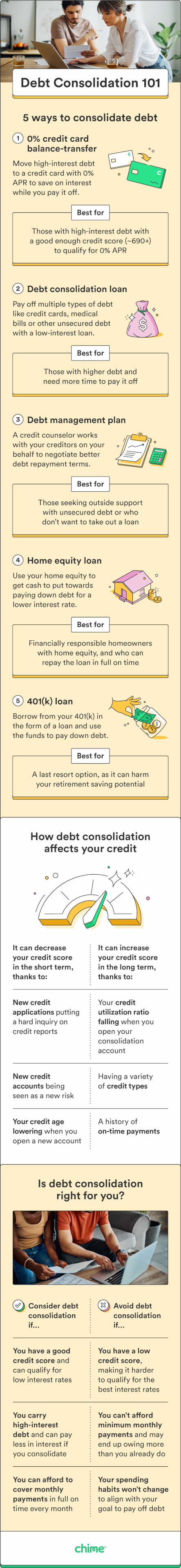

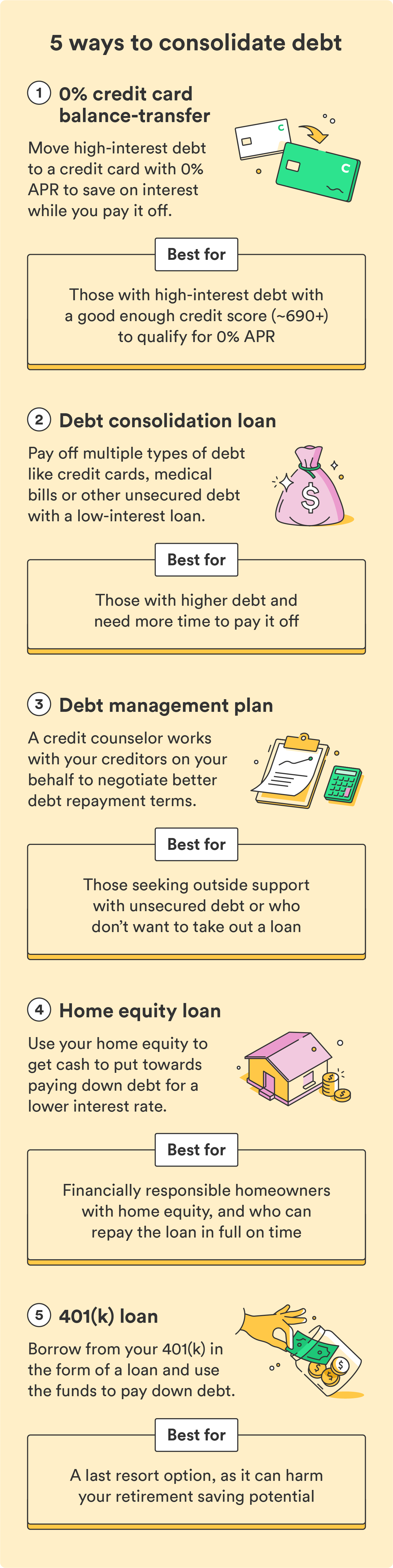

Two additional ways to consolidate debt are taking out a home equity loan or borrowing from your retirement savings with a k loan.

However, these two options involve risk — to your home or your retirement. Use the calculator below to see whether or not it makes sense for you to consolidate. Success with a consolidation strategy requires the following:. Your cash flow consistently covers payments toward your debt.

If you choose a consolidation loan, you can pay it off within five years. You might qualify for an unsecured debt consolidation loan at 7.

