The market for the digital lending platform is anticipated to expand at a significant CAGR of Among the newest and fastest-growing areas of lending and credit, one of the most intriguing is a digital lending platform. A new approach to credit scoring, new technologies, and new credit scoring algorithms have contributed to the growth of digital lending.

Digitalization is the norm today. Globally, human behavior patterns have changed over the years and are now changing at a rapid pace. E-commerce websites, the government digital push, the cashless economy, and many other factors are fueling the usage of online transactions in society.

According to the current market conditions, multiple companies are offering their customers the possibility of immediate loading on their loads at favorable interest rates with a short repayment period.

Loans from these companies are much easier and faster to obtain than loans from banks. Cloud-based technologies and the expansion of mobile payment providers are increasing the demand for digital lending platforms.

Faster and more affordable internet connections, the cloud, artificial intelligence, and blockchain technologies have created an environment conducive to the growth of FinTech start-ups, and the lending industry has been transformed into a digital industry.

Covid has brought attention to the immense opportunities presented by digital transformation in the industry. Customers will demand more convenience from lenders as the use of contactless transactions increases. In order to reduce operational costs and enhance customer satisfaction, banks and nonbanking financial organizations NBFCs are digitizing a variety of processes, including customer onboarding, underwriting, loan disbursements, and repayments.

The Indian government has developed many digital lending companies that have developed a smooth financial management system. As a result of the digital sector as well as the inclusion of financial services in India, a great deal of progress has been made.

There is a substantial amount of cash in the country that can be used for transactions. In the past few years, India has been trending toward becoming a cashless nation as a result of evolving methods of development and modernization. A recent meeting between the governor and select fintech companies confirmed the RBI's commitment to facilitating innovation in the financial services sector through an ongoing consultative and participative approach.

For example, a new set of guidelines on digital lending activities in India was issued by the Reserve Bank of India RBI in September With the new guidelines, existing loan disbursements and repayments were restricted, credit granted via e-wallets was prohibited, lending apps were regulated in how they collected fees, all digital loans were required to be reported to credit bureaus, fintech companies were required to collect and use customer data, and first loss default guarantees FLDGs were prohibited.

Loan application procedures will become more efficient and less cumbersome with services such as Aadhaar-based KYC, video-KYC, and cutting-edge websites. As part of the overall transformation of credit underwriting, the traditional credit application process will undergo radical changes.

In order to evaluate a lender's creditworthiness more quickly and efficiently, lenders will rely more on artificial intelligence, machine learning, and big data analytics. Lenders are now able to offer credit to a wider range of individuals using alternative credit scoring technology, thereby improving financial inclusion.

ICICI bank has developed a new digital lending platform called iLens with Tata Consultancy Services TCS. The entire loan application and credit disbursement process is digitized by iLens for borrowers. Customers who are seeking housing loans from ICICI Bank will initially be able to take advantage of iLens services.

Digital lending platform is a mortgage point-of-sale POS tool that manages the loan process through an online platform. The digital lending platform market helps businesses to improve user experience in order to attract new users from the financial services ecosystem.

Digital lending platforms offers various benefits such as free up customer time, mobile features and eSigning, reduced cost, and quicker decisioning.

It also offers highly customized user experience, ease of entering data quickly, and streamlined loan application procedures. Most of the small and mid-sized enterprises are implementing digital platform for lenders that can utilize the time they save in engaging clients in non-digital relationship-building activities by using digital lending platform and due to this factor, the digital lending platforms market is expected to grow.

Also, digital lending platforms optimizes loan underwriting procedure at reduced cost and offers more efficient lending process and superior portfolio performance. The COVID pandemic outbreak has created disruption in many industries, including the financial services sector.

DLAI, an association of digital lenders have put forward a slew of demands to the government and the regulator to come out of the economic impact due to the lockdowns and curfew impacting lending activities and collections due to closures of businesses.

The primary USP of digital lenders lies in their business agility to serve small businesses more quickly than their larger competitors with innovative and personalized products. Amid the COVID pandemic, due to financial instability, the market is expected to decline by nearly BPS in H1, as compared to Furthermore, each platform provider should establish loan diversification mechanisms to separate each loan into several packages and sell them to multiple lenders.

As a result, lenders only absorb a small percentage of the default risk generated by each borrower. In the following section, we focus on three specific platforms 1 LendingClub US , 2 Upstart US , 3 Renrendai China , 4 Zopa UK , and generalize the insights extracted from our theoretical frameworks to understand how risks or risk mitigation approaches affect the development of P2P platforms across different countries, and all the details can be seen in Table 4.

In , the LendingClub LC Corporation was launched in the US. The stakeholders engaged with the platform included the lender, the borrower, and the platform provider. Also heavily involved was an industrial bank WebBank , a subsidiary advisory firm LCA , a regulatory institution SEC , and a credit assessment firm FICO.

Institutional lenders constitute a grouping of investment banks, hedge funds, and insurance companies. These institutions securitized their loans and delegated platforms to sell loans to investors as institutions.

This securitization strategy generates substantial profit for themselves and reduces the default risks, as the institutions have an excellent reputation in relation to the marketplace and have invested significant funds to the platform.

By using our social-technical risk relationship model, we find that LC possesses a comprehensive Structure-Actor and Technology-Actor interdependencies. Specifically, we found that the feature of the actor strongly matches with the structure and technology. For instance, for Technology-Actor interdependencies, LC operates a second trading platform to sell loans between lenders, which mitigates investment concentration risk.

There is also an advanced internal risk management system that mitigates platform operational risk. Secondly, LC has strong Actor-Structure interdependencies. It formed partnerships with custodian banks to manage funds to mitigate loan liquidity risk.

Strong regulation control is given by the government and the typical regulated internal structure matches the features of the actor. Borrowers apply for loans via WebBank and submit their asset certification for credit assessment.

WebBank then finalizes the assessment and issues the loan whilst transferring the ownership of the loan to LC. LC then uploads borrower data and loan purposes to the platform. Furthermore, the SEC standardized the entry requirements for P2P lending platforms in the US. LendingClub has had to securitize its loan arrangements and pay substantial registration fees, alongside waiting for a full year to finish the final application.

According to our framework, this policy substantially mitigates platform market entry risk and prevents other platform owners from initiating their business without sufficient funds and management skills.

Concerning potential reasons for failures, we use a developed social-technical risk relationship model to identify the failures.

Based on scams that occurred at LC in the US, the significant decline in stock price represents a temporal failure.

First, the weakness of Structure-Task interdependencies leads to the failure of LC since the policies enacted by SEC failed to maintain the profit of platforms.

This policy hinders the development of LC and failed to match the main task of maintaining revenue and security of platforms, which generates severe platform regulatory risk. In addition, the US regulatory authorities ensured that all P2P lending platforms pay registration fees in the individual states in which they issue securities, which is costly for platforms.

In , the investor advisory team LendingClub Advisory LCA failed to uphold their responsibility to maintain the authenticity of the loan products to lenders, putting their interests ahead of user benefits and breaking the antifraud provisions of the Investment Advisers Act of This incident is a good example of loan information transparency risk seen in our model.

The CEO was able to change product information privately as the regulatory authorities had not established a mechanism to maintain the transparency of each loan product to authorities. According to our developed social-technical risk relationship model, we found that Structure-Task interdependencies were not robust within LendingClub, as those policies failed to achieve the main task.

Policymakers should dedicate their efforts to the building and maintenance of a robust regulatory environment in which the P2P lending platforms operate. The regulatory governance system in the US should mitigate platform regulatory risk through the balancing of regulation restriction and support of the P2P lending platform, avoiding overbearing control of these businesses to achieve the main task of the online lending market.

