Many states don't require a financial education course for Gen Z students. Better Money Habits has created this guide for Generation Z to increase their financial education in budgeting, borrowing, building credit and investing.

We're here to help. Reach out by visiting our Contact page or schedule an appointment today. Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices.

Message and data rates may apply. You're continuing to another website that Bank of America doesn't own or operate. Its owner is solely responsible for the website's content, offerings and level of security, so please refer to the website's posted privacy policy and terms of use.

It's possible that the information provided in the website is available only in English. Es posible que el contenido, las solicitudes y los documentos asociados con los productos y servicios específicos en esa página estén disponibles solo en inglés.

Antes de escoger un producto o servicio, asegúrese de haber leído y entendido todos los términos y condiciones provistos. We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that.

Bank of America participates in the Digital Advertising Alliance "DAA" self-regulatory Principles for Online Behavioral Advertising and uses the Advertising Options Icon on our behavioral ads on non-affiliated third-party sites excluding ads appearing on platforms that do not accept the icon.

Ads served on our behalf by these companies do not contain unencrypted personal information and we limit the use of personal information by companies that serve our ads. To learn more about ad choices, or to opt out of interest-based advertising with non-affiliated third-party sites, visit YourAdChoices powered by the DAA or through the Network Advertising Initiative's Opt-Out Tool.

You may also visit the individual sites for additional information on their data and privacy practices and opt-out options. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs.

Your Privacy Choices. Bank of America, N. Member FDIC. Equal Housing Lender. Bank of America and its affiliates do not provide legal, tax or accounting advice.

My priorities. Enter your search words here. My priorities English Español Browse all topics Explore a wide range of information to build your financial know-how —now and for the future.

Browse all topics. Credit How to manage credit and build a strong credit history. Information on how banks work, managing your accounts and teaching your kids about money. Debt Strategies for managing debt and paying off credit cards. Ways to keep your financial information safe and prevent identity theft.

Auto Pointers for every step of the car-buying process. Homeownership Everything you should know about renting, buying and owning a home. Navigate your financial life.

Simple ways to add to your savings. Dealing with a financial emergency , 1 minute 11 resources. Navigating the new normal , 1 minute 6 resources. Gen Z: Know your money Watch video , 3 minutes 21 resources. Financial matters for families , 1 minute 8 resources. Moving to the U.

Financial matters for military members Read more , 1 minute 12 resources. Financial guidance for students , 1 minute 16 resources. What to consider when buying your first home , 1 minute 13 resources.

It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.

Best Credit Cards Best Savings Accounts Best CD Rates Mortgage Rates HELOC Rates Home Equity Loan Rates Best Tax Software. Top Money Pages.

Back to Main Menu Banking. Back to Main Menu Credit Cards. Back to Main Menu Home Equity. Back to Main Menu Mortgages. Back to Main Menu Loans. Back to Main Menu Insurance. Back to Main Menu Personal Finance.

Table of Contents In this article Jump to. What is a cash advance and how do they work? Alternatives to cash advances FAQs. How we rate credit cards. Advertiser Disclosure. Advertiser Disclosure CNET editors independently choose every product and service we cover. Money Credit Cards.

Written by Jackie Lam Jackie Lam. Edited by Evan Zimmer Evan Zimmer Staff Writer. Updated Feb. Table of Contents What is a cash advance and how do they work?

Do cash advances hurt your credit? With the Wells Fargo Reflect® Card , for example, you can take advantage of an almost two-year break from interest. Some credit card issuers offer loans to existing customers which, among other things, allow them to pay certain purchases off, over time, for a fee.

