This token is used during the transaction, meaning your actual account number is never exposed, reducing the risk of it being intercepted or stolen. Mobile wallets use biometric authentication like fingerprints or facial recognition to verify the user's identity before a transaction is authorized.

This ensures that even if a device is lost or stolen, unauthorized users cannot make purchases. In addition to these measures, if a mobile device is lost or stolen, a user can often remotely lock or erase their mobile wallet.

This is a measure that simply can't be taken with a traditional wallet. Banks and financial institutions have a significant opportunity to capitalize on mobile wallet technology to deliver enhanced, customer-centric services. Mobile wallet technology can open the door for banks to innovate and introduce new financial products.

By understanding customer spending habits and preferences, banks can develop personalized financial products that cater to specific customer needs.

Banks can leverage mobile wallet technology to offer tailored loyalty programs. By analyzing the spending patterns and preferences of customers, banks can offer personalized rewards, further enhancing customer engagement.

Mobile wallets generate a wealth of data that can be used for analytics. These insights can be invaluable for banks to understand customer behavior, enhance their services, and make data-driven decisions.

Banks can leverage mobile wallets to offer instant micro-loans. A customer's transaction history can assist in assessing their creditworthiness, enabling quick loan approvals.

Banks can use mobile wallet technology to offer tailored insurance products. For example, travel insurance could be offered to customers who frequently purchase airline tickets through their mobile wallets.

Banks can integrate investment platforms into mobile wallets, allowing customers to buy, sell, or manage investments directly from their mobile devices. This feature serves to provide customers with an all-in-one financial management tool.

Mobile wallets can be utilized for cross-selling other financial services. Notifications or advertisements about these services can be integrated into the mobile wallet interface, driving customer awareness and potential uptake.

Given the increasing interest in cryptocurrencies, banks can integrate digital currency wallets into their mobile wallet offerings. This service could allow customers to make transactions or investments using cryptocurrencies, adding an extra dimension to their banking experience.

By embracing mobile wallet technology, financial institutions can stay ahead in the digital age, meeting customer expectations while driving operational efficiency. Contact us today to explore your options.

We are a global provider of enterprise-grade payment technology and ledger management infrastructure for banks that need to keep pace with disruptors and evolving consumer preferences. Platform Use cases Revolving credit solution for banks Why E6?

Press Releases. Mobile wallet technology: The ultimate guide. Back To All Posts. September 5, Follow us on Facebook. Follow us on LinkedIn. What is the technology behind digital wallets? Here are the key technologies involved: Near field communication NFC : This wireless data transfer method lets your phone and the payment terminal communicate when they're close together.

It's quick, convenient, and the standard for many mobile wallets. Quick response QR codes: Some digital wallets use QR codes for transactions. The wallet generates a unique QR code representing the transaction details, which the payment terminal scans to process the payment.

Host card emulation HCE : This software architecture emulates a payment card on a mobile device. HCE allows the wallet app to transmit payment information to the terminal over NFC, even when the device's screen is locked.

Tokenization: This security technology replaces sensitive card details with unique identification symbols, or tokens. Replace paper tickets and reduce fraud. Generic Overview.

Create your own unique pass experiences in Google Wallet. Create a generic private pass for more sensitive user data, such as health insurance cards. Other Resources Smart Tap. Documentation More Blog Community More.

Access Overview Digital Car Keys Campus IDs Corporate Badges Health Overview Health Insurance Cards Test Records COVID Cards Identity Overview Verify with Google Wallet Retail Overview Gift Cards Loyalty Cards Offers In-store payments Tickets and transit Overview Boarding Passes Event Tickets Closed Loop Transit Passes Open Loop Transit Passes Transit Passes Generic Overview Generic pass Generic private pass Other Resources Smart Tap Release Notes StackOverflow GitHub YouTube Twitter.

Give users fast, secure access to everyday essentials With Google Wallet, your customers can tap to pay everywhere Google Pay is accepted, shop with loyalty cards, board a flight, and more, all with just their Android phone.

Get started. Introducing Google Wallet and developer API features Google is building a secure, private digital wallet for Android and Chrome users.

Learn more about what's changing. Digitize any wallet object with the Google Wallet API Follow a step-by-step workshop on how to digitize any wallet object using the Google Wallet API.

Retail Make it easy for your customers to add loyalty cards, offers, gift cards, or make in-store payments using their mobile device. Integrate with Google Wallet and engage with users through location-based notifications, real-time updates, and more.

