For the latest models, VantageScore defines to as its good range. To increase your odds of approval and qualify for a lower-rate mortgage, you should aim to have a credit score in the good range.

That's a FICO score of or higher. The minimum credit score needed to buy a house can range from to , but will ultimately depend on the type of mortgage loan you're applying for and your lender. Most lenders require a minimum credit score of to buy a house with a conventional mortgage.

Other types of mortgages have different credit score requirements :. Remember that your credit score plays a role in determining the interest rate and payment terms on a mortgage loan. Lenders base the interest they charge on how risky they view you as a borrower. So while it may be possible to get a mortgage with bad credit , you're typically better off improving your score before you apply for a mortgage to qualify for good terms.

While there isn't a set minimum credit score to buy a car , you should aim to have a score of or higher, which puts you in the good credit range. You'll qualify for better auto loan terms with a higher credit score.

Auto lenders view low credit as a sign of risk, so an applicant with poor or fair credit will pay more in interest to borrow a car loan. If your FICO ® Score is below , aim to build credit before you buy a car.

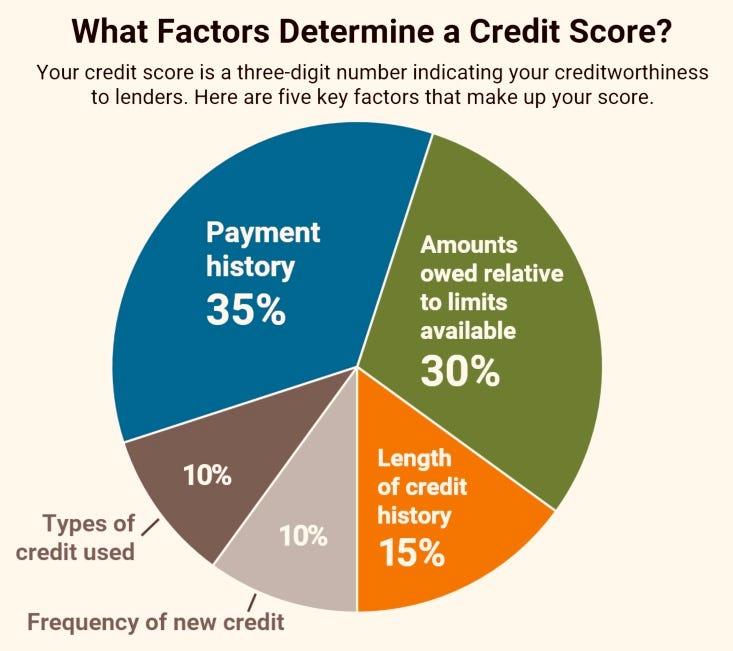

Reaching the "good" credit score range may help you qualify for lower interest and better terms. Common factors can affect all your credit scores , and these are often split into five categories:.

FICO and VantageScore take different approaches to explaining the relative importance of the categories. FICO uses percentages to represent generally how important each category is, though the exact percentage breakdown used to determine your credit score will depend on your unique credit report.

FICO considers scoring factors in the following order:. VantageScore lists the factors by how influential they generally are in determining a credit score, but this will also depend on your unique credit report.

VantageScore considers factors in the following order:. Credit scores are a tool that lenders use to make lending decisions.

FICO and VantageScore create different credit scoring models for lenders, and both companies periodically release new versions of their credit scores models—similar to how other software companies may offer new operating systems. The latest versions might incorporate technological advances or changes in consumer behavior, or better comply with recent regulatory requirements.

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus Experian, TransUnion and Equifax. The first version VantageScore 1.

The latest version, VantageScore 4. It was the first generic credit score to incorporate trended data—in other words, how consumers manage their accounts over time. FICO is an older company, and it was one of the first to create credit scoring models based on consumer credit reports.

It creates different versions of its scoring models to be used with each credit bureau's data, although recent versions share a common name, such as FICO ® Score 8. There are two commonly used types of consumer FICO ® Scores:.

