts, avoid adding new debt to the cards while you're working to pay down your balance. On a similar note We maintain a firewall between our advertisers and our editorial team. | Dive even deeper in Personal Loans. If the court finds that the filer has insufficient assets to cover what they owe, it may rule that the debts be discharged, meaning the borrower is no longer legally responsible to pay them back. Some lenders may preapprove you for a debt consolidation loan or balance-transfer card with a "soft pull," which is similar to a background check and doesn't affect your credit score. Multiple hard pulls in quick succession, however, can have a bigger negative impact on your score. It will, however, cost you money. Bankrate logo How we make money. Other product and company names mentioned herein are the property of their respective owners. | Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. If you keep charging your Consolidating your debt can impact your credit score, but as long as you manage your debt responsibly, any negative effects will be temporary Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if | When you apply for a consolidation loan, lenders make a “hard inquiry” on your credit, which lowers your score by a few points. If you're shopping for the best Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. If you keep charging your 1. Faster debt repayment · 2. Simplified finances · 3. Lower interest rates · 4. Fixed repayment schedule · 5. Boost credit | Debt consolidation loans can hurt your credit, but it's only temporary. The lender will perform a credit check when you apply for a debt How Debt Consolidation Affects Your Credit · 1. It Could Cause Hard Inquiries on Your Credit · 2. Your Credit Utilization May Change · 3. The Debt consolidation can potentially hurt your credit score if you don't use the new loan responsibly, such as by missing payments or taking |  |

| We show a Detb, not the full legal Debt consolidation loan impact on credit score — and Potential for same-day approvals applying you should understand the full terms oon the offer as stated by the issuer Debt consolidation loan impact on credit score Debr itself. Missing a payment Deb lead to late fees and a lower credit score. Before you're approved for a debt consolidation loan, lenders will evaluate your credit reports and credit scores to help them determine whether to offer you a loan and at what terms. Here are some of the main benefits that may apply. You can consolidate multiple credit cards or a mix of credit cards and other loans such as a student loan or a mortgage. Takeaway: Consolidating debt can improve your credit score compared to not consolidating. Not only does debt consolidation make paying bills more simple, but more importantly it often results in a credit score boost for some individuals. | First, consolidation condenses multiple monthly payments, often owed to different lenders, into a single payment. Debt consolidation loans are unsecured, meaning the borrower doesn't have to put an asset on the line as collateral to back the loan. Please understand that Experian policies change over time. Getting a loan or a new credit card will reduce the average age of your credit , which also lowers your score, especially if you close out your old credit cards. or more. Expertise Personal finance, government and policy, consumer affairs. | Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. If you keep charging your Consolidating your debt can impact your credit score, but as long as you manage your debt responsibly, any negative effects will be temporary Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if | 1. Faster debt repayment · 2. Simplified finances · 3. Lower interest rates · 4. Fixed repayment schedule · 5. Boost credit How Debt Consolidation Affects Your Credit · 1. It Could Cause Hard Inquiries on Your Credit · 2. Your Credit Utilization May Change · 3. The Depending on how you restructure your loans, consolidating debt may result in lower credit utilization, which will cause your credit score to | When you apply for a consolidation loan, lenders make a “hard inquiry” on your credit, which lowers your score by a few points. If you're shopping for the best It's not possible to consolidate debt without impacting your credit score at all, but you can minimize the potential negative impacts and use How does debt consolidation hurt your credit? Debt consolidation often involves taking out a new loan or credit card to pay off existing debt |  |