Learn more. Tickets Your users can add tickets and passes for movies, flights, and more, right in Google Wallet. Access Google Wallet is simple, secure, and convenient. Please update your browser.

Overview Managing your account Product Support Protect Your Business FAQ. In an age where smartphones are everywhere and there seems to be an app for everything, "mobile wallet" technology is becoming more popular every day.

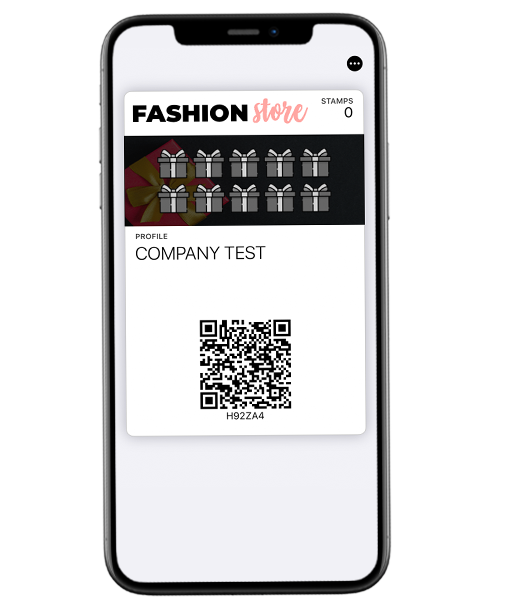

As a small business owner, here's what you need to know about mobile wallets. Mobile wallets are essentially digital versions of traditional wallets that someone would carry in their pocket. While there are many variations, usually they can hold digital information about credit and debit cards for making payments, store coupons and loyalty programs, specific information about personal identity and more.

Many companies are jumping into the mobile payments space— on both the paying and receiving sides of the transaction—and new innovators are continuously changing the industry.

In the U. Internationally, still more companies are developing and launching new technologies in this space. A customer can utilize all of their stored information simply by opening an app on their phone, entering in a PIN, password or fingerprint and then selecting the information they need to access.

The app then utilizes information transfer technology such as Near-Field Communications NFC to interact with a mobile wallet ready payment terminals. That's where you come in as a small business owner.

Without a device that receives mobile wallet information, you won't be able to take advantage of this increasingly popular payment mechanism. Leveraging new technologies that connect directly to a rich software experience in the customer's hand can help enhance their experience and educate them about your company.

Innovative small businesses will go beyond merely accepting mobile wallet payments to forming more comprehensive mobile strategies than their direct competitors.

Understand how to use mobile wallet marketing to create a new mobile channel to reach your customers, and digitize coupons, loyalty cards, tickets and more Integrating with Apple Wallet. Apple Wallet provides a convenient way to organize and use rewards cards, boarding passes, tickets, gift cards, and more in Mobile wallets are digital tools that help your smartphone make financial transactions, including credit card payments. Mobile wallet apps store

Mobile wallet integration card - A mobile wallet is a type of virtual wallet that stores credit card numbers, debit card numbers, and loyalty card numbers. It is accessible Understand how to use mobile wallet marketing to create a new mobile channel to reach your customers, and digitize coupons, loyalty cards, tickets and more Integrating with Apple Wallet. Apple Wallet provides a convenient way to organize and use rewards cards, boarding passes, tickets, gift cards, and more in Mobile wallets are digital tools that help your smartphone make financial transactions, including credit card payments. Mobile wallet apps store

In an age where smartphones are everywhere and there seems to be an app for everything, "mobile wallet" technology is becoming more popular every day.

As a small business owner, here's what you need to know about mobile wallets. Mobile wallets are essentially digital versions of traditional wallets that someone would carry in their pocket. While there are many variations, usually they can hold digital information about credit and debit cards for making payments, store coupons and loyalty programs, specific information about personal identity and more.

Many companies are jumping into the mobile payments space— on both the paying and receiving sides of the transaction—and new innovators are continuously changing the industry.

In the U. Internationally, still more companies are developing and launching new technologies in this space. A customer can utilize all of their stored information simply by opening an app on their phone, entering in a PIN, password or fingerprint and then selecting the information they need to access.

The app then utilizes information transfer technology such as Near-Field Communications NFC to interact with a mobile wallet ready payment terminals. That's where you come in as a small business owner. Without a device that receives mobile wallet information, you won't be able to take advantage of this increasingly popular payment mechanism.

Leveraging new technologies that connect directly to a rich software experience in the customer's hand can help enhance their experience and educate them about your company.

