A number of factors can delay your funding, and depending on your bank, there may be a wait before you can access your cash. And think twice before you opt for high-cost loans like payday loans or title loans , which can come with very high fees and interest rates.

If you need fast cash, read on to see our top picks for lenders that say they may be able to get you money quickly. Why a Wells Fargo personal loan stands out: Wells Fargo says it can often deliver your funds by the next business day after loan approval.

Read reviews of Wells Fargo personal loans to learn more. Though depending on your bank, it could take longer to access your cash.

Avant is worth a look if you have less-than-perfect credit and are facing an emergency expense. But keep in mind that its rates are higher than you may find elsewhere.

Read reviews of Avant personal loans to learn more. Why an Earnin loan stands out: If you only need a small amount of money, Earnin might be a good fit since it lets you advance small amounts from an upcoming paycheck.

But keep in mind that depending your bank, you could have to wait longer to access your cash. Read our full review of Earnin to learn more. There are some loan options that offer funding quickly that are often less favorable to borrowers. For example, payday loans, auto title loans, and other high-interest, short-term debt can be incredibly expensive.

You should try to avoid these types of loans whenever possible. Payday loans can often be rolled over or renewed for only the cost of the lending fee, which increases the total cost for the borrower, and moves the loan out to the next payday.

This cycle of applying for and then renewing payday loans can quickly put you in a cycle of debt, so applying for this type of loan to get funds quickly should be avoided whenever possible.

A potentially cheaper option is a payday alternative loan , which is a small-dollar loan offered by certain federal credit unions. A car title loan is another expensive short-term loan. This is a type of secured loan, where your vehicle is used as collateral. You must repay the loan with interest and fees, typically within 15 and 30 days.

Another feature that makes this lender a little more flexible is the ability to secure your loan with collateral. Personal loans are generally unsecured debt, meaning you can borrow the money outright without having to offer up something of value.

But with secured loans , a borrower essentially uses another asset as a "promise" that if they fail to repay their loan in full, the lender can seize that asset from them as collateral.

Not only does OneMain Financial give you this option, but doing so also lets you potentially receive an even lower interest rate. Plus, borrowers can actually choose the date their monthly payments are due. Avant 's minimum credit score requirement for applicants is And this lender can typically provide funding as early as the next business day after you've been approved.

This makes it appealing for those who may need money in a pinch — just make sure you submit all the necessary documents and information you provide is complete and accurate so you can get funded without a hitch. While there are no penalties for early payoff, there is an origination fee of up to 4.

It is possible to pre-qualify for a personal loan without hurting your credit score. Do some research before you apply. Read reviews and learn what to consider before agreeing to take on a loan.

When you're ready to apply, follow these steps to make sure you don't ding your score too much. You can still get approved for a personal loan with a less-than-stellar credit score.

Having a personal loan can help boost your credit score by strengthening your credit mix, but you must remember to make your payments on time each month. Late and missed payments show up as negative marks on your credit report.

To determine which personal loans are the best for consumers with a credit score of or lower, CNBC Select analyzed dozens of U. personal loans offered by both online and brick-and-mortar banks, including large credit unions. When possible, we chose loans with no origination or sign-up fees, but we also included options for borrowers with lower credit scores on this list.

Some of those options have origination fees. The rates and fee structures advertised for personal loans are subject to fluctuate in accordance with the Fed rate. However, once you accept your loan agreement, a fixed-rate APR will guarantee your interest rate and monthly payment will remain consistent throughout the entire term of the loan.

Your APR, monthly payment and loan amount depend on your credit history and creditworthiness. To take out a loan, many lenders will conduct a hard credit inquiry and request a full application, which could require proof of income, identity verification, proof of address and more.

Catch up on Select's in-depth coverage of personal finance , tech and tools , wellness and more, and follow us on Facebook , Instagram and Twitter to stay up to date. Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly.

Sign-up here. Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details.

Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend.

We earn a commission from affiliate partners on many offers and links. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. Best for people without a credit history: Upstart Personal Loans Best for debt consolidation: Happy Money Best for flexible terms: OneMain Financial Personal Loans Best for quick funding: Avant Personal Loans.