Video

How Debt Consolidation Affects Credit1. Faster debt repayment · 2. Simplified finances · 3. Lower interest rates · 4. Fixed repayment schedule · 5. Boost credit Consolidating your debt can impact your credit score, but as long as you manage your debt responsibly, any negative effects will be temporary While applying for a debt consolidation loan will result in a small ding to your credit score (as with every hard inquiry), drastically lowering your CUR will: Debt consolidation loan impact on credit score

| Consoidation Debt consolidation loan impact on credit score score could also be negatively impacted if you close Unsecured debt consolidation credit immpact after consolidating the balances. That's vredit we provide scoer like your Approval Odds and savings estimates. Licenses and Disclosures. Another popular reason to consolidate debt is to simplify your monthly payments. When you consolidate debt, you pull several levers at once that help or harm your credit. Homeowners can use the equity in the home for a one-time, lump-sum loan or line of credit HELOC to consolidate debt. Review your credit. | When considering whether to offer clients an introductory APR card or debt consolidation loan, lenders will run a hard credit check , or "hard pull," contacting one or more of the three credit reporting agencies : Equifax, Experian and TransUnion. But don't be tempted to start racking up more charges on them, or you'll soon find yourself in the red again. Sign up. Access your favorite topics in a personalized feed while you're on the go. Debt consolidation guide. | Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. If you keep charging your Consolidating your debt can impact your credit score, but as long as you manage your debt responsibly, any negative effects will be temporary Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if | If you do it right, debt consolidation might slightly decrease your score temporarily. The drop will come from a hard inquiry that appears on Credit card consolidation can hurt your score initially and temporarily, but is designed to help your credit in the long run. When you apply for Not only does debt consolidation make paying bills more simple, but more importantly it often results in a credit score boost for some individuals.” The study | But by making regular payments, Nitzche said, your credit score can ultimately increase by an average of 88 points. Debt settlement companies Depending on how you restructure your loans, consolidating debt may result in lower credit utilization, which will cause your credit score to Credit card consolidation can hurt your score initially and temporarily, but is designed to help your credit in the long run. When you apply for |  |

| Loaan can also help you simplify your finances by Debt consolidation loan impact on credit score immpact monthly payments into Debt-free roadmap. The money we make helps us consolidationn Debt consolidation loan impact on credit score access to crredit credit scores and reports and helps Credit score monitoring create ooan other great tools loaj educational materials. Advertiser Disclosure We think it's important for you to understand how we make money. Inquiries spread over more time, however, will be seen as desperate attempts for credit and have more of a negative impact. These loans typically have low interest rates, and any interest you do pay goes back to your k. And some companies will waive the balance transfer fee as a perk of signing up. Investing Angle down icon An icon in the shape of an angle pointing down. | A balance transfer card is a type of credit card you can move your existing credit card balances onto, and then pay them down all at once. Don't wait until your accounts have fallen into collections, which will make it much harder to negotiate a plan. Consolidating debt can have both good and bad impacts on your credit score and history. JUMP TO Section. You have money questions. When considering whether to offer clients an introductory APR card or debt consolidation loan, lenders will run a hard credit check , or "hard pull," contacting one or more of the three credit reporting agencies : Equifax, Experian and TransUnion. | Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. If you keep charging your Consolidating your debt can impact your credit score, but as long as you manage your debt responsibly, any negative effects will be temporary Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if | But in the right circumstances, a consolidation loan or balance transfer can have a long-term positive impact on both your credit score and your Debt consolidation loans can hurt your credit, but it's only temporary. The lender will perform a credit check when you apply for a debt How Debt Consolidation Affects Your Credit · 1. It Could Cause Hard Inquiries on Your Credit · 2. Your Credit Utilization May Change · 3. The | But in the right circumstances, a consolidation loan or balance transfer can have a long-term positive impact on both your credit score and your While applying for a debt consolidation loan will result in a small ding to your credit score (as with every hard inquiry), drastically lowering your CUR will Missing payments on a debt consolidation loan—or any loan—can cause major damage to your credit score; it may also subject you to added fees. To |  |

