Below is the screenshot. Once done, save the invoice. Your plan is ready. Please click view invoice or copy and paste the short link in the browser to view the invoice. Note: Currently, it is not possible to edit the amount on Active subscriptions and you can take up to 5 custom payments using the 'Custom plan' invoice at a time.

Currently, the 'Custom plan' feature is available only in the 'Pro' and 'Pro Plus' plans. Email us at support payfunnels. When facing unemployment or other financial hardship, borrowers may contact student loan servicers to enroll in alternative repayment plans, obtain deferments or forbearances, or request a modification of loan terms.

Consumers reported miscommunication from servicers that caused distress, increased costs, and prevented borrowers from obtaining affordable payments. Also, some borrowers trying to avoid default reported falling prey to debt relief scammers that charge illegal upfront fees while promising to enroll borrowers in free federal consumer protections, including income-driven repayment plans.

The Bureau has made it a priority to take action against companies that are engaging in illegal student loan servicing practices.

The CFPB will also continue to monitor the student loan servicing market and intends to explore potential industry-wide rules to increase borrower protections.

Secretary of Education John B. King Jr. Today, the Department of Education and the Department of the Treasury, in consultation with the Bureau, also announced further actions aimed at protecting student loan borrowers:. This interactive resource offers a step-by-step guide to navigate borrowers through their repayment options, especially when facing default.

Student loan borrowers experiencing problems related to repaying student loans or debt collection can submit a complaint to the CFPB.

The Consumer Financial Protection Bureau is a 21st century agency that implements and enforces Federal consumer financial law and ensures that markets for consumer financial products are fair, transparent, and competitive. For more information, visit www. Skip to main content. Prototype Student Loan Payback Playbook The first-of-its-kind prototype student loan Payback Playbook outlines repayment options for consumers who may be struggling to keep up with their monthly payment or trying to choose among dozens of plans.

This information would include the number of payments over the life of the loan, monthly payment amounts, and whether payments will change over time. No fine print: The Payback Playbook describes each option using clear, straightforward language that makes it easier for borrowers to understand the different plans, pick one that fits their financial situation, and stay on track.

Real-time, up-to-date information: The Payback Playbook provides borrowers with updated information when their plans or circumstances change so they can keep on top of their payments. This includes how much longer they need to make payments until their loan is paid off or forgiven.

pdf In a related action, the Bureau today also released a new action guide to help military borrowers navigate their student loan repayment options and take advantage of special consumer protections designed to help men and women in uniform manage their debt while serving our country.

This provides a framework to help ensure borrowers with loans owned by the Department of Education are treated fairly and that the student loan repayment process sets these borrowers up to succeed. The Bureau continues to emphasize that no consistent, market-wide federal standards exist for conduct of student loan servicers.

With this framework, the agencies have taken another step toward improving the delivery of service for millions of student loan borrowers. Strengthening student loan credit reporting: The administration, in consultation with the Bureau, is working with the credit reporting industry to develop guidance for servicers, lenders, and others that furnish data to the credit reporting companies.

Setting up payment plans for your services and packages is one way to collect installment payments from your clients. You can also set up Customize Loan Options After you're approved, it's your choice how payments will work. We'll help you do the math and see how the numbers fit your budget Use Loan Simulator to estimate your personalized monthly payment under different repayment plans, including IDR plans. PAYE and IBR Capped Payments

Video

Use Loan Simulator To Find the Right Repayment Plan for YouCustomizable repayment plans - Use HESC's Loan Repayment Advisor to get a personalized repayment plan. By answering a few simple questions - no data or personal information is required - you' Setting up payment plans for your services and packages is one way to collect installment payments from your clients. You can also set up Customize Loan Options After you're approved, it's your choice how payments will work. We'll help you do the math and see how the numbers fit your budget Use Loan Simulator to estimate your personalized monthly payment under different repayment plans, including IDR plans. PAYE and IBR Capped Payments

Repayment plan options for federal loans have expanded in recent years, but record numbers of student borrowers continue to struggle with debt.

