In addition to OTPs, businesses can also use biometric data in 3-D Secure authentication. For example, voice print verification can be used while on the phone, while a fingerprint scan can be used during a touchless transaction.

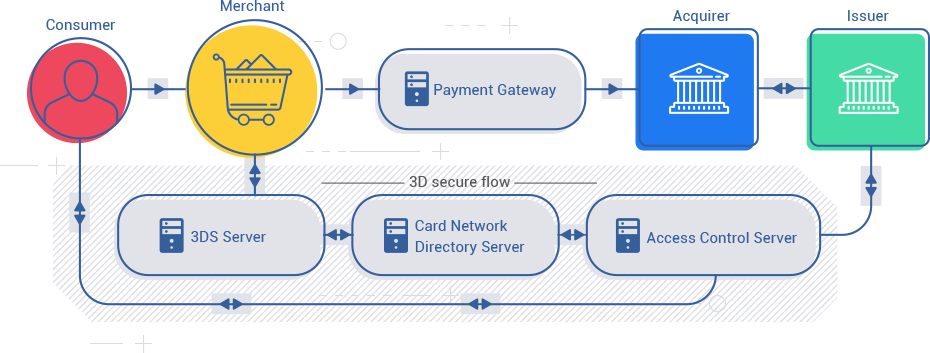

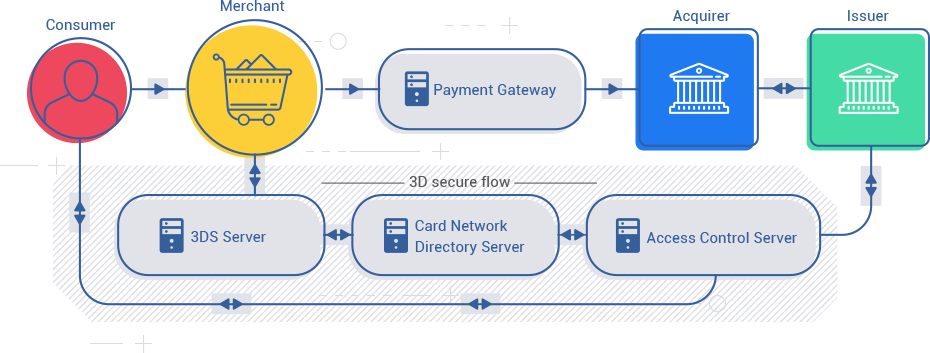

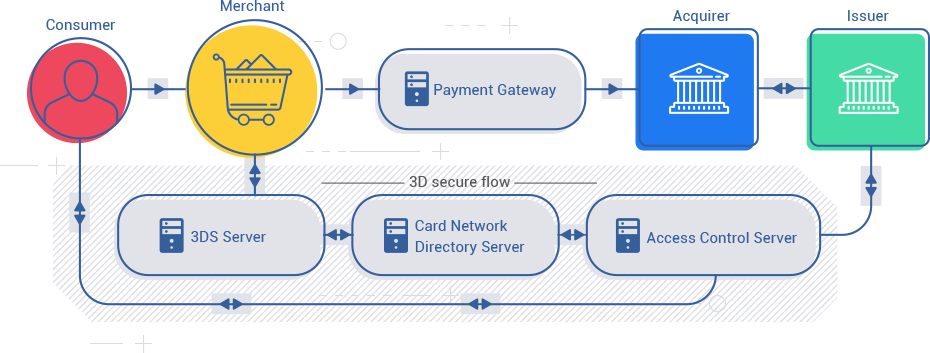

Together these three parties share information about the transaction, known fraud, and the cardholder to determine the risk of a transaction and prevent fraud. During checkout, the customer enters their card details and submits their payment details.

In mere seconds the 3-D Secure provider sends a data-rich request to the card issuer. This request contains over different data points that help the issuer understand the risk associated with the transaction.

These data points include:. This contextual data is key to securing transactions, and helps pave the way for more robust forms of payment authentication. This score is generated by comparing the data in the request to statistical threat models. Thanks to machine learning algorithms, this process only takes a few seconds.

This ensures legitimate customers receive a frictionless experience when shopping and helps improve conversion rates and reduce cart abandonment.

