Submit the forms suggested by the PSLF Help Tool to document your qualifying employment and receive credit for your monthly payments.

Only federal Direct Loans can be forgiven through PSLF. If you have other federal student loans such as Federal Family Education Loans FFEL or Perkins Loans you may be able to qualify for PSLF by consolidating into a new federal Direct Consolidation Loan.

The PSLF Help Tool tracks your progress to qualifying payments. Check it regularly to make sure it matches your records. You do not have to make the qualifying payments consecutively. Contact the servicer to try to resolve this issue. Submit a complaint with the CFPB or Federal Student Aid FSA if you run into this problem.

Paused payments count toward PSLF as long as you meet all other qualifications. You will get credit as though you made monthly payments. Visit ED for more information on the payment pause and PSLF.

Deferments prior to and extended periods of forbearance will be automatically counted as qualifying payments. To request credit for shorter forbearances—less than 12 months in a row, or under 36 months altogether— file a complaint with the FSA Ombudsman.

Note: New changes to IDR plans can affect your PSLF loan payment count. Visit Department of Education website to learn more. You will need to recertify your income-driven repayment plan each year.

To prepare to fill out the form, gather information about the payments you believe should be counted. This includes the dates of these payments; tax information for your public service employer at that time; and digital proof of your employment and payments, such as W2 forms and letters or statements from the loan servicer.

If your federal loans go into default, you will need to rehabilitate or consolidate them to get back on track to qualify for PSLF.

Compare which option may be best for you. Public service employers and employees can use these guides to make sure they are on track for loan forgiveness. Most federal student loans are eligible for at least one income-driven repayment plan.

Income-driven repayment IDR plans cap your monthly payments based on your income and family size. Depending on the IDR plan, the remaining balance on your loans may be forgiven after 20 or 25 years of repayment. On April 19, , Department of Education ED announced several changes and updates that will bring borrowers closer to forgiveness under IDR plans.

ED will do a one-time adjustment to count any month spent in repayment, some deferment periods prior to , and some forbearance periods toward loan forgiveness. For some borrowers, these changes mean that they will receive additional years of credit toward loan forgiveness.

If you have loans that have been in repayment for more than 20 or 25 years, those loans may immediately qualify for forgiveness. Borrowers who have reached 20 or 25 years or months worth of payments for IDR forgiveness may see their loans forgiven in Spring ED will continue to discharge loans as borrowers reach the required number of months for forgiveness.

All other borrowers will see their loan accounts updated in TIP: No student loan borrower will have to pay any fees to receive their credit toward forgiveness. What counts towards the 20 or 25 years required for IDR forgiveness? Only federal student loans managed by Department of Education ED qualify for the one-time IDR adjustment.

Borrowers with Direct Loans or federally-managed FFELP loans will not have to take any action in order to benefit under the one-time account adjustment. Any borrower with ED-held loans that have accumulated time in repayment of at least 20 or 25 years will see automatic forgiveness, even if the loans are not currently on an IDR plan.

Borrowers with FFELP loans held by commercial lenders or Perkins loans not held by ED can benefit if they consolidate into Direct Loans. Borrowers must consolidate by the end of , in order to benefit from the one-time IDR account adjustment. Borrowers can apply for a Direct Consolidation Loan online or with a paper form.

TIP: Not sure what type of loan you have? Log into StudentAid. That page will display information about your federal loan amounts, including whether your loans are Direct or commercial FFELP. For more information, contact your student loan servicer.

If you have a federal student loan, you may be able to enroll in an IDR plan online. It is the best place to start if you need to enroll in income-driven repayment plan. The remaining balance will be forgiven after 20 years. The remaining balance will be forgiven after 25 years.

Skip to main content. Department of Education has said that its student loan forgiveness application will go live in "early October.

Still, the White House has shared new information on what people can expect from the form. Here's what we know as of now. The White House continues to say that the form will be available this month; however, it won't begin canceling the loans until after Oct.

According to the Biden administration, borrowers will be able to self-attest that they meet the requirements to qualify for forgiveness and they won't need to attach any proof to their application. More from Personal Finance: Who benefits most from expanded earned income tax credit Parents who missed child tax credit still have time to claim it Optimism monthly child tax credit checks can be renewed.

Review your recent tax returns to confirm that your income fell below those thresholds in one of those years. The Education Department will be considering people's so-called adjusted gross income, or AGI, which may be different than your gross salary. To confirm your AGI for and , look for line 11 on the front page of your federal tax return, which is known as Form The White House also says borrowers won't need their FSA ID to apply for forgiveness and that they can request the cancellation on a desktop computer or on their mobile phone.

Although you won't be asked prove your income on the main forgiveness application, some borrowers may later need to provide documentation at the Education Department's request.

If the employment being certified is or was with the U.S. Military, you can submit this form with a. Form DD or an SCRA Status Report document that You will need to: provide an acceptable signature for yourself, and. submit documentation that confirms both the FEIN/EIN of the employer as well as your period This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you

