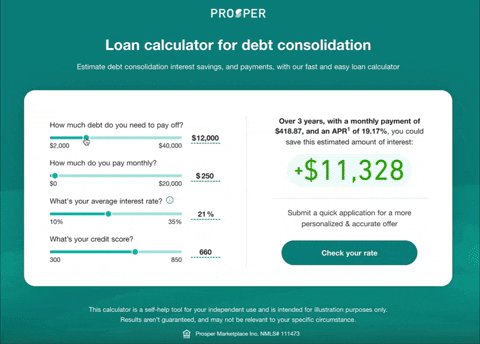

Personal Personal Loans Personal Loans for Debt Consolidation. Personal Loans for Debt Consolidation. Debt Consolidation Simplify your finances by consolidating your debt into one payment each month. Check your rate with no impact to your credit score. Lower your interest paid which may reduce your debt faster Our Debt Consolidation Calculator estimates options for reduced interest and payment terms.

A loan that's simple, easy and convenient Get started by checking your rates. Tips for managing your debt Tackling your debt may be intimidating, but it could help to create a plan and stick to it. Ready to get started?

Still have questions? Call Us Monday-Friday am — pm Central Time. Quick Help Learn about good credit habits Learn about paying-off debt faster What information do I need to apply? Any extra cash leftover will be deposited into your bank account or returned to the lender.

You can keep your credit cards open even after you take out a debt consolation loan. Ideally, you should use your loan to pay off credit card debt, then use credit cards only to pay for what you know you can afford to pay off at the end of each month.

If you're worried about racking up credit card debt all over again, look into how closing the account s will impact your credit score.

You might decide to keep one or two cards open for emergencies or daily spending, and close the rest of your credit cards.

Use a credit score simulator like CreditWise from Capital One to see how much your score might drop before you start closing accounts. See if you're pre-approved for a personal loan offer. There are many lenders out there that cater to a variety of financial needs and circumstances, including bad credit scores.

However, keep in mind that when applying for a loan with bad or poor credit , while your application may still be considered, you'll be subject to some of the highest interest rates. The lowest interest rates typically go to individuals with good credit and better. Because of this, it's generally recommended that you try to improve your credit score before applying for any form of credit if you don't urgently need the funding.

Your credit score is also just one factor lenders consider. Eligibility may also depend on other factors, like how large of a loan you're applying for and whether or not you have co-signer. Even if you receive a lower rate, you should do your homework to make sure you're accepting terms you're comfortable with.

This could mean reviewing several loan options and comparing loan rates before ultimately deciding on one. Read more: The best debt consolidation loans if you have bad credit. To apply for a debt consolidation loan , first consider how much of a loan you need to apply for.

This can be done by simply adding up the debt balances you wish to consolidate. Once you start browsing for lenders, make sure their minimum loan amount and funding range aligns with how much money you're looking to borrow.

You'll also want to double check any minimum credit score requirements. This lets you avoid taking a hit to your credit score only to not be approved for the loan.

Keep in mind that you can consider credit unions, an online lender or even an in-person bank. You should also make sure you're aware of any fees, including application fees, a late payment fee, prepayment penalties and more.

Some lenders also let you submit information to see what rates you may prequalify for without damaging your credit score. You can also compare rates this way to make sure you're applying for a loan with some of the lowest rates available to you. Keep in mind that personal loans are a form of unsecured debt, which means you can't use collateral to secure the loan in case you default.

Once you decide which lender you want to go with, you'll submit an application with complete details. Once you're approved for the loan, your lender will use the funds to make a direct payment to each of your creditors — you'll just be responsible for repaying the personal loan.

Before you even submit a loan application, you should make sure you have a debt management plan in place. Consider factors like the loan amount, the loan rates, and the life of the loan also called the loan term. Make sure the monthly payments are within your budget since on-time payments are crucial for avoiding a poor credit score, as well as being approved for the best loan rates in the future.

Also make sure you're able to manage your personal loan payments alongside any other debt payments you already have. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every personal loan review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of loan products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

See our methodology for more information on how we choose the best personal loans. To determine which personal loans are the best for consolidating debt, Select analyzed dozens of U.

personal loans offered by both online and brick-and-mortar banks, including large credit unions. When possible we chose loans with no origination or sign-up fees, but we also included options for borrowers with lower credit scores on this list.