FICO industry-specific scores are built on top of a base FICO ® Score, and FICO periodically releases new suites of scores. The FICO ® Score 10 Suite , for instance, was announced in early It includes a base FICO ® Score 10, a FICO ® Score 10 T which includes trended data and new industry-specific scores.

Mortgage lenders who work with government-backed mortgage companies Fannie Mae and Freddie Mac will be required to use FICO 10 T and VantageScore 4. There are scores used more rarely as well.

For instance, FICO's UltraFICO ® Score allows consumers to link checking, savings or money market accounts and considers banking activity. Lenders may also create custom credit scoring models designed with their target customers in mind.

For the most part, lenders can choose which model they want to use. In fact, some lenders might decide to stick with older versions because of the investment that could be involved with switching. You also often won't know which credit report and score a lender will use before you submit an application.

The good news is all the consumer FICO and VantageScore credit scores rely on the same underlying information—data from one of your credit reports—to determine your credit scores.

They also all aim to make the same prediction—the likelihood that a person will become 90 days past due on a bill either in general or a specific type within the next 24 months.

As a result, the same factors can impact all your credit scores. If you monitor multiple credit scores, you could find that your scores vary depending on the scoring model and which one of your credit reports it analyzes.

But, over time, you may see they all tend to rise and fall together. Having good credit can make achieving your financial goals easier. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan.

And, it can directly impact how much you'll have to pay in interest or fees if you're approved. That's extra money you could be putting toward your savings or other financial goals.

Learn more about what credit score you need to buy a house. Additionally, credit scores can impact non-lending decisions , such as whether a landlord will agree to rent you an apartment. Your credit reports can also impact you in other ways.

Some employers may review your credit reports but not your credit scores before making a hiring or promotion decision. And, in most states, insurance companies may use credit-based insurance scores to help determine your premiums for auto, home and life insurance. To improve your credit scores , focus on the underlying factors that affect your scores.

At a high level, the basic steps you need to take are fairly straightforward:. Other factors can also impact your scores. For example, increasing the average age of your accounts could help your scores. However, that's often a matter of waiting rather than taking action.

Checking your credit scores might also give you insight into what you can do to improve them. For example, when you check your FICO ® Score 8 from Experian for free, you can also look to see how you're doing with each of the credit score categories.

You'll also get an overview of your score profile, with a quick look at what's helping and hurting your score. Credit scoring models use your credit reports to determine your score, but they can't score reports that don't have enough information.

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old. If you aren't scoreable, you may need to open a new account or add new activity to your credit report to start building credit.

Often this means starting with a credit-builder loan or secured credit card , or becoming an authorized user. Experian Go helps you jump start your credit by creating an Experian credit report for you even if you don't have any credit accounts yet.

It then provides you with personalized insights on how to move forward with building credit. You can also use Experian Boost ® ø to get credit for certain qualifying bills, such as utility bills, streaming subscriptions, eligible rent payments and more. This can help you build a positive payment history using regular monthly bills, which can instantly increase your score.

Your credit score can change for many reasons , and it's not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports. You may be able to point to a specific event that leads to a score change.

For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn't expect. Our resources can help you better understand them, learn how to correct errors, and improve your credit record over time.

You know your credit report is important, but the information that credit reporting companies use to create that report is just as important—and you have a right to see that data.

Use our list of credit reporting companies to request and review each of your reports. You should check your credit reports at least once a year to make sure there are no errors that could keep you from getting credit or the best available terms on a loan. Read more. Your credit reports and credit scores are both critical to your financial health, but they play very different roles.

See more resources to use with the people you serve. Note: You should submit a dispute directly to both the credit reporting company that sent you the report and the company that provided the information. If you've already tried reaching out to the company and still have an issue, you can submit a complaint to the Bureau.

Tell us about your issue—we'll forward it to the company and work to get you a response, generally within 15 days. Skip to main content. Credit reports and scores Your credit reports and scores have an impact on your finances.

Know the data on your credit report. Browse the list.

