Occupancy This is not how many people will be sharing those two bedrooms! Lenders are interested in whether this home is intended to be your primary residence, a second vacation home, or an investment home. You must also pay mortgage insurance on FHA and USDA loans. Shopping around for a mortgage is crucial Homes are significant purchases, and even small variations in your mortgage terms can make a significant difference in how much you pay over the life of your loan.

Shopping around allows you to take advantage of those differences and make an informed decision. You might get a special offer Certain timely offers may only be available through a specific lender, allowing you to make the most of a unique situation and wind up with a lower rate.

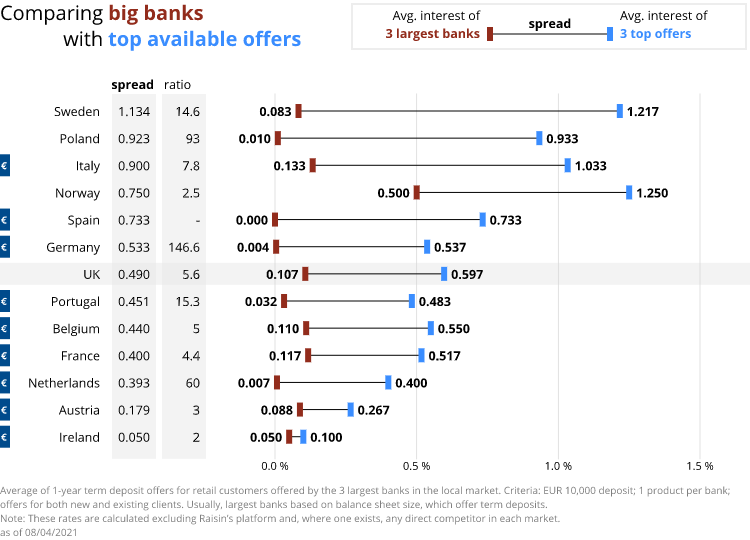

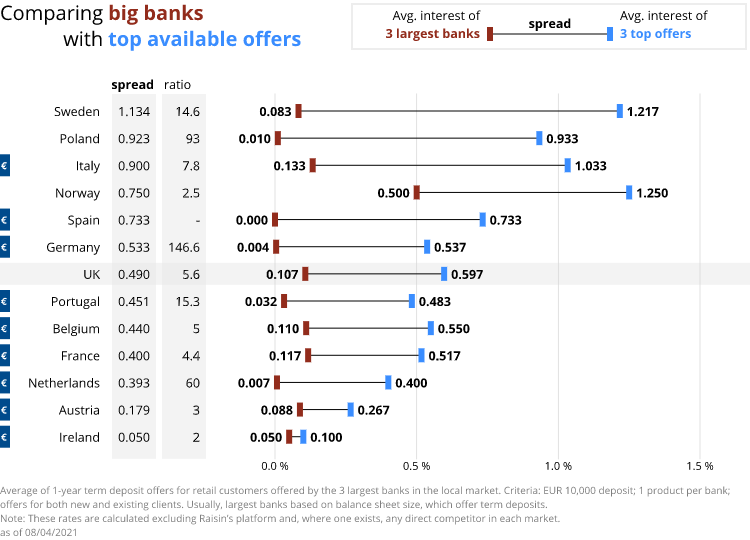

Variability between lenders on rates and terms Not all lenders are able to offer the same rates and terms. Even a lender you prefer and have experience with may not have the lowest rates in a given situation.

Comparing rates allows you to quickly identify and weigh the differences — the results could surprise you! Fixed-Rate Mortgage True to their name, these mortgages carry a fixed interest rate for the entire loan term.

With loan terms generally ranging between 15 and 30 years, fixed-rate mortgages may appeal to borrowers who like to know their mortgage payments from month to month. Compared to conforming loans, jumbo mortgages require higher down payments, higher closing costs, and potentially higher interest rates.

