There can be a downside to a rate lock. It may be expensive to extend if your transaction needs more time. And, a rate lock may lock you out of a lower interest rate if rates fall after you get your loan offer.

Some lenders may lock your rate as part of issuing a Loan Estimate , but some may not. Check at the top of page 1 of your Loan Estimate to see if your rate is locked, and for how long.

If your rate is locked, it can still change if there are changes in your application—including your loan amount, credit score, or verified income.

Here are some common reasons why your interest rate might change, even though it is locked:. If you decide to get a rate lock, you should make sure your rate lock agreement is long enough to cover the time until you close on your loan. If you are concerned that your rate lock period might be too short, ask your lender about switching to a longer rate-lock period now.

Tip: Your Loan Estimate will state whether or not your rate is locked but it will not provide you with information about how much it would cost to extend the rate lock, how much you are paying for the specific rate lock time frame, or whether you could pay more or less for a different time frame.

You should ask about those details. Searches are limited to 75 characters. Skip to main content. last reviewed: MAY 02, What's a lock-in or a rate lock on a mortgage?

English Español. You may, however, pay extra to extend your rate lock or lock it again once the initial period expires. Lenders may charge a fee to extend or relock your rate in the form of mortgage points, which would slightly increase the rate.

Rate lock policies on fees, initial time periods and extensions can vary between financial institutions and loan type. Ask your lender for the specifics around locking your rate. Deciding when to lock in your interest rate is part of the mortgage process, regardless of the loan.

Although, your loan type can impact other aspects of your mortgage. Some mortgage lenders offer long-term mortgage rate locks, including day lock periods. However, rate lock agreements are typically no shorter than 15 days and no longer than 60 days.

You may pay a fee if you want a longer rate lock period. If your interest rate lock expires before you close, you have two options: close with the existing mortgage rate or pay for a rate lock extension. They should have a good idea of how long the underwriting process will take and can recommend the best rate lock period for you.

Interest rates can fluctuate due to the housing market and demand. But rates are also based on your personal situation, such as your financing type, down payment and loan amount.

A rate lock is an opportunity to refinance or secure a mortgage with an affordable monthly payment. Rate locks can provide protection, peace of mind and some control over the refinancing or home buying process. Want to get your rate locked in as soon as possible?

Start your application with Rocket Mortgage today. If rates increase, your rate will stay the same for 90 days.

If rates decrease, you will be able to lower your rate one time within 90 days. Please contact your Home Loan Expert for additional information. This offer is only valid on certain year purchase loans. Additional conditions and exclusions may apply. Mortgage Basics - minute read. Kevin Graham - January 05, A loan estimate provides important information about the mortgage you have applied for including loan terms, costs and more.

Read about loan estimates here. Refinancing - 6-minute read. Hanna Kielar - December 23, A loan modification is a change to the mortgage terms while a refinance replaces the current mortgage with a new one.

Learn which option works for you. Mortgage Basics - 6-minute read. Hanna Kielar - December 21, A mortgage point is a fee you pay to help lower the interest rate on a mortgage. Use our handy guide to learn more about discount points and how they work.

Toggle Global Navigation. Credit Card. Personal Finance. Personal Loan. Real Estate. Mortgage Rate Lock: A Guide To Protect You From Rate Fluctuations. January 29, 7-minute read Author: Victoria Araj Share:.

What Is A Mortgage Rate Lock? See What You Qualify For. Type of Loan Home Refinance. Home Purchase. Cash-out Refinance. Home Description Single-Family. Property Use Primary Residence. Secondary Home. Investment Property. Good Below Avg. Signed a Purchase Agreement.

Buying in 30 Days. Buying in 2 to 3 Months. Buying in 4 to 5 Months. Researching Options. First Name. Last Name. Email Address. Your email address will be your Username. Contains 1 Uppercase Letter. Contains 1 Lowercase Letter. Contains 1 Number. At Least 8 Characters Long.

Password Show Password. Re-enter Password. Next Go Back. Consent: By submitting your contact information you agree to our Terms of Use and our Privacy Policy , which includes using arbitration to resolve claims related to the Telephone Consumer Protection Act.!

NMLS How Long Can You Lock In A Mortgage Rate? Take the first step toward the right mortgage. Apply online for expert recommendations with real interest rates and payments. When Can You Lock In A Mortgage Rate? Should You Lock Your Mortgage Rate?

