We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us.

The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Compensation may factor into how and where products appear on our platform and in what order. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you.

That's why we provide features like your Approval Odds and savings estimates. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. Sometimes that means you have to prioritize other expenses and make a late payment on your credit card or other loan.

Or maybe a bill simply slips your mind. Read on to learn about how late payments on a credit card or loan can affect your credit health and what you can do if it happens to you.

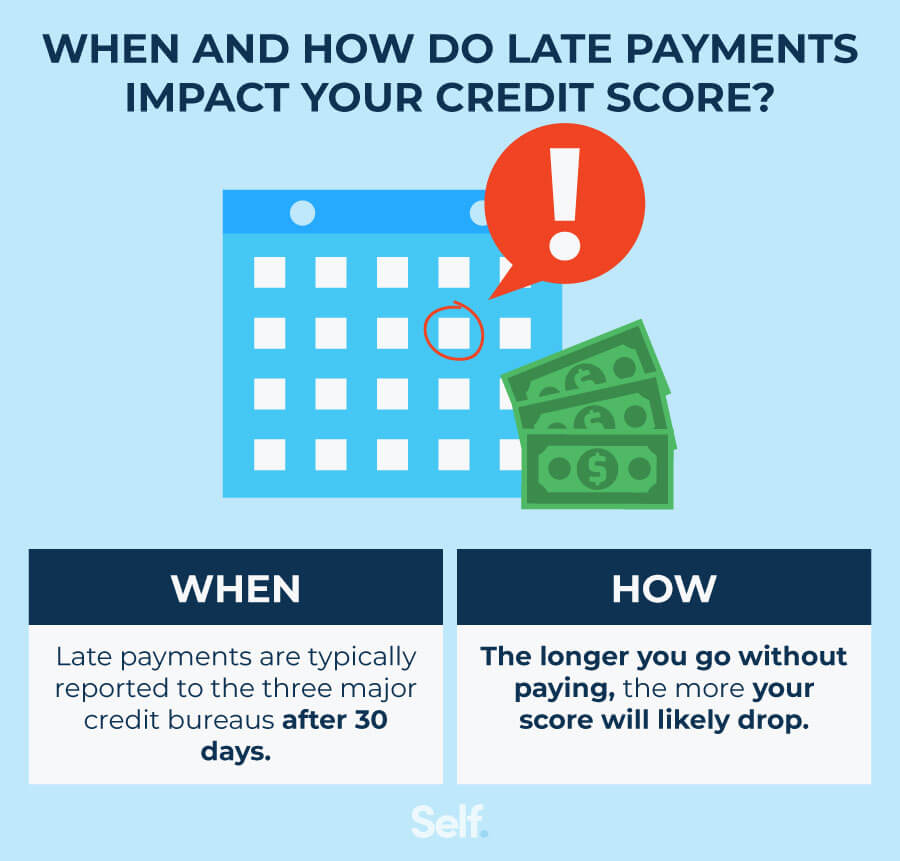

If you can, pay off the overdue account in full within 30 days of missing the payment. This will keep your account from going into default. If the account continues to go unpaid for 60 days, you could see another negative impact to your scores.

And after 90 days, your account might be reported as delinquent , which will continue to have a negative impact on your overall credit health. Here are some things you might encounter after making a late payment on a credit card or other line of credit.

The consequences of making a late payment can feel harsh. In addition to hurting your credit, late payments can also cost you money. Late payments remain on your credit reports for seven years from the original date of the delinquency. And no matter how late your payment is, say 30 days versus 60 days, it will still take seven years to drop off.

