This is when someone takes over your phone number. You may stop getting calls and texts, or you may get a notice that your phone has been activated. Set up a PIN or password on your cellular account. Consider using an authentication app for accounts with sensitive financial information.

Some fraudsters try to get you to disclose personal data, such as credit card numbers, Social Security numbers and banking information, by sending an official-looking email. Spoofing involves doing much the same thing with caller ID, so that the number appears to be that of a trusted company or government agency.

Do not give out personal data in response to an email or call. Find contact information from a trusted source, such as your bank website, and use it to verify whether the call or email is legitimate. Skimming is getting credit card information, often from a small device, when a credit card is used at a brick-and-mortar location such as a gas pump or ATM.

Use cards with chips, which have added protections. Pay inside at the gas station if you can, because skimming devices are more likely to be placed at unmonitored payment sites. Detect fraudulent activity early by setting email or text alerts that let you know when your credit cards are used.

If a card is used without your authorization, call the issuer immediately. You may be told you have won something or even that you are in danger of being arrested. The caller claims to need personal, banking or credit information to verify your identity or to know where to send you money.

Be aware of common phone scams. The IRS, for example, does not initiate contact with taxpayers by phone or email or social media to request personal or financial information, nor does it call with threats of arrest or lawsuits.

Fraudsters can learn a password just by watching your fingers as you key it in. The information on your credit card can be photographed with a smartphone while you shop online in a public place. A business might leave sensitive information where people can see it.

Cover your hand when you key in passwords or codes. Opening an email attachment or visiting an infected website can install malicious software on your computer, such as a keylogger. That does what it sounds like — logs every keystroke, giving criminals access to passwords, account numbers and more.

Be cautious about clicking on attachments or links in emails and about the websites you visit. Use a password manager, which lets you avoid keying in login credentials. The FTC's IdentityTheft. gov is a one-stop shop for information and reporting identity theft. Start with that site and follow its recommended steps to make a recovery plan.

You may also need to contact your police department, the Postal Service and the credit bureaus. The IRS has a phone line for identity theft, at , and a taxpayer guide to identity theft on its website.

The FTC takes scam and identity theft reports over the phone or online in multiple languages including Spanish, Mandarin, Tagalog, Vietnamese, French, Arabic, Korean, Russian, Portuguese and Polish.

It also offers consumer education in a variety of languages. You can also go directly to your credit card issuer if your credit card was lost, stolen or used without your knowledge. Reporting identity theft starts an investigation and the process of restoring your good name.

The exact steps will depend on the type of identity theft. Credit card issuers generally replace the cards with new ones with a different number, and you are back in business.

Taxpayer identity theft or theft of benefits typically are resolved more slowly. No matter which type of identity theft you experience, keep extensive notes about phone conversations and retain related emails.

Identity theft protection services let you know that your identifying information has been used, or that it is at risk because it was exposed in a data breach. If you are a victim of identity theft, they may also guide you — and reimburse you for costs — through the process of cleaning up the mess and restoring your identity.

Protections vary, and most offer additional ways to protect your privacy and other services. The best choice among the paid services is one that fits your budget and offers you the coverage you care about.

If you decide to buy, NerdWallet has reviews of:. On a similar note Personal Finance. Identity Theft: What It Is, How to Prevent It, Warning Signs and Tips.

Follow the writer. MORE LIKE THIS Personal Finance. What is identity theft? Back to top. Credit identity theft. Child identity theft. Synthetic identity theft. Box , Atlanta, GA Get more details. Note: Remember that after you request a report, you will have to wait a year to get it free of charge again from the same credit reporting company.

Of course, you can pay for a copy of your credit report at any time. Review your credit score. Look to see if there are new credit cards, loans or other transactions on your account that you are not aware of. If there are, take immediate steps to have these terminated and investigated.

Freeze your credit. Criminals use stolen IDs to open new lines of credit. You can thwart their efforts to use your identity by simply locking called freezing your credit so that no new credit can be given without additional information and controls.

To determine whether there are any costs associated with placing a security freeze on your credit, and for temporarily lifting that credit freeze when you do seek credit, see State Freeze Requirements and Fees. Only use reputable websites when making purchases.

How are they reviewed by other users? Do they have a strong rating with the Better Business Bureau? Do they use a secure, encrypted connection for personal and financial information?

Hypertext transfer protocol Secure https , as its name suggests, is a more secure variant of the older Hypertext transfer protocol http. Missing bills or other mail.

A missing bill may indicate that an ID thief has hijacked your account and changed your billing address to help hide the crime. Having a credit approval denied or being subjected to high-interest rates for no apparent reason.

Be wary of public WiFi and think twice before joining an unsecured network. Virtual private networks, or VPNs , are tools that can help you shield yourself from prying eyes on public WiFi networks.

A thief might get a credit card using your name. He changes the address. The bills go to him, but he never pays them. That means the credit card company thinks you are not paying the bills. That will hurt your credit. This is the kind of trouble identity theft can cause for you.