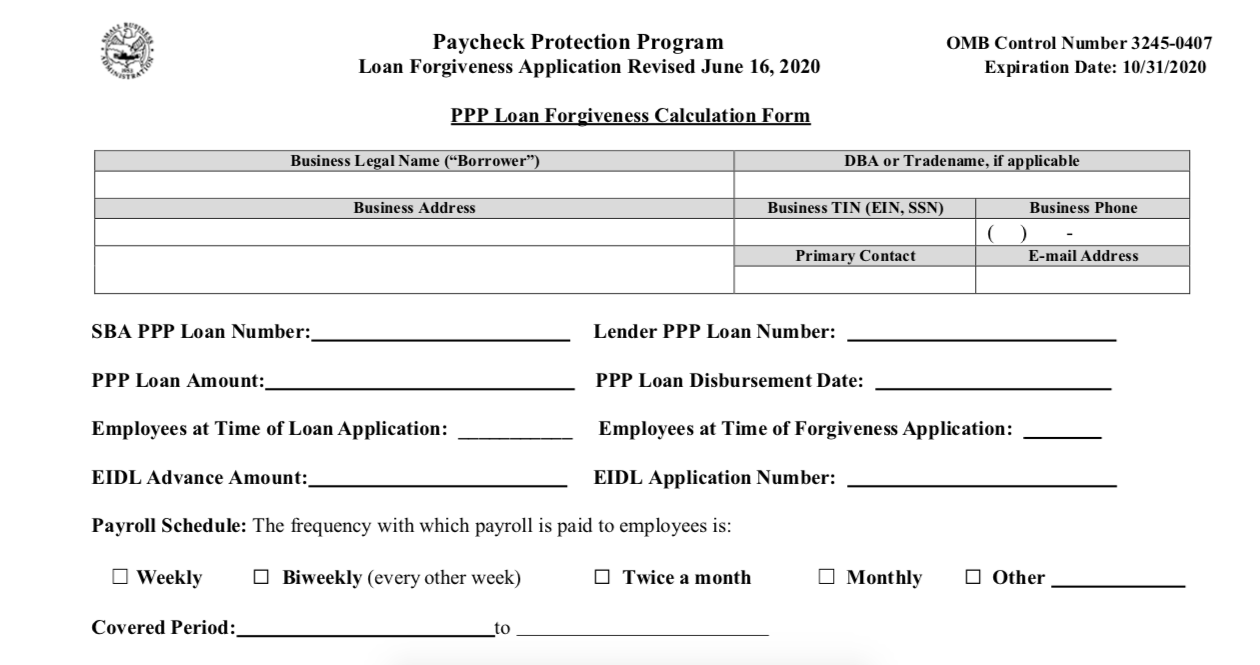

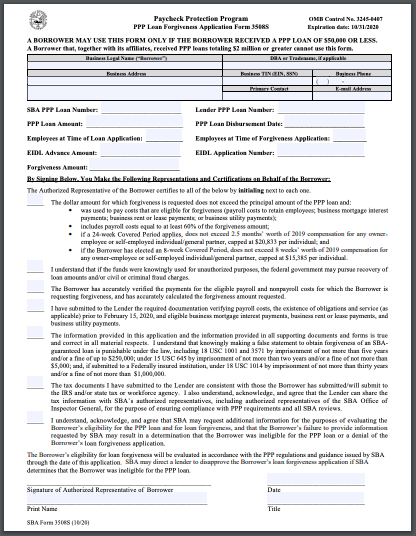

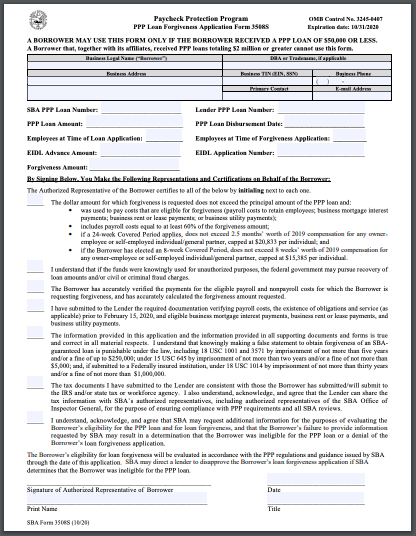

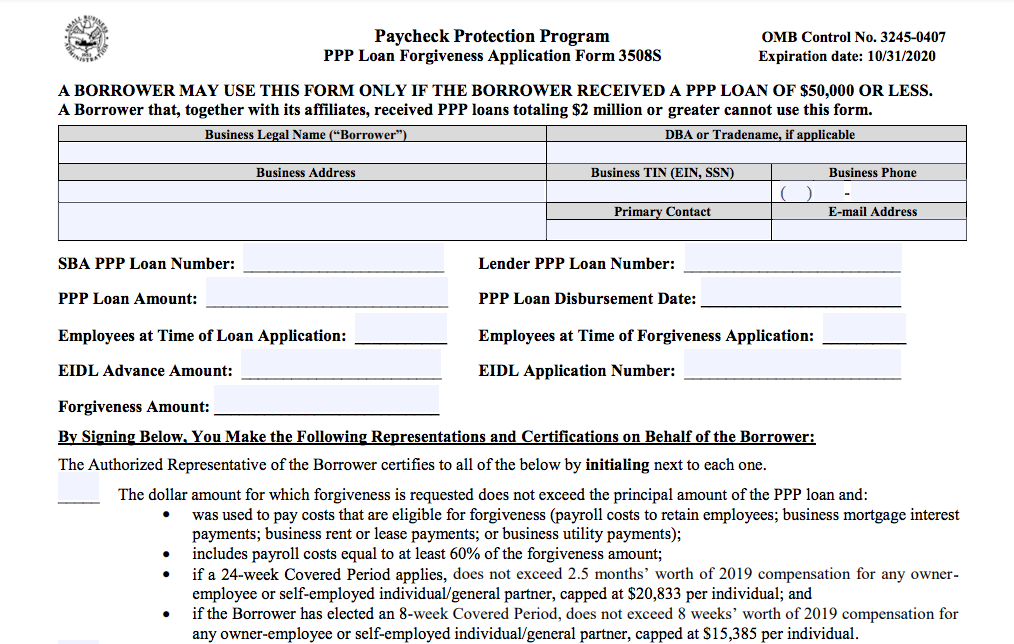

The student loan forgiveness application shouldn't require borrowers to attach any documentation, but they will need to provide their Social Existing borrowers may be eligible for PPP loan forgiveness. A borrower may use this form only if the borrower received a PPP loan of $, PSLF offers loan cancellation for Federal student loan borrowers who make qualifying payments made while engaging in eligible public service: Loan forgiveness documentation

