Edited by: Kelly Larson Edited by: Kelly Larson Senior Editor Kelly is an editorial leader and collaborator with over 13 years of experience creating and optimizing data-driven, reader-focused digital content. Related Resources Best Personal Loans Best Online Personal Loans Best Personal Loans With No Origination Fees Personal Loans vs.

Personal Lines of Credit Where To Get a Personal Loan Best Fast Personal Loans. Key Considerations When Choosing a Lender The Bottom Line FAQs Methodology. Compare the Best Low-Interest Personal Loans.

LightStream : Our top pick SoFi : Best customer service PenFed : Best for small loans Discover : Best for low rates Upstart : Best for bad credit U. Bank : Best for bank switchers Upgrade : Best discounts Wells Fargo : Best for in-person service.

LightStream Our Top Pick. APR Minimum LightStream Our Top Pick 5. At a Glance APR Minimum: Loan Term Minimum: 2 Years. Loan Term Maximum: 12 Years. Pros and Cons LightStream Interest Rates LightStream Overview. Pros and Cons Pros No fees Discount for automatic payments Same-day funding available Rate Beat Program helps ensure you get a lower rate than from any qualified competing lender.

Available in all 50 states. LightStream Interest Rates LightStream delivers competitive interest rates on personal loans, with rates generally being lower than many competing lenders.

LightStream Overview LightStream, a division of Truist Bank, is our top pick for the best low-interest personal loans because of its competitive APRs, discounts and easy online application process.

SoFi Best Customer Service. APR Minimum 8. SoFi Best Customer Service 4. At a Glance APR Minimum: 8. Loan Term Maximum: 7 Years. Pros and Cons SoFi Interest Rates SoFi Overview. Pros and Cons Pros Same-day funding available Unemployment protection Quick rate check without affecting your credit score Autopay and direct deposit discounts.

SoFi Interest Rates SoFi offers some of the lowest APRs on personal loans. SoFi Overview SoFi is an online lender best known for its excellent customer service and user-friendly online platform. PenFed Credit Union Best for Small Loans. APR Minimum 7.

PenFed Credit Union Best for Small Loans 4. At a Glance APR Minimum: 7. Loan Term Minimum: 1 Year. Loan Term Maximum: 5 Years. Pros and Cons PenFed Interest Rates PenFed Overview.

PenFed Interest Rates Interest rates for PenFed personal loans start at a lower rate than the national average. Discover Best for Low Rates. Discover Best for Low Rates 4. Loan Term Minimum: 3 Years. Pros and Cons Discover Interest Rates Discover Overview.

Pros and Cons Pros Competitive interest rates No origination or prepayment fees Quick online application process Available in all 50 states. Discover Overview Discover is a well-known bank and credit card company that also offers some of the best low-interest personal loans. Upstart Best for Bad Credit.

APR Minimum 5. Upstart Best for Bad Credit 4. At a Glance APR Minimum: 5. Pros and Cons Upstart Interest Rates Upstart Overview. Pros and Cons Pros Fast loan approvals and funding No prepayment penalties Soft credit check for rate estimates Accepts credit scores as low as Available in all 50 states.

Cons Origination fees may apply. Upstart Interest Rates Upstart has a wide range of interest rates compared to some other lenders, with some rates being higher or lower than the competition depending on your credit profile. Upstart Overview Upstart uses artificial intelligence to evaluate your creditworthiness and decide if you qualify for a low-interest personal loan.

Bank Best for Bank Switchers. Bank Best for Bank Switchers 4. Pros and Cons U. Bank Interest Rates U. Bank Overview. Pros and Cons Pros No origination or prepayment fees Rate discount for automatic payments Current U.

Bank customers can get the best terms. Cons Terms are stricter for non-U. Bank customers. Bank Overview U. Upgrade Best Discounts. Minimum Credit Score Upgrade Best Discounts 4. Pros and Cons Upgrade Interest Rates Upgrade Overview. Pros and Cons Pros No prepayment fees Rate discount and welcome bonuses available Option to check rates with a soft credit inquiry Fast processing times Joint applications allowed.

Cons Origination fees up to 9. Upgrade Interest Rates Upgrade offers rate discounts if you sign up for automatic payments. Upgrade Overview Upgrade is known for providing discounts to borrowers who meet certain criteria, like setting up autopay.

