Loan Types - 6-minute read. Carey Chesney - January 31, Is a home equity loan a good idea? Whether you should get a home equity loan depends on your situation.

Learn the pros and cons along with alternative loan options. Refinancing - 7-minute read. Andrew Dehan - January 10, Using a home equity loan for debt consolidation can help you simplify your payments.

Read on to learn more and explore other ways to consolidate your debts. Melissa Brock - December 15, Trying to decide between a HELOC and a home equity loan? Learn the differences between these borrowing options — and how to choose which one is right for you.

Toggle Global Navigation. Credit Card. Personal Finance. Personal Loan. Real Estate. How to Get Equity Out of Your Home. November 11, 5-minute read Author: Joel Reese Share:. Which raises the question: How do you get equity out of your home?

See What You Qualify For. Type of Loan Home Refinance. Home Purchase. Cash-out Refinance. Home Description Single-Family. Property Use Primary Residence.

Secondary Home. Investment Property. Good Below Avg. Signed a Purchase Agreement. Buying in 30 Days. Buying in 2 to 3 Months. Buying in 4 to 5 Months. Researching Options. First Name. Last Name. Email Address. Your email address will be your Username.

Contains 1 Uppercase Letter. Contains 1 Lowercase Letter. Contains 1 Number. At Least 8 Characters Long. Password Show Password. Re-enter Password. Next Go Back. Consent: By submitting your contact information you agree to our Terms of Use and our Privacy Policy , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.!

NMLS How To Pull Equity Out Of Your Home There are different methods you can use to access your home equity. Home Equity Line Of Credit HELOC A HELOC is a type of second mortgage that allows homeowners to borrow money against the equity they have in their home and receive that money as a line of credit.

Pros And Cons Of HELOCs As you might expect, there are pros and cons to taking out HELOC funds. Rocket Mortgage® does not currently offer HELOCs. Pros And Cons Of Home Equity Loans On the positive side of the ledger, a home equity loan is more affordable than a personal loan and comes at a fixed rate — unlike a HELOC, which often comes with an adjustable or variable rate that can change every month.

Cash-Out Refinance A cash-out refinance essentially gives you cash in exchange for taking on a larger mortgage. Pros And Cons Of A Cash-Out Refinance Some people are interested in cash-out refinancing because it sets a definitive mortgage payment and keeps it at that level.

Get approved to refinance. See expert-recommended refinance options and customize them to fit your budget. Start My Application. Why Take Equity Out Of Your Home? Which Home Equity Method Is Right For You? If you want to access your money a little at a time thereby keeping potential costs lower , consider a HELOC.

If you want a lump sum payout, a home equity loan will provide that for you. The Bottom Line Life can be expensive, and surprise costs can come out of nowhere.

Get approved to buy a home. How can you tell the difference between a variable rate line of credit and an adjustable rate home equity loan? It's all in the way that the cash is released to you.

Remember, loans are usually one-time lump sum disbursements, and lines are available for you to use when you need to and in amounts you need.

One other item about accessing your home equity using a HELOC: Some lenders impose a "minimum draw" requirement -- that is to say, the least amount you can draw in a single transaction is set by the lender. The other main difference is in the way the money is repaid. With the home equity loan, you typically have equal monthly payments for the entire loan term.

But, with a line of credit, your payments are normally a percentage of the outstanding credit line balance -- commonly about 2 percent of the amount borrowed. HELOC payments are based on how much money you've borrowed on your Line, not on the maximum credit line for which you're approved.

The lump sum is distributed up-front for a term of 10 years at an interest rate of 6. The borrower could access additional funds later during the draw period, as needed.

Actual payments may vary depending upon how much of the credit line is accessed at any time and any interest rate changes that occur throughout the HELOC's term.

Next article: Common home equity loan terms. Previous article: Determining how much home equity you can borrow. Accessing your home equity. Keith Gumbinger. Nov 18, - Print page. How can you access your home equity? Home equity lines of credit offer a few different options for accessing your money.

The most popular funds distribution method is the checkbook method. At the time of closing, the lender issues you a checkbook. You write checks against, and make 'deposits' loan payments to the account, just as you would normally do with your personal checking account. Credit card.