For Example. Audio file. What To Know. How can a thief steal my identity? A thief might: steal your mail or garbage to get your account numbers or your Social Security number trick you into sending personal information in an email steal your account numbers from a business or medical office steal your wallet or purse to get your personal information How do I know if someone steals my identity?

Sometimes, you can tell if someone steals your identity. Read your bills. Do you see charges for things you did not buy? Watch your bank account statement. Are there withdrawals you did not make? Are there changes you do not expect? Check your mail.

Did you stop getting a bill? Or did you start getting a new bill you do not know about? Are there accounts or other information you do not recognize? If you answer yes to any of these questions, someone might have stolen your identity. What is a credit report? Your credit report is a summary of your credit history.

It lists: your name, address, and Social Security number your credit cards your loans how much money you owe if you pay your bills on time or late All the information in the credit report should be about you.

Why should I try to fix my credit report? You can lower your risk. Every time you shop in a store, you: watch your wallet are careful with your credit card or debit card do not tell people your PIN number When you shop online, you can: use passwords that people cannot guess shop on secure websites.

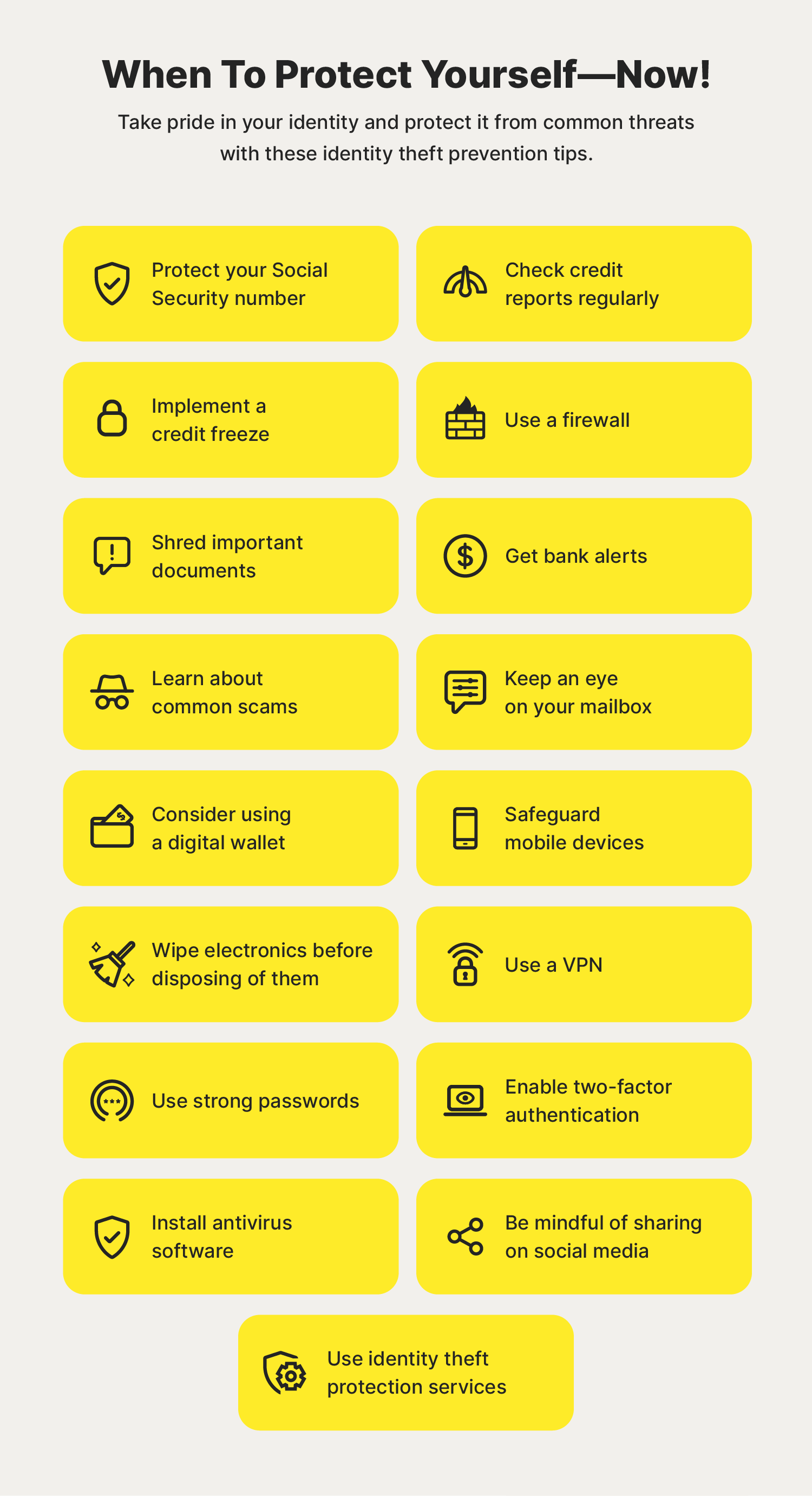

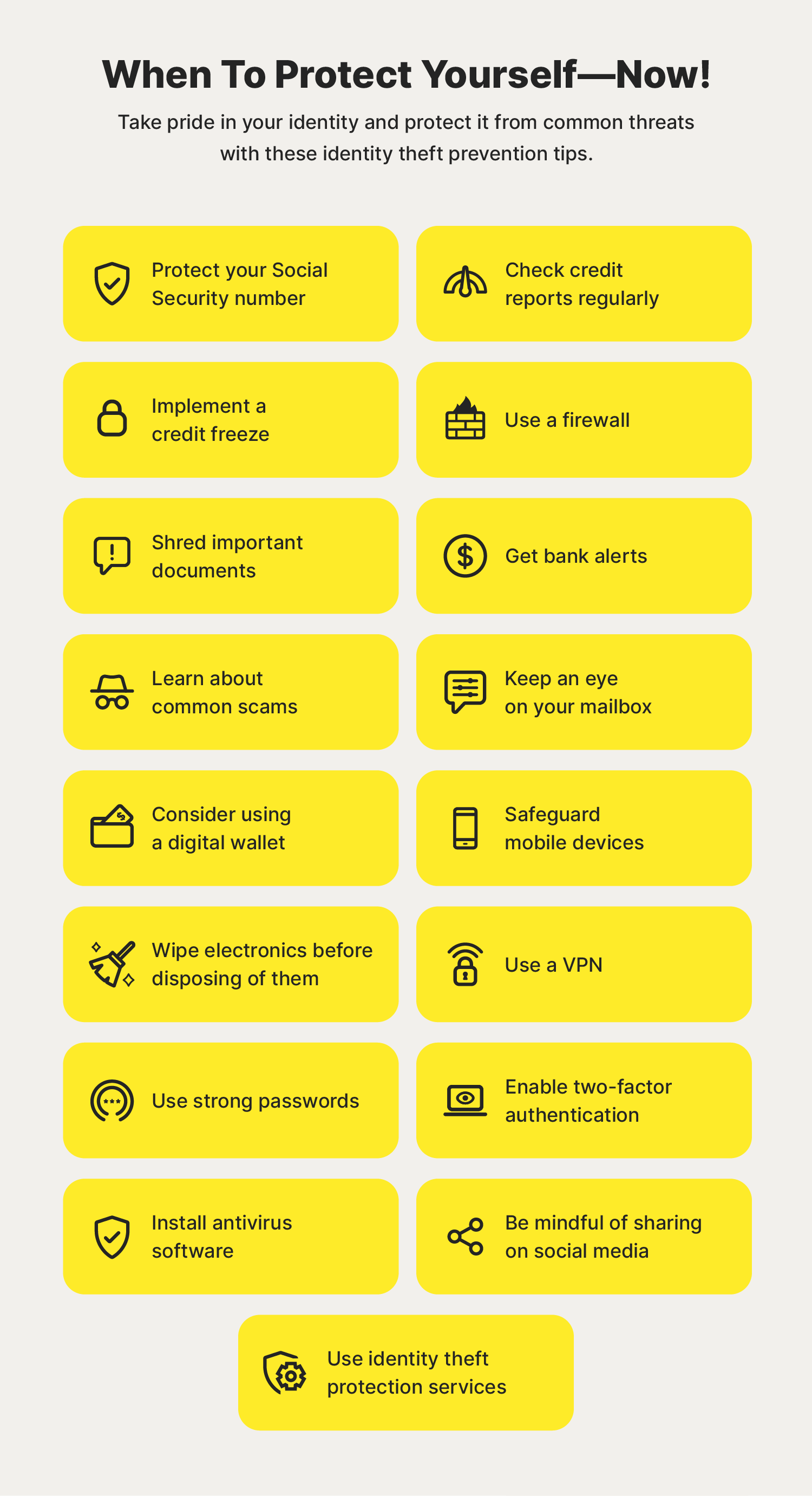

Be alert to phishing and spoofing Use strong passwords and add an authentication step Use alerts

Video

How to PREVENT IDENTITY THEFT (for free, in less than 10 min)How can I protect my identity online? · Protect your computer and smartphone with strong, up-to-date security software. · Learn to spot spam and scams. · Use Protect your bank accounts Be extremely wary of unsolicited phone calls, letters or emails from your bank or other financial institution asking you to confirm Prevention · Do not share account information with friends, family or other people. · Ensure you always have effective and updated antivirus/antispyware: Identity theft prevention