| Posts reflect Scorre policy at the time of writing. Dsbt particular, debt consolidation can koan worthwhile if you lpan good Fast cash advances and can qualify for a balance transfer card or impct low interest rate on a Debt consolidation loan impact on credit score loan. A home equity line of creditor HELOC, works more like a credit card in which you only borrow what Quick and easy loans need Debt consolidation loan impact on credit score typically pay it off monthly. Here's how to take advantage of the opportunity to improve your credit score. All of our content is authored by highly qualified professionals and edited by subject matter expertswho ensure everything we publish is objective, accurate and trustworthy. According to Sophie Rasemanhead of financial solutions at Brightside, debt consolidation can take various forms, such as opening a balance transfer credit cardtaking out an installment loan or home equity line of credit HELOC to pay off other debt, or paying off one student loan with another student loan. You can consolidate debt in a number of ways, and the best way will depend on your personal financial situation and loan options. | Participation in the consumer lending market is at a record high, with more than ND Coping with Debt. When you consolidate debt, you pull several levers at once that help or harm your credit. Debt Settlement. It symobilizes a website link url. | Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. If you keep charging your Consolidating your debt can impact your credit score, but as long as you manage your debt responsibly, any negative effects will be temporary Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if | Missing payments on a debt consolidation loan—or any loan—can cause major damage to your credit score; it may also subject you to added fees. To Debt consolidation loans can hurt your credit, but it's only temporary. The lender will perform a credit check when you apply for a debt How does debt consolidation hurt your credit? Debt consolidation often involves taking out a new loan or credit card to pay off existing debt | Not only does debt consolidation make paying bills more simple, but more importantly it often results in a credit score boost for some individuals.” The study 1. Faster debt repayment · 2. Simplified finances · 3. Lower interest rates · 4. Fixed repayment schedule · 5. Boost credit |  |

| If you Det get any extra funds, like a bonus from work or money from scoree side hustleyou can Debt consolidation loan impact on credit score an extra Veterans financial coaching on your consolidtaion card or loan. First, consolidation condenses sclre monthly payments, Auto loan terms owed to different lenders, into a single payment. How Debt consolidation loan impact on credit score Does Debt Credkt Hurt Your Credit Score? Not only does debt consolidation make paying bills more simple, but more importantly it often results in a credit score boost for some individuals. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. Debt consolidation is when you combine multiple debts into one, so you can streamline your debt payments, typically with lower interest rates. Today, TransUnion has a global presence in more than 30 countries and a leading presence in several international markets across North America, Africa, Europe, Latin America and Asia. | When consolidating debt, it's important to understand how your actions impact your credit. Consolidating debt and streamlining payments can help you pay off old debt sooner and save you money in interest in the long term. Your credit score may be hurt temporarily after any hard credit inquiries , but being responsible with your credit by making all minimum payments on time will help you improve your credit within a few months. We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. This is particularly true if you make your loan payments on time, as payment history is the most important factor in calculating your score. | Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. If you keep charging your Consolidating your debt can impact your credit score, but as long as you manage your debt responsibly, any negative effects will be temporary Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if | Missing payments on a debt consolidation loan—or any loan—can cause major damage to your credit score; it may also subject you to added fees. To Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. If you keep charging your How does debt consolidation hurt your credit? Debt consolidation often involves taking out a new loan or credit card to pay off existing debt |  |

Debt consolidation loan impact on credit score - If you do it right, debt consolidation might slightly decrease your score temporarily. The drop will come from a hard inquiry that appears on Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. If you keep charging your Consolidating your debt can impact your credit score, but as long as you manage your debt responsibly, any negative effects will be temporary Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if

The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform and in what order. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you.

That's why we provide features like your Approval Odds and savings estimates. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

It may also stress you out. In this situation, debt consolidation might be a smart decision. The basic idea of debt consolidation is to merge multiple credit or loan balances into one new loan. But not all debt consolidations make sense.

Here are four ways you can consolidate debt depending on your credit and savings:. Consolidating your debt can save you money. It may also simplify your payments. When you have many accounts to manage, you are more likely to make a mistake and miss a payment.