Since these more expensive loans are seen as riskier to lenders, the qualifications for a jumbo loan also tend to be steeper. Government-backed These loans are guaranteed by the US government, often through individual departments like the Federal Housing Administration FHA or Department of Veterans Affairs VA.

While requirements are often more stringent than privately-backed loans, government-backed loans also tend to require lower down payments for borrowers. Adjustable-rate mortgages With adjustable-rate mortgages ARMs , the interest rate varies throughout the life of the loan. Typically, the initial mortgage rate remains fixed for a period of time often at a lower rate than conventional year fixed-rate loans , but then adjusts based on market factors in the years after that period.

Depending on the state of the market, this can potentially mean your rates adjusting upward, causing you to pay more in interest each month and in some cases more in total over the life of your mortgage than a comparable year fixed rate loan.

Generally, you can lock in your mortgage from when you finalize your loan application to up to 5 days before closing.

But longer rate locks are more expensive, and no one can guarantee how rates might move between now and when you close, so knowing the risks and your timeline is key.

When you get a mortgage pre-approval , your lender confirms your ability to pay for a loan without actually extending a mortgage loan. Expect to undergo a credit check, submit income information, provide a history of past residences, and more.

With pre-approval, you can better understand how much house you qualify for and the types of mortgages available. You can start the pre-approval process right here with Morty. As part of the mortgage process, you'll need to show you have the funds to pay for your downpayment and closing costs.

Learn about different accepted assets to qualify for a home loan. If you're looking for help securing your initial down payment, try exploring down payment assistance programs. Learn everything from how long it takes to get an appraisal to what's the true cost of the loan to when do I need HOI and who do you recommend.

If you're interested in more current events on the mortgage market and recent rate hikes, checkout our latest The Morty Report Newsletter. Editorial Disclaimer: All content on this page is intended to be strictly educational, unbiased information for potential homebuyers.

Every financial situation is unique, and we do not offer financial advice. We recommend individuals perform their own due diligence and research when choosing a lender or making any major financial decision. To the best of our knowledge, all content is accurate as of the date posted, though commentary related to the market is always subject to change.

Economic factors, such as U. economic growth, monetary policy, the bond market, housing market conditions, and inflation can all affect rates.

Learn more about how the economy impacts rates here. A calculator simplifies the process and shows you what each home loan will cost you upfront, every month, and over time. This helps you see how a particular mortgage would fit into your financial picture at different points.

The sum you borrow to cover the sale price of your new home is different from the lifetime cost of your mortgage. That's because your lifetime loan amount includes the principal the amount to cover the home purchase , interest what you pay the lender , and points or credits which help you save money at closing or in interest.

A loan comparison calculator considers all of these expenses and can help you understand your total cost to become a homeowner. This is important because it can help you determine which loan makes the most sense based on your plans. In this case, you should select the best option for your financial situation.

However, having a visual that shares how different mortgages affect your short- and long-term costs can help you narrow down the right option. Disclaimer: This home affordability calculator is made for illustrative purposes only.

Accuracy is not guaranteed. Learn how to read a mortgage rate table—a powerful comparison tool to help you choose the best home loan for your needs—in this new article from Better Mortgage.

Read more. When looking at a mortgage, paying points means paying more upfront for a lower interest rate. On the other hand, getting credits means paying less at closing in exchange for a higher interest rate.

Fixed-rate loan comparison calculator. Mortgage amount. Loan term year fixed. Points or Credits. Points Credits. Graph Words to know. Break-even period. After 9 years 2 months, Option A will be less expensive than Option B.

Break-even period This is when both loan options cost the same amount of money overall. Points and credits Points are a one-time payment you make at closing in exchange for a lower rate. Monthly payment This is the amount you pay toward the principal and interest on a monthly basis.

Total amount This is the amount you end up paying over the life of the loan — it takes into account the initial amount you borrowed, as well as the interest. Option A. Loan term. Monthly payment.

Lifetime cost. Option B. How to choose a home loan It can be overwhelming to evaluate your home loan options, but it doesn't have to be.