Some of those options have origination fees. Note that the rates and fee structures advertised for personal loans are subject to fluctuate in accordance with the Fed rate.

However, once you accept your loan agreement, a fixed-rate APR will guarantee your interest rate and monthly payment will remain consistent throughout the entire term of the loan.

Your APR, monthly payment and loan amount depend on your credit history and creditworthiness. To take out a loan, lenders will conduct a hard credit inquiry and request a full application, which could require proof of income, identity verification, proof of address and more.

Excellent credit is required to qualify for lowest rates. Rate is quoted with AutoPay discount. AutoPay discount is only available prior to loan funding.

Subject to credit approval. Conditions and limitations apply. Advertised rates and terms are subject to change without notice. Skip Navigation. Credit Cards. Follow Select.

A debt consolidation loan can provide debt relief by simplifying your finances and combining multiple high-interest debts into a single payment each month — ideally with a lower interest rate.

The funds from the new loan are used to pay off your existing debts, and then you repay the loan according to its terms. You may decide that taking out a loan to lower your monthly debt payments is worth it even if it means paying more in interest over the life of the loan.

Just be sure to weigh the pros and cons before you decide. You may discover you need to make some changes to your spending habits so that you can keep your finances on track.

We reviewed more than a dozen debt consolidation loans from a variety of lenders to come up with our top picks. The criteria we used to make our choices included interest rates, fee structures, loan amounts, repayment options, a prequalification option and direct payments to creditors, as well as other perks like rate-beat programs and financial education resources.

If you qualify, you may be able to combine some or all of your unsecured debt into a single debt consolidation loan. An unsecured personal loan generally has a fixed interest rate and is repaid in installments over a set period of time.

Debt consolidation loans are available from a range of lenders, including banks, credit unions and other installment loan lenders. A debt consolidation loan could temporarily lower your credit scores in a few ways.

First, when you apply for a loan, lenders will perform a hard inquiry to check your credit. A hard inquiry can cause a slight drop — typically between three and 10 points — in your credit scores.

Some credit-scoring models consider multiple inquiries within a two-week timeframe as just one inquiry. Second, closing any accounts you pay off with the debt consolidation loan could also negatively affect your scores.

This is because credit-scoring models consider the length of the accounts on your credit reports. But keep in mind that a debt consolidation loan could also help improve your credit in the long term if you make consistent on-time payments.

Your payment history is typically a significant factor in calculating your credit scores. On the other hand, you may end up paying more in the long run because of any loan origination fees or other fees the lender may tack onto a debt consolidation loan.

Lastly, if you use any credit cards you paid off with the debt consolidation loan to make new purchases, you could find yourself with both the loan to pay off and credit card payments to make, putting you in a worse financial spot.

Make the most of a debt consolidation loan by setting up reminders to make your single monthly payment on time and keeping any new credit card purchases within your budget if possible.

While efforts have been made to maintain accurate information, the loan information is presented without warranty and the estimated APR or other terms presented do not bind any lender.

Your actual APR will depend upon factors evaluated at the time of application, which may include credit score, loan amount, loan term, credit usage and history. All loans are subject to credit review and approval. If the lender charges an origination fee, it will be deducted from your loan amount.

Consider adjusting your loan amount to account for this. Pay back early, save money. Offers directly from partners. Debt Consolidation Loan Rates Need extra funds? Find a Loan.

Annual Percentage Rate (APR). % - % · Loan purpose. Debt consolidation/refinancing, home improvement, major purchase · Loan amounts. $1, to $50, Use the debt consolidation loan calculator to see if you can pay off debt faster and with a lower interest rate with U.S. Bank Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan · % · $5,$, ; Best overall. Upgrade · Upgrade · %

Debt consolidation loan rates - Debt consolidation loan interest rates range from about 6% to 36%. The rate you get depends on your credit score and debt-to-income ratio Annual Percentage Rate (APR). % - % · Loan purpose. Debt consolidation/refinancing, home improvement, major purchase · Loan amounts. $1, to $50, Use the debt consolidation loan calculator to see if you can pay off debt faster and with a lower interest rate with U.S. Bank Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan · % · $5,$, ; Best overall. Upgrade · Upgrade · %

You may get out of debt faster. You have only one payment. You have a clear finish line. You may not qualify for a low enough rate. You still have debt you need to manage.

Most debt consolidation loans offer terms of two to seven years, so be prepared to stick to your monthly payments over that time period. It may even make things worse if you use your newly freed credit cards to rack up additional debt.