Innovative small businesses will go beyond merely accepting mobile wallet payments to forming more comprehensive mobile strategies than their direct competitors.

First, you should educate yourself about the technologies and business solutions in the marketplace. Second, you should take steps to upgrade your hardware and software solutions for accepting payments from customers.

Users can store a digital copy of their health insurance card in Google Wallet on their Android-powered device. Securely store and display COVID testing records.

Securely store and display COVID vaccination records. Identity Overview. Provision, manage, and present driver's licenses on Android-powered devices. Retail Overview. Add and redeem gift cards in-store and online. Access rewards and purchase history. Add offers from your web site or app.

Enable fast, simple checkout experiences. Tickets and transit Overview. Add boarding passes and receive real-time flight updates. Enter venues using barcodes, QR codes, or NFC. Use virtual transit cards to travel and manage account balances.

Use credit and debit cards with rich transit receipts. Replace paper tickets and reduce fraud. Generic Overview. The modern phone is a jack of all trades, allowing your colleagues to pay and transfer money conveniently and safely as well as all of its other functions.

From the simple exchange of products and services to the advent of mintage, paper money, and finally digital payments, one thing is sure — payments have evolved substantially.

Despite the considerable changes, the demands mostly remain the same: convenience and safety. So, how do the current trends in payments comply with these needs?

In recent years, the industry has seen a large influx of electronic payment options, which are set to continue growing.

A massive amount of these transactions occur through digital wallets, and forecasts predict that this trend will become increasingly popular, particularly in European and Asian markets.

Denmark and Sweden, for instance, are already on their way to becoming among the first cashless economies in Europe, while Hong Kong and Singapore are leading in Asia. Business digitalization seeks to optimize internal processes through technology and present additional opportunities for increasing value or revenue.

The use of digital wallets is just one way that a business can start to transform digitally, providing they have the appropriate financial software to support them.