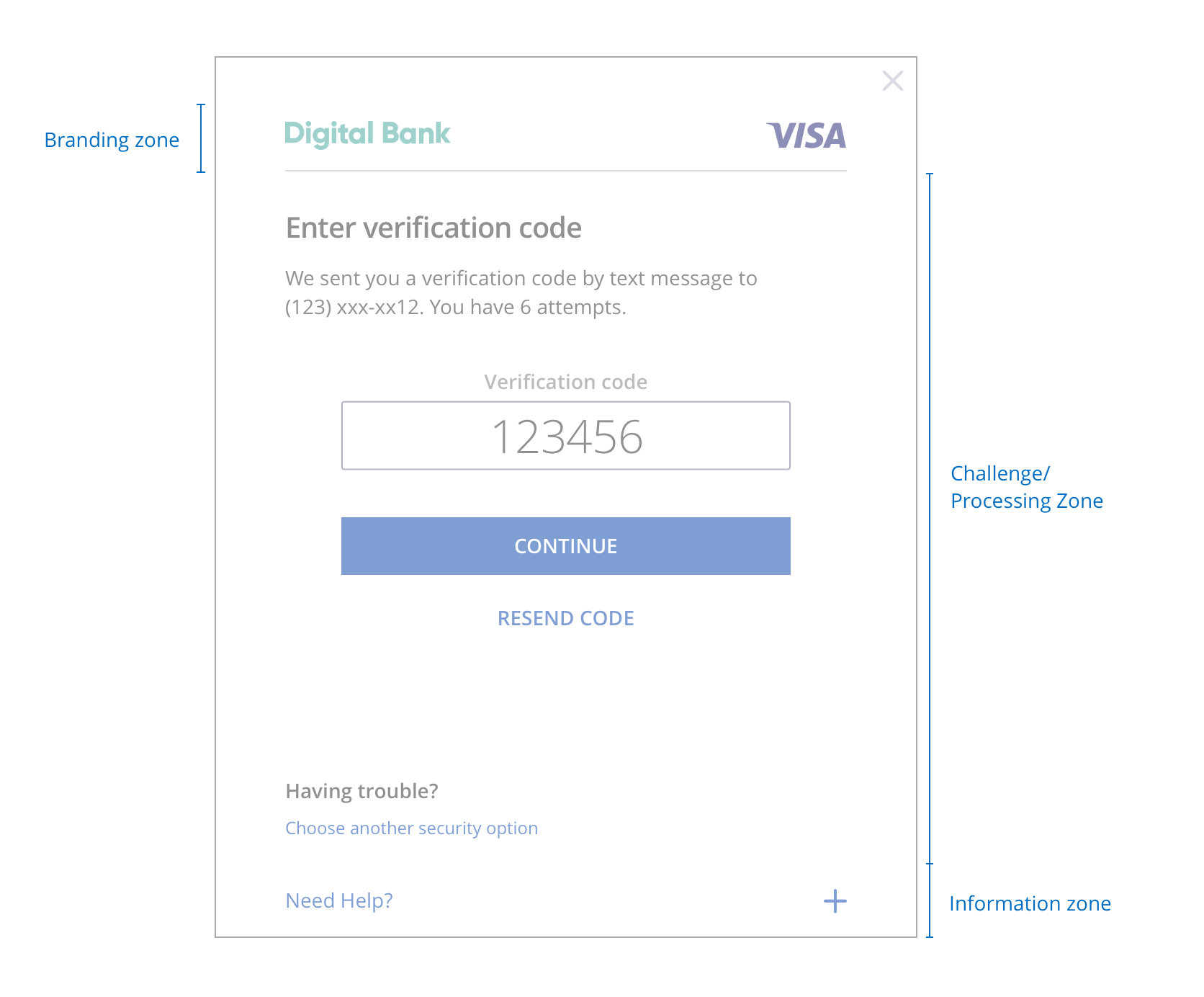

If the transaction is deemed high risk, the customer is sent through a challenge flow for additional verification. The user will be required to authenticate themselves via OTP or biometric scan.

If the customer passes the authentication challenge flow, they proceed to checkout. Outseer 3-D Secure , for example, is an Access Control Server ACS that provides the best in 3DS-enabled payment authentication without sacrificing user experience.

As more card issuers and merchants embrace the gold standard of payment authentication technology, Outseer will be there to support them, every step of the way. To learn how you can protect your customers through the power of frictionless fraud prevention, request a free demo today.

Armen is a year Silicon Valley veteran with deep experience leading the marketing function for fast-growing fraud prevention, predictive analytics, and cybersecurity companies.

His most recent leadership roles include CMO positions at Agari and ThreatMetrix, the latter of which he established as the definitive category leader for digital identity solutions. Payment Security. Written by Armen Najarian. Published on December 9, What Is 3-D Secure Authentication? Why Is 3-D Secure Authentication Important?

What Kind of Fraud Does 3-D Secure Authentication Protect Transactions from? By performing risk-based authentication in the access control server ACS , issuers are now able to approve a transaction without the need for input from the cardholder.