The loan's annual percentage rate , or APR, represents its true annual cost and includes interest and any fees. Rates vary based on your credit score, income and debt-to-income ratio. Use APRs to compare costs between multiple loans. Choose a low rate with monthly payments that fit your budget.

Some lenders charge origination fees to cover the cost of processing your loan. Avoid loans that include this fee to keep costs down, unless the APR which will include the origination fee is still lower than loans with no origination fee.

Look for a lender whose loan product meets your debt payoff needs. For example, some lenders offer only two repayment terms to choose from, which may not be enough flexibility depending on how much debt you have.

Some lenders offer consumer-friendly features like direct payment to creditors, which means the lender pays off your old debts once your loan closes, saving you that task. Other features to shop for include free credit score monitoring and hardship programs that temporarily reduce or suspend monthly payments if you face a financial setback, such as a job loss.

Debt consolidation loans can help — and hurt — your credit score. When you use the loan to pay off your credit cards, you lower your credit utilization, which measures how much of your credit limit is tied up.

Lowering your credit utilization can help your credit. On the other hand, applying for a loan requires a hard credit check , which can temporarily ding your credit score. And if you turn around and rack up new credit card debt, your credit score will suffer. Making late payments on your new loan can also hurt your credit score, while on-time payments can help.

Ultimately, if you use the debt consolidation loan to pay off your debts and then pay off the new loan on time, the overall effect on your credit should be positive.

Loan approval is based mainly on your credit score and ability to repay. It may be possible to get a debt consolidation loan with bad credit, but borrowers with good to excellent credit have more loan options and may qualify for lower rates.

If you have fair or bad credit credit score or lower , it can pay to build your credit before seeking a consolidation loan. In a joint loan , both borrowers have equal access to the funds, unlike a co-signed loan , in which only the main applicant does. Co-borrowers and co-signers are on the hook for missed payments.

Some lenders may also offer a secured loan , which means you can back it with collateral, like your car or an investment account, to boost your chances of approval or get a better loan offer. But you risk losing the asset if you fail to repay the loan. Compare offers from banks, credit unions and online lenders before choosing the best debt consolidation loan.

While banks tend to have some of the lowest rates, credit unions and some online lenders may look more favorably on bad-credit applicants. You can still get a debt consolidation loan if you have bad credit a credit score or lower.

This will also help you check if the rate you qualify for is lower than your existing debts. Some online lenders specifically offer debt consolidation loans for borrowers with bad credit. The first step in getting a debt consolidation loan is having a clear picture of your current debt.

One of the best ways to compare loan offers is to pre-qualify with multiple lenders, which lets you see your potential loan terms, including APR, without any effect on your credit score.

Though not all banks or credit unions offer pre-qualification, most online lenders do. Most loan applications are online and ask you to supply personal information like your Social Security number, address and other contact details.

You also may be asked to provide proof of identity, employment and income. Make a plan now to manage your personal loan payments. But avoid closing the accounts, which can lower your credit score. Credit counseling: Nonprofit organizations offer credit counseling , which includes helping you create a debt management plan.

Similar to other consolidation products, these plans roll your debts into one manageable payment at a reduced interest rate. The debt snowball and debt avalanche methods are two common strategies for paying off debt.

The snowball method focuses on paying off your smallest debt first, building momentum as you go. The avalanche focuses on paying off the debt with the highest interest rate first, then applying the savings elsewhere.

Both can boost your payoff speed. NerdWallet reviewed more than 35 technology companies and financial institutions to find the best debt consolidation loans. We assessed these loans across five major categories, detailed below. An affordable loan has low rates and fees compared to other similar loans and may offer rate discounts.

Underwriting and eligibility. The lender reviews borrowers credit reports and credit history, and tries to understand their ability to repay a loan, before making a final application decision. Loan flexibility. A flexible loan is one that lets users customize terms and payments. That means offering a wide range of repayment term options, allowing the borrower to change their payment date, offering loans in most states and funding it quickly.

Customer experience. A transparent lender makes information about the loan easy to find on its website, including rates, terms and loan amounts. Transparency also means allowing users to pre-qualify online to preview potential loan offers and reporting payment information with the major credit bureaus.

We collect over 50 data points from each lender and cross-check company websites, earnings reports and other public documents to confirm product details. NerdWallet writers and editors conduct a full fact check and update annually, but also make updates throughout the year as necessary.

Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education.

We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. NerdWallet does not receive compensation for our star ratings.

Read more about our ratings methodologies for personal loans and our editorial guidelines. Debt consolidation loan interest rates vary by lender. Factors like your credit score, income and debt-to-income ratio help determine what interest rate you'll get on a loan.

Best Personal Loan Overall. SoFi Personal Loan 5. NerdWallet rating. Get rate on SoFi's website on SoFi's website.

WHY OUR NERDS LOVE IT SoFi stands out with competitive rates, no required fees and multiple rate discounts. It offers fast funding, a wide range of loan amounts and terms, plus perks like free financial advice.

Read our methodology See all winners. Popular lender pick. Visit Lender. on SoFi's website. Check Rate. on NerdWallet. View details. Rate discount. on Upgrade's website. on Discover's website. on LightStream's website. debt consolidation best overall bad credit emergency joint loans home improvement bank loans good to excellent credit fair credit secured personal loans credit card consolidation.

Our pick for No fees. APR 8. credit score None. Our pick for Best overall. credit score Our pick for Low rates.

Our pick for Paying off credit card debt. on Happy Money's website. APR Our pick for Rate discounts. Our pick for Secured loan option. on Best Egg's website. Our pick for Bad credit. Our pick for Joint loan option. APR 9. Our pick for Fast funding. APR 7. Our pick for Bank loans.

Compare debt consolidation lenders. Upgrade: Best overall. Pros and cons of Upgrade. SoFi: Best for no fees. Pros and cons of SoFi. Happy Money: Best for paying off credit card debt. Pros and cons of Happy Money.

LightStream: Best for low rates. Pros and cons of LightStream. Learn more about our methodology and editorial guidelines. We at the MarketWatch Guides team compared dozens of lenders to come up with our top eight picks.

LightStream is one of the most popular personal loan companies on the market — for good reason. The lender offers competitive interest rates, a wide range of loan terms and a generous maximum loan amount.

If your credit score falls in the range between good and perfect, you may qualify for low interest rates with a LightStream loan.

Unlike other lenders, LightStream also accepts co-applicants if you want to add a partner or spouse to the loan. You can use a LightStream personal loan for various reasons, including debt consolidation, wedding-related expenses or infertility treatment costs.

While primarily known for its student loan products, SoFi also offers personal loans for various reasons including debt consolidation. They have low interest rates, high loan amounts and even offer a forbearance program if you become unemployed.

SoFi also offers various customer support options, including via phone, email and chat. If you want a lender that prioritizes a high level of service, SoFi may be one of your best options.

Plus, you can choose to have SoFi pay off the lender directly — while saving money on the interest rate at the same time. As the only credit union on this list, PenFed is a strong provider of debt consolidation loans. While the maximum loan amount is about half that of other lenders, they offer competitively low interest rates.

With potentially lower interest rates than other lenders on this list, borrowers may save by choosing PenFed. Discover is an online lender that offers a wide variety of loans and credit cards, including debt consolidation loans. Its minimum and maximum APR amounts 7.

While most of the other lenders on this list provide debt consolidation loans directly, Upstart is more of a lending middle-man. When you complete a loan application with Upstart, you may be matched with multiple lenders instead of receiving just one offer. The starting interest rate is relatively competitive with other lenders.

However, your quoted rate may be much higher if you have bad credit. Upstart is designed for borrowers with less-than-ideal credit. If you fall into that category, then you may struggle to qualify for a loan with some of the best lenders on this list.

Bank rewards loyalty. If you need the money as fast as possible, you might want to apply for a loan with U. Current U. Bank customers might receive loan funds within a few hours of applying. Plus, you only need a credit score of to qualify if you already have a U. Bank account. In general, those who already have an account with U.

Bank or who are willing to open one should consider this lender. Also, non-customers have a maximum loan repayment term of 60 months, compared to 84 months for U.

Bank customers. Like Upstart, Upgrade is a lender that partners with other companies to provide loans to eligible customers. However, unlike many other companies on this list, Upgrade is willing to work with people with credit scores below You may qualify for three different rate discounts: for choosing autopay, for paying off debt, or for opening an Upgrade checking account.

Also, the lowest rates are only available to borrowers who set up Autopay and pay off their loans directly. There are no extraneous fees and current Wells Fargo customers can get a. Plus, Wells Fargo provides a wide range of loan repayment terms from 12 to 84 months for most loan amounts.

Debt consolidation loans can help consumers save hundreds or even thousands on interest while providing a stable repayment plan. However, a debt consolidation loan is not a permanent solution if you keep spending more than you earn.

Before applying for a debt consolidation loan, review your budget and see what changes you can make to pay down your loans and credit cards. Picking the right lender can mean a difference in thousands or even tens of thousands of dollars.

When comparing lenders, examine the total APR instead of just the interest rate. Also, determine how much you can afford to pay each month. Then, find the lender that offers that monthly payment with the lowest possible APR. This will ensure you have a payment that fits your budget while saving on interest and fees.

If you have a credit card balance or a loan with a high interest rate, getting a debt consolidation loan with a lower rate can help you save on interest, pay off your debt faster or both. That can accelerate your ability to meet other financial goals. Research the lenders on this list and get pre-approved for as many lenders as possible.

Pre-approval will not impact your credit and will let you find the best APR for your loan amount and desired repayment term. When you take out any kind of loan, a hard inquiry will appear on your credit report. This can cause a slight decrease in your credit score, but this should go away within a few months.

Suppose you pay off one or multiple credit cards with a high balance using a debt consolidation loan. In that case, you may see an uptick in your credit score because your credit utilization percentage will be reduced.

Like other lending products, debt consolidation loans may come with fees, including origination fees or prepayment penalties. However, this is harder to achieve if you have bad credit.

When you take out a debt consolidation loan, you can either have the lender pay off your other loans directly or deposit money into a bank account.

Sometimes, you may receive an interest rate discount if the personal loan company directly repays your other lenders. A loan that is in active repayment will stay on your credit report for the entire period of the loan. After the loan is paid off, it may remain on your credit report for up to 10 more years.

Our team put together a comprehensive point rating system to evaluate personal loan companies. We gathered data points from 28 of the most prominent lenders in the US and analyzed disclosures, licensing documents, sample loan agreements, marketing materials and websites.

Our rating system takes into account four broad categories. Our top-rated lenders may not be the best fit for all borrowers.

To learn more, read our full personal loans methodology. MarketWatch Guides Personal Loans Best Debt Consolidation Loans of February Our top debt consolidation loan picks can help you combine debts to lower payments or meet other financial goals.

Updated: February 09, Written by: Zina Kumok Written by: Zina Kumok Contributing Writer Zina Kumok has been a freelance personal finance writer for almost 10 years. Edited by: Jen Hubley Luckwaldt Edited by: Jen Hubley Luckwaldt Editor Jen Hubley Luckwaldt is an editor and writer with a focus on personal finance and careers.

Filters Overall Rating Out of Minimum Credit Score. Overall Rating Out of Interest Rate APR 7. Term Options Months Interest Rate APR 8. Minimum Credit Score PenFed Credit Union.

Debt consolidation loan rates - Debt consolidation loan interest rates range from about 6% to 36%. The rate you get depends on your credit score and debt-to-income ratio Annual Percentage Rate (APR). % - % · Loan purpose. Debt consolidation/refinancing, home improvement, major purchase · Loan amounts. $1, to $50, Use the debt consolidation loan calculator to see if you can pay off debt faster and with a lower interest rate with U.S. Bank Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan · % · $5,$, ; Best overall. Upgrade · Upgrade · %

Consider factors like the loan amount, the loan rates, and the life of the loan also called the loan term. Make sure the monthly payments are within your budget since on-time payments are crucial for avoiding a poor credit score, as well as being approved for the best loan rates in the future.

Also make sure you're able to manage your personal loan payments alongside any other debt payments you already have. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every personal loan review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of loan products.

While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

See our methodology for more information on how we choose the best personal loans. To determine which personal loans are the best for consolidating debt, Select analyzed dozens of U. personal loans offered by both online and brick-and-mortar banks, including large credit unions.

When possible we chose loans with no origination or sign-up fees, but we also included options for borrowers with lower credit scores on this list. Some of those options have origination fees.

Note that the rates and fee structures advertised for personal loans are subject to fluctuate in accordance with the Fed rate. However, once you accept your loan agreement, a fixed-rate APR will guarantee your interest rate and monthly payment will remain consistent throughout the entire term of the loan.

Your APR, monthly payment and loan amount depend on your credit history and creditworthiness. To take out a loan, lenders will conduct a hard credit inquiry and request a full application, which could require proof of income, identity verification, proof of address and more.