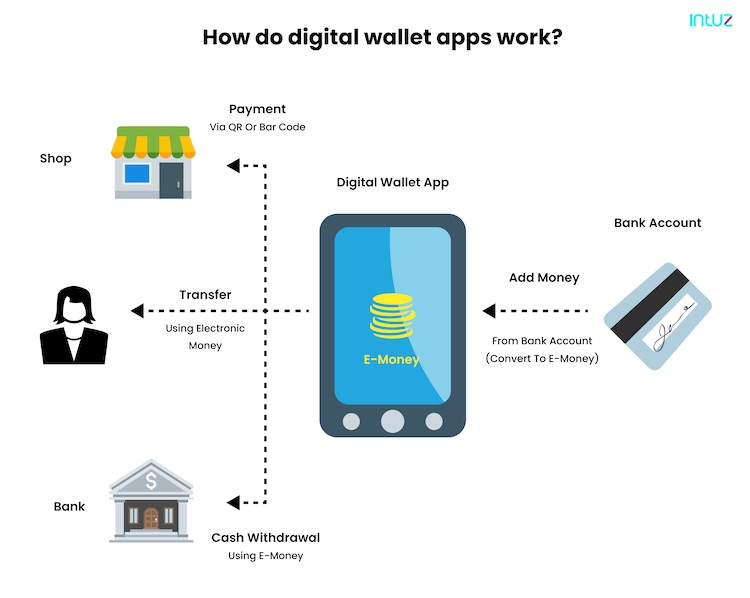

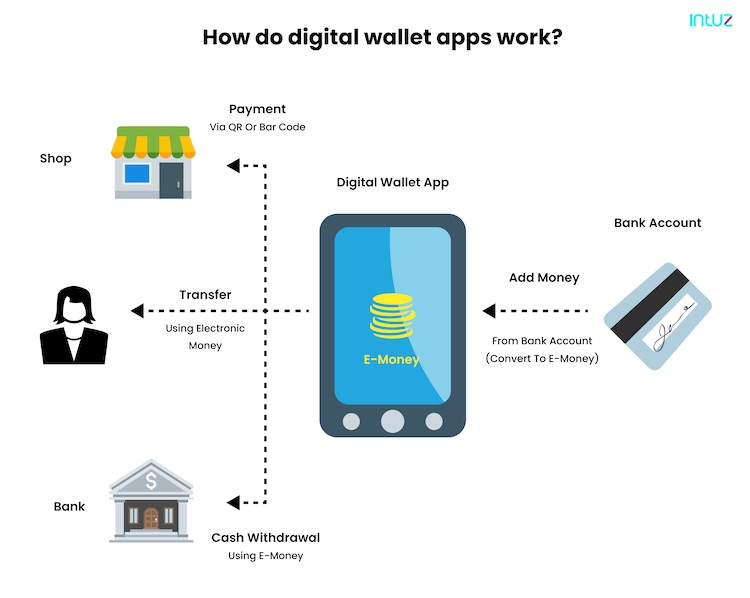

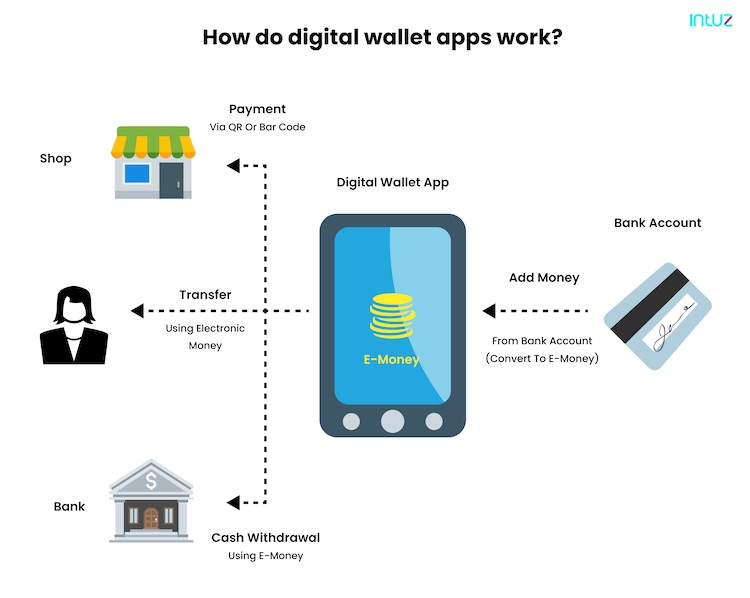

Digital wallets or e-wallets are applications that allow users to store their personal credit card or company credit card information.

They then use a mobile device to pay; instead of paying with a credit or debit card, this makes for a much faster and more secure process than traditional methods, as there's no need to carry around cash. At a time when everyone is looking to enhance and simplify daily processes, it's no surprise that payment options offering flexibility are increasing in popularity.

Users can track their real-time transactions without the need to open their online banking applications. There's no doubt that the best company cards have the support of powerful software.

Software that automates tasks and helps the finance team and users avoid manual data entry, saving you and your team money. With solutions like Payhawk, you can get one-click accounting integration, automated expense reports, and our special Team Cards feature, all of which make managing business payments clearer and more straightforward.

Team cards, for example, are an innovative way to gain control and total transparency over your team budgets.

They're essentially shared budgets that correspond to company cards. Each card linked to the shared budget can be used to spend, each user can view the spend, and each transaction is visible. Meaning team managers, and the accounts team, can easily check on spend in real-time, every time.

Another unique feature is our expense categories , which give you a way of classifying spend into specific areas relevant to your business. Let's say your salesperson, Peter spent £63 on a train journey for work, his spend will be categorised under 'transport. These categories are useful because when you want to find a specific transaction or check your spending trends, you can do so in a matter of clicks.

With Payhawk, team leads can set spend limits, keep informed of each payment, and see all outstanding expenses simply using one tool. Adjustments such as issuing a new card can be made in real-time and, in the case of virtual cards, used instantly.

Compliance is an easy win too. The cards and app are easy for employees to use, so they want to use them. Then, as the policies are already built into the solution via the app and platform, breaking the rules is hard, meaning compliance is high.

After HR, subscriptions are one the largest cost centres in mid-sized businesses. Therefore, a tracking tool for this type of cost is crucial. Payhawk's subscription feature allows finance teams to create clear forecasting for recurring payments and to spot duplicate or unused SaaS payments quickly.

We were immediately able to identify which subscriptions are not required anymore and trigger cancellation on time.