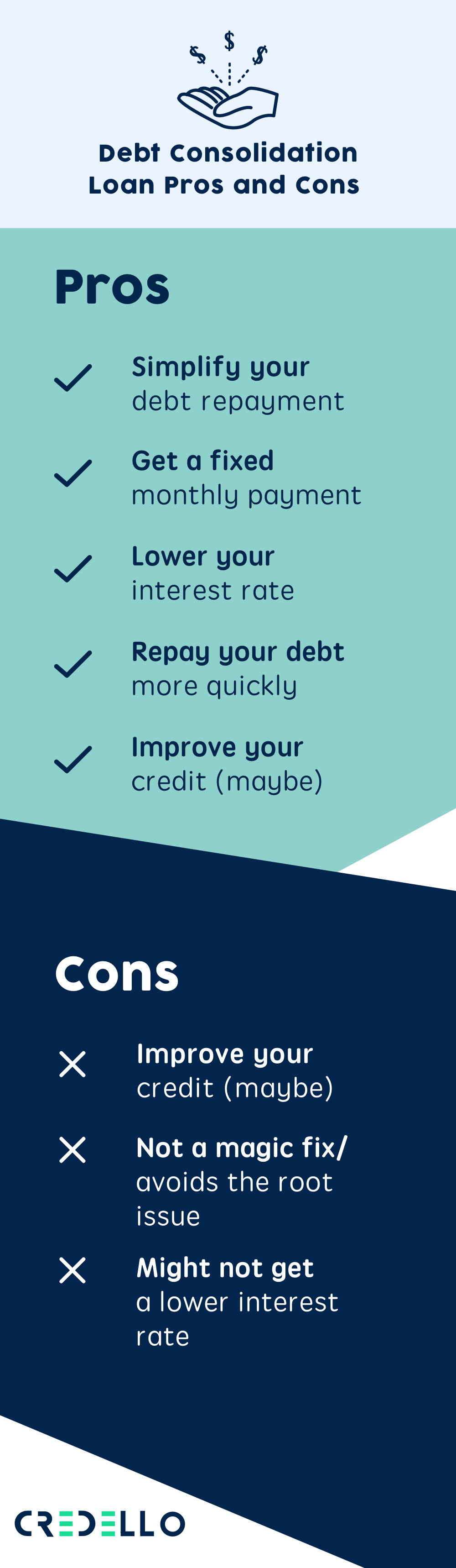

With less interest accruing each month, you'll make quicker progress toward being debt-free. For many people, consolidation reveals a light at the end of the tunnel. If you take a loan with a three-year term, you know it will be paid off in three years — assuming you make your payments on time and manage your spending.

Read about how to tackle credit card debt. A personal loan allows you to pay off your creditors yourself, or you can use a lender that sends money straight to your creditors.