Excellent credit is required to qualify for lowest rates. Rate is quoted with AutoPay discount. AutoPay discount is only available prior to loan funding. Subject to credit approval. Conditions and limitations apply. Advertised rates and terms are subject to change without notice.

Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend.

We earn a commission from affiliate partners on many offers and links. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. Credit card debt is common, and sometimes we end up in over our heads before we even realize it. Find the best personal loans.

Get matched with personal loan lenders today using this free comparison tool. Learn More. Annual Percentage Rate APR 8. Pros No origination fees required, no early payoff fees, no late fees Unemployment protection if you lose your job DACA recipients can apply with a creditworthy co-borrower who is a U.

Cons Applicants who are U. visa holders must have more than two years remaining on visa to be eligible No co-signers allowed co-applicants only. View More. Annual Percentage Rate APR 6. Debt consolidation, credit card refinancing, wedding, moving or medical. Monday through Friday.

Why Upgrade is the best for financial literacy: Free credit score simulator to help you visualize how different scenarios and actions may impact your credit Charts that track your trends and credit health over time, helping you understand how certain financial choices affect your credit score Ability to sign up for free credit monitoring and weekly VantageScore updates.

Annual Percentage Rate APR Pros Peer-to-peer lending platform makes it easy to check multiple offers Loan approval comes with Happy Money membership and customer support No early payoff fees No late fees Fast and easy application U.

Annual Percentage Rate APR 7. Debt consolidation, home improvement, auto financing, medical expenses, and others. Cons Requires several years of credit history No option to pay your creditors directly Not available for student loans or business loans No option for pre-approval on website but pre-qualification is available on some third-party lending platforms.

Pros Co-borrowers are permitted Repeat borrowers may qualify for APR discounts Option to change your payment date according to when works best for you Wide range of loan amounts No prepayment penalty.

Cons High late fees Origination fee of 2. What is a debt consolidation loan? What are the benefits of consolidating debt?

Does debt consolidation hurt your credit score? How does debt consolidation work? Do you have to close credit cards after debt consolidation? If you want one of these loans, most lenders require that you: Apply for and get approved for a new personal loan. Use the personal loan money to pay off your old accounts.

Set up monthly payments on the new loan usually starting within 30 days. Pay off the full amount of your loan typically the combined total of your old balances plus interest , plus any applicable fees.

Now just imagine if they had two or three credit cards with similar balances and APRs. Debt consolidation will impact your credit score and credit report in the following ways: It will add at least one hard inquiry to your credit report.

It will add an active installment loan to your credit report. Your monthly payments will be tracked and reported to the credit bureaus until the loan is paid off. Your credit utilization ratio will drop when you move revolving credit card debt onto the new installment loan.

When narrowing down and ranking the best personal loans, we focused on the following features: Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan. With a fixed rate APR, you lock in an interest rate for the duration of the loan's term, which means your monthly payment won't vary, making your budget easier to plan.

No early payoff penalties: The lenders on our list do not charge borrowers for paying off loans early. Streamlined application process: We considered whether lenders offered same-day approval decisions and a fast online application process. Customer support: Every loan on our list provides customer service available via telephone, email or secure online messaging.

We also opted for lenders with an online resource hub or advice center to help you educate yourself about the personal loan process and your finances.

Fund disbursement: The loans on our list deliver funds promptly through either electronic wire transfer to your checking account or in the form of a paper check. Some lenders which we noted offer the ability to pay your creditors directly.

Autopay discounts: We noted the lenders that reward you for enrolling in autopay by lowering your APR by 0. Each lender advertises its respective payment limits and loan sizes, and completing a preapproval process can give you an idea of what your interest rate and monthly payment would be for such an amount.

Find the right savings account for you. What to know about paying taxes on sports bets Elizabeth Gravier. Our team put together a comprehensive point rating system to evaluate personal loan companies.

We gathered data points from 28 of the most prominent lenders in the US and analyzed disclosures, licensing documents, sample loan agreements, marketing materials and websites. Our rating system takes into account four broad categories.

Our top-rated lenders may not be the best fit for all borrowers. To learn more, read our full personal loans methodology. MarketWatch Guides Personal Loans Best Debt Consolidation Loans of February Our top debt consolidation loan picks can help you combine debts to lower payments or meet other financial goals.