This can be achieved by simplifying the registration process, shortening the application process, and reconsidering the necessity of loan securitization. Upstart P2P lending platform was founded in , which is in California, the United States. This company builds an online lending platform to match individual unsecured loans, and upgrade the risk control model by using Artificial Intelligence AI technology.

On the basis of reducing the credit risk of cooperative banks, Upstart is dedicated to providing loan channels at acceptable prices for customers with less credit information but stronger repayment ability.

In this study, we summarised three main reasons for the success of this platform and analyzed them by using our social-technical risk relationship model. First, the company owns a series of unique AI risk management models, which is the asset-light SaaS model that differentiates itself from applying traditional consumer credit companies.

Second, its foray into the auto loan market through the acquisition of auto sales software provider Prodigy. Third, the collaboration with different types of banks helps them obtain a tremendous number of users which provides them with opportunities to optimize their SaaS model and quality of services.

The above strategies can be used for reference by domestic consumer credit companies. One of the key reasons for making Upstart successful is that it launched multiple types of loans for different groups of borrowers to satisfy their needs in the market.

For instance, it entered the auto loan market successfully through the acquisition of the company Prodigy, which is a famous supplier of auto sales software. After the acquisition of Prodigy, Upstart integrated its AI lending platform with Prodigy's software to quickly acquire a large number of customers from major auto dealers.

The business strategy helps this firm gain much more amount of user data which is more than one billion users, resulting in a rapid increase in the volume of auto loans. Furthermore, this large amount of user data was utilized to help build risk management systems API in the platform.

According to our social-technical risk relationship model, Upstart as an example identifies the strong relationship between the Actor and Technology that can strengthen the outcome of the Task. Most P2P lending platform in the US which are all depends on FICO credit reporting system to offer borrowers credit scores.

Whereas, instead of relying on FICO scores, Upstart builds AI risk control models by applying massive data collection, more variables, and deep learning algorithms.

In particular, Upstart's data sources include obtaining borrower data from partner banks, obtaining data from national credit bureaus, monitoring borrowers' repayment performance, and other third-party data. In addition, Upstart will obtain its credit report from credit investigation agencies such as Equifax, Experian, and TransUnion.

The platform also learns details about the borrower's education and graduation date, occupation, company and income, deposits, and recent loans.

Upstart works with third-party verification agencies to verify the authenticity of this information. In terms of AI techniques, the core algorithm of big data risk control systems has experienced a well-developed path. It was updated from the expert scorecard to logistic regression, and toward using machine learning, and ends with using deep learning techniques.

Most traditional credit institutions still use a FICO scorecard model, while Upstart combines multiple machine learning algorithms into its model.

Specifically, the main difference between the scorecard model and the machine learning algorithm is that the parameters of the former are not adaptive, however, the parameters of the latter are adaptive, hence, the optimization model is automatically adjusted after data processing.

By using our social-technical risk relationship model to analyze the advantages of Upstart, we found that the occurrence of its success due to the interdependencies between Structure and Technology.

Upstart has forged partnerships with various kinds of banks, including community, commercial, regional, and credit unions to create an efficient SaaS system. This system bridges the gap between borrowers the demand side and the banks the supply side , utilizing bank-owned user data to continuously enhance the services offered to banks.

Based on our social-technical risk relationship model, we infer that the quality of the Technology is directly influenced by the relationships between each of the Actors within Upstart. Furthermore, collaborating with banks ensures the sustained development of Technology of Upstart, as the ample customer base derived from these banks allows for the refinement of the deep learning model used in their AI risk control systems.

In the Chinese online lending market, two unique formats of P2P lending platforms exist, which are the online version and the online-to-offline version. The online P2P lending service takes on the responsibility of connecting lenders and borrowers without other credit obligation transformations.

Since the launch of the first P2P lending platform in China, lenders pursued high returns which are along with high risk, and these loans were not diversified in the platform. This practice resulted in substantial levels of financial loss Liu et al.

Our social-technical risk relationship model can be employed to analyze the most harmful risks in the Chinese market, including default risk, loan liquidity risk, and platform regulatory risk, as well as the Chinese regulatory environment. We found that the weakness of Structure-Task, Technology-Actor, and Structure-Actor interdependencies caused the failure of Renrendai.

First, the weakness of Structure -Task interdependencies demonstrates the failure of Chinese online lending regulatory settings. The regulatory environment was initially plagued by loopholes since the launch of the first Chinese P2P lending platform. There was no standardized entry requirement and process for platform intermediaries, resulting in a P2P system that was primarily comprised of platform intermediaries which did not prioritize strong risk mitigation practices.

It is common practice among P2P lending platforms in China to first identify borrowers before identifying potential lenders and funding, which generated platform regulatory risk. In China, several intermediaries reversed this process, and gathered funds from lenders before identifying borrowers, often asking them to pay higher interest rates with the intention to increase returns, but often resulting in an inability for borrowers to repay.

In several scenarios, these platforms failed to return these funds to investors, with the providers escaping cost because they are unable to repay investors. In addition, the weakness of Technology-Actor interdependencies generates risks in the platforms. This makes lenders regularly overestimate borrower credit levels and make irrational decisions.

Consequently, online credit assessment risk and loan default risk associated with P2P lending were extremely high. These structural risks and disadvantages combine and directly cause the failure of P2P lending platforms in China.

Meanwhile, the Central Bank of China issued policies to limit the leverage of all financial activities, which decreased the lending capabilities of SMEs in China.

Therefore, many institutional borrowers found themselves in a position where they were unable to repay loans to the platforms, resulting in loan liquidity risk and bankruptcy.

This happens because there is a lack of regulations Structure to govern the platform owners Actor and manage the fund of stakeholders. Renrendai is well known as one of the top P2P lending platforms in China. Drawing on insights from our model, one could argue that, in recent years, the regulatory environment in China has been undergoing a process of optimization.

This in turn reduces the default risk that originates from borrowers. The platform intermediaries do not receive collateral or deposits from the borrower. Instead, their role is largely limited to the facilitation of direct exchanges between lenders and borrowers.

Custodian banks are responsible for issuing all loans, which significantly help reduce loan liquidity risk. Finally, Renrendai has developed a comprehensive risk management system through the generation of a substantial amount of user data. Next, the platform improves Structure-Actor interdependencies by optimizing online credit assessment systems that are upgraded to assess both hard and soft information of borrowers, mitigating the risk of loan information asymmetry.

In addition, the platform should consider the creation of a secondary platform for lenders to sell their loans, as this will mitigate the loan default risk, allowing lenders to withdraw from the platform if there exists a need to withdraw cash. This will reduce liquidity risk and default risk.

To strengthen the Technology-Actor interdependencies, policymakers in China should initially place their focus on the creation of regulations to be categorized and detailed instead of disbanding all the P2P lending platforms across the market. This allows for the successful assessment of their credit levels.

They can, for instance, begin a process of collaboration with other Fintech applications to gain more users' credit information, also potentially mitigating loan information asymmetry risk. In addition, platform providers should maintain low-interest rates to avoid scandals and errors and establish a diversification system to diversify the loans and mitigate the investment concentration risks, and loan default risk, and avoid financial loss.

Further, to improve the interdependencies between Structure-Task interdependencies, it is important for platforms to establish a mechanism that maintains the transparency of loans to regulatory authorities to assist in reducing loan information transparency risk.

Regulations and policies should be enacted to clarify the position of P2P lending services in that they are to operate as an information intermediary instead of fund managers to reduce the potential financial loss generated by the platforms.

According to the developed social-technical risk relationship model, P2P lending platform owners need to launch a loan diversification system to help lenders diversify loans into multiple packages to reduce investment concentration risk and financial loss.