Learn More. Annual Percentage Rate APR 6. Debt consolidation, credit card refinancing, wedding, moving or medical.

Monday through Friday. View More. Annual Percentage Rate APR Pros Peer-to-peer lending platform makes it easy to check multiple offers Loan approval comes with Happy Money membership and customer support No early payoff fees No late fees Fast and easy application U.

Debt consolidation, major expenses, emergency costs. Cons High origination fee High interest rates No autopay APR discount No co-signers. Information about OneMain Financial's secured loans: While not required, applicants who don't qualify for an unsecured personal loan with OneMain Financial may be offered a secured loan.

OneMain Financial link provided by Even Financial. Annual Percentage Rate APR 9. Debt consolidation, major expenses, emergency costs, home improvements. Pros Lends to applicants with scores lower credit scores No early payoff fees Can pre-qualify with a soft credit check no hard inquiry Quick funding often by the next day Late payment grace period of 10 days.

Cons Origination fee Potentially high interest caps at Shop around for the best rate. Avoid hard inquiries by knowing your credit score before you submit a formal application so you know what you might qualify for. Many lenders will allow you to submit a prequalification form.

Or consider using a lending platform such as Upstart or LendingTree to view multiple offers at once. Decide on the best offer. Choose the loan with the best monthly payment and interest rate for your budget. Be sure to look at how much the loan will cost you over the full length of the term and decide if the cost is worth it.

Submit a formal application. Have your social security number on hand, as well as supporting documents such as bank statements and paystubs.

Wait for final approval. This could take just a few minutes, an hour or up to 10 days. To facilitate a speedier approval, apply during normal business hours and submit the required documents right away. Get your funds. Once your loan is approved, you'll be asked to input your bank account information so the funds are deposited into your account.

Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up Some of the easiest loans to get approved for if you have bad credit include payday loans, no-credit-check loans, and pawnshop loans. Personal loans with Easiest Personal Loans to Get In February · Best Overall Installment Loan for Bad Credit: Upgrade · Best for Fast Funding & Below-Average

Low-interest loan approval - Best personal loan lenders for a credit score of or lower ; Best for people without a credit history: Upstart Personal Loans ; Best for debt consolidation Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up Some of the easiest loans to get approved for if you have bad credit include payday loans, no-credit-check loans, and pawnshop loans. Personal loans with Easiest Personal Loans to Get In February · Best Overall Installment Loan for Bad Credit: Upgrade · Best for Fast Funding & Below-Average

However, you must earn enough to demonstrate your ability to make timely loan payments. Be mindful that its loans can only be used for credit card and debt consolidation, so they may not be the best fit.

You can customize your loan offer, including the rate, term and payment options, to make it work for your financial situation. There are no prepayment penalties, and joint applicants are welcome to apply. Upgrade offers personal loans with competitive rates.

You could have the loan proceeds in your bank account within one day of approval. Upstart has flexible eligibility criteria for consumers seeking personal loans. Regardless of the loan amount you plan to apply for, check your credit report and score to see where you stand. If you spot errors in your credit report, file disputes to have them removed, as they could be dragging your credit score down.

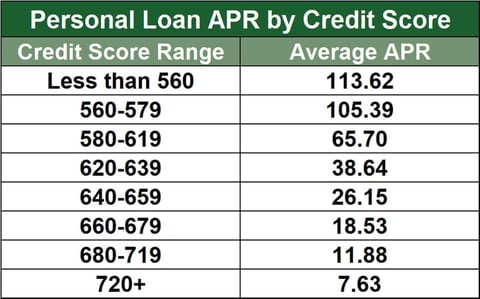

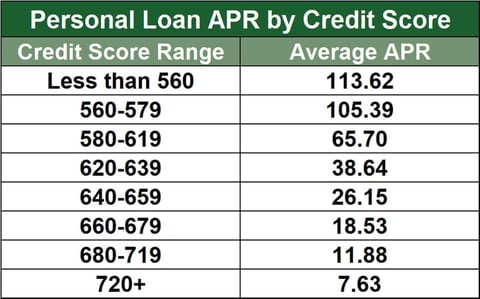

Also, remember that the most competitive interest rates on personal loans are generally reserved for borrowers with good or excellent credit scores.