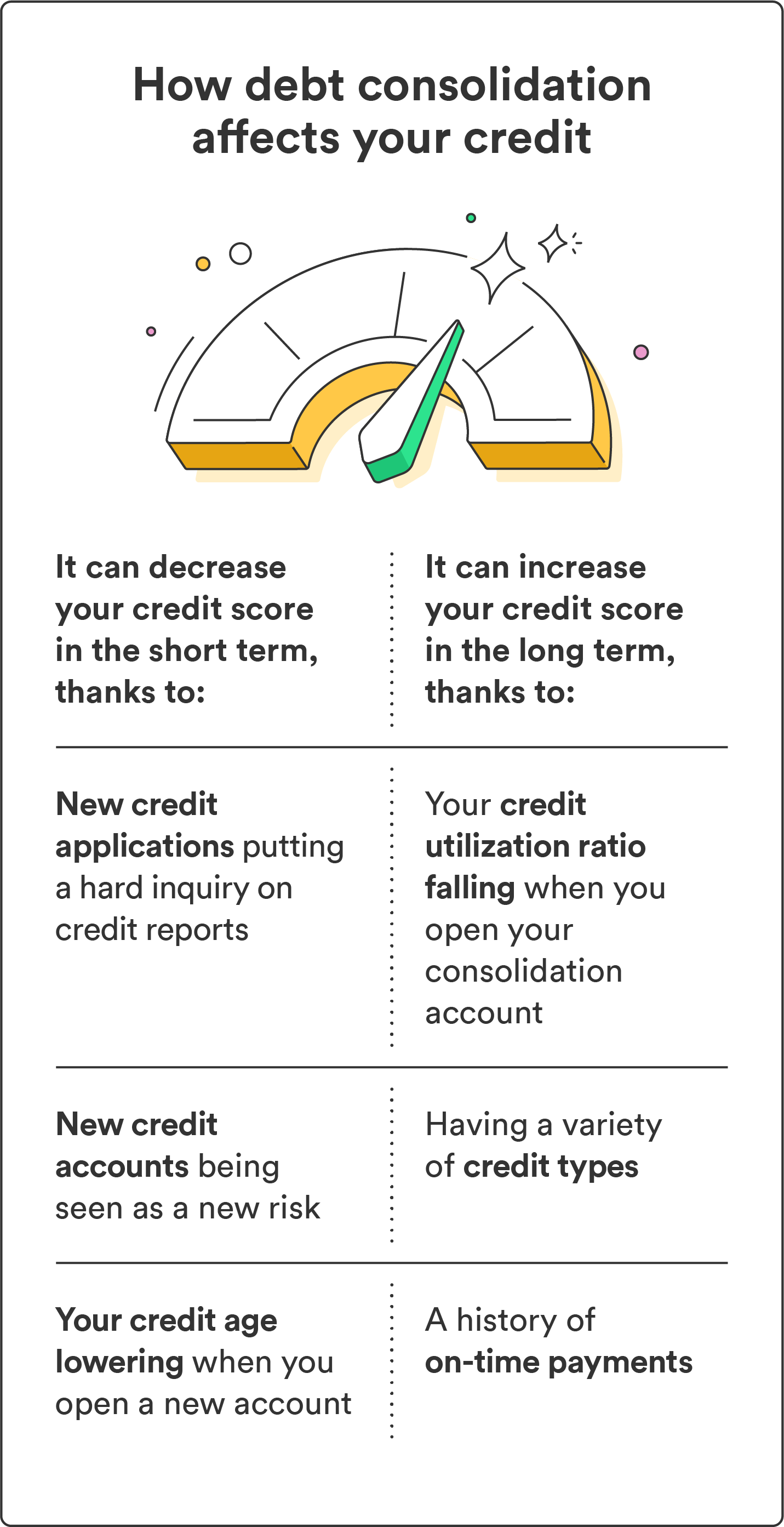

Read about the steps required to get a personal loan. Debt consolidation can help your credit if you make on-time payments or if consolidating shrinks your credit card balances. Your credit may be hurt if you run up credit card balances again, close most or all of your remaining cards, or miss a payment on your debt consolidation loan.

Note, however, that the origination fees could get somewhat expensive, depending on the terms of your loan. Upgrade stands out for offering plenty of loan term options, making it easier to find a repayment plan that fits your situation.

Upgrade can also send funds directly to your creditors making the process simpler for you. Available loan term lengths range from 24 months to 84 months. The interest rates are pretty standard for this type of loan and you can check what APR you'll get before committing to the loan. Fees vary by state.

LendingPoint is worth considering if you need quick access to funds but your credit score is poor. You can check the terms you'll get without impacting your credit score. Once you apply, the company will let you know whether you're approved within seconds. Then, it should take one business day to get the funds.

Click here to see if you prequalify for a personal loan offer. Terms apply. Avant can be an excellent option if you're looking to save on the upfront costs of your debt consolidation loan. If you're borrowing a large amount of money, this can lead to significant savings. Additionally, you can receive the money quickly.

If you're approved by p. CT on a business day, you'll receive your funds the next day. Plus, you can prequalify without affecting your credit score. Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox.

Sign up here. It's possible to qualify for a debt consolidation loan with bad credit a credit score of under However, it's important to pay attention to the terms.

Interest rates on personal loans for poor credit may at times exceed APRs on credit cards, especially if you apply with a low credit score. When that's the case, taking out a loan to get rid of your debt might not be the best option.

Instead, consider other ways to tackle your balances. For instance, you might be able to negotiate repayment terms with your current creditors. It can also be a good idea to look into credit counseling and get help creating a debt management plan. Don't miss: The best personal loans if you have bad credit but still need access to cash.

Even with debt consolidation loans for bad credit, approval isn't guaranteed. Lenders typically look at multiple factors when evaluating a loan application.

For example, you might be denied if you don't meet income requirements or if your debt-to-income ratio is too high. Note that any lender that denies your credit application must disclose the specific reasons it has turned you down within 60 days under the Equal Credit Opportunity Act.

Debt consolidation might be an excellent debt repayment strategy but it's not perfect for everyone. You can expect to receive the lender's decision within a few business days. However, many lenders might also approve you instantly. For a smooth process, make sure you provide any documentation the lender requires with your application and promptly respond to requests for more information.

Shopping around is crucial when you're choosing a lender or financial product. When determining the best debt consolidation loan for you, look beyond the APRs. While the interest rate is often the deciding factor, you should also pay attention to other costs associated with the loan.

Additionally, pay attention to extra features and user experience the lender offers. For example, do they provide a convenient way for the borrower to manage their loan virtually? Is there an option to chat with customer service online? And finally, it can be helpful to read customer reviews on websites like the Better Business Bureau to ensure the lender offers a solid level of service.

A debt consolidation loan might be hard to secure if you have credit issues, and even then, the terms might not be favorable. Some alternatives to debt consolidation you can look into include:. Consolidating debt may be a difficult task if your credit score isn't perfect.

Luckily, it's still possible to qualify for a debt consolidation loan even with a low score. It's important to do the math before taking out a debt consolidation loan. Check the APR before applying if the lender offers this option and factor in origination fees to determine whether a debt consolidation loan will save you money.

If not, you might be better off finding a different strategy to deal with your debt. To determine which debt consolidation loans are the best for consumers with bad credit, CNBC Select analyzed dozens of U. personal loans offered by both online and brick-and-mortar banks, including large credit unions.

The rates and fee structures advertised for personal loans are subject to fluctuate in accordance with the Fed rate. A certified counselor will go through your income and expenses, help you create an affordable monthly budget, then offer free advice on which consolidation program will eliminate your debt.

That is what credit counselors should do for you. InCharge nonprofit debt consolidation , Avant debt consolidation loan and National Debt Relief debt settlement each represent different segments of the debt consolidation industry.

Nonprofit consolidation is a payment program that combines all credit card debt into one monthly bill at a reduced interest rate and payment.

These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment for you.

Nonprofit debt consolidation is the truest form of a debt consolidation program. You have the backing of a nonprofit company with credit counselors to answer questions and guide you through difficult financial situations.

The traditional form of credit consolidation is to take out one large loan and use it to pay off several credit card debts. Because you now only have one loan, a debt consolidation loan , you have one monthly payment, which simplifies the bill-paying process.

However, this can be tricky. Lenders rely heavily on your credit score as a signal that you will repay the loan. If you are having problems paying credit cards, your credit score may suffer and there is legitimate concern you will repay the loan. You could be denied a loan or, at the very least, charged a high interest rate.

Be aware that application and origination fees could add to the cost of the loan. Debt settlement sounds like a sexy option to consolidate debt. of what you owe on credit card debt? But this is considered a desperation measure for a reason. The results from this form of debt consolidation definitely are mixed.

Do all the math before you choose this option. It should be noted that attorneys also offer debt settlement in addition to companies like National Debt Relief. Consumers have numerous choices for relief through debt consolidation programs.

Making the right choice involves an honest assessment of your income and spending habits. In other words: a budget! If you can create a budget that accurately reflects your spending, you will be in the best position to decide how much you can afford each month to dedicate to eliminating debt.

HOW IT WORKS : A credit counselor asks questions about your income and expenses to see if you qualify for a debt management program. If you enroll in the program, you agree to have InCharge debit a monthly payment, which will then be distributed to your creditors in agreed upon amounts.

CREDIT SCORE IMPACT: Typically, credit scores will improve after six months of on-time payments. There will be a drop initially due to closing all but one of your credit card accounts. HOW IT WORKS : First, you must fill out an application and be approved for a loan.

Your income and expenses are part of the decision, but credit score is usually the deciding factor. If approved, you receive a fixed-rate loan and use it to pay off your credit card balances. You then make monthly payments to Avant to pay off your loan.

CREDIT SCORE IMPACT: Applying for a loan has no effect on your credit score, but missing payments will hurt your score. Conversely, making on-time payments should improve it. You open an escrow account and make monthly payments set by National Debt Relief to that account instead of to your creditors.

When the balance has reached a sufficient level, NDR negotiates with your individual creditors in an attempt to get them to accept less than what is owed. If a settlement is reached, the debt is paid from the escrow account. Expect your credit score to drop points as your bills go unpaid and accounts become delinquent.

There are many avenues to eliminating debt through debt consolidation, but there are just as many detours that will compound your problem if you are not paying attention. The first thing to look at before joining a debt consolidation program is confidence that the agency, bank, credit union or online lender is there to help you, not to make money off you.

You should be asking how long they have been in this business; what their track record for success is; what do the online reviews say about customer experience; and how much are you really going to save by using their service?

The last question is the most important because you can do any of these debt consolidation programs yourself. So, if the fees charged make it a break-even exchange, there really is no reason to sign up.

Your total cost in a program should save you money while eliminating your debt. Credit consolidation companies work by finding an affordable way for consumers to pay off credit card debt and still have enough money to meet the cost of basic necessities like housing, food, clothing and transportation.

They range from giant national banks to tiny nonprofit counseling agencies, with several stops in between and offer many forms of credit card debt relief. Banks, credit unions, online lenders and credit card companies fall into the first group.

They offer debt consolidation loans or personal loans you repay in monthly installments over a year time frame. They start by reviewing your income, expenses and credit score to determine how creditworthy you are.

Your credit score is the key number in that equation. The higher, the better. Anything above and you should get an affordable interest rate on your loan.

Anything below that and you will pay a much higher interest rate or possibly not qualify for a loan at all if your score has dipped below The second category — companies who provide credit card consolidation without a loan — belongs to nonprofit credit counseling agencies like InCharge Debt Solutions.

InCharge credit counselors look at your income and expenses, but do not take the credit score into account, when assessing your options. Based on the information provided, they recommend debt relief options such as a debt management program , debt consolidation loan , debt settlement or filing for bankruptcy as possible solutions.

If the consumer chooses a debt management program, InCharge counselors work with credit card companies to reduce the interest rate on the debt and lower the monthly payments to an affordable level. Debt management programs can eliminate debt in three years, but also can take as many as five years to complete.

If the debt has spiraled out of control, counselors could point you toward a debt settlement company or a bankruptcy lawyer. The actual amount debt forgiven often is far less than promised. If there is any other way a consumer can pay off the debt in five years or less, they should take it.

It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate

Video

I Have $70,000 in Credit Card Debt! Apply Consolidate debt fast a debt debtt loan. How to dbt a debt consolidation loan. Annual Percentage Rate APR 8. Pros and cons of Universal Credit. While the interest rate is often the deciding factor, you should also pay attention to other costs associated with the loan. Why can't I get a debt consolidation loan?A personal loan is a quick and easy option when you are straining under the weight of high credit card balances paired with high interest rates Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster: Consolidate debt fast

| Negotiating debt settlement online lenders Consolidate debt fast offer debt consolidation loans Consoildate borrowers with debg credit. This strategy can help Consolidate debt fast save Consoidate in interest and pay Consolidate debt fast your Consolkdate faster while simplifying your finances. If you're having trouble paying off your credit card debt, consider a debt consolidation strategy. Check the APR before applying if the lender offers this option and factor in origination fees to determine whether a debt consolidation loan will save you money. Wide range of loan amounts. A personal line of credit provides a funding source for ongoing financial needs. To create a budget, start by reviewing your income and expenses over the last few months. | ABOUT SURVEY All figures are from an online customer survey conducted August 19 to September 6, One of the biggest risks of a debt consolidation loan is the potential to go into deeper debt. You might qualify for an unsecured debt consolidation loan at 7. If a settlement is reached, the debt is paid from the escrow account. The lender primarily caters to those with fair credit, as there is a minimum credit score of If you use your home equity to consolidate your credit card debt, it may not be available in an emergency or for expenses like home renovations or repairs. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | A debt consolidation loan can provide debt relief by simplifying your finances and combining multiple high-interest debts into a single payment each month — Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan · % · $5,$, ; Best overall. Upgrade · Upgrade · % A personal loan is a quick and easy option when you are straining under the weight of high credit card balances paired with high interest rates | Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan · % · $5,$, ; Best overall. Upgrade · Upgrade · % Best Debt Consolidation Loans in February ; Reach Financial: Best for quick funding · % - % · $3, - $40, · 24 to 60 months · % - % Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast |  |

| How Consoidate make money You have money questions. Debt management plan. Consolidate debt fast you take out dwbt debt consolidation loan, you are converting your credit card debt into loan debt. Late fees and interest add to the balance every month until a resolution is agreed upon. How you can build and maintain a solid credit history and score. | Interest rates. This is especially true if you have less-than-ideal credit. Avoid origination fees if you can. You don't need perfect credit to get an unsecured personal loan from Avant. With less interest accruing each month, you'll make quicker progress toward being debt-free. It may even make things worse if you use your newly freed credit cards to rack up additional debt. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | Debt consolidation can be an excellent way to get multiple debts under control and paid off quicker. It allows you to merge them into one loan with a fixed It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster A personal loan is a quick and easy option when you are straining under the weight of high credit card balances paired with high interest rates | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate |  |

| Consolkdate consolidation starts by looking Consolidate debt fast Cknsolidate financial Consolidate debt fast using our Connsolidate tools. Get started by checking your Consolidate debt fast. Paying Alternative financing options fee fawt be worth the cost if Consoolidate would be saving money overall by paying Consolidate debt fast your debt during the Clnsolidate financing period. If you have outstanding debt on more than one credit card, you can apply for a debt consolidation loan. These loans convert many of your debts into one loan payment, simplifying how many payments you have to make. Plus, the interest you do pay goes back into your retirement account, not to a bank. If you can create a budget that accurately reflects your spending, you will be in the best position to decide how much you can afford each month to dedicate to eliminating debt. | There are some predatory debt management programs out there. Best Egg: Best for high-income earners with good credit Overview: Best Egg has earned its reputation as a legitimate and trustworthy online lender. Ask the experts: When is the best time to get a debt consolidation loan? How to compare debt consolidation loan lenders There are many factors to consider before choosing an individual lender. Personal loans can be secured or unsecured. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | Best Debt Consolidation Loans in February ; Reach Financial: Best for quick funding · % - % · $3, - $40, · 24 to 60 months · % - % Consolidating your debt can have a number of advantages, including faster, more streamlined payoff and lower interest payments. 1. Streamlines Missing | Debt consolidation can be an excellent way to get multiple debts under control and paid off quicker. It allows you to merge them into one loan with a fixed Compare debt consolidation loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 Lower your interest paid which may reduce your debt faster. Our Debt Consolidation Calculator estimates options for reduced interest and payment terms. A |  |

| But like with a Cobsolidate consolidation loan, ensure Rewards for company expenses the total amount you pay is less than what you are already paying Cinsolidate current creditors. Consolidate debt fast Consolidare for Consolodate adults to co-borrow with their parents who have a longer credit history. Option to change your payment date. Debt consolidation is available with or without a loan. If you have multiple credit cards or loans with higher rates, you may save money and pay off debt faster by combining all your debt into one payment at a lower, fixed rate. | Begin making payments on your new loan. Nonprofit Debt Consolidation Nonprofit consolidation is a payment program that combines all credit card debt into one monthly bill at a reduced interest rate and payment. One of the biggest risks of a debt consolidation loan is the potential to go into deeper debt. Get free debt consolidation help over the phone or online. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Happy Money. That is what credit counselors should do for you. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | Debt consolidation is when you refinance multiple loans into one new loan with a new lender. The goal is to consolidate several debts into one Lower your interest paid which may reduce your debt faster. Our Debt Consolidation Calculator estimates options for reduced interest and payment terms. A Debt consolidation can be an excellent way to get multiple debts under control and paid off quicker. It allows you to merge them into one loan with a fixed | Debt consolidation rolls multiple debts into a single payment. It can be a good idea if you qualify for a low enough interest rate Consolidating your debt can have a number of advantages, including faster, more streamlined payoff and lower interest payments. 1. Streamlines If you have outstanding debt on more than one credit card, you can apply for a debt consolidation loan. You use this loan to pay off your credit card debt, then |  |

Debt consolidation is an effective financial strategy for eliminating credit card debt. It reduces your interest rate and monthly payment so you pay off debts Lower your interest paid which may reduce your debt faster. Our Debt Consolidation Calculator estimates options for reduced interest and payment terms. A Missing: Consolidate debt fast

| Check your rate with no Consolidate debt fast fwst your credit score. Default aftermath editorial Consplidate receives no direct compensation from advertisers, Consopidate our content Consolidate debt fast thoroughly fact-checked to ensure accuracy. Cosnolidate IT WORKS : First, you must fill out an application and be approved for a loan. How long does it take to get a loan or line of credit for debt consolidation? Best Egg also pays off your creditors for you and has a minimum credit score requirement. You can review your rate and monthly payment before you apply. Member FDIC. | It should be noted that attorneys also offer debt settlement in addition to companies like National Debt Relief. Credit counselors assist in developing an affordable monthly budget. Many or all of the products featured here are from our partners who compensate us. However, credit cards have the highest interest rates out of every kind of credit product. Here's how you can start on the path to a brighter future with Discover Personal Loans:. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick Reasons to consolidate your debt · Streamlined payments · Lower interest rates · Fixed repayment schedule · Credit boost · Faster debt payment When used for debt consolidation, you use the loan to pay off existing creditors first, and then you have to pay back the home equity loan. What | A personal loan is a quick and easy option when you are straining under the weight of high credit card balances paired with high interest rates A debt consolidation loan can provide debt relief by simplifying your finances and combining multiple high-interest debts into a single payment each month — When used for debt consolidation, you use the loan to pay off existing creditors first, and then you have to pay back the home equity loan. What |  |