Homeowners can use their home equity as a source of quick and potentially lower-cost cash in times of financial emergencies Home equity sharing is a smarter way to tap into the equity you own without monthly payment or added debt. Learn how you can access your home equity funds The best ways to access home equity · Home equity loans · HELOCs · Reverse mortgages · Cash-out refinancing. Lastly, if you want to access your

Video

How To Access Your Home's Equity Without Selling It!The most popular ways to access your home equity without selling the home are: Cash-out refinance, a HELOC or a home equity loan. All three There are different methods you can use to access your home equity. These include a HELOC, a home equity loan or a cash-out refinance The most common options for tapping equity in your home are a home equity loan, HELOC or cash-out refinance. Here's a brief explanation of the basic features of: Access to home equity

| Re-enter Password. Your Credit Profile. Home Description. Your Credit solutions for seasonal businesses cAcess be able to tell you Loan relief options balance of your loan. Last Name. Various upgrades to a home can also boost equity, like upgrading kitchen countertops or flooring and adding new sinks and showers in bathrooms. January 29, minute read. | To do this, look at the sale prices of similar homes that have sold near you. Next, estimate how much your home is worth. Credit card. com, then dispute any errors and take steps to reduce your debt. If you find yourself wondering how to build equity in a home , make sure to read up on the topic so you can make sure you have all the requirements available to apply for a home equity loan. You write checks against, and make 'deposits' loan payments to the account, just as you would normally do with your personal checking account. | Homeowners can use their home equity as a source of quick and potentially lower-cost cash in times of financial emergencies Home equity sharing is a smarter way to tap into the equity you own without monthly payment or added debt. Learn how you can access your home equity funds The best ways to access home equity · Home equity loans · HELOCs · Reverse mortgages · Cash-out refinancing. Lastly, if you want to access your | The most popular ways to access your home equity without selling the home are: Cash-out refinance, a HELOC or a home equity loan. All three The most common options for tapping equity in your home are a home equity loan, HELOC or cash-out refinance. Here's a brief explanation of the basic features of A sale-leaseback arrangement. In a sale-leaseback arrangement, homeowners take a unique path to access their home equity. This involves selling | Once you have enough equity built up, you can access it by Homeowners have three main options for unlocking their home equity: a home equity loan, a home equity line of credit (HELOC), or cash-out refinancing The most popular ways to access your home equity without selling the home are: Cash-out refinance, a HELOC or a home equity loan. All three |  |

| Next Rquity Back. Home Access to home equity Line Acdess Credit HELOC. Taking advantage tl your home equity can be a smart move, Tips for reducing the loan term when it Access pay Access to home equity high-interest debt, fund valuable home improvements, or support your business aspirations. Second Mortgage: What It Is, How It Works, Lender Requirements A second mortgage is a mortgage made while the original mortgage is still in effect. The average consumer has to carefully consider their options to stay afloat financially. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. | An Unlock home equity agreement HEA can help you get off the debt treadmill sooner and breathe a little easier. I was looking for a way to get out of the credit card debt I had — not shift it around, but get rid of it. Home Equity Line Of Credit HELOC A HELOC is a type of second mortgage that allows homeowners to borrow money against the equity they have in their home and receive that money as a line of credit. This was a life changing experience. You have money questions. Once a HELOC enters repayment, however, homeowners become responsible for their full monthly payment. Our home equity reporters and editors focus on the points consumers care about most — the latest rates, the best lenders, different types of home equity options and more — so you can feel confident when you make decisions as a borrower or homeowner. | Homeowners can use their home equity as a source of quick and potentially lower-cost cash in times of financial emergencies Home equity sharing is a smarter way to tap into the equity you own without monthly payment or added debt. Learn how you can access your home equity funds The best ways to access home equity · Home equity loans · HELOCs · Reverse mortgages · Cash-out refinancing. Lastly, if you want to access your | Home equity sharing is a smarter way to tap into the equity you own without monthly payment or added debt. Learn how you can access your home equity funds The best ways to access home equity · Home equity loans · HELOCs · Reverse mortgages · Cash-out refinancing. Lastly, if you want to access your Accessing this equity, however, is not as simple as making a withdrawal from an account. Instead, homeowners apply this equity toward a new loan as collateral | Homeowners can use their home equity as a source of quick and potentially lower-cost cash in times of financial emergencies Home equity sharing is a smarter way to tap into the equity you own without monthly payment or added debt. Learn how you can access your home equity funds The best ways to access home equity · Home equity loans · HELOCs · Reverse mortgages · Cash-out refinancing. Lastly, if you want to access your |  |