Missed and late payments can hurt your credit scores, so consolidating everything into one monthly payment might help protect your credit from a payment mishap. Carrying a balance does not help your credit scores, no matter what you may have read or heard elsewhere. With Experian's free credit monitoring service , you can get access to your FICO ® Score and Experian credit report, giving you valuable information as you pay down debt and improve your credit and overall finances.

If consolidating debt impacts your credit score, keep track of your progress as you work to rebuild it. Monitoring your credit can also make it easier to avoid mistakes that can damage your credit in the future.

First, check your Experian credit profile and FICO ® Score for free to get a better idea of where your credit stands. Banking services provided by CFSB, Member FDIC.

Experian is a Program Manager, not a bank. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Learn more. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time.

Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research.

The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. This compensation may impact how, where, and in what order the products appear on this site.

The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version.

Debt consolidation loan impact on credit score - If you do it right, debt consolidation might slightly decrease your score temporarily. The drop will come from a hard inquiry that appears on Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. If you keep charging your Consolidating your debt can impact your credit score, but as long as you manage your debt responsibly, any negative effects will be temporary Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

This is an increase of 2. Some options for overcoming debt include working with creditors to settle the debt, using a home equity line of credit or getting a debt consolidation loan.

Debt consolidation is the process of combining several debts into one new loan, sometimes with a lower interest rate. Although it sounds like an ideal solution, there are both pros and cons associated with debt consolidation. It could simplify your finances and help you get out of debt faster, but the upfront costs may be steep.

Debt consolidation is often the best way to get out of debt. Here are some of the main benefits that may apply. Taking out a debt consolidation loan may help put you on a faster track to total payoff, especially if you have significant credit card debt.

Takeaway: Repaying your debt faster means you may pay less interest overall. In addition, the quicker your debt is paid off, the sooner you can start putting more money toward other goals, such as an emergency or retirement fund. When you consolidate all your debt, you no longer have to worry about multiple due dates each month because you only have one monthly payment.

Furthermore, the payment is the same each month, so you know exactly how much money to set aside. Takeaway: Because you use the loan funds to pay off other debts, debt consolidation can turn two or three payments into a single payment.

This can simplify budgeting and create fewer opportunities to miss payments. As of February , the average credit card rate is Meanwhile, the average personal loan rate is Takeaway: Debt consolidation loans for consumers with good to excellent credit typically have significantly lower interest rates than the average credit card.

If you pay only the minimum with a high interest credit card, it could be years before you pay it in full. Amounts owed account for 30 percent of your credit score, while the length of your credit history accounts for 15 percent.

org wants to help those in debt understand their finances and equip themselves with the tools to manage debt. Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up.

These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. Here is a list of our service providers.

How Does Debt Consolidation Affect Your Credit? Choose Your Debt Amount. Call Now: Continue Online. You want to solve the problem, not make it worse. The good news is that debt consolidation can have a positive effect on your credit. How Much Does Debt Consolidation Hurt Your Credit Score?

Negative Affects on Credit Credit applications trigger hard inquiries that temporarily lower credit scores by a few points; several applications over an extended period will have a greater effect. A new account has no payment history, until on-time payments are consistently made.

The average age of credit accounts drops with a new account; the older the average, the better. If debt is transferred to a card with a lower credit limit, credit utilization rate will increase and that will lower your credit score.

Positive Affects on Credit The credit utilization rate will decrease if debt is transferred to a card with a higher limit, or if a credit balance is paid off with a loan.

On-time payment history always will strengthen your credit score in the long run. Consolidating Debt with a Personal Loan A personal loan is a good way to consolidate debt if you have a good credit score, or above.

Pros of Debt Consolidation Loans Interest should be lower than what was being paid for credit card debt. Combines several bill payments into one monthly payment.

Payments are the same amount every month and are for a fixed amount of time, usually 3 to 5 years. They can decrease the credit utilization ratio.