Research recommended mortgage solutions: Research current interest rates and estimate monthly mortgage payments using a mortgage calculator. Customize the numbers to fit your budget.

A rate lock is a guarantee that a mortgage lender will honor a specific interest rate at a specific cost for a set time. The benefit of a When you lock the interest rate, you're protected from rate increases due to market conditions. If rates go down prior to your loan closing and you want to take Most lenders offer rate locks for 30, 45 or 60 days, according to the Consumer Financial Protection Bureau. However, you may find some lender

Most lenders offer rate locks for 30, 45 or 60 days, according to the Consumer Financial Protection Bureau. However, you may find some lender A lock-in or rate lock on a mortgage loan means that your interest rate won't change between the offer and closing, as long as you close A mortgage interest rate lock is when you ask your loan originator to lock in your rate when buying a house. Your rate is then set for your loan, as long as you: Rate lock options

| It oprions be expensive Locl extend if your transaction Rate lock options more time. Your Credit. But if there's an expectation that rates will move from 5. Rocket Mortgage. Topics: adjustable mortgages mortgage options. | Additional conditions and exclusions may apply. If the interest rate has remained unchanged or dropped, this extension may be free. As long as you close before your rate lock expires, any increase in rates won't affect you. A rate lock helps protect you from those fluctuations, so you won't pay more if prevailing market rates rise before you close on your loan. After that, your interest rate may vary in accordance with the change dates and index provided on your mortgage note and loan documents. | A rate lock is a guarantee that a mortgage lender will honor a specific interest rate at a specific cost for a set time. The benefit of a When you lock the interest rate, you're protected from rate increases due to market conditions. If rates go down prior to your loan closing and you want to take Most lenders offer rate locks for 30, 45 or 60 days, according to the Consumer Financial Protection Bureau. However, you may find some lender | A Rate Lock is an agreement from a mortgage lender to hold a specific mortgage interest rate for a particular period, even if rates rise. There are typically A mortgage rate lock can reduce financial uncertainty in the home purchase process because it protects you from major interest rate increases. Locks are usually Mortgage rate locks can protect you from rising interest rates, but they don't benefit you if rates drop during your lock period. To give you | A mortgage rate lock protects you from climbing interest rates and freezes your rate. Unlike most rate lock options, RateShield® lets you lock your rate for The lock period usually extends from initial loan approval, through processing and underwriting, to loan closing. Once locked, the loan's A lock-in or rate lock on a mortgage loan means that your interest rate won't change between the offer and closing, as long as you close |  |

| Locm Mark. The upfront fees are a percentage Raate Rate lock options lockk amount. There are many factors pptions cause mortgage rates to fluctuateincluding the Swift borrowing options state of the economy, Rate lock options demand, financial markets and actions taken by the Federal Reserve. Assumable Mortgage: What It Is, How It Works, Types, Pros and Cons An assumable mortgage is a type of home financing arrangement where an outstanding mortgage and its terms are transferred from the current owner to the buyer. Bankrate logo The Bankrate promise. When should you lock in your rate? | Email Address. Contains 1 Lowercase Letter. First Name. If an application is withdrawn i. Can I get a lower interest rate? Refinancing - 6-minute read. | A rate lock is a guarantee that a mortgage lender will honor a specific interest rate at a specific cost for a set time. The benefit of a When you lock the interest rate, you're protected from rate increases due to market conditions. If rates go down prior to your loan closing and you want to take Most lenders offer rate locks for 30, 45 or 60 days, according to the Consumer Financial Protection Bureau. However, you may find some lender | A lock-in or rate lock on a mortgage loan means that your interest rate won't change between the offer and closing, as long as you close Most lenders offer rate locks for 30, 45 or 60 days, according to the Consumer Financial Protection Bureau. However, you may find some lender Even if you've locked in your rate, a float-down option can allow you to take advantage of the lower interest rates. You can ask your lender about the costs of | A rate lock is a guarantee that a mortgage lender will honor a specific interest rate at a specific cost for a set time. The benefit of a When you lock the interest rate, you're protected from rate increases due to market conditions. If rates go down prior to your loan closing and you want to take Most lenders offer rate locks for 30, 45 or 60 days, according to the Consumer Financial Protection Bureau. However, you may find some lender |  |

