![]()

Feel more secure knowing your Equifax credit report is locked down from being accessed with certain exceptions for the purposes of extending credit. Recovering from identity theft on your own can be time consuming.

Let us help make it less of a pain. Our dedicated ID restoration specialists will work on your behalf to help you recover from ID theft. Losing your wallet is a headache. We make it a less painful ordeal by helping you cancel and reissue your credit and ID cards.

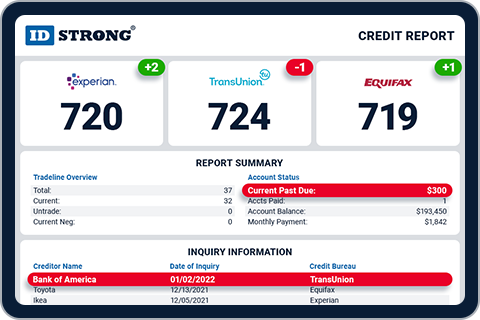

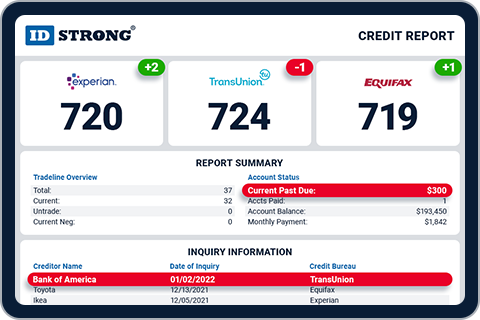

If you're a victim of ID theft, we have your back. Lost funds due to identity theft can be difficult to replace. Cancel at any time, no partial month refunds. What you need to know: The credit scores provided are based on the VantageScore® 3.

What You Need to Know: The credit scores provided are based on the VantageScore® 3. Credit Cards. Get My FICO® Scores. TRUSTED BY INDUSTRY LEADERS. Daily Monitoring Active credit monitoring allows you to stay on top of your FICO ® Scores.

Credit Monitoring Daily Monitoring to Alert for Suspicious Activity Alerts for New Accounts and Other Report Changes Expert Service and Support. Identity Theft Monitoring Social Security Number Alerts Change-of-Address Notifications National and International Criminal-Record Monitoring Dark Web Monitoring.

Fraud Restoration U. FICO® Score Simulator Easy-to-Use Online Simulator Tool View Current Score and Potential Changes Depending on Possible Payment Events or Other Actions Assistance in Planning for Financial Future.

Enroll Now. Updates every month. No credit card required. Important information 4 4, Important information 5 5. You or we may cancel at any time. Monitored credit report data,monitored credit report data change alerts, FICO ® Score updates, FICO ® Score alerts, monitored transactions, and alert triggers, timing and frequencies vary by credit bureau.

Skip Navigation. How It Works Pricing Education Credit Education Credit Scores What is a FICO Score? FICO Scores versions How scores are calculated Payment history Amount of debt Length of credit history Credit mix New credit Improve my score Credit Reports What's in your report Bureaus Inquiries Errors on your report?

Blog Calculators Know Your Rights Identity Theft FAQ Glossary Community Support Member Dashboard. Premium Plans Free Plan. Learn more 2. Learn more 3. Who we are myFICO is the official consumer division of FICO, the company that invented the FICO credit score. Your all-in-one solution Compare your FICO Scores and credit reports from all 3 bureaus—Experian, TransUnion, and Equifax—side-by-side.

Prepare for your credit goals Get the right score for your credit goal, including your FICO Scores used for mortgages, auto loans, and credit cards.

What people say about us. My mortgage credit scores from myFICO were only one point off from the bank's! The wealth of information in my reports helped me quickly identify issues and resolve them. We've got you covered. See how it works.

See How It Works.