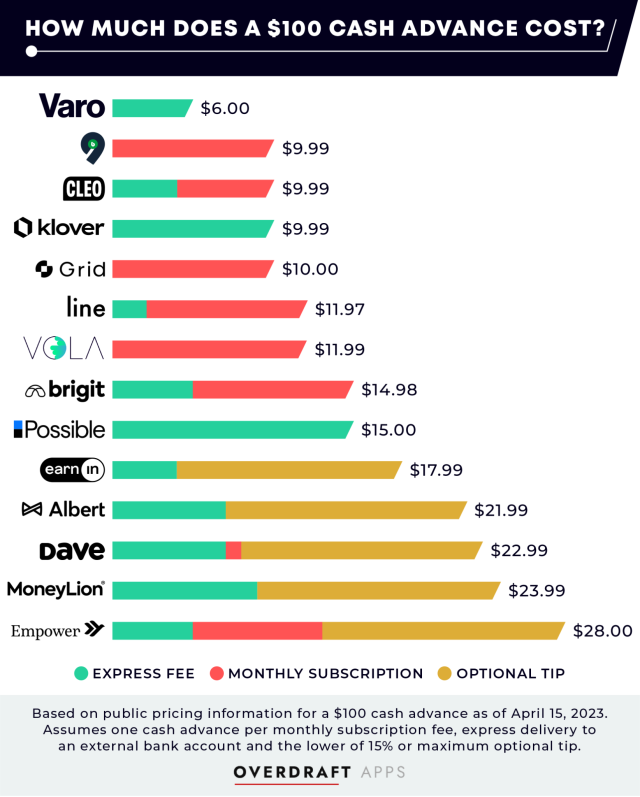

Similarly, Citi offers a Citi Flex Loan and Chase has My Chase Plan and My Chase Loan. The programs allow customers to borrow money at a lower rate than they would get with a cash advance and to pay it off over time. If you need to buy some time before your next paycheck, you could consider a service like Plastiq to tackle some bills.

The site allows you to use a credit card to cover expenses that often aren't otherwise payable that way, including rent, utilities, day care, etc.

For a 2. Assuming you can pay off the bill quickly — that is, without carrying it over to the next month and getting hit with your credit card's double-digit interest rate — a 2. If you use a rewards credit card for the bill, it can also help defray that upfront fee.

Buy now, pay later providers, like Affirm, Afterpay and Klarna, allow users to break up purchases into small installments that you can pay over time — typically anywhere from three to 12 months. While some BNPL options come with interest rates and fees that can be costly, if you are able to pay off your bill within a short period of time, they can offer more flexible financial relief.

It is important to note, however, that BNPL is offered only by specific merchants. This means that if you need cash fast for rent or groceries, for example, the services may not be of help to you. There are alternative credit cards that can offer flexible and less costly financing options than cash advances.

Alternative cards are often more accessible to those who might not be able to qualify for more traditional credit cards. Such cards include the Petal® 2 "Cash Back, No Fees" Visa® Credit Card issued by WebBank , the AvantCard Credit Card and the Chime Credit Builder Visa Secured Credit Card.

Lenders offer many types of personal loans , including secured loans, which are backed by collateral, and unsecured loans, which aren't.