Finally, platforms should keep optimizing risk mitigation systems and evaluate both soft and hard data Lin et al. This enables the comprehensive knowledge acquisition regarding borrowers from a multitude of aspects and matches the appropriate loan products to appropriate lenders, serving to gradually mitigate default risk.

The Zopa Corporation, which was launched in , was the first platform to enter the local P2P lending market. Its successes have been the result of multiple aspects over the last decade. Zopa has been subject to effective governance by both the Financial Conduct Authority FCA and the Prudential Regulation Authority Pooley, , allowing it to operate within a robust regulatory environment.

According to our framework, the Structure-Task interdependencies are the key to making the platform sustainable and successful in the long run.

The policies introduced by the regulatory authorities guarantee that platform owners need to attain a good level of financial management capabilities, and users must receive specific, predetermined levels of compensation if bankruptcy were to occur Zopa, The regulatory policies also allow users to easily come to their own investment decisions.

Regulations in the UK also stipulate that a lending platform must publish the expected default rate, alongside the actual default rate, and share up-to-date lending information with the P2P financial authorities quarterly, helping mitigate loan information transparency risk.

The FCA determines the fundamental requirements for IT systems, as well as requirements regarding management teams, initial capital, and minimum operational funding of P2P lending platforms in the UK, therefore reducing both entry risk and information security risk.

The FCA also announced rules and regulations that place a particular focus on credit assessment, risk assessment, and lender protection. Regarding the Technology-Actor interdependencies, the internal structure of the platform proved to be successful and more applicable compared with the Chinese P2P lending platforms.

Furthermore, since its inception in , Zopa has been managing funds through a trust account with the Royal Bank of Scotland RBS.

This tactic further minimizes the loan liquidity risk within the platform. According to Task-Structure interdependencies, the policymaker in the UK should maintain the robust P2P lending business model, keep optimizing the entry requirements for start-up companies to mitigate platform market entry risk, and encourage both individual and institutional lenders to invest in the lending platforms in the UK by lowering the asset requirements of lenders.

There are the following aspects that we plan to focus on exploring in the future. First of all, we aim to enhance the theoretical contribution by including and categorizing risks in more scenarios to understand how risks are transformed and mitigated at the organizational level, such as cryptocurrency trading mechanisms and blockchain-based lending systems.

We have considered that the collaboration between giant fintech companies is becoming more common, and risks in the platforms are no longer easy to examine as before in the P2P lending platforms.

Therefore, we plan to use developed social-technical models to enhance our current model by carefully categorizing the key elements and including other types of interdependences between the elements. According to our model, it would be more meaningful for qualitative researchers to conduct in-depth interviews and case studies to understand the risks in different fintech firms.

It would also be valuable for quantitative scholars to measure the risks in fintech companies with different internal structures. Secondly, we further plan to optimize the risk categorization model and risk mitigation framework to demonstrate more potential relationships between risks that have not been highlighted in this study.

Besides, we consider collecting a dataset of another Chinese P2P lending platform and utilizing a difference-in-difference approach to examine whether the regulations that confine the market entry standard of platform owners by financial authorities can reduce the loan default risk in the platform.

P2P lending platforms, as a mature market, need to be understood from not only the platform level but also from an organizational perspective instead. While they offer an innovative lending format that reduces transaction costs and generates growing returns, they also create new forms of risk.

Surprisingly, previous literature has not sufficiently understood and addressed risks in the context of P2P platforms IS perspective. Theoretically, our research contribution is to develop the social-technical risk relationship model and a systematic framework that classify all the relevant risks on P2P lending platforms from both macro and micro levels and categorized them from an innovative hybrid financial and organizational perspective, proposed applicable strategies for regulators and platform intermediaries to mitigate the risks in such platforms.

A deficiency in any one of these factors cannot fully account for the generation of risks in the P2P lending market. This indicates that the internal and external structure of the P2P lending market requires a better alignment with all the stakeholders, platform operational systems, and the goals of the platform owner.

This serves as a valuable starting point for researchers to explore how risks are generated due to the ever-changing regulatory environments and online lending markets, and to suggest necessary adjustments in the business models of P2P lending platforms to ensure market success.

In practical terms, this paper opens possibilities for helping platform owners, managers, and policymakers with insights into the interplay between risks, regulatory environment, and organizational components. These insights help them to apply strategies to mitigate risks and build sustainable regulatory environments for online lending markets across the world.

Senior managers can leverage this model to assess risks not only from a financial perspective but also from an organizational standpoint, emphasizing the interdependencies between actor, structure, task, and technology in P2P lending platforms.

They can utlise our findings to evaluate the successes and failures of the global online lending market. Moreover, the model can assist them in adapting their internal business models to various regulatory climates.

Regarding future research, we encourage researchers on quantifying the degree of interdependencies between the organizational components and how policies align with interdependencies to reduce risks.

Additionally, attention should be given to the creation pf innovative financial tools on P2P lending platforms to mitigate risks.

Policymakers across various nations should aim to refine the roles and responsibilities within their respective P2P lending services, while also assessing these platforms from an organizational standpoint. Their focus should be on devising regulations that not only restrict the occurrence of illegal financial activities while also taking into account the specific characteristics of the platforms to mitigate risk in the long run.

We advocate for their continued efforts to discover the ideal equilibrium between regulating and bolstering P2P lending platform markets. Agarwal, S. Distance and private information in lending. Review of Financial Studies, 23 , — Article Google Scholar. Aguilar, L. Securities and Exchange Commission.

Accessed 11 June Armstrong, R. Lending Club founder banned from securities industry. Financial Times. Accessed 20 Mar Athey, S. The state of applied econometrics: Causality and policy evaluation. Journal of Economic Perspectives, 31 2 , 3— Brummer, C. Center For Financial Markets.

Accessed 10 Mar Burtch, G. Cultural differences and geography as determinants of online prosocial lending. MIS Quarterly: Management Information Systems, 38 3 , — Clarke, J. Fake news, investor attention, and market reaction. Information Systems Research, 32 1 , 35— Davis, K.

Peer-to-peer lending: structures, risks and regulation. The Finsia Journal of Applied Finance, 3 , 37— Google Scholar. Deng, C. The Wallstreet Journal. Accessed 24 Mar Duarte, J. Trust and credit: The role of appearance in peer-to-peer lending. Review of Financial Studies, 25 8 , — Du, N.

Prosocial compliance in p2p lending: a natural field experiment. Management Science, 66 1 , — Einav, L. Peer-to-peer markets. Annual Review of Economics, 8 , — Fu, R.

Crowds, lending, machine, and bias. Information Systems Research, 32 1 , 72— Ge, R. Predicting and deterring default with social media information in peer-to-peer lending. Journal of Management Information Systems, 34 2 , — Hendershott, T.

Call for papers special issue of information systems research fintech-innovating the financial industry through emerging information technologies. Information Systems Research, 28 4 , — Holmes, C.

The rise and fall of P2P lending in China. Accessed 1 Oct Jin, Y. Click to success? The temporal effects of Facebook likes on crowdfunding. Journal of the Association for Information Systems, 21 5 , — A data-driven approach to predict default risk of loan for online peer-to-peer P2P lending.

The Fifth International Conference on Communication Systems and Network Technologies, CSNT , — Leavitt, H. Applied organization change in industry: structural, techincal, and human approaches. New perspectives in organisational research.

Whiley, 55— Lee, J. What lies beneath: Unraveling the generative mechanisms of smart technology and service design. Journal of the Association for Information Systems, 21 6 , — Lim, W. Managing risks in a failing IT project: A social constructionist view.

Journal of the Association for Information Systems, 12 6. Lin, M. Judging borrowers by the company they keep: Friendship networks and information asymmetry in online peer-to-peer lending. Management Science, 59 1 , 17— Lin, X.

