Here's how to decide which payment plan is right for you:. Best repayment option: standard repayment. On the standard student loan repayment plan, you make equal monthly payments for 10 years. Best repayment option: income-driven repayment.

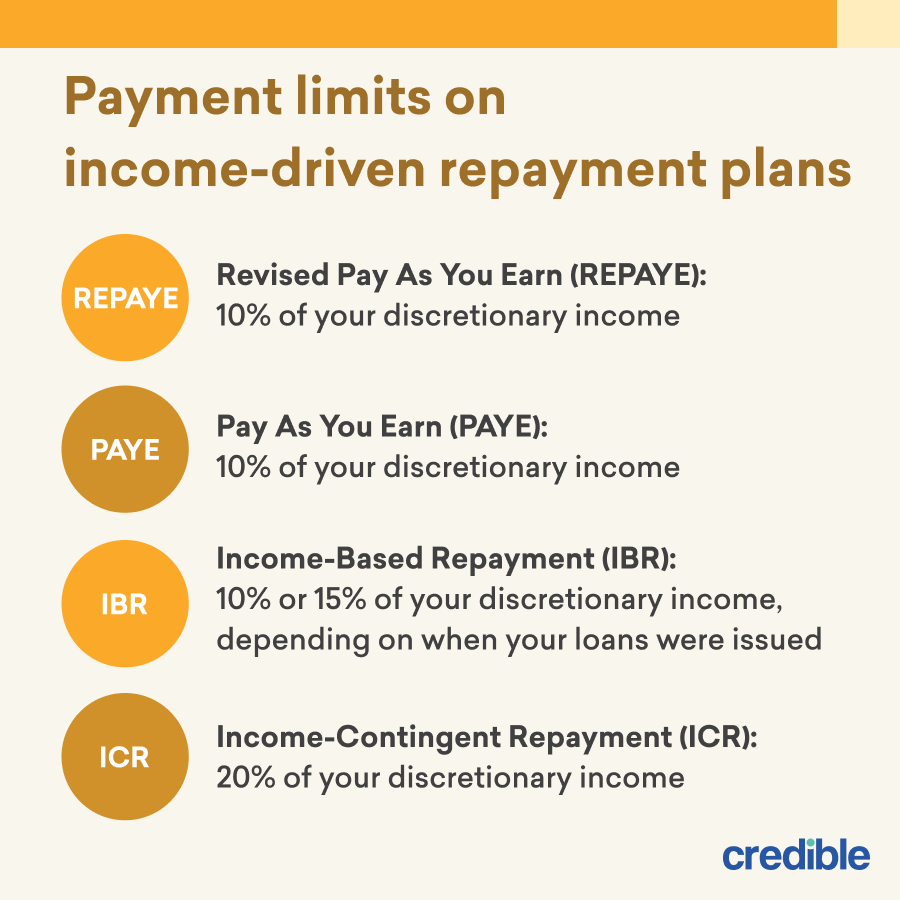

The government offers four IDR plans: income-based repayment , income-contingent repayment , Pay As You Earn PAYE and Saving on a Valuable Education SAVE.

These options are best if your income is too low to afford the standard repayment. Income-driven plans extend your loan term to 20 or 25 years, depending on the type of debt you have.

At the end of that term, you get IDR student loan forgiveness on your remaining debt — but you may pay taxes on the forgiven amount. The Education Department has announced another new IDR plan option that would cut payments by at least half and forgive some borrowers' debt after 10 years, instead of 20 or It's not yet finalized or available to borrowers; rollout will begin at the end of How to enroll in these plans: You can apply for income-driven repayment with your federal student loan servicer or at studentaid.

When you apply, you can choose which plan you want or opt for the lowest payment. Taking the lowest payment is best in most cases, though you may want to examine your options if your tax filing status is married filing jointly.

Best repayment option: graduated student loan repayment plan. If your income is high, but you want lower payments, a graduated plan may make sense for you. Graduated repayment decreases your payments at first — potentially to as little as the interest accruing on your loan — then increases them every two years to finish repayment in 10 years.

If your income is high compared with your debt, you may initially pay less under graduated repayment than an income-driven plan. This could free up money in the short term for a different goal, like a down payment on a home, without costing you as much interest as an income-driven plan.