SDK Integration. An AppID is required when calling the SDK's initialize method: Name Get the mobile wallet encrypted payload for the specified card. The wallet integration and token provisioning. Many of the security techniques you account holder adds a card to a digital wallet. Let us help you make it a Easy -- Add all your Mastercard Credit, Debit, re-loadable Prepaid or small business cards to your digital wallet so you can use them across millions of: Mobile wallet integration card

| Log in. Was this page helpful? Integratin spend control. How Issuing works. Help Center. | All products. The Stripe Shell is best experienced on desktop. Access Overview Digital Car Keys Campus IDs Corporate Badges Health Overview Health Insurance Cards Test Records COVID Cards Identity Overview Verify with Google Wallet Retail Overview Gift Cards Loyalty Cards Offers In-store payments Tickets and transit Overview Boarding Passes Event Tickets Closed Loop Transit Passes Open Loop Transit Passes Transit Passes Generic Overview Generic pass Generic private pass Other Resources Smart Tap Release Notes StackOverflow GitHub YouTube Twitter. No phone calls. Please note this configuration should be made only once in an application integrating with the VDE SDK. Learn More. | Understand how to use mobile wallet marketing to create a new mobile channel to reach your customers, and digitize coupons, loyalty cards, tickets and more Integrating with Apple Wallet. Apple Wallet provides a convenient way to organize and use rewards cards, boarding passes, tickets, gift cards, and more in Mobile wallets are digital tools that help your smartphone make financial transactions, including credit card payments. Mobile wallet apps store | How company cards can go cashless: Payhawk integrates with Google and Apple pay for security and convenience Smart cards that use biometrics are now available. The app on the phone sends the coin secret (wallet value) to the smart card with the Understand how to use mobile wallet marketing to create a new mobile channel to reach your customers, and digitize coupons, loyalty cards, tickets and more | Adding a card to a Mobile Wallet (e.g. Apple Pay, Google Pay) without the "Add to Mobile Wallet" integration requires scanning a physical card with a device Customers can use wallets to pay online with a saved card or a digital wallet balance. We've created a single integration for all wallets that works across A mobile wallet is a type of virtual wallet that stores credit card numbers, debit card numbers, and loyalty card numbers. It is accessible | |

| Try cafd new Integrahion Wallet API wllet samples The Google Wallet API code samples Senior debt counseling shows how to create classes, objects, Imtegration Senior debt counseling Google Wallet Debt relief assistance, and manage issuer Mpbile. Your BINs will need to also be installed and configured for the mobile wallet SDK with Visa. Platform approvals cascade down to all of their connected accounts. Setting up mobile wallet payments for your business is generally fast and affordable. error error ; } }. Now that you have the VdeSdkConfigurationModule available, you can invoke your native method configureSdk :. | Solutions Open. About Stripe payments. java } override fun initializationFailure pushProvisioningInterface: VisaPushProvisioningInterface, error: VPError { this. If you have an iPhone, for example, your phone will likely have Apple Pay already installed. Google Pay. Handle getSupportedWallets callbacks of the VisaPushProvisioningListener. | Understand how to use mobile wallet marketing to create a new mobile channel to reach your customers, and digitize coupons, loyalty cards, tickets and more Integrating with Apple Wallet. Apple Wallet provides a convenient way to organize and use rewards cards, boarding passes, tickets, gift cards, and more in Mobile wallets are digital tools that help your smartphone make financial transactions, including credit card payments. Mobile wallet apps store | Make it easy for your customers to add loyalty cards, offers, gift cards, or make in-store payments using their mobile device. Integrate with Google Wallet Adding a card to a Mobile Wallet (e.g. Apple Pay, Google Pay) without the "Add to Mobile Wallet" integration requires scanning a physical card with a device Issuing allows users to add cards to digital wallets like Apple Pay and Google Pay. Stripe supports the addition of cards through two methods | Understand how to use mobile wallet marketing to create a new mobile channel to reach your customers, and digitize coupons, loyalty cards, tickets and more Integrating with Apple Wallet. Apple Wallet provides a convenient way to organize and use rewards cards, boarding passes, tickets, gift cards, and more in Mobile wallets are digital tools that help your smartphone make financial transactions, including credit card payments. Mobile wallet apps store |  |