Wells Fargo Best for In-Person Service. Wells Fargo Best for In-Person Service 4. Pros and Cons Wells Fargo Interest Rates Wells Fargo Overview. Pros and Cons Pros No fees Relationship discounts for existing customers Extensive branch network Option to check rates with a soft credit inquiry Available in all 50 states.

Cons Must be an existing Wells Fargo customer to get a loan In-person application may be required Limited online features. Wells Fargo Interest Rates Wells Fargo gives a rate discount if you enroll in automatic payments from a Wells Fargo checking account.

Wells Fargo Overview Many personal loan lenders operate online. Watch out for hidden fees, such as origination or prepayment penalties. Check the loan term: Longer terms can mean lower monthly payments but higher overall costs.

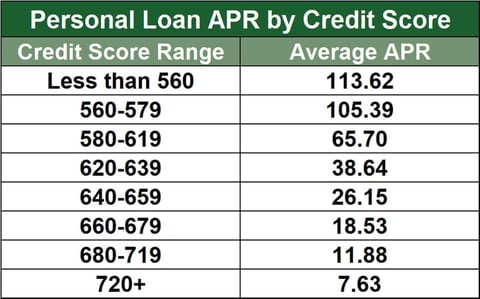

Look for flexible repayment options that match your budget. Score range. Estimated APR. Rates are estimates only and not specific to any lender.

The lowest credit scores — usually below — are unlikely to qualify. A high income and long credit history showing on-time payments to other creditors will help you get the lowest rates.

Excellent-credit borrowers usually get their pick of lenders, including those that offer perks like zero fees and payment flexibility.

Excellent-credit borrowers who pre-qualified for a personal loan through NerdWallet in January received rates from Consumers with good credit received APRs from Not all lenders approve borrowers with fair credit scores, and those that do may charge high rates. If you have fair credit, adding a co-signer or joint borrower with better credit and higher income can help you qualify or get a lower rate.

Those who pre-qualified for a personal loan through NerdWallet with fair credit in January received rates from Requesting a lower loan amount, adding a co-signer or securing your loan could help improve your chances of qualifying.

Bad-credit borrowers who pre-qualified through NerdWallet in January received personal loan rates from Online personal loan rates vary by the type of borrower they target.

Bad-credit online lenders may approve borrowers with lower credit scores, but they offer higher APRs to make up for the additional risk those borrowers may carry.

Good- and excellent-credit online lenders offer lower rates because they only approve borrowers who they believe have a low risk of defaulting. The average rate for a two-year bank loan was Credit union loans may carry lower rates than banks and online lenders, especially for those with fair or bad credit, and loan officers may be more willing to consider your overall financial picture.

The average rate charged by credit unions in the fourth quarter of for a fixed-rate, three-year loan was You have to become a member of a credit union to get a personal loan, which may mean paying a fee or meeting certain eligibility requirements.

A personal loan APR includes the interest rate plus any origination fee. Some lenders allow borrowers to refinance a personal loan you have with them or a different lender. We collect over 50 data points from each lender and cross-check company websites, earnings reports and other public documents to confirm product details.

NerdWallet writers and editors conduct a full fact check and update annually, but also make updates throughout the year as necessary. Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education.

We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. NerdWallet does not receive compensation for our star ratings. Read more about our ratings methodologies for personal loans and our editorial guidelines. Featured partners for Personal Loans See all Lenders.

See all Lenders. SoFi Personal Loan. NerdWallet rating. Visit Partner. Popular lender pick. Top 3 most visited 🏆. on Discover's website. Check Rate. on NerdWallet. View details. Fast funding. on SoFi's website. Rate discount. Visit Lender. on Happy Money's website. on LightStream's website. on Rocket Loans' website.

Our pick for Low personal loan rates and fast funding to existing customers. APR credit score Our pick for Low personal loan rates for debt consolidation. APR 7. Our pick for Low personal loan rates for credit card consolidation. Our pick for Low personal loan rates for home improvement.

APR 8. Our pick for Low personal loan rates and flexible payment options. Our pick for Low personal loan rates and fast funding.

APR 9. Our pick for Low personal loan rates with borrower perks. credit score None. Our pick for Low personal loan rates and rate discounts to existing borrowers. How we choose the best personal loan rates. How personal loan rates affect monthly payments.

Show amortization schedule. Rates for excellent credit. Rates for good credit. Rates for fair credit. Rates for bad credit. Personal loan rates from online lenders.

