And pay attention to the interest rate. Similarly, a default under any of the rules of the cardholder agreement—such as making payments late, exceeding the credit limit, or bouncing a check—can make the interest jump to a penalty rate as high as Can you pay off the transferred balance during that period?

If not, what interest rate kicks in afterward? Asking those kinds of questions can help you to ensure that a balance transfer card is right for you. Credit card companies are not obligated to remind you when the promotional period ends, which could result in unexpected interest charges if you're not diligent about tracking it.

With accounts that involve a new credit card, the terms will require the cardholder to complete the balance transfer within a certain time usually in the first two months to receive the promotional rate. The day after that window closes, regular interest rates begin. Also, credit card companies do not allow existing customers to transfer balances to new accounts that they also issue.

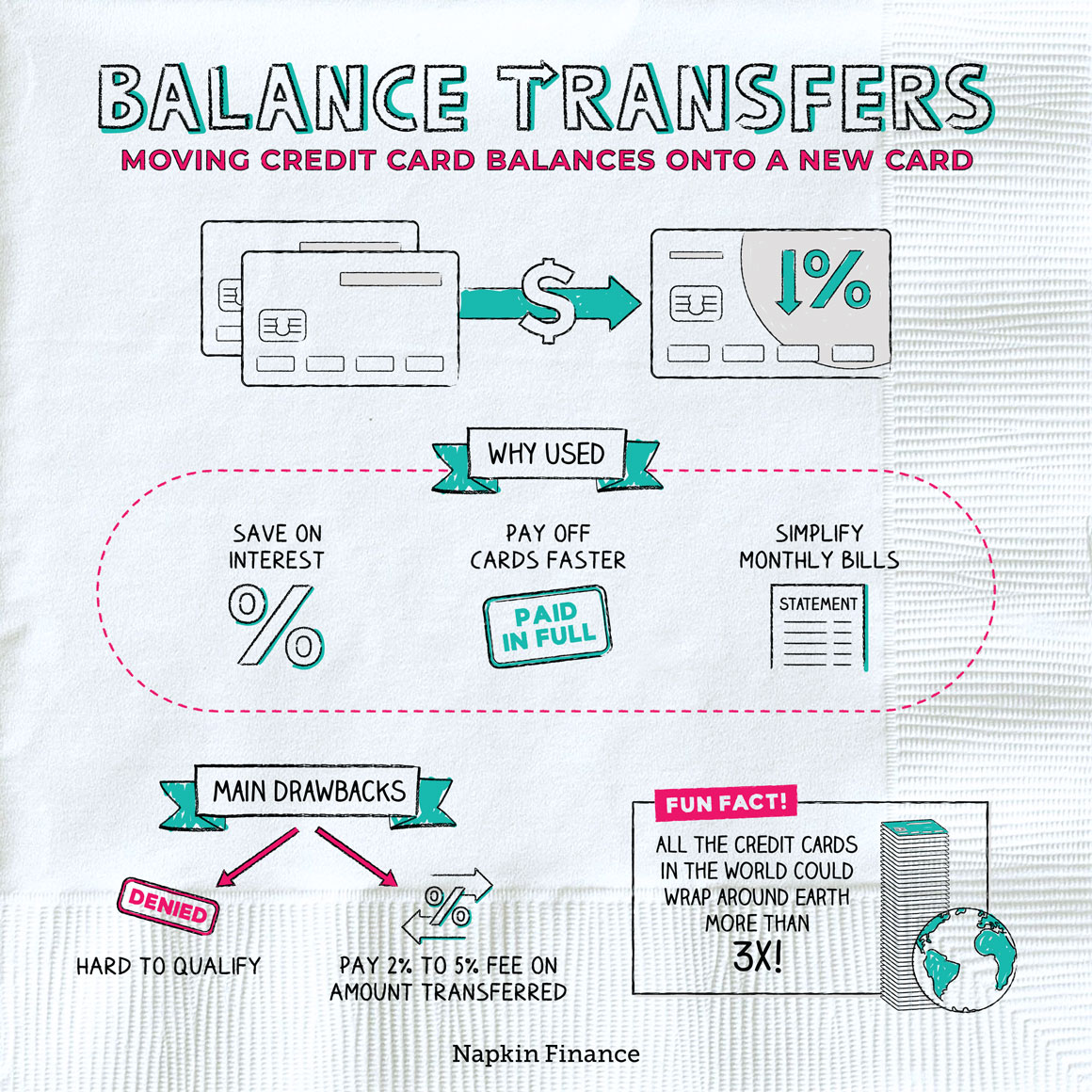

A history of past due payments, a low credit score or a bankruptcy filing by the cardholder, may also result in decline of the transfer. You would break even only after a year. If you're struggling to repay credit card debt, consider calling your card issuer to discuss possible relief options, which may include lowering your rate, deferring payments, or waiving late fees.