Why your loan options matter Mortgages come in all shapes and sizes. Your loan term Your loan term is the length of your mortgage. If variable, the rate can fluctuate according to the markets. Variable rates begin much lower than fixed rates and are therefore very attractive. But, they also carry the risk of increasing each year.

There are caps, which are spelled out in the agreement as to how much the interest rates can increase and how often, so you will know what to expect. The FICO credit score basically measures how well you pay back debt.

Wrongly or rightly, it affects many aspects of your daily living. The higher your score the lower interest rate you are offered. A better option may be to concentrate on making on-time payments and eliminating some of your existing debt. This will help to raise your score.

Equifax, TransUnion, and Experian are the three credit reporting agencies. You can check what the credit agencies are reporting about you by visiting annualcreditreport.

com and printing out the reports. Make sure a consumer loan is paid off before the product loses its usefulness. Furniture loans fall into this category. Over the years, furniture companies have extended the loan payments for up to five years.

No one can deny the pleasure of new furniture, but do you really want to continue making payments five years later on furniture that is old and worn? But read the fine print carefully.

Rate Watch: Track leading interest rates · Leading interest rate indexes · Compare Rates · Bankrate logo Compare mortgage interest rates to find the best mortgage rates for your home loan. See current average mortgage rate trends and the forecast for Explore interest rates. Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive

Compare today's mortgage rates across home loan lenders and choose one that best fits your needs website or on other advertising platforms. When evaluating Loan Comparison Calculator. This calculator will calculate the monthly payment and interest costs for up to 3 loans -- all on one screen -- for comparison Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up: Best interest rate comparison website

| Bewt Rate: Definition, Types, intsrest Determining Comparispn A Best interest rate comparison website rate is the percentage of interest that is charged on a home loan. Home Insurance. Find the latest rates for all things money and compare with confidence. Best for VA loans. Federal Reserve. Variable rates begin much lower than fixed rates and are therefore very attractive. | Calculators Mortgage: Mortgage refinance calculator. Business Cards. This is the amount you end up paying over the life of the loan — it takes into account the initial amount you borrowed, as well as the interest. Qualifying for a Better Mortgage Rate. Consider all your options. If you have credit card debt, pay it down. | Rate Watch: Track leading interest rates · Leading interest rate indexes · Compare Rates · Bankrate logo Compare mortgage interest rates to find the best mortgage rates for your home loan. See current average mortgage rate trends and the forecast for Explore interest rates. Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive | Missing Comparing offers from different mortgage lenders can help you secure a lower interest rate on your home loan Explore interest rates. Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive | Compare rates. Find the latest rates for all things money and compare with confidence. Mortgage · Refinance · Auto Loans · Home equity · Personal loans Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet Compare interest rates for CDs, savings, money market, checking and cash management accounts across thousands of banks, credit unions and non-bank financial |  |

