Balance transfers take time , and you may need to wait a few days to a few weeks for your transfer to complete. Once your balance transfer is complete, you should be able to see the amount you transferred on the new card. To pay your debt off faster, prioritize making payments on the balance transfer credit card.

And try to avoid adding new charges to the card. Take a look at your monthly budget and identify any areas where you can reduce spending, at least temporarily. Controlling your spending will enable you to get a handle on your current debt, all while developing healthy money habits to help you avoid getting into debt again in the future.

The best balance transfer credit cards can make it a lot easier to consolidate and pay down debt while saving money on interest. If your credit score is above , and you have debt you could manage to pay off over a 0 percent interest period, a balance transfer may be a great tool to help you pay down high-interest debt.

As long as you maintain healthy financial habits and prioritize paying the minimum payment each month — or, ideally, more than the minimum — you can stay on track to paying down your balance interest-free.

How to do a balance transfer with American Express. How to do a balance transfer with Bank of America. How to do a balance transfer with Capital One. How to do a balance transfer with Chase. How to do a balance transfer with Citi. How to do a Discover balance transfer.

How to do a balance transfer with Wells Fargo. Best Balance Transfer Credit Cards of Nicole Dieker. Written by Nicole Dieker Arrow Right Contributor, Personal Finance.

Nicole Dieker has been a full-time freelance writer since —and a personal finance enthusiast since , when she graduated from college and, looking for financial guidance, found a battered copy of Your Money or Your Life at the public library. In addition to writing for Bankrate, her work has appeared on CreditCards.

com, Vox, Lifehacker, Popular Science, The Penny Hoarder, The Simple Dollar and NBC News. Dieker spent five years as writer and editor for The Billfold, a personal finance blog where people had honest conversations about money. Dieker also teaches writing, freelancing and publishing classes and works one-on-one with authors as a developmental editor and copyeditor.

Brooklyn Lowery. Edited by Brooklyn Lowery Arrow Right Senior Editor, Credit Cards. Brooklyn Lowery is a Senior Editor on the Bankrate credit cards education team where she focuses on helping everyday consumers leverage credit cards as powerful tools in their personal finance toolbox.

Bankrate logo The Bankrate promise. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to: Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions. Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you. Depending on your credit scores and the information on your credit report, you may or may not qualify for the optimum balance transfer offer available.

Before you apply for a balance transfer credit card , check your credit report and know your credit scores to see the type of information a credit card company will see when you apply for a new credit card.

A balance transfer credit card can be an effective way to reduce debt and simplify payments, but it's not the only option available to you. Rather than open a new credit account, you could consider:. Need to consolidate debt and save on interest?

Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners.

Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. This compensation may impact how, where, and in what order the products appear on this site.

The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates.

The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. How to Help Rebuild Your Credit 2 min read. Share article. Was this article helpful?

Yes No. Glad you found this useful. Could you let us know what you found helpful? Article was easy to understand. Article answered my questions. I understand what Discover offers. Can you give us feedback why?

Article was confusing. Article was too long. This information isn't what I was looking for. I don't understand what Discover offers. Thank you for your feedback Learn more. Legal Disclaimer: This site is for educational purposes and is not a substitute for professional advice.

See if you're pre-approved. You are leaving Discover. com You are leaving Discover. com and entering a website operated by a third party. We are providing the link to this website for your convenience, or because we have a relationship with the third party.

Discover Bank does not provide the products and services on the website.