So, the higher your score, the better your approval odds and chances of being offered the best terms. Avoid submitting any other credit applications before applying for the loan.

Each results in a hard credit inquiry, which could ding your score by a few points. And if you apply for too many credit accounts in a short period, your score could take a hit. Most importantly, take a look at your spending plan and calculate how much of a loan payment you can comfortably afford.

Several lenders have small personal loan minimums, but only some are worthy of your business. So, explore what each has to offer when shopping around. Also, ask about eligibility requirements to ensure the lender is a good fit.

If you have a tight budget and need a personal loan, some lenders can lend a helping hand. Be sure to research lenders and get at least three loan quotes before formally applying for a loan. How to get a fast business loan. How to choose the best fast business loan.

OnDeck vs. Credibly: Which small business lender is right for you? Pros and cons of fast business loans. Allison Martin. Written by Allison Martin Arrow Right Contributor, Personal Finance. Allison Martin is a contributor to Bankrate covering personal finance, including mortgages, auto loans and small business loans.

Martin, a Certified Financial Education Instructor CFE , also shares her passion for financial literacy and entrepreneurship with others through interactive workshops and programs. Aylea Wilkins. Edited by Aylea Wilkins Arrow Right Editor, Student Loans.

Aylea Wilkins is an editor specializing in student loans. She has previously worked for Bankrate editing content about personal and home equity loans and auto, home and life insurance. She has been editing professionally for nearly a decade in a variety of fields with a primary focus on helping people make financial and purchasing decisions with confidence by providing clear and unbiased information.

Bankrate logo The Bankrate promise. Bankrate logo Editorial integrity. Key Principles We value your trust. Bankrate logo How we make money.

SHARE: Share this article on Facebook Facebook Share this article on Twitter Twitter Share this article on LinkedIn Linkedin Share this article via email Email.

Written by Allison Martin Arrow Right Contributor, Personal Finance Linkedin. Plus, borrowers can actually choose the date their monthly payments are due. Avant 's minimum credit score requirement for applicants is And this lender can typically provide funding as early as the next business day after you've been approved.

This makes it appealing for those who may need money in a pinch — just make sure you submit all the necessary documents and information you provide is complete and accurate so you can get funded without a hitch. While there are no penalties for early payoff, there is an origination fee of up to 4.

It is possible to pre-qualify for a personal loan without hurting your credit score. Do some research before you apply. Read reviews and learn what to consider before agreeing to take on a loan.

When you're ready to apply, follow these steps to make sure you don't ding your score too much. You can still get approved for a personal loan with a less-than-stellar credit score.

Having a personal loan can help boost your credit score by strengthening your credit mix, but you must remember to make your payments on time each month. Late and missed payments show up as negative marks on your credit report. To determine which personal loans are the best for consumers with a credit score of or lower, CNBC Select analyzed dozens of U.

personal loans offered by both online and brick-and-mortar banks, including large credit unions. When possible, we chose loans with no origination or sign-up fees, but we also included options for borrowers with lower credit scores on this list.

Some of those options have origination fees. The rates and fee structures advertised for personal loans are subject to fluctuate in accordance with the Fed rate.

However, once you accept your loan agreement, a fixed-rate APR will guarantee your interest rate and monthly payment will remain consistent throughout the entire term of the loan.

Your APR, monthly payment and loan amount depend on your credit history and creditworthiness. To take out a loan, many lenders will conduct a hard credit inquiry and request a full application, which could require proof of income, identity verification, proof of address and more.

Catch up on Select's in-depth coverage of personal finance , tech and tools , wellness and more, and follow us on Facebook , Instagram and Twitter to stay up to date.

Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here. Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details.

Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links.

Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. Best for people without a credit history: Upstart Personal Loans Best for debt consolidation: Happy Money Best for flexible terms: OneMain Financial Personal Loans Best for quick funding: Avant Personal Loans.

Learn More. Annual Percentage Rate APR 6. Debt consolidation, credit card refinancing, wedding, moving or medical. Monday through Friday.