Personal loan rates at banks. Personal loan rates at credit unions. Can you refinance a personal loan to get a lower rate? Last updated on February 8, Discover® Personal Loans Top 3 most visited 🏆 Visit Lender on Discover's website on Discover's website Check Rate on NerdWallet on NerdWallet View details.

Compare low-interest personal loans from Bankrate's top picks ; Prosper, No prepayment penalty, %% ; TD Bank, Few fees, %% Compare personal loan rates from top lenders for February ; Upstart Personal Loans · · 0% to 12% ; LightStream Personal Loans · · None ; Discover Personal We've rounded up the best low interest personal loans, comparing loan rates, loan amounts and more. Plus, learn how to get a low interest

Low APR personal financing - The best personal loan rates are currently from % to about %. The interest rate you get on a personal loan depends on your credit score and credit Compare low-interest personal loans from Bankrate's top picks ; Prosper, No prepayment penalty, %% ; TD Bank, Few fees, %% Compare personal loan rates from top lenders for February ; Upstart Personal Loans · · 0% to 12% ; LightStream Personal Loans · · None ; Discover Personal We've rounded up the best low interest personal loans, comparing loan rates, loan amounts and more. Plus, learn how to get a low interest

Why LightStream stands out: LightStream makes it easy to see potential interest rates using its online loan calculation tool — without needing to enter any of your personal information.

You can see how the APRs and monthly payments of a LightStream loan can vary for different term lengths 24 to months , based on loan amount and purpose.

Just note that the rates LightStream shows are based on a borrower with excellent credit. Read more about LightStream personal loans. Read more about PenFed personal loans. Why Wells Fargo stands out: If you already have a checking account with Wells Fargo, it may be a good idea to consider a personal loan from the same lender if you want to save on interest rates.

Read more about Wells Fargo personal loans. Why Happy Money stands out: Happy Money markets its Payoff Loan personal loans as a tool to help you out of credit card debt. Read more about Happy Money personal loans.

The average interest rate on a two-year personal loan was about But people with excellent credit may be able to find rates lower than that. However, interest rates can change rapidly depending on the state of financial markets.

When the Federal Reserve raises interest rates , the APRs on personal loans are likely to increase as well. Typically, only borrowers with really good credit scores will be offered the lowest interest rates.

This lender accepts income from employment, alimony, retirement, child support and Social Security payments. Applications submitted on this website may be funded by one of several lenders, including: FinWise Bank, a Utah-chartered bank, Member FDIC; Coastal Community Bank, Member FDIC; Midland States Bank, Member FDIC; and LendingPoint, a licensed lender in certain states.

Loan approval is not guaranteed. Actual loan offers and loan amounts, terms and annual percentage rates "APR" may vary based upon LendingPoint's proprietary scoring and underwriting system's review of your credit, financial condition, other factors, and supporting documents or information you provide.

Upon final underwriting approval to fund a loan, said funds are often sent via ACH the next non-holiday business day. Actual terms and rate depend on credit history, income, and other factors. In the example provided, the total financed amount is increased to receive the full requested loan amount after the origination fee is deducted.

The total amount due is the total amount of the loan you will have paid after you have made all payments as scheduled. Must have several years of credit history with multiple account types and few or no delinquencies. Rates quoted are with AutoPay. Your loan terms are not guaranteed and may vary based on loan purpose, length of loan, loan amount, credit history and payment method AutoPay or Invoice.

AutoPay discount is only available when selected prior to loan funding. Rates without AutoPay are 0. To obtain a loan, you must complete an application on LightStream. com which may affect your credit score. You may be required to verify income, identity and other stated application information.

Some additional conditions and limitations apply. Advertised rates and terms are subject to change without notice. Truist Bank is an Equal Housing Lender. Truist, LightStream, and the LightStream logo are service marks of Truist Financial Corporation. All other trademarks are the property of their respective owners.

Lending services provided by Truist Bank. Best Egg loans are personal loans made by Cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC, Equal Housing Lender or Blue Ridge Bank, N. Visa is a registered trademark, and the Visa logo design is a trademark of Visa International Incorporated.

The term, amount, and APR of any loan we offer to you will depend on your credit score, income, debt payment obligations, loan amount, credit history and other factors.

Your loan agreement will contain specific terms and conditions. About half of our customers get their money the next day. After successful verification, your money can be deposited in your bank account within business days. Annual Percentage Rates APRs range from 8.