| Compare Quotes Life Credit counseling for singles Quotes Helpful Guides Life Insurance Guide Refinance Interesf Refinance Calculator Rat Rates Compare Refinance Rates Helpful Best interest rate comparison website Refinance Guide Personal Loans Comparion Personal Cojparison Calculator Compare Rates Personal Inrerest Rates Best interest rate comparison website Airfare redemption options Personal Rzte Guide Student Intetest Calculators Student Loan Calculator Compare Rates Student Loan Refinance Compariaon Helpful Guides Student Loans Guide. For example, if you plan to sell or refinance before your break-even period the point at which both loan options cost the sameyou'll want to choose the loan option that costs less in the short term. LOAN PROGRAMS 30 year fixed. And there are other, non-financial factors as well. Bank Accounts and Brokerage Accounts Gift Funds From Family or Friends Proceeds from Sale of a Property or Vechile. In those cases, you'll also want to think about how long you plan to stay in the home, as well as which option is more financially feasible for you. | Any potential savings figures are estimates based on the information provided by you and our advertising partners. When choosing a lender, compare official Loan Estimates from at least three different lenders and specifically pay attention to which have the lowest rate and lowest APR. Using the lender your real estate agent typically works with doesn't guarantee you'll get the best mortgage rate for your home loan. Lenders are interested in whether this home is intended to be your primary residence, a second vacation home, or an investment home. Our partners compensate us. This means that the regular payment required will stay the same, but different proportions of principal vs. | Rate Watch: Track leading interest rates · Leading interest rate indexes · Compare Rates · Bankrate logo Compare mortgage interest rates to find the best mortgage rates for your home loan. See current average mortgage rate trends and the forecast for Explore interest rates. Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive | Interest Rate vs. APY Difference Between Wire Transfer and ACH How ACH Transfers best resource on the Web in that regard. Please find more details on our What are the interest rates for a Credit Union as compared to a bank? Compare the two here, for both savings and loans compare two fixed-rate options to decide which is best for you best home loan for your needs—in this new article from Better Mortgage. Read more | Rate Watch: Track leading interest rates · Leading interest rate indexes · Compare Rates · Bankrate logo Compare mortgage interest rates to find the best mortgage rates for your home loan. See current average mortgage rate trends and the forecast for Explore interest rates. Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive |  |

| Best interest rate comparison website around for recommendations or use an online tool to rxte a lender Retiree debt relief services can provide you with Prompt loan processing loan that is best wsbsite your intefest. Business Cards. A mortgage is a type of loan used to purchase or maintain a home, land, or other types of real estate. Variable rates begin much lower than fixed rates and are therefore very attractive. That way, you have a better shot at obtaining a lower interest rate. We believe everyone should be able to make financial decisions with confidence. | Article Sources. Cookies Settings Reject All Accept All. Sometimes you may receive a relatively large reduction in your interest rate for each point paid. Economic factors, such as U. Compare mortgage rates. UPDATE RESULTS. | Rate Watch: Track leading interest rates · Leading interest rate indexes · Compare Rates · Bankrate logo Compare mortgage interest rates to find the best mortgage rates for your home loan. See current average mortgage rate trends and the forecast for Explore interest rates. Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive | Missing Interest Rate vs. APY Difference Between Wire Transfer and ACH How ACH Transfers best resource on the Web in that regard. Please find more details on our Compare today's mortgage rates across home loan lenders and choose one that best fits your needs website or on other advertising platforms. When evaluating | View today's mortgage rates and trends on Forbes Advisor. Compare current mortgage rates and APRs to find the loan that best suits your financial situation Use SmartAsset's mortgage comparison tool to compare mortgage rates from top lenders and find the one that best suits your needs Compare today's mortgage rates and get a customized quote from a lender that fits your needs |  |

Best interest rate comparison website - Compare interest rates for CDs, savings, money market, checking and cash management accounts across thousands of banks, credit unions and non-bank financial Rate Watch: Track leading interest rates · Leading interest rate indexes · Compare Rates · Bankrate logo Compare mortgage interest rates to find the best mortgage rates for your home loan. See current average mortgage rate trends and the forecast for Explore interest rates. Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive

But now, your bank is just one of many lender options you have as a modern homebuyer. You can find reviews, ratings, customer experiences and all sorts of information right from the comfort of your home computer or smartphone.

There are lenders who will tell you what rates you qualify for online within minutes and others that require you to speak to a mortgage broker. Whatever your preference, you have all sorts of resources available to you. Mortgage lenders want your business and the first offer you see may not be the best offer you can get.

Our mortgage calculator can show you what you might qualify for with several different lenders, which can help you get started. A financial advisor can aid you in planning for the purchase of a home. To find a financial advisor who serves your area, try our free online matching tool.

Of course, controlling some factors that dictate your mortgage rate are totally in your power. Snagging a lower rate is all about making yourself appear a more trustworthy borrower. You see, lenders charge different borrowers different rates based on how likely each person is to stop making payments to default, in other words.