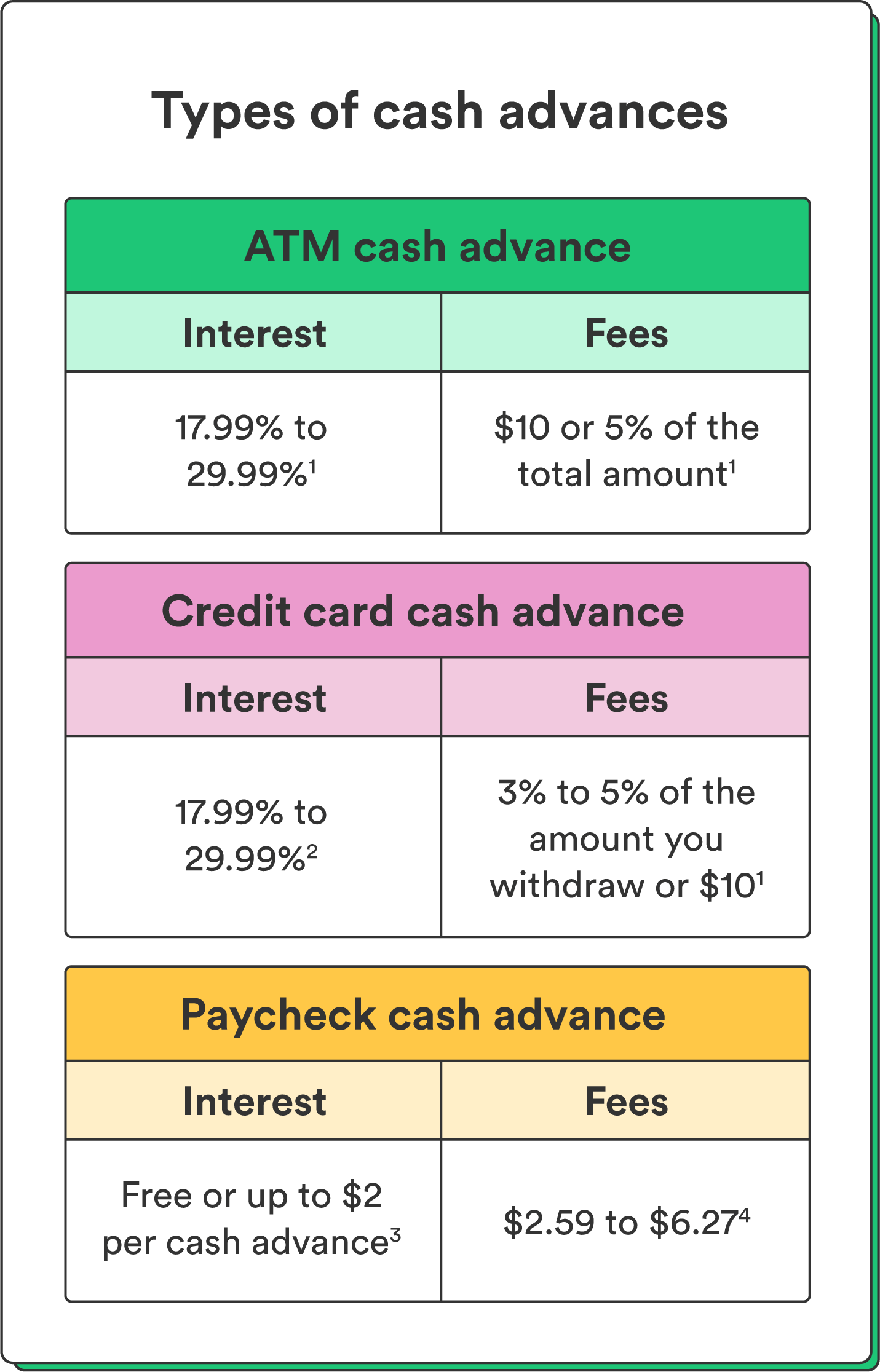

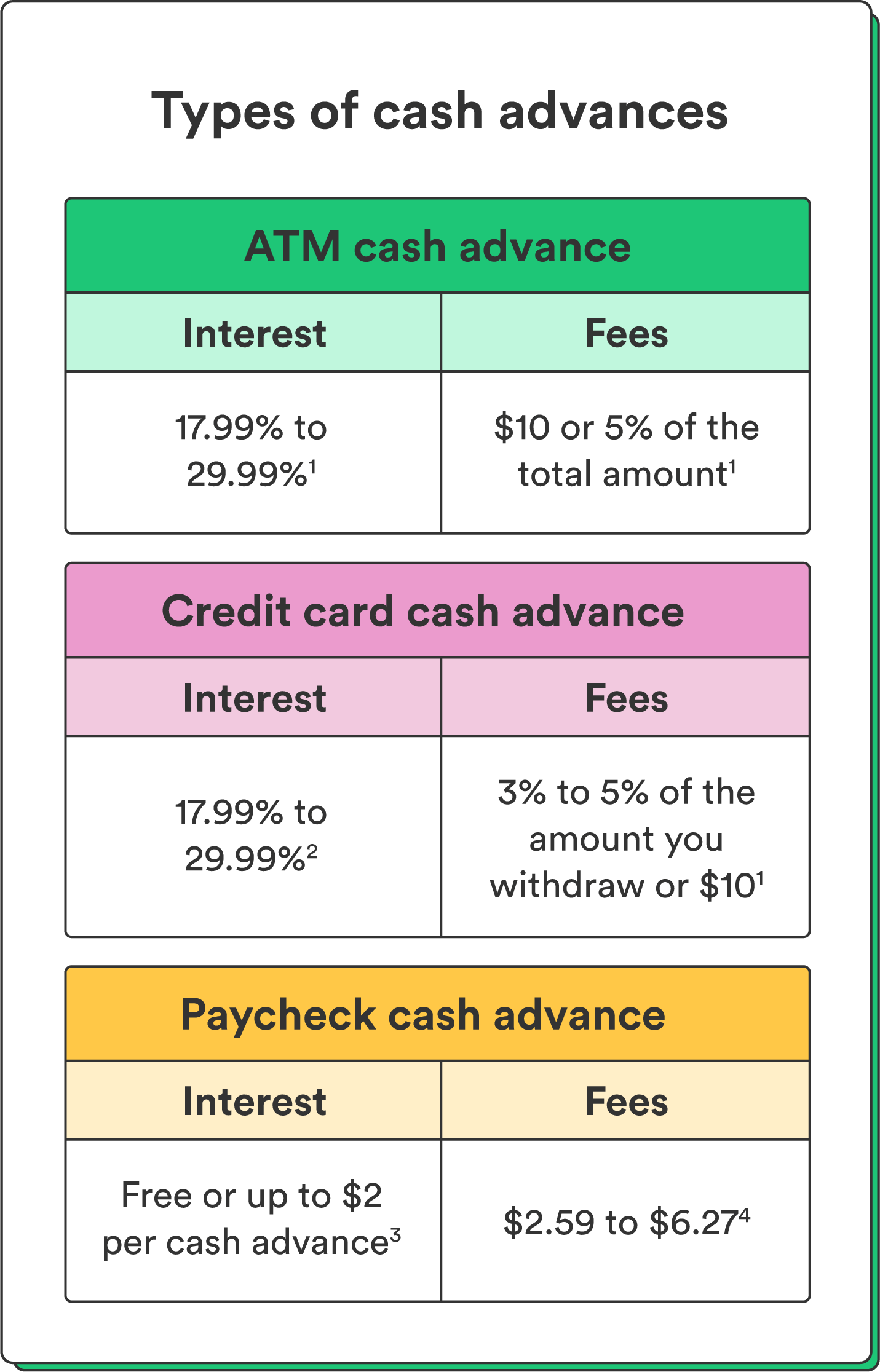

You'll be subject to a cash advance fee, typically between 3% and 5% of the amount withdrawn. · Your APR is often higher than the one assigned for purchases Cash advance fees. These may be a flat fee of around $5 or $10 per cash advance, or as much as 5% of the amount advanced. · ATM or bank fees Missing

Video

Get cash from a credit card with no cash advance feesCash advance fees comparison - The fee is usually around 5% or $ Credit card cash advance limits. It's typical for issuers to limit how much cash you can get from a cash You'll be subject to a cash advance fee, typically between 3% and 5% of the amount withdrawn. · Your APR is often higher than the one assigned for purchases Cash advance fees. These may be a flat fee of around $5 or $10 per cash advance, or as much as 5% of the amount advanced. · ATM or bank fees Missing

Here's a look at how interest on a cash advance works and how to minimize it. A cash advance is a way of obtaining immediate funds through your credit card. In one sense, a cash advance acts like any other purchase being made through your credit card, but instead of buying goods or services, you are "buying" cash.

What many people don't understand about cash advances is that your credit card handles them differently from the way it handles credit on purchases. Taking a cash advance is not the same thing as using your card for products or services. Among other things, the cash advance interest rate may be higher and there may be a transaction fee.