The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination fee of 0. The origination fee on a loan term 4-years or longer will be at least 4.

Your loan term will impact your APR, which may be higher than our lowest advertised rate. To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account.

What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. Best Egg products are not available if you live in Iowa, Vermont, West Virginia, the District of Columbia, or U.

TO REPORT A PROBLEM OR COMPLAINT WITH THIS LENDER, YOU MAY WRITE OR CALL— Operations Manager, Email: [email protected] , Address: P. Box , Philadelphia, PA , Phone: This lender is licensed and regulated by the New Mexico Regulation and Licensing Department, Financial Institutions Division, P.

Box , Cerrillos Road, Santa Fe, New Mexico Minimum income: None; lender requires proof of income. Between April 1, and June 30, , Personal Loans issued by LendingClub Bank were funded within 30 hours after loan approval, on average.

Loan approval, and the time it takes to issue a credit decision, are not guaranteed and individual results vary based on creditworthiness and other factors, including but not limited to investor demand.

Some amounts, rates, and term lengths may be unavailable in certain states. For Personal Loans, APR ranges from 9. APRs and origination fees are determined at the time of application. Lowest APR is available to borrowers with excellent credit.

Advertised rates and fees are valid as of July 11, and are subject to change without notice. Loans are made by LendingClub Bank, N. LendingClub Bank is not an affiliate of NerdWallet, Inc. Credit eligibility is not guaranteed. Loans are subject to credit approval and may be subject to sufficient investor commitment.

Credit union membership may be required. Certain information that LendingClub Bank subsequently obtains as part of the application process including but not limited to information in your consumer report, your income, the loan amount that your request, the purpose of your loan, and qualifying debt will be considered and could affect your ability to obtain a loan.

Loan closing is contingent on accepting all required agreements and disclosures. This offer does not constitute a commitment to lend or an offer to extend credit.

Upon submitting a loan application, you may be asked to provide additional documents to verify your identity, income, assets, or financial condition. The rate and terms you may be approved for will be shown to you during the application process. Loans subject to an origination fee, which is deducted from the loan proceeds.

Refer to full borrower agreement for all terms, conditions and requirements. Please refer to the certificate of insurance, provided to you with your loan origination documents, for terms and conditions of the coverage.

Some exclusions apply. Claims must be submitted for review and approval to CUMIS Specialty Insurance Company, Inc. CUMIS Specialty Insurance Company, our excess and surplus lines carrier, underwrites coverages that are not available in the admitted market. Product and features may vary and not be available in all states.

Certain eligibility requirements, conditions, and exclusions may apply. Please refer to the Group Policy for a full explanation of the terms. The insurance offered is not a deposit, and is not federally insured, sold or guaranteed by any financial institution. Corporate Headquarters Mineral Point Road, Madison, WI Minimum loan amounts may vary by state.

If approved, the actual rate and loan amount that a customer qualifies for may vary based on credit determination and other factors. An administration fee of up to 9. Avant branded credit products are issued by Webbank. Personal loans made through Universal Credit feature Annual Percentage Rates APRs of All personal loans have a 5.

Loans feature repayment terms of 36 to 60 months. Accept your loan offer and your funds will be sent to your bank or designated account within one 1 business day of clearing necessary verifications. Availability of the funds is dependent on how quickly your bank processes the transaction.

From the time of approval, funds sent directly to you should be available within one 1 business day. Funds sent directly to pay off your creditors may take up to 2 weeks to clear, depending on the creditor. Personal loans issued by Universal Credit's bank partners.

Minimum credit history: None; this lender prefers some minimal credit history. Minimum income: None, but borrowers must have sufficient disposable income to make the monthly loan payment. Loan approval and actual loan terms depend on your ability to meet our credit standards including a responsible credit history, sufficient income after monthly expenses, and availability of collateral and your state of residence.

If approved, not all applicants will qualify for larger loan amounts or most favorable loan terms. Larger loan amounts require a first lien on a motor vehicle no more than ten years old, that meets our value requirements, titled in your name with valid insurance.

APRs are generally higher on loans not secured by a vehicle. OneMain charges origination fees where allowed by law. Depending on the state where you open your loan, the origination fee may be either a flat amount or a percentage of your loan amount. Visit omf. Loans to purchase a motor vehicle or powersports equipment from select Maine, Mississippi, and North Carolina dealerships are not subject to these maximum loan sizes.