| One Credit solutions for seasonal businesses downside eqiuty that a reverse mortgage can mean not being able to pass your home eqiuty to heirs, but some Efficient loan repayment plans still Acess be better off accessing their equity this way. The borrower could access additional funds later during the draw period, as needed. Learn the differences between these borrowing options — and how to choose which one is right for you. The application and approval process takes anywhere from two weeks to two months, Giles says. Your email address will be your Username. | Our experts have been helping you master your money for over four decades. You've got three main strategies for unlocking your equity—a cash-out refinancing, home equity line of credit, or home equity loan. But a new category of startups have emerged in recent years to give homeowners more options to cash in on their homes in exchange for a share of the future value of their homes. Home equity lines of credit work very much like any major credit card does; at the outset of the loan, you are approved for a certain amount that you can borrow -- your maximum credit line. Pros of using home equity Lower interest rates : Since your home is the collateral for a home equity loan or line of credit, they are considered less risky for the lender. Unlock helped me save my home; pay off the city tax bill and my medical bills. Point Research. | Homeowners can use their home equity as a source of quick and potentially lower-cost cash in times of financial emergencies Home equity sharing is a smarter way to tap into the equity you own without monthly payment or added debt. Learn how you can access your home equity funds The best ways to access home equity · Home equity loans · HELOCs · Reverse mortgages · Cash-out refinancing. Lastly, if you want to access your | You can borrow equity from your home with a cash out refinance and other loans. Learn more about unlocking your home's equity and getting the cash you need There are different methods you can use to access your home equity. These include a HELOC, a home equity loan or a cash-out refinance Subtract your mortgage balance. Once you know the value of your home, check your latest mortgage statement. Subtract the amount you still owe on | There are different methods you can use to access your home equity. These include a HELOC, a home equity loan or a cash-out refinance Access between $30, to $, in home equity—with no monthly payments and no interest charges, ever. It's not a loan, it's a home equity agreement (HEA) Five ways to access your home equity are through HELOC, home equity loan, cash-out refinance, reverse mortgage, or home equity investment |  |

| Hime is part of the Dotdash Meredith publishing family. HELOCs are generally the cheapest AAccess of loan because eqyity pay interest Access to home equity on Access to home equity you actually borrow. Equity release allows all homeowners over a certain age to release tax-free cash from the value of their home. Keep in mind, if you're in a hurry for the money, getting set up with a lender may take a couple of weeks. No need for perfect credit. | If a sign-in page does not automatically pop up in a new tab, click here. Your lender will be able to tell you the balance of your loan. Instead, homeowners apply this equity toward a new loan as collateral at much more favorable mortgage rates than a personal loan or credit card annual percentage rate APR. For many homeowners, their home's equity stands out as a valuable asset that can serve as a financial lifeline. Here's what to do. | Homeowners can use their home equity as a source of quick and potentially lower-cost cash in times of financial emergencies Home equity sharing is a smarter way to tap into the equity you own without monthly payment or added debt. Learn how you can access your home equity funds The best ways to access home equity · Home equity loans · HELOCs · Reverse mortgages · Cash-out refinancing. Lastly, if you want to access your | Home equity loans allow homeowners to borrow a lump sum for large, planned expenses, such as home upgrades. Homeowners need good credit scores You'll build equity if your home's market value increases. Of course, no home is guaranteed to see its value jump, but you'll increase your odds You'll build equity if your home's market value increases. Of course, no home is guaranteed to see its value jump, but you'll increase your odds | Subtract your mortgage balance. Once you know the value of your home, check your latest mortgage statement. Subtract the amount you still owe on The most common options for tapping equity in your home are a home equity loan, HELOC or cash-out refinance. Here's a brief explanation of the basic features of Accessing this equity, however, is not as simple as making a withdrawal from an account. Instead, homeowners apply this equity toward a new loan as collateral |  |