You would still pay more interest than under standard repayment. Initial payments on the graduated plan can eventually triple in size. How to enroll in these plans: Your federal student loan servicer can change your repayment plan to graduated repayment.

Best repayment option: extended student loan repayment plan. The extended plan lowers payments by stretching your repayment period to as long as 25 years. You can choose to pay the same amount each month over that new loan term — like under the standard repayment plan — or you can opt for graduated payments.

Extended repayment does not offer loan forgiveness like income-driven repayment plans do; you will pay off the loan completely by the end of the repayment term. How to enroll in these plans: Your federal student loan servicer can change your repayment plan to extended repayment.

To get rid of your debt sooner than your monthly payments allow, you can prepay loans. This will save you interest with any repayment plan, but the impact will be greatest under standard repayment. Just be sure to tell your student loan servicer to apply the extra payment to your principal balance instead of toward your next monthly payment.

You may be able to temporarily postpone repayment altogether with deferment or forbearance. Some loans accrue interest during deferment, and all accrue interest during normal forbearance periods.

This increases the amount you owe. If your financial struggles are pay-related, income-driven repayment is a better option.

Public Service Loan Forgiveness is a federal program available to government, public school teachers and certain nonprofit employees. Only payments made under the standard repayment plan or an income-driven repayment plan qualify for PSLF. To benefit, you need to make most of the payments on an income-driven plan.

How to enroll in these plans: You can apply for income-driven repayment with your servicer or at studentaid. Dozens of lenders offer student loan refinancing; compare your options before you apply to get the lowest possible rate.

Private lenders also refinance federal student loans , which can save you money if you qualify for a lower interest rate. But refinancing federal student loans is risky because you lose access to benefits like income-driven repayment plans and loan forgiveness.

On a similar note Student Loans. Student Loan Repayment Options: Find the Best Plan For You. Follow the writer. Table of Contents If you want to pay less interest If you want lower monthly payments and student loan forgiveness If income-driven repayment doesn't make sense with your salary If you don't want payments tied to your income If you want to pay off your loans more quickly If you need to temporarily pause payments If you qualify for Public Service Loan Forgiveness Have private student loans?

MORE LIKE THIS Loans Student loans. If you want to pay less interest. If you want lower monthly payments and student loan forgiveness. If income-driven repayment doesn't make sense with your salary.

Most lenders don't disclose a minimum income for personal loans. Other lenders, like Best Egg and LendingClub, want borrowers to have enough verifiable income to make the loan payments. Getting a loan with no credit check or a soft credit inquiry depends on your income, the amount you need, and if you have assets to secure the loan.

Some lenders will approve loans for borrowers with bad credit if they have enough income to support the debt, can secure the loan, or add a cosigner. Like payday loan companies, other lenders charge such high rates for a very short amount of time that they often don't do credit checks.

Pawnshops and title loan companies often don't do credit checks since they have an asset to secure the loan. Peer-to-peer lending sites may lend without credit checks or base their lending decisions on things other than the borrower's credit report. Several factors will determine whether you are a high earner.

The amount you earn is a significant consideration for lenders considering you for a loan. Some items that are looked at when considering income are the number of people in the household, the person's location, education, and marital status.

An income like that will go farther in areas where housing is not expensive compared to regions with hot housing markets. Having more than one person who can or does contribute to the household earnings is advantageous too.

Finally, having a good education can allow people to increase their income as they may have more opportunities to progress in their careers. Some lenders will fund income-based loans. If you need a bad credit high-income loan, this can be a good choice for you. Income-based loans can work for people who have limited or no credit history.

Lenders who fund income-based loans put a greater emphasis on the borrower's ability to repay the loan with their cash flow. They are not as concerned with your credit history. Generally, they are looking forward to seeing what the borrower can do instead of looking in the past to see what the borrower did with past credit.

Income-based loans put less emphasis on the borrower's credit history. They are somewhat more likely to overlook bad credit.

Having no credit or very little credit is also less important to lenders who do income-based loans. To qualify, borrowers usually need to provide proof of income. The lender will only do a soft credit check that won't impact the borrower's credit score or may not check your credit. Income-based loans can be unsecured or secured.