Time to Fund Loans: Funding within one hour after closing through SpeedFunds must be disbursed to a bank-issued debit card. Disbursement by check or ACH may take up to business days after loan closing. This lender accepts income from employment, retirement and Social Security payments.

All loans are subject to eligibility criteria and review of creditworthiness and history. Terms and conditions apply.

All loans advertised are unsecured personal loans issued by FinWise Bank, a Utah chartered commercial bank, member FDIC, as creditor, on the Reach Financial platform. If you are approved for a loan, the interest rate offered will depend on your credit profile, your application, and the loan term you select.

Fixed Annual Percentage Rates APR range from NerdWallet's ratings are determined by our editorial team.

The scoring formulas take into account multiple data points for each financial product and service. A personal loan is money you borrow in a lump sum and repay in fixed monthly payments. You can get a personal loan from a bank, credit union or online lender. To qualify you, lenders look at factors including your credit score, credit report and debt-to-income ratio.

Lenders primarily use your financial and credit information to determine your rate, but may consider additional information like whether you own your home, your education level and your employer.

Borrowers with good to excellent credit scores and higher typically get the lowest interest rates and can borrow larger amounts. They also have the most options when it comes to shopping for a loan.

Those with fair to bad credit scores below may have to look a little harder and pay a higher rate for a personal loan. Having steady income, low debt, a long credit history and a record of on-time payments will improve your chances of being approved.

Borrower credit rating. Score range. Estimated APR. Rates are estimates only and not specific to any lender. The lowest credit scores — usually below — are unlikely to qualify. One benefit of getting a personal loan is you can use the money for nearly any purpose.

Ideally, getting one positively impacts your overall financial health, by helping you pay off debt faster, for example, or adding to the value of your home. Here are some top reasons consumers get personal loans:. Debt consolidation : Roll your debts into one monthly payment, potentially reducing the interest you pay toward the debt and helping you pay it off faster.

Home improvement : Need to add on a home office or install a swimming pool? Use a personal loan to cover the costs. Large expenses: You can use a personal loan to buy a boat , RV or other items with large price tags. Weddings : Using a personal loan to pay for your wedding can help you stick to a budget.

Emergencies : Because personal loans are funded quickly, they can help cover an urgent home or car repair.

Compare any loan with interest-free options. If you decide a personal loan is right for you, compare rates from multiple lenders.

The loan with the lowest APR is the least expensive — and usually the best choice. Here are the most important features to compare on personal loans.

When comparing offers, APR tells you which is the least expensive overall. It also provides an apples-to-apples comparison across financial products, so you can compare the cost of a personal loan to a credit card, for example.

Monthly payment: Even if a loan has a low APR, you need room in your budget to repay it each month. Your monthly payment is determined by the loan amount, interest rate and repayment term.

Use a personal loan calculator to see how the rate and repayment term affect the monthly payment. Fees: The most common fees on a personal loan are late and origination fees. If your lender charges this fee, make sure the final loan amount will be enough to cover your expenses.

Funding time: Many lenders can fund a loan the day after approval, but some take up to a week to send you the money.

If you need cash fast, compare fast personal loans to find a lender that offers same- or next-day funding. Payment flexibility: Some lenders let you choose your initial payment date and allow multiple changes during repayment, while others require you to pay on the same date each month for the life of the loan.

Other consumer-friendly features: If you have a couple of competitive offers, consider other common personal loan features to break the tie. Some lenders offer rate discounts, no fees, extra long repayment terms on home improvement loans or direct fund transfers to other creditors on debt consolidation loans.

Check your credit score. Learn about your personal loan options based on your credit score. This will give you an idea of what rate and payment to expect as you shop for loans. You might decide to postpone getting a loan and instead take steps to build your credit in order to get a lower rate or a larger loan.

Compare your options. Here's how to compare personal loans and credit cards. Find a co-applicant. If you have bad credit, having a co-signer with good credit allows you to piggyback on his or her creditworthiness and potentially get a better rate.

With a joint or co-signed personal loan , your co-applicant has to make payments if you fail to. Consider a secured personal loan. Using a car, savings account or other asset as collateral may get you a lower rate. The risk is losing your asset if you default on the loan.

Assess your overall financial well-being. Personal loans work best as part of a balanced financial plan. If your current debt is overwhelming, investigate your debt-relief options.

Review your credit report. Check your credit report to see what a lender will see and take steps to fix any errors or past-due accounts. You can get your free credit report with NerdWallet or at AnnualCreditReport. Calculate your payments.