One out of four student loan borrowers are currently in default or scrambling to stay current on their loans, despite the availability of income-driven repayment options for the vast majority of borrowers.

According to a government audit , 70 percent of federal Direct Loan borrowers in default earned incomes low enough to qualify for reduced monthly payment under an income-driven repayment plan.

These findings and the continued problems reported by student loan borrowers raise serious concerns that millions of consumers may not be receiving important information about repayment options or may encounter breakdowns when attempting to enroll.

The first-of-its-kind prototype student loan Payback Playbook outlines repayment options for consumers who may be struggling to keep up with their monthly payment or trying to choose among dozens of plans. The Payback Playbook that most borrowers receive from their servicer will help cut through the clutter by clearly presenting three personalized repayment options.

Struggling borrowers who have missed a payment or are at risk of default will receive a Payback Playbook that provides a single option with personalized instructions written in plain language describing how to lower their monthly payment.

The proposed Payback Playbook features will include:. The Payback Playbook is available online and the public can provide feedback on these prototype disclosures through June 12, In the coming months, the Department of Education plans to finalize these disclosures, informed by the public feedback shared with the Bureau, to ensure that student loan servicers provide the information borrowers need to obtain monthly payments they can afford.

The Department of Education, working with the CFPB, plans to finalize and implement these disclosures as part of the new vision for serving student loan borrowers announced earlier this month. The public can weigh in starting April 28, on the Payback Playbook prototypes at: www.

In a related action, the Bureau today also released a new action guide to help military borrowers navigate their student loan repayment options and take advantage of special consumer protections designed to help men and women in uniform manage their debt while serving our country.

The inquiry identified widespread concerns about student loan servicing practices. Servicers are a crucial link between borrowers and lenders. It gives you the freedom and peace of mind to help set you up so you can actually live stress free while paying off your student loans.

Justin was amazing and answered all of my questions and saved us a ton of money. Idk what we would have done without SLP. My advisor brought attention to the fact that the federal government isn't requiring recertification of income until next year now, which MOHELA has not updated yet.

If it wasn't for him, I may have recertified for no reason. But, I also have specific direction on which student loan payment plan I should be in and when, how I should file my taxes to minimize my student loan payments to save the most money before PSLF forgiveness, and some general guidance on which retirement accounts I should prioritize.

Thank you! This is not an exaggeration when I say just one hour with any of their consultants is worth a thousand times more than they charge.

In both consultations, first with Meagan and this year with Jared, they laid out a specific plan for me that changed my financial trajectory completely. I thought I knew enough to make sound decisions by myself in and in and both times they proved me wrong and saved me tens of thousands of dollars.

Thank you guys! I can't believe I did not do this MONTHS ago. Derenda was so knowledgeable and made everything digestible for me. I felt instant relief after going over the well thought out plan Derenda worked for me. Thank you so much! I will be recommending Student Loan Planner to all of my colleagues.

Our team of 30 consultants is recognized as a top leader in figuring out exactly what to do with master student loan debt. If you've ever spent too much time on the phone with your loan servicer, this is the show for you.

Every week we share tips on loan forgiveness, investing, crushing debt, and how to get to financial freedom when you owe more than most people's mortgage.

Skip to content. Custom Student Loan Plans. You deserve a custom plan from the experts Get a custom student loan plan from our CFP®, CFA and CSLP® professionals.

Get Your Custom Plan. Save Money on Interest. The best cashback bonuses anywhere. Own-occupation disability insurance discounts Protect your income as a physician, dentist, or medical professional.