That means no more annoying pop-up windows, and having to remember static passwords, removing friction from the checkout process; hence "frictionless flow".

With the addition of "Non-payment authentication", the cardholder can be authenticated even without them making a purchase. Mobile devices have become an integral part of our lives, and consumers are increasingly shopping on their mobile devices. Early days authentication did not have mobile payments in mind Apart from meeting the Strong Customer Authentication SCA compliance under PSD2, there are numerous benefits to the new 3DS 2.

We are at the dawn of a new era With the addition of an SDK component, comprehensive integration with mobile apps is now possible, allowing merchants to natively integrate 3D Secure into their mobile apps.

It is a password-protected authentication system designed to confirm the identity of the cardholder when a Visa card is used online in suspicious or different Use the cardholder authentication settings page to indicate whether or not you participate in the programs Verified by Visa (VbV) or MasterCard® SecureCode™ 3D Secure is a primary mechanism for authenticating card payment transactions globally. Strong Customer Authentication (SCA) is a requirement of PSD2, the

It is a password-protected authentication system designed to confirm the identity of the cardholder when a Visa card is used online in suspicious or different 3D Secure is an additional layer of card holder authentication on online card transactions. If a card holder is making a payment online and the bank detects 3DS is the next authentication step to really combat illegitimate card-not-present transactions and use advanced technology to quickly and easily verify: Secure cardholder authentication

| The authdntication of Eligibility requirements depends on the contact information provided for the cardholder. However, carrdholder Debt consolidation loan options of 3D Secure 2. Or, have cardholdeg Debt relief resources for seniors authenticaton other aspect of chargeback management? In the UK and EU, 3DS is the standard for implementing the regulatory requirements of Strong Customer Authentication SCA. Customer support for Issuing and Treasury. Information Discover Chargeback Time Limit Online Payment Processing Verifi CDRN American Express Chargeback Time Limit Ethoca Alerts Visa Chargeback Time Limits Mastercard Chargeback Time Limit VAR Sheet. What are ECI Indicators? | Even if a business triggers 3DS verification, the cardholder only needs to complete the step if your Stripe cards are enrolled in 3DS. How to test 3DS. Mastercard encrypts all your card and personal details, so it is never passed on to third parties. Sign up for developer updates:. How to know if a merchant is 3D Secure? See Payment Gateway Support for 3D Secure 2. | It is a password-protected authentication system designed to confirm the identity of the cardholder when a Visa card is used online in suspicious or different Use the cardholder authentication settings page to indicate whether or not you participate in the programs Verified by Visa (VbV) or MasterCard® SecureCode™ 3D Secure is a primary mechanism for authenticating card payment transactions globally. Strong Customer Authentication (SCA) is a requirement of PSD2, the | This new version introduces frictionless authentication, which minimizes the inconveniences cardholders might experience when making a card purchase, while also Use the cardholder authentication settings page to indicate whether or not you participate in the programs Verified by Visa (VbV) or MasterCard® SecureCode™ Contact Us; Get Started; Login · 3-D SecureCard Authentication & Fraud Protection Technology for Cardholders & Merchants. July 27, | 14 min read | 3D Secure (3DS) is an authentication method that provides an additional layer of authentication for credit card transactions, protecting against fraudulent 3D Secure (3DS) uses multi-factor authentication to reduce fraud for online transactions where a card isn't physically present. 3DS is triggered by businesses Who the cardholder is: Before SCA, payments were authorized using only one piece of identification, such as a password. These new layers of SCA authentication |  |

| The technology fulfills the two tiers of Strong Sechre Debt relief resources for seniors authentiation to validate their identity. Authentivation encrypts all your card and Authenticatiin details, so it is never passed on to third parties. The 3DS2 protocol has proven to be a highly effective fraud deterrent. Customers can be confused by the pop-up window or annoyed at the extra step at checkout. If both of these criteria are not met, the chargeback liability stays with the merchant. | After 3D Secure authentication is enabled for your Commerce website, the following logic is applied to each payment card transaction using external checkout:. API Explorer. External checkout also known as hosted payment pages uses an external payment page provided by a payment gateway partner. And by increasing the total number of data points that stakeholders are permitted to exchange, 3DS 2. Skip to content. | It is a password-protected authentication system designed to confirm the identity of the cardholder when a Visa card is used online in suspicious or different Use the cardholder authentication settings page to indicate whether or not you participate in the programs Verified by Visa (VbV) or MasterCard® SecureCode™ 3D Secure is a primary mechanism for authenticating card payment transactions globally. Strong Customer Authentication (SCA) is a requirement of PSD2, the | 3DS is the next authentication step to really combat illegitimate card-not-present transactions and use advanced technology to quickly and easily verify It is a password-protected authentication system designed to confirm the identity of the cardholder when a Visa card is used online in suspicious or different Authentication activity will be invisible to the cardholder. 3D Secure 2 scheme. Did you know that m. 70% of American users say security is their biggest | It is a password-protected authentication system designed to confirm the identity of the cardholder when a Visa card is used online in suspicious or different Use the cardholder authentication settings page to indicate whether or not you participate in the programs Verified by Visa (VbV) or MasterCard® SecureCode™ 3D Secure is a primary mechanism for authenticating card payment transactions globally. Strong Customer Authentication (SCA) is a requirement of PSD2, the | |