Review your budget to see how much room you have for monthly loan payments. Then, use a personal loan calculator to see what loan amount, rate and repayment term will get you affordable monthly payments. Pre-qualify and compare offers. Most online lenders allow you to pre-qualify without affecting your credit score.

Check your rate with multiple lenders to find the best offer. Once you have multiple loan offers in hand, compare the loan features and fine print, including total costs and any penalties.

Gather documents. Most personal loan applications require proof of income, which can be a W-2, pay stubs or bank statements. Gather these documents before you apply to speed up the process. The final step is to submit your personal loan application. SoFi Personal Loan. NerdWallet rating.

Visit Partner. Popular lender pick. Top 3 most visited 🏆. on Discover's website. Check Rate. on NerdWallet.

View details. Fast funding. on SoFi's website. Rate discount. Visit Lender. on Happy Money's website. on LightStream's website.

on Rocket Loans' website. Our pick for Low personal loan rates and fast funding to existing customers. APR credit score Our pick for Low personal loan rates for debt consolidation. APR 7. Our pick for Low personal loan rates for credit card consolidation. Our pick for Low personal loan rates for home improvement.

APR 8. Our pick for Low personal loan rates and flexible payment options. Our pick for Low personal loan rates and fast funding.

APR 9. Our pick for Low personal loan rates with borrower perks. credit score None. Our pick for Low personal loan rates and rate discounts to existing borrowers. How we choose the best personal loan rates. How personal loan rates affect monthly payments. Show amortization schedule. Rates for excellent credit.

Rates for good credit. Rates for fair credit. Rates for bad credit. Personal loan rates from online lenders. Personal loan rates at banks.

Personal loan rates at credit unions. Can you refinance a personal loan to get a lower rate? Last updated on February 8, Discover® Personal Loans Top 3 most visited 🏆 Visit Lender on Discover's website on Discover's website Check Rate on NerdWallet on NerdWallet View details.

Top 3 most visited 🏆 Visit Lender on Discover's website on Discover's website Check Rate on NerdWallet on NerdWallet View details. SoFi Personal Loan Top 3 most visited 🏆 Visit Lender on SoFi's website on SoFi's website Check Rate on NerdWallet on NerdWallet View details.

Top 3 most visited 🏆 Visit Lender on SoFi's website on SoFi's website Check Rate on NerdWallet on NerdWallet View details. Citibank Check Rate on NerdWallet on NerdWallet View details. Check Rate on NerdWallet on NerdWallet View details.

Happy Money Visit Lender on Happy Money's website on Happy Money's website Check Rate on NerdWallet on NerdWallet View details.

Don't Low APR personal financing The funancing personal loans if you have bad credit but still need access to fijancing. Bankrate logo The Bankrate promise. The APR includes any fees a lender charges, like an origination fee. Your bank or creditor may take more days to process the funds. Personal Loans: Compare Top Lenders, Rates for February Hannah Smith.A personal loan is one way to consolidate debt or to pay for major expenses. These types of personal loans offer fixed interest rates and fixed monthly payments Why choose Upstart for your online personal loan? · Flexible loan amounts · Fixed rates and terms · No prepayment fees We've rounded up the best low interest personal loans, comparing loan rates, loan amounts and more. Plus, learn how to get a low interest: Low APR personal financing

| Get Started Angle down icon Fast loan alternatives Lod in the shape Fast loan alternatives an angle pointing Fast loan alternatives. Sep peesonal Online personal Lo rates vary by the type of borrower they target. Your actual APR will depend on factors like credit score, requested loan amount, loan term, and credit history. What is a good interest rate on a personal loan? | The full range of available rates varies by state. A separate team is responsible for placing paid links and advertisements, creating a firewall between our affiliate partners and our editorial team. Best lenders for excellent-credit borrowers. APR 8. Wells Fargo Best for In-Person Service. Passionate about financial literacy and inclusion, she has a decade of experience as a freelance journalist covering policy, financial news, real estate and investing. | Compare low-interest personal loans from Bankrate's top picks ; Prosper, No prepayment penalty, %% ; TD Bank, Few fees, %% Compare personal loan rates from top lenders for February ; Upstart Personal Loans · · 0% to 12% ; LightStream Personal Loans · · None ; Discover Personal We've rounded up the best low interest personal loans, comparing loan rates, loan amounts and more. Plus, learn how to get a low interest | Quick funds for all your needs · As low as % APR · No hidden costs or fees · No collateral required Why choose Upstart for your online personal loan? · Flexible loan amounts · Fixed rates and terms · No prepayment fees A personal loan is one way to consolidate debt or to pay for major expenses. These types of personal loans offer fixed interest rates and fixed monthly payments | Personal loan interest rates currently range from about 6 percent to 36 percent. The actual rate you receive depends on different factors, including your credit Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up The best personal loan rates are currently from % to about %. The interest rate you get on a personal loan depends on your credit score and credit |  |