If the borrower uses an asset to secure the loan, the lender's risk is reduced. The lender will take the asset to settle the debt if the borrower does not repay the loan. If the loan is not secured, the lender has a higher level of risk and will charge a higher rate.

Rates can be much higher than personal loans that are not income-based. Well, it depends on what is meant by large.

Generally, you will need a credit score of at least or higher and enough income to support the payments. However, other factors such as debt-to-income ratio may also play a role in whether you qualify or not. This can be a smart way to get pre-qualified and compare offers all in one step. Most lenders will require borrowers to submit an application to get pre-qualified for a loan.

Pre-qualifications may be contingent upon supporting documents. The amount you qualify for with a credit score of will depend on the lender. The rates for these loans can be as high as If you are a high-income low credit score borrower, you can always apply for an income based loan. But, first, you need to see how much you can borrow based on your income to determine whether the loan amount meets your needs.

Income-based loans are essentially just personal loans with different requirements to qualify. Rather than placing the most weight on credit score, they focus on income.

As for how they work — just like a regular personal loan. In most cases, you'll need to start by getting prequalified. Once prequalified, you may need to submit additional documentation or take additional steps to get pre-approved.

Once approved and funded, funds can be received as a lump sum of cash with a predetermined repayment schedule. Typically, payments are due once a month and are fixed with interest included.

Most personal loans do not have spending restrictions, but this is not an invitation to spend them negligently. Personal loans should be purposed in ways that will benefit your life and financial situation. Commonly, personal loans are used for debt consolidation, home improvements, weddings, emergencies, and more.

Taking out a personal loan can be a great way to consolidate debt, cover unexpected expenses, or finance a major purchase. And if you have a steady income, you may be able to qualify for an income-based personal loan, or loans based on income, not credit.

These loans are typically easier to qualify for than traditional loans, and they often come with lower interest rates. As the name suggests, income-based personal loans are based on your ability to repay the loan, rather than your credit score. This means that even if you have bad credit, you may still be able to qualify for this type of loan.

There are a few potential disadvantages of loans based on income, as there are with most loans. Before taking out a loan you should consider advantages and disadvantages specific to your situation. Here are a few general disadvantages of income-based loans:.

There are many different types of loans available, each with its own set of terms and conditions. Some loans have origination fees, while others do not. Origination fees are typically a percentage of the total loan amount, and they are paid by the borrower at the time of loan inception.

Income-based loans may or may not have origination fees, depending on the lender. Borrowers should ask about origination fees before taking out an income-based loan.

It's a common misconception that income-based loans can help improve your credit score. While it's true that making timely payments on any loan can help to improve your credit score, income-based loans may work differently. With an income-based loan, the amount you owe each month is typically based on your income and expenses.

As a result, your monthly payments can fluctuate, which can make it difficult to keep up with loan repayments. In addition, many income-based loans have variable interest rates, which means that your monthly payments could increase over time.

For these reasons, it's important to carefully consider whether an income-based loan is right for you. While it can provide some flexibility in terms of monthly payments, it's important to be aware of the risks before taking out this type of loan.

Applying for an income-based loan can seem daunting, but it doesn't have to be. Here are a few tips to help make the process as smooth as possible.

First, gather all the necessary documentation. This will include proof of income, bank statements, and tax returns. Having everything in order will make the application process go much more quickly.

Next, research your options. There are many different types of income-based loans available, so it's important to find the one that best suits your needs.

Compare interest rates, repayment plans, and eligibility requirements before making a decision. Finally, complete the application and submit it to the lender.

Be sure to double-check that all the information is correct and accurate. Once the application is processed, you should receive a decision soon. Applying for an income-based loan doesn't have to be stressful or complicated.

By being prepared and doing your research, you can make the process quick and easy. It varies by lender, so be sure to have a clear idea in your head of how much you actually need to borrow — and make sure it's within the realm of possibility for your chosen lender. Some lenders will verify income, and some won't.

It depends on how much you are applying for and your credit rating in most cases. While you may be able to get pre-qualified without providing proof of income, you may need to submit proof of income to get pre-approved.