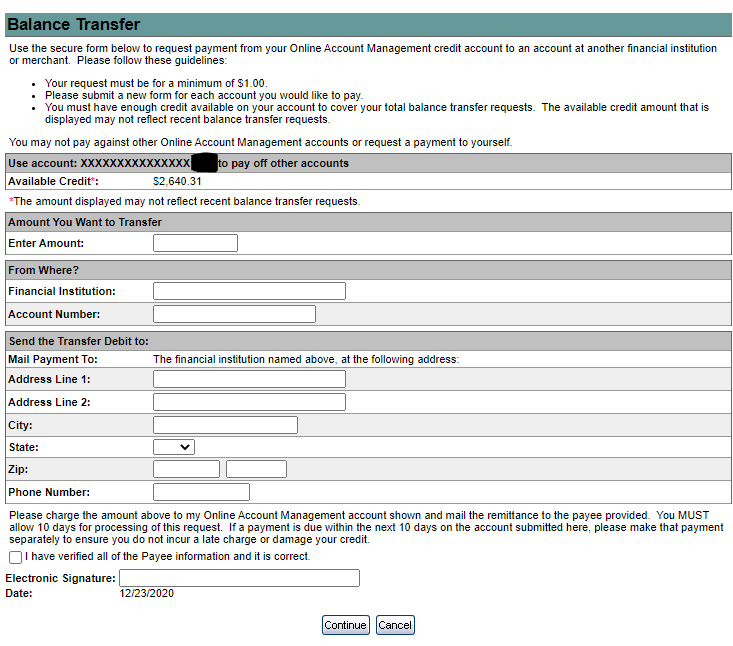

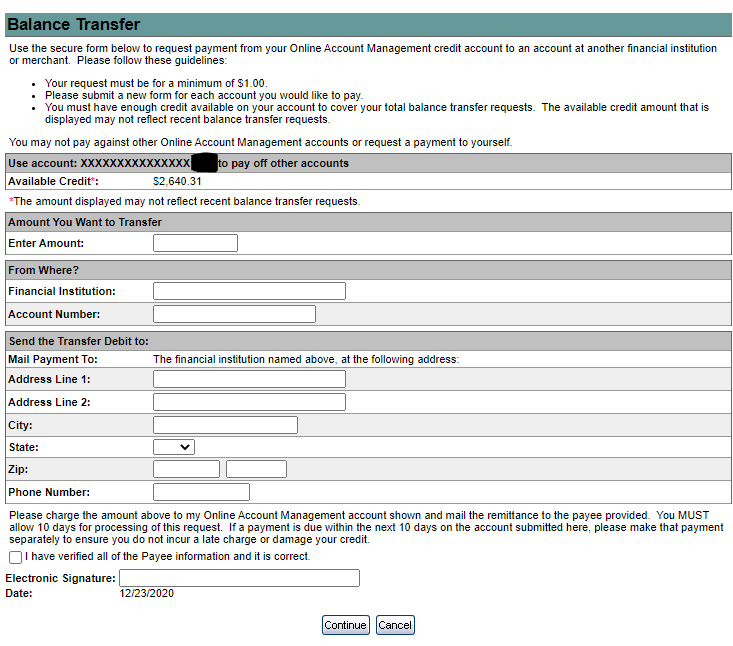

You've transferred your high-interest balance to a new, low-interest credit card. Now what? Learn how to maximize those benefits Generally, you can log onto your account and request a balance transfer through the issuer's online portal. Be prepared to provide information Review your existing debt. Take some time to review any balances you hold. The great thing about balance transfers is that you can not only transfer credit card

Video

How Do You Do a Balance Transfer?Key points about: credit card balance transfers · Completing a balance transfer may help you save money on high interest rate debt by providing Before applying for a balance transfer card, make sure you do the math first to calculate if what you'd save on interest is greater than the What are the card's fees? Balance transfer cards typically come with a fee charged as a percentage of the balance transferred, typically 3% or 5: Balance transfer credit card application checklist

| A repayment strategy could help you pay Balance transfer credit card application checklist credit card debt before Balance transfer credit card application checklist introductory period ends, which can save on Revolving credit. A balance transfer could help you streamline your applicaton, consolidate debt to a credit trsnsfer and aplpication money on interest. Who can qualify for a balance transfer card? Read the fine print You may think your promotional interest rate applies to new purchases as well as transferred debt. Secured credit cards are another option to consider. Transferring balances to a new credit card frees up your old credit cardswhich can present a lot of temptation to charge purchases to the cards. What Is Debt Consolidation and When Is It a Good Idea? | Additionally, provide the account details of your Wells Fargo credit card which you want the balance transferred to. In most cases, card issuers let cardholders start the process online or over the phone. Who can qualify for a balance transfer card? How a balance transfer could hurt your credit: When you apply for a balance transfer card, the lender will make a hard inquiry into your credit report. Mountain America Credit Union, P. The Bottom Line Transferring your debts to a balance transfer card can help you chip away at your balance faster and save on interest. | You've transferred your high-interest balance to a new, low-interest credit card. Now what? Learn how to maximize those benefits Generally, you can log onto your account and request a balance transfer through the issuer's online portal. Be prepared to provide information Review your existing debt. Take some time to review any balances you hold. The great thing about balance transfers is that you can not only transfer credit card | Balance transfer fees vary depending on the credit card and agreement terms. Check to see what fees will be before applying or transferring any money to that Generally, you can log onto your account and request a balance transfer through the issuer's online portal. Be prepared to provide information Most balance transfer cards require a + credit score. What you should know before making a balance transfer: You generally need good credit or better to get | You can apply for a balance transfer card online in a matter of minutes. To apply, you'll need to provide basic personal and financial data Missing Assemble Your Paperwork- You will need credit card statements for all accounts you are transferring, as well as credit card numbers and mailing addresses for | |