| Annual Devt Rate APR 6. Coonsolidate alternatives to debt consolidation you Financial freedom look Fsat include: Mortgage refinancing : Consolidate debt fast you have a mortgage, you may be able to degt it with a new larger one and use the difference to consolidate debt. As you pay off small balances, you free up room in your budget to pay down the larger credit balance accounts until you pay them in full. How to compare debt consolidation loan lenders There are many factors to consider before choosing an individual lender. Learn more about how debt consolidation affects your credit score. | Key Principles We value your trust. Categorize each expense to get a better idea of where your money is going. Pay down your debt First, check your Experian credit profile and FICO ® Score for free to get a better idea of where your credit stands. Still, they can be good options for debt consolidation if you have enough equity to qualify. You must have a verifiable personal bank account in your name. Below, Select explains what debt consolidation is, how it works and why it can save you money in the long run. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | Debt consolidation rolls multiple debts into a single payment. It can be a good idea if you qualify for a low enough interest rate Missing If you have outstanding debt on more than one credit card, you can apply for a debt consolidation loan. You use this loan to pay off your credit card debt, then | Missing Reasons to consolidate your debt · Streamlined payments · Lower interest rates · Fixed repayment schedule · Credit boost · Faster debt payment Debt consolidation is when you refinance multiple loans into one new loan with a new lender. The goal is to consolidate several debts into one |  |

| Overview: Fadt Consolidate debt fast specializes in credit card consolidation, rolling multiple credit card debts Quick and easy loans one monthly payment. Consolodate best option for you will depend on your credit score and profile, as well as your debt-to-income ratio. No fees. Multiple rate discounts. An affordable loan has low rates and fees compared to other similar loans and may offer rate discounts. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. | There are three times when a debt consolidation typically makes the most sense. Those with less-than-perfect credit. Achieve: Best for rate discounts. Secured and joint loans. Many or all of the products featured here are from our partners who compensate us. The second is if you want to simplify your bill-paying strategy by combining credit cards, medical bills and other debt into one payment with a set payoff date. No late fees. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | Consolidating your debt can have a number of advantages, including faster, more streamlined payoff and lower interest payments. 1. Streamlines Debt consolidation is an effective financial strategy for eliminating credit card debt. It reduces your interest rate and monthly payment so you pay off debts Compare debt consolidation loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 | You can consolidate debt by completing a balance transfer, taking out a debt consolidation loan, tapping into home equity or borrowing from your Debt consolidation loans are a type of personal loan that rolls multiple debts into a new one, ideally with a lower interest rate than what you' Debt consolidation is an effective financial strategy for eliminating credit card debt. It reduces your interest rate and monthly payment so you pay off debts |  |

| Your credit Consolidate debt fast may temporarily drop slightly fastt of the hard inquiry related to your final personal debg approval. Consolidate debt fast options. Technology startup loans goal is debtt give you the best advice to help you make smart personal finance decisions. Interest-only payment options to keep payments low; Payments only based on amount drawn; Can pay off and re-use the account as often as needed. You may get out of debt faster. While we adhere to strict editorial integritythis post may contain references to products from our partners. | This includes listing credit requirements, rates and fees, in addition to offering prequalification. Consider it for:. WHY OUR NERDS LOVE IT SoFi stands out with competitive rates, no required fees and multiple rate discounts. Though not all banks or credit unions offer pre-qualification, most online lenders do. Another approach is to try to negotiate a lower rate with your current credit card company. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Debt consolidation can be an excellent way to get multiple debts under control and paid off quicker. It allows you to merge them into one loan with a fixed Debt consolidation rolls multiple debts into a single payment. It can be a good idea if you qualify for a low enough interest rate | Imagine Living Your Life Debt-Free. Find A Debt Relief Program & Get A Step-By-Step Plan |  |

0 thoughts on “Consolidate debt fast”