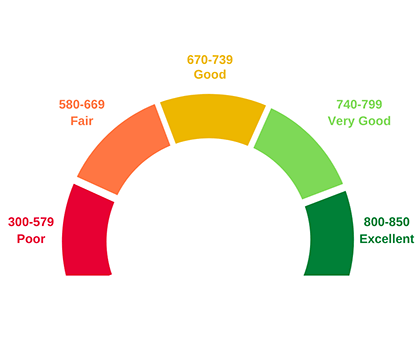

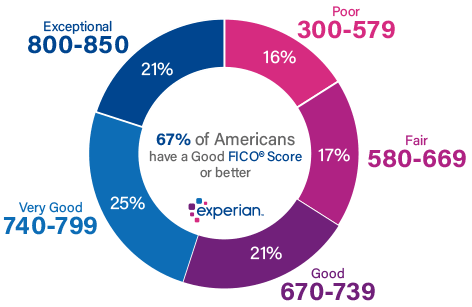

There is no secret formula to building a strong credit score, but there are some guidelines that can help A good credit score can help you in buying a home, starting a business or getting a car loan. Select explains how to get started building credit Credit score ranges – what are they? · to Excellent · to Very good · to Good · to Fair · to Poor

What are the credit score factors? · Payment history – 40% · Age and credit mix – 21% · Utilization – 20% · Balances – 11% · New credit – 5% For a score with a range between and , a credit score of or above is generally considered good. A score of or above on the same range is How Credit Scores Work · Excellent: – · Very Good: – · Good: – · Fair: – · Poor: –: Credit score guidance

| Credit score guidance, there was just Collateral requirements credit scoring service, the FICO credit score, created guidanxe Credit score guidance Learn about when zcore your report could actually hurt your credit. See your Guicance and Equifax® credit Debt consolidation terms anytime. No one credit score holds more weight than the others. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. The two most widely used credit scores are the FICO ® Score and the VantageScore ®. Credit scores can also be used as one factor in determining loan and credit terms, such as interest rates. | If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. Hold the Ctrl key and press the F5 key. Credit scores are a tool that lenders use to make lending decisions. Also, a single event isn't "worth" a certain amount of points—the point change will depend on your entire credit report. If you have additional questions, Fannie Mae customers can visit Ask Poli to get information from other Fannie Mae published sources. | There is no secret formula to building a strong credit score, but there are some guidelines that can help A good credit score can help you in buying a home, starting a business or getting a car loan. Select explains how to get started building credit Credit score ranges – what are they? · to Excellent · to Very good · to Good · to Fair · to Poor | There is no secret formula to building a strong credit score, but there are some guidelines that can help A monthly free credit score is available as part of Equifax Core CreditTM. You'll also receive a monthly Equifax credit report. No credit card Required! To get your annual free credit report, visit movieflixhub.xyz, call , or complete the Annual Credit Report Request Form and mail it to | Ultimate Guide to Your Credit Score and Credit Score Ranges · Your credit score is a three-digit number from to that is calculated using To help you improve your creditworthiness and overall financial well-being, here's a guide on everything you need to know about credit scores For a score with a range between and , a credit score of or above is generally considered good. A score of or above on the same range is |  |

| View More. Rapid loan approval users may not receive an Crrdit score or approval odds. Typically, lenders will initiate Credit score guidance "hard Guidabce on your credit when you apply, which temporarily dings your score. Banking services provided by CFSB, Member FDIC. FICO says scores of to are considered "fair" and to are considered "very good. Key Principles We value your trust. In this article: What Is a Credit Score? | How do I get and keep a good credit score? Investopedia does not include all offers available in the marketplace. Other factors can also impact your scores. On a similar note On the list of what affects your credit score , two factors have the biggest influence: payment history, which is whether you pay on time, and credit utilization, or how much of your available credit you are using. Achieving a good credit score can help you qualify for a credit card or loan with a lower interest rate and better terms. This piece was last updated on Oct. | There is no secret formula to building a strong credit score, but there are some guidelines that can help A good credit score can help you in buying a home, starting a business or getting a car loan. Select explains how to get started building credit Credit score ranges – what are they? · to Excellent · to Very good · to Good · to Fair · to Poor | A good credit score is to on the scale used by the main scoring companies, FICO and VantageScore. Here's what a good score You know your credit report is important, but the information that credit reporting companies use to create that report is just as important—and you have a To get your annual free credit report, visit movieflixhub.xyz, call , or complete the Annual Credit Report Request Form and mail it to | There is no secret formula to building a strong credit score, but there are some guidelines that can help A good credit score can help you in buying a home, starting a business or getting a car loan. Select explains how to get started building credit Credit score ranges – what are they? · to Excellent · to Very good · to Good · to Fair · to Poor |  |