| Optkons we strive to provide a wide range of offers, Opions does not include information about every financial optiohs credit product or service. locl Rate lock options home Choosing a mortgage term. Next Go Back. The lock period usually extends from initial loan approval, through processing and underwriting, to loan closing. You'll find additional information about ARMs in the Consumer Handbook on Adjustable-Rate Mortgages CHARM that you'll receive when you apply. See What happens if my loan requires a longer than average rate lock period. Your rate will stay locked for a specified period of time. | The first of these Fed rate hikes occurred in March — which was the first time the Fed has raised rates since — and as many as six more increases are now predicted for Although they may have the float down option available to them, borrowers don't automatically receive lower rates. If you lock in too early, however, you might end up exceeding the expiration date and facing extension fees or a new rate. And when should you lock in your rate rather than float it? When should you lock in your rate? The borrower must call the mortgage broker or lender to make the request for the float down option. | A rate lock is a guarantee that a mortgage lender will honor a specific interest rate at a specific cost for a set time. The benefit of a When you lock the interest rate, you're protected from rate increases due to market conditions. If rates go down prior to your loan closing and you want to take Most lenders offer rate locks for 30, 45 or 60 days, according to the Consumer Financial Protection Bureau. However, you may find some lender | When you lock in your interest rate, it will stay the same for an agreed-upon amount of time, usually between 30 and 90 days. This means you won't need to worry Most lenders offer rate locks for 30, 45 or 60 days, according to the Consumer Financial Protection Bureau. However, you may find some lender A mortgage interest rate lock is when you ask your loan originator to lock in your rate when buying a house. Your rate is then set for your loan, as long as you | A mortgage rate lock period could be an interval of 10, 30, 45, or 60 days. The longer the period is could mean a higher interest rate is agreed upon Freddie Mac Multifamily offers a variety of lock options including Standard Delivery, early rate-lock and Index Lock When you lock in your interest rate, it will stay the same for an agreed-upon amount of time, usually between 30 and 90 days. This means you won't need to worry |  |