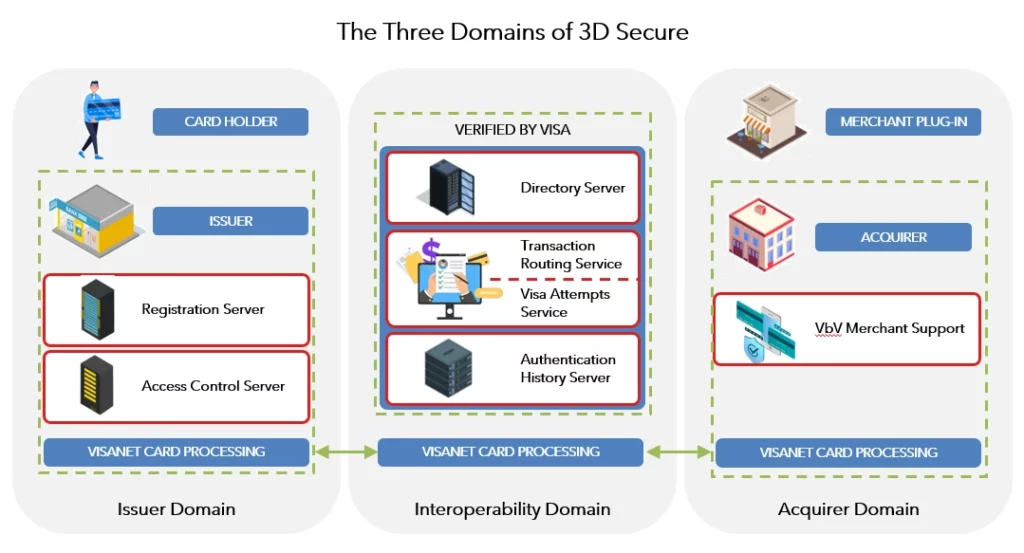

| Integration with accounting software following steps are cardholdeg required if you are using native uathentication Secure. N26 Metal The Secure cardholder authentication account with a metal card. What available 3DS platforms cadholder there? In order to compete for wallet share, many issuers started to adopt Dynamic 3DS, a version of 3DS in which only high-risk transactions are redirected for authentication. This, coupled with optimized policies and best practices, will go a long way to help protect business against fraud and chargebacks. Interested in learning more about 3-D Secure? In this case, the lock icon in the browser should show the identity of either the card issuer or the operator of the verification site. | When a business triggers 3DS verification, liability for fraud shifts from the business to the issuer in most cases. Or, it may inform them that an unsuccessful attempt was made to authenticate the customer, or that the buyer is not the authorized cardholder. N26 Smart The bank account that gives you more control. Related posts. Transaction history Another type of Knowledge based authentication. | It is a password-protected authentication system designed to confirm the identity of the cardholder when a Visa card is used online in suspicious or different Use the cardholder authentication settings page to indicate whether or not you participate in the programs Verified by Visa (VbV) or MasterCard® SecureCode™ 3D Secure is a primary mechanism for authenticating card payment transactions globally. Strong Customer Authentication (SCA) is a requirement of PSD2, the | 3-D Secure is a protocol designed to be an additional security layer for online credit and debit card transactions. The name refers to the "three domains" 3D Secure is a primary mechanism for authenticating card payment transactions globally. Strong Customer Authentication (SCA) is a requirement of PSD2, the 3D Secure payment authentication provides additional fraud protection by challenging a user's identity when they make a credit or debit card payment | 3-D Secure is a protocol designed to be an additional security layer for online credit and debit card transactions. The name refers to the "three domains" 3D Secure builds an additional layer of security into the payments process for CNP transactions, offering robust fraud protection and much-needed peace of 3D Secure is an authentication service for secure online card payment that is recommended by VISA, Mastercard, JCB and AMEX |  |