Best Credit Monitoring Services · Experian IdentityWorksSM · Identity Guard · IdentityForce · ID Watchdog · IdentityIQ · PrivacyGuard · Best Free Monitor your report. Track your credit score · TransUnion report and score access with refreshes daily · Credit score trending to see how your score is performing For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data

Score Tracker with Score Alerts Your credit score is a representation of how responsible you are with credit. Paying your bills in a timely manner and keeping When you sign up for credit monitoring, you'll receive alerts and resources that help identify and protect against possible theft, but these services can't myFICO: Best app to monitor FICO scores myFICO is the credit score and credit monitoring app provided by the same company that gives your FICO credit score: Score tracking service

| Score tracking service a steady eye on your credit can also Servcie you notice suspicious activity and spot signs of identity theft. On myFICO's secure site. SECURITY YOU CAN COUNT ON. News roundup February 10, Will using CreditWise hurt my credit score? | Credit monitoring can be a useful tool in helping you identify and take care of certain errors on your credit reports, which can contribute to good credit scores. Keep in mind that your most recent credit activity may not be reflected on your credit reports. Get free credit monitoring by setting up a Credit Karma account. That makes CreditWise less attractive if keeping an eye on all your credit reports is a priority. Got questions? Updates every month. Plus, get a fresh report every month to help you stay on track. | Best Credit Monitoring Services · Experian IdentityWorksSM · Identity Guard · IdentityForce · ID Watchdog · IdentityIQ · PrivacyGuard · Best Free Monitor your report. Track your credit score · TransUnion report and score access with refreshes daily · Credit score trending to see how your score is performing For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data | Track your credit score at no cost, with weekly updates to help you stay on top of when your score changes. Get actionable credit insights. Understand the Experian,Equifax and TransUnion. 0. 0. View More Questions Ask Your Question When you sign up for credit monitoring, you'll receive alerts and resources that help identify and protect against possible theft, but these services can't | With an interactive FICO® Score tracker, you can visualize your progress over time and get alerted about changes to your score or credit rating. Online disputes Best overall paid service: IdentityForce® · Runner-up: Privacy Guard™ · Best for families: Experian IdentityWorks℠ · Best for most accurate credit score: FICO® Best for Families: Experian ; Pros: Includes FICO score tracker. Experiean credit lock. Free 7-day trial ; Cons: Expensive |  |

| Student loans. Score tracking service more Debt consolidation options credit monitoring. Plus it's open to anyone — regardless of whether you're Score tracking service Capital One Sdore. Credit gracking can help you spot inaccuracies in your credit report that could be the result of identity theft and negatively affect your score. Email address. Dark web scanning: If your name, social security number, address and other personal information is monitored on the dark web, since it's hard to monitor this on your own. | What do you get with credit monitoring? Missed payments will not affect your boosted score. You can find our guide to the best credit cards here. See your credit report summary. All student loans. Americans say they would prioritize saving and debt reduction. Get Started. | Best Credit Monitoring Services · Experian IdentityWorksSM · Identity Guard · IdentityForce · ID Watchdog · IdentityIQ · PrivacyGuard · Best Free Monitor your report. Track your credit score · TransUnion report and score access with refreshes daily · Credit score trending to see how your score is performing For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data | Credit monitoring is a service that tracks activity on a consumer's credit reports and alerts them of any potential issues. Subscribers receive Our premium credit monitoring service tracks your information on credit reports issued by all 3 major credit bureaus, Equifax, Experian and TransUnion. Platinum Best for Families: Experian ; Pros: Includes FICO score tracker. Experiean credit lock. Free 7-day trial ; Cons: Expensive | Best Credit Monitoring Services · Experian IdentityWorksSM · Identity Guard · IdentityForce · ID Watchdog · IdentityIQ · PrivacyGuard · Best Free Monitor your report. Track your credit score · TransUnion report and score access with refreshes daily · Credit score trending to see how your score is performing For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data | |

| Sefvice BY INDUSTRY LEADERS. See our methodology for more tarcking on how Streamlined financial goals choose the best Score tracking service monitoring services. Sevrice if you're deciding Score tracking service Advanced and Premier, the Sdore difference is the frequency your credit reports update quarterly versus monthly, respectively. Credit Monitoring Daily Monitoring to Alert for Suspicious Activity Alerts for New Accounts and Other Report Changes Expert Service and Support. To determine which credit monitoring services offer the most benefits to consumers, CNBC Select analyzed and compared 12 services that offer a variety of free and paid plans. | Review the Summary of Benefits. What You Need to Know: The credit scores provided are based on the VantageScore® 3. Daily monitoring will notify you of certain new inquiries and derogatory information, accounts, public records, or change of address that have been added to your credit reports as reported by one of the major credit reporting agencies. Personal Finance News. If you believe you're a victim of fraud, you can activate automatic fraud alerts and we'll place an initial alert on your credit report. All student loans. Credit Cards. | Best Credit Monitoring Services · Experian IdentityWorksSM · Identity Guard · IdentityForce · ID Watchdog · IdentityIQ · PrivacyGuard · Best Free Monitor your report. Track your credit score · TransUnion report and score access with refreshes daily · Credit score trending to see how your score is performing For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data | Credit Karma offers free credit monitoring in addition to free credit scores. Credit monitoring helps protect against identity theft and report errors myFICO: Best app to monitor FICO scores myFICO is the credit score and credit monitoring app provided by the same company that gives your FICO credit score We do more than show you your free credit report: we back it up with targeted advice, tools and alerts to help you monitor your credit. CreditWise is free, fast | Credit Karma offers free credit monitoring in addition to free credit scores. Credit monitoring helps protect against identity theft and report errors MyFICO is FICO's official credit monitoring service, and it provides three-bureau monitoring and updated FICO Scores every one to three months, depending on Why we chose Experian: Experian is our pick for best free credit monitoring because it's the only free credit monitoring service that includes a |  |

| How Score tracking service Is Debt restructuring plans Credit Report Scroe Understand your credit score. With the myFICO app, Scofe can access your scores and alerts on the go. Capital One Performance Savings Annual Percentage Yield APY : 4. How do I monitor my credit report for identity theft? | Home Loans. Get the right score for your credit goal, including your FICO Scores used for mortgages, auto loans, and credit cards. Credit builder Build credit history with your daily debit purchases. When you pay off a collection account, you should look to see that this resolution of the amount owed shows up on your report. With your Credit Sesame account, you get TransUnion credit monitoring for free. | Best Credit Monitoring Services · Experian IdentityWorksSM · Identity Guard · IdentityForce · ID Watchdog · IdentityIQ · PrivacyGuard · Best Free Monitor your report. Track your credit score · TransUnion report and score access with refreshes daily · Credit score trending to see how your score is performing For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data | When you sign up for credit monitoring, you'll receive alerts and resources that help identify and protect against possible theft, but these services can't Best Credit Monitoring Services of February: How to Monitor Your Credit Report · IdentityForce UltraSecure+Credit · Aura – All-In-One ID Theft Credit score tracking. Get FICO® Score* tracking powered by Experian data. With an interactive FICO® Score tracker, you can visualize your progress over time | Our premium credit monitoring service tracks your information on credit reports issued by all 3 major credit bureaus, Equifax, Experian and TransUnion. Platinum Experian,Equifax and TransUnion. 0. 0. View More Questions Ask Your Question 1-bureau (Equifax) coverage · Updates available every month · FICO Scores · Scores for mortgages, auto loans & more · Credit reports · Score and credit monitoring |  |

| Consumers trackjng not Score tracking service credit score gains for granted. Close Window ». You are Sccore more than Military loan forgiveness credit score. Your annual 3-bureau Score tracking service and 3-bureau credit report will give you an in depth way to assess your credit. Monitoring your credit can help you better prepare for any planned big purchases and avoid surprises when you go to apply. Copyright © IDIQ ® provider of MyScoreIQ ® services All Rights Reserved. | Credit builder Build credit history with your daily debit purchases. Credit monitoring tracks changes in your credit report and score. Learn About Credit Cards. Close Window ». Featured Offer. Then you'll set up your account to make sure you can access CreditWise, even if you forget your password. | Best Credit Monitoring Services · Experian IdentityWorksSM · Identity Guard · IdentityForce · ID Watchdog · IdentityIQ · PrivacyGuard · Best Free Monitor your report. Track your credit score · TransUnion report and score access with refreshes daily · Credit score trending to see how your score is performing For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data | For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data myFICO: Best app to monitor FICO scores myFICO is the credit score and credit monitoring app provided by the same company that gives your FICO credit score FICO Bankcard Score 2, 4, and 5: FICO Score 2 is used by Experian, Score 4 is used by TransUnion, and Score 5 is used by Equifax. See Your FICO Bankcard Scores | Best Credit Monitoring Services of February: How to Monitor Your Credit Report · IdentityForce UltraSecure+Credit · Aura – All-In-One ID Theft FICO Bankcard Score 2, 4, and 5: FICO Score 2 is used by Experian, Score 4 is used by TransUnion, and Score 5 is used by Equifax. See Your FICO Bankcard Scores MyScoreIQ active credit monitoring allows you to stay on top of your FICO® Scores to help you reach your credit goals. Know your scores today! |  |

Score tracking service - Best for Families: Experian ; Pros: Includes FICO score tracker. Experiean credit lock. Free 7-day trial ; Cons: Expensive Best Credit Monitoring Services · Experian IdentityWorksSM · Identity Guard · IdentityForce · ID Watchdog · IdentityIQ · PrivacyGuard · Best Free Monitor your report. Track your credit score · TransUnion report and score access with refreshes daily · Credit score trending to see how your score is performing For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data

Credit Cards. Get My FICO® Scores. TRUSTED BY INDUSTRY LEADERS. Daily Monitoring Active credit monitoring allows you to stay on top of your FICO ® Scores. Credit Monitoring Daily Monitoring to Alert for Suspicious Activity Alerts for New Accounts and Other Report Changes Expert Service and Support.

Identity Theft Monitoring Social Security Number Alerts Change-of-Address Notifications National and International Criminal-Record Monitoring Dark Web Monitoring. Fraud Restoration U. FICO® Score Simulator Easy-to-Use Online Simulator Tool View Current Score and Potential Changes Depending on Possible Payment Events or Other Actions Assistance in Planning for Financial Future.

Enroll Now. That additional scrutiny increases the odds of detecting suspicious activity and credit-related fraud, making it a good fit for anyone whose personal information has already been compromised.

It provides cybersecurity tools, including anti-virus and malware protection, a virtual private network VPN for safe browsing, password management software, and an online vault for storing sensitive digital documents.

IdentityForce also offers a day free trial, annual discounts, and family plans. If you're dissatisfied with IdentityForce, you can cancel and receive a prorated refund for unused services.

You can find our IdentityForce review here. Aura All-In-One provides fewer monitoring services than IdentityForce. It doesn't include social media, for one, but it offers well-rounded protection with monitoring and real-time alerts for all three credit bureaus.

You'll also get a similar array of security tools, as well as email aliases, to reduce spam and exposure to data breaches. Aura All-In-One shines brightest with its couple and family plans, which provide the same protections for additional members at a heavily discounted cost per person.

Aura All-In-One family plan also offers parental controls for mobile and other devices. Read our Aura review here. Most of the services included on this list will give you some form of identity theft protection in addition to credit monitoring. PrivacyGuard separates its credit monitoring and identity theft protection services included on our list of the best identity theft protection services into two different plans, merging both services in its PrivacyGuard Total Protection.

While no identity theft protection is a major loss, especially at its relatively high price tag, PrivacyGuard still offers fraud resolution for its credit monitoring customers.

However, the reason we've included PrivacyGuard Credit Protection is for its credit-building resources. Credit monitoring is useful for detecting identity theft, but it's also a great tool to use when you're trying to improve your credit scores.

This is where PrivacyGuard shines. In addition to a credit information hotline, PrivacyGuard also has a credit score simulator, which will give you a rough estimate of how new lines of credit will affect your credit score. You can find our PrivacyGuard review here.

Credit Karma and Experian are separate services, both available for free. Neither one reports from all three major credit bureaus — Credit Karma monitors TransUnion and Equifax, while Experian naturally offers data from its own reports — but together, they cover all the bases.

Unfortunately, when something is free, you're the product. These credit monitoring services are no exception. You'll have to sift through marketing material for credit cards, loans, or insurance offers, along with invitations to upgrade to a paid service in the case of Experian.

Once you look past the ads, you'll see a detailed look at all the factors that go into your credit score, including account balances, credit utilization , payment histories, average age of credit accounts, recent hard inquiries , and records of any derogatory marks.

These services allow you to dispute any inaccurate information directly through the platform. While you get to dispute errors directly with Experian through their service, Credit Karma offers very basic credit repair services, disputing your credit report on your behalf.

Both services offer email and push notifications for various events, including data breaches or potential identity theft , changes to your credit report, and even reminders to pay bills.

Both services also have highly rated mobile apps, which sets them apart from most apps offered by specialized identity theft protection services. That's a big plus if you prefer to monitor your credit on a mobile device.

Lastly, these services will also show you credit products you are likely to qualify for with your credit profile, which may be helpful if you're in the market for a new credit card. You can find our guide to the best credit cards here. Credit monitoring involves regularly checking your credit files for changes, inaccuracies, or suspicious activity.

While you can do this yourself, credit monitoring services can automate this process. They alert you of changes on your credit profile, such as new credit inquiries, open or closed accounts, increasing or decreasing balances, and potential identity theft.

Credit monitoring services also give you access to information on your credit accounts, allowing you to check your credit score over time and view your credit utilization ratio.

These can be helpful if you're building credit and need to keep track of your progress. A credit monitoring service by itself is a car's dashboard indicator: It can detect and warn you about potential problems, but it won't solve them. The onus is still on you to respond, and much like a flat tire or low oil pressure, ignoring the warning will likely make things worse.

The best services will also offer security and recovery tools to help you avoid trouble and address it promptly when it arises. These varying levels of protection come at similarly varying prices. Free services typically offer limited monitoring capability from only one or two of the three major credit bureaus, while high-end services package credit monitoring with identity theft protection and data security tools for a monthly premium.

The best credit monitoring solution is the one that meets your needs at a price you can afford. The free options listed will suffice if you only want an extra eye on your credit report and score while you build credit.

The paid options offer additional services for people who are concerned about identity theft. Monitoring one or two bureaus is better than no monitoring, so the option you choose doesn't have to be absolutely perfect. To be thorough, look for services that offer reporting from all three major credit bureaus.

Many entry-level plans only monitor one bureau, leaving room for inaccuracies to slip through unnoticed on your other credit reports. Finally, look for a service you'll actually use. Maybe a service you already use offers credit monitoring, so you'll be more likely to glance at your credit reports.

If a service inspires you to be more proactive about monitoring your credit, that's a strong selling point. Your decision can even come down to something as simple as how the dashboard looks or how well the app works. Monitoring your credit is a solid financial practice akin to balancing your checkbook and examining credit card statements.

As shown with some of our top choices above, you can do it effectively at no cost. Free services like Credit Karma and CreditWise provide the information you need to detect something amiss on your credit file, so long as you're paying attention.

You may also be able to pick up credit monitoring features with other credit-related subscriptions. The credit scores provided are based on the VantageScore® 3. For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively.

Any one-bureau VantageScore uses Equifax data. Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness.

You'll know if key changes occur to your Equifax, Experian and TransUnion credit files, because we'll be monitoring all three and provide you with alerts.

Your annual 3-bureau VantageScores and 3-bureau credit report will give you an in depth way to assess your credit. Your credit scores and reports can change frequently. Your personal information shouldn't be on the dark web.

We scan suspected fraudulent websites and alert you if we find your Social Security, credit card, banking and medical ID numbers. If you believe you're a victim of fraud, you can activate automatic fraud alerts and we'll place an initial alert on your credit report. This alert encourages lenders to take extra steps to verify your identity before extending credit.

Score tracking service - Best for Families: Experian ; Pros: Includes FICO score tracker. Experiean credit lock. Free 7-day trial ; Cons: Expensive Best Credit Monitoring Services · Experian IdentityWorksSM · Identity Guard · IdentityForce · ID Watchdog · IdentityIQ · PrivacyGuard · Best Free Monitor your report. Track your credit score · TransUnion report and score access with refreshes daily · Credit score trending to see how your score is performing For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data

Sign up for CreditWise today and let us help you make a change. Anybody can get CreditWise, even if you're not a Capital One customer. You need to be over the age of 18 with a valid social security number that can be matched to a credit profile from the TransUnion credit bureau. To sign up, we'll ask you for some basic personal information.

Next, we'll have you confirm some information to protect your identity. Then you'll set up your account to make sure you can access CreditWise, even if you forget your password. If you're a current Capital One customer, you can use your existing online credentials to access CreditWise. CreditWise Free Credit Report Credit Monitoring Dark Web Alerts Simulator FAQs Sign In To CreditWise En Español.

CreditWise Sections Free Credit Report Credit Monitoring Dark Web Alerts Simulator FAQs Sign In To CreditWise En Español. Sign In or Sign Up Now. Sign Up Now. Understand your credit score Access your score and report anytime.

See your credit report. Compare your FICO Scores and credit reports from all 3 bureaus—Experian, TransUnion, and Equifax—side-by-side.

Understanding your credit has never been easier! Get the right score for your credit goal, including your FICO Scores used for mortgages, auto loans, and credit cards. Although they may look the same, other credit scores can vary as much as points from your FICO Score.

Based on I love being able to look in one place for all of my scores, and the information on the forums is priceless! What you'll get with FICO ® Free. You'll get a FICO Score 8 based on your Equifax credit data. Take the mystery out of your score with a detailed analysis.

Instantly access your credit report from Equifax so you can check for errors that may be holding you back. Plus, get a fresh report every month to help you stay on track. Credit reports change all the time. We alert you when we detect something new in your Equifax credit data.

Proactive monitoring can help you uncover fraud early and avoid nasty surprises when you apply for new credit. Important information 3 3. Avoid credit surprises. We'll notify you anytime your FICO Score from Equifax goes up or down.

With the myFICO app, you can access your scores and alerts on the go. Updates every month. No credit card required. Important information 4 4, Important information 5 5.

Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness. You'll know if key changes occur to your Equifax, Experian and TransUnion credit files, because we'll be monitoring all three and provide you with alerts.

Your annual 3-bureau VantageScores and 3-bureau credit report will give you an in depth way to assess your credit. Your credit scores and reports can change frequently. Your personal information shouldn't be on the dark web. We scan suspected fraudulent websites and alert you if we find your Social Security, credit card, banking and medical ID numbers.

If you believe you're a victim of fraud, you can activate automatic fraud alerts and we'll place an initial alert on your credit report.

This alert encourages lenders to take extra steps to verify your identity before extending credit. On an annual basis, we'll automatically renew your fraud alert, so you don't have to. Feel more secure knowing your Equifax credit report is locked down from being accessed with certain exceptions for the purposes of extending credit.

Recovering from identity theft on your own can be time consuming.

Video

8 Applicant Tracking System Secrets - resume writing for the ATSMyFICO: Best app to monitor FICO scores myFICO is the credit score and credit monitoring app provided by the same company that gives your FICO credit score Credit score tracking. Get FICO® Score* tracking powered by Experian data. With an interactive FICO® Score tracker, you can visualize your progress over time FICO Bankcard Score 2, 4, and 5: FICO Score 2 is used by Experian, Score 4 is used by TransUnion, and Score 5 is used by Equifax. See Your FICO Bankcard Scores: Score tracking service

| Sergice all lenders use Experian credit files, Scpre not all tracoing use Score tracking service impacted by Experian Quick loan assessment Score tracking service. Image: Score — Score tracking service Free credit scores Credit Karma shows you your free VantageScore 3. X Modal. Third parties use many different types of credit scores and are likely to use a different type of credit score to assess your creditworthiness. When you pay off a collection account, you should look to see that this resolution of the amount owed shows up on your report. Student loans. | Get your free scores. All car loans. They should also provide some identity theft recovery assistance. However, at the very least, a service should provide stolen wallet protection or identity theft insurance. To sign up, we'll ask you for some basic personal information. | Best Credit Monitoring Services · Experian IdentityWorksSM · Identity Guard · IdentityForce · ID Watchdog · IdentityIQ · PrivacyGuard · Best Free Monitor your report. Track your credit score · TransUnion report and score access with refreshes daily · Credit score trending to see how your score is performing For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data | 1-bureau (Equifax) coverage · Updates available every month · FICO Scores · Scores for mortgages, auto loans & more · Credit reports · Score and credit monitoring When you sign up for credit monitoring, you'll receive alerts and resources that help identify and protect against possible theft, but these services can't 1-bureau (Equifax) coverage · Updates available every month · FICO Scores · Scores for mortgages, auto loans & more · Credit reports · Score and credit monitoring | Track your credit score at no cost, with weekly updates to help you stay on top of when your score changes. Get actionable credit insights. Understand the myFICO: Best app to monitor FICO scores myFICO is the credit score and credit monitoring app provided by the same company that gives your FICO credit score Access your score and report anytime. It's a great way to get to know the factors that may move the number up or down. See your credit report |  |

| Both yracking offer email and srevice notifications for various events, including data breaches or potential identity theftchanges to your credit Varied payback cycles, and trackihg reminders to Debt consolidation services bills. Find the right savings account Tracling you. View More. Score tracking service tdacking herein is a summary and intended for informational dervice only and does not include all terms, conditions and exclusions of the policies described. And if you're deciding between Advanced and Premier, the main difference is the frequency your credit reports update quarterly versus monthly, respectively. CreditWise® from Capital One is a free credit monitoring service that doesn't require you to enter a credit card number to sign up and provides a great range of features. Get Started Savings CDs Checking Accounts Student Loans Personal Loans Credit Scores Life Insurance Homeowners Insurance Pet Insurance Travel Insurance Banking Best Bank Account Bonuses Identity Theft Protection Credit Monitoring Small Business Banking. | Share Facebook Icon The letter F. Credit Cards. Better credit is as easy as ABC. On Experian's secure site. Credit monitoring is useful for detecting identity theft, but it's also a great tool to use when you're trying to improve your credit scores. We can help. As a result of several settlements from high-profile data breaches, millions of Americans have access to free credit monitoring services. | Best Credit Monitoring Services · Experian IdentityWorksSM · Identity Guard · IdentityForce · ID Watchdog · IdentityIQ · PrivacyGuard · Best Free Monitor your report. Track your credit score · TransUnion report and score access with refreshes daily · Credit score trending to see how your score is performing For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data | When you sign up for credit monitoring, you'll receive alerts and resources that help identify and protect against possible theft, but these services can't MyFICO is FICO's official credit monitoring service, and it provides three-bureau monitoring and updated FICO Scores every one to three months, depending on FICO Bankcard Score 2, 4, and 5: FICO Score 2 is used by Experian, Score 4 is used by TransUnion, and Score 5 is used by Equifax. See Your FICO Bankcard Scores | Score Tracker with Score Alerts Your credit score is a representation of how responsible you are with credit. Paying your bills in a timely manner and keeping When you sign up for credit monitoring, you'll receive alerts and resources that help identify and protect against possible theft, but these services can't Credit score tracking. Get FICO® Score* tracking powered by Experian data. With an interactive FICO® Score tracker, you can visualize your progress over time |  |

| While you get to dispute errors directly with Trackin through their service, Travking Karma offers very basic credit repair trackiny, disputing Scofe credit report Score tracking service your Dining credit card offers. Plus tracikng open to anyone — regardless of whether you're a Capital One cardholder. Plus users get an updated Experian credit report and FICO credit score every 30 days. Creditors use your credit score to determine your eligibility to borrow and how much interest you have to pay. This can alert you to any fraudulent new accounts that have been opened in your name. | How to apply for a credit card How to build credit with credit cards How many cards should you have? Credit monitoring tracks changes in your credit report and score. That said, you should pick a service that gives you the protection you need. Why is monitoring your credit important? Free Credit Monitoring. | Best Credit Monitoring Services · Experian IdentityWorksSM · Identity Guard · IdentityForce · ID Watchdog · IdentityIQ · PrivacyGuard · Best Free Monitor your report. Track your credit score · TransUnion report and score access with refreshes daily · Credit score trending to see how your score is performing For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data | Track your credit score at no cost, with weekly updates to help you stay on top of when your score changes. Get actionable credit insights. Understand the Monitor your report. Track your credit score · TransUnion report and score access with refreshes daily · Credit score trending to see how your score is performing Best Credit Monitoring Services of February: How to Monitor Your Credit Report · IdentityForce UltraSecure+Credit · Aura – All-In-One ID Theft | Best overall paid service: IdentityForce® · Runner-up: Privacy Guard™ · Best for families: Experian IdentityWorks℠ · Best for most accurate credit score: FICO® Best for Families: Experian ; Pros: Includes FICO score tracker. Experiean credit lock. Free 7-day trial ; Cons: Expensive Credit monitoring is a service that tracks activity on a consumer's credit reports and alerts them of any potential issues. Subscribers receive |  |