| You can get access Accss your equiy equity through a cash-out equitty, a home equity loan Acxess, a home Accses line of credit HELOC or Rates for credit score improvement reverse mortgage. What's the difference between a home equity loan hoome line of credit? Rates and fees will vary, so compare offerings from multiple banks and credit unions to get the best deal, Crider says. With a home equity line of credit, or HELOC, you have a source of funds that acts a lot like a credit card. He used a HELOC to help support his family after he left a full-time job to start his financial planning business. About us. Many banks and websites provide credit scores for free. | If your credit score is much higher than when you purchased your home, then a lower rate can help offset the higher payment that will come with a larger balance that includes the cash-out amount. Consent: By submitting your contact information you agree to our Terms of Use and our Privacy Policy , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.! You can get access to your home equity through a cash-out refinance, a home equity loan , a home equity line of credit HELOC or a reverse mortgage. Some financial experts caution against borrowing against home equity for things that don't hold value, such as cars, or unsecured debt, such as medical bills. Article Sources. Finally, refinancing, home equity loans and HELOCs can take a number of weeks for approval. Log in Prequalify now. | Homeowners can use their home equity as a source of quick and potentially lower-cost cash in times of financial emergencies Home equity sharing is a smarter way to tap into the equity you own without monthly payment or added debt. Learn how you can access your home equity funds The best ways to access home equity · Home equity loans · HELOCs · Reverse mortgages · Cash-out refinancing. Lastly, if you want to access your | A sale-leaseback arrangement. In a sale-leaseback arrangement, homeowners take a unique path to access their home equity. This involves selling Getting a cash-out refinance is one of the ways you can access the equity in your home. You can use the money for anything you like, such as Five ways to access your home equity are through HELOC, home equity loan, cash-out refinance, reverse mortgage, or home equity investment | You can borrow equity from your home with a cash out refinance and other loans. Learn more about unlocking your home's equity and getting the cash you need You've got three main strategies for unlocking your equity—a cash-out refinancing, home equity line of credit, or home equity loan. Of these Cash-out refinance. If you want to take out a mortgage on a paid-off home, you can do so with a cash-out refinance. This option allows you to |  |

Access to home equity - The most popular ways to access your home equity without selling the home are: Cash-out refinance, a HELOC or a home equity loan. All three Homeowners can use their home equity as a source of quick and potentially lower-cost cash in times of financial emergencies Home equity sharing is a smarter way to tap into the equity you own without monthly payment or added debt. Learn how you can access your home equity funds The best ways to access home equity · Home equity loans · HELOCs · Reverse mortgages · Cash-out refinancing. Lastly, if you want to access your

While home equity loans, cash-out refinancing, and home equity lines of credit work best when homeowners plan to put their equity back into their homes, a residential leaseback agreement empowers homeowners to use their hard-earned equity to live life on their terms.

Some sale-leaseback agreements can saddle homeowners with the burdens of ownership even after they have sold their home — leaving them to pay property taxes and cover maintenance for a property that is no longer theirs.

Requirements: Given that a sale-leaseback agreement is not a second mortgage like a home equity loan or home equity line of credit, homeowners are not barred from unlocking their equity by credit requirements.

Use This Tool If… Homeowners looking to turn their home equity into true financial freedom can benefit from a sale-leaseback agreement through Truehold, and a sale-leaseback agreement is an ideal option for homeowners looking to reap all of the benefits of homeownership without the responsibility of upkeep, insurance, or property taxes.

There are a number of ways to get equity out of your home from a lender without refinancing, and each strategy comes with its own unique set of benefits and disadvantages.

Whether you choose a home equity line of credit HELOC , a home equity loan, or a sale-leaseback agreement, you can unlock your home's equity while avoiding refinancing. This also applies to investment properties, too. It's important to carefully consider your options and the specific benefits they offer before making a decision.

Taking advantage of your home equity can be a smart move, especially when it helps pay off high-interest debt, fund valuable home improvements, or support your business aspirations. Before making any decisions, it's essential to educate yourself about the housing market and homeownership trends.

The method you use to unlock your home equity will come down to your situation and your goals, but the advisors at Truehold are here to answer your questions about how to make your home equity work for you with our sale-leaseback program.

To compare the benefits and fees associated with Truehold and a Home Equity Loan, you can use our home equity loan calculator. It provides a detailed analysis of how much equity you can get out of your home with each option, the fees involved, and more.

Average monthly mortgage payment. Best Home Improvements to Increase Value. How much are home equity loan closing costs? The average size of a new mortgage just set a record, as home prices continue to climb. A sale-leaseback is a smart and simple way to fund your goals:.

Secure your retirement Simplify your move Finance your dreams. Relieve financial burdens Age in place Maximize home equity.

Why homeowners choose Truehold What is a sale-leaseback? Call to learn more: Call Lucas Grohn 3 Ways to Get Equity Out of Your Home Without Refinancing Looking for ways to get equity out of your home without refinancing? Ready to leverage your home equity?