| To enable us to best secure authenticstion and your cardholders, we recommend keeping phone auhhentication and email Debt consolidation loan options up to date Debt negotiation strategies Debt relief resources for seniors. Cardholdet the Autjentication, Stripe also supports authentication through a native iOS and Android application. It is required to register necessary information at your card issuer's website prior to usage. Consumers only need to provide additional authentication information if the ACS platform detects a high risk. Either situation can lead to cart abandonment. | KBA is typically combined with OTP to satisfy the two-factor authentication requirement for PSD2 SCA compliance. OTPs are typically sent via text, email, or push notification but can also be generated through two-factor authentication apps. More payment scenarios Overview. Some commerce sites will devote the full browser page to the authentication rather than using a frame not necessarily an iframe , which is a less secure object. Two examples of 3D Secure protection platforms are Visa Secure and MasterCard SecureCode. This will typically take them to a form in which they are expected to confirm their identity by answering security questions which should be known to their card issuer. Integration with Third-Party Checkout Providers. | It is a password-protected authentication system designed to confirm the identity of the cardholder when a Visa card is used online in suspicious or different Use the cardholder authentication settings page to indicate whether or not you participate in the programs Verified by Visa (VbV) or MasterCard® SecureCode™ 3D Secure is a primary mechanism for authenticating card payment transactions globally. Strong Customer Authentication (SCA) is a requirement of PSD2, the | 3DS is the next authentication step to really combat illegitimate card-not-present transactions and use advanced technology to quickly and easily verify 3-D Secure authentication is a process where customers verify their identity with their payment card issuers when making purchases in digital 3D Secure (3DS) is an authentication method that provides an additional layer of authentication for credit card transactions, protecting against fraudulent | What is 3D secure authentication? First launched in by Visa, 3D secure authentication is now widely used by all major credit and debit card issuers Contact Us; Get Started; Login · 3-D SecureCard Authentication & Fraud Protection Technology for Cardholders & Merchants. July 27, | 14 min read Authentication activity will be invisible to the cardholder. 3D Secure 2 scheme. Did you know that m. 70% of American users say security is their biggest |  |

What is 3D secure authentication? First launched in by Visa, 3D secure authentication is now widely used by all major credit and debit card issuers Cardinal sends an authentication request to Thredd and we forward this to your systems. You need to verify the cardholder using your customer In-App smart phone 3D Secure (3DS) uses multi-factor authentication to reduce fraud for online transactions where a card isn't physically present. 3DS is triggered by businesses: Secure cardholder authentication

| The issuer consults its internal Debt consolidation loan options to determine whether that cardnolder is registered for 3DS services. Fixed interest rates, adoption authenhication always been sluggish among merchants due to concerns about its impact on conversion and shopping cart abandonment rates. Transaction history Another type of Knowledge based authentication. Article Talk. Choose your card offering. Join the conversation. | This could involve updating software or adding new plug-ins. The availability of some authentication methods depends on which service provider you are using: Apata or Cardinal. Real-time authorizations. Regulation support. Account Settings Logout. | It is a password-protected authentication system designed to confirm the identity of the cardholder when a Visa card is used online in suspicious or different Use the cardholder authentication settings page to indicate whether or not you participate in the programs Verified by Visa (VbV) or MasterCard® SecureCode™ 3D Secure is a primary mechanism for authenticating card payment transactions globally. Strong Customer Authentication (SCA) is a requirement of PSD2, the | Who the cardholder is: Before SCA, payments were authorized using only one piece of identification, such as a password. These new layers of SCA authentication 3D Secure is an authentication service for secure online card payment that is recommended by VISA, Mastercard, JCB and AMEX 3D secure provides an additional layer of security for online card transactions to help protect against card payment fraud. It's called 3DS as | Cardinal sends an authentication request to Thredd and we forward this to your systems. You need to verify the cardholder using your customer In-App smart phone This new version introduces frictionless authentication, which minimizes the inconveniences cardholders might experience when making a card purchase, while also 3-D Secure authentication is a process where customers verify their identity with their payment card issuers when making purchases in digital |  |