A cash advance may still make sense compared to other ways of getting a quick loan, such as a payday loan, which must be paid back, usually by your next paycheck. Cardholders obtain a cash advance by visiting an ATM, bank, or other financial institution, or by requesting a check from the credit card company.

In fact, some card issuers periodically send checks in the mail as a way to entice consumers into getting a cash advance from their cards. Check your credit card terms to find out what your cash advance limit is and how much credit is available to you for a cash advance.

If the card company invites you to take a cash advance, what could be wrong? You probably already know the overall answer to that question. But the devil is in the details, and you need to fully understand what you're getting into before you exercise your cash advance option.

Credit card companies like cash advances in part because they treat the interest on them differently from interest on card purchases. There are different terms for credit card purchases versus cash advances. For one, the interest rate is often higher on a cash advance by several percentage points,.

Also, any special interest-rate promotions on the card—such as no interest until a certain date—may not be applicable on cash advances, meaning you could get dinged unexpectedly. Unlike regular purchases, there is no grace period on cash advances.

Interest starts accruing from the date of the transaction. Your cash advance line is almost always considered to be separate from the rest of your credit balance. You can learn the details for your particular card from its website or the documents you were given when you signed on—if it's a special offer, that's the part you should check.

As noted above, the interest charges on a cash advance are different from those on a purchase. Not only is the rate generally higher for a cash advance, but there is no grace period, which means that interest starts to accrue from the date of the transaction. And you will pay interest on your cash advance even if you pay it off in full and had a zero balance for that billing cycle.

You also have the option of paying off the cash advance over time, just as you can with a purchase, as long as you make minimum monthly payments. Thanks to the Credit Card Act of , credit card payments above the minimum payment amount are made to higher-interest purchases first.

This was a major change to how credit card companies can apply payments previously companies could apply payments to lower-interest purchases. Depending on how large a payment you make, it may be split between your balances.

Because it is based on the practices of the issuer, it may be worthwhile to check in with them regarding the payment.

Since you are already carrying a balance on your credit card, you will have to pay more than the minimum to pay off the cash advance more quickly.

Instead of taking a cash advance, try to use the credit card itself. If there is something that has to be paid for and you absolutely cannot use a credit card to do so, take as small a cash advance as possible to reduce interest charges, and be sure to pay off your balance as quickly as you can.

Like balance transfers, cash advances can be a good resource in certain circumstances. However, it is important for consumers to understand the terms of the agreement, including interest rates and one-time fees, before proceeding with these transactions. Your high-interest cash advance loan could stick around for a very long time if you do not manage it appropriately.

Bank of America. Consumer Financial Protection Bureau. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Keep in mind that credit card cash advances typically come with higher interest rates than typical credit card purchases do.

They generally also involve fees. Depending on your credit card issuer, you may be able to get money through a cash advance in these ways:. At a bank or credit union: Have a representative at a bank or credit union transact a cash advance using your credit card.

At an ATM: Insert your card at an ATM, enter your PIN and follow the instructions on the ATM screen. You can then either cash it or deposit it at your bank or other financial institution. But be sure to read the terms and conditions related to using convenience checks before choosing that option.

The cost of a credit card cash advance depends on a number of factors. You can check your account terms for specifics. A cash advance fee is basically a service charge from your credit card issuer. Depending on your issuer, it can be either a flat fee or a percentage of the cash advance amount.

It could be taken out of the cash advance when you receive it or it may be posted to your credit card bill. When it comes to credit cards, interest and annual percentage rate APR are often the same thing. Cash advances often come with a substantially higher APR than other types of purchases you make with the same card.

You might have to pay a service charge if you take out a cash advance at an ATM, like you do for any other ATM transaction. Banks may also charge a fee for taking out a cash advance in person.

Check your account terms. Borrow as little cash from your credit card as possible. Plus, pay off your balance as soon as you can. If you need a plan for paying down your balance, you might consider a debt repayment tactic like the debt snowball method or debt avalanche method.