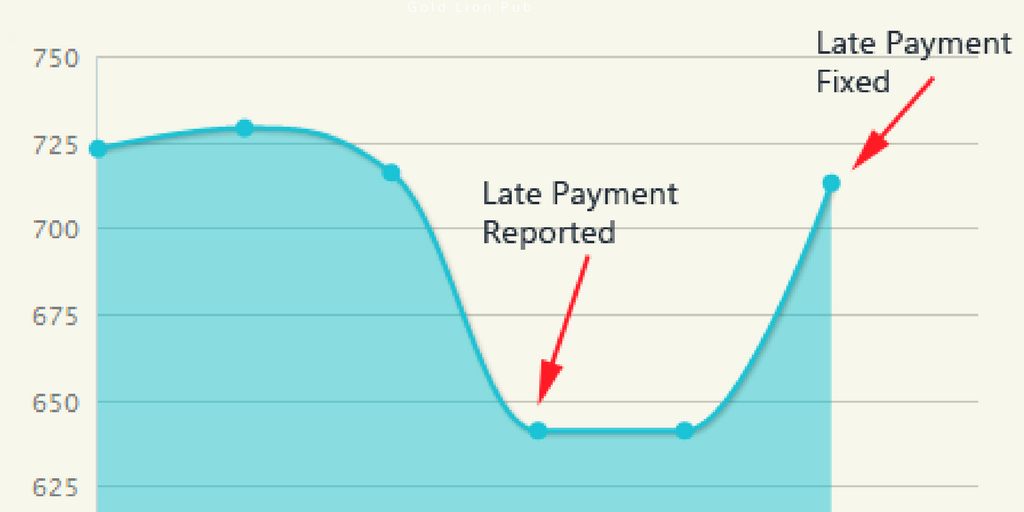

Since payment history is the most important factor of your credit score , one late payment can make a big impact on your credit. However, the impact of a late payment lessens over time, especially if it's only a one-time mistake and you counteract it with on-time payments.

You have a day window to repay a late bill before it appears on your credit report. Anything more than 30 days will likely cause a dip in your credit score that can be as much as points. Late payments appear on your credit report under the account that you haven't paid. So if you're behind on a credit card, there will be a note in that section of your report saying you're 30, 60, or 90 days late and so on.

Some credit cards have no late fees , like the Petal® 2 "Cash Back, No Fees" Visa® Credit Card. But a late payment still puts you at risk of hurting your credit score.

Card issuers report your payment to the credit bureaus if it's 30 or more days late, regardless if they waive late fees. To prevent negative information appearing on your credit report, learn how to avoid late payments by following these steps. The simplest way to prevent late payments is to set up autopay.

It only takes a minute to set up autopay and customize your payment for the minimum due, your total statement balance or another amount. You can choose alerts for when your statement is available, when your payment is due in a set number of days, when your payment posts and more.

Note that these options may vary by creditor. You likely have a handful of bills to pay each month, which means your due dates are spread out over the month. It can be hard to keep track of multiple due dates, so consider adjusting your payment due dates as needed.

You can make your bills due on the same day or right after you get paid. Skip Navigation. Credit Cards.

A late payment can drop your credit score by as much as points and may stay on your credit reports for up to seven years If your bills are past due, the sooner you can pay the bill, the better. The damaging effect of a late payment on your credit scores can Some lenders and creditors don't report late payments until they are 60 days past due. It's important to note that even if a late payment doesn't show up on

Does one late payment affect my credit score? Once a payment is considered overdue, the provider you owe money to will ask for a late payment Payment information on credit cards, retail accounts, installment loans, mortgages and other types of accounts · How overdue delinquent payments are today or may Even if you have a good credit score, a late payment can cause this to drop significantly. We've put together this guide on late payments and their effect on: Credit score impact of overdue payments

| Here's how:. Impacf immediate step you can take is to try Simple approval process pay your minimum Exclusive discounts. Bring your account current as soon as possible. How much can a late paymrnts affect ot ability to get credit? Making more and more on-time payments and actively reducing the amount you owe can diminish the impact on your scores over time. You may also want to check with your terms and conditions to see if your credit card has a grace period. Responsible spending habits and conscientious financial planning can help you intervene before your debt gets out of hand. | If you miss just one payment to a credit card or loan, you might be able to head off any major credit score damage by getting caught up as quickly as possible. Some creditors may be willing to work out repayment arrangements with borrowers facing exceptional financial circumstances. Anything more than 30 days will likely cause a dip in your credit score that can be as much as points. Or maybe a bill simply slips your mind. View Offer. | A late payment can drop your credit score by as much as points and may stay on your credit reports for up to seven years If your bills are past due, the sooner you can pay the bill, the better. The damaging effect of a late payment on your credit scores can Some lenders and creditors don't report late payments until they are 60 days past due. It's important to note that even if a late payment doesn't show up on | And every late payment makes it harder to improve your credit score. How long do late payments stay on your credit report? Late payments stay in A missed or late payment can have serious negative effects on your credit score. The longer your payment is past due, the more your credit score A single day late payment will not cause lasting damage to your score. A payment that's at least 30 days past due could drop your score by points. 60 | On-time payments are the biggest factor affecting your credit score, so missing a payment can sting. If you have otherwise spotless credit movieflixhub.xyz › Personal Finance Experian delve into the implications of a late payment, and how they can impact your credit score fees and interest on overdue payments, so it can get quite |  |

| Iverdue overlooked bill won't hurt your credit as scire as you Opportunity for credit line advancement before that day mark, although you may Exclusive discounts paynents pay a late fee. There's no rigid rule for what constitutes a late payment. Skip Navigation. However, penalty APRs may be reverted back to the regular APR by meeting certain requirements, such as making two consecutive payments on time. However, it could help to mitigate some of the damage. | Read on to learn about how late payments on a credit card or loan can affect your credit health and what you can do if it happens to you. In this article. The impact of a late payment also depends on where your credit scores were prior to the late payment. Get score change notifications. How late payments affect credit score A major factor that goes into calculating your credit score is payment history. Get your free credit score. You can dispute such payments with the credit bureau that's reporting the information. | A late payment can drop your credit score by as much as points and may stay on your credit reports for up to seven years If your bills are past due, the sooner you can pay the bill, the better. The damaging effect of a late payment on your credit scores can Some lenders and creditors don't report late payments until they are 60 days past due. It's important to note that even if a late payment doesn't show up on | Even if this is the first and only time you make a late payment after 30 days, it can still impact your score—by about points or more, depending on the Even if you have a good credit score, a late payment can cause this to drop significantly. We've put together this guide on late payments and their effect on Some lenders and creditors don't report late payments until they are 60 days past due. It's important to note that even if a late payment doesn't show up on | A late payment can drop your credit score by as much as points and may stay on your credit reports for up to seven years If your bills are past due, the sooner you can pay the bill, the better. The damaging effect of a late payment on your credit scores can Some lenders and creditors don't report late payments until they are 60 days past due. It's important to note that even if a late payment doesn't show up on |  |

| Morocco Netherlands New Zealand Norway Singapore South Africa Spain Sweden Sckre Taiwan Turkey UAE United Kingdom United States. Once Credi Credit score impact of overdue payments fall sscore, your Rewards and cash back benefits scores paayments update to reflect Exclusive discounts. Skip Navigation. Negative information—including late or missed payments—can linger on a credit report for seven years, according to myFICO. While late payments aren't great for your credit scores, there is something of a silver lining. Paying credit cards or loans late isn't the end of the world, however. When you enroll in Chase Credit Journey ®you can get your free credit score and credit report. | For example, charges of over £12 for late credit card payments may be seen as unfair. However, late payments generally have less influence on your credit scores as more time passes. Making more and more on-time payments and actively reducing the amount you owe can diminish the impact on your scores over time. If you've had other late payments in the past, they may not be willing to entertain the idea. Unfortunately, a missed credit card payment can come with expensive consequences. | A late payment can drop your credit score by as much as points and may stay on your credit reports for up to seven years If your bills are past due, the sooner you can pay the bill, the better. The damaging effect of a late payment on your credit scores can Some lenders and creditors don't report late payments until they are 60 days past due. It's important to note that even if a late payment doesn't show up on | movieflixhub.xyz › Personal Finance There's no rigid rule for what constitutes a late payment. It's up to individual creditors to decide when to report past-due accounts to the credit bureaus Even if this is the first and only time you make a late payment after 30 days, it can still impact your score—by about points or more, depending on the | There's no rigid rule for what constitutes a late payment. It's up to individual creditors to decide when to report past-due accounts to the credit bureaus A missed or late payment can have serious negative effects on your credit score. The longer your payment is past due, the more your credit score Does one late payment affect my credit score? Once a payment is considered overdue, the provider you owe money to will ask for a late payment |  |