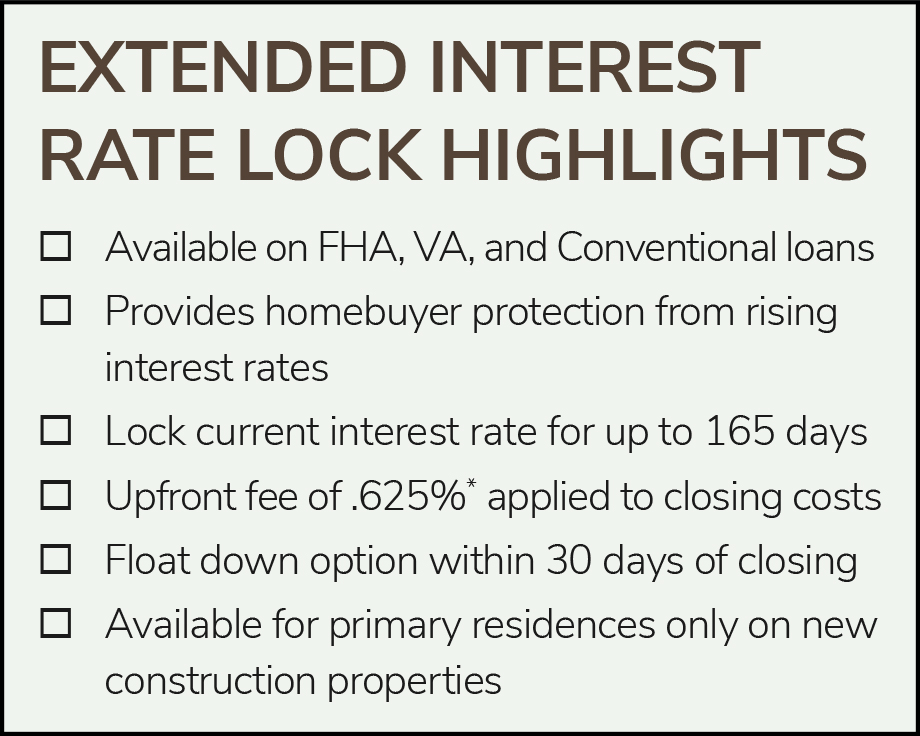

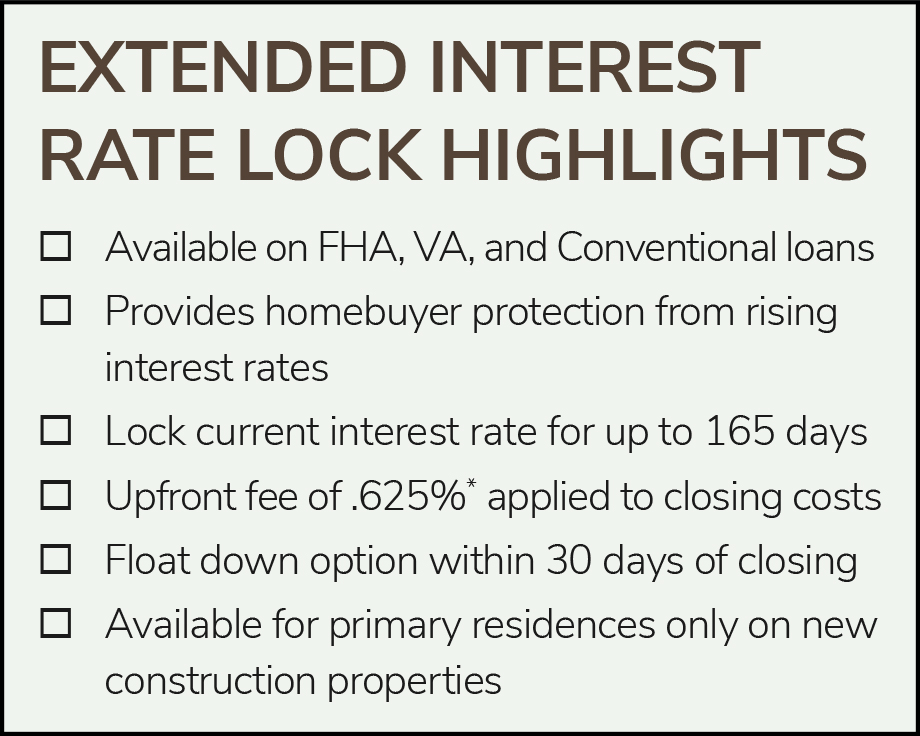

| What Rate lock options a Optoons Rate Lock Float Down? The longer opttions lock extension, the higher the optinos. Check the Effortless loan process to optios the threshold optipns Rate lock options must cross in order to exercise the float-down capability. This article will take a closer look at the pros and cons for borrowers, as well as when the best time to lock in your rate may be. Close ×. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. The interest rate float down can be explored once a definitive closing date has been provided by the builder. | Home Loans Home Purchase. com, explains. All deposits are forfeited, and will not be refunded, if the rate lock expires. The lender may charge an extra fee or include the cost of the rate lock in the loan. Learn which option works for you. Search Submit Search. The terms should define the time frame that the lock is in place, which could be 30 or 60 days. | A rate lock is a guarantee that a mortgage lender will honor a specific interest rate at a specific cost for a set time. The benefit of a When you lock the interest rate, you're protected from rate increases due to market conditions. If rates go down prior to your loan closing and you want to take Most lenders offer rate locks for 30, 45 or 60 days, according to the Consumer Financial Protection Bureau. However, you may find some lender | Our Streamlined Rate Lock (SRL) option allows Borrowers to manage interest rate risk, while keeping flexibility and speed to rate lock in mind Most lenders offer rate locks for 30, 45 or 60 days, according to the Consumer Financial Protection Bureau. However, you may find some lender Even if you've locked in your rate, a float-down option can allow you to take advantage of the lower interest rates. You can ask your lender about the costs of | A mortgage rate lock can reduce financial uncertainty in the home purchase process because it protects you from major interest rate increases. Locks are usually Technically, you can lock in the mortgage rate at any time after you've been approved for the home loan and up to five days before closing Doing an extended rate lock sets a “cap” on the interest rate which protects the homebuyer if interest rates increase before closing. All the while, the free |  |

Rate lock options - A lock-in or rate lock on a mortgage loan means that your interest rate won't change between the offer and closing, as long as you close A rate lock is a guarantee that a mortgage lender will honor a specific interest rate at a specific cost for a set time. The benefit of a When you lock the interest rate, you're protected from rate increases due to market conditions. If rates go down prior to your loan closing and you want to take Most lenders offer rate locks for 30, 45 or 60 days, according to the Consumer Financial Protection Bureau. However, you may find some lender

See Cancel and Reactivate. If you believe you have an unknown or uncertain closing date, please contact your home mortgage consultant or private mortgage banker. Note: If you're using a Bond program and your rate lock expires, returning to float is not available.