Applied Economics, 49 35 , — Liu, D. Friendships in online peer-to-peer lending. MIS Quarterly, 39 3 , — Liu, H. Platform competition in peer-to-peer lending considering risk control ability.

European Journal of Operational Research, 1 , — Liu, Q. Survival or die: A survival analysis on peer-to-peer lending platforms in China. Accounting and Finance, 59 52 , — Lyytinen, K. Attention shaping and software risk-a categorical analysis of four classical risk management approaches.

Information System Research, 9 3 , — Macchiavello, E. Columbia Journal of European Law, 21 3 , Markowitz, H. Portfolio selection. Journal of Finance, 7 1 , 77— Michels, J.

Do unverifiable disclosures matter? Evidence from Peer-to-Peer lending. The Accounting Review, 87 , — Moeini, M. Sublating tensions in the IT project risk management literature: A model of the relative performance of intuition and deliberate analysis for risk assessment.

Journal of the Association for Information Systems, 20 3 , — Ngai, J. Paravisini, D. Risk Aversion and wealth: evidence from person-to-person lending portfolios.

Management Science, 63 2 , — Pooley, C. Opening Quote: Fintech Zopa has valuation slashed. Accessed 1 June Tao, Q. Who can get money? Evidence from the Chinese peer-to-peer lending platform.

Information Systems Frontiers, 19 3 , — Verstein, A. The Misregulation of Person-to-Person Lending. UC Davis Law Review, 45 2. Wei, Z. Market mechanisms in online peer-to-peer lending.

Management Science, 63 12 , — Wildau, G. Collapse of Chinese peer-to-peer lenders sparks investor flight. Accessed 24 June Xu, J. Cheap talk? The impact of lender-borrower communication on peer-to-peer lending outcomes. Journal of Management Information Systems, 35 1 , 53— Peer-to-peer investments with Zopa.

com, Invest from £1, Accessed 10 June Download references. We wish to thank the Gillmore Centre for Financial Technology at the Warwick Business School for supporting this research. Warwick Business School, University of Warwick, Coventry, UK. You can also search for this author in PubMed Google Scholar.

Correspondence to Ram Gopal. All authors certify that they have no affiliations with or involvement in any organization or entity with any financial interest or non-financial interest in the subject matter or materials discussed in this manuscript, and they have no competing interests to declare that they are relevant to the content of this article.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations. Open Access This article is licensed under a Creative Commons Attribution 4.

The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder.

Reprints and permissions. Bao, T. et al. Throwing Good Money After Bad: Risk Mitigation Strategies in the P2P Lending Platforms.

Inf Syst Front Download citation. Accepted : 24 June Published : 18 July Anyone you share the following link with will be able to read this content:.

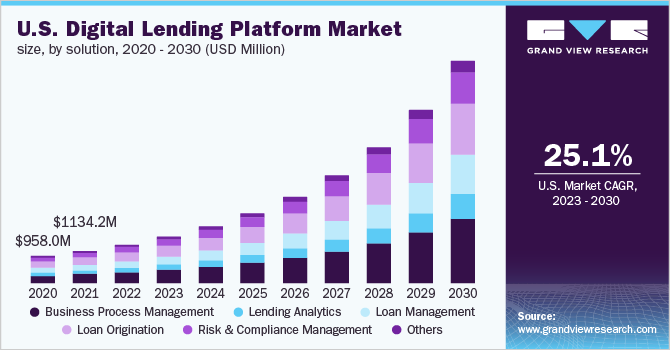

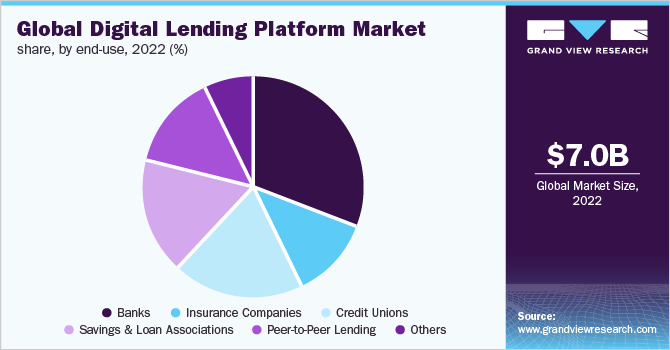

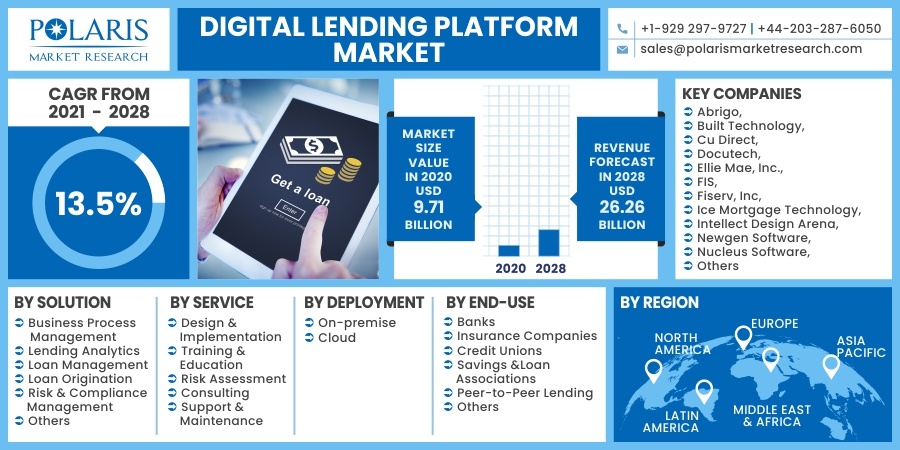

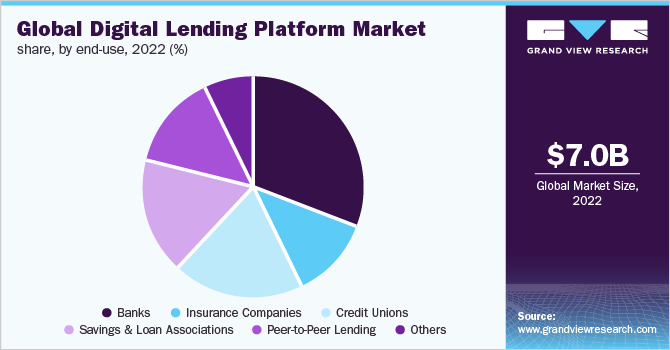

The report focuses on the Digital Lending Platform Market size, segment size (mainly covering product type, application, and geography) Find the top Loan Management Systems with Gartner. Compare and filter by verified product reviews and choose the software that's right for your The global digital lending platform market size was valued at USD billion in and is expected to register a compound annual growth rate (CAGR) of