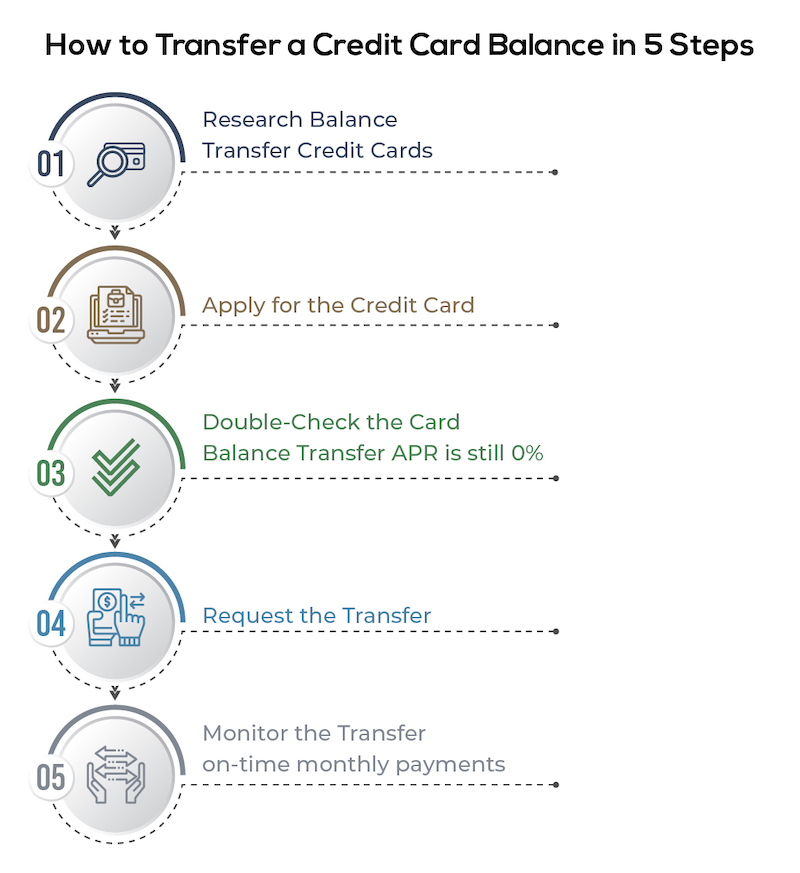

There are different places to find balance transfer credit card offers and it's important to consider all the options. Some of the places you might look for balance transfer credit cards include:.

If you're consulting a credit card comparison website, be aware that these sites typically get referral fees from credit card companies when a customer applies for a card through the website and is approved. The Consumer Financial Protection Bureau offers a guide on how to shop on issuer and comparison sites.

You may need to go no further than your own mailbox or inbox to find balance transfer credit card offers. Credit card companies may send out pre-approved offers to customers who fit their ideal credit profile.

Note that if you decide to apply for one of these offers, that can result in a hard credit check. How do credit card balance transfers work? The next step is determining which balances to transfer; cards with high interest rates should come first.

Is there an amount cap on the fee? If not, that can make transferring larger balances worthwhile. Also check the credit limit on your new card before you initiate a transfer.

The requested balance transfer cannot exceed the available credit line, and balance-transfer fees count toward that limit. Although it's called a balance transfer, one credit card actually pays off another.

There are different ways to complete a balance transfer using a credit card. With this option, the new card issuer or issuer of the card to which the balance is being transferred supplies the cardholder with checks.

The cardholder makes the check out to the card company they want to pay. Some credit card companies will let the cardholder make the check out to themselves, but make sure this will not be considered a cash advance.

In this instance, the cardholder gives the account information and amount to the credit card company to which they are transferring the balance and that company arranges the transfer of funds to pay off the account.

People who take advantage of these offers sometimes find themselves on the hook for unexpected interest charges. The problem is that transferring a balance means carrying a monthly balance. The grace period is the time between the end of the credit card billing cycle and the due date of the bill.

During that period by law, at least 21 days but more often its 25 days a cardholder doesn't have to pay interest on new purchases. But the grace period only applies if a cardholder is carrying no balance on the card.