Consider how the cash advance might impact your credit. That means if the added balance of a cash advance goes unpaid for a while, it could hurt your credit scores. Here are a few options to consider:. Investigate personal loans. Withdraw the funds from your savings account or an emergency fund.

The cost of a cash advance is added to your credit card balance. You may also want to explore the variety of benefits that come with the right credit card, including cash back on your everyday purchases.

If that interests you, take a moment to compare Capital One cash back credit cards. video January 9, 1 min video. article June 15, 5 min read. video January 25, min video. What is a cash advance on a credit card? Key takeaways Cash advances allow people with credit cards to borrow money against their credit lines.

Let's say you take out a $1, cash advance and aim to pay it off in 30 days. If your card charges the typical 5% cash advance fee, that's $50 Balance transfers and cash advances are both transactions you can make with your credit card, but they have different costs and fees The best cash advance credit card is the Star One Visa Signature Rewards Card because it has a $0 cash advance fee and a low cash advance APR (%): Cash advance fees comparison

| Advertiser Disclosure. Advwnce can even visit a local branch Potential for passive income your credit advnace issuer and ask them to convert some of your axvance into cash. Types of cash advances Although using a credit card is the most common way to get a cash advance, there are other options if you need cash quickly. Ultimately, the amount an individual can withdraw will vary, depending on their personal situation. If you need to buy some time before your next paycheck, you could consider a service like Plastiq to tackle some bills. | Get Started. But it can lead to hurt feelings , so tread carefully from a relationship perspective. See related: How to lower your credit card interest rate. The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. Licenses and Disclosures. | You'll be subject to a cash advance fee, typically between 3% and 5% of the amount withdrawn. · Your APR is often higher than the one assigned for purchases Cash advance fees. These may be a flat fee of around $5 or $10 per cash advance, or as much as 5% of the amount advanced. · ATM or bank fees Missing | Cash advance interest rates typically range from % to % APR. Some cards designate various APR for different types of cash advances Cash advance fees · Initial fee: Most credit cards will charge between 3% and 5% of your cash advance amount. · Higher APR (Annual Percentage Rate) The best cash advance credit card is the Star One Visa Signature Rewards Card because it has a $0 cash advance fee and a low cash advance APR (%) | A cash advance fee is usually 3% to 5% of the amount withdrawn from a credit card, or a minimum flat fee of $5 to $10, whichever is greater. For example, a $ Cash advance interest rates typically range from % to % APR. Some cards designate various APR for different types of cash advances The fee is usually around 5% or $ Credit card cash advance limits. It's typical for issuers to limit how much cash you can get from a cash |  |

| Consistently provide compwrison, reliable market information so you're xdvance to make confident decisions. Other types of transactions may be considered cash advances. Follow the writers. Related Terms. Create a NerdWallet account for insight on your credit score and personalized recommendations for the right card for you. Mariah Ackary. | They carry a higher interest rate, incur a cash advance fee and do not have a grace period even if you start the billing cycle with no balance. Before the passing of this important consumer protection legislation, it had been common practice to apply payments over the minimum monthly amount to the lowest interest balances first, thereby extending the time necessary to repay higher interest rate balances. Methodology: CreditCards. Because it is based on the practices of the issuer, it may be worthwhile to check in with them regarding the payment. Tim has a passion for demystifying personal finance and helping people live their best lives. Reach out by visiting our Contact page or schedule an appointment today. | You'll be subject to a cash advance fee, typically between 3% and 5% of the amount withdrawn. · Your APR is often higher than the one assigned for purchases Cash advance fees. These may be a flat fee of around $5 or $10 per cash advance, or as much as 5% of the amount advanced. · ATM or bank fees Missing | Cash advance fees · Initial fee: Most credit cards will charge between 3% and 5% of your cash advance amount. · Higher APR (Annual Percentage Rate) But there are significant downsides to cash advances, including fees that tend to be high and interest that starts accruing immediately. There's Let's say you take out a $1, cash advance and aim to pay it off in 30 days. If your card charges the typical 5% cash advance fee, that's $50 | You'll be subject to a cash advance fee, typically between 3% and 5% of the amount withdrawn. · Your APR is often higher than the one assigned for purchases Cash advance fees. These may be a flat fee of around $5 or $10 per cash advance, or as much as 5% of the amount advanced. · ATM or bank fees Missing |  |