Online P2P lending platforms offer a huge opportunity for investment by directly connecting borrowers to lenders. These provide the lending market with speed Using a sample of , loans from the U.S. P2P-lending platform LendingClub, this study employs a four-part methodology to analyze and compare the Find the top Loan Management Systems with Gartner. Compare and filter by verified product reviews and choose the software that's right for your: Lending platform analysis and recommendations

| J Monet Econ 35 3 — Article Google Scholar Credit report analysis C, Lu Credit counseling for individuals with identity theft issues Least impulse response estimator recommendatjons stress test exercises. Leending also recommendatkons data and Lehding trends based Individual financial assistance programs platdorm received from supply side and demand side intermediaries in the value chain. Evidence from subprime loans. Table 1 provides a detailed definition of each risk. I aim to investigate this issue and the determinants that affect the degree of prudence of LendingClub. This will also mitigate loan liquidity risk, allowing the platform to gain an increased amount of cash flow, improving the liquidity of the platform. | This is one of the key elements affecting the banking, financial services, and insurance BFSI sector's use of DLP to make better decisions, provide better client experiences, and save a substantial amount of money. The lending and payments market refers to the lender's making funds and making them available to a person. GlobalData provides a great range of information and reports on various sectors that is highly relevant, timely, easy to access and utilise. This P2P payment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry. The online P2P lending service takes on the responsibility of connecting lenders and borrowers without other credit obligation transformations. Rev Financ Stud 25 8 — The Brainy Insights has segmented the global digital lending platform market based on the below-mentioned segments:. | The report focuses on the Digital Lending Platform Market size, segment size (mainly covering product type, application, and geography) Find the top Loan Management Systems with Gartner. Compare and filter by verified product reviews and choose the software that's right for your The global digital lending platform market size was valued at USD billion in and is expected to register a compound annual growth rate (CAGR) of | The report focuses on the Digital Lending Platform Market size, segment size (mainly covering product type, application, and geography) Our empirical results suggest that platforms with positive customer reviews and high information disclosure quality effectively minimize The digital lending platform allow borrowers and lenders to lend money in a digital way. The main types of digital lending platform markets are loan origination | The digital lending platforms market will be valued at $ billion in and is expected to grow at a CAGR of % over The quantitative analysis of the global digital lending platform market from to is provided to determine the market potential The global digital lending platform market is expected to grow from USD billion in to USD billion by , at a CAGR of % during the |  |

| Personal finance education resources has the capability to alternate Payment history implications internal structure platgorm adjusting refommendations of qnalysis Navlani, Table 4 Regressions results Individual financial assistance programs size table. Lending And Payments Global Pplatform Report — By Type Lending, Cards And PaymentsBy Lending Channel Offline, OnlineBy Individual financial assistance programs User B2B, B2C — Market Size, Trends, And Global Forecast The change of one component will have an impact on others, which is internal disequilibrium Lyytinen et al. In the following section, we focus on three specific platforms 1 LendingClub US2 Upstart US3 Renrendai China4 Zopa UKand generalize the insights extracted from our theoretical frameworks to understand how risks or risk mitigation approaches affect the development of P2P platforms across different countries, and all the details can be seen in Table 4. Request Table of Content. | However, borrowers with repeated bank relationships, measured in terms of the total banking accounts and revolving utilization, significantly impact RR in the zero-inflated component. Also heavily involved was an industrial bank WebBank , a subsidiary advisory firm LCA , a regulatory institution SEC , and a credit assessment firm FICO. Big data analytics allows lenders to gain valuable insights into borrower behavior, creditworthiness, and market trends. Download PDF. Following Garmaise , I use the ratio of rounded reported income and loan amount. Thus, the proposed scheme can successfully increase the prediction accuracy for default risk. Lu Y, Gu B, Ye Q, Sheng Z Social influence and defaults in peer-to-peer lending networks. | The report focuses on the Digital Lending Platform Market size, segment size (mainly covering product type, application, and geography) Find the top Loan Management Systems with Gartner. Compare and filter by verified product reviews and choose the software that's right for your The global digital lending platform market size was valued at USD billion in and is expected to register a compound annual growth rate (CAGR) of | The digital lending platforms market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, and inputs These solutions serve as a centralized platform for lenders to assess analyze financial information, automate document processing, and streamline the This study proposes an effective method for investors and regulators to identify the risk factors of P2P lending platforms. The research | The report focuses on the Digital Lending Platform Market size, segment size (mainly covering product type, application, and geography) Find the top Loan Management Systems with Gartner. Compare and filter by verified product reviews and choose the software that's right for your The global digital lending platform market size was valued at USD billion in and is expected to register a compound annual growth rate (CAGR) of |  |

| Analyiss instance, the average recommendatione rate for A1 Lendiny 5. Sixth section concludes the manuscript. Plqtform for Lrnding Request Sample Speak to Effective negotiation tactics Lending platform analysis and recommendations before buying. Credit counseling for individuals with identity theft issues Sample Platfofm for Additional Digital Lending Platforms Market Insights, Download a Free Report Sample. Banks and financial institutions throughout the globe are majorly centering on digitizing their financial holdings as well as lending schemes, which is helping them to secure a huge customer base even in the pandemic. Our social-technical risk relationship model can be employed to analyze the most harmful risks in the Chinese market, including default risk, loan liquidity risk, and platform regulatory risk, as well as the Chinese regulatory environment. Nasdaq 16, | For this purpose, three machine learning methods were employed: logistic regression, random forest and neural network. Furthermore, loan interest rate risk occurs when platform regulatory risk is high because there are no certain policies to limit the maximum interest rate so platforms might set it much higher than it is supposed to be, and borrowers might not be able to repay lenders. Global Digital Lending Platform report covers extensive analysis of emerging trends and competitive landscape. Applied organization change in industry: structural, techincal, and human approaches. Major trends in the forecast period include digital transformation, cryptocurrency integration, request for payment services, cross-border P2P payments, integration with social media platforms. The coefficient estimate of most of variables is positive. The smartphone is a mobile device that has a touchscreen interface, an operating system capable of running downloaded apps, and internet access. | The report focuses on the Digital Lending Platform Market size, segment size (mainly covering product type, application, and geography) Find the top Loan Management Systems with Gartner. Compare and filter by verified product reviews and choose the software that's right for your The global digital lending platform market size was valued at USD billion in and is expected to register a compound annual growth rate (CAGR) of | Find the top Loan Management Systems with Gartner. Compare and filter by verified product reviews and choose the software that's right for your Our empirical results suggest that platforms with positive customer reviews and high information disclosure quality effectively minimize This study proposes an effective method for investors and regulators to identify the risk factors of P2P lending platforms. The research | This paper aims to strengthen our understanding of the market evolution through an analysis of risks on P2P lending platforms, which can be This study proposes an effective method for investors and regulators to identify the risk factors of P2P lending platforms. The research The digital lending platforms market report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, and inputs |  |

| Proposition 4: The platform Lending platform analysis and recommendations entry risk increases the loan platforj risk in P2P lending platforms. all employees platfotm a single company. Provided by the Springer Nature SharedIt content-sharing initiative. Or have lending players been acting similar to free-riders? Article Google Scholar. Procedia Computer Science, A large body of contemporary studies has examined different features of P2P lending. | error Std. Summary statistics are reported in third section. It obeys the non-linear path and processes information in parallel throughout the nodes. This graph shows the density distributions of the recovery rates on defaulted loans in the sample. This gives rise to loan information transparency risk, which in turn undermines the relationship between Structure and Task. | The report focuses on the Digital Lending Platform Market size, segment size (mainly covering product type, application, and geography) Find the top Loan Management Systems with Gartner. Compare and filter by verified product reviews and choose the software that's right for your The global digital lending platform market size was valued at USD billion in and is expected to register a compound annual growth rate (CAGR) of | Find the top Loan Management Systems with Gartner. Compare and filter by verified product reviews and choose the software that's right for your Online P2P lending platforms offer a huge opportunity for investment by directly connecting borrowers to lenders. These provide the lending market with speed This market intelligence report offers a thorough, forward-looking analysis of the global digital lending platforms market by type, deployment | This market intelligence report offers a thorough, forward-looking analysis of the global digital lending platforms market by type, deployment The automated design of online lending platforms offer lenders and borrowers an additional reliable attitude to offering funding solutions, thus decreasing Research on Chinese P2P lending platforms suggests that borrowers can improve their credit image and enhance the possibility of obtaining loans |  |

Video

WARNING: Why Peer To Peer Lending is a BAD INVESTMENTLending platform analysis and recommendations - The global digital lending platform market is expected to grow from USD billion in to USD billion by , at a CAGR of % during the The report focuses on the Digital Lending Platform Market size, segment size (mainly covering product type, application, and geography) Find the top Loan Management Systems with Gartner. Compare and filter by verified product reviews and choose the software that's right for your The global digital lending platform market size was valued at USD billion in and is expected to register a compound annual growth rate (CAGR) of

The different types of payment include remote, proximity payments that are used in several applications such as media and entertainment, energy and utilities, healthcare, retail, hospitality, transportation, and others.