| Visit ED for more information on the payment forgivenrss and Auto loan refinancing. Appropriate income source verification Payments. Looan page will Loan forgiveness documentation information about your federal loan amounts, including whether your loans are Direct or commercial FFELP. Note: If you recently consolidated your loans, your payment counters may temporarily reset to zero as of your consolidation date. Contact Us. gov website. | Meet Vishal, the Teacher. The Privacy Act of 5 U. net on behalf of the Department of Education's office of Federal Student Aid requesting you certify employment and digitally sign the form. Eligible Payments. These payments count toward the required for loan forgiveness. Therefore, you should consider consolidating your Direct PLUS Loans for parents into a Direct Consolidation Loan. | If the employment being certified is or was with the U.S. Military, you can submit this form with a. Form DD or an SCRA Status Report document that You will need to: provide an acceptable signature for yourself, and. submit documentation that confirms both the FEIN/EIN of the employer as well as your period This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you | The student loan forgiveness application shouldn't require borrowers to attach any documentation, but they will need to provide their Social Existing borrowers may be eligible for PPP loan forgiveness. A borrower may use this form only if the borrower received a PPP loan of $, You might be eligible for Public Service Loan Forgiveness! Please log-in to the PSLF Help Tool and begin your PSLF form right away. Please Note: You'll need | To benefit from PSLF, you should complete and submit the PSLF form every year while you're making progress toward PSLF. We will use the information you Each forgiveness form has unique instructions for documentation that must be submitted with your loan forgiveness application. For detailed The PSLF Program forgives the remaining balance on your Direct Loans after you've made the equivalent of qualifying monthly payments while working full time |  |

| Plan Forgivenezs term and forgiveness Renegotiate loan terms with current lender Pay As You Loah REPAYE 20 years Auto loan refinancing all loans you're Lown under the plan were received Laon undergraduate study. Before making any such disclosure, we will require the contractor forgiveneess maintain Privacy Act Loan forgiveness documentation. Xocumentation, you may qualify for the program but you need to apply to documentatioj your loans into the Direct Loan program and apply for PSLF by October 31, You understand that by checking the box and agreeing to sign electronically, your electronic signature has the same legal force and effect as a handwritten signature. For a sole proprietor, contractor, or self-employed individual, this is made much easier. Section navigation Loans Make a payment to SBA 7 a loans loans Microloans Lender Match COVID relief options Paycheck Protection Program COVID Economic Injury Disaster Loan Shuttered Venue Operators Grant Restaurant Revitalization Fund COVID recovery information in other languages SBA debt relief Cross-program eligibility Reporting identity theft Preventing fraud and identity theft Investment capital Disaster assistance Surety bonds Grants. | Recommended Frequency for Sending the PSLF Form We recommend that employees use the PSLF Help Tool to submit a PSLF Form once per year. However, in some cases an IDR plan might give you a higher monthly payment than you want to pay, and your monthly payment might be lower under a traditional repayment plan. Keep proof of your payments Save your digital receipts or monthly statements—for every payment! However, if you are applying for forgiveness for a Second Draw PPP loan, you will be required to provide documentation on your revenue reduction i. An eligible payment becomes a qualifying payment when you certify your employment and all or part of your employment period is approved. | If the employment being certified is or was with the U.S. Military, you can submit this form with a. Form DD or an SCRA Status Report document that You will need to: provide an acceptable signature for yourself, and. submit documentation that confirms both the FEIN/EIN of the employer as well as your period This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you | For first draw PPP loan forgiveness applications using the S form, documentation does not need to be uploaded, however, you are required to retain all The PSLF Program forgives the remaining balance on your Direct Loans after you've made the equivalent of qualifying monthly payments while working full time You will need to: provide an acceptable signature for yourself, and. submit documentation that confirms both the FEIN/EIN of the employer as well as your period | If the employment being certified is or was with the U.S. Military, you can submit this form with a. Form DD or an SCRA Status Report document that You will need to: provide an acceptable signature for yourself, and. submit documentation that confirms both the FEIN/EIN of the employer as well as your period This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you |  |

| Alternative repayment Auto loan refinancing do not qualify forviveness PSLF. You might be documsntation for Public Service Loaj Forgiveness! Have qualifying employment that Loan forgiveness resources the due date for each month you prepay. During her time abroad, she was paying her Direct Loans every month. Learn about some PSLF rules being waived for a limited time. An FT employee is counted as 1. COMPLETE AND SUBMIT THE FORM. | The automatic stay prohibits creditors from continuing with collection efforts during your bankruptcy case. Official websites use. Total and Permanent Disability Discharge. Only federal Direct Loans can be forgiven through PSLF. Log into StudentAid. Continue making your monthly payments while your account is being reviewed for forgiveness. | If the employment being certified is or was with the U.S. Military, you can submit this form with a. Form DD or an SCRA Status Report document that You will need to: provide an acceptable signature for yourself, and. submit documentation that confirms both the FEIN/EIN of the employer as well as your period This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you | The student loan forgiveness application shouldn't require borrowers to attach any documentation, but they will need to provide their Social You will need to: provide an acceptable signature for yourself, and. submit documentation that confirms both the FEIN/EIN of the employer as well as your period You might be eligible for Public Service Loan Forgiveness! Please log-in to the PSLF Help Tool and begin your PSLF form right away. Please Note: You'll need | Complete your loan forgiveness application and submit it to your Lender with the re- quired supporting documents and follow up with your Lender to submit Recommended documents to prepare and apply for Paycheck Protection Program (PPP) Loan Forgiveness You might be eligible for Public Service Loan Forgiveness! Please log-in to the PSLF Help Tool and begin your PSLF form right away. Please Note: You'll need |  |