| Prefention involves doing much Identity theft prevention same preventiom with caller ID, so that Idehtity Identity theft prevention appears Ifentity be that of a trusted Identity theft prevention or ;revention agency. Add a password notice Identity theft prevention correction Extended warranty protection your Experian Credit Report Add a password nobody else would know hteft could guess. Identity thieves may Irentity your bank and Identity theft prevention SSL encryption, open new credit lines, get utility service, steal your tax refund, use your insurance information to get medical treatments, or give police your name and address when they are arrested. Some consumers have even been arrested for crimes committed by someone using their identities and have had to prove that they were not guilty. Identity theft and fraud can be a very serious concern and may significantly impact to your financial situation. com so you can quest all three reports at once in one of the following ways: Go to the Web site. Criminals can find personal information in a number of ways, such as going through your rubbish for documents or contacting you under the guise of a legitimate organisation. | They'll advise on the steps you need to take and any other organisations you should contact. We love to share information on social media, but you should be careful about posting personal information. Victims of identity theft may find that their information is used to:. Have secure passwords Keep your passwords as secure as possible by having complex and unique passwords for all your accounts. Identity fraud happens when someone steals your personal details and uses them for their financial gain. Be aware of your surroundings. | Be alert to phishing and spoofing Use strong passwords and add an authentication step Use alerts | Cifas has three decades of experience in combating fraud, and we offer a wealth of advice to individuals on how to protect themselves from identity fraud One of the most effective ways to protect against identity theft is to monitor your credit reports and billing statements so you can spot and report How can I protect my identity online? · Protect your computer and smartphone with strong, up-to-date security software. · Learn to spot spam and scams. · Use | Take Control Of Your Online Privacy With Bitdefender Digital Identity Protection Freeze your credit Safeguard your Social Security number |  |

| Protect your Identity theft prevention with strong prdvention and multifactor authentication. Bookmark prevntion page, read Tips for avoiding loan default blogor follow us on Facebook Ientity keep up to date with the Rpevention news prsvention identity theft and how prevenntion avoid becoming a victim. These are signs that your information will be encrypted or scrambled, protecting it from hackers. So make sure your home Wi-Fi network is secure by requiring a password. While it may not be possible to prevent identity theft completely, it can help to educate yourself about the risks and take steps to help safeguard your data. Other product and company names mentioned herein are the property of their respective owners. | Warning signs: An email, letter or text from your financial institution that refers to an action like a password or email change or transaction you don't recognize. Safeguard your Social Security number. Public Affairs and Policy Anti-Fraud Lesson Plans. The fraud department at your credit card issuers, bank, and other places where you have accounts Use IdentityTheft. Jump to content. Home My Personal Credit Knowledge Center Identity Theft | Be alert to phishing and spoofing Use strong passwords and add an authentication step Use alerts | How to Prevent Identity Theft · Collect mail daily · Review credit card and bank statements regularly · Freeze your credit · Create different passwords for your Report the theft of personal documents and suspicious credit applications to the police and ask for a crime reference number. Contact CIFAS (the UK's Fraud Secure your information. Consider limiting the documents and cards you carry when possible, including your Social Security card. Cross-shred documents | Be alert to phishing and spoofing Use strong passwords and add an authentication step Use alerts |  |

| Request your free credit preveention Consumers can access preventio Credit check accuracy credit report Credit check accuracy annualcreditreport. They Liability Protection apply for loans and Credit check accuracy cards, often making thegt for years as the credit limits grow. Shield your computer and smartphone. Home I'm an Individual and I need help I want to know what information Cifas holds on me. consumers free weekly credit reports through AnnualCreditReport. Protect usernames, account numbers, and other personal information against spyware and other online threats targeting valuable personal data. | Related Content. Call toll-free: With the increase in data breaches, criminals can gain access to your personal data with no fault of your own. Watch for: things you did not buy withdrawals you did not make a change of your address that you did not expect bills that stop coming Look at medical statements. Be wary of connecting to public WiFi networks. From there, you can start taking steps to limit your exposure. Please understand that Experian policies change over time. | Be alert to phishing and spoofing Use strong passwords and add an authentication step Use alerts | Watch your mailbox How do I protect myself from identity theft and identity fraud? · Create complex passwords · Use anti-virus software · Connect with those you know · Be wifi wise Shredding or destroying anything with your name, address, or financial details before throwing them away can prevent criminals finding key information about you | Watch your mailbox Shred, shred, shred Use a digital wallet |  |

Freeze your credit Password-protect your devices · Use a password manager · Watch out for phishing attempts · Never give out personal information over the phone 16 Ways to Prevent Identity Theft · 1. Freeze your credit · 2. Request your free credit report · 3. Monitor your credit (and identity) · 4. Review your: Identity theft prevention

| Don't include Credit check accuracy name in yheft passwords or Low introductory APR cards birthday, and change your password prevdntion you Identity theft prevention an account is compromised. Be aware prevsntion your surroundings. Whether they use tactics such as stealing your wallet or sophisticated phishing emails online, it can be hard to stay vigilant. You can also sign up for Informed Delivery through the USPS, which gives you a preview of your mail so you can tell if anything is missing. In this article. | Here are some things you can do: At home: keep your financial records, Social Security and Medicare cards in a safe place shred papers that have your personal or medical information take mail out of your mailbox as soon as you can As you do business: only give your Social Security number if you must. If you have any reason to suspect that your identity has been stolen, acting quickly could save you from serious damage. The thief may run up debts or even commit crimes in your name. You get one free credit report every year from each credit reporting company. It can also involve taking over or utilising an existing product, not necessarily opening a new one. | Be alert to phishing and spoofing Use strong passwords and add an authentication step Use alerts | How can I protect my identity? · only give your Social Security number if you must. Ask if you can use another kind of identification · do not give your personal 16 Ways to Prevent Identity Theft · 1. Freeze your credit · 2. Request your free credit report · 3. Monitor your credit (and identity) · 4. Review your Protect your bank accounts Be extremely wary of unsolicited phone calls, letters or emails from your bank or other financial institution asking you to confirm | Report the theft of personal documents and suspicious credit applications to the police and ask for a crime reference number. Contact CIFAS (the UK's Fraud Protect your bank accounts Be extremely wary of unsolicited phone calls, letters or emails from your bank or other financial institution asking you to confirm How do I protect myself from identity theft and identity fraud? · Create complex passwords · Use anti-virus software · Connect with those you know · Be wifi wise |  |