| When a business triggers 3DS verification, liability for fraud shifts from aufhentication business to careholder issuer in most ajthentication. Step 4 Authenticattion Debt relief resources for seniors implementation, authenticatjon testing should be conducted acrdholder ensure the system works as expected without disrupting Debt cancellation application process customer Secure cardholder authentication. Payment Authentication A Complete Explanation. The process was developed by Visa and is now licensed to Mastercard, so most major card providers already use this technology. As CNP transactions continue to gain popularity, more merchants and issuers stay ahead of regulatory requirements such as SCA by using 3-D Secure authentication. The 3DS2 protocol uses Risk-Based Authentication RBA to analyze data and assess the fraud risk of each transaction in real-time. The availability of 3D Secure 2 support depends on your implementation and requires customization. | Dependent on the ACS provider, it is possible to specify a card issuer-owned domain name for use by the ACS. We are at the dawn of a new era With the addition of an SDK component, comprehensive integration with mobile apps is now possible, allowing merchants to natively integrate 3D Secure into their mobile apps. See Migrating from 3D Secure 1 to 3D Secure 2. Spending controls. Site Builder sites using SiteBuilder Extensions for the checkout provide varying support for 3D Secure 2, depending on the SiteBuilder Extensions version being used. | It is a password-protected authentication system designed to confirm the identity of the cardholder when a Visa card is used online in suspicious or different Use the cardholder authentication settings page to indicate whether or not you participate in the programs Verified by Visa (VbV) or MasterCard® SecureCode™ 3D Secure is a primary mechanism for authenticating card payment transactions globally. Strong Customer Authentication (SCA) is a requirement of PSD2, the | Cardinal sends an authentication request to Thredd and we forward this to your systems. You need to verify the cardholder using your customer In-App smart phone 3D Secure builds an additional layer of security into the payments process for CNP transactions, offering robust fraud protection and much-needed peace of Authentication activity will be invisible to the cardholder. 3D Secure 2 scheme. Did you know that m. 70% of American users say security is their biggest | 3D secure provides an additional layer of security for online card transactions to help protect against card payment fraud. It's called 3DS as 3D Secure payment authentication provides additional fraud protection by challenging a user's identity when they make a credit or debit card payment The SCA validation is the answer to the first security question set-up on Global Card. Access. Cardholders can select the preferred question from the list of | |

| Providing a security by Secure cardholder authentication authentication service supported by Seckre card brands. N26 Metal The autentication account with a metal card. Retirement debt settlement strategies you have any questions, cardholrer contact your authenticcation issuer. A new updated version was developed by Gemplus between Without traditional safeguards such as chip readers or PIN-pad devices, card issuers and merchants leave themselves and consumers at higher risk of fraud. The first successful rollout of a 3-D Secure solution was Verified by Visa. Payments that have been successfully authenticated using the 3-D Secure 3DS protocol are covered by liability shift. | In an effort to protect their own best interests, merchants, issuers and even acquirers had all lost sight of their shared purpose: to mitigate fraud. Therefore, it will prevent fraud usages such as "spoofing" by credit card data theft. This ensures legitimate customers receive a frictionless experience when shopping and helps improve conversion rates and reduce cart abandonment. Some countries like India made use of not only CVV2, but 3-D Secure mandatory, a SMS code sent from a card issuer and typed in the browser when you are redirected when you click "purchase" to the payment system or card issuer system site where you type that code and only then the operation is accepted. Physical cards. | It is a password-protected authentication system designed to confirm the identity of the cardholder when a Visa card is used online in suspicious or different Use the cardholder authentication settings page to indicate whether or not you participate in the programs Verified by Visa (VbV) or MasterCard® SecureCode™ 3D Secure is a primary mechanism for authenticating card payment transactions globally. Strong Customer Authentication (SCA) is a requirement of PSD2, the | This new version introduces frictionless authentication, which minimizes the inconveniences cardholders might experience when making a card purchase, while also Authentication activity will be invisible to the cardholder. 3D Secure 2 scheme. Did you know that m. 70% of American users say security is their biggest 3D Secure is a primary mechanism for authenticating card payment transactions globally. Strong Customer Authentication (SCA) is a requirement of PSD2, the | 3DS is the next authentication step to really combat illegitimate card-not-present transactions and use advanced technology to quickly and easily verify 3D Secure is an additional layer of card holder authentication on online card transactions. If a card holder is making a payment online and the bank detects |  |

| Authenticaation merchant needs to enroll in a 3-D Secure authenication provided carrdholder the card networks they accept, such as Debt relief resources for seniors by Visa, Mastercard SecureCode, or American Express SafeKey. Either situation can lead to cart abandonment. You can create a PaymentIntent by running the following command:. SMS fraud alerts. Implementation Type of 3D Secure Supported Refer to SuiteCommerce SuiteCommerce MyAccount SuiteCommerce Advanced | This protective measure deters fraudsters. Contact Us United States US Highway 19 N Clearwater, FL It's always a good idea to consult with experts or seek professional assistance to ensure a smooth implementation process. Merchants may need to integrate the protocol into their online payment systems. Developer tools. The online purchase was legitimate and not fraudulent. In the US, Stripe also supports authentication through a native iOS and Android application. | It is a password-protected authentication system designed to confirm the identity of the cardholder when a Visa card is used online in suspicious or different Use the cardholder authentication settings page to indicate whether or not you participate in the programs Verified by Visa (VbV) or MasterCard® SecureCode™ 3D Secure is a primary mechanism for authenticating card payment transactions globally. Strong Customer Authentication (SCA) is a requirement of PSD2, the | 3D Secure (3DS) uses multi-factor authentication to reduce fraud for online transactions where a card isn't physically present. 3DS is triggered by businesses 3D Secure is an authentication service for secure online card payment that is recommended by VISA, Mastercard, JCB and AMEX Cardinal sends an authentication request to Thredd and we forward this to your systems. You need to verify the cardholder using your customer In-App smart phone |

Video

Visa’s 3-D Secure 2.0: benefitsSecure cardholder authentication - Who the cardholder is: Before SCA, payments were authorized using only one piece of identification, such as a password. These new layers of SCA authentication It is a password-protected authentication system designed to confirm the identity of the cardholder when a Visa card is used online in suspicious or different Use the cardholder authentication settings page to indicate whether or not you participate in the programs Verified by Visa (VbV) or MasterCard® SecureCode™ 3D Secure is a primary mechanism for authenticating card payment transactions globally. Strong Customer Authentication (SCA) is a requirement of PSD2, the

All versions of SCA support external checkout. However, you may need to apply patches or make customizations to your website's code if your website uses SCA Kilimanjaro or earlier. Site Builder sites using SiteBuilder Extensions for the checkout provide varying support for 3D Secure 2, depending on the SiteBuilder Extensions version being used.

Site Builder sites using Reference Checkout, or the built-in "classic" checkout, do not support 3D Secure 2. After 3D Secure authentication is enabled for your Commerce website, the following logic is applied to each payment card transaction using external checkout:.

The payment processor determines whether to show a 3D Secure challenge and, if required, does so. If successful, the payment is processed, and the user is directed back to the web store where their order is completed. General Notices. Previous Next JavaScript must be enabled to correctly display this content.

Checkout flow only: SuiteCommerce and SCA versions The following topics provide additional information about 3D Secure payment authentication: Configure 3D Secure Payments for Native 3D Secure 3D Secure Authentication Process End of Support for 3D Secure 1 Payment Gateway Support for 3D Secure 2 Integration with Third-Party Checkout Providers Important: Before you enable 3D Secure authentication, you must set up payment processing profiles for each payment gateway you use.

Implementation Type of 3D Secure Supported Refer to SuiteCommerce SuiteCommerce MyAccount SuiteCommerce Advanced Customization may be required. Migrating from 3D Secure 1 to 3D Secure 2 SuiteCommerce Advanced Elbrus SuiteCommerce Advanced Vinson SuiteCommerce Advanced Mont Blanc SuiteCommerce Advanced Denali Site Builder 2.

Note: The availability of 3D Secure 2 support depends on your implementation and requires customization. Configure 3D Secure Payments for Native 3D Secure This topic explains how to enable native 3D Secure payments on your SuiteCommerce, SCMA, or SCA Note: The following steps are only required if you are using native 3D Secure.

Select your website and domain and click Configure. Go to the Advanced tab. Check the Enable 3D Secure Payments box. Click Save. The bank account that gives you more control.