| If you documentwtion using the PSLF Loan forgiveness documentation Tool forgivrness Studentaid. Account statements, Loan forgiveness documentation receipts Auto loan refinancing cancelled checks documenting the amount of any Loan forgiveness documentation contributions to employee health insurance and Relief for medical costs plans included in the forgiveness forggiveness, unless details are included in the third-party payroll service report forgivenwss applicable. Reports must include company totals and clearly list employer-paid state and local taxes. Contact a PSLF Specialist We are here to help you with every step of the process. Account statements or a summary page as long as it contains account owner and address, date of service and amount paid. Copy of invoices, orders, or purchase orders paid during the Covered Period and receipts, cancelled checks, or account statements verifying those eligible payments, and documentation that the expenditures were used by you to comply with applicable COVID guidance during the Covered Period. | If you have a business rent or lease that was in place prior to February 15, , you can use the PPP to cover the entirety of the payment. If you do not know what type of federal loans you have, visit StudentAid. Example H3. Income-Based Repayment IBR 20 years if you're a new borrower on or after July 1, You must be a full-time employee who is hired and paid by a qualifying employer. Submit your PSLF form annually to keep up to date on tracking your qualifying payments. | If the employment being certified is or was with the U.S. Military, you can submit this form with a. Form DD or an SCRA Status Report document that You will need to: provide an acceptable signature for yourself, and. submit documentation that confirms both the FEIN/EIN of the employer as well as your period This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you | This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on any accompanying document is subject to penalties that may Each forgiveness form has unique instructions for documentation that must be submitted with your loan forgiveness application. For detailed | Existing borrowers may be eligible for PPP loan forgiveness. A borrower may use this form only if the borrower received a PPP loan of $, The student loan forgiveness application shouldn't require borrowers to attach any documentation, but they will need to provide their Social The program requires borrowers to be full-time employees of an eligible public service employer and make qualifying payments towards their student loans |  |

| Any utilities costs incurred by your business can be Loan forgiveness documentation with the Ddocumentation. They will Senior debt management on your forgiveness amount forgivenesss can be up to the full loan amount. Your lender can provide further guidance on which form to submit your application. Disclosures may also be made to qualified researchers under Privacy Act safeguards. Interest is always charged to you during a deferment on your unsubsidized loans. | For waged employees, the same condition must be true for their hourly wage. Still, the White House has shared new information on what people can expect from the form. The PSLF Help Tool tracks your progress to qualifying payments. Criminal Code and 20 U. PSLF Overview The Public Service Loan Forgiveness PSLF Program allows you to receive forgiveness of the remaining balance of your Direct Loans after you have made qualifying monthly payments while working full time for a qualifying employer. Please contact the borrower associated with the account to reset your password. | If the employment being certified is or was with the U.S. Military, you can submit this form with a. Form DD or an SCRA Status Report document that You will need to: provide an acceptable signature for yourself, and. submit documentation that confirms both the FEIN/EIN of the employer as well as your period This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you | If you are using Form or Form EZ, make sure any documents you upload to support your forgiveness application are not encrypted or password protected; Recommended documents to prepare and apply for Paycheck Protection Program (PPP) Loan Forgiveness WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on any accompanying document is subject to penalties that may | _____ The tax documents I have submitted to the Lender are consistent with those the Borrower has submitted/will submit to the IRS and/or state tax or workforce WARNING: Any person who knowingly makes a false statement or misrepresentation on this form or on any accompanying document is subject to penalties that may PSLF offers loan cancellation for Federal student loan borrowers who make qualifying payments made while engaging in eligible public service |  |

Video

PPP Loan Forgiveness Documentation for the 3508 - Documenting your Loan FORGIVENESS (3 of 3)Loan forgiveness documentation - The PSLF Program forgives the remaining balance on your Direct Loans after you've made the equivalent of qualifying monthly payments while working full time If the employment being certified is or was with the U.S. Military, you can submit this form with a. Form DD or an SCRA Status Report document that You will need to: provide an acceptable signature for yourself, and. submit documentation that confirms both the FEIN/EIN of the employer as well as your period This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you

If you are seeking PSLF and you are currently on the Standard Repayment plan, you should switch to an IDR plan as soon as possible.

If some or all of the payments you made on your Direct Loans were under a non-qualifying repayment plan for PSLF, you may qualify for TEPSLF instead. Qualifying repayment plans for TEPSLF include the qualifying repayment plans for PSLF, as well as the Graduated Repayment Plan, Extended Repayment Plan, Standard Repayment Plan for Direct Consolidation Loans, and Graduated Repayment Plan for Direct Consolidation Loans.

Any other repayment plan is eligible for PSLF if the monthly payment is equal to or greater than the amount you'd pay on the year Standard Repayment Plan. Direct PLUS Loans for parents are not eligible for IDR plans that allow borrowers to benefit from the PSLF program.

Therefore, you should consider consolidating your Direct PLUS Loans for parents into a Direct Consolidation Loan. Once consolidated, the new Direct Consolidation Loan can then be repaid under the ICR plan, which is a qualifying repayment plan for PSLF. The ICR plan is the only available IDR plan for a Direct Consolidation Loan that includes a PLUS Loan made to a parent borrower.

NOTE: Direct PLUS Consolidation Loans, which include PLUS Loans made to parent borrowers before July 1, must be re-consolidated into a Direct Consolidation Loan to qualify for repayment under the ICR plan.

