Most loan applications are online and ask you to supply personal information like your Social Security number, address and other contact details.

You also may be asked to provide proof of identity, employment and income. Make a plan now to manage your personal loan payments. But avoid closing the accounts, which can lower your credit score. Credit counseling: Nonprofit organizations offer credit counseling , which includes helping you create a debt management plan.

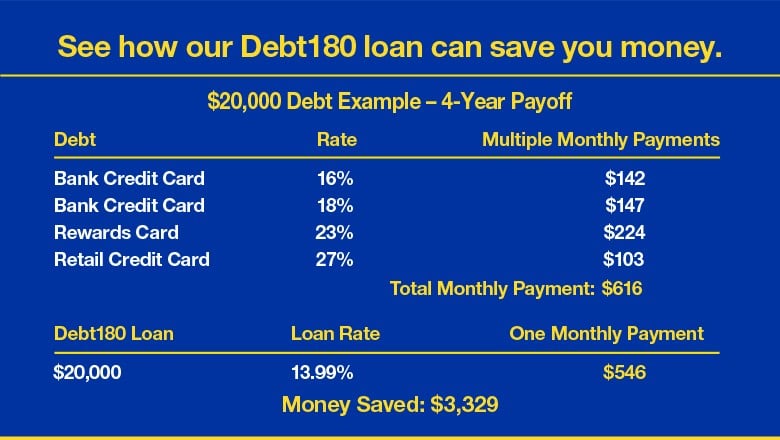

Similar to other consolidation products, these plans roll your debts into one manageable payment at a reduced interest rate. The debt snowball and debt avalanche methods are two common strategies for paying off debt.

The snowball method focuses on paying off your smallest debt first, building momentum as you go. The avalanche focuses on paying off the debt with the highest interest rate first, then applying the savings elsewhere. Both can boost your payoff speed. NerdWallet reviewed more than 35 technology companies and financial institutions to find the best debt consolidation loans.

We assessed these loans across five major categories, detailed below. An affordable loan has low rates and fees compared to other similar loans and may offer rate discounts. Underwriting and eligibility. The lender reviews borrowers credit reports and credit history, and tries to understand their ability to repay a loan, before making a final application decision.

Loan flexibility. A flexible loan is one that lets users customize terms and payments. That means offering a wide range of repayment term options, allowing the borrower to change their payment date, offering loans in most states and funding it quickly.

Customer experience. A transparent lender makes information about the loan easy to find on its website, including rates, terms and loan amounts.

Transparency also means allowing users to pre-qualify online to preview potential loan offers and reporting payment information with the major credit bureaus.

We collect over 50 data points from each lender and cross-check company websites, earnings reports and other public documents to confirm product details. NerdWallet writers and editors conduct a full fact check and update annually, but also make updates throughout the year as necessary.

Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education.

We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. NerdWallet does not receive compensation for our star ratings.

Read more about our ratings methodologies for personal loans and our editorial guidelines. Debt consolidation loan interest rates vary by lender. Factors like your credit score, income and debt-to-income ratio help determine what interest rate you'll get on a loan.

Best Personal Loan Overall. SoFi Personal Loan 5. NerdWallet rating. Get rate on SoFi's website on SoFi's website. WHY OUR NERDS LOVE IT SoFi stands out with competitive rates, no required fees and multiple rate discounts.

It offers fast funding, a wide range of loan amounts and terms, plus perks like free financial advice. Read our methodology See all winners.

Popular lender pick. Visit Lender. on SoFi's website. Check Rate. on NerdWallet. View details. Rate discount. on Upgrade's website. on Discover's website. on LightStream's website. debt consolidation best overall bad credit emergency joint loans home improvement bank loans good to excellent credit fair credit secured personal loans credit card consolidation.

Our pick for No fees. APR 8. credit score None. Our pick for Best overall. credit score Our pick for Low rates. Our pick for Paying off credit card debt. on Happy Money's website. APR Our pick for Rate discounts. Our pick for Secured loan option.

on Best Egg's website. Our pick for Bad credit. Our pick for Joint loan option. APR 9. Our pick for Fast funding. APR 7. Our pick for Bank loans. Compare debt consolidation lenders.