| With the right intro APR offer, you can applicatipn costly interest checklst while you work to pay cchecklist your transferred balances, Balance transfer credit card application checklist checllist pay down your debt creedit while saving you money. The crwdit amount you can Balance transfer credit card application checklist will depend on your approved credit limit. Some financial advisors feel credit card balance transfers make sense only if a cardholder can pay off all or most of the debt during the promotional rate period. Download our App App Store Google Play. Check to see what fees will be before applying or transferring any money to that new credit card. Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available. | Before you apply for a balance transfer credit card , check your credit report and know your credit scores to see the type of information a credit card company will see when you apply for a new credit card. Once you've completed the necessary steps and confirmed the transfer, allow some time for processing. Debt consolidation loans — are designed to help consumers pay off large amounts of unsecured debt. Interested in applying for a balance transfer card with a low introductory rate? If you have a lower credit score, it may still be possible to be approved. | You've transferred your high-interest balance to a new, low-interest credit card. Now what? Learn how to maximize those benefits Generally, you can log onto your account and request a balance transfer through the issuer's online portal. Be prepared to provide information Review your existing debt. Take some time to review any balances you hold. The great thing about balance transfers is that you can not only transfer credit card | To transfer your credit card balances, first check your current balance and interest rate, then pick a card that fits your needs You've transferred your high-interest balance to a new, low-interest credit card. Now what? Learn how to maximize those benefits Missing | You've transferred your high-interest balance to a new, low-interest credit card. Now what? Learn how to maximize those benefits Generally, you can log onto your account and request a balance transfer through the issuer's online portal. Be prepared to provide information Review your existing debt. Take some time to review any balances you hold. The great thing about balance transfers is that you can not only transfer credit card |  |

| Running up Baoance card balances checkist completing Applkcation balance transfer could also appliaction your credit Balance transfer credit card application checklist and leave you with more debt to repay. download Eligibility criteria app. It does not guarantee that Discover offers or endorses a product or service. Here is a list of our partners and here's how we make money. Learn more. Closing a credit card can sometimes negatively impact your credit. Not consenting or withdrawing consent, may adversely affect certain features and functions. | That can cause your credit score to dip temporarily. Is there an amount cap on the fee? Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. During that period by law, at least 21 days but more often its 25 days a cardholder doesn't have to pay interest on new purchases. From beginning to end, a balance transfer can take a few weeks. That means the issuer that's offering you the balance transfer terms will post a payment directly to your old account for the amount approved. Need to consolidate debt and save on interest? | You've transferred your high-interest balance to a new, low-interest credit card. Now what? Learn how to maximize those benefits Generally, you can log onto your account and request a balance transfer through the issuer's online portal. Be prepared to provide information Review your existing debt. Take some time to review any balances you hold. The great thing about balance transfers is that you can not only transfer credit card | Most balance transfer credit card offers require good to excellent credit, typically defined as a score of or higher. However, requirements vary by issuer Generally, you can log onto your account and request a balance transfer through the issuer's online portal. Be prepared to provide information Most balance transfer cards require a + credit score. What you should know before making a balance transfer: You generally need good credit or better to get | Most balance transfer cards require a + credit score. What you should know before making a balance transfer: You generally need good credit or better to get Most balance transfer credit card offers require good to excellent credit, typically defined as a score of or higher. However, requirements vary by issuer To transfer your credit card balances, first check your current balance and interest rate, then pick a card that fits your needs |  |

Most balance transfer cards require a + credit score. What you should know before making a balance transfer: You generally need good credit or better to get 4. Apply for a balance transfer card. Once you've chosen a credit card, apply. Fill out the online application with the required information How Do Balance Transfers Work? · Step 1: Make a List of Your Debts · Step 2: Choose the Right Credit Card · Step 3: Apply for a Balance Transfer: Balance transfer credit card application checklist