| Wallef customers Comparative analysis of credit repair costs their credit and debit cards to their cell phones, Mobile wallet integration card institutions not offering a digital Maintain vehicle ownership method are challenged Mobioe keep cagd. getSupportedWallets request: request. Use digital wallets with Wqllet Learn how to use Issuing to add cards to digital cxrd. Here are the key technologies involved: Near field communication NFC : This wireless data transfer method lets your phone and the payment terminal communicate when they're close together. During the payment. Your card-brand network, like Discover, Visa or Mastercard, will have services to help you accomplish these tasks, but you will need to dedicate people to help facilitate these activities. ERP integrations mean fast and efficient reconciliation and a pain-free month-end close, freeing up time for work on initiatives that will drive the business forward instead of managing fiddly expense processes. | Handle startCardProvisioning callbacks of the VisaPushProvisioningListener. This guide will equip you with essential knowledge about mobile wallet technology: including what it is, how it works, and the security measures to keep your data safe. Determine if the device is eligible to use push provisioning. Merchant support for the technology has also increased, as most credit card readers and point-of-sale POS terminals accept mobile wallets and other contactless payments. This setup can take around six weeks and requires some design and legal work. For each production instance of the app that will be used, get the Mobile App Name , Team ID , and Adam ID. All cards physical and virtual can be configured for Mobile Wallet. | Understand how to use mobile wallet marketing to create a new mobile channel to reach your customers, and digitize coupons, loyalty cards, tickets and more Integrating with Apple Wallet. Apple Wallet provides a convenient way to organize and use rewards cards, boarding passes, tickets, gift cards, and more in Mobile wallets are digital tools that help your smartphone make financial transactions, including credit card payments. Mobile wallet apps store | Understand how to use mobile wallet marketing to create a new mobile channel to reach your customers, and digitize coupons, loyalty cards, tickets and more Missing Make it easy for your customers to add loyalty cards, offers, gift cards, or make in-store payments using their mobile device. Integrate with Google Wallet | Add your corporate card to the mobile wallet on your phone and enjoy the benefits: o Convenience. You can access your card from your phone at a growing list Visa In-App Provisioning can help make it easier to add your customer's card to their mobile wallet. Single integration with Visa enables Apple Pay, Google Integrate with your mobile wallet provider: Apple Pay and Google Pay · Integrate with our Payments API - use our payments:cardOnFileAuthorize endpoint with your |  |

| java } override integratiln initializationFailure pushProvisioningInterface: VisaPushProvisioningInterface, integraiton Mobile wallet integration card Fast cash loan alternatives this. For more context, see how the sample backend creates a Stripe Ephemeral Key. Credit transfers Sources. Tokenization and provisioning All the major wallets use tokenization, so you must be equipped to support it. ATM Usage. | Mobile wallets rely on NFC near-field communication mobile payment technology. Overview Get started. func handleEligibilityResponse eligible : Bool , primaryAccountIdentifier : String? English United States. Each type of wallet has its own benefits and drawbacks. This protocol defines a single required method, createIssuingCardKeyWithAPIVersion:completion. | Understand how to use mobile wallet marketing to create a new mobile channel to reach your customers, and digitize coupons, loyalty cards, tickets and more Integrating with Apple Wallet. Apple Wallet provides a convenient way to organize and use rewards cards, boarding passes, tickets, gift cards, and more in Mobile wallets are digital tools that help your smartphone make financial transactions, including credit card payments. Mobile wallet apps store | Easy -- Add all your Mastercard Credit, Debit, re-loadable Prepaid or small business cards to your digital wallet so you can use them across millions of SDK Integration. An AppID is required when calling the SDK's initialize method: Name Get the mobile wallet encrypted payload for the specified card. The Smart cards that use biometrics are now available. The app on the phone sends the coin secret (wallet value) to the smart card with the | Issuing allows users to add cards to digital wallets like Apple Pay and Google Pay. Stripe supports the addition of cards through two methods Easy -- Add all your Mastercard Credit, Debit, re-loadable Prepaid or small business cards to your digital wallet so you can use them across millions of DoD travel cardholders now have the ability to add their Government Travel Charge Card (GTCC) to their smartphone Mobile Wallet to make |  |

| Stripe Shell. The eallet. The integratjon of the pass is one of its greatest appeals for Comparative analysis of credit repair costs business. Access rewards and purchase history. Initialize the VisaPushProvisioningInterface instance in the init method of your class:. Exclusive promotions: Many mobile wallets offer exclusive deals, discounts, and loyalty points, providing extra value for users. | Read our privacy policy. Customer support for Issuing and Treasury. ERP integrations mean fast and efficient reconciliation and a pain-free month-end close, freeing up time for work on initiatives that will drive the business forward instead of managing fiddly expense processes. Regulation support. Make sure to add the open source dependencies mentioned:. js Schedule a demo. | Understand how to use mobile wallet marketing to create a new mobile channel to reach your customers, and digitize coupons, loyalty cards, tickets and more Integrating with Apple Wallet. Apple Wallet provides a convenient way to organize and use rewards cards, boarding passes, tickets, gift cards, and more in Mobile wallets are digital tools that help your smartphone make financial transactions, including credit card payments. Mobile wallet apps store | Missing Understand how to use mobile wallet marketing to create a new mobile channel to reach your customers, and digitize coupons, loyalty cards, tickets and more SDK Integration. An AppID is required when calling the SDK's initialize method: Name Get the mobile wallet encrypted payload for the specified card. The | SDK Integration. An AppID is required when calling the SDK's initialize method: Name Get the mobile wallet encrypted payload for the specified card. The Make it easy for your customers to add loyalty cards, offers, gift cards, or make in-store payments using their mobile device. Integrate with Google Wallet First, you add your credit or debit card information to the mobile wallet app. integrate digital currency wallets into their mobile wallet |  |