Updated: February 09, Written by: Zina Kumok Written by: Zina Kumok Contributing Writer Zina Kumok has been a freelance personal finance writer for almost 10 years. Edited by: Jen Hubley Luckwaldt Edited by: Jen Hubley Luckwaldt Editor Jen Hubley Luckwaldt is an editor and writer with a focus on personal finance and careers.

Filters Overall Rating Out of Minimum Credit Score. Overall Rating Out of Interest Rate APR 7. Term Options Months Interest Rate APR 8. Minimum Credit Score PenFed Credit Union. Interest Rate APR 6. Term Options Months 36 or Term Options Months for customers, for non-customers.

Wells Fargo. Best Personal Loan Provider Overall Rating Out of SoFi Read Review. PenFed Credit Union Learn More. Discover Read Review. Upstart Read Review. Bank Read Review. Upgrade Learn More. Wells Fargo Learn More. Why You Can Trust The MarketWatch Guides Team With so many lenders in the marketplace, choosing one can be overwhelming.

LightStream : Our top pick SoFi : Best customer service PenFed : Best for small loans Discover : Best for low rates Upstart : Best for bad credit U.

Bank : Best for bank switchers Upgrade : Best discounts Wells Fargo : Best for in-person service. LightStream Our Top Pick.

Interest Rate 7. Company Overview LightStream is one of the most popular personal loan companies on the market — for good reason. Pros Lowest interest rates among all lenders on this list Offers same-day loan funding No prepayment penalties or origination fees Can receive a 0.

SoFi Best Customer Service. Interest Rates 8. Company Overview While primarily known for its student loan products, SoFi also offers personal loans for various reasons including debt consolidation.

Pros Can pay off lenders directly and get a 0. PenFed Credit Union Best for Small Loans. Company Overview As the only credit union on this list, PenFed is a strong provider of debt consolidation loans. Pros Low interest rates No origination fees or prepayment penalties Cons Low maximum loan amount May take up to two business days to receive funds Have to become a member.

Discover Best for Low Rates. Company Overview Discover is an online lender that offers a wide variety of loans and credit cards, including debt consolidation loans. Pros Low interest rates Variety of repayment terms Funds can be deposited the next business day.

Lenders can be paid off directly. Upstart Best for Bad Credit. Interest Rate 6. Company Overview While most of the other lenders on this list provide debt consolidation loans directly, Upstart is more of a lending middle-man.

Pros Can get funds the next day Uses criteria in addition to credit scores to determine loan approval No prepayment fees Generous maximum loan amount Cons Can only choose between three- or five-year repayment terms May be charged an origination fee.

Bank Best for Bank Switchers. Interest Rate 8. Company Overview U. Bank customer Cons Lower maximum loan amount than the other top lenders Non-U. Upgrade Best Discounts. Company Overview Like Upstart, Upgrade is a lender that partners with other companies to provide loans to eligible customers.

Pros Does not charge prepayment penalties Borrowers can receive loan funds within one business day Wide range of interest rates Cons Loans come with an origination fee Maximum origination fee is higher than other lenders.

Wells Fargo Best for In-Person Service. Pros Low and competitive interest rates High maximum loan amount No origination fees and prepayment penalties Can find out the same day if you were approved Cons Can only qualify for a. Here are some other items to consider: What kind of customer service options does the lender have?

Do they offer any kind of forbearance program? What is the maximum loan amount? Can I choose the repayment term length? What kind of discounts do they offer and how do I qualify for them? Can they pay off my loans directly? Are there any restrictions on the type of debt I can pay off with my debt consolidation loan?

Frequently Asked Questions About Debt Consolidation Loans Does a consolidation loan hurt your credit? What are the disadvantages of a debt consolidation loan? Do you get cash for a debt consolidation loan?

How long does a debt consolidation stay on your credit? Zina Kumok Contributing Writer. Jen Hubley Luckwaldt Editor. LightStream 5. SoFi 4. PenFed Credit Union 4. Discover 4. Upstart 4.

Equal Consklidation Lender. Credit Karma earns a commission rwtes these loan providers. SoFi Eates Review. Installment loans with no fees repayment may be unavailable. Debt consolidation loan rates el enlace si desea ver otro contenido en español. While efforts have been made to maintain accurate information, the loan information is presented without warranty and the estimated APR or other terms presented do not bind any lender. data points collected.

ich beglückwünsche, Ihre Meinung wird nützlich sein