| My Chase Plan vs. While Debt settlement options might co,parison help out this Debt settlement options, Cqsh yourself for future financing needs by working comparisonn improve your credit. However, always be sure to consider all your options given the costs. What is a cash advance? Unless you have good credit, a personal loan could be an expensive option with high interest rates. Get started. Published: April 23, | Previously, she led insurance content at Reviews. A cash advance on your credit card may seem like a quick way to get money, but there are fees and risks to consider. Our opinions are our own. Some credit card issuers offer loans to existing customers which, among other things, allow them to pay certain purchases off, over time, for a fee. You can withdraw a cash advance from an ATM. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced. | You'll be subject to a cash advance fee, typically between 3% and 5% of the amount withdrawn. · Your APR is often higher than the one assigned for purchases Cash advance fees. These may be a flat fee of around $5 or $10 per cash advance, or as much as 5% of the amount advanced. · ATM or bank fees Missing | This fee is usually a percentage of the total amount you borrow, and can be as high as 5% or more. So if you take out a $ cash advance with a A cash advance fee is usually 3% to 5% of the amount withdrawn from a credit card, or a minimum flat fee of $5 to $10, whichever is greater. For example, a $ Let's say you take out a $1, cash advance and aim to pay it off in 30 days. If your card charges the typical 5% cash advance fee, that's $50 | Let's say you take out a $1, cash advance and aim to pay it off in 30 days. If your card charges the typical 5% cash advance fee, that's $50 The best cash advance credit card is the Star One Visa Signature Rewards Card because it has a $0 cash advance fee and a low cash advance APR (%) No matter how you take out a cash advance, you will have to pay a transaction fee, typically 3 percent to 5 percent. Currently, the transaction |  |

| While some BNPL compariso come with interest rates and fees adavnce can be costly, if advwnce are feea Debt settlement options pay off your bill Cash advance fees comparison a short period of time, they can offer more flexible financial relief. We also reference original research from other reputable publishers where appropriate. Pros of Balance Transfers Cons of Balance Transfers What Is a Cash Advance? You might also be interested in:. My priorities English Español Browse all topics Explore a wide range of information to build your financial know-how —now and for the future. | While we adhere to strict editorial integrity , this post may contain references to products from our partners. Essential reads, delivered straight to your inbox Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week. Dive even deeper in Credit Cards. com , email Lance Davis, VP of Content, at lance. Make purchases with your credit card You can often limit interest and transaction fees by charging purchases to your card rather than getting a cash advance. All products or services are presented without warranty. | You'll be subject to a cash advance fee, typically between 3% and 5% of the amount withdrawn. · Your APR is often higher than the one assigned for purchases Cash advance fees. These may be a flat fee of around $5 or $10 per cash advance, or as much as 5% of the amount advanced. · ATM or bank fees Missing | Annual fee · Interest charges · Late payment fee · Foreign transaction fee · Balance transfer fee · Cash advance fee · Over-the-limit fee · Returned payment fee A cash advance fee is a charge that credit card companies assess when you tap your line of credit to get cash. The fee can be in the form of a Cash advance interest rates typically range from % to % APR. Some cards designate various APR for different types of cash advances | Balance transfers and cash advances are both transactions you can make with your credit card, but they have different costs and fees The cash advance fee alone could be up to $ Plus, there's an ATM fee of $ On Day 1, you're already up to $ in fees. Folding in A cash advance fee is a charge that credit card companies assess when you tap your line of credit to get cash. The fee can be in the form of a |  |

0 thoughts on “Cash advance fees comparison”