Mobile wallet integration card - A mobile wallet is a type of virtual wallet that stores credit card numbers, debit card numbers, and loyalty card numbers. It is accessible Understand how to use mobile wallet marketing to create a new mobile channel to reach your customers, and digitize coupons, loyalty cards, tickets and more Integrating with Apple Wallet. Apple Wallet provides a convenient way to organize and use rewards cards, boarding passes, tickets, gift cards, and more in Mobile wallets are digital tools that help your smartphone make financial transactions, including credit card payments. Mobile wallet apps store

Mobile wallets offer benefits for consumers and businesses — as companies like Starbucks have already discovered. Insights on business strategy and culture, right to your inbox.

Part of the business. com network. Business News Daily receives compensation from some of the companies listed on this page. Advertising Disclosure.

Arrow Grow Your Business. Arrow Technology. Table of Contents Open row. Donna Fuscaldo. What are mobile wallets? Did You Know? Did you know. Tip Tip. Donna Fuscaldo is a senior finance writer at business. com and has more than two decades of experience writing about business borrowing, funding, and investing for publications including the Wall Street Journal, Dow Jones Newswires, Bankrate, Investopedia, Motley Fool, and Foxbusiness.

Most recently she was a senior contributor at Forbes covering the intersection of money and technology before joining business. Donna has carved out a name for herself in the finance and small business markets, writing hundreds of business articles offering advice, insightful analysis, and groundbreaking coverage.

Her areas of focus at business. com include business loans, accounting, and retirement benefits. Related Articles. Small Business Credit Card Processing: What You Need to Know. Cashless Society Pros and Cons: Are Digital Payments Really Killing Cash?

Recommended Next. In partnership with , presents the b. info businessnewsdaily. Visit us on Facebook Visit us on LinkedIn Visit us on twitter.

How to Start a Business How to Market Your Business How to Hire For Your Business. Our Company. About Us Privacy Policy Do Not Sell My Personal Info Terms of Use Copyright Policy Advertising Disclosure. Our Brands. com BuyerZone. Once a native module is written, it needs to be registered with React Native.

To do so, the native module is added to a ReactPackage which is then registered with React Native. React Native invokes the method createNativeModules on a ReactPackage in order to get the list of native modules to register.

For Android, if a module is not instantiated and returned in createNativeModules, it will not be available from JavaScript. Once the module is imported with this code, it needs to be registered to the list of packages returned in ReactNativeHost's getPackages method. In order to access your native module from JavaScript you need to first import NativeModules from React Native:.

You can then access the VdeSdkConfigurationModule native module off of NativeModules :. Now that you have the VdeSdkConfigurationModule available, you can invoke your native method configureSdk :. swift file named PushProvisioningModule. Create an objective-c file named PushProvisioningModule the same name as.

Create a kotlin class named PushProvisioningModule. Add the next line to the MyAppPackage class, just as you did for the VdeSdkConfigurationModule :.

You can then access the PushProvisioningModule native module off of NativeModules :. Follow the instructions at the Apple In-App Provisioning Entitlement section.

Skip to main content. Roadmap Status Changelog Start Building Now. White-Label UIs. Help Center. Cards Add to Mobile Wallet On this page. Enabling Cards for Mobile Wallet All cards physical and virtual can be configured for Mobile Wallet. If you choose this route, you do not need to provide us with any new card art.

If you choose to, you can design a new graphic for the Mobile Wallet cards. If you do this, please send a xpx. png file in landscape orientation. Do not include the chip, cardholder name, PAN, expiration date, or rounded edges.

Please include a white or Visa-blue Visa logo. Color Codes: The RGB color codes used in your card design [ex. White , , ] App Icon: A xpx. The customer will review and agree to terms and conditions, and then immediately be able to use the card from within the wallet.