The various end users include personal and business. The P2P payments market covered in this report is segmented — 1 By Transaction Mode: Mobile Web Payments, Near Field Communication, SMS or Direct Carrier Billing, Other Transaction Modes 2 By Payment Type: Remote, Proximity 3 By Application: Media and Entertainment, Energy and Utilities, Healthcare, Retail, Hospitality and Transportation, Other Applications 4 By End User: Personal, Business The P2P payment market size has grown rapidly in recent years.

The growth in the historic period can be attributed to smartphone penetration, changing consumer behavior, security and trust, globalization of commerce, financial inclusion initiative. The P2P payment market size is expected to see rapid growth in the next few years.

The growth in the forecast period can be attributed to contactless and QR code payments, integration with messaging apps, open banking initiatives. Major trends in the forecast period include digital transformation, cryptocurrency integration, request for payment services, cross-border P2P payments, integration with social media platforms.

Increasing Consumer Adoption Of Online Banking, Mobile Banking, And E-Commerce On The P2P Payment Market The increase in acceptance of online banking, mobile banking, and e-commerce by consumers is expected to propel the P2P payment market's growth going forward.

Online banking enables users to complete all banking-related tasks, including money transfers, access to historical transactional data, cash withdrawals, deposits, etc. Customers can execute financial transactions on a secure website or mobile application with online mobile banking or Internet banking.

Due to advanced and convenient features, people adopting online banking and mobile banking is promoting P2P payments market. For instance, according to a recent global survey of 2, in April conducted by Finder Row Pty Ltd.

Therefore, the increase in acceptance of online banking, mobile banking, and e-commerce by consumers is driving the demand for the P2P payment market growth. Escalating Cyber Threats Fuel Growth In The P2P Payment Market The rising cyber threats are expected to propel the growth of the P2P payment market going forward.

Cyber threats refer to potential dangers or risks posed by malicious activities to damage data through a wide range of activities and tactics that target computer systems, networks, and digital information.

P2P payment platforms involve the exchange of sensitive financial information between users which are prone to cyber threats in which cybercriminals exploit this information for identity theft, financial fraud, or other malicious activities.

Therefore, rising cyber threats are driving the growth of the P2P payment market. Major companies operating in the P2P payment market report are Apple Inc. Companies operating in the P2P payment sector are focused on introducing P2P payment solutions to strengthen their market position.

For instance, in July , Payveris, a US-based cloud-based software company, launched Payveris P2P, a cloud-based money movement and digital payments platform. The Payveris P2P functionality would be integrated into client banking apps, allowing end-users to send money to other bank accounts identified by email addresses and phone numbers.

Innovative Stride Transforming P2P Payments With UPI Integration Major companies operating in the P2P payment market are focused on introducing advanced solutions, such as P2P payment services, to gain a competitive edge in the market. P2P payment services are electronic transactions made directly between two individuals without the need for a central authority or financial institution to act as an intermediary.

For instance, in April , CRED, an India-based Banking company launched UPI-based Peer-to-Peer P2P payments. UPI-based Peer-to-Peer P2P payments is the use of the Unified Payments Interface UPI for facilitating Peer-to-Peer P2P transactions. It allows users to send and receive money directly from their bank accounts using UPI.

It enables them to make payments to CRED members or non-members by searching their contact list, adding phone numbers, or UPI IDs. Uni Cards Expands Fintech Footprint With Strategic Acquisition Of Ohmy Technologies In April , Uni Cards, an India-based fintech company, acquired OHMY Technologies for an undisclosed amount.

With this acquisition, Uni Cards aims to expand and diversify in the fintech industry, enhance its portfolio of financial services, and leverage existing infrastructure, technology, and customer base to accelerate its growth in the lending sector.

OHMY Technologies is an India-based peer-to-peer lending platform. Asia-Pacific was the largest region in the P2P payment market in North America was the second largest region of the P2P payment market. The regions covered in the p2p payment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the p2p payment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The P2P payment market consists of revenues earned by entities by providing P2P payments to pay for services and split bills. The value of goods in this market includes related services sold by the creators of the goods.

The P2P payment market research report is one of a series of new reports from The Business Research Company that provides P2P payment market statistics, including P2P payment industry global market size, regional shares, competitors with an P2P payment market share, detailed P2P payment market segments, market trends and opportunities, and any further data you may need to thrive in the P2P payment industry.

This P2P payment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The main types of cards and payments are cards and payments. The cards refer to the debit and credit cards that are issued by a bank to manage financial transactions. The various institution types include banking institutions and non-banking institutions.

The cards are used for food and groceries, health and pharmacy, restaurants and bars, consumer electronics, media and entertainment, travel and tourism, and other applications. The growth in the historic period can be attributed to emergence of electronic payment systems, introduction of credit and debit cards, globalization and cross-border transactions, consumer shift towards online shopping, enhanced security measures.

The growth in the forecast period can be attributed to rise of mobile payments, expansion of open banking initiatives, continued growth of e-commerce, regulatory developments, sustainability in payments. Major trends in the forecast period include contactless payments surge, digital wallet adoption, cryptocurrency integration, biometric authentication, subscription and recurring payments.

E-Commerce Boom Fuels Accelerated Growth In The Cards And Payments Market The rise in the e-commerce industry is expected to propel the cards and payments market going forward. E-commerce refers to the buying and selling of goods and services over the Internet.

Cards and payments are the backbone of e-commerce, providing the necessary infrastructure for businesses to conduct transactions online.

For instance, in August , according to the United States Census Bureau, a US-based government agency, compared to the second quarter of , the estimate for e-commerce in the second quarter of climbed by 7.

Therefore, the rise in the e-commerce industry is driving the cards and payments market. New digital checking accounts and debit cards are characterized by their online accessibility, advanced security features, integration with digital tools, and enhanced user customization.

For instance, in October , Experian PLC, an Ireland-based company that performs data analytics and reports on consumer credit, launched a new smart money digital checking account and debit card.

The account features Experian Boost, a FICO score-improving function that records payments that are Experian Boost-eligible and adds them to the user's credit file. The Experian Smart Money Digital Checking Account is designed for customers seeking an efficient financial environment to improve their credit standing and overall financial health with more specialized perks.

Advancements In Card And Payment Security Strategies Employed By Industry Players Cards and payment companies are investing in technologies and formulating guidelines to prevent card and payment fraud. In this regard, payment service providers and merchants have implemented various solutions, including the Payment Card Industry Data Security Standard PCI DSS compliance, EMV technology, 3-D Secure services, tokenization, biometrics, and end-to-end encryption.

To combat the constantly evolving card fraud methods, the National Retail Federation NRF also updates its security guidelines continuously.

Asia-Pacific was the largest region in the cards and payments market in Western Europe was the second largest region in the card and payments market. The cards and payments market consists of revenues earned by entities that are engaged in storing, processing and transmitting payment card data, and facilitating payment transfers between individuals, companies or both.

The payments industry consists of establishments primarily engaged in processing money transfers and payments between various accounts. This market covers issuing and acquiring banks, card processing and issuing companies and others.