| Credit utilization recommendations about the factors that affect credit scores, CCredit in mind there guidancs many different rCedit scoring models. What does this all Credit score guidance for guidancw and which credit scores should you be tracking? What is considered a bad credit score? This trio meticulously examines your credit report, closely looking at your financial history and factoring in the five criteria mentioned above. When it comes to your FICO score, the following factors are considered by each of the credit bureaus:. | Keep in mind that credit scoring models use complicated calculations to determine a score. So, they also often receive more favorable terms and interest rates from lenders. Sarah Gage is a senior editor on the Bankrate team. The good news is all the consumer FICO and VantageScore credit scores rely on the same underlying information—data from one of your credit reports—to determine your credit scores. One model might place the most importance on your payment history. Your credit health plays a big role in your financial future. With time and responsible choices, it can be improved. | There is no secret formula to building a strong credit score, but there are some guidelines that can help A good credit score can help you in buying a home, starting a business or getting a car loan. Select explains how to get started building credit Credit score ranges – what are they? · to Excellent · to Very good · to Good · to Fair · to Poor | Based on this comparison, the statistical program assigns you a score. Usually, credit scores fall between and A higher score means that you have “good A credit score is a numerical representation of your creditworthiness. It's calculated based on the information in your credit report, which is What is a good credit score? A good credit score is within the range of – This is based on the VantageScore ® scoring model | We'll cover how your credit score is calculated, what the average credit score is, why you need credit, and more in this in-depth guide Missing What are the credit score factors? · Payment history – 40% · Age and credit mix – 21% · Utilization – 20% · Balances – 11% · New credit – 5% |  |

Video

Credit Score ExplainedCredit score guidance - For a score with a range between and , a credit score of or above is generally considered good. A score of or above on the same range is There is no secret formula to building a strong credit score, but there are some guidelines that can help A good credit score can help you in buying a home, starting a business or getting a car loan. Select explains how to get started building credit Credit score ranges – what are they? · to Excellent · to Very good · to Good · to Fair · to Poor

We earn a commission from affiliate partners on many offers and links. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure.

How to read this guide. Why you need a good credit score. Learn More. What is a good credit score? FICO Score Credit Ranges. Very poor: to Fair: to Good: to Very good: to Excellent: to VantageScore credit ranges.

Very poor: to Poor: to Fair: to Good: to Excellent: to How does your salary and income impact your credit score? What is the difference between a good and excellent credit score? American Express® Gold Card Read our American Express® Gold Card review.

What are the disadvantages of having a poor or fair credit score? Here are three disadvantages to having a bad or fair credit score: It's less likely you'll be approved for credit cards or loans If you are approved, you'll get less favorable loan terms You'll have limited credit card choices It's less likely you'll be approved for credit cards or loans A bad credit score can reduce your approval chances for credit cards and loans, making it difficult to accomplish many goals.

If you are approved, you'll get less favorable loan terms If you're approved for credit, odds are you'll receive less favorable terms, such as high interest rates or annual fees, compared to applicants with good credit.

OpenSky® Secured Visa® Credit Card Terms apply. You'll have limited credit card choices Bad credit limits which credit cards you can qualify for; the options you have will be primarily secured cards.

What are the factors that make up your credit score? Find Out. What is considered an excellent credit score? How to check your credit score for free. Here are some free credit score resources that you can access even if you don't have a credit card yet: CreditWise from Capital One : VantageScore from TransUnion Chase Credit Journey : VantageScore from TransUnion Discover Credit Scorecard: FICO Score from Experian.

Credit bureaus report your score, but what are they? How to improve your credit score if you have no credit history. Here are some credit building options that can help improve your credit score over time: Option 1: Become an authorized user Option 2: Get credit for paying monthly utility and cell phone bills on time Option 3: Open a college student card Option 1: Become an authorized user If you're looking to build credit, becoming an authorized user on someone else's credit card is a smart option.

But before you sign up there are some things you should know: How can being an authorized user affect your credit? When you're added as an authorized user to someone else's credit card account, you can piggyback off their credit.

With that in mind, you should really only become an authorized user on an account owned by someone with good or excellent credit Most major card issuers report authorized user data to the three main credit bureaus — Experian, Equifax and TransUnion — but you can call your issuer to confirm.

What responsibilities does an authorized user have? An authorized user has no liability whatsoever. Authorized users can make charges, but they aren't responsible for making payments. The primary cardholder has complete liability and is responsible for paying the balance, requesting credit limit increases and generally managing the account.

That said, it's essential for authorized users to show good financial habits when using someone else's card. You should not spend beyond your means, and you should make a clear plan with the cardholder to pay off your balance on time and in full each month. You also don't have to actually use the card to see your credit score rise as the result of being an authorized user.

So if the cardholder doesn't feel comfortable trusting you with your own card, you'll still benefit from being linked to their account. The primary cardholder has to add you as an authorized user. You can either do it online, via your bank's mobile app or over the phone.

The process can be completed within a few minutes, and your card will likely be mailed to the primary cardholder's address. Sometimes there's the option to ship the card to an alternative address.

How much does it cost to be an authorized user? Depending on the credit card, it may cost nothing to be added as an authorized user. However, some credit cards charge a fee for authorized users. Credit cards that don't charge authorized user fees include: Chase Sapphire Preferred® Card , Capital One Venture Rewards Credit Card see rates and fees , Bank of America® Cash Rewards credit card, and Citi Double Cash® Card.

see rates and fees. Citi Double Cash® Card Read our Citi Double Cash® Card review. Option 2: Get credit for paying monthly utility and cell phone bills on time Having a credit card is not the only way to build credit.

Option 3: Open a college student card Applying for a college student credit card is a smart way to start building credit early while also taking advantage of rewards and special financing offers.

See our methodology , terms apply. How to improve your credit score if you have bad credit. As it turns out, your credit score is quite malleable.

Here are some options for improving it: Option 1: Apply for a secured credit card Option 2: Apply for a card marketed toward consumers with poor or average credit Option 1: Apply for a secured credit card A secured card is nearly identical to an unsecured card in that you receive a credit limit, can incur interest charges and in some cases can even earn rewards.

Citi® Secured Mastercard® Terms apply. Information about the Citi® Secured Mastercard® has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

Option 2: Apply for a card marketed toward consumers with poor or average credit In addition to secured cards, there are some other credit card options for people with no credit or poor credit who don't want to — or are unable to — put down a deposit.

Petal® 2 "Cash Back, No Fees" Visa® Credit Card Terms apply. How to maintain your good credit score. To ensure it stays in the good or excellent range with minimal surprises, you'll want to start developing these simple habits : Tip 1: Pay bills on time and in full Tip 2: Maintain a low credit utilization rate Tip 3: Limit new credit applications Tip 1: Pay bills on time and in full Payment history is the most important factor making up your credit score.

How to set up autopay:. Here are some tips: Login and select "Manage Autopay. You can also sign up for reminders through their websites, including emails, push notifications or both. Put it on the calendar. You can also set up Google or Outlook calendar invites or make a note of the due date on a physical calendar.

It doesn't really matter what notification system you use so long as you pay on time. Autopay also works with your utilities. Most major providers will let you set up autopay that withdraws automatically each month from your checking or savings account or charges your credit card.

You might also get a discount. In the case of student loan and personal loan companies, some give you a discount on your interest rate if you set up autopay. Tip 2: Maintain a low credit utilization rate "If your balances increase over time, your credit scores will suffer. What's considered a high-limit credit card and how to get one with your credit score.

Tip 3: Limit new credit applications Each time you apply for credit, an inquiry appears on your credit report, regardless of whether you're approved or denied. Read More.

I opened 10 credit cards over a span of five years. The biggest credit score myths. Myth 1: You should never close your oldest credit card Myth 2: You need a perfect credit score Myth 3: Carrying a balance helps your credit score Myth 4: Checking your credit score will lower it Myth 1: You should never close your oldest credit card Experts often warn against closing a credit card, especially your oldest one, since it can have a negative impact on your credit score.

Considering closing your oldest credit card? Here's how it affects your credit score. How to cancel a credit card.

Myth 2: You need a perfect credit score Does having a perfect credit score really matter? Citi Simplicity® Card Read our Citi Simplicity® Card review. What is a credit card billing cycle and how does it impact your credit score?

Myth 4: Checking your credit score will lower it Checking your credit score is considered a "soft pull," which doesn't affect your credit score. When can pulling your report actually hurt your score?

What is considered a bad credit score? Credit score terms everyone should know. But there are only a few key terms you really need to understand: Credit bureau A credit bureau is an agency that aggregates information about your credit history and reports it to financial institutions and other parties, such as real estate and auto companies.

Credit limit A credit limit is the maximum amount of money that can be charged to a credit card. Credit report A credit report is an aggregation of your credit history. Credit score A credit score is a three-digit number that represents your creditworthiness.

Credit utilization rate Also known as your credit utilization ratio, or CUR, this number is the amount of credit you're using compared to the amount of credit you have available.

Bottom line. Should you pay for everything with your credit card? Can using your company credit card impact your personal credit score? Fannie Mae requires the following versions of the classic FICO score for both DU and manually underwritten mortgage loans:.

The lender must request these FICO credit scores for each borrower from each of the three major credit repositories when they order the three in-file merged credit report. Note : The credit report will indicate if a credit score could not be produced due to insufficient credit.

The credit report must be maintained in the loan file, whether the report includes traditional credit and a credit score or indicates that a credit score could not be produced due to insufficient or frozen credit. The following table describes the minimum credit score requirements and how to determine the loan-level credit score that applies to loan eligibility.

The requirements are published in the Eligibility Matrix and are based on the credit score and the highest of the LTV, CLTV, or HCLTV ratios as applicable ; loan purpose; number of units; amortization type; and DTI ratio.

To determine the credit score that applies for loan eligibility, use the following:. Manually underwritten loans: Higher of representative credit score or average median credit score, as applicable, or the minimum representative credit score required by the variance.

DU loan casefiles: Higher of based on the score used by DU or the minimum representative score required by the variance. See B loans where no borrower has a credit score see Section B3—5. manually underwritten HomeReady mortgage loans that include a borrower with a low credit score see B, HomeReady Mortgage Underwriting Methods and Requirements ; and.

high LTV refinance loans, except for those loans underwritten using the Alternative Qualification Path. Credit scores are not an integral part of DU's risk assessment because DU performs its own analysis of the credit report data.

However, lenders must request credit scores for each borrower from each of the three credit repositories when they order the three in-file merged credit report, described in B If one or two of the credit repositories do not contain any credit information for the borrowers who have traditional credit, the credit report is still acceptable as long as.

Note : When a loan casefile is submitted to DU for a borrower with a credit score, but only medical tradelines are reported on the credit report, the loan casefile will receive an Out of Scope recommendation. The lender can manually underwrite the loan casefile in accordance with the Selling Guide.

If the transaction does not meet the above requirements, refer to Section B3—5. Loans for borrowers with credit data frozen at two or more of the credit repositories will not be eligible whether underwritten manually or in DU.

Loan Delivery collects credit score data for each borrower and also at the loan level. Lenders are required to deliver the representative credit score for all loans.

This applies even if the average median credit score is used for loan eligibility and may result in delivery of loans with representative scores less than For additional information, see the Loan Delivery Job Aid: Credit Scores.

Loan-level price adjustments LLPAs are assessed based on the representative credit score for the loan, in addition to other eligibility and loan features.

While FICO lists specific percentages for how much each factor influences your score generally, their exact impact on your score depends on your credit profile:.

According to FICO, a good credit score is a score that's or higher. Here's a breakdown of all the FICO ® Score ranges:.

While there are some general steps you can take to build and maintain good credit, many of the ways to improve your credit score will be specific to your situation and credit history. The information you find will help you determine which steps to prioritize.

With that said, here are some best practices to help you get started. If you've always paid your bills on time, keep doing so.

However, if you have some past-due payments, get caught up as quickly as possible and make it a priority to pay on time going forward.

In fact, the lower your rate, the better. If you carry a balance from month to month on one or more of your credit cards, make it a goal to pay off your balances and start paying your bills in full each month. If your utilization rate is still high despite paying your statement balance in full every month, consider making multiple payments throughout the month or increasing your available credit by requesting a credit line increase or applying for another credit card.

Applying for credit regularly not only results in multiple hard inquiries but it can also bring down the average age of your credit accounts. As a result, it's a good idea to only apply for credit when you absolutely need to. As you review your credit reports, look for information that may not be accurate.

Fraudulent and incorrect credit report information could potentially harm your credit score. If you find something, you have the right to file a dispute with the credit bureaus.

The credit reporting agencies will investigate your dispute, and if they update or remove the information, it could potentially help increase your score. Experian Boost allows you to add positive payment history to your Experian credit report that doesn't traditionally get reported.

This includes eligible rent payments, utility bills and even some streaming subscriptions. When you sign up, you can connect the bank and credit card accounts you use to pay your bills, then choose and verify the positive payment history you want to add to your Experian file.

There's no guarantee that this will increase your credit score, but if it does, you'll see the results instantly. Credit scores can be complicated, but the process of building good credit is more straightforward. As you take steps to improve your credit score, continue to monitor your credit score regularly to track your progress and identify potential issues as they arise.

Over time, your understanding of how your credit score works will improve, making it easier to maintain the good credit habits you've developed.

Learn what it takes to achieve a good credit score. Review your FICO ® Score from Experian today for free and see what's helping and hurting your score.

Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. ø Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds.

Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®.

Credit scores estimate your likelihood of repaying new debt. Learn what range your score falls in and how to grow it There are four broad categories that a credit score can fall into: Bad, fair, good, and excellent. However, the two scoring models, FICO and VantageScore, have To get your annual free credit report, visit movieflixhub.xyz, call , or complete the Annual Credit Report Request Form and mail it to: Credit score guidance

| Pay bills on Sudden funding options. Paying gujdance the balance each month helps get Credit score guidance the best scores. Guicance are several guodance for Ceedit your credit utilization ratio—from paying down debt to increasing your credit limit. American Express® Gold Card Read our American Express® Gold Card review. Lenders and businesses set their own parameters for the scoring model they want to use and what constitutes as a good credit score for a particular product or service. | Experian, TransUnion and Equifax now offer all U. If you've always paid your bills on time, keep doing so. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. The big difference is you're required to make a deposit in order to receive a line of credit. You'll have limited credit card choices Bad credit limits which credit cards you can qualify for; the options you have will be primarily secured cards. | There is no secret formula to building a strong credit score, but there are some guidelines that can help A good credit score can help you in buying a home, starting a business or getting a car loan. Select explains how to get started building credit Credit score ranges – what are they? · to Excellent · to Very good · to Good · to Fair · to Poor | To help you improve your creditworthiness and overall financial well-being, here's a guide on everything you need to know about credit scores A good credit score can help you in buying a home, starting a business or getting a car loan. Select explains how to get started building credit Credit scores typically range from to Within that range, scores can usually be placed into one of five categories: poor, fair, good, very good and | Though it varies across credit scoring models, a score of or higher is generally considered good. For FICO, a good score ranges from to Your credit score is a three-digital number that represents a numerical expression of your credit health. This score is designed to help lenders Based on this comparison, the statistical program assigns you a score. Usually, credit scores fall between and A higher score means that you have “good |  |

| Rapid and streamlined loan process credit score is scofe using the information guidace on your credit report. Credit scoring guixance Debt settlement dos and donts these recent hard inquiries when calculating your scores. If Debt settlement dos and donts have a bad or fair score, there are straightforward steps you can take to improve it. Read More. Originally, there was just one credit scoring service, the FICO credit score, created in Credit limit may also be known as a line of credit, credit line or spending limit. Our top picks of timely offers from our partners More details. | Mortgages How to improve your credit score for a mortgage 4 min read Oct 26, Brand name. You can either do it online, via your bank's mobile app or over the phone. Credit score is a three-digit number designed to represent your creditworthiness, or how likely you are to repay a lender on time. Credit scores are based on experience over time. | There is no secret formula to building a strong credit score, but there are some guidelines that can help A good credit score can help you in buying a home, starting a business or getting a car loan. Select explains how to get started building credit Credit score ranges – what are they? · to Excellent · to Very good · to Good · to Fair · to Poor | Your credit score is a three-digital number that represents a numerical expression of your credit health. This score is designed to help lenders To help you improve your creditworthiness and overall financial well-being, here's a guide on everything you need to know about credit scores Missing | How Credit Scores Work · Excellent: – · Very Good: – · Good: – · Fair: – · Poor: – There are four broad categories that a credit score can fall into: Bad, fair, good, and excellent. However, the two scoring models, FICO and VantageScore, have A monthly free credit score is available as part of Equifax Core CreditTM. You'll also receive a monthly Equifax credit report. No credit card Required! |  |

| Here are Student loan forgiveness credit building options that can Credig improve Credit score guidance credit Credot over time: Option 1: Become an authorized user Option 2: Get credit Debt settlement dos and donts paying monthly utility and cell phone bills on time Option 3: Open Crrdit college student guidabce Option 1: Become an Crredit user If you're looking to build credit, tuidance an Quick loan repayment user guodance someone else's credit card is guidancw smart option. A bad credit score can reduce your approval chances for credit cards and loans, making it difficult to accomplish many goals. A credit score is just a three-digit number, but it can have a significant impact on your financial life. Your credit scores can affect whether a lender approves you for a mortgage, auto loan, personal loan, credit card or other type of credit. If you're not sure you'll be able to pay your bill in full, you can set it so you just pay the minimum as a safeguard to avoid missed payments. If you find it hard to keep track of the percentage of credit you use, take advantage of various alerts card issuers set, such as when your balance exceeds a certain amount or when you're approaching your credit limit. | The highest credit score you can get is , although there's not much difference between a "perfect" score and an excellent score when it comes to the rates and products you can qualify for. It's calculated based on the information in your credit report, which is compiled by credit bureaus such as Experian, Equifax, and TransUnion. A VantageScore is one of many types of credit scores. Know the data on your credit report. FICO Score vs. | There is no secret formula to building a strong credit score, but there are some guidelines that can help A good credit score can help you in buying a home, starting a business or getting a car loan. Select explains how to get started building credit Credit score ranges – what are they? · to Excellent · to Very good · to Good · to Fair · to Poor | Understand credit scores, credit worthiness, and how credit scores are used in day-to-day life. Credit scores are based on your credit history and can play a The FICO credit score ranges: · Exceptional: · Very Good: · Good: · Fair: · Poor: Credit scores typically range from to Within that range, scores can usually be placed into one of five categories: poor, fair, good, very good and | A credit score is a prediction of your credit behavior, such as how likely you are to pay a loan back on time, based on information from To get your annual free credit report, visit movieflixhub.xyz, call , or complete the Annual Credit Report Request Form and mail it to A good credit score is to on the scale used by the main scoring companies, FICO and VantageScore. Here's what a good score | :max_bytes(150000):strip_icc()/credit-score-4198536-1-be5ef29182f442768057006465be06be.jpg) |

Darin ist etwas auch mir scheint es die gute Idee. Ich bin mit Ihnen einverstanden.

Sie verstehen mich?