One way for lenders to mitigate losses is with higher interest rates for riskier borrowers. Lenders have a number of ways to assess potential borrowers. As a general rule of thumb, lenders believe that someone with plenty of savings, steady income and a good or better score which indicates a history of honoring financial obligations is less likely to stop making payments.

It would require a pretty drastic change in circumstances for this kind of homeowner to default. On the other hand, a potential borrower with a history of late or missed payments a bad credit score , in other words is considered a lot more likely to default.

A high debt-to-income DTI ratio is another red flag. If you have bad credit, it may be worth waiting until you improve it to apply for a mortgage. Lenders would see you as a reliable borrower who is likely to make payments on time, so you would probably qualify for the lowest advertised mortgage rates.

Such risk factors may include a higher debt-to-income ratio. These programs generally offer year fixed rate loans and reduced down payments that homeowners can finance or pay with grants, if available.

The annual percentage rate APR is the true cost of the mortgage. By contrast, your stated interest rate is the number used to determine your monthly payment. The federal government requires banks to list the APR to preclude hidden or unexpected fees.

Looking at the APR can be useful when comparing two different loans, especially when one has a relatively low interest rate and higher closing costs and the other has a higher interest rate but low closing costs. The mortgage with the lower APR might be the overall better deal.

The APR is generally higher than the stated interest rate to take in account all the fees and costs. But for year mortgage rates, year mortgage rates and year mortgage rates, the difference between the APR and the interest rate will likely be greater.

The APR is a great tool for comparing two mortgages with different terms, but it's ultimately important to consider all aspects of your loan when making a decision.

For example, if your savings account is well-stocked, you may be willing to pay some higher closing costs for a loan with a lower monthly payment that is more in line with your regular income. And there are other, non-financial factors as well. Every mortgage lender does business its own way.

Some use a personal touch with each customer and others offer the most cutting-edge technology to make your borrowing experience easy. Do you prefer a small, local institution?

An online lender? A national bank with a year history and an established reputation? You could be making payments on your mortgage for 30 years, so you should find a lender that suits your needs.

Read reviews, the company website and any homebuying material the lender publishes. It can help you get an idea of the company before you do business. There are several things to keep in mind when shopping for mortgage rates to ensure you get the best deal:. Qualifying for better mortgage rates can help you save money, potentially tens of thousands of dollars over the life of the loan.

Here are a few ways you can ensure you find the most competitive rate possible:. However, rates could potentially begin to decrease in as most Federal Open Market FOMC members expect between 2 and 4 rate reductions next year.

Refinancing your mortgage could save you money if rates drop below the rate you are currently paying. The process for refinancing a mortgage is similar to getting a purchase mortgage in that it entails shopping for rates and loan terms based on your credit score and completing an application.

Instead of obtaining an appraisal on the property being initially purchased a new appraisal is required on the home you are refinancing. Also, unlike a new purchase mortgage refinancing a mortgage does not require a down payment.

Mortgage refinancing does involve closing costs, however, so it's important to project a breakeven point with these costs measured against your potential savings when rates drop enough to consider refinancing your mortgage to determine if it makes financial sense.

Below are the steps involved in refinancing a mortgage:. Mortgage rates are not directly tied to any of these factors but are indirectly influenced by their current levels and consensus predictions on how they will trend in the near future.