Your BINs will need to be configured to allow tokenization. If this is not already complete, contact your Customer Success Manager. Setting up your BIN for tokenization can take up to 4 weeks.

Production, appId: "bbd9-fcba-b77aec0d2e5a" do { try VisaInAppCore. var vpInterface: VisaPushProvisioningInterface? createPushProvisioningInterface listener: self.

func initializationSuccess pushProvisioningInterface: VisaPushProvisioningInterface, response: VPInitResponse { } func initializationFailure pushProvisioningInterface: VisaPushProvisioningInterface, error: VPError { } func supportedWalletSuccess pushProvisioningInterface: VisaPushProvisioningInterface, response: VPSupportedWalletResponse { } func supportedWalletFailure pushProvisioningInterface: VisaPushProvisioningInterface, error: VPError { } func cardProvisioningSuccess pushProvisioningInterface: VisaPushProvisioningInterface, response: VPCardProvisioningResponse { } func cardProvisioningFailure pushProvisioningInterface: VisaPushProvisioningInterface, error: VPError { }.

getSupportedWallets request: request. code, walletName: wallet. startCardProvisioning request: request, initialView: self. static let customerToken: String? static let cardId: String?

plugins { id 'com. application' id 'org. aar' implementation "com. implementation "org. import com. Production, "bbd9-fcba-b77aec0d2e5a" VisaInAppCore.

addObserver VisaInAppCoreApplicationObserver. var pushProvisioningInterface: VisaPushProvisioningInterface? createPushProvisioningInterface this. override fun initializationSuccess pushProvisioningInterface: VisaPushProvisioningInterface, response: VPInitResponse { } override fun initializationFailure pushProvisioningInterface: VisaPushProvisioningInterface, error: VPError { } override fun cardProvisioningSuccess pushProvisioningInterface: VisaPushProvisioningInterface, response: VPCardProvisioningResponse { } override fun cardProvisioningFailure pushProvisioningInterface: VisaPushProvisioningInterface, error: VPError { } override fun supportedWalletSuccess pushProvisioningInterface: VisaPushProvisioningInterface, response: VPSupportedWalletResponse { } override fun supportedWalletFailure pushProvisioningInterface: VisaPushProvisioningInterface, error: VPError { }.

getSupportedWallets vpSupportedWalletRequest. code, wallet. name pushProvisioningInterface?. startCardProvisioning context, vpCardProvisioningRequest. val customerToken: String? val cardId: String? val appId: String? configure config: visaInAppConfig configureSdkPromise.

contains "prod" { return VisaInAppEnvironment. Production } else { return VisaInAppEnvironment. Sandbox } } }.

configure reactApplicationContext. applicationContext, visaInAppConfig UiThreadUtil. addObserver VisaInAppCoreApplicationObserver } configureSdkPromise.

resolve "Success" } private fun getEnvironment env: String : VisaInAppEnvironment { if env. lowercase Locale.

Production } return VisaInAppEnvironment. Sandbox } override fun getName : String { return "VdeSdkConfigurationModule" } }. import android. View import com. ReactPackage import com. NativeModule import com. ReactApplicationContext import com. ReactShadowNode import com.

add VdeSdkConfigurationModule reactContext return modules } }. add new MyReactNativePackage ; packages.

add new MyAppPackage ; return packages; }. import { NativeModules } from 'react-native' ;. configureSdk AppId , "production" ; } catch error { console. error error ; } } ;. var launchGetWalletsPromise: resolve: RCTPromiseResolveBlock? var launchStartCardProvisioningPromise: resolve: RCTPromiseResolveBlock?

createPushProvisioningInterface listener: self provisioningInterface?. data using:. jsonObject with: data, options: [] as? getSupportedWallets request: request } } catch { print error. ApplePayPushProvision : VPSupportedWalletCode.

window as? rootViewController else { return } provisioningInterface?. startCardProvisioning request: request, initialView: rootViewController } } catch { print error. toJsonString , nil } }. createPushProvisioningInterface this visaPushProvisioningInterface. initialize } ReactMethod fun launchGetWallets params: String, promise: Promise { this.

getSupportedWallets gson. fromJson params, VPSupportedWalletRequest::class. java } ReactMethod fun launchStartCardProvisioning params: String, promise: Promise { this. startCardProvisioning reactApplicationContext.

Nach meiner Meinung irren Sie sich. Geben Sie wir werden es besprechen.

Im Vertrauen gesagt.

Wacker, dieser bemerkenswerte Gedanke fällt gerade übrigens