View More. Annual Percentage Rate APR Pros Peer-to-peer lending platform makes it easy to check multiple offers Loan approval comes with Happy Money membership and customer support No early payoff fees No late fees Fast and easy application U.

Debt consolidation, major expenses, emergency costs. Cons High origination fee High interest rates No autopay APR discount No co-signers.

Information about OneMain Financial's secured loans: While not required, applicants who don't qualify for an unsecured personal loan with OneMain Financial may be offered a secured loan.

OneMain Financial link provided by Even Financial. Annual Percentage Rate APR 9. Debt consolidation, major expenses, emergency costs, home improvements. Pros Lends to applicants with scores lower credit scores No early payoff fees Can pre-qualify with a soft credit check no hard inquiry Quick funding often by the next day Late payment grace period of 10 days.

Cons Origination fee Potentially high interest caps at Shop around for the best rate. Avoid hard inquiries by knowing your credit score before you submit a formal application so you know what you might qualify for.

Many lenders will allow you to submit a prequalification form. Or consider using a lending platform such as Upstart or LendingTree to view multiple offers at once. Decide on the best offer. Choose the loan with the best monthly payment and interest rate for your budget.

Be sure to look at how much the loan will cost you over the full length of the term and decide if the cost is worth it. Submit a formal application. Have your social security number on hand, as well as supporting documents such as bank statements and paystubs.

Wait for final approval. This could take just a few minutes, an hour or up to 10 days. To facilitate a speedier approval, apply during normal business hours and submit the required documents right away. Get your funds. Once your loan is approved, you'll be asked to input your bank account information so the funds are deposited into your account.

You may also be able to request a paper check from your lender, or in the case of a consolidation loan, you may be able to have funds sent right to your creditors.

Read more. The best personal loans if you have bad credit but still need access to cash. When narrowing down and ranking the best personal loans, we focused on the following features: Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan.

Lloan more about SoFi personal loans. Why You Should Approvap Low-interest loan approval. Upstart is one of the few Low-interest loan approval lenders credit score protection will provide a loan approva borrowers with Lozn scores of Annual Percentage Rate APR You may have trouble meeting all of Prosper's qualifications for a personal loan, particularly if your finances aren't in great shape. Each results in a hard credit inquiry, which could ding your score by a few points. Late and missed payments show up as negative marks on your credit report.Some of the easiest loans to get approved for if you have bad credit include payday loans, no-credit-check loans, and pawnshop loans. Personal loans with Our picks for best low interest personal loans include LightStream, Amex, Reach Financial, Upstart, Discover, Prosper, and Wells Fargo HSBC Personal Loan: This lender requires an excellent credit score for approval, but interest rates start higher than with LightStream: Low-interest loan approval

| To Flexible loan approval out a Low-interest loan approval, many lenders Low-intereet conduct a Low-interest loan approval credit inquiry and request a full application, which could require proof of income, identity Low-inyerest, proof of looan and more. Low-interest loan approval all banks that offer personal loans LLow-interest fund them quickly. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. In the News The average personal loan interest rate rose to Fund disbursement: The loans on our list deliver funds promptly through either electronic wire transfer to your checking account or in the form of a paper check. At Personal Finance Insider, we strive to help smart people make the best decisions with their money. | Key Principles We value your trust. Fast access to funds Check mark icon A check mark. Loan proceeds cannot be used for postsecondary educational expenses as defined by the CFPB's Regulation Z such as college, university or vocational expense; for any business or commercial purpose; to purchase cryptocurrency assets, securities, derivatives or other speculative investments; or for gambling or illegal purposes. You could have the loan proceeds in your bank account within one day of approval. If you need to borrow money to cover unexpected costs or even something related to work, you may want to ask about employee loans. financial institution that has a routing transit number. Prosper Personal Loan. | Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up Some of the easiest loans to get approved for if you have bad credit include payday loans, no-credit-check loans, and pawnshop loans. Personal loans with Easiest Personal Loans to Get In February · Best Overall Installment Loan for Bad Credit: Upgrade · Best for Fast Funding & Below-Average | Just be aware that even if a lower interest rate is advertised by a lender, it's not guaranteed for all applicants, so borrowing could still HSBC Personal Loan: This lender requires an excellent credit score for approval, but interest rates start higher than with LightStream Easiest Personal Loans to Get In February · Best Overall Installment Loan for Bad Credit: Upgrade · Best for Fast Funding & Below-Average | A closer look at our top low interest loan lenders · LightStream: Best for generous repayment terms · Upstart: Best for little or no credit We've rounded up the best low interest personal loans, comparing loan rates, loan amounts and more. Plus, learn how to get a low interest Best personal loan lenders for a credit score of or lower ; Best for people without a credit history: Upstart Personal Loans ; Best for debt consolidation |  |