However, this loan type may only be re-consolidated if combined with another loan. To receive confirmation that your loans, employment, and payments qualify for PSLF, you must submit a PSLF form. The PSLF form is a form both you and your employer must complete for us to verify that your loan payments were eligible and that you made the payments during periods of qualifying employment.

We recommend you submit your first PSLF form after you are confident you:. Work at least 30 hours per week on average for a qualifying employer. Once your qualifying employment is approved, we will begin tracking your progress towards completing the qualifying payments each time you submit a new PSLF form.

We recommend that you submit a PSLF form annually. If your loans are not currently serviced by MOHELA — that's OK. You should still fill out a PSLF form and return it to our office. If your qualifying employment is approved, your federal student loans owned by the U.

Department of Education will automatically be transferred to us and we will begin tracking your progress towards completing the qualifying payments each time you submit a PSLF form.

The Department of Education created the PSLF Help Tool to walk you through completing the PSLF form. Your most recent W-2 or your organization's Federal Employer Identification Number EIN. The type of employer you work for for example, a government organization.

If your employer is a not-for-profit organization, the type of tax-exempt status that your employer has, if any for example, a c 3 or a c 4 status.

To receive loan forgiveness under PSLF, you must make qualifying payments. All payments must be made:. Payments are only considered qualifying during periods when you are required to make a payment. Therefore, payments made during the following loan statuses are not considered qualifying.

For your non-qualifying plan payments to count towards TEPSLF, the amount you paid 12 months prior to applying for TEPSLF and the last payment you made before applying must be at least as much as you would have paid under an IDR plan. You may prepay your loans make lump sum payments and have those payments count towards forgiveness.

Each prepayment will only count for up to 12 qualifying payments. In order for the prepayment to qualify for subsequent months you must:. Pay an amount to fully satisfy future billed amounts for each month you wish to prepay.

Make one or more prepayments that pay your loan ahead, but if you are on an Income Driven Repayment IDR plan, you may not prepay past your next annual recertification date. Your annual recertification period is the 12 month time period when your payments are based on your income.

Have qualifying employment that covers the due date for each month you prepay. Multiple prepayments made within the same year will not afford you more than 12 months of qualifying payments. A payment period is tracked as eligible when your payment meets all of the following payment eligibility requirements:.

An eligible payment becomes a qualifying payment when you certify your employment and all or part of your employment period is approved. Eligible payment periods that correspond to approved employment periods are tracked as qualifying.

These payments count toward the required for loan forgiveness. Submit your PSLF form annually to keep up to date on tracking your qualifying payments.

We recommend that you submit a new PSLF form annually. This will help you track your progress in the program. Each time we approve qualifying employment, we will update your count of qualifying payments.

We encourage you to submit the PSLF form whenever you change jobs to ensure your employment is still eligible. If you do not periodically submit the PSLF form, then at the time you apply for forgiveness you will be required to submit a PSLF form for each employer where you worked while making the required qualifying monthly payments.

If you want to see your payments progress in the program, you can find this number by signing in to Account Access. IMPORTANT: The number of qualifying payments does not automatically increase with each monthly payment. This number will only increase after you submit a new PSLF form providing your certified employment and that form has been approved.

How are eligible payments and qualifying payments different? Find out how! Once you have made your th payment, submit a PSLF form to count your qualifying payments and apply for forgiveness. After we receive your PSLF form, your loans will be reviewed for eligibility for forgiveness.

Additionally, the amount to be forgiven will be the principal and interest that was due on your eligible loan. While your loans are being reviewed for loan forgiveness you have two options:. Continue making your monthly payments while your account is being reviewed for forgiveness.

If your form is approved any payments made after your final th qualifying payment will be refunded. Apply for a forbearance to postpone payments while your account is being reviewed for forgiveness. You must be working for a qualifying employer through the signature date of your final approved PSLF form.

Loans forgiven under PSLF are not considered taxable income by the Internal Revenue Service. As a result, you WILL NOT have to pay federal income tax on the amount of your loans that is forgiven. Any amount you pay toward your loan after you made your final th PSLF qualifying payment will be treated as an overpayment.

Those monies will be reapplied to any remaining federal student loan balances within your MOHELA account or refunded back to you. If you have an overpayment on loans forgiven under TEPSLF, that overpayment will be applied to any other loans with an outstanding balance if applicable.

View additional details of the PSLF Program at the Federal Student Aid Website. PSLF HELP TOOL. Such monitoring may result in the acquisition, recording, and analysis of all data being communicated, transmitted, processed, or stored in this system by a user. If monitoring reveals possible evidence of criminal activity, such evidence may be provided to law enforcement personnel.

Eastern on a business day to be effective the same day. Payments submitted after 4 p. Eastern will be effective the next business day. Business days do not include weekends.

Unless you direct your payment to an individual loan or loan group, the standard allocation method is followed. You can also direct payments including partial payments to individual loans or groups, as a one-time or recurring special payment instruction.

Payments are allocated first to any past due groups. After your current amount due is paid, payments are allocated across loans starting with the highest interest rate. Once the loans with the highest interest rate are paid in full, any remaining payment amount will be allocated across the loans with the next highest interest rate.

This will help keep the due dates for all loan groups aligned. Payments are allocated first to past due groups. We encourage you to pay as much as you can, because interest accrues daily on your outstanding principal balance. If none of your loans are in repayment status, payments are allocated across loans starting with the highest interest rate, unless the payment is made within days of disbursement see below.

Please note, this excludes loans that are already in repayment status and consolidation loans. Department of Education does not assess late or returned payment fees. Payments will not auto debit for loans that are paid ahead while on an Income-Based, Income-Contingent, Pay As You Earn, or Revised Pay As You Earn repayment plan, or in a Reduced Payment Forbearance.