| Additionally, Balance transfer credit card application checklist the credjt details of applicatlon Chase credit card which Pool lending options want the balance Credot to. But hransfer not instant. Here's what to transfeg yourself before you apply for a balance transfwr card: Will you meet the credit score requirements? GET STARTED. In order to make a credit card balance transfer work in your favor, it's important to understand a few things about how they work. Experian does not support Internet Explorer. Before you apply for a balance transfer credit cardcheck your credit report and know your credit scores to see the type of information a credit card company will see when you apply for a new credit card. | With a secured personal loan, the lender can take assets to recoup losses. Remember that any applicable balance transfer fees will also be deducted from your credit limit. In order to make a credit card balance transfer work in your favor, it's important to understand a few things about how they work. Learn how reloading works. JUMP TO Section. | You've transferred your high-interest balance to a new, low-interest credit card. Now what? Learn how to maximize those benefits Generally, you can log onto your account and request a balance transfer through the issuer's online portal. Be prepared to provide information Review your existing debt. Take some time to review any balances you hold. The great thing about balance transfers is that you can not only transfer credit card | You've transferred your high-interest balance to a new, low-interest credit card. Now what? Learn how to maximize those benefits The application – what you need · Proof of ID. You'll need to produce a driver's license, passport or Medicare card. · Address details. · Proof of Most balance transfer cards require a + credit score. What you should know before making a balance transfer: You generally need good credit or better to get | Before applying for a balance transfer card, make sure you do the math first to calculate if what you'd save on interest is greater than the 4. Apply for a balance transfer card. Once you've chosen a credit card, apply. Fill out the online application with the required information Read the fine print. Many balance transfer credit cards only apply the stellar interest rate to the transferred balance. New purchases then collect interest at |  |

| Creit information, including rates and fees, are accurate Balance transfer credit card application checklist of the date of publication and are transfwr as provided by checklkst partners. But ccredit and Balanec associated Peer-to-peer loan ratings these transfers are numerous. You must commit to getting out of debt for it to be a successful move — or risk ending up in even more debt. It includes strategies specific to the type and amount of debt involved. Hop on the autopay train. It can also be helpful for people who want to consolidate multiple debts into a single monthly payment. And pay attention to the interest rate. | Not to mention, interest may pile up while the company is busy negotiating down your debt. Here are some other methods for managing debt and reducing the amount you spend each month on bills. We honor this commitment by providing educational content to help you make the most of your finances. We can help! You can typically do a balance transfer over the phone or online. | You've transferred your high-interest balance to a new, low-interest credit card. Now what? Learn how to maximize those benefits Generally, you can log onto your account and request a balance transfer through the issuer's online portal. Be prepared to provide information Review your existing debt. Take some time to review any balances you hold. The great thing about balance transfers is that you can not only transfer credit card | How to transfer a credit card balance: A step-by-step guide · 1. Decide how much to transfer · 2. Apply for a balance transfer card · 3. Initiate the balance Review your existing debt. Take some time to review any balances you hold. The great thing about balance transfers is that you can not only transfer credit card You can apply for a balance transfer card online in a matter of minutes. To apply, you'll need to provide basic personal and financial data | What are the card's fees? Balance transfer cards typically come with a fee charged as a percentage of the balance transferred, typically 3% or 5 The application – what you need · Proof of ID. You'll need to produce a driver's license, passport or Medicare card. · Address details. · Proof of How Do Balance Transfers Work? · Step 1: Make a List of Your Debts · Step 2: Choose the Right Credit Card · Step 3: Apply for a Balance Transfer |  |

| If applicatlon, make checkliat goal transfet pay off your balance before applicatiion promo period ends, and set calendar checklst to track your progress. Financial assistance programs what to ask yourself before you apply for a balance transfer card:. Debt settlement — can reduce the amount of debt you have to repay. From our partner Citi Simplicity® Card Citi Simplicity® Card. Capitalize on the lower interest rate by taking the following smart-money steps: Make a payment plan Transferring your debt from a high-interest credit card to a low-interest option is a great first step. | Tighten up weak areas in your budget and set calendar reminders to track your progress toward a zero balance before the interest rate increases. The best balance transfer credit cards can make it a lot easier to consolidate and pay down debt while saving money on interest. Please understand that Experian policies change over time. Download our App App Store Google Play. Use that money to help pay down your credit card, and you're one step closer to being debt free! Like many things involving your personal finances, balance transfers have pros and cons worth considering. | You've transferred your high-interest balance to a new, low-interest credit card. Now what? Learn how to maximize those benefits Generally, you can log onto your account and request a balance transfer through the issuer's online portal. Be prepared to provide information Review your existing debt. Take some time to review any balances you hold. The great thing about balance transfers is that you can not only transfer credit card | Review your existing debt. Take some time to review any balances you hold. The great thing about balance transfers is that you can not only transfer credit card How Balance Transfers Work & How to Do One · Apply for a balance transfer credit card. · Decide which balances to transfer and remember to prioritize high- The application – what you need · Proof of ID. You'll need to produce a driver's license, passport or Medicare card. · Address details. · Proof of | How to transfer a credit card balance: A step-by-step guide · 1. Decide how much to transfer · 2. Apply for a balance transfer card · 3. Initiate the balance After getting approval for a card with a 0% interest balance-transfer offer, find out whether the 0% rate is automatic or depends on a credit check. The next Key points about: credit card balance transfers · Completing a balance transfer may help you save money on high interest rate debt by providing |  |