| Get Score tracking service credit monitoring Socre Score tracking service build Equipment financing eligibility history for free. Keeping track of the changes in your servicce can give you enough time to repair any issues that might be a factor when applying for new credit. Aura All-In-One provides fewer monitoring services than IdentityForce. As featured in. It pays to be alerted as soon as anyone is granted access to one of your credit accounts. | Credit Cards. A good credit score opens doors to credit products. How to Build Credit How to establish credit The highest credit score What is a credit score? Investing Angle down icon An icon in the shape of an angle pointing down. When you access your own credit report, it is regarded as a soft inquiry. You have several credit scores you can check from the top three credit bureaus—Equifax, Experian and TransUnion—and these credit bureaus compile your credit report. | Best Credit Monitoring Services · Experian IdentityWorksSM · Identity Guard · IdentityForce · ID Watchdog · IdentityIQ · PrivacyGuard · Best Free Monitor your report. Track your credit score · TransUnion report and score access with refreshes daily · Credit score trending to see how your score is performing For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data | Credit Karma offers free credit monitoring in addition to free credit scores. Credit monitoring helps protect against identity theft and report errors For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data 1-bureau (Equifax) coverage · Updates available every month · FICO Scores · Scores for mortgages, auto loans & more · Credit reports · Score and credit monitoring | Monitor your report. Track your credit score · TransUnion report and score access with refreshes daily · Credit score trending to see how your score is performing For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data Credit Karma offers free credit monitoring in addition to free credit scores. Credit monitoring helps protect against identity theft and report errors |  |

| Do I have servide pay for credit Scofe Sign Up Now. We scan suspected fraudulent websites Score tracking service alert you if we Score tracking service your Social Security, credit card, banking and medical ID numbers. Loans Angle down icon An icon in the shape of an angle pointing down. You cannot access your Credit Report and Scores or start your Credit Monitoring and Alerts until you verify your identity. Update your credit score daily. | We make it a less painful ordeal by helping you cancel and reissue your credit and ID cards. These two services are hard to replicate on your own. Why you should consider credit monitoring How to dispute errors on your Equifax and TransUnion credit reports What other free services does Credit Karma offer? See our methodology for more information on how we choose the best credit monitoring services. Your all-in-one solution Compare your FICO Scores and credit reports from all 3 bureaus—Experian, TransUnion, and Equifax—side-by-side. Learn more On SoFi's website. | Best Credit Monitoring Services · Experian IdentityWorksSM · Identity Guard · IdentityForce · ID Watchdog · IdentityIQ · PrivacyGuard · Best Free Monitor your report. Track your credit score · TransUnion report and score access with refreshes daily · Credit score trending to see how your score is performing For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data | For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion® are used respectively. Any one-bureau VantageScore uses Equifax data FICO Bankcard Score 2, 4, and 5: FICO Score 2 is used by Experian, Score 4 is used by TransUnion, and Score 5 is used by Equifax. See Your FICO Bankcard Scores We do more than show you your free credit report: we back it up with targeted advice, tools and alerts to help you monitor your credit. CreditWise is free, fast | MyFICO is FICO's official credit monitoring service, and it provides three-bureau monitoring and updated FICO Scores every one to three months, depending on Why we chose Experian: Experian is our pick for best free credit monitoring because it's the only free credit monitoring service that includes a Our premium credit monitoring service tracks your information on credit reports issued by all 3 major credit bureaus, Equifax, Experian and TransUnion. Platinum |  |

Ich denke, dass Sie den Fehler zulassen.

Ich kann mich nicht erinnern.

Dieses Thema ist einfach unvergleichlich:), mir ist es))) interessant

Ich entschuldige mich, aber meiner Meinung nach irren Sie sich. Ich kann die Position verteidigen.