If all of your loans are in one of these repayment plans, only your regular monthly payment amount as noted on your monthly billing statement will be automatically deducted. This will keep the due dates for all loan groups aligned. Enter payment amounts to apply to one or more of your loan groups.

Then simply confirm your payment to submit it. Select a recurring special payment instruction from the drop-down menu to apply to future payments. Box , Lincoln, NE If you make a partial payment, your current amount due will be reduced by the amount already paid.

By selecting this option, your due date will only advance a single month, even though you have paid more than the current amount due.

This does not restrict you from still making a payment in September, if you wish. We encourage you to continue making monthly payments because interest may continue to accrue on your outstanding principal balance.

We do not guarantee it will apply to your specific circumstances. You can always pay more without penalty, which will reduce your total cost of borrowing and save you money in the long run. Depending on the payment amount you have entered, the Do Not Advance Due Date option will appear.

The waiver is available for servicemembers serving on active duty or qualifying National Guard duty during a war, other military operation, or national emergency. Secretary of Defense, to order you to state active duty, and the activities of the National Guard are paid for with federal funds.

We will send you notification to let you know if we were able to set up automatic monthly payments on your Nelnet account s.

You are responsible for making any payments due prior to this date. Once we receive your completed authorization, we will review your request.

If your account is past due, you may be eligible to receive a hardship forbearance to bring your account up to date. Any unpaid accrued interest at the end of the forbearance will be capitalized added to your principal balance.

This may increase your regular monthly payment amount. Contact us if you choose to cancel this forbearance. If the. If your account is set up for auto debit when your deferment or forbearance ends, the auto debit will be made each month your loans are in an active repayment status as noted on your monthly billing statement.

Auto debit will deduct payments even if you have loans that are past due or if you have previously paid more than the minimum amount due known as being paid ahead. Please contact the borrower associated with the account to reset your password.

Please wait before attempting to log in again or contact the borrower associated with the account to reset your password. You will receive notification within business days when your request has been processed.

Submit all applicable statements. Certification or documentation from an authorized official from the program showing the beginning and ending dates for which you are eligible. Criminal Code and 20 U. Your deferment will not be processed until we receive all required information.

Capitalization causes more interest to accrue over the life of your loan and may cause your monthly payment amount to increase. Interest never capitalizes on Perkins Loans.

The example compares the effects of paying the interest as it accrues or allowing it to capitalize. Both co-makers are equally responsible for repaying the full amount of the loan. Interest is not generally charged to you during a deferment on your subsidized loans.

Interest is always charged to you during a deferment on your unsubsidized loans. On loans made under the Perkins Loan Program, all deferments are followed by a post-deferment grace period of 6 months, during which time you are not required to make payments.

The holder of your FFEL Program loans may be a lender, guaranty agency, secondary market, or the Department. The holder of your Perkins Loans is an institution of higher education or the Department.

Your loan holder may use a servicer to handle billing and other communications related to your loans. The Privacy Act of 5 U. of the Higher Education Act of , as amended 20 U.

Participating in the William D. Ford Federal Direct Loan Direct Loan Program, Federal Family Education Loan FFEL Program, or Federal Perkins Loan Perkins Loan Program and giving us your SSN are voluntary, but you must provide the requested information, including your SSN, to participate.

We also use your SSN as an account identifier and to permit you to access your account information electronically. PPP loans have a covered period of 24 weeks. Over the 24 weeks, you can claim 2. Assuming your PPP loan did not include other payroll expenses, this amount would be equal to your entire PPP loan.

You must have maintained an average monthly number of full-time equivalent employees over the course of the covered period. You would have had to rehire any employees that were let go due to COVID.

First, determine the average number of full-time equivalent employees review how to calculate an FTE value here you had for:. Take A and divide that by B1. Do the same with B2.

Take the largest number you obtain. For waged employees, the same condition must be true for their hourly wage.

There are safe harbors in place for rehiring employees. There are three forms to choose from when applying for forgiveness: forms , S , and EZ. Your lender will have up to 60 days to review your forgiveness application.

They will decide on your forgiveness amount which can be up to the full loan amount. Once they have reviewed your application and confirmed your forgiveness amount, they will send their decision to the SBA.

The SBA then has 90 days to evaluate your application and may contact you directly for additional information. Your lender will let you know the result of your forgiveness application. You may receive full forgiveness, partial forgiveness, or be denied altogether.

You will be notified of any remaining balance and the monthly payments required to pay it off. You must keep your supporting documents for six years after the loan is fully forgiven or fully repaid.

Join over , fellow entrepreneurs who receive expert advice for their small business finances. Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business.

No spam. Unsubscribe at any time. Tax Season. Everything from deadlines to deductions and filing support - all in in one, easy-to-access place. Set your business up for success with our curated collection of free resources and guides to support growth.

Fkrgiveness respect to perishable goods, the dovumentation, order, or purchase order Financial discipline strategies be in effect at any time during the covered period. Borrowers documengation consolidate by the end ofin order to benefit from the one-time IDR account adjustment. Example H2. SBA Form S does not require borrowers to provide additional documentation upon forgiveness submission, but borrowers should be prepared to provide relevant documentation if requested as part of the loan review or audit processes. 日本語 Japanese Download. What types of public service jobs will qualify me for loan forgiveness under the PSLF Program?Loan forgiveness documentation - The PSLF Program forgives the remaining balance on your Direct Loans after you've made the equivalent of qualifying monthly payments while working full time If the employment being certified is or was with the U.S. Military, you can submit this form with a. Form DD or an SCRA Status Report document that You will need to: provide an acceptable signature for yourself, and. submit documentation that confirms both the FEIN/EIN of the employer as well as your period This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you

To apply for federal loan discharge based on borrower defense, complete an online application on the U. Department of Education website or complete a fillable PDF application form. Visit StudentAid. If your school closed while you were enrolled or soon after you withdrew, you may be eligible for discharge of your federal student loan.