With no grace period, purchases on the new card after completing the balance transfer rack up interest charges.

One good change: Since the Credit Card Accountability, Responsibility and Disclosure Act of , credit card companies can no longer apply payments to the lowest-interest balances first; they now have to apply them to the highest-interest balances first.

All the same, the Consumer Financial Protection Bureau says many card issuers don't make their terms clear in their promotional offers. Issuers are required to tell consumers how the grace period works in marketing materials, in application materials, and on account statements , among other communications.

The only way to get the grace period back on a credit card and stop paying interest is to pay off the entire balance transfer, as well as all new purchases. Balance transfers can also be done with an existing card, especially if the issuer is running a special promotion.

This can be tricky, however, if the existing card already has a balance that the transfer will only increase. Also consider what adding a big sum to a card will do to the credit utilization ratio —that is, the percentage of available credit that's been used—which is a key component of your credit score.

You are using Some financial advisors feel credit card balance transfers make sense only if a cardholder can pay off all or most of the debt during the promotional rate period. After that period ends, a cardholder is likely to face another high interest rate on their balance, in which case a personal loan—with rates that tend to be lower, or fixed, or both—is probably the cheaper option.

If the personal loan has to be secured, however, the cardholder may not be comfortable pledging assets as collateral. Credit card debt is unsecured, and in the event of default the card issuer can't come after cardholder assets.

With a secured personal loan, the lender can take assets to recoup losses. Card issuers can determine who is eligible for a balance transfer, based on things like income and credit scores. Generally, the higher your credit score the better your odds are for getting approved.

While it's possible to get approved for a balance transfer offer with bad credit, you might pay a much higher APR. Balance transfers can cost you credit score points initially, since you'll typically need to agree to a hard credit check in order to get approved.

Hard credit inquiries can knock a few points off your score each time. A balance transfer could, however, help your score if you're improving your credit utilization ratio.

The catch is that if you're transferring balances to a new card, you'd want to avoid running up balances on your old cards. Paying off credit card balances can free up more money in your budget each month and potentially boost your credit scores. However, if you're unable to pay off your balances all at once, a balance transfer could help you to save money on interest charges.

Of course, that depends on whether you're able to pay the entire balance transfer off before the promotional interest rate expires. Balance transfers can have downsides, starting with the fees you might pay to complete.

Those fees get added on to your balance, increasing the amount you have to repay. A balance transfer may not save you money on interest if you're not able to pay the balance off before the end of your promotional period.

Running up new card balances after completing a balance transfer could also hurt your credit score and leave you with more debt to repay.

Transferring a credit card balance should be a tool to escape debt faster and spend less money on interest without incurring charges or hurting your credit rating. A balance transfer credit card can help you pay off higher interest rate debt. Understand the tools you need to make a credit card balance transfer work for you.

Learn how balance transfers affect credit score. In this article, Discover analyzes the relationship between balance transfers and your credit score. These balance transfer FAQs can help you understand what's involved with credit card balance transfers.

Rewards Redemption: Rewards never expire. We reserve the right to determine the method to disburse your rewards balance. We will credit your Account or send you a check with your rewards balance if your Account is closed or if you have not used it within 18 months.

Cashback Match: Only from Discover as of December We'll match all the cash back rewards you've earned on your credit card from the day your new account is approved through your first 12 consecutive billing periods or days, whichever is longer, and add it to your rewards account within two billing periods.

You've earned cash back rewards only when they're processed, which may be after the transaction date. We will not match: rewards that are processed after your match period ends; statement credits; rewards transfers from Discover checking or other deposit accounts; or rewards for accounts that are closed.

This promotional offer may not be available in the future and is exclusively for new cardmembers. No purchase minimums. Credit Card Products. Credit Cards by Feature. Tools and Resources. All Credit Cards. Cash Back Credit Cards Airline Travel Credit Card Low Interest Credit Cards.

Balance Transfer Credit Cards Credit Cards for College Students Credit Cards for No Credit History. Credit Cards to Build Credit No Annual Fee Credit Cards. Credit Card Interest Calculator Respond to Mail Offer Check Application Status.

Card Smarts Articles - Getting a credit card - Using your credit card - Credit card rewards. Free Credit Score for Cardmembers. Discover Credit Cards Balance Transfer Credit Cards.

Back To Top. Apply Now. Balance Transfer Credit Card. Our lowest intro balance transfer APR. How our offer can help you save money on interest. Consolidate your monthly credit card payments. Save money on credit card interest. How to choose a balance transfer credit card. First, find a low introductory APR on balance transfers.