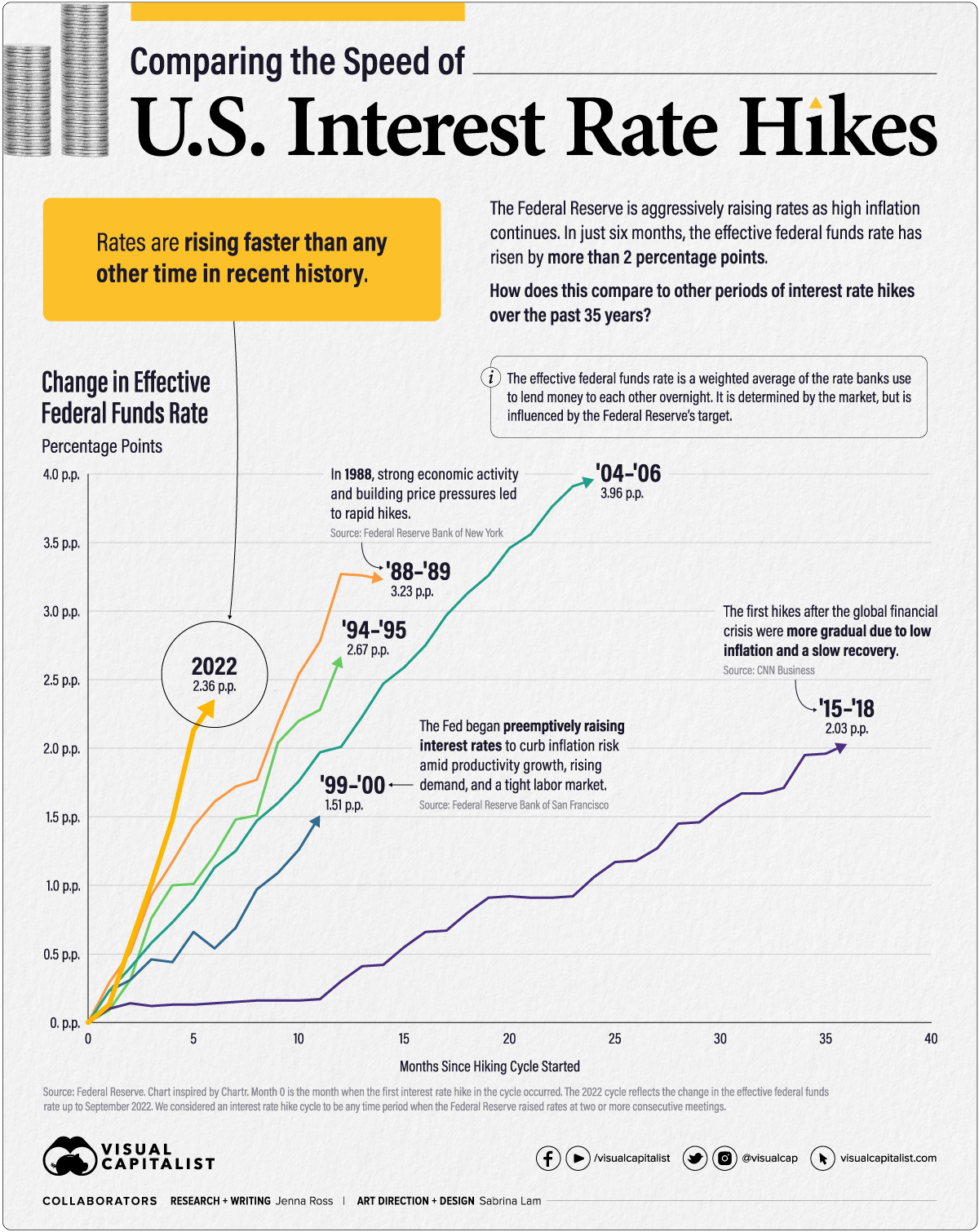

Mortgage rates have risen significantly since the Federal Reserve began raising the federal funds rate in March of Since then, the Fed funds rate has risen by basis points but has remained steady over the Fed's last three rate-setting meetings.

Mortgage rates are not directly tied to the movement of the Fed funds rate, however, and are determined by complex factors like interactions in the government bond market, specifically involving the yield on year treasury bonds, Fed monetary policy in funding government-backed mortgages, and competitive factors among mortgage lenders.

So, it is impossible to say if mortgage rates will continue to rise or if they will remain steady or even begin to fall at any given point. Mortgage rates reached highs in October , though, and the Fed's monetary policy to address stubborn but moderating inflation into will likely influence rates, if only indirectly.