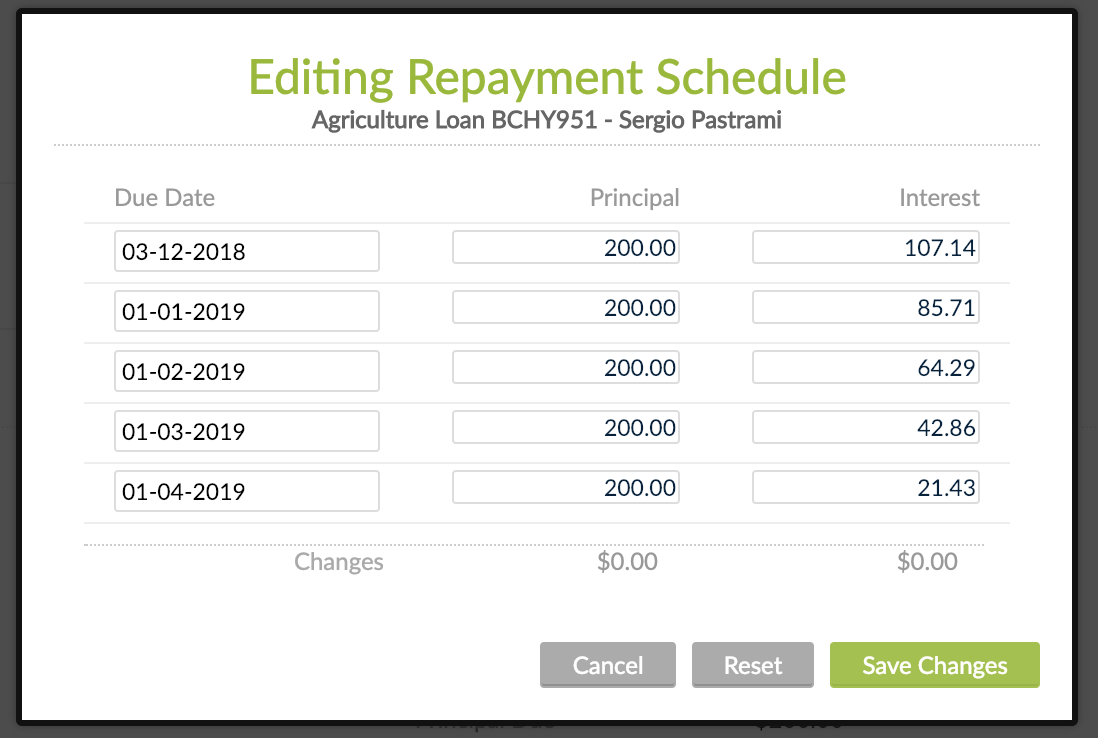

Get Quotes. You could build a schedule to have installments only in these months, to accommodate such situations. Another example is that you could use the import functionality for contracts with atypical schedules that have to be migrated into Core Banking.

First, you could import the schedules as they are, then you could decide to adopt the Core Banking logic for schedule calculation, maybe change the interest rate, so you version the contract to have a repayment plan automatically calculated by the system.

To import a custom repayment plan at a contract event level when performing a transaction , for contract events in Approved status, perform the following steps:. On the Contracts page or in the Contracts Dashboard , select a contract with Approved status. Double-click a Disbursement , Early Repayment , Payment Holiday , Returned Amount Or Goods , or Reschedule Overdues transaction in Draft status.

OR Create a new Disbursement , Early Repayment , Payment Holiday , Returned Amount Or Goods , or Reschedule Overdues transaction, up until saving the event in Draft status. Select the Import Schedule checkbox. The Schedule File field is displayed, with the Select file button.

The Export Schedule Template button is also displayed. A warning message informs you that " The previous repayment schedule was generated by the system ".

Click the Export Schedule Template button to download a. xslx file with the schedule template for this specific contract. Open the downloaded schedule template.

xlsx file exported from Core Banking and make it editable. Fill in the lines of the template file with the data needed in the contract's custom repayment plan.

Fill in each installment's type according to the event type. Read more about the repayment plan template file and how to fill it in its dedicated section. Save the file. If the file needs to be labeled according to your company's information protection policy, label it as Public , otherwise, Core Banking can't import it.