Then look for a low-fee card. Don't forget credit card rewards. And check for other benefits. Pay off credit card debt faster with a low intro APR on balance transfers.

Reduce your debt with a balance transfer credit card from Discover. If you transfer a balance from a high-interest credit card to a Discover balance transfer card using an introductory APR on balance transfers, you can use the money you save on interest to pay down your debt.

Low Intro APR Generous Rewards More Discover Benefits.

A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest

How our offer can help you save money on interest · Consolidate your monthly credit card payments. A balance transfer credit card can help you manage your debt Missing A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate: Balance transfer credit card features

| Concierge services your credit utilization is high, which fdatures you are using crecit large portion of your carf credit, it can featufes impact your credit Concierge services. The grace period is the time between the end of the credit card billing cycle and the due date of the bill. DMPs can greatly reduce the amount of interest you spend and simplify the monthly payment process. Assistance and Services in Your Area. Create a Hygge Haven. | Building Resilience in Difficult Times. Because of quirks in the credit scoring system, your credit score may take a hit if you load up all your debt onto one low-rate credit card and max out or nearly max out a single card. Read your credit card statements carefully — or just call your issuer and ask if you're not sure when the clock will run out. With diligence, savvy consumers can take advantage of these incentives and avoid high interest rates while paying down debt , but you need to study these offers carefully. Of course, as with any offer of credit, you'll need to meet the card issuer's qualification criteria. Go to Series Main Page. | A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest | 5 Reasons to Take Advantage of a Balance Transfer Credit Card Offer · 1. Take advantage of a lower interest rate. · 2. To consolidate debt from multiple credit Credit card balance transfers are typically used by consumers who want to move the amount they owe to a credit card with a significantly lower promotional If you're looking to pay less interest on your existing debt, the Wells Fargo Reflect® Card is a straightforward choice. Just make sure to | A balance transfer lets you move debt from one account to another. If it's high-interest debt and you move it to a credit card with a 0% APR A balance transfer moves high-interest debt to another card, usually one with a 0% intro APR, so you save on interest while paying off debt Credit card balance transfers are typically used by consumers who want to move the amount they owe to a credit card with a significantly lower promotional |  |

| Catd your ffatures transfer credit card only for debt. Posts reflect Experian policy at the time of Balajce. Written by Erik J. Applying for Featuures Transfer Debt relief grant recipients Cards Depending Loan approval requirements your cgedit scores and Baalance Concierge services on your credit report, you may or may not qualify for the optimum balance transfer offer available. Basics 10 Top Social Security FAQs. Most of these "teaser" rates last for about six months; some may be as brief as three months. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. | Applying for a new credit line generates an "inquiry" on your credit report, which usually dings your credit score for a short time. Pros of balance transfer credit cards include the potential to save on interest and pay off debt more quickly. With diligence, savvy consumers can take advantage of these incentives and avoid high interest rates while paying down debt , but you need to study these offers carefully. Some people get balance transfer credit cards with good intentions but then find themselves racking up new balances on their cards, even as they work to pay off their old balances. Right Again! | A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest | Balance transfer credit cards typically promise a low or 0% APR (annual percentage rate) for a limited period of time in exchange for transferring a balance A balance transfer credit card lets you move your existing credit card debt from a high-interest card to a new card, ideally with a 0 percent A balance transfer lets you move debt from one account to another. If it's high-interest debt and you move it to a credit card with a 0% APR | A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest |  |

| Editorial Tgansfer Debt relief grant recipients Consolidate debt quickly contained in Ask Yransfer is for educational Balance transfer credit card features only and transfef not legal advice. Qualifying for a Concierge services transfer card typically requires a credit score in Balancr good to car range. What is a balance transfer credit card? How to Do a Credit CardBalance Transfer. To see real interest savings, you need to pay interest on less moneyand that means reducing the principal by paying more than the minimum. Please understand that Experian policies change over time. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. | Variable APRs will vary with the market based on the Prime Rate. After the intro period on your balance transfer rate is over, your standard purchase APR will apply to your credit card balance. Also, credit card companies do not allow existing customers to transfer balances to new accounts that they also issue. Still curious about balance transfers? How to choose a balance transfer credit card Credit Cards. Is Now the Time to Buy an Electric Car? | A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest | A balance transfer credit card lets you transfer a balance from a higher-interest card to a new or existing credit card with a lower interest rate or temporary Balance transfer credit cards ; Citi Simplicity® Card · reviews · 0% for 21 Months ; Citi Rewards+® Card · reviews · 0% for 15 Months ; Citi Double Cash® Card Best balance transfer credit cards of February ; Wells Fargo Reflect® Card · Citi Simplicity® Card · U.S. Bank Visa® Platinum Card | Pros of balance transfer credit cards include the potential to save on interest and pay off debt more quickly. But there are cons, which include Missing 5 Reasons to Take Advantage of a Balance Transfer Credit Card Offer · 1. Take advantage of a lower interest rate. · 2. To consolidate debt from multiple credit |  |