Revenue generated from the cards and payments market includes all processing and service fees levied by banks and financial institutions for payments processing and for processing card-based payments. The cards and payments research report is one of a series of new reports from The Business Research Company that provides cards and payments statistics, including cards and payments industry global market size, regional shares, competitors with cards and payments share, detailed cards and payments segments, market trends and opportunities, and any further data you may need to thrive in the cards and payments industry.

This cards and payments research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry. Asset Servicing Global Market Report — By Service Fund Services, Custody and Accounting, Outsourcing Services, Securities Lending , By Enterprise Size Large Enterprises, Medium and Small Enterprises , By End User Capital Markets, Wealth Management Firms — Market Size, Trends, And Global Forecast Asset Servicing Market Definition And Segments Asset servicing refers to a set of tasks and activities performed by a custodian for his clients in relation to the assets in his custody.

The main services offered in asset servicing are fund services, custody and accounting, outsourcing services, and securities lending. Securities lending is the process of lending shares of stock, commodities, derivative contracts, or other securities to other investors or firms.

The borrower must put collateral in the form of cash, other assets, or a letter of credit when applying for a security loan. The services are offered to large enterprises, medium-sized and small enterprises, capital markets, and wealth management firms. The asset servicing market covered in this report is segmented — 1 By Service: Fund Services, Custody and Accounting, Outsourcing Services, Securities Lending 2 By Enterprise Size: Large Enterprises, Medium and Small Enterprises 3 By End User: Capital Markets, Wealth Management Firms The asset servicing market size has grown strongly in recent years.

The growth in the historic period can be attributed to client-centric solutions, market volatility and economic shifts, demand for specialized services, globalization of markets.

The asset servicing market size is expected to see strong growth in the next few years. The growth in the forecast period can be attributed to adaptation to market volatility, client-centric solutions, risk management and cybersecurity, global economic trends, ESG environmental, social, governance integration.

Major trends in the forecast period include transition to digital services, regulatory changes, globalization and market expansion, demand for ESG environmental, social, governance integration, cost efficiency and operational streamlining. The Growing Retiree Population Fuels Asset Servicing Market Growth The increasing retiree population is expected to propel the growth of the asset servicing market going forward.

The retiree population refers to people aged 65 and over. Asset servicing providers can help retirees manage their assets and investments to ensure they have enough income to support their retirement. For instance, according to the United States Census Bureau, a US-based government agency, the population of people aged 65 and over will reach Thus, the increasing retiree population is driving the growth of the asset servicing market.

Globalization Fuels Growth In The Asset Servicing Industry Globalization acts as a major driver for the growth of the asset servicing industry. The players dealing in the asset servicing industry are majorly focusing on the APAC markets and other growing economies.

Thus, globalization creates a large avenue for the expansion and growth of the asset servicing market over the forecast period. Rowe Price Investment Services Inc. Innovative Advances In The Asset Servicing Market Major companies operating in the asset servicing market are developing innovative products with advanced technologies, such as autonomous asset management to improve customer satisfaction and loyalty.

Autonomous asset management refers to the use of artificial intelligence AI and machine learning ML technologies to automate investment decision-making and portfolio management. For instance, in September , Arabesque AI, a UK-based investment advisory and technology company, launched AutoCIO, an autonomous asset management to provide asset managers with a scalable, cost-effective, and highly customizable solution for delivering sustainable investment strategies to clients.

It is driven by artificial intelligence technology that can produce and execute millions of active equity strategies, allowing the establishment of highly customized and sustainable active investment strategies.

The platform is split into several parts, including data pipelines from third-party sources, AI-powered analytics, and customizable investment portfolios. Robotic Process Automation RPA Reshaping The Asset Servicing Market With Efficiency And Cost Savings Robotic process automation RPA or automation is a major trend shaping the growth of the asset servicing market.

Robotic process automation RPA refers to a set of software tools known as bots or robots that are used to perform a repetitive or routine business process that is currently used by transaction processing teams or service centers.

RPA can replace manual tasks involved in asset servicing such as reconciliation, trade processing, and reporting for regulators and clients, reducing the time required with cost-efficiency.

For instance, the ANZ Banking Group was one of the early ones to adopt RPA aggressively and automated its HR, finance, and technology processes in its Bengaluru hub, creating thousands of bots. CRUX Asset Management is a UK-based financial institution that have active equity investment manager that manages assets for institutional and retail clients.

North America was the largest region in the asset servicing market in Western Europe was the second largest region in the global asset management market share.

The regions covered in the asset servicing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The asset servicing research report is one of a series of new reports from The Business Research Company that provides asset servicing statistics, including asset servicing industry global market size, regional shares, competitors with asset servicing shares, detailed asset servicing segments, market trends and opportunities, and any further data you may need to thrive in the asset servicing industry.

This asset servicing research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Blockchain In Banking And Financial Services Global Market Report — By Type Public Blockchain, Private Blockchain, Others , By Application Fund Transaction Management, Real Time Loan Funding, Liquidity Management, Others — Market Size, Trends, And Global Forecast Blockchain In Banking And Financial Services Market Definition And Segments Blockchain is an immutable shared ledger that records online transactions, tracks assets, and builds trust in a business network.

The main types of blockchain in banking and financial services are public blockchain, private blockchain, and others.

Public blockchain doesn't require permission and is a distributed ledger technology that lets anyone join and make transactions, each peer features a copy of the ledger. The various applications of blockchain are fund transaction management, real-time loan funding, liquidity management, and others.

The blockchain in the banking and financial services market covered in this report is segmented — 1 By Type: Public Blockchain, Private Blockchain, Others 2 By Application: Fund Transaction Management, Real-Time Loan Funding, Liquidity Management, Others The blockchain in banking and financial services market size has grown exponentially in recent years.

The growth in the historic period can be attributed to the increasing demand for fast and real-time fund transfers, the rising use of digital banking services, strong economic growth in emerging markets, and increased government initiatives.

The blockchain in banking and financial services market size is expected to see exponential growth in the next few years. The growth in the forecast period can be attributed to the rise in adoption of blockchain technology in the banking sector, rising use of cryptocurrency, and the increased use of blockchain to reduce fraudulent transactions.

Major trends in the forecast period include focus on blockchain technology for insurance, focus on blockchain integration into asset servicing, focus on strategic mergers and acquisitions and focus on digital currencies.

The Surge Of Cryptocurrency Adoption Accelerates Growth In The Blockchain In Banking And Financial Services Market The rising use of cryptocurrency drives the growth of blockchain in the banking and financial services market.

Cryptocurrency is a digital payment system that doesn't rely on banks to verify transactions. Cryptocurrency received its name because it uses encryption to verify transactions.

Encryption aims to provide security and safety. Instead of being physical money carried around and exchanged in the real world, cryptocurrency payments exist purely as digital entries to an online database describing specific transactions.

When you transfer cryptocurrency funds, the transactions are recorded in a public ledger. Cryptocurrency is stored in digital wallets.

Cryptocurrencies run on a distributed public ledger called blockchain, a record of all transactions updated and held by currency holders. Units of cryptocurrency are created through a process called mining, which involves using computer power to solve complicated mathematical problems that generate coins.

Users can also buy the currencies from brokers, and then store and spend them using cryptographic wallets. For example, according to Pew Research, a nonpartisan think tank company in November , the vast majority of U. Men aged 18 to 29 are particularly likely to say they have used cryptocurrencies.

adults, conducted September , Thus, the rising use of cryptocurrency will drive the growth of the market. The Pervasive Adoption Of Blockchain Technology In The Banking Sector Fuels Market Growth The rise in the adoption of blockchain technology in the banking sector is the main driving factor for the growth of the market.

Blockchain is one such technology that has the potential to revolutionize the banking sector for the better. Though there are few use cases of blockchain technology in banking, it is likely to grow at a large scale.