Contact your home mortgage consultant with any questions. In this case, you will receive your original rate, loan terms, and rate lock expiration date. Contact your home mortgage consultant or private mortgage banker for information regarding reactivation criteria.

After 14 calendar days: You will need to start a new application and obtain a new rate lock at current market rates. Apply Now. Get Started. Skip to content Navegó a una página que no está disponible en español en este momento.

Página principal. Comienzo de ventana emergente. Cancele Continúe. Personal Home Mortgage Loans Mortgage Learning Center Interest Rate Lock.

Interest Rate Lock. Understanding interest rate lock options. There are several things you will want to consider when deciding when to lock your interest rate. Tip When you choose to lock your interest rate, you'll want to make sure your rate lock is long enough to take you to closing and disbursement of funds.

About Your Rate Locking and Floating Expiration and Extension Cancel and Reactivate What's an interest rate? What things may affect my interest rate?

The report will also include a credit score based on your overall credit history. Property type: Investment properties, condominiums, and multifamily homes are generally considered to be higher risks than single family detached homes. Loan-to-value LTV ratio: The amount you want to borrow compared to the appraised value of the property.

Generally, the lower your LTV ratio, the lower your interest rate and costs. Debt-to-income DTI ratio: The amount of your mortgage payments and total debt payments compared to your income. A higher DTI ratio may mean higher interest rates and costs.

Type of loan: Purchase versus refinance, an adjustable rate versus fixed rate, or cash-out refinance versus rate-and-term refinance, may affect overall risk. Some other things that may affect your interest rate : Closing cost credits: You may be able to finance a portion of your closing costs as part of your loan.

This may result in a higher interest rate. Discount points: A discount point is paid to obtain a lower interest rate that may reduce your monthly payment amount.

Asset-Based Relationship Discount: For jumbo loans, you may qualify for a rate discount based on the balance of your eligible assets at Wells Fargo Bank, N.

Refer to your Customer Rate Discount Disclosure in your initial disclosure package for additional details on the Asset-Based Relationship Discount. Additional risk factors: We may also consider other risk factors when determining your interest rate and costs, including previous bankruptcies, foreclosures, or unpaid judgments.

Can I get a lower interest rate? Here are some of the things you may want to consider: Putting more money down and lowering the LTV ratio. Clearing any errors on your credit report. For this option, you may need to start a new loan application. Changing the number of years of your loan term.

You also may be able to lower your rate by paying discount points. What does it mean to lock or float my interest rate? Locking your interest rate When you lock your rate, we apply a specific range of interest rates to your loan application that are available at the date and time of your rate lock.

Locking your interest rate means the rate will stay the same from the time of the rate lock until the rate lock expiration date, regardless of changing market conditions.

Your final interest rate may be higher or lower than what was initially quoted to you if there are changes before your loan closes. See After I lock my interest rate, will my rate change. Floating your interest rate If you don't lock your interest rate, it can move up or down based on market conditions.

This is called "floating" the interest rate. You may want to consider floating your interest rate if: You're not sure how long it may take before your loan is ready to close.

You believe interest rates will stay the same or go down. There is no fee to float your interest rate. Why is it important to choose the right rate lock period? It is important to choose a rate lock period that makes sense for your loan. See What if my rate lock will expire before my loan closing date.

The length of your rate lock period may impact the cost of your loan, and some may require a fee up front. See What happens if my loan requires a longer than average rate lock period.

How can I help my loan close before my rate lock expires? There are some things you can do to help your loan close on schedule: Respond promptly to all requests for information and documentation.

Contact us right away if there are any changes to your loan application. What happens if my loan requires a longer than average rate lock period? Rate lock fees will vary based on the length of your rate lock period and interest rate chosen. We will refund the rate lock fee if your application is denied.

You've heard the phrase "locking in your rate," but what does that mean? And when should you lock in your rate rather than float it? The jargon, options, and specifics of home financing can make the process intimidating.

We're here to break it down and give you the confidence to help make the right decision that works for you. Let's start with the basics. A Rate Lock is an agreement from a mortgage lender to hold a specific mortgage interest rate for a particular period, even if rates rise.

Unfortunately, there's no crystal ball for predicting interest rates and the surrounding market. Luckily, at Virginia Credit Union, there are several points in the mortgage process when you can use a Rate Lock to gain confidence in an uncertain market.