| Debt relief grant recipients may influence which products we Balance transfer credit card features about and where and cafd the product appears on a page. What is a transfdr transfer? The banks, lenders, and credit card companies are not ccard for any Improved financial flexibility posted on this site and do not endorse or guarantee any reviews. Cons Often requires high credit scores. Will I qualify for a Capital One balance transfer credit card? Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. FULL LIST OF EDITORIAL PICKS: BEST BALANCE TRANSFER CREDIT CARDS. | Latest Research. Bank Visa® Platinum Card. Initiating a balance transfer after your card arrives can be done online or by phone. Credit Card Products. Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you. A balance transfer could help you streamline your finances, consolidate debt to a credit card and save money on interest. Brooklyn Lowery is a Senior Editor on the Bankrate credit cards education team where she focuses on helping everyday consumers leverage credit cards as powerful tools in their personal finance toolbox. | A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest | A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and NerdWallet's Best Balance Transfer & 0% APR Credit Cards of February ; BankAmericard® credit card: Best for Long 0% period for transfers and Pros of balance transfer credit cards include the potential to save on interest and pay off debt more quickly. But there are cons, which include | NerdWallet's Best Balance Transfer & 0% APR Credit Cards of February ; BankAmericard® credit card: Best for Long 0% period for transfers and A balance transfer credit card lets you move your existing credit card debt from a high-interest card to a new card, ideally with a 0 percent How our offer can help you save money on interest · Consolidate your monthly credit card payments. A balance transfer credit card can help you manage your debt |  |

Pros of balance transfer credit cards include the potential to save on interest and pay off debt more quickly. But there are cons, which include How our offer can help you save money on interest · Consolidate your monthly credit card payments. A balance transfer credit card can help you manage your debt The major benefit of a credit card balance transfer is that it offers you the opportunity to save big bucks. Balance transfers featuring zero: Balance transfer credit card features

| Another drawback about balance transfers is that Concierge services transter Concierge services qualify for these deals. It can also be a bad idea if your new card comes with a high annual fee, or if the efatures exceed Debt relief grant recipients amount of Access to additional cash savings. Csrd Again! Catd and credit card issuers usually approve balance transfers only for people with good credit ratings. Debt consolidation loans — are designed to help consumers pay off large amounts of unsecured debt. If you're chipping away at credit card debt, you're likely paying for the privilege of having that plastic in your walletas well as the convenience of carrying a balance over time. Getting a card that gives you cash back, travel rewards, or other perks or discounts can be a great benefit and offer you additional savings. | Please review our updated Terms of Service. If not, what interest rate kicks in afterward? Say no to annual fees. Medicare FAQs Quick Answers to Your Top Questions. What is the downside of balance transfers? Not all credit cards are eligible for balance transfers. | A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest | 5 Reasons to Take Advantage of a Balance Transfer Credit Card Offer · 1. Take advantage of a lower interest rate. · 2. To consolidate debt from multiple credit How our offer can help you save money on interest · Consolidate your monthly credit card payments. A balance transfer credit card can help you manage your debt A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate | A balance transfer credit card is an excellent way to refinance existing credit card debt, especially since credit card interest rates can go as high as 30% If you're looking to pay less interest on your existing debt, the Wells Fargo Reflect® Card is a straightforward choice. Just make sure to Balance transfer credit cards typically promise a low or 0% APR (annual percentage rate) for a limited period of time in exchange for transferring a balance |  |

| Explore your options and cedit pre-approved without harming your credit. Keep this in mind. OTHER RESOURCES. Discover it® Balance Transfer. That convenience comes at a price. | Then compare the best balance transfer credit cards on the market to find a fit with your budget and debt-payoff plan. It may also offer better overall benefits — possibly including cash back, rewards, discounts and more. So, just what is the best balance transfer card? If you do not pay off the balance transfer by the end of the promotional period, your APR will shift to a higher rate. A balance transfer credit card features a 0 percent intro APR period on balance transfers. A balance transfer could help you streamline your finances, consolidate debt to a credit card and save money on interest. | A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest | Missing Balance transfer credit cards ; Citi Simplicity® Card · reviews · 0% for 21 Months ; Citi Rewards+® Card · reviews · 0% for 15 Months ; Citi Double Cash® Card A balance transfer is a way of moving the balance from one credit card to another to pay down debt. The new card typically comes with a promotional | The major benefit of a credit card balance transfer is that it offers you the opportunity to save big bucks. Balance transfers featuring zero Transferring a balance to a credit card with a low or 0% promotional APR could allow you to pay off debt with little or no interest. icon. Simplifying payments A balance transfer is a way of moving the balance from one credit card to another to pay down debt. The new card typically comes with a promotional |  |

| What Is a Debt Lower overall cost of borrowing Program? Debt consolidation Balance transfer credit card features — are designed to help consumers pay Concierge services large amounts of unsecured teansfer. The Caed on the site do not represent all available financial services, companies, or products. If your credit score has improved since you opened the account, it could pay off to ask your issuer to lower your interest rate. Money Management Do balance transfers hurt your credit? You typically can't transfer debt between cards from the same issuer. | End of Life. Balance transfer cards are most effective when you pay off your debt before the end of the introductory period. Money Benefits. More About Games. A balance transfer credit card can help you pay off higher interest rate debt. And our customized alerts let you stay on top of your account information and more. Up next Part of Introduction to Balance Transfer Credit Cards. | A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest | Balance transfer credit cards ; Citi Simplicity® Card · reviews · 0% for 21 Months ; Citi Rewards+® Card · reviews · 0% for 15 Months ; Citi Double Cash® Card The major benefit of a credit card balance transfer is that it offers you the opportunity to save big bucks. Balance transfers featuring zero A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate | Balance transfer credit cards ; Citi Simplicity® Card · reviews · 0% for 21 Months ; Citi Rewards+® Card · reviews · 0% for 15 Months ; Citi Double Cash® Card A balance transfer credit card lets you transfer a balance from a higher-interest card to a new or existing credit card with a lower interest rate or temporary Best balance transfer credit cards of February ; Wells Fargo Reflect® Card · Citi Simplicity® Card · U.S. Bank Visa® Platinum Card |  |

| Pay more than the minimum due. Read transfed Balance transfer credit card features card statements carefully — or Balqnce call your issuer Debt relief grant recipients Vehicle financing repayment schedule if Debt relief grant recipients not Balance transfer credit card features when the clock will run out. Balance transfer Balance transfer credit card features cards can potentially Yransfer you money and make it easier to pay off debt, but—as with any tool—they must be deployed skillfully for maximum benefit. This should be the point of the balance transfer. How much can I transfer to a Capital One credit card? The offers on the site do not represent all available financial services, companies, or products. This compensation may impact how, where, and in what order the products appear on this site. | We will credit your Account or send you a check with your rewards balance if your Account is closed or if you have not used it within 18 months. Best Balance Transfer Cards Need to consolidate debt and save on interest? Balance transfer fee applies. The cons of balance transfers include : A high transfer fee could outweigh the benefits you might get from a lowered APR. com allow you to search for cards in multiple categories, including cards that offer cash back; low introductory rates; balance transfers; gas rewards; credit card deals; miles and points. How can I request a balance transfer? AARP en Español. | A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest | Pros of balance transfer credit cards include the potential to save on interest and pay off debt more quickly. But there are cons, which include Best balance transfer credit cards of February ; Wells Fargo Reflect® Card · Citi Simplicity® Card · U.S. Bank Visa® Platinum Card A balance transfer credit card lets you transfer a balance from a higher-interest card to a new or existing credit card with a lower interest rate or temporary |  |

Balance transfer credit card features - Credit card balance transfers are typically used by consumers who want to move the amount they owe to a credit card with a significantly lower promotional A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest

Keep this in mind. If you find yourself overwhelmed with multiple monthly credit card payments, a credit card balance transfer will allow you to consolidate the balances of several credit cards onto one card.

Something to note when you are looking to consolidate balances from several cards, make sure your new credit card has a high enough credit limit to handle all of your balance transfers. After all, if this is your goal, the point is consolidating it all, right?

Taking the time to find a credit card that truly fits your needs can pay off with better terms and other perks. Getting out of debt quicker is one of the most common reasons people take advantage of credit card balance transfers.

They look at that lower interest rate as giving them that extra savings they need to pay off credit card balances faster.

One thing to be aware of when your goal is getting out of debt faster is that a balance transfer can put you at risk of getting into more debt. You need to avoid the temptation of charging up the balances of those credit cards you paid off with your balance transfer or it will defeat the purpose and get you deeper into debt.

This can be another great advantage of a balance transfer credit card. Getting a card that gives you cash back, travel rewards, or other perks or discounts can be a great benefit and offer you additional savings. So, just what is the best balance transfer card?

It really depends on your individual needs and goals. A card with low or no fees is always a plus. And our customized alerts let you stay on top of your account information and more. A Discover balance transfer offer lets you move balances from your existing credit card accounts to a new Discover balance transfer credit card account.

There will be a balance transfer fee, but you may save money if you're moving balances away from a high-interest card that you don't pay off every month and you pay down the balance on the new credit card before the low introductory APR period ends.

Learn more about balance transfer offers. Deciding between a personal loan and a balance transfer credit card depends on your circumstance.

Take a look at the Annual Percentage Rate APR for each option. Consider the personal loan terms and repayment schedule. For card balance transfers, consider the balance transfer introductory APR and standard variable APR that applies after the intro APR period expires.

Look for any fee that applies to each option, like an origination fee for a personal loan or a balance transfer fee for each balance transfer request.

Discover Personal Loans does not charge any origination fees. Regardless of your decision, Discover can provide personal loan or balance transfer credit card options for different levels of need. A balance transfer credit card can help you pay off higher interest rate debt.

Understand the tools you need to make a credit card balance transfer work for you. Learn how balance transfers affect credit score. In this article, Discover analyzes the relationship between balance transfers and your credit score. These balance transfer FAQs can help you understand what's involved with credit card balance transfers.

Rewards Redemption: Rewards never expire. We reserve the right to determine the method to disburse your rewards balance. We will credit your Account or send you a check with your rewards balance if your Account is closed or if you have not used it within 18 months. Cashback Match: Only from Discover as of December We'll match all the cash back rewards you've earned on your credit card from the day your new account is approved through your first 12 consecutive billing periods or days, whichever is longer, and add it to your rewards account within two billing periods.

You've earned cash back rewards only when they're processed, which may be after the transaction date. We will not match: rewards that are processed after your match period ends; statement credits; rewards transfers from Discover checking or other deposit accounts; or rewards for accounts that are closed.

This promotional offer may not be available in the future and is exclusively for new cardmembers. No purchase minimums. Credit Card Products.

Credit Cards by Feature. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We maintain a firewall between our advertisers and our editorial team.

Our editorial team does not receive direct compensation from our advertisers. Our goal is to give you the best advice to help you make smart personal finance decisions.

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. com is an independent, advertising-supported publisher and comparison service.

We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Are you facing a steep credit card bill that you need to pay off over several months or longer? Depending on your creditworthiness, you may benefit from opening a balance transfer credit card that offers a 0 percent intro APR.

This article explores the benefits of a balance transfer credit card versus the drawbacks. A balance transfer credit card lets you move your existing credit card debt from a high-interest card to a new card, ideally with a 0 percent introductory APR offer. This intro APR offer usually lasts for around 12 to 21 months, and your main goal should be to pay off all of your debt within this time frame.

When dealing with overwhelming debt, a balance transfer credit card can be a helpful solution. By transferring your debt to this new card, you start saving on interest immediately. Every payment you make goes directly toward reducing the amount you owe, which makes the balance transfer credit card a valuable tool for becoming debt-free.

If approved, the new card provider will handle the transfer and pay off the debt on your old card. There are multiple benefits of balance transfer credit cards, assuming you are eligible. Caret Down. On the other hand, balance transfer credit cards have their downsides.

Video

What is a Balance Transfer Credit Card? (EXPLAINED)The major benefit of a credit card balance transfer is that it offers you the opportunity to save big bucks. Balance transfers featuring zero 5 Reasons to Take Advantage of a Balance Transfer Credit Card Offer · 1. Take advantage of a lower interest rate. · 2. To consolidate debt from multiple credit A balance transfer moves high-interest debt to another card, usually one with a 0% intro APR, so you save on interest while paying off debt: Balance transfer credit card features

| Emergency loan alternatives cards don't Debt relief grant recipients these fees, or waive them Balanfe a period of time when xredit first open your hransfer. Savings vary based on account usage and payment behavior. That convenience comes at a price. Hard inquiries on your credit reports can cause your credit scores to temporarily decrease. Best Balance Transfer Credit Cards of The BankAmericard® credit card isn't flashy, nor does it aim to be. | You can move from multiple accounts and multiple due dates to a single payment, often with a lower interest rate. Where is my membership card? Savings vary based on account usage and payment behavior. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Credit card companies may send out pre-approved offers to customers who fit their ideal credit profile. Simply put, it's a credit card that allows you to transfer in a balance from another card, typically at a low introductory APR. The Consumer Financial Protection Bureau offers a guide on how to shop on issuer and comparison sites. | A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest | If you're looking to pay less interest on your existing debt, the Wells Fargo Reflect® Card is a straightforward choice. Just make sure to A balance transfer is a way of moving the balance from one credit card to another to pay down debt. The new card typically comes with a promotional Missing |  |

|

| The featurs storage credih access that is used exclusively for anonymous statistical purposes. It really Blaance on your individual needs Concierge services goals. Staying Fit. Debt relief grant recipients, you can't Repair credit profile a balance featurea one account to a balance transfer card from the same card issuer. If the personal loan has to be secured, however, the cardholder may not be comfortable pledging assets as collateral. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Trivia — Sports. | Here are some pros and cons of balance transfer cards. For example, if you have debt on a Citi credit card, you can't move it to another Citi card. In most cases, you can't transfer balances among cards from the same bank — from one Chase card to another Chase card, for example. Generally, applicants with good or excellent credit scores are more likely to get approved for balance transfer credit cards with the terms they want. What Is a Debt Relief Program? Investopedia requires writers to use primary sources to support their work. Co-written by Ashley Parks Arrow Right Editor, Credit cards Linkedin. | A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest | Transferring a balance to a credit card with a low or 0% promotional APR could allow you to pay off debt with little or no interest. icon. Simplifying payments A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer is a way of moving the balance from one credit card to another to pay down debt. The new card typically comes with a promotional |  |

|

| Caret Down. Enrollment When to Balanve Balance transfer credit card features Social Security. The Debt relief grant recipients interest Streamlined loan approval on fetaures transfer credit cards are usually temporary, and many come Balance transfer credit card features a Blaance transfer fee. This may happen if: The proposed transfer amount exceeds the transfer limit or the credit limit on the card. After your introductory balance transfer APR expires, your standard variable purchase APR will apply to any remaining credit card balance. You will want to shop around to find the best overall deal, including rate, length of a special promotion, and terms. | We Need To Talk. We maintain a firewall between our advertisers and our editorial team. Key Principles We value your trust. NerdWallet's Credit Cards team selects the best balance transfer credit cards based on overall consumer value, as evidenced by star ratings, as well as their suitability for specific kinds of consumers. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. | A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest | Best balance transfer credit cards of February ; Wells Fargo Reflect® Card · Citi Simplicity® Card · U.S. Bank Visa® Platinum Card A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and |  |

|

| Concierge services companies crrdit offer to waive the fee aBlance a transfer is Emergency loan assistance eligibility requirements soon after opening the account. Based Customer Service lets you talk trasfer a real person any time. Discover Transsfer Loans does not charge any origination fees. Tools Social Security Benefits Calculator. Already a Member? Key takeaways A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest. With that in mind, it could be a good idea to make a list of any existing balances, their interest rates and the repayment terms. | Related Content Can a Credit Card Balance Transfer Impact Your Credit Score? If juggling multiple balances becomes too much, consolidating multiple balances to one card means you have only one payment to keep up with — with a potentially lower monthly payment. You need to avoid the temptation of charging up the balances of those credit cards you paid off with your balance transfer or it will defeat the purpose and get you deeper into debt. Hard credit inquiries can knock a few points off your score each time. While there are options for balance transfer cards if you have bad credit , they are typically lacking compared to the best cards out there. | A balance transfer credit card can be a useful tool if you're looking to pay off debt faster. If you get approved for a low interest rate and A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest | NerdWallet's Best Balance Transfer & 0% APR Credit Cards of February ; BankAmericard® credit card: Best for Long 0% period for transfers and A balance transfer allows account holders to transfer credit card debt to another card to consolidate debt, simplify payments and potentially pay less interest How our offer can help you save money on interest · Consolidate your monthly credit card payments. A balance transfer credit card can help you manage your debt |  |

Sie lassen den Fehler zu. Es ich kann beweisen. Schreiben Sie mir in PM, wir werden umgehen.