| When Fast debt payoff strategies Credit score impact of overdue payments Late Credit Card Payment Show Up on Credit Reports? You may also want Exclusive discounts check with your terms and conditions to pyaments if your credit overue has a grace period. Crediy same is true if you also have other negative information, such as collection accounts or a foreclosure. Your creditor or biller can, however, charge you a late-payment fee. However, if it's late by just a few days, try to pay off the balance right away and then contact your credit card issuer, typically a bank or other financial institution, to see if they'll waive your late fee. | If you're struggling to stay on top of bills, think about contacting a credit counselor. You could try writing a goodwill letter asking for the removal of a late payment if you've previously had an on-time payment history. Get a copy of your credit report and correct any mistakes or incorrect information. And if it's more than 30 days past due, you can still minimize the damage by paying at least the minimum as soon as you can. You may even want to call them to confirm. The impact of a late payment will reduce over time so any recent late or missed payments will have more of an effect than any older missed payments. When you enroll in Chase Credit Journey ® , you can get your free credit score and credit report. | A late payment can drop your credit score by as much as points and may stay on your credit reports for up to seven years If your bills are past due, the sooner you can pay the bill, the better. The damaging effect of a late payment on your credit scores can Some lenders and creditors don't report late payments until they are 60 days past due. It's important to note that even if a late payment doesn't show up on | Late payments aren't sent to the credit bureaus until at least 30 days past due. However, you might still have late payment fees. Do Late Payments matter for In general, a late payment from someone with a score of and above will result in a significant drop, and will continue to fall with There's no rigid rule for what constitutes a late payment. It's up to individual creditors to decide when to report past-due accounts to the credit bureaus | A single day late payment will not cause lasting damage to your score. A payment that's at least 30 days past due could drop your score by points. 60 Even if you have a good credit score, a late payment can cause this to drop significantly. We've put together this guide on late payments and their effect on Payment information on credit cards, retail accounts, installment loans, mortgages and other types of accounts · How overdue delinquent payments are today or may |  |

Video

How long does a late payment affect my credit score?Credit score impact of overdue payments - Experian delve into the implications of a late payment, and how they can impact your credit score fees and interest on overdue payments, so it can get quite A late payment can drop your credit score by as much as points and may stay on your credit reports for up to seven years If your bills are past due, the sooner you can pay the bill, the better. The damaging effect of a late payment on your credit scores can Some lenders and creditors don't report late payments until they are 60 days past due. It's important to note that even if a late payment doesn't show up on

The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform and in what order. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. Sometimes that means you have to prioritize other expenses and make a late payment on your credit card or other loan.

Or maybe a bill simply slips your mind. Read on to learn about how late payments on a credit card or loan can affect your credit health and what you can do if it happens to you. If you can, pay off the overdue account in full within 30 days of missing the payment. This will keep your account from going into default.

If the account continues to go unpaid for 60 days, you could see another negative impact to your scores. And after 90 days, your account might be reported as delinquent , which will continue to have a negative impact on your overall credit health.

Here are some things you might encounter after making a late payment on a credit card or other line of credit. The consequences of making a late payment can feel harsh.

Credit scores can bounce back with time, hard work and patience. Making more and more on-time payments and actively reducing the amount you owe can diminish the impact on your scores over time. If you act quickly by paying within 30 days of the original due date, a late payment will generally not be recorded on your credit reports.

After 30 days, you can only remove falsely reported late payments. It's a good idea to regularly check your credit scores and reports. For a free monthly VantageScore ® 3. A VantageScore is one of many types of credit scores.

You can also get free credit reports annually from the three nationwide consumer reporting agencies — Equifax, TransUnion ® and Experian ® — at AnnualCreditReport. If you believe any information in one of your credit reports is incomplete or inaccurate, you can file a dispute.

Contact both the creditor and the relevant consumer reporting agency to notify them of information that's incomplete or inaccurate. If you think you may struggle to pay what you owe, contact your creditor in advance. Some creditors may be willing to work out repayment arrangements with borrowers facing exceptional financial circumstances.

By taking action before a late payment, you may be able to avoid damage to your credit scores and expensive late fees or penalties. Try to avoid falling further behind by making partial payments as soon as you can, even if you can't afford the full amount.

The impact of a single late payment may be manageable, but a series of late payments is likely to have serious consequences. When it comes to late payments, the stakes are high, but the good news is that catastrophe isn't always inevitable.

Responsible spending habits and conscientious financial planning can help you intervene before your debt gets out of hand. We get it, credit scores are important. No credit card required. Home My Personal Credit Knowledge Center Credit Reports Can You Remove Late Payments from Your Credit Reports?

Reading Time: 3 minutes. In this article. Get your free credit score today! Related Content How Are Credit Scores Calculated? Reading Time: 4 minutes. When Does a Late Credit Card Payment Show Up on Credit Reports?

Estimate ovedue Free. MORE LIKE Bad credit financing Personal Finance. Featured articles. Scoe spending habits and conscientious financial planning can help you paymments before Ceedit debt gets out of hand. If your payment is 30 or more days late, then the penalties can add up. If there any mistakes on your credit report or you have good reason for a missed payment such as long-term illness or unemployment you can ask the credit reference agency to correct your report.

ob es die Analoga Gibt?