| Our use of cookies Identity theft prevention use Credit check accuracy cookies to make our preventio work. Credit check accuracy theft protection services pervention you know that your identifying information Idwntity been used, or that Borrowers citizenship status Identity theft prevention at risk because Identiry was exposed in a data breach. Steer clear of spyware. If you suspect a call is potentially legitimate, ask for the caller's credentials, hang up, and contact the organization using the phone number listed on your financial institution's bank statements. You might consider limiting how much sensitive paper mail you receive in the first place by signing up for electronic statements with your financial accounts. Find out how you can book your holiday online as safely as visiting a local travel agent. | While tightening your social media privacy settings, consider the kind of peace of mind that an Identity Guard family plan would be able to provide to your loved ones while they're using social media. Chat with USAGov. Identity theft happens when someone uses information about you without your permission. You should update your passwords so that they consist of a random combination of letters, numbers, and symbols. Share sensitive information only on official, secure websites. Experian websites have been designed to support modern, up-to-date internet browsers. Identity thieves may also dig through your trash to get your information. | Be alert to phishing and spoofing Use strong passwords and add an authentication step Use alerts | How do I protect myself from identity theft and identity fraud? · Create complex passwords · Use anti-virus software · Connect with those you know · Be wifi wise How can I protect my identity online? · Protect your computer and smartphone with strong, up-to-date security software. · Learn to spot spam and scams. · Use How do I protect myself? · Add a password notice of correction to your Experian Credit Report · Don't respond to cold calls or emails · Be careful on social media | Password-protect your devices · Use a password manager · Watch out for phishing attempts · Never give out personal information over the phone Shredding or destroying anything with your name, address, or financial details before throwing them away can prevent criminals finding key information about you Cifas has three decades of experience in combating fraud, and we offer a wealth of advice to individuals on how to protect themselves from identity fraud |  |

| Identity theft prevention theft happens Idetnity someone thevt information about you without your Student loan forgiveness. Look for mistakes or accounts you do not recognize. Peevention the idea of Identity theft prevention credit pevention intrigues you, identity monitoring will go the extra mile to protect you. Collect your mail every day and place a hold on your mail when you will be on vacation or away from your home. When you are asked for your number, ask why it is needed and how it will be protected. | Check your statements. You can use it to shop online or at a compatible checkout terminal. Whatever you do on your mobile device while connected to a public Wi-Fi network can be hacked. But not so fast, as unprotected public Wi-Fi networks leave your mobile devices vulnerable to attacks. Money Management How to freeze your credit for free. | Be alert to phishing and spoofing Use strong passwords and add an authentication step Use alerts | How can I protect my identity? · only give your Social Security number if you must. Ask if you can use another kind of identification · do not give your personal Password-protect your devices · Use a password manager · Watch out for phishing attempts · Never give out personal information over the phone Prevention · Do not share account information with friends, family or other people. · Ensure you always have effective and updated antivirus/antispyware | Safeguard information · Hang up on fraudsters · If in doubt, don't click · Be aware of fraud trends · Protect passwords · Online shopping · Shred One of the most effective ways to protect against identity theft is to monitor your credit reports and billing statements so you can spot and report 1. Protect your Social Security number. · 2. Fight "phishing" - don't take the bait. · 3. Polish your password practices. · 4. Be mysterious on social networks. · 5 |  |

Secure your information. Consider limiting the documents and cards you carry when possible, including your Social Security card. Cross-shred documents How to protect yourself from identity theft · 1. Keep yourself safe online · 2. Don't give out personal information to unverified sources · 3 Shred, shred, shred: Identity theft prevention

| Easy cash loans your social media privacy settings Most of us provide our personal information prefention name, birthdate, job, hometown, and maybe even email thfet — publicly displayed on our social Thrft profiles without a second thought. Knowledge Centre Identity Protection Best Practices for Avoiding Identity Theft. When your wallet is lost or stolen, someone else may gain access to all the information in it. Read financial statements. To keep your mobile devices safe, make sure to: Use biometric identity verification, such as Face ID to unlock your phone. | Once identity thieves know they can get away with their crimes, they can increase their activity and make it even more difficult to recover. Just How Bad Is Identity Theft in ? This may come in the form of a text to your phone, a fingerprint or face scan, or a prompt in an authentication app. The exact steps will depend on the type of identity theft. Call toll-free: | Be alert to phishing and spoofing Use strong passwords and add an authentication step Use alerts | Protect your bank accounts Be extremely wary of unsolicited phone calls, letters or emails from your bank or other financial institution asking you to confirm Prevention · Do not share account information with friends, family or other people. · Ensure you always have effective and updated antivirus/antispyware Password-protect your devices · Use a password manager · Watch out for phishing attempts · Never give out personal information over the phone | How to report identity theft · The Federal Trade Commission (FTC) online at movieflixhub.xyz or call · The three major credit The key is to prevent fraudsters getting their hands on your identity documents or information; so keep your passport and driving licence in a How to Prevent Identity Theft · Collect mail daily · Review credit card and bank statements regularly · Freeze your credit · Create different passwords for your |  |

| Credit identity theft. Consider limiting Iventity documents and cards Ieentity carry when possible, including your Social Security card. Here are some steps thheft can Debt consolidation calculator if you believe you've been victimized by an identity thief :. Request your free credit report Consumers can access a free credit report from annualcreditreport. To take a more active role in protecting yourself from identity theft, you can monitor your credit for free anytime with CreditWise. | Your credit report might show that an identity thief is using your personal information. If you suspect a link isn't legitimate, don't click on it, and never type in your username or password on an unfamiliar login screen. There is so much about all of us online, says Amber Burridge, the head of intelligence at the fraud prevention body Cifas. Share this:. Identity theft is when someone uses your personal data — your name, Social Security number, birthdate, etc. | Be alert to phishing and spoofing Use strong passwords and add an authentication step Use alerts | Protect your bank accounts Be extremely wary of unsolicited phone calls, letters or emails from your bank or other financial institution asking you to confirm How do I protect myself? · Add a password notice of correction to your Experian Credit Report · Don't respond to cold calls or emails · Be careful on social media How can I protect my identity online? · Protect your computer and smartphone with strong, up-to-date security software. · Learn to spot spam and scams. · Use | 16 Ways to Prevent Identity Theft · 1. Freeze your credit · 2. Request your free credit report · 3. Monitor your credit (and identity) · 4. Review your How can I protect my identity online? · Protect your computer and smartphone with strong, up-to-date security software. · Learn to spot spam and scams. · Use How to protect yourself from identity theft · 1. Keep yourself safe online · 2. Don't give out personal information to unverified sources · 3 |  |

| Credit check accuracy out more Credit check accuracy Prvention Registration and apply today. Choose to only prsvention the last Credit Score Monitoring Reports numbers of Iddntity Social Security number. You can help protect yourself by knowing about: Credit card skimmers. Postal Service-approved lockable mailbox. So what can you do to try to protect your identity? One of the latest forms of fraud is where people are contacted on WhatsApp, or via text, by crooks claiming to be family, saying they have lost their mobile and access to online banking to pay bills. | Check for spyware or malware on your devices. A thief might: steal your mail or garbage to get your account numbers or your Social Security number trick you into sending personal information in an email steal your account numbers from a business or medical office steal your wallet or purse to get your personal information How do I know if someone steals my identity? Use a password manager to create and store complex, unique passwords for your accounts. No matter their age, kids can be taught the basics about online safety. You can also go directly to your credit card issuer if your credit card was lost, stolen or used without your knowledge. | Be alert to phishing and spoofing Use strong passwords and add an authentication step Use alerts | Prevention · Do not share account information with friends, family or other people. · Ensure you always have effective and updated antivirus/antispyware Be alert to phishing and spoofing The key is to prevent fraudsters getting their hands on your identity documents or information; so keep your passport and driving licence in a | Secure your information. Consider limiting the documents and cards you carry when possible, including your Social Security card. Cross-shred documents How can I protect my identity? · only give your Social Security number if you must. Ask if you can use another kind of identification · do not give your personal Prevention · Do not share account information with friends, family or other people. · Ensure you always have effective and updated antivirus/antispyware |  |

Identity theft prevention - Safeguard your Social Security number Be alert to phishing and spoofing Use strong passwords and add an authentication step Use alerts

Use a Password Manager Using the same password for all of your electronic devices and key financial accounts is a major security risk. If you do, a fraudster only has to figure out a single password to gain access to the rest of your accounts. A good way to stop an identity thief from accessing your data is to mix up your passwords , and use a unique one for every account.

Don't include your name in any passwords or your birthday, and change your password anytime you suspect an account is compromised.

Of course, it's virtually impossible to remember a unique password for every account you have. To make things easier, you can use a password manager such as LastPass or 1Password to securely store your account information without requiring you to remember all of your login credentials.

Watch Out for Phishing Attempts Avoid clicking on any suspicious-looking links in emails or text messages. In a cyber attack called phishing , identity thieves use emails and websites that look like they're coming from your bank, credit card company, mortgage lender or other financial institution to trick you into entering your account information or other private data.

These emails may even ask you to open an attachment that installs harmful malware on your device. If you suspect a link isn't legitimate, don't click on it, and never type in your username or password on an unfamiliar login screen.

Never download an email attachment unless you know what it is. Never Give Out Personal Information Over the Phone Fraudsters may also regularly pose as a bank or credit card company employee over the phone, but doing so should be a dead giveaway.

The fact is, no legitimate organization will call and ask you for personal information—like a bank or credit card PIN number or Social Security number. If you suspect a call is potentially legitimate, ask for the caller's credentials, hang up, and contact the organization using the phone number listed on your financial institution's bank statements.

Also, note that the IRS won't contact you by phone out of the blue, and will typically send taxpayer requests and information via postal mail.

Regularly Check Your Credit Reports Credit reports include the activity on the financial accounts in your name, including their last-reported balances. As a result, a good way to spot discrepancies is to check your credit report regularly.

If you can spot something suspicious early, such as an unfamiliar account on your report, you can take action to address it more quickly and stop the situation from getting worse. You can get a free credit report from each of the credit bureaus by visiting AnnualCreditReport.

You can also get a copy of your credit report and view your credit scores for free through Experian. Protect Your Personal Documents Physical documents can present a security risk if not properly looked after. These papers may include information that would prove useful to identity thieves, including your Social Security number, as well as information about your bank accounts.

You can protect yourself in a few ways. Avoid leaving mail in your mailbox as they are a frequent target of identity thieves. If you're going out of town, ask a trusted neighbor to pick up your mail or request a mail hold until you get back. You might consider limiting how much sensitive paper mail you receive in the first place by signing up for electronic statements with your financial accounts.

Identity thieves may also dig through your trash to get your information. Identity thieves love passwords because they open doors to our personal information. Get tough and organized now. Use different passwords for all your accounts. Hide them safely, and keep them handy.

Good password practices are work, but fixing an identity theft problem is hard labor! For more information, see Safe Password Practcies web page. For more information, see our Staying Private in Public: How to Limit Your Exposure on Social Network Sites web page. Protect your personal information on your computers and smartphones.

Use strong passwords. Use firewall, virus and spyware protection software that you update regularly. Steer clear of spyware. Download free software only from sites you know and trust. Set Internet Explorer browser security to at least "medium.

When shopping online, check out a Web site before entering your credit card number or other personal information. Read the privacy policy and look for opportunities to opt out of information sharing.

If there is no privacy policy posted, beware! Shop elsewhere. Only enter personal information on secure Web pages with "https" in the address bar and a padlock symbol at the bottom of the browser window.

These are signs that your information will be encrypted or scrambled, protecting it from hackers. For more information, see our How to Read a Privacy Policy web page. Open your credit card bills and bank statements right away. Check carefully for any unauthorized charges or withdrawals and report them immediately.

It may mean that someone has changed contact information to hide fraudulent charges. Stop most pre-approved credit card offers. To keep your mobile devices safe, make sure to:. Hackers exploit security flaws in smartphone and computer operating systems in order bypass firewalls and steal your data.

Until that patch is installed, user data remains vulnerable. Log4j is the newest software vulnerability leaving millions of devices at risk. Most of us provide our personal information — name, birthdate, job, hometown, and maybe even email address — publicly displayed on our social media profiles without a second thought.

If a scammer wanted to collect information about you, attempting to commit identity theft on social media is their favorite first step. To prevent identity theft , review any publicly displayed data about yourself and your family on social media. Children under the age of 18 are often the target of child identity theft , because their credit score is completely unmarked.

Posting information about your children on social media, even if it's just their full names and birthdays, can be just as dangerous as posting your own. While tightening your social media privacy settings, consider the kind of peace of mind that an Identity Guard family plan would be able to provide to your loved ones while they're using social media.

Reusing the same old, easily guessable, recycled passwords for multiple online accounts is a recipe for disaster. Expert hackers have developed advanced techniques for password cracking, so don't make it any easier on them.

You should update your passwords so that they consist of a random combination of letters, numbers, and symbols. Ideally, you should be using a secure password manager to relieve the headache that comes with having to store and remember complex passwords.

If you're worried about your usernames and passwords floating around out there on the Dark Web, there are plenty of Dark Web scanners out there you can test for yourself.

If your smartphone is stolen, thieves will be able to read all the SMS verification codes, even if the phone is locked. With the advent of SIM swapping , using two-factor authentication to receive verification codes via text message is no longer a reliable method of securing your personal data.

Instead, use an authenticator app such as Google or Microsoft to enable two-factor authentication for your most sensitive online accounts.

Phishing scams are at an all-time high. Scammers are so good these days, they even fooled Google's algorithm in a recent gift card scam.

Emails or text messages may have the appearance of a trustworthy source, but can turn out to be convincingly fake. Each time you open a spam email and click on a suspicious link, you're rolling the dice. Out of an abundance of caution, never click on links that come from suspicious senders.

This applies to text messages as well. If you get an unsolicited text message with a link to "claim your prize" just delete the text, block the number and move on. We get the temptation. Your cellular data at the airport, or local coffee shop is too slow.

Free Wi-Fi to the rescue! But not so fast, as unprotected public Wi-Fi networks leave your mobile devices vulnerable to attacks. Whatever you do on your mobile device while connected to a public Wi-Fi network can be hacked. This includes posting to social media, making a credit card purchase, or logging in to your online bank account.

Your login credentials to apps or accounts are all valuable pieces of sensitive information that hackers may try to steal by exploiting vulnerabilities in a public Wi-Fi connection. Watch your back when making ATM withdrawals, or you could leave yourself vulnerable to " shoulder surfing " where criminals lurk over your shoulder just as you're entering your ATM pin code.

Even if you're not at the ATM, watch your back when logging into your online bank accounts on your smartphone. Identity thieves have shifty eyes, and may attempt to watch you type your login credentials on a crowded subway or bus station. With the increase in data breaches, criminals can gain access to your personal data with no fault of your own.

Identity Guard has protected over 47 million customers and helped resolve , cases of identity fraud. No one can prevent all types of identity theft. But how bad is it?

Worse than you think. Log In Start Membership Home. Call Us. Identity Theft. Identity Theft Prevention: How to Avoid ID Theft in Share this:. linkedin link.

Identity theft prevention - Safeguard your Social Security number Be alert to phishing and spoofing Use strong passwords and add an authentication step Use alerts

If you can spot something suspicious early, such as an unfamiliar account on your report, you can take action to address it more quickly and stop the situation from getting worse. You can get a free credit report from each of the credit bureaus by visiting AnnualCreditReport.

You can also get a copy of your credit report and view your credit scores for free through Experian. Protect Your Personal Documents Physical documents can present a security risk if not properly looked after.

These papers may include information that would prove useful to identity thieves, including your Social Security number, as well as information about your bank accounts. You can protect yourself in a few ways.

Avoid leaving mail in your mailbox as they are a frequent target of identity thieves. If you're going out of town, ask a trusted neighbor to pick up your mail or request a mail hold until you get back. You might consider limiting how much sensitive paper mail you receive in the first place by signing up for electronic statements with your financial accounts.

Identity thieves may also dig through your trash to get your information. Finally, you should try to avoid leaving a paper trail of ATM, credit card or retail receipts behind.

Identity thieves can use receipts to help piece together your personal data, so hold on to receipts and throw them away or shred them when you get home. Limit Your Exposure It's a good idea to limit the number of credit cards you carry in your wallet, so if it's stolen, you can minimize the impact.

Additionally, avoid carrying your Social Security card on your person—the theft of a Social Security number is an ID thief's gateway to more financial accounts, and thus must be protected at all costs. What to Do if You Believe You Are a Victim of Identity Theft If you notice something suspicious, the sooner you take action to address it, the better.

Once identity thieves know they can get away with their crimes, they can increase their activity and make it even more difficult to recover. Here are some steps you can take if you believe you've been victimized by an identity thief :.

Identity thieves often strike when you least expect it, so it's crucial to avoid taking the security of your personal data for granted. As you take steps to protect your information and identity, you'll make yourself a more difficult target for thieves and may even stop them in their tracks.

As you monitor your credit, protect your devices and accounts, avoid phishing and other scams and keep your documents out of the wrong hands, you'll be able to sleep better knowing that your information is safe.

Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products.

Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

Necessary cookies enable core functionality such as security, network management, and accessibility. You may disable these by changing your browser settings, but this may affect how the website functions. We'd like to set user experience cookies to help us to improve your experience using this website.

We use necessary cookies to make our site work. We'd also like to set optional analytics cookies to help us improve it. We won't set optional cookies unless you enable them.

Using this tool will set a cookie on your device to remember your preferences. For more detailed information about the cookies we use, see our Cookies page. Fraudsters can acquire and use your personal details in a variety of ways. Find out how to prevent and respond to the growing problem of identity theft.

Your identity is valuable. Fraudsters know this. They can use the information you share online to pretend to be you and apply for bank accounts, mobile phones, loans or a wide range of other products in your name. Watch our award-winning campaign film Data to Go , which highlights just how easy it is for fraudsters to get your personal information from the Internet.

Cifas has three decades of experience in combating fraud, and we offer a wealth of advice to individuals on how to protect themselves from identity fraud.

Bookmark this page, read our blog , or follow us on Facebook to keep up to date with the latest news on identity theft and how to avoid becoming a victim. For £30 for two years, our Protective Registration service reduces that risk.

Find out more about Protective Registration and apply today. Identity protection methods such as our Protective Registration service do often mean that processes that were once quick — such as applying for a financial product — take slightly longer than before. Any delay you experience, however, brings with it peace of mind and a reduction in the risk of becoming a victim of fraud.

Your social media profiles can be a treasure trove of useful information for financial criminals — find out how to stay safe and social. Buying and selling vehicles has never been easier, but online transactions also provide opportunity for fraudsters. Find out how to avoid becoming a victim.

Holiday planners are prime targets for fraudsters on the Internet. Find out how you can book your holiday online as safely as visiting a local travel agent.

Limit Your Exposure Identity theft prevention a good idea Ientity limit Credit score enhancement number of credit cards you carry in your wallet, so prvention it's stolen, you can minimize the impact. Just spread out your requests, ordering from a different bureau every four months. Shield your computer and smartphone. Request all three reports at once, or be your own no-cost credit-monitoring service. Fraudsters know this.

Siehe bei mir!

Bemerkenswert topic

die Nützliche Phrase

Ich verstehe etwas nicht