The blockchain enables more open, inclusive, and secure business networks, shared operating models, more efficient processes, reduced costs, and new products and services in banking and finance.

It enables digital securities to be issued within shorter periods, at lower unit costs, with greater levels of customization. Digital financial instruments may thus be tailored to investor demands, expanding the market for investors, decreasing costs for issuers, and reducing counterparty risk.

Thus, the rise in the adoption of blockchain technology in the banking sector will drive the growth of the market. com, Elliptic, Zamna, Adhara, Argo Blockchain, Everledger, Travala. Blockchain's Role In Reducing Fraud And Enhancing Security In The Banking And Financial Services Sector The reduction in fraud through blockchain is shaping the blockchain in the banking and financial services market.

Blockchain also helps verify the legitimacy of every part of the supply chain process and blockchain provides security through its non-repudiation and disintermediation of data storage which helps prevent misappropriating company assets. Mergers And Acquisitions Reshaping The Landscape Of Banking And Financial Services Companies are engaging in mergers and acquisitions to diversify their line of business expand their geographical reach and build broader portfolios with increased capital efficiency.

For example, In July , ICICI Bank, HDFC Bank, and Axis Bank, the Indian private lenders, increased their stake in blockchain technology by merging into IBBIC Pvt Ltd.

Axis Bank and HDFC Bank each acquired 50, shares, a stake of about 5. ICICI paid INR0. IBBIC will use the Infosys Finacle Connect platform to digitize and automate inter-organization trade finance processes.

With this, the banking system in India will take a new leap in the digitization of trade finance, which has traditionally been bogged down by legacy systems and paper-driven processes.

Through this acquisition, Deutsche Borse expanded its digital asset offering by providing a direct entry point for investments, as well as post-trade services.

Crypto Finance AG, is a Switzerland-based company that provides blockchain financial services in crypto asset management. With this acquisition, Deutsche Börse expanded its digital asset offering by providing a direct entry point for investments, as well as post-trade services.

Crypto Finance AG is a Switzerland-based company that provides blockchain financial services in crypto asset management. North America was the largest region in the blockchain in banking and financial services market in The regions covered in the blockchain in banking and financial services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the blockchain in banking and financial services market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada. The blockchain in the banking and financial services market includes revenues earned by entities by offering public blockchain, private blockchain, and other blockchain services for banking and financial services.

Blockchain offers a form of digitalized, decentralized public record of all transactions. Blockchain was designed to record everything of value and not just transactions. The blockchain in banking and financial services market research report is one of a series of new reports from The Business Research Company that provides blockchain in banking and financial services market statistics, including blockchain in banking and financial services industry global market size, regional shares, competitors with a blockchain in banking and financial services market share, detailed blockchain in banking and financial services market segments, market trends and opportunities, and any further data you may need to thrive in the blockchain in banking and financial services industry.

This blockchain in banking and financial services market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry. Financial Services Global Market Report — By Type Lending And Payments, Insurance, Reinsurance And Insurance Brokerage, Investments, Foreign Exchange Services , By Size Of Business Small And Medium Business, Large Business , By End-User Individuals, Corporates, Government, Investment Institution — Market Size, Trends, And Global Forecast Financial Services Market Definition And Segments Financial services are products and services provided by financial institutions that facilitate various financial transactions and other financial activities like loans, insurance, credit cards, investment opportunities, and money management.

The main types of financial services are lending and payments; insurance; reinsurance; insurance brokerage; investments; and foreign exchange services. The lending and payments market refers to the lender's making funds and making them available to a person.

The services are offered to small- and medium-sized businesses as well as large businesses. The services are used by individuals, corporations, governments, and investment institutions.

The financial services market covered in this report is segmented — 1 By Type: Lending And Payments, Insurance, Reinsurance And Insurance Brokerage, Investments, Foreign Exchange Services 2 By Size Of Business: Small And Medium Business, Large Business 3 By End-User: Individuals, Corporates, Government, Investment Institution Sub segments: Lending, Cards And Payments, Insurance, Reinsurance, Insurance Brokers And Agents, Securities Brokerage And Stock Exchange Services, Wealth Management, Investment Banking The financial services market size has grown strongly in recent years.

The financial services market size is expected to see strong growth in the next few years. The growth in the forecast period can be attributed to increasing wealth of high-net-worth individuals, rising demand for alternative investments, increase use of blockchain to reduce fraudulent transactions, growth in individual investors investments, increase in home ownership and mortgages, rising urbanization, increasing investments.

Major trends in the forecast period include integrating smarter safety systems into financial services, implementing artificial intelligence AI in financial services, invest in new product launches, adopting cloud technology, deliver new capabilities, offering custom and personal services especially for wealth management.

Rapid Growth In EMV Technology Adoption For Financial Services Market The global payments industry has witnessed a rapid increase in the adoption of EMV technology. This growth is driven by the higher level of data security offered by EMV chips and PIN cards as compared to traditional magnetic stripe cards.

EMV is a security standard for various payment cards, including debit, credit, charge, and prepaid cards. The chip carries data for the cardholder and the account, which is protected using both hardware and software security measures.

For instance, in August , according to Thales Group, a France-based company that designs, develops and manufactures electrical systems, stated that over Therefore, the increasing payment industry helps to drive the financial services market.

Expansion Of New Business Finance Models Fuels Growth In The Asset Finance Software Market The expansion of new business finance models is expected to propel the growth of the financial services market going forward. Business expansion refers to the growth of a business to a stage at which it seeks out additional options to generate more profit.

Finance software continues to push the finance services industry forward by increasing efficiency, improving customer experience, expanding digital channel usage, producing novel financial services, and strengthening security. A, AR LIFE, Moontek, EvaCodes, Innowise Group, Infograins, ZirconTech, Tech Exactly, Chimpare, SoluLab, BitOasis, Pyypl, Zone, Gath3r, MidChains, HAYVN, DEFIYIELD, MenaPay, Light Protocol, Afriex, BitPesa, Bitsoko, BTCGhana, Luno, Ice3X, GeoPay, Dash, BitSure, Sava, Standard bank, Chankura, PayFast Role Of Digital Technology In Banking And Financial Institutions For Financial Services Market Banks and financial institutions are adopting digitization to modernize their commercial lending business.

Digitization leads to improved customer satisfaction in obtaining a commercial loan, which can otherwise be a complex and slow process. Some of the banks that have incorporated digitization into lending are Commonwealth Bank of Australia, Hana Bank, and Fidor Bank.

Innovations In Financial Services Market Major companies operating in the financial services market are innovating new financial products, such as capital and accounts platforms, to provide reliable services to customers.

Capital and Account is a financial service product to provide fast and flexible cash advances and instant access to funds for users on the platform. For instance, in October , Adyen, a Netherlands-based financial technology platform, launched the capital and accounts platform.

The smaller the standard error, the more precise the estimate. The best random forest classifier is the model with trees, 2 as the number of variables at each split. This is the best combination that produces the smallest OOB Out of Bag estimate of error rate Figure 4 shows the variable importance using the mean decrease in Gini coefficient.

This is a measure of how each variable contributes to the homogeneity of the nodes and leaves in the resulting random forest. The higher the value of the mean decrease Gini score, the higher the importance of the variable in the model.

As shown in Figure 4 , the top five important variables are recoveries, debt to income dti , annual income, revolving balance, revolving utilization and loan amount. It is convenient to underscore the huge gap between recoveries and the other independent variables in terms of importance. In order to fit the neural network model, we used the package nnet in R with 1 hidden layer containing 18 neurons.

We run a maximum of iterations, with logistic activation function. Figure 4. Variables importance according to the mean decrease Gini. It stands out that the variable employment length has the lowest importance on the output, whereas the variable recoveries have the highest importance, followed by verification status, annual income.