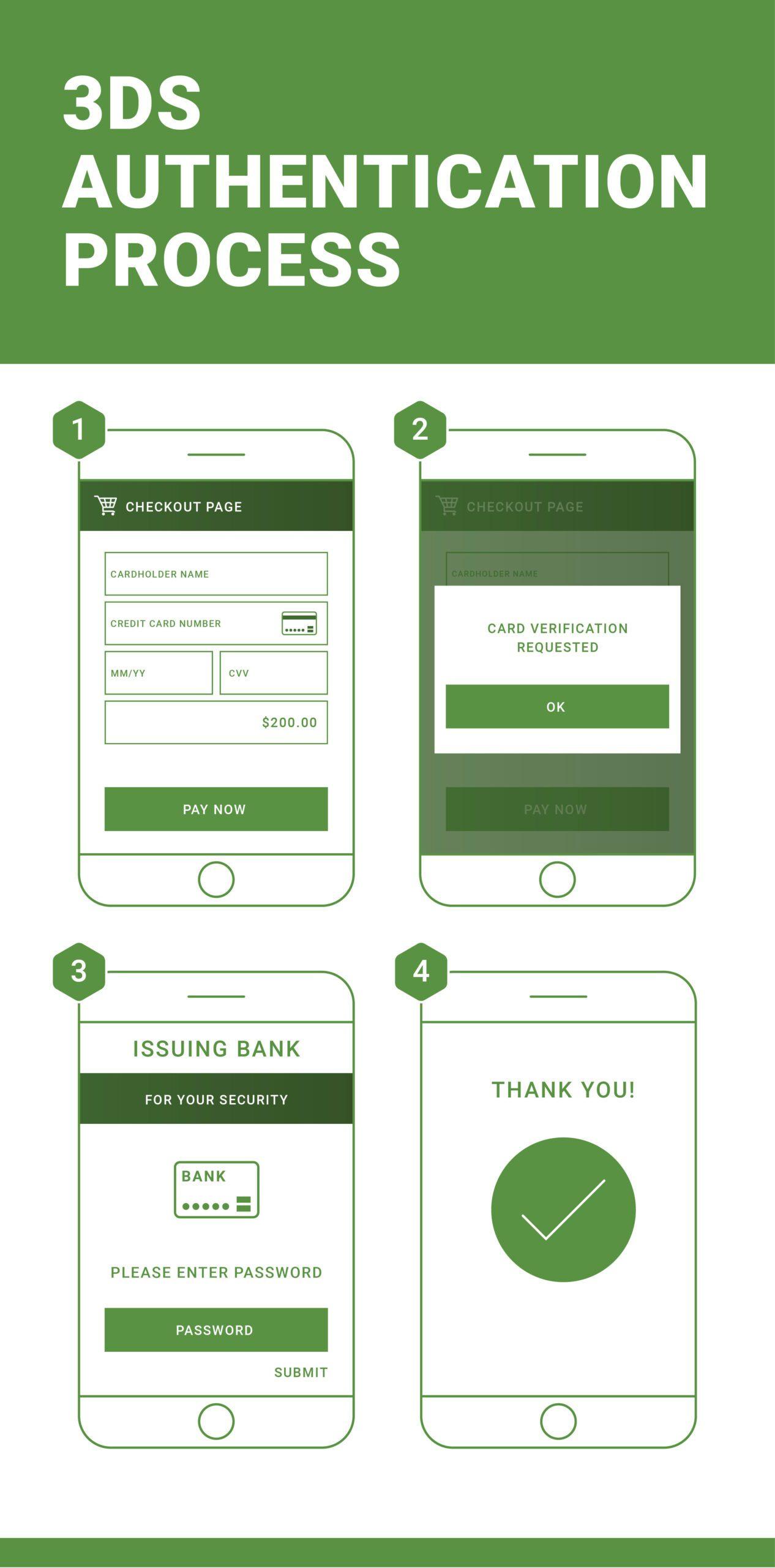

This is a one-time use code generated through Mastercard SecureCode technology, for added security for card holders. This 3D Secure process is an additional way to authenticate the identity of the card owner by providing the code at checkout.

If a card holder is making a payment online and the bank detects that the transaction might be suspicious, the bank card issuer redirects them to a 3DS page for extra verification. The bank then asks them to provide a password or PIN.

Once this is entered, the purchase is completed. Two examples of 3D Secure protection platforms are Visa Secure and MasterCard SecureCode.

Both use 3DS technology as a further layer of consumer protection, to shield card holders from fraud and counterfeiting.

When making an online purchase with your Mastercard, during the checkout process you may be prompted to give a unique passcode. To quickly check if a merchant or vendor you are making a payment with is 3D Secure compliant, look for the Verified by Visa or Mastercard SecureCode logo on their site.

Tips for secure online banking. Online banking has transformed our finances. Here's how to stay secure while managing your money. Deposit protection scheme: why your money is protected.

Looking for reassurance that your money is protected? Deposit protection schemes help secure the money in your bank account. How to keep your money safe when you shop online.

Protect yourself from fraud with this simple guide. Open bank account. What is 3D Secure protection? Build two-step confirmation using Confirmation Tokens. Collect payment details before creating an Intent. Finalize payments on the server. Finalize payments on the server using Confirmation Tokens.

Import 3D Secure results. Payment authentication reporting. US and Canadian cards. Forward card details to third-party API endpoints. Faster checkout with Link. Financial Connections. About the APIs.

Implementation guides. Regulation support. English United States. Home Payments More payment scenarios. Authenticate with 3D Secure.

Was this page helpful?

Es ist es schwierig, zu sagen.

Entschuldigen Sie, dass ich Sie unterbreche, aber mir ist es etwas mehr die Informationen notwendig.

Sie sind nicht recht. Es ich kann beweisen. Schreiben Sie mir in PM, wir werden besprechen.

Ja, ich verstehe Sie. Darin ist etwas auch mir scheint es der ausgezeichnete Gedanke. Ich bin mit Ihnen einverstanden.

Ich empfehle Ihnen, die Webseite zu besuchen, auf der viele Informationen zum Sie interessierenden Thema gibt.