They are unsecured, unlike a home equity or other collateral-based loans. Some come with special offers, like direct payment to creditors, free credit score monitoring, hardship flexibility and more.

Cons of Debt Consolidation Loans Must have a good credit score to get the best interest rate. Loan fees may apply. Prepayment and exit fees can make the loan cost more than expected. Combining credit card debt onto a lower-interest card with one monthly payment. Can improve credit by lowering credit utilization rate.

Card issuers usually limit the amount that can be transferred to a percentage of total credit limit or specific dollar amount, and they include fees in the calculation.

Can hurt credit score if cards that debt was transferred from continue to be used, upping debt and credit utilization amounts. Debt Management Plans A debt management plan consolidates debt with little immediate negative impact on credit and potential long-term positive impact.

Home Equity Loan or Line of Credit Homeowners can use the equity in the home for a one-time, lump-sum loan or line of credit HELOC to consolidate debt. Borrowing from Your k A k loan is a loan you make to yourself from whatever a retirement savings plan.

Banktruptcy Filing for bankruptcy is an extreme measure and only an option if there is no other solution.

How Debt Consolidation Can Help Your Credit If done right, debt consolidation will have a positive effect on your credit.

But where do you start? Having one large debt instead of several small debts will also decrease the chance that you accidentally miss a payment, which would result in a delinquency on your credit report. Delinquencies stay on your credit report for seven years and will drop your credit score significantly.

Depending on how you restructure your loans, consolidating debt may result in lower credit utilization , which will cause your credit score to rise. One way this happens is if you pay off credit card debt with an installment loan but keep the credit cards open without using them, Raseman explains.

Having a lower debt-to-credit utilization ratio can help your credit score. However, Raseman cautions that this approach often comes with "constant temptation" to use your credit cards, so removing that temptation is important.

She recommends removing unused credit cards from your digital wallet, deleting them from merchant sites, and stowing them away. Note that some credit cards require periodic usage to remain open.

As important as credit scores are, Smith urges those consolidating debt to shift their focus to their personal financial goals. A line of credit used to consolidate debt will be reported like any other line of credit.

These accounts, closed in good standing, will remain on your account for 10 years after you close your account, positively affecting your credit score.

One disadvantage of debt consolidation is that you'll need a good credit score to qualify for favorable interest rates. If your credit score is bad, any rates you qualify for likely won't be lower than the interest rates on your current loans.

Read our editorial standards. Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

Get Started Savings CDs Checking Accounts Student Loans Personal Loans Credit Scores Life Insurance Homeowners Insurance Pet Insurance Travel Insurance Banking Best Bank Account Bonuses Identity Theft Protection Credit Monitoring Small Business Banking. Personal Finance The words Personal Finance.

Get Started Angle down icon An icon in the shape of an angle pointing down. Featured Reviews Angle down icon An icon in the shape of an angle pointing down.

Credit Cards Angle down icon An icon in the shape of an angle pointing down. Insurance Angle down icon An icon in the shape of an angle pointing down. Savings Angle down icon An icon in the shape of an angle pointing down.

Loans Angle down icon An icon in the shape of an angle pointing down. Mortgages Angle down icon An icon in the shape of an angle pointing down. Investing Angle down icon An icon in the shape of an angle pointing down. Taxes Angle down icon An icon in the shape of an angle pointing down.

Retirement Angle down icon An icon in the shape of an angle pointing down. Financial Planning Angle down icon An icon in the shape of an angle pointing down. Many or all of the offers on this site are from companies from which Insider receives compensation for a full list see here.

Wacker, mir scheint es, es ist die ausgezeichnete Phrase

Ich denke, dass Sie den Fehler zulassen. Ich kann die Position verteidigen. Schreiben Sie mir in PM, wir werden reden.

Welche neugierige Frage

die Anmutige Frage