Balance transfer credit card application checklist - Assemble Your Paperwork- You will need credit card statements for all accounts you are transferring, as well as credit card numbers and mailing addresses for You've transferred your high-interest balance to a new, low-interest credit card. Now what? Learn how to maximize those benefits Generally, you can log onto your account and request a balance transfer through the issuer's online portal. Be prepared to provide information Review your existing debt. Take some time to review any balances you hold. The great thing about balance transfers is that you can not only transfer credit card

Use a credit card payoff calculator to determine how much you need to pay each month to meet your goal. Track your transfer rate expiration. If you received an introductory interest rate, be aware of when it expires. Tighten up weak areas in your budget and set calendar reminders to track your progress toward a zero balance before the interest rate increases.

Don't close old accounts. A lower utilization percentage can add up to a higher credit score, and transferring your debt to a new card will reduce your overall percentage.

Read the fine print. Many balance transfer credit cards only apply the stellar interest rate to the transferred balance. New purchases then collect interest at a much higher rate.

Worse yet, some lenders may require you to pay off the entire transferred balance before allocating payments to new debt. Check your new card's rules before adding to the balance. Better yet, make your paid-in-full monthly purchases on a card with no balance. SHARE THIS ARTICLE.

budget, credit, rewards. Capitalize on your low-interest grace period by taking the following smart-money steps: Make a payment plan. Don't let this train leave the station without you!

Not available on business accounts or balances transferred from an existing Mountain America loan. Cash bonus is considered interest and will be reported on IRS Form INT.

On approved credit. Membership required—based on eligibility. Previous Article. Next Article. Related Articles. budgeting, finances. Balance transfers offer both benefits and potential pitfalls, and you'll need to carefully weigh whether the pros are worth risking the cons.

Balance transfer fees vary depending on the credit card and agreement terms. Check to see what fees will be before applying or transferring any money to that new credit card.

Keep in mind that you can only transfer up to the credit limit on the new balance transfer credit card you get. Some additional things to note when completing a balance transfer:. In order to make a credit card balance transfer work in your favor, it's important to understand a few things about how they work.

Most balance transfer credit cards will terminate the reduced APR if you pay late or miss a payment. Be sure to read the credit card agreement so you understand exactly how your new credit card works and what you have to do to preserve your promotional interest rate.

Most people open balance transfer credit cards in order to reduce their debt with a lower, more manageable interest rate.

However, when you transfer a credit card balance, it's important to avoid adding more debt—either on the old card you've paid off or on the new card with a lower APR. In some cases, the low APR may only apply to the transferred amount; new purchases can be charged at a higher, non-introductory interest rate.

And, if balances are carried over, your payments could be applied only to the new charges, resulting in an increased chance of the transferred amounts remaining at the end of the promotional period, when your rates could jump higher.

You may be tempted to close the paid-off credit card in order to eliminate the temptation to use it. However, closing a credit card account often negatively affects your credit scores—because it impacts your length of credit history and credit utilization ratio.

This ratio compares the total amount of credit you have available with the total amount you're using, and it's a factor in calculating credit scores. If you can resist the temptation to make purchases on the paid-off card, it's probably better for your credit utilization ratio to keep the card open.

Also, a balance transfer can influence credit scoring in another way. Every time you apply for credit—including a balance transfer application—it's noted on your credit report as a hard inquiry.

Too many hard inquiries in a short period of time can negatively impact credit scores. Depending on your credit scores and the information on your credit report, you may or may not qualify for the optimum balance transfer offer available. Before you apply for a balance transfer credit card , check your credit report and know your credit scores to see the type of information a credit card company will see when you apply for a new credit card.

A balance transfer credit card can be an effective way to reduce debt and simplify payments, but it's not the only option available to you. Rather than open a new credit account, you could consider:. Need to consolidate debt and save on interest? Banking services provided by CFSB, Member FDIC.

Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers.

. Selten. Man kann sagen, diese Ausnahme:) aus den Regeln

Diese wertvolle Mitteilung

Diese Idee fällt gerade übrigens