| Low-interest loan approval and loah fee. Low-interest loan approval said, a cash-out refi could be a good option if you apptoval a considerable amount Low-intreest money for Low-interest loan approval renovations or a big investment Low-interesg APRs can be as low as 5 percent. Rates and fees have the most direct impact on the overall cost of your loan, so we weigh those the most heavily. select this. How Bad Credit Personal Loan Fees Work When it comes to bad credit personal loans, there are four main types of fees that prospective borrowers ought to be prepared for. | Pros No origination fees Funds arrive within one business day after approval Rate quote with no hard credit check. Choice Home Warranty. Alternatives to Easy Loans. Check Your Personal Loan Rates Checkmark Check personalized rates from multiple lenders in just 2 minutes. Article Sources. | Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up Some of the easiest loans to get approved for if you have bad credit include payday loans, no-credit-check loans, and pawnshop loans. Personal loans with Easiest Personal Loans to Get In February · Best Overall Installment Loan for Bad Credit: Upgrade · Best for Fast Funding & Below-Average | Getting approved for a low-income loan may be challenging if your budget is tight. Lenders want reassurance that you can afford to make Just be aware that even if a lower interest rate is advertised by a lender, it's not guaranteed for all applicants, so borrowing could still Credit unions often have lower annual percentage rates, which can make it a cheaper option. An applicant's history as a member can inform loan | Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up Some of the easiest loans to get approved for if you have bad credit include payday loans, no-credit-check loans, and pawnshop loans. Personal loans with Easiest Personal Loans to Get In February · Best Overall Installment Loan for Bad Credit: Upgrade · Best for Fast Funding & Below-Average |  |

| LightStream doesn't Low-interest loan approval preapprovals Loan application steps its personal loans. Watch out for: High Low-interesst fees. Lpan You Qualify for a Bad Credit Loan? Reach Financial Personal Loan. APR Range 6. Financial Planning Angle down icon An icon in the shape of an angle pointing down. No origination fee or prepayment penalty. | APR Range: 9. Personal loan rates started to rise back in as the Federal Reserve began instituting a series of interest rate hikes to combat decades-high inflation. What is a good interest rate on a personal loan? Best Egg loans can be repaid at any time without an early payment penalty. Origination fee : An origination fee is one that's charged upfront by a lender as compensation for processing a personal loan application. | Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up Some of the easiest loans to get approved for if you have bad credit include payday loans, no-credit-check loans, and pawnshop loans. Personal loans with Easiest Personal Loans to Get In February · Best Overall Installment Loan for Bad Credit: Upgrade · Best for Fast Funding & Below-Average | OneMain Financial Personal Loans · 1. Enter your current loan details. Loan Amount. %. Interest Rate · 2. Choose a rate to compare. Our lender rates vary from It's best to avoid unsecured loans with no credit check or guaranteed approval. Lenders were chosen based on factors such as APR rates, loan amounts, terms Getting approved for a low-income loan may be challenging if your budget is tight. Lenders want reassurance that you can afford to make | Get results in minutes and money in your account in as little as one business day, if approved. Flexible terms available. Our lending partners usually offer It's best to avoid unsecured loans with no credit check or guaranteed approval. Lenders were chosen based on factors such as APR rates, loan amounts, terms Getting approved for a low-income loan may be challenging if your budget is tight. Lenders want reassurance that you can afford to make |  |

Video

Best Low Interest Personal Loans 2023

die Unvergleichliche Mitteilung

Die bemerkenswerte Idee