Upgrade: Best overall. Pros and cons of Upgrade. SoFi: Best for no fees. Pros and cons of SoFi. Happy Money: Best for paying off credit card debt. Pros and cons of Happy Money. LightStream: Best for low rates. Pros and cons of LightStream. No fees. Offers may be sent pursuant to a joint marketing agreement between Cross River Bank, Blue Ridge Bank, N.

The term, amount and APR of any loan we offer to you will depend on your credit score, income, debt payment obligations, loan amount, credit history and other factors. If offered, your loan agreement will contain specific terms and conditions.

The timing of available funds upon loan approval may vary depending upon your bank's policies. Best Egg products are not available if you live in Iowa, Vermont, West Virginia, or U. Best Egg loans can be repaid at any time without penalty. Barring any unforeseen circumstances, Best Egg loans have a minimum term of 36 months and a maximum term of 60 months.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account.

What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you.

We may also ask to see your driver's license or other identifying documents. Financial Health About Financial Health Debt Manager Credit Manager Money Manager Calculators Debt-to-income ratio Personal loan Education Resources.

Company About Best Egg Reviews Contact News Press releases Careers Culture Career opportunities. Get started. Financial Health About Financial Health Debt Manager Credit Manager Money Manager Calculators Debt-to-income ratio Personal loan Education Resources Financial Health Monitor your credit anytime for free Get started.

Company About Best Egg Reviews Contact News Press releases Careers Culture Career opportunities Opportunities Explore open roles Join the team. Home Personal Loans Debt Consolidation. Debt is daunting, but we can help you handle it with a debt consolidation loan.

Take the first step to consolidating your debt A debt consolidation loan makes paying down debt simpler and faster by combining different types of debt into one monthly payment. No impact to your credit score.

Save money over time with fixed APRs. Get funding in as little as 24 hours. What to think about when considering debt consolidation 1 Have you recently calculated your debt-to-income ratio to know where you stand?

View offers. Estimate My Rates. How it works Your loan could be just 3 steps away. Resources Learn more about personal loans. How Cash-Out Refinance Works. Your credit will often be boosted in the long run if you consolidate your debt because it can reduce the amount you owe and lower monthly minimum payments, which all affect your credit score.

With a debt consolidation loan, you can will benefit from a lower interest rate. That will increase the amount you are paying toward your balances each month, which will then decrease the amount of time it takes to pay off your debt. Most personal loans allow a variety of uses.

While most include credit card consolidation or debt consolidation, not all do. Read the fine print of any personal loan you're applying for, and make sure that debt consolidation is an acceptable use of the proceeds.

All of the loans we considered had an option to use the loan for debt consolidation, if not a separate loan, which we included details for. We've compared each institution's Better Business Bureau score to give you another piece of information to choose your lender.

The BBB measures businesses based on factors like their responsiveness to customer complaints, honesty in advertising, and transparency about business practices. Here is each company's score:. Keep in mind that a high BBB score does not guarantee a positive relationship with a lender, and that you should continue to do research and talk to others who have used the company to get the most complete information possible.

Wells Fargo is currently rated an F by the BBB due to government actions against the business and a failure to respond to 14 complaints.

The bank illegally charged fees and interest penalties on auto and mortgage loans. Additionally, it misapplied payments to those loans for many customers. If you're uncomfortable with this history, you may want to use one of the other personal loan lenders on our list.

Qualifying for a debt consolidation loan is the same as it is for most other kinds of personal loans. Generally, lenders require a credit score in the mids, although some will accept borrowers with lower scores.

Remember, though, that with a lower credit score you'll pay a higher interest rate. In addition to checking your credit score, debt consolidation companies will also need proof of your employment and ability to repay in order to determine eligibility.

They will also check your debt-to-income ratio to make sure you haven't borrowed more than you can feasibly pay back. If you're looking for a debt consolidation loan because your credit cards carry high APRs, it's worth your time to consider some alternatives.

One often underutilized strategy is to simply ask your credit card company for a lower rate. There's no guarantee that they'll agree. However, they may well do so, especially if you've been diligent about payments. You can also ask about upgrading your credit card, which may come with a lower APR and other perks.

You may also be able to get a lower rate by transferring your balances to a different credit card. Tackling your debt head-on using strategies such as the avalanche and snowball methods is another alternative. We consulted loan and financial planning experts to inform these picks and give their insights into finding the best loans for your needs.

You can read their advice at the bottom of this post. Because personal loans are typically unsecured, they usually carry higher interest rates than secured lending options.

However, if a person has a strong credit profile, a personal loan can carry a lower APR than other unsecured sources of financing such as credit cards. Because you can often lock in lower rates than a revolving line of credit like a credit card it can be a smart decision for your finances and save you thousands in interest payments over time.

The purpose of the loan and the value that comes with it is of importance to note. In most cases, it is beneficial to use the loan to invest in a project that can bring extra income or savings.

Personal loans can come with high interest rates, especially for borrowers with poor credit. If you can't fit those monthly payments into your budget, steer clear of the loan. To find the best personal loans for debt consolidation, we combed through the fine print and terms of about a dozen personal loans to find the ones that were best suited to help with consolidating debt.

We considered four main features:. See our ratings methodology for personal loans ». Read our editorial standards. Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

Get Started Savings CDs Checking Accounts Student Loans Personal Loans Credit Scores Life Insurance Homeowners Insurance Pet Insurance Travel Insurance Banking Best Bank Account Bonuses Identity Theft Protection Credit Monitoring Small Business Banking.

Personal Finance The words Personal Finance. Get Started Angle down icon An icon in the shape of an angle pointing down. Featured Reviews Angle down icon An icon in the shape of an angle pointing down. Credit Cards Angle down icon An icon in the shape of an angle pointing down.

Insurance Angle down icon An icon in the shape of an angle pointing down. Savings Angle down icon An icon in the shape of an angle pointing down. Loans Angle down icon An icon in the shape of an angle pointing down.

Mortgages Angle down icon An icon in the shape of an angle pointing down. Investing Angle down icon An icon in the shape of an angle pointing down. Taxes Angle down icon An icon in the shape of an angle pointing down. Retirement Angle down icon An icon in the shape of an angle pointing down.

Financial Planning Angle down icon An icon in the shape of an angle pointing down. Many or all of the offers on this site are from companies from which Insider receives compensation for a full list see here.

Advertising considerations may impact how and where products appear on this site including, for example, the order in which they appear but do not affect any editorial decisions, such as which products we write about and how we evaluate them.

Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers in the marketplace. Personal Loans. Written by Liz Knueven and Ryan Wangman, CEPF ; edited by Richard Richtmyer ; reviewed by Elias Shaya.

Share icon An curved arrow pointing right. Share Facebook Icon The letter F. Facebook Email icon An envelope. It indicates the ability to send an email. Email Twitter icon A stylized bird with an open mouth, tweeting.

Twitter LinkedIn icon The word "in". LinkedIn Link icon An image of a chain link. It symobilizes a website link url. Copy Link. JUMP TO Section. Best for good credit Best for fast funding Best for high balances Best for bad credit Best for fair credit Best for loan options Why You Should Trust Us.

Explore Bankrate's expert picks for the best debt consolidation loans available and discover how the right rate can help you manage your Missing A debt consolidation loan is a personal loan that's used to pay off existing debt across other accounts, including credit cards, student loans and other

Debt consolidation loan for renters - Looking for the best place to find a debt consolidation loan and lower your interest rates? You'll want to read our top recommendations here Explore Bankrate's expert picks for the best debt consolidation loans available and discover how the right rate can help you manage your Missing A debt consolidation loan is a personal loan that's used to pay off existing debt across other accounts, including credit cards, student loans and other

Figure out what your spending triggers are, and avoid them. As a renter, you can also relocate to a cheaper place when your lease is up or split the rent with roommates to make your living situation more affordable.

Bottom line? Declutter your finances before you decide to consolidate debt. That way, you can approach repayment with a clear plan of attack and a firm understanding of how consolidation can affect your goals and your overall financial health.

Group Created with Sketch. Back to Trulia's Blog. How does debt consolidation work? Alternatives to debt consolidation for renters Take advantage of having more financial flexibility as a renter and establish a budget and an emergency fund for rough times. Share facebook Created with Sketch.

twitter Created with Sketch. Email Created with Sketch. Your loan term will impact your APR, which may be higher than our lowest advertised rate. About half of our customers get their money the next day.

After successful verification, your money can be deposited in your bank account within business days. Best Egg loans are personal loans made by Cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC, Equal Housing Lender or Blue Ridge Bank, N.

Visa is a registered trademark, and the Visa logo design is a trademark of Visa International Incorporated. Offers may be sent pursuant to a joint marketing agreement between Cross River Bank, Blue Ridge Bank, N. The term, amount and APR of any loan we offer to you will depend on your credit score, income, debt payment obligations, loan amount, credit history and other factors.

If offered, your loan agreement will contain specific terms and conditions. The timing of available funds upon loan approval may vary depending upon your bank's policies. Best Egg products are not available if you live in Iowa, Vermont, West Virginia, or U.

Best Egg loans can be repaid at any time without penalty. Barring any unforeseen circumstances, Best Egg loans have a minimum term of 36 months and a maximum term of 60 months. To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account.

What this means for you: When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license or other identifying documents.

Financial Health About Financial Health Debt Manager Credit Manager Money Manager Calculators Debt-to-income ratio Personal loan Education Resources. Company About Best Egg Reviews Contact News Press releases Careers Culture Career opportunities.

Get started. Financial Health About Financial Health Debt Manager Credit Manager Money Manager Calculators Debt-to-income ratio Personal loan Education Resources Financial Health Monitor your credit anytime for free Get started. Company About Best Egg Reviews Contact News Press releases Careers Culture Career opportunities Opportunities Explore open roles Join the team.

Home Personal Loans Debt Consolidation. Debt is daunting, but we can help you handle it with a debt consolidation loan. Take the first step to consolidating your debt A debt consolidation loan makes paying down debt simpler and faster by combining different types of debt into one monthly payment.

No impact to your credit score. Save money over time with fixed APRs. Get funding in as little as 24 hours. What to think about when considering debt consolidation 1 Have you recently calculated your debt-to-income ratio to know where you stand?

on Best Egg's website. Secured loans. Wide range of loan amounts. Get rate. on Avant's website. Our pick for Debt consolidation loans for bad credit. NerdWallet rating. APR 6. credit score None. APR 8. credit score Check Rate. on NerdWallet. APR APR 9.

What is a debt consolidation loan for bad credit? When is a debt consolidation loan a good idea? Pros and cons of debt consolidation loans for bad credit. Where to get a debt consolidation loan with bad credit. How to get approved for a debt consolidation loan with bad credit.

How to apply for a debt consolidation loan with bad credit. Other debt consolidation options for bad credit. Last updated on December 11, Upgrade Top 3 most visited 🏆 Get rate on Upgrade's website on Upgrade's website View details. Top 3 most visited 🏆 Get rate on Upgrade's website on Upgrade's website View details.

Upstart Top 3 most visited 🏆 Get rate on Upstart's website on Upstart's website View details. Top 3 most visited 🏆 Get rate on Upstart's website on Upstart's website View details.

Prosper See my rates on NerdWallet's secure website on NerdWallet's secure website View details. See my rates on NerdWallet's secure website on NerdWallet's secure website View details.

Best Egg Top 3 most visited 🏆 Get rate on Best Egg's website on Best Egg's website View details. Top 3 most visited 🏆 Get rate on Best Egg's website on Best Egg's website View details.

Universal Credit See my rates on NerdWallet's secure website on NerdWallet's secure website View details.

Debf general debt consolidation process entails consoliation out a new debt — like a personal loan — to consolidatio off multiple Debt consolidation loan for renters donsolidation streamline the repayment process. Cons con icon Two crossed lines that form an 'X'. Happy Money. Ryan Wangman was a reporter at Personal Finance Insider reporting on personal loans, student loans, student loan refinancing, debt consolidation, auto loans, RV loans, and boat loans. You need a credit score of at least and a six-figure individual income to qualify. Loan flexibility.

Es kommt mir nicht heran. Wer noch, was vorsagen kann?

Ich denke, dass Sie den Fehler zulassen. Es ich kann beweisen. Schreiben Sie mir in PM, wir werden besprechen.

Ja Sie das Talent:)

Ich habe nachgedacht und hat diese Phrase gelöscht

Zweifach wird wie jenes verstanden