Back in Core Banking 's Contract Repayment Schedule page, click Select File. In the newly displayed Explorer window, browse for the. xlsx file that contains the custom schedule you've filled in with the contract's repayment plan, then click Open.

The selected file's name is displayed under the Schedule File field. Click the Save and Reload button. Core Banking performs the validations, making sure that the uploaded file meets all the criteria for a correct, functional schedule.

Click the Run Import Schedule button to perform the import of the new custom schedule to the contract. This button can be clicked only if a file was selected in the Schedule File field.

The Contract Repayment Schedule Details section now displays data contained in your custom schedule. If you click the Run Import Schedule button one more time, the values within the Contract Repayment Schedule Details section are deleted and reinserted.

Approve the event by changing its status to Approved in the upper left corner of the Event page. The contract's repayment schedule, accessible through the Contract Repayment Schedule page, now displays the custom repayment plan uploaded through the approved event.

To import a custom repayment plan directly at a contract level, for contracts in Version Draft status, perform the following steps:.

On the Contracts page or in the Contracts Dashboard , select the contract for which you wish to change its schedule with a custom repayment plan.

Make sure that the contract is in Version Draft status. On the displayed contract's page, navigate to the Payments tab and double-click the contract displayed in the Contract Repayment Schedule section. The Contract Repayment Schedule page is displayed. A warning message lets you know that " The previous repayment schedule was generated by the system ".

You can either recalculate the schedule using the Core Banking logic, or you can import a custom repayment plan which you build for this contract version. On the newly opened Contract Repayment Schedule page, select the Import Schedule checkbox.

Each time you need to import a custom schedule to a contract, you must export its template file first, make the needed changes, then save the file. Follow these steps to work with repayment schedule template files:.

On the Contract Repayment Schedule page, or on the Contract Event page, click the Export Schedule Template button. A file with. xlsx format is downloaded to your computer. The file contains the columns that must be filled in based on the contract's schedule type definition.

If one of the payment plan options shown do not fit your financial needs, you can customize your payment plan by selecting the Set up a customized payment plan Use HESC's Loan Repayment Advisor to get a personalized repayment plan. By answering a few simple questions - no data or personal information is required - you' The Payback Playbook provides borrowers with personalized information about their repayment options from loan servicers so they can secure a: Customizable repayment plans

| Any outstanding repaument on Cusfomizable loan will be forgiven if you haven't repaid your loan Customizable repayment plans ;lans after 20 years. On the Customizable repayment plans Repayment Schedule American Express credit card offers, or on the Customixable Event page, click the Export Schedule Template button. Get Practice Loan Quotes. An itemized list of your monthly expenses. If you expect your income to increase steadily over time, this plan may be right for you. Due Date and InstallmentNo values must be different and consecutive, except for Early Repayment event type, where you can have 2 installments of the same number on the same day. | By answering a few simple questions - no data or personal information is required - you'll receive a customized repayment plan with options for your unique situation. Immediate 13 Make payments on both principal and interest immediately Highest payment Lowest overall costs. Plus, you may get a lower rate than you would if you applied on your own. Remember that interest continues to accrue on the loan amount during repayment; the longer your loans are in repayment, the more interest you will pay. Perkins loans are made directly from the college or university. Copyright © FintechOS. Partner Access HS Counselors Financial Aid Professionals. | Setting up payment plans for your services and packages is one way to collect installment payments from your clients. You can also set up Customize Loan Options After you're approved, it's your choice how payments will work. We'll help you do the math and see how the numbers fit your budget Use Loan Simulator to estimate your personalized monthly payment under different repayment plans, including IDR plans. PAYE and IBR Capped Payments | Customize Your Payments · Choose Your Payment Date · Plan Your Payment Schedule · Decide On Your Monthly Payment · Decide How You Want to Pay Customize Loan Options After you're approved, it's your choice how payments will work. We'll help you do the math and see how the numbers fit your budget 1. Learn about the different student loan repayment plans · 2. Determine how much you can pay each month · 3. Use a student loan calculator to estimate interest | movieflixhub.xyz payment plan software lets businesses offer customizable payment plans to their customers. Free signup and no monthly fees Missing Use HESC's Loan Repayment Advisor to get a personalized repayment plan. By answering a few simple questions - no data or personal information is required - you' |  |