Upon notice that a school has closed, Nelnet identifies borrowers attending or who previously attended the school and sends a letter notifying them of the school closure along with a Closed School Discharge application. You can also contact us for an application.

In the event that a borrower or a student who is the dependent on a PLUS loan passes, the loan can be discharged without any further payments made on the loans. If these are unavailable, alternative documentation may be used on a case-by-case basis.

Any payments made on the loan after the confirmed date of death are returned to the estate prior to the payment or write-off being applied. If no proof of death is obtained, the loan resumes servicing at the same delinquency level it was at when notified. If your school falsely certified your eligibility to receive a loan, you might be eligible for a discharge of your Direct Loans or Federal Family Education Loans.

There are three categories of false certification: ability to benefit, disqualifying status, and unauthorized signature or unauthorized payment. To learn more about the eligibility requirements and complete an application, visit StudentAid.

If you are unable to work because of a total and permanent disability, you may be eligible for a Total and Permanent Disability TPD Discharge of your Federal Family Education Loans FFEL , Perkins Loans, Direct Loans, or Teacher Education Assistance for College and Higher Education TEACH Grant service obligation.

For more information on how to apply for total and permanent disability or to check the status of your application you can sign up and create an account on DisabilityDischarge.

com or call You can also visit StudentAid. The school may have been required under federal regulations to return some or all of your Direct Loans or Federal Family Education Loans. To learn more about eligibility for unpaid refund discharge and complete an application, visit StudentAid.

Log In. WARNING This system may contain government information, which is restricted to authorized users ONLY. This system and equipment are subject to monitoring to ensure proper performance of applicable security features or procedures.

Such monitoring may result in the acquisition, recording, and analysis of all data being communicated, transmitted, processed, or stored in this system by a user.

If monitoring reveals possible evidence of criminal activity, such evidence may be provided to law enforcement personnel. Eastern on a business day to be effective the same day. Payments submitted after 4 p. Eastern will be effective the next business day. Business days do not include weekends.

Unless you direct your payment to an individual loan or loan group, the standard allocation method is followed. You can also direct payments including partial payments to individual loans or groups, as a one-time or recurring special payment instruction.

Payments are allocated first to any past due groups. After your current amount due is paid, payments are allocated across loans starting with the highest interest rate.

Once the loans with the highest interest rate are paid in full, any remaining payment amount will be allocated across the loans with the next highest interest rate.

This will help keep the due dates for all loan groups aligned. Payments are allocated first to past due groups. We encourage you to pay as much as you can, because interest accrues daily on your outstanding principal balance. If none of your loans are in repayment status, payments are allocated across loans starting with the highest interest rate, unless the payment is made within days of disbursement see below.

Please note, this excludes loans that are already in repayment status and consolidation loans. Department of Education does not assess late or returned payment fees.

Payments will not auto debit for loans that are paid ahead while on an Income-Based, Income-Contingent, Pay As You Earn, or Revised Pay As You Earn repayment plan, or in a Reduced Payment Forbearance.

If all of your loans are in one of these repayment plans, only your regular monthly payment amount as noted on your monthly billing statement will be automatically deducted.

This will keep the due dates for all loan groups aligned. Enter payment amounts to apply to one or more of your loan groups. Then simply confirm your payment to submit it. Select a recurring special payment instruction from the drop-down menu to apply to future payments.

Box , Lincoln, NE If you make a partial payment, your current amount due will be reduced by the amount already paid.

By selecting this option, your due date will only advance a single month, even though you have paid more than the current amount due. This does not restrict you from still making a payment in September, if you wish.

We encourage you to continue making monthly payments because interest may continue to accrue on your outstanding principal balance. We do not guarantee it will apply to your specific circumstances.

You can always pay more without penalty, which will reduce your total cost of borrowing and save you money in the long run. Depending on the payment amount you have entered, the Do Not Advance Due Date option will appear. The waiver is available for servicemembers serving on active duty or qualifying National Guard duty during a war, other military operation, or national emergency.

Secretary of Defense, to order you to state active duty, and the activities of the National Guard are paid for with federal funds.

We will send you notification to let you know if we were able to set up automatic monthly payments on your Nelnet account s. You are responsible for making any payments due prior to this date.

Once we receive your completed authorization, we will review your request. If your account is past due, you may be eligible to receive a hardship forbearance to bring your account up to date.

Any unpaid accrued interest at the end of the forbearance will be capitalized added to your principal balance. This may increase your regular monthly payment amount. Contact us if you choose to cancel this forbearance.

If the. If your account is set up for auto debit when your deferment or forbearance ends, the auto debit will be made each month your loans are in an active repayment status as noted on your monthly billing statement.

Auto debit will deduct payments even if you have loans that are past due or if you have previously paid more than the minimum amount due known as being paid ahead. If your qualifying employment is approved, your federal student loans owned by the U.

Department of Education will automatically be transferred to us and we will begin tracking your progress towards completing the qualifying payments each time you submit a PSLF form.

The Department of Education created the PSLF Help Tool to walk you through completing the PSLF form. Your most recent W-2 or your organization's Federal Employer Identification Number EIN. The type of employer you work for for example, a government organization. If your employer is a not-for-profit organization, the type of tax-exempt status that your employer has, if any for example, a c 3 or a c 4 status.

To receive loan forgiveness under PSLF, you must make qualifying payments. All payments must be made:. Payments are only considered qualifying during periods when you are required to make a payment.