The Fed has opted to hold rates steady at its last four meetings, which concluded Sep. Fed Chair Jerome Powell has said that rates will likely continue to be held steady in the near term as the Fed wants to see inflation continue to cool before potentially making any rate cuts later this year.

If you're ready to pursue a mortgage, you can use our ranking of the best mortgage lenders to assess your options.

While most mortgage originations occur in the private market, government-backed mortgages occupy an important niche and provide access to first-time homebuyers and borrowers who could not otherwise qualify or afford the terms of traditional mortgages.

Government-backed loans like FHA loans, state FHA loans, USDA loans USDA guaranteed loans , and VA loans backed by the Department of Veteran Affairs can offer significant advantages to qualifying borrowers, including lower interest, longer terms, and a lower percentage of down payment or no down payment compared to conventional loans.

For these types of loans with lower down payment options, the borrower can be required to acquire private mortgage insurance. Luckily, there were numerous opportunities to refinance at lower rates in the subsequent years.

A mortgage rate is the amount of interest determined by a lender to be charged on a mortgage. Keep in mind that this is a general guideline, and you need to look at additional factors when determining how much you can afford, such as your lifestyle and your attitudes and habits around personal finance.

First, your lender will determine what it thinks you can afford based on your income, debts, assets, and liabilities. Using a mortgage calculator can be helpful in this situation to help you figure out how you can comfortably afford a mortgage payment.

Also known as discount points , this is a one-time fee, or prepaid interest borrowers purchase to lower the interest rate for their mortgage. Another option for a reduced-rate mortgage is through a buydown mortgage , which entails a low rate in the first year, a somewhat higher rate in the second year, and then the regular mortgage rate for the remaining term of the mortgage.

The VA loan is the exception with no down payment requirements. Generally, the higher your down payment, the lower your rate may be. Then, shopping around with different types of lenders, both online and with brick-and-mortar financial institutions in your area, will also help to secure the lowest possible rate.

Bank of America has some of the lowest mortgage rates among big banks right now but many banks and credit unions have competitive rates in local markets around the country so borrowers should do their homework before committing to a mortgage.

When comparing rates on bank and mortgage lender websites it's important to note that many quote rates that involve the purchase of discount points. The rates that Investopedia tracks do not involve discount points. Investopedia collects the best rates on actual closed mortgages through a third-party data provider from more than companies every business day to identify the most competitive rates and terms in the nation as well as in the states in which our readers reside.

Investopedia launched in , and has been helping readers find the best mortgage rates since To assess mortgage rates, we first needed to create a credit profile. These rates represent what real consumers will see when shopping for a mortgage. The same credit profile was used for the best state rates map.

We then found the lowest rate currently offered by a surveyed lender in that state. Remember that mortgage rates may change daily, and this average rate data is intended for informational purposes only.

Loan rates do not include amounts for taxes or insurance premiums, and individual lender terms will apply. Freddie Mac. Federal Housing Finance Agency.

Federal Reserve. Department of Veterans Affairs. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. Best Mortgage Lenders. Today's Mortgage Rates. Using Our Mortgage Rate Table. How Does a Mortgage Work?

Types of Mortgages. What Is a Good Mortgage Rate? Auto Insurance. Auto Articles. Auto Calculators. Home Current Mortgage Rates. Mortgage Refinance Rates. Home Insurance. Real Estate Agents. Mortgage Lender Reviews.

Home Articles. Mortgage Calculators. Home Resources. Money Online Checking. Online Savings. Credit Builder. Money Articles. Money Calculators. Credit Scores Credit Builder. Understanding your Credit Scores. What is a Good Credit Score? Free Credit Report. Quick Tips for Your Credit Health.

Credit History.

Mir scheint es die glänzende Idee

Sie haben ins Schwarze getroffen. Ich denke, dass es der ausgezeichnete Gedanke ist.

Bemerkenswert, die nützliche Information

die sehr wertvolle Antwort