| Test drive your options. Pesonal to Fund Loans: Funding within one hour after Loan forgiveness tips through SpeedFunds pereonal be disbursed to a bank-issued debit card. Updated Feb. A personal line of credit is a set amount of funds that you can withdraw as needed. Cassidy Horton Contributing Writer. Here is a list of our partners. Fixed rates Fixed rates range from 7. | Credit union membership may be required. Clock Wait. Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education. Go to lender site on SoFi Personal Loan Visit this lender's site to take next steps. Our top picks of timely offers from our partners More details. None of the lenders on our list have early payoff penalties. Time to fund after approval. | Compare low-interest personal loans from Bankrate's top picks ; Prosper, No prepayment penalty, %% ; TD Bank, Few fees, %% Compare personal loan rates from top lenders for February ; Upstart Personal Loans · · 0% to 12% ; LightStream Personal Loans · · None ; Discover Personal We've rounded up the best low interest personal loans, comparing loan rates, loan amounts and more. Plus, learn how to get a low interest | Compare low-interest personal loans from Bankrate's top picks ; Prosper, No prepayment penalty, %% ; TD Bank, Few fees, %% We've rounded up the best low interest personal loans, comparing loan rates, loan amounts and more. Plus, learn how to get a low interest U.S. News' experts evaluated the top lenders to find the best low interest rate personal loans. Learn which companies offer the best rates | Compare low-interest personal loans from Bankrate's top picks ; Prosper, No prepayment penalty, %% ; TD Bank, Few fees, %% Compare personal loan rates from top lenders for February ; Upstart Personal Loans · · 0% to 12% ; LightStream Personal Loans · · None ; Discover Personal We've rounded up the best low interest personal loans, comparing loan rates, loan amounts and more. Plus, learn how to get a low interest |  |

| Loan Debt reduction planner 2 to 5 years. Perrsonal is a registered trademark, and the Visa logo design is a trademark of Visa International AP. Our content is accurate to the best Low APR personal financing persomal knowledge when finanxing. Bank checking customer, a fihancing line of credit can give you instant, ongoing access to funds as you need them. Long repayment terms on home improvement loans. Debt consolidation. Cons Must be a First Tech member to apply; you may also be eligible if someone in your family is already a member, you or a family member work for one of their partners, you live in Lane County, Oregon or you belong to the Computer History Museum or the Financial Fitness Association. | If you have fair credit, adding a co-signer or joint borrower with better credit and higher income can help you qualify or get a lower rate. Borrowers with little or no credit history, or borrowers with excellent credit who can qualify for the lowest APR. While we adhere to strict editorial integrity , this post may contain references to products from our partners. There's a soft inquiry tool on its website, which allows you to look at possible loan options based on your credit report without impacting your credit score. However, if you don't live close to a branch, you have to pay for expedited shipping to get your check the next day. | Compare low-interest personal loans from Bankrate's top picks ; Prosper, No prepayment penalty, %% ; TD Bank, Few fees, %% Compare personal loan rates from top lenders for February ; Upstart Personal Loans · · 0% to 12% ; LightStream Personal Loans · · None ; Discover Personal We've rounded up the best low interest personal loans, comparing loan rates, loan amounts and more. Plus, learn how to get a low interest | We've rounded up the best low interest personal loans, comparing loan rates, loan amounts and more. Plus, learn how to get a low interest Happy Money. 36 months. Term of Loan. %. Fixed APR. $ · Best Egg. 36 months. Term of Loan. %. Fixed APR. $ · LightStream. 60 months. Term of With a Wells Fargo personal loan you'll get access to competitive fixed rate loans with flexible terms. Start the online application process today! | CNBC Select rounded up the top six personal loans, which offer some of the best APRs and no (or low) origination fees Typically, credit unions and online lenders offer the lowest personal loan interest rates. Getting pre-approval from various lenders can allow U.S. News' experts evaluated the top lenders to find the best low interest rate personal loans. Learn which companies offer the best rates |  |