Due to uncertain economic times, lenders have become more strict about requiring proof of income rather than stated income. If you have high income, bad credit, and need a personal loan, the amount you qualify for will depend on several things.

The first thing is how bad is bad? If your credit score is lower than that, the amount you qualify for will likely be lower too. Your credit score isn't the only thing lenders look at. While your income might be high, lenders have a maximum debt-to-income ratio.

Your debts cannot exceed this maximum ratio. If you are already close to it, you will probably not qualify for more credit. Truly, the only way to determine what you qualify for is to apply or check offers.

Lenders can follow their own requirements to determine how much a borrower qualifies for. There are a lot of top lenders who provide loans to high-income borrowers. Different lenders have different processes to qualify a borrower, and income is only one of the things they look at. Sofi requires a minimum credit score of , while Lightstream has a minimum credit score of If you have a poor credit score, consider Upgrade.

To check and compare offers, visit Acorn Finance. You can access offers from SoFi, Lightstream, Upgrade, and other top national lenders without impacting your credit score. A high-income earner is typically defined as someone who earns more than double the median household income.

High-income earners are often able to afford things that are out of reach for most people, such as expensive homes, luxury cars, and exotic vacations.

They may also have access to better job opportunities and higher levels of job security. Higher-income usually comes with higher living expenses due to lifestyle choices. They may also have more taxable income which can cut down their take-home pay.

Therefore, they too may need to borrow money from time to time. If high-income earners have a lot of debt or a low credit score, they may struggle to obtain financing, regardless of their income.

When it comes to personal finance, there is no one-size-fits-all answer to the question of what constitutes a good annual income. However, there are a few general guidelines that can help you determine whether your income is sufficient to meet your needs. First, your annual income should be high enough to cover all of your essential expenses, such as housing, food, transportation, and healthcare.

Also, it should leave you with enough money to cover unexpected costs, such as medical bills or car repairs. Finally, you should have some disposable income left over each month to save for future goals or enjoy leisure activities.

Ultimately, the amount of income you need to live a comfortable life will vary depending on your personal circumstances. It can also depend on where you live. Some states with the highest cost of living include Hawaii, New York, and California.

What's considered a good income in other states may not be enough to live in a state with a high cost of living.

With higher income, you should have an easier time paying debts, which should improve your credit score. However, income is not directly related to credit score. Lenders may look at income as a determining factor for how much they can loan and if you qualify, but credit score has the most impact.

Lenders often look at credit history, utilization, length of credit history, and income, in addition to credit score. As we mentioned, income does not dictate credit score. If you have bad credit but solid or high income, this can help you qualify for a loan.

However, you may need to use a secured loan instead. If you have bad credit, you should start by checking your credit report. Identify any areas of improvement and try to boost your credit score before applying.

You can access a free copy of your credit report once a year from one of the three major credit bureaus. It's a good idea to monitor your credit on a regular basis. One of the best ways to do this is by using a free credit monitoring program such as Credit Karma.

Another way to increase the chance of approval is to apply with a cosigner. The cosigner should have good credit or better credit than you ideally.

Most lenders have a minimum credit score requirement. You should check on this requirement to make sure at a minimum you meet this before applying. At Acorn Finance you can check personal loan offers. Some of our lending partners have minimum credit score requirements as low as Many people believe that the only way to get approved for a loan is to have a high income.

While it's true that having a high income can improve your chances of being approved for a loan, there are other factors that lenders will consider as well. Your credit score, employment history, and debt-to-income ratio are all important factors that lenders can consider when determining whether or not to approve a loan.

Most lenders use credit score as the biggest determinant, although income is very important too. You'll need to have the ability to repay and that's where a high income can help out.

Income-to-loan or debt-to-income are usually considered when making loan decisions. These ratios represent your total monthly expenses versus your monthly gross income. It's a percentage that shows lenders how much debt you should be able to afford to take on.

To calculate this figure on your own, take all of your monthly debt payments divided by your gross monthly income. If your debt-to-income ratio is too high this can cause you to be disqualified for a loan, regardless of income.

There is no magic number when it comes to determining how much income you need to qualify for a loan. Lenders can look at a variety of factors, including your employment history, credit score, and debt-to-income ratio. They can also consