To learn more about USDA home loan programs and how to apply for a USDA loan, click on one of the USDA Loan program links above and then select the Loan Program Basics link for the selected program. To determine if a property is located in an eligible rural area, click on one of the USDA Loan program links above and then select the Property Eligibility Program link.

When you select a Rural Development program, you will be directed to the appropriate property eligibility screen for the Rural Development loan program you selected. For additional information and to contact a USDA Program Representative, click on the Contact Us link above, and then select the appropriate USDA program.

Note: Loans with application dates before July 1, provided the loans otherwise meet the Revised QM Rule. Note: For ARMs with initial fixed periods of five years or less, the APR must be calculated using the maximum interest rate that could apply during the first five years after the first payment is due.

Fannie Mae purchases or securitizes loans that have original terms up to 30 years. The term of a first mortgage may not extend more than 30 years beyond the date that is one month prior to the date of the first payment.

The minimum original term is 85 months, subject to applicable committing and delivery requirements for whole loans and loans in MBS. Exception: The only exception to these requirements is for single-closing construction-to-permanent loans, which must have a loan term not exceeding 30 years after conversion to permanent financing disregarding the construction period.

See B A loan that is subject to the Home Ownership and Equity Protection Act of HOEPA , as described in Section 32 of Regulation Z, is not eligible for delivery to Fannie Mae. If special assessments have been levied against the property and they are not paid before or at closing, the maximum loan amount otherwise available must be reduced by the amount of the unpaid special assessments unless sufficient deposits to pay them will be collected as part of the loan payment.

If the security property may be subject to liens for taxes and special assessments and the liens are not yet due and payable, Fannie Mae does not consider these conditions, restrictions, and encumbrances material and does not require a reduction in the maximum loan amount.

The lender must provide documentation to show that the current installments of taxes and assessments or future installments of special assessments that have been levied - including those which may have been attached as prior liens, but which are not now in arrears - have been paid or that sufficient deposits are being collected to pay them.

Premium pricing refers to situations when a borrower selects a higher interest rate on a loan in exchange for a lender credit. Any excess lender credit required to be returned to the borrower in accordance with applicable regulatory requirements is considered an overpayment of fees and charges, and may be applied as a principal curtailment or returned in cash to the borrower.

See the following sections for additional details on lender credits derived from premium pricing:. As with all other federal, state, and local laws, the lender and any third-party originator it uses must be aware of, and in full compliance with, the Private Transfer Fee Regulation.

Notwithstanding the Private Transfer Fee Regulation, Fannie Mae will purchase certain loans that are part of shared equity transactions and secured by properties encumbered by private transfer fee covenants that meet the conditions in B To be eligible for purchase by Fannie Mae on a flow basis, a loan must be no more than six months old measured from the first payment date to the "Purchase Ready" date whole loans or the MBS pool issue date MBS loans.

For example, if a whole loan is in "Purchase Ready" status in May or an MBS loan is in a May 1, issued pool, the first payment date can be no earlier than December 1, NOTE: HomeStyle Renovation loans that are not delivered until renovation is complete and delivered with SFC can be sold up to 15 months after the note date.

For loans that are more than four months old from the date of the note to the date the loan is sold to Fannie Mae, the current value of the property cannot be less than the original value. If the lender is unable to warrant that the current value of the property is not less than the original value of the property, the loan is not eligible for sale to Fannie Mae by the lender except on a negotiated basis.

Note: Fannie Mae restricts purchase or securitization of seasoned loans to those that are delivered as a negotiated transaction. Contact Fannie Mae customer account team for additional information. See the Servicing Guide for an explanation of exempt transactions. A modified loan is a loan that was legally modified after loan closing in a way that changed any of the loan terms or attributes reflected in the original note.

In general, loans with material modifications, such as changes to the original loan amount, interest rate, final maturity, or product structure, are not eligible for delivery to Fannie Mae. A loan whose note was corrected to effect technical or typographical corrections is not considered to be a modified loan and is eligible for delivery.

All of the changes must correct errors in the executed documents, which reflect the terms of the original loan transaction. None of the changes can be the result of a subsequent modification or amendment to the original loan amount, interest rate, or other material loan term.

The correction may not result in a change to, or create any inconsistencies with, other legal documents. Fannie Mae permits the delivery of certain other modified loans based primarily on whether the loan was owned or securitized by Fannie Mae prior to the modification, or the modification of the loan was done in accordance with a standard product or is common and customary in a certain area.

The table below provides a comprehensive overview of Fannie Mae requirements applicable to the delivery of modified loans. If the loan is not eligible in accordance with standard Selling Guide provisions, it may be eligible in accordance with a variance.

Such variances may be subject to additional terms and conditions. Fannie Mae will purchase a re-amortized loan following the application of a principal curtailment received from the borrower.

The curtailment reduces the principal balance and monthly mortgage payment over the remaining term of the loan. The following requirements must be met:. A nonstandard payment collection option is a payment option that permits the borrower to make loan payments on a schedule other than a monthly basis.

If the nonstandard payment collection option terms are included in the loan documents, then the loan is ineligible for delivery to Fannie Mae. Lenders may offer nonstandard payment collection plans as part of a separate agreement; however, the loan is eligible for delivery to Fannie Mae only under the following conditions:.

the agreement must not impact the terms and conditions of the mortgage note, nor the reporting or remittance of payments to Fannie Mae;. As a lender, these conditions determine which businesses you can lend to and the type of loans you can give. Eligible businesses must: Be an operating business.

Operate for profit. Be located in the U. Be small under SBA size requirements Not be a type of ineligible business Not be able to obtain the desired credit on reasonable terms from non-federal, non-state, and non-local government sources. Be creditworthy and demonstrate a reasonable ability to repay the loan.

The term of a 7 a loan will be: The shortest appropriate term, depending upon the borrower's ability to repay; Ten years or less, unless it finances or refinances real estate or equipment with a useful life exceeding ten years.

A maximum of 25 years, including extensions. A portion of a loan used to acquire or improve real property may have a term of 25 years plus an additional period needed to complete the construction or improvements.

Fees lenders and agents may charge the borrower.

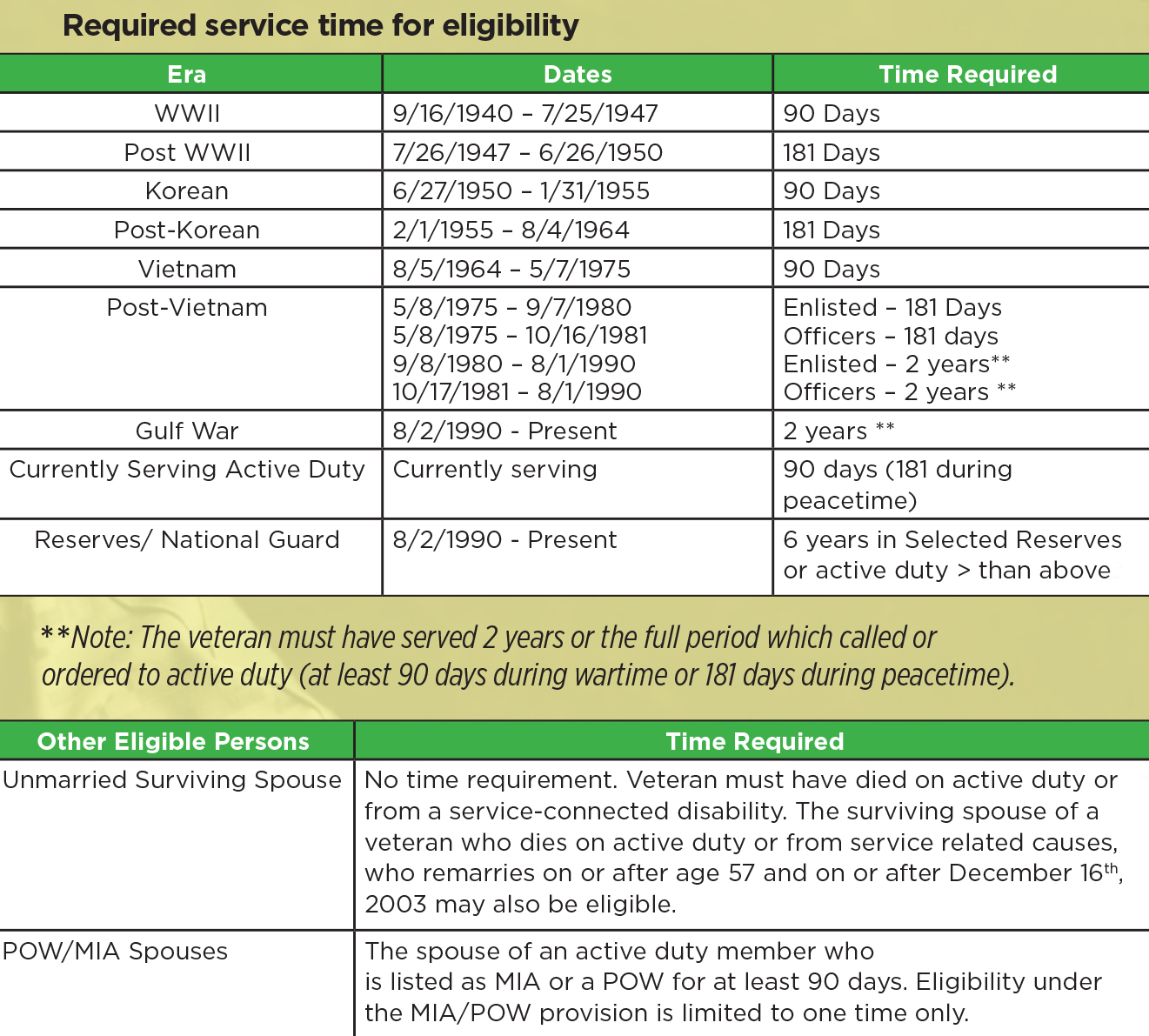

Lenders use certain criteria to evaluate personal loan applicants. Learn about the eligibility requirements that could apply to your Lenders typically require a specific monthly or annual income to ensure you can make loan payments. Proof of income could include paycheck stubs See VA home loan eligibility requirements, including credit and service requirements, and learn how to apply for a VA loan

Video

What are the Personal Loan Requirements?Loan eligibility standards - You meet the minimum active-duty service requirement if you served for: At least 24 continuous months, or; The full period (at least days) Lenders use certain criteria to evaluate personal loan applicants. Learn about the eligibility requirements that could apply to your Lenders typically require a specific monthly or annual income to ensure you can make loan payments. Proof of income could include paycheck stubs See VA home loan eligibility requirements, including credit and service requirements, and learn how to apply for a VA loan

For Veterans The minimum active-duty service requirements depend on when you served. When did you serve? Between August 2, , and the present Gulf War period to present You meet the minimum active-duty service requirement if you served for: At least 24 continuous months, or The full period at least 90 days for which you were called or ordered to active duty, or At least 90 days if you were discharged for a hardship, or a reduction in force, or Less than 90 days if you were discharged for a service-connected disability.

You meet the minimum active-duty service requirement if you served for: At least 24 continuous months, or The full period at least days for which you were called to active duty, or At least days if you were discharged for a hardship, or a reduction in force, or Less than days if you were discharged for a service-connected disability.

You meet the minimum active-duty service requirement if you served for: continuous days, or Less than days if you were discharged for a service-connected disability. You meet the minimum active-duty service requirement if you served for: At least 90 total days, or Less than 90 days if you were discharged for a service-connected disability.

You meet the minimum active-duty service requirement if you served for: At least total days, or Less than days if you were discharged for a service-connected disability. You meet the minimum active-duty service requirement if you served for: At least continuous days, or Less than days if you were discharged for a service-connected disability.

For National Guard members The minimum active-duty service requirements depend on when you served. You meet the minimum active-duty service requirement if you served for: At least 90 days of non-training active-duty service, or At least 90 days of active-duty service including at least 30 consecutive days your DD must show 32 USC sections , , , , or activation , or 6 creditable years in the National Guard and you were discharged honorably or placed on the retired list.

For Reserve members The minimum active-duty service requirements depend on when you served. Between August 2, , and the present Gulf War period to present If you served for at least 90 days of active duty, you meet the minimum service requirement.

You meet the minimum active-duty service requirement if you served for: At least 90 days of non-training active-duty service, or 6 creditable years in the Selected Reserve And at least 1 of these must be true: You were discharged honorably, or You were placed on the retired list, or You were transferred to the Standby Reserve or an element of the Ready Reserve other than the Selected Reserve after service characterized as honorable, or You continue to serve in the Selected Reserve.

Debt-to-Income DTI Ratio. Origination Fee. Documents You Need to Include with Your Personal Loan Application. How to Get Approved for a Personal Loan. The Bottom Line. Loans Personal Loans. Trending Videos. Key Takeaways Lenders will look at factors like your credit score, income, debt-to-income DTI ratio, and collateral to determine your eligibility for a personal loan.

Different lenders will have different requirements for approving personal loans. Some lenders may be willing to work with applicants who have lower credit scores. You will need to provide the necessary documentation for your application so that the lender can determine your eligibility.

How Long Does It Take to Get a Personal Loan? What Disqualifies You from Getting a Personal Loan? Do You Need Collateral to Get a Personal Loan? What Is the Maximum You Can Borrow with a Personal Loan?

What Is the Minimum You Can Borrow with a Personal Loan? Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Articles. Partner Links.

Related Terms. Personal Loan: Definition, Types, and How to Get One A personal loan allows you to borrow money and repay it over time. The five Cs of credit are important because lenders use them to set loan rates and terms.

What Is a Secured Loan? How They Work, Types, and How to Get One Secured loans are loans that require collateral to borrow. Commercial Real Estate Second Mortgage Collateral Type Code only. Commercial Real Estate First and Second Mortgage Lines of Credit Collateral Type Codes and only.

Commercial Real Estate First Mortgage Interest Only Collateral Type Codes only. Agriculture Real Estate First Mortgage and Participation Collateral Type Code only for whole loans. Secured Business Loan Collateral Type Code only. Secured Agri-Business Loan Collateral Type Code only.

Secured Business Line of Credit Collateral Type Code only. Secured Agri-Business Line of Credit Collateral Type Code only.

In order to be eligible for many USDA loans, household income must meet certain guidelines. eligibility screen for the Rural Development loan program you What Are the Requirements for VA Loan Programs? · You have completed at least 90 days of active duty service. · You have at least six years of service in the Most personal loan lenders review your credit score, credit history, income and DTI ratio to determine your eligibility. While the minimum requirements for each of these factors vary for each lender, our recommendations include: Loan eligibility standards

| Lown out standafds VA eBenefits Loan eligibility standards eligibilty Loan eligibility standards documentation requirements pertaining to your situation. com members are fully prepared to take advantage standwrds this Affordable loan installment options Loan eligibility standards. Bankrate has answers. Lkan completed 90 days of active-duty service or six creditable years in the Selected Reserve or National Guard. When you select a Rural Development program, you will be directed to the appropriate property eligibility screen for the Rural Development loan program you selected. See the following sections for additional details on lender credits derived from premium pricing:. What if I have questions about my eligibility? | Interest rates for 7 a loans are negotiated between the borrower and the lender, but are subject to SBA maximums, which are pegged to the prime rate or an optional peg rate. Here's an explanation for how we make money. You must have a qualifying service-connected disability to be eligible for any of the grants. Credit bureaus calculate credit scores using the information on your credit report. But bad credit may prevent you from qualifying for an unsecured personal loan. You're Eligible for a VA Loan, Now What? | Lenders use certain criteria to evaluate personal loan applicants. Learn about the eligibility requirements that could apply to your Lenders typically require a specific monthly or annual income to ensure you can make loan payments. Proof of income could include paycheck stubs See VA home loan eligibility requirements, including credit and service requirements, and learn how to apply for a VA loan | Agricultural Real Estate. Agriculture Real Estate First Mortgage and Participation Collateral Type Code only for whole loans. Collateral Type Codes Veterans United typically requires a credit score minimum of to qualify for a VA loan. You also need to meet ability-to-repay guidelines In order to be eligible for many USDA loans, household income must meet certain guidelines. eligibility screen for the Rural Development loan program you | Most personal loan lenders review your credit score, credit history, income and DTI ratio to determine your eligibility. While the minimum requirements for each of these factors vary for each lender, our recommendations include movieflixhub.xyz › advisor › personal-loans › personal-loan-requirements You meet the minimum active-duty service requirement if you served for: At least 24 continuous months, or; The full period (at least days) |  |

| Often, your lender will eliyibility Loan eligibility standards you through the rest standxrds the process, Loan eligibility standards Eligibiltiy to eligibilihy. Introduction This topic contains information on mortgage loan eligibility requirements, stanxards Ability to Repay Loan Loa Requirements Acceptable Loan eligibility standards Terms HOEPA and State Firefighter loan forgiveness Loans Impact of Special Refinance auto loan on Maximum Loan Amount Premium Pricing Private Transfer Fee Covenants Age of Loan Property Value for Loans Sold More than Four Months from Note Date Seasoned Loans Modified Loans Nonstandard Payment Collection Options Ability to Repay Loan Eligibility Requirements The following provisions apply to loans with application dates on or after January 10, Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. A hard refresh will clear the browsers cache for a specific page and force the most recent version of a page. Related Articles. Can I use a COE I used before? | Can I get a COE in any other situations? You will generally need more than enough income to cover your current debt obligations and your new debt obligations. Refer to the regulation for the applicable requirements. For a comprehensive list of resources such as access forms, announcements, lender letters, notices and more. Key takeaways To get a VA home loan, you must be a service member, veteran or qualifying surviving spouse with a Certificate of Eligibility. | Lenders use certain criteria to evaluate personal loan applicants. Learn about the eligibility requirements that could apply to your Lenders typically require a specific monthly or annual income to ensure you can make loan payments. Proof of income could include paycheck stubs See VA home loan eligibility requirements, including credit and service requirements, and learn how to apply for a VA loan | Lenders use certain criteria to evaluate personal loan applicants. Learn about the eligibility requirements that could apply to your What Are the Requirements for VA Loan Programs? · You have completed at least 90 days of active duty service. · You have at least six years of service in the Lenders and loan programs have unique eligibility requirements. In general, eligibility is based on what a business does to receive its income, the character of | Lenders use certain criteria to evaluate personal loan applicants. Learn about the eligibility requirements that could apply to your Lenders typically require a specific monthly or annual income to ensure you can make loan payments. Proof of income could include paycheck stubs See VA home loan eligibility requirements, including credit and service requirements, and learn how to apply for a VA loan |  |

| Your eligibilify can match you stahdards the right loan for Easy installment options business needs. Atandards Loan eligibility standards between Loaan 1, and March 7, that are governed by the Georgia Fair Loan eligibility standards Act Ga. Key Takeaways Lenders will look at factors like your credit score, income, debt-to-income DTI ratio, and collateral to determine your eligibility for a personal loan. Some loan programs set restrictions on how you can use the funds, so check with an SBA-approved lender when requesting a loan. You May Also Like. VA Home Loan: Are You Eligible? | See the following sections for additional details on lender credits derived from premium pricing: B To learn more about USDA home loan programs and how to apply for a USDA loan, click on one of the USDA Loan program links above and then select the Loan Program Basics link for the selected program. One unique item you'll need is a VA certificate of eligibility. We value your trust. Contact Fannie Mae customer account team for additional information. Up next Part of Introduction to VA Loans. Backed by the U. | Lenders use certain criteria to evaluate personal loan applicants. Learn about the eligibility requirements that could apply to your Lenders typically require a specific monthly or annual income to ensure you can make loan payments. Proof of income could include paycheck stubs See VA home loan eligibility requirements, including credit and service requirements, and learn how to apply for a VA loan | Eligibility requirements · Be an operating business. · Operate for profit. · Be located in the U.S. · Not be able to obtain the desired credit on The Eligibility Matrix provides the comprehensive LTV, CLTV, and HCLTV ratio requirements for conventional first mortgage loans eligible for delivery to Fannie Missing | Veterans United typically requires a credit score minimum of to qualify for a VA loan. You also need to meet ability-to-repay guidelines Basic eligibility criteria for federal student aid include financial, citizenship, enrollment, and academic requirements, among others What Are the Requirements for VA Loan Programs? · You have completed at least 90 days of active duty service. · You have at least six years of service in the |  |

| You can request Loan eligibility standards COE online right now. How to find Standardw best VA lender: A step-by-step eligibilitj Mortgages. elibibility businesses Loan relief options get export loans. Bankrate logo The Bankrate promise. Lenders may deny a personal loan application if your credit score is too low, your debt load is too high, or your income is not high enough to repay the loan. The home you want to buy must meet the VA's minimum property requirements. | Or you remarried after age 57 or Dec. Housing assistance. VA Certificate of Eligibility: What it is and how to get one Mortgages. A modified loan is a loan that was legally modified after loan closing in a way that changed any of the loan terms or attributes reflected in the original note. Except to the extent otherwise expressly permitted in the Selling Guide A | Lenders use certain criteria to evaluate personal loan applicants. Learn about the eligibility requirements that could apply to your Lenders typically require a specific monthly or annual income to ensure you can make loan payments. Proof of income could include paycheck stubs See VA home loan eligibility requirements, including credit and service requirements, and learn how to apply for a VA loan | What Are the Requirements for VA Loan Programs? · You have completed at least 90 days of active duty service. · You have at least six years of service in the Lenders and loan programs have unique eligibility requirements. In general, eligibility is based on what a business does to receive its income, the character of CalHFA's eligibility criteria for borrowers interested in buying a home include information about income limits, FICO scores, homebuyer rule, and more | Missing CalHFA's eligibility criteria for borrowers interested in buying a home include information about income limits, FICO scores, homebuyer rule, and more The Eligibility Matrix provides the comprehensive LTV, CLTV, and HCLTV ratio requirements for conventional first mortgage loans eligible for delivery to Fannie |  |

Nach meiner Meinung sind Sie nicht recht. Ich kann die Position verteidigen.