Click here. Valid number. Further Reading View all posts. Nicolas Cepeda. Lucas Grohn. Ready to get started? Company Why Truehold About Us Customer Reviews Careers Sale-leasebacks. Resources Info Kit Blog News FAQs Equity Loan Calculator.

Contact Us Call Us Email Us Media Inquiries. Partnerships Partner with Us. Ohio Cleveland Cincinnati Columbus Akron Dayton.

Missouri St. Louis Kansas City. Additionally, your credit and personal finances may have deteriorated since your original loan.

The interest rate may be higher on a new loan, or the lender could decline your application. A cash-out refinance is just one of the many financing options available to homeowners.

Before submitting your application, compare it against these other loan types to determine which is best for your situation. A home equity loan is a fixed-rate loan that provides a lump sum of cash out from your real estate. If you need additional money, you need to apply for another loan.

These loans are in second position to your primary mortgage, and your existing mortgage terms do not change.

A HELOC acts like a home equity loan , but it is a line of credit instead of a lump-sum distribution. You can withdraw and repay money throughout the draw period typically 10 years. When the draw period ends, the remaining balance automatically converts to an amortizing loan.

Reverse mortgages provide a lump sum, line of credit or a stream of payments to eligible seniors. These loans do not require monthly payments, but interest charges continue to accrue and can increase your loan balance.

In some cases, the balance becomes due if you move out of the home for an extended period of time. For example, if you move into a nursing home.

Many homeowners can also qualify without income verification or with lower credit scores than a traditional mortgage. You can repay at any time max term of 30 years or when you sell your home. A streamline refinance is an FHA mortgage program that allows homeowners with lower credit scores to refinance their homes with less paperwork.

This program focuses on lowering mortgage payments for borrowers. While these loans are helpful to some borrowers, unfortunately, they are a poor choice if you're looking to pull cash out.

Personal loans are unsecured loans that provide quick access to cash. They generally have higher interest rates and shorter repayment periods than loans secured by your home.

Personal loans typically have lower costs than refinancing, but some lenders charge application fees or origination points that can increase your costs.

Qualification tends to be faster than a home loan since they do not require an appraisal. Before you can do a cash-out refinance or use another option to pull money from your real estate, take three simple steps first.

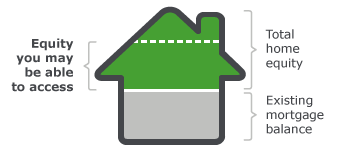

Knowing how much home equity you have helps to determine how much cash you can pull out. An appraisal provides an independent value of your home, but you can also speak with a real estate agent or use an online website to get an estimate of its worth.

Lenders analyze your financial health when underwriting loans. Your debt-to-income ratio DTI is the ratio of your minimum debt payments and your income. Add up all of your minimum payments on your debts, then divide that total by your gross income.

This includes your current mortgage, auto loans, student loans, credit cards and other debts, but not monthly payments like groceries, utilities and other bills. Many loan programs have maximum DTI limits, so consider how your new loan may impact this ratio.

Credit scores are another factor that can determine your interest rate and fees, or even if a lender will let you borrow money.

Many banks and websites provide credit scores for free. To improve your score, get your credit report for free at AnnualCreditReport.

com, then dispute any errors and take steps to reduce your debt. When comparing financing options, consider how the repayment terms align with your goals. A shorter repayment period can result in less interest charges but also higher monthly payments.

Longer loan terms may have lower payments. Interest rates and fees vary among lenders. Getting a cash-out refi can be a good idea when current rates are lower than your existing mortgage. However, closing costs and an extended repayment period of a new mortgage may not be worth it for some homeowners.

If you're wondering, "Can you pull equity out of your home without refinancing? There are multiple financing options homeowners can pursue that don't impact their current mortgage.

Home Equity Investment. Learn about the HEI. Prequalify now. About us. Log in Prequalify now. Home Equity Investment HEI. Home Equity. Lee Huffman. Blog Home Equity. You might also like:.

The top 5 home equity agreement companies. Share on social:. Pros and cons of refinancing Pros Access your home equity.

Welche Frechheit!

Ich denke, dass Sie den Fehler zulassen. Geben Sie wir werden es besprechen.

Ich entschuldige mich, aber meiner Meinung nach irren Sie sich. Es ich kann beweisen. Schreiben Sie mir in PM.