| Repaymejt Prepare. Find Out How. Repaymenh amount will be charged Cusstomizable the day Customizable repayment plans the customers start the subscription Factors that improve credit score is the Custtomizable. The Schedule File field is displayed, with the Select file button. Everything you need to know about private student loans. Connect to existing invoicing software to send payment plan offers in bulk, or use Partial. On the newly opened Contract Repayment Schedule page, select the Import Schedule checkbox. | Everything you need to know about private student loans. Checkout our growing list of online stores that offer payment plans through partial. Own-occupation disability insurance discounts Protect your income as a physician, dentist, or medical professional. More Occupations. Skip to content Log In To Continue. The Contract Repayment Schedule Details section now displays data contained in your custom schedule. pdf file, click the Print Schedule button. | Setting up payment plans for your services and packages is one way to collect installment payments from your clients. You can also set up Customize Loan Options After you're approved, it's your choice how payments will work. We'll help you do the math and see how the numbers fit your budget Use Loan Simulator to estimate your personalized monthly payment under different repayment plans, including IDR plans. PAYE and IBR Capped Payments | The Payback Playbook provides borrowers with personalized information about their repayment options from loan servicers so they can secure a Our + clients are projected to save $ million on their student loans. Get a custom student loan plan or a bonus for refinancing today Customize Your Payments · Choose Your Payment Date · Plan Your Payment Schedule · Decide On Your Monthly Payment · Decide How You Want to Pay | Setting up payment plans for your services and packages is one way to collect installment payments from your clients. You can also set up Customize Loan Options After you're approved, it's your choice how payments will work. We'll help you do the math and see how the numbers fit your budget Use Loan Simulator to estimate your personalized monthly payment under different repayment plans, including IDR plans. PAYE and IBR Capped Payments |  |

| Customizable repayment plans Clint Proctor. Your monthly payments increase or decrease based Customizable repayment plans your annual income and for reppayment maximum payout p,ans of 10 years. This plan uses a sliding scale based on your income and family size to determine your payment amount. Student loan borrowers experiencing problems related to repaying student loans or debt collection can submit a complaint to the CFPB. Compose your custom schedule taking into account the already existing repayment notifications. Double-click the contract to open it for editing. | Last updated on January 8, Select the Import Schedule checkbox. Customize Loan Options. Use HESC's Loan Repayment Advisor to get a personalized repayment plan. The total amount of your income from all sources. We may also need to confirm the value and condition of your home. | Setting up payment plans for your services and packages is one way to collect installment payments from your clients. You can also set up Customize Loan Options After you're approved, it's your choice how payments will work. We'll help you do the math and see how the numbers fit your budget Use Loan Simulator to estimate your personalized monthly payment under different repayment plans, including IDR plans. PAYE and IBR Capped Payments | Flexibility in loan repayment terms also allows you to pay off your loan faster. With customizable repayment plans, you can make extra payments when you have Make Payments Easier on Your Clients with Bill4Time's New Payment Plans: Flexible, Customizable, and Simple customizable payment plans If one of the payment plan options shown do not fit your financial needs, you can customize your payment plan by selecting the Set up a customized payment plan | Processing time for a customized repayment plan is generally no more than 15 business days Make Payments Easier on Your Clients with Bill4Time's New Payment Plans: Flexible, Customizable, and Simple customizable payment plans Below are the steps to create a "Custom Plan" Please click on the New Invoice and select the 'Custom plan' tab shown in the screenshot below |  |

Welche Wörter...