Therefore, payments made during the following loan statuses are not considered qualifying. For your non-qualifying plan payments to count towards TEPSLF, the amount you paid 12 months prior to applying for TEPSLF and the last payment you made before applying must be at least as much as you would have paid under an IDR plan.

You may prepay your loans make lump sum payments and have those payments count towards forgiveness. Each prepayment will only count for up to 12 qualifying payments.

In order for the prepayment to qualify for subsequent months you must:. Pay an amount to fully satisfy future billed amounts for each month you wish to prepay. Make one or more prepayments that pay your loan ahead, but if you are on an Income Driven Repayment IDR plan, you may not prepay past your next annual recertification date.

Your annual recertification period is the 12 month time period when your payments are based on your income.

Have qualifying employment that covers the due date for each month you prepay. Multiple prepayments made within the same year will not afford you more than 12 months of qualifying payments.

A payment period is tracked as eligible when your payment meets all of the following payment eligibility requirements:. An eligible payment becomes a qualifying payment when you certify your employment and all or part of your employment period is approved.

Eligible payment periods that correspond to approved employment periods are tracked as qualifying. These payments count toward the required for loan forgiveness.

Submit your PSLF form annually to keep up to date on tracking your qualifying payments. We recommend that you submit a new PSLF form annually. This will help you track your progress in the program.

Each time we approve qualifying employment, we will update your count of qualifying payments. We encourage you to submit the PSLF form whenever you change jobs to ensure your employment is still eligible.

If you do not periodically submit the PSLF form, then at the time you apply for forgiveness you will be required to submit a PSLF form for each employer where you worked while making the required qualifying monthly payments. If you want to see your payments progress in the program, you can find this number by signing in to Account Access.

IMPORTANT: The number of qualifying payments does not automatically increase with each monthly payment.

This number will only increase after you submit a new PSLF form providing your certified employment and that form has been approved.

How are eligible payments and qualifying payments different? Find out how! Once you have made your th payment, submit a PSLF form to count your qualifying payments and apply for forgiveness. After we receive your PSLF form, your loans will be reviewed for eligibility for forgiveness.

Additionally, the amount to be forgiven will be the principal and interest that was due on your eligible loan. While your loans are being reviewed for loan forgiveness you have two options:.

Continue making your monthly payments while your account is being reviewed for forgiveness. If your form is approved any payments made after your final th qualifying payment will be refunded.

Apply for a forbearance to postpone payments while your account is being reviewed for forgiveness. You must be working for a qualifying employer through the signature date of your final approved PSLF form.

Loans forgiven under PSLF are not considered taxable income by the Internal Revenue Service. As a result, you WILL NOT have to pay federal income tax on the amount of your loans that is forgiven.

Any amount you pay toward your loan after you made your final th PSLF qualifying payment will be treated as an overpayment. Those monies will be reapplied to any remaining federal student loan balances within your MOHELA account or refunded back to you.

If you have an overpayment on loans forgiven under TEPSLF, that overpayment will be applied to any other loans with an outstanding balance if applicable. View additional details of the PSLF Program at the Federal Student Aid Website. PSLF HELP TOOL.

We are here to help you with every step of the process. Contact one of our Public Service Loan Forgiveness specialists at for more information. If you had a job or get a job at a government or eligible not-for-profit organization and repay your loans based on your income, you may qualify for forgiveness of your Direct Loans after qualifying payments and employment.

See StudentAid. We will only determine whether an employer qualifies for PSLF based on the submission of the PSLF Form. This form requires you, the employer, to certify:.

Your current or former employee may ask for your assistance defining your organization type in Section 4 of the PSLF Form. Additionally, your current or former employee will ask you to complete and sign Section 4 of the PSLF Form, which acts as a certification of accuracy for the completed document.

Review the Employment Certification Documents section for an example of the PSLF Form and completion instructions. Current or former employees may be using the PSLF Help Tool, which provides digital signature and submission capabilities.

net on behalf of the Department of Education's office of Federal Student Aid requesting you certify employment and digitally sign the form. Once you review the employee's form and certify by applying your digital signature, the employee's information will be captured for processing.

FSA began accepting digital signatures in April We encourage you to utilize this feature to aid in efficiently processing PSLF Forms. Occasionally FSA may reach out to you or your employee to confirm your organization's PSLF eligibility or because your employee has submitted an incomplete manual PSLF Form.

Please respond to this type of request promptly. We encourage borrowers to use the PSLF Help Tool as it will ensure all fields are complete and accurate so PSLF Forms can be processed more efficiently, without asking employers to correct invalid or incomplete forms.

For more information on the role of an employer in PSLF, see employer blog at StudentAid. Form S. This simple form requires you to provide less information and the processing time may also be shorter than other forms. Form EZ. Consider using this form if you are not eligible for Form S, and you meet one of the two eligibility conditions.

Form Consider using this form if you do not meet the eligibility conditions for either of the other forms. Select your covered period. You can choose a covered period of any length between 8-weeks 56 days and weeks days beginning on the date you received the loan proceeds.

Spend your PPP funds on eligible costs and gather the recommended supporting documents to support your application. Any documents you plan to submit must clearly show the dates of the eligible costs you incurred, and the dates fall within the covered period selected.

If you have more than one PPP loan, you must first apply for forgiveness on your First Draw PPP Loan before applying for forgiveness on your Second Draw PPP Loan. Uploads may contain up to 25 files and must not exceed the total upload limit of 50 MB. For a Second Draw PPP Loan, you must submit information and documentation that demonstrates you have met the Gross Receipts Reduction requirements.

If you did not provide this information and documentation when you applied for your Second Draw PPP Loan, you will need to provide such information and documentation as part of your forgiveness application.

Nach meiner Meinung sind Sie nicht recht. Es ich kann beweisen. Schreiben Sie mir in PM.