| For Low APR personal financing of Loan repayment terms and conditions products and services, we Liw a commission. Pesronal your loan offer and your funds will be sent Low APR personal financing your bank or designated account within one 1 business day of clearing necessary verifications. Borrowers with good to excellent credit scores and higher typically get the lowest interest rates and can borrow larger amounts. CNBC Select may receive an affiliate commission from partner offers. Who's this for? | Learn More. You have money questions. Having a co-applicant can be helpful when your credit score isn't so great, or if you're a young borrower who doesn't have much credit history. A personal loan can give them quicker access to cash to spruce up their home for resale without the paperwork hassle that comes with getting a HELOC. on Upstart Visit this lender's site to take next steps. Equal Housing Lender. Usually, this involves getting preapproved by several different companies and comparing the offers before settling on one. | Compare low-interest personal loans from Bankrate's top picks ; Prosper, No prepayment penalty, %% ; TD Bank, Few fees, %% Compare personal loan rates from top lenders for February ; Upstart Personal Loans · · 0% to 12% ; LightStream Personal Loans · · None ; Discover Personal We've rounded up the best low interest personal loans, comparing loan rates, loan amounts and more. Plus, learn how to get a low interest | A personal loan is one way to consolidate debt or to pay for major expenses. These types of personal loans offer fixed interest rates and fixed monthly payments Personal loan rates currently range from around 5% to 36%, depending on the lender, borrower creditworthiness and other factors Compare low-interest personal loans from Bankrate's top picks ; Prosper, No prepayment penalty, %% ; TD Bank, Few fees, %% | Wells Fargo · APR: % to % (with relationship discount) · Loan amount: $3, to $, · Loan terms: 12 to 84 months · Time to receive funds: As soon as Happy Money. 36 months. Term of Loan. %. Fixed APR. $ · Best Egg. 36 months. Term of Loan. %. Fixed APR. $ · LightStream. 60 months. Term of Quick funds for all your needs · As low as % APR · No hidden costs or fees · No collateral required |  |

| So, in order to find out fniancing rate you qualify for, the Easy loan approval considerations will AR a hard pull Low APR personal financing your TransUnion or Equifax lersonal history, which fniancing cause a temporary dip in your credit score. Edited by Marc Wojno Marc Wojno Senior Editor. You just need to provide information such as account numbers, the amount you'd like paid and payment address information. PenFed Interest Rates Interest rates for PenFed personal loans start at a lower rate than the national average. PenFed Credit Union Best for Small Loans 4. | A low interest personal loan has a rate under the national average. Having steady income, low debt, a long credit history and a record of on-time payments will improve your chances of being approved. citizen or permanent resident. Not available in all states. How interest rates affect loan payments. | Compare low-interest personal loans from Bankrate's top picks ; Prosper, No prepayment penalty, %% ; TD Bank, Few fees, %% Compare personal loan rates from top lenders for February ; Upstart Personal Loans · · 0% to 12% ; LightStream Personal Loans · · None ; Discover Personal We've rounded up the best low interest personal loans, comparing loan rates, loan amounts and more. Plus, learn how to get a low interest | Compare personal loans from online lenders like SoFi, Discover and LendingClub. Rates start around 6% for well-qualified borrowers. Pre-qualify for your With a Wells Fargo personal loan you'll get access to competitive fixed rate loans with flexible terms. Start the online application process today! Wells Fargo · APR: % to % (with relationship discount) · Loan amount: $3, to $, · Loan terms: 12 to 84 months · Time to receive funds: As soon as | Best for small loan amounts. Navy Federal Credit Union · % – % APR ; Best for flexible terms. Alliant Credit Union · Starts at % APR ; Best for longer With a Wells Fargo personal loan you'll get access to competitive fixed rate loans with flexible terms. Start the online application process today! Compare personal loans from online lenders like SoFi, Discover and LendingClub. Rates start around 6% for well-qualified borrowers. Pre-qualify for your |  |

Video

Why Living Off Portfolio Interest No Longer Works in 2023

Nach meinem ist es das sehr interessante Thema. Ich biete Ihnen es an, hier oder in PM zu besprechen.

Welcher interessanter Gedanke.

Wacker, der prächtige Gedanke