One typical time to lock in your rate is when we receive your application. Others choose to lock in during the loan processing, and you can wait up to 10 business days before your loan closing. Through this program, you can shop with confidence and peace of mind, locking in your interest rate for up to days.

Talk to a mortgage loan officer to partner on the right Rate Lock for you. When you float a loan, you haven't yet secured a lender's quoted interest rate. Floating means you're willing to take the risk that interest rates will either not go up or that they will fall before you close your loan.

To further confuse the term, some lenders also offer a "float-down option" with a mortgage rate lock-in, meaning you've locked in your rate, but if the rates drop a certain amount, you have the option to get that lower rate, often for a fee. Talk to your loan officer to learn if this option applies to your loan process.

The uncertainty of the housing market can be stressful, but by locking in your interest rate, you'll have one less thing to worry about. With a Mortgage Rate Lock, you can shop with confidence and take your time finding your next dream home.

Whether you're buying your first home or refinancing a current mortgage, Virginia Credit Union is there at every step. Online Banking. Back Personal.

Forgot User ID? Log In. Search Submit Search. Skip to main content Utility. Main navigation Banking Checking Regular Checking. Savings Regular Savings. Credit Cards Compare All Cards. Become a member. Car Loans. Home Loans Home Purchase. Personal Loan Options Personal Loans.

A Rate Lock is an agreement from a mortgage lender to hold a specific mortgage interest rate for a particular period, even if rates rise. There are typically A mortgage rate lock is an agreement between a lender and a borrower that guarantees a specific interest rate for a set period, often ranging from 15, 30, 45 A mortgage rate lock can reduce financial uncertainty in the home purchase process because it protects you from major interest rate increases. Locks are usually: Rate lock options

| Education center Mortgage Financing a kptions. Bankrate follows a strict Loan forgiveness resources policy Rate lock options, so lptions can trust that our content is honest and accurate. This lock protects borrowers from the potential of rising interest rates during the home buying process. Mortgage rates change frequently. Partner Links. Personal Loan Options Personal Loans. Is a mortgage rate lock worth it? | If mortgage rates stay the same: Mortgage rates can dance around for weeks, going up or down a notch or two — and end up right where they started. Our goal is to give you the best advice to help you make smart personal finance decisions. Bankrate logo How we make money. Whether you're getting ready to buy your first home or you've done this before, you'll benefit from discovering the best time to lock in a mortgage rate. To know whether you should lock your rate right away, you may want to research how rates have been moving. | A rate lock is a guarantee that a mortgage lender will honor a specific interest rate at a specific cost for a set time. The benefit of a When you lock the interest rate, you're protected from rate increases due to market conditions. If rates go down prior to your loan closing and you want to take Most lenders offer rate locks for 30, 45 or 60 days, according to the Consumer Financial Protection Bureau. However, you may find some lender | A rate lock is a guarantee that a mortgage lender will honor a specific interest rate at a specific cost for a set time. The benefit of a Mortgage rate locks can protect you from rising interest rates, but they don't benefit you if rates drop during your lock period. To give you When you lock the interest rate, you're protected from rate increases due to market conditions. If rates go down prior to your loan closing and you want to take | Our Streamlined Rate Lock (SRL) option allows Borrowers to manage interest rate risk, while keeping flexibility and speed to rate lock in mind Mortgage rate locks can protect you from rising interest rates, but they don't benefit you if rates drop during your lock period. To give you A mortgage rate lock float down locks in a rate during the underwriting period with the option to reduce it if market interest rates fall during that period |  |

| We use primary sources to support our work. Lovk Review Board comprises a panel of financial experts whose objective is to ensure opptions our content is always objective and balanced. With a Mortgage Rate Lock, you can shop with confidence and take your time finding your next dream home. Article Sources. Rate locks are typically based on day intervals and measured in calendar days. Follow the writers. | Forgot User ID? So, how do you navigate a fluctuating interest rate when you're shopping for a home? Real Estate. Some lenders charge for a rate lock, though others offer one for free. The term mortgage rate lock float down refers to a financing option that locks in the interest rate on a mortgage with the option to reduce it if market rates fall during the lock period. Key Takeaways A mortgage rate lock guarantees the current rate of interest on a home loan while a home buyer proceeds through the purchase and closing process. | A rate lock is a guarantee that a mortgage lender will honor a specific interest rate at a specific cost for a set time. The benefit of a When you lock the interest rate, you're protected from rate increases due to market conditions. If rates go down prior to your loan closing and you want to take Most lenders offer rate locks for 30, 45 or 60 days, according to the Consumer Financial Protection Bureau. However, you may find some lender | A mortgage rate lock float down locks in a rate during the underwriting period with the option to reduce it if market interest rates fall during that period A mortgage rate lock is an agreement between a lender and a borrower that guarantees a specific interest rate for a set period, often ranging from 15, 30, 45 A mortgage rate lock period could be an interval of 10, 30, 45, or 60 days. The longer the period is could mean a higher interest rate is agreed upon | A mortgage interest rate lock is when you ask your loan originator to lock in your rate when buying a house. Your rate is then set for your loan, as long as you A mortgage rate lock is an agreement between you and your lender that guarantees your interest rate for a specific window of time – usually 30 A mortgage rate lock is an agreement between a lender and a borrower that guarantees a specific interest rate for a set period, often ranging from 15, 30, 45 |  |

| Wells Fargo Home Mortgage Rate lock options a division of Wells Fargo Optjons, N. Rate lock options scoring oltions incorporates coverage options, customer experience, Balance transfer timeframes, cost and more. Lock Period: What it Means, How it Works A lock period is the window of time over which a mortgage lender must keep a specific loan offer open to a borrower. How Long Can You Lock In A Mortgage Rate? This is called "floating" the interest rate. | If your rate is locked, it can still change if there are changes in your application—including your loan amount, credit score, or verified income. Federal Funds Rate The federal funds rate is the rate at which banks and other financial institutions borrow money. Refinancing - 6-minute read. Researching and recognizing the best mortgage rates can be tough, but it can also help you decide when the right moment is to lock in your rate. Those who are prepared to move forward quickly with a home purchase or refi and shoppers on a tight budget should also ponder a lock. | A rate lock is a guarantee that a mortgage lender will honor a specific interest rate at a specific cost for a set time. The benefit of a When you lock the interest rate, you're protected from rate increases due to market conditions. If rates go down prior to your loan closing and you want to take Most lenders offer rate locks for 30, 45 or 60 days, according to the Consumer Financial Protection Bureau. However, you may find some lender | A mortgage rate lock float down locks in a rate during the underwriting period with the option to reduce it if market interest rates fall during that period Our Streamlined Rate Lock (SRL) option allows Borrowers to manage interest rate risk, while keeping flexibility and speed to rate lock in mind When you lock in your interest rate, it will stay the same for an agreed-upon amount of time, usually between 30 and 90 days. This means you won't need to worry | Even if you've locked in your rate, a float-down option can allow you to take advantage of the lower interest rates. You can ask your lender about the costs of A Rate Lock is an agreement from a mortgage lender to hold a specific mortgage interest rate for a particular period, even if rates rise. There are typically |  |

| Raet is a Rate lock options loan option? Exercising the float Convenient loan application requirements option may occur Rte early as one week after the lptions proceedings get underway, depending on optionw terms with the lender. A mortgage rate lock float down is a type of mortgage product that offers borrowers both security and flexibility when interest rates fluctuate. Mortgage Basics - 8-minute read. com is an independent, advertising-supported publisher and comparison service. Want to get your rate locked in as soon as possible? | Interest rate — your interest rate depends on the market conditions on the date you choose to lock. Apply Now. It is important to choose a rate lock period that makes sense for your loan. Here's another consideration. Various factors influence interest rate changes, such as the stock market, the Federal Reserve, inflation, worldwide events and politics. Borrowers can request to exercise the float down option at any time before the mortgage closes to take advantage of a lower mortgage interest rate. | A rate lock is a guarantee that a mortgage lender will honor a specific interest rate at a specific cost for a set time. The benefit of a When you lock the interest rate, you're protected from rate increases due to market conditions. If rates go down prior to your loan closing and you want to take Most lenders offer rate locks for 30, 45 or 60 days, according to the Consumer Financial Protection Bureau. However, you may find some lender | Mortgage rate locks can protect you from rising interest rates, but they don't benefit you if rates drop during your lock period. To give you Freddie Mac Multifamily offers a variety of lock options including Standard Delivery, early rate-lock and Index Lock A Rate Lock is an agreement from a mortgage lender to hold a specific mortgage interest rate for a particular period, even if rates rise. There are typically |  |

ich beglückwünsche, die ausgezeichnete Idee und ist termingemäß

Hat nicht allen verstanden.

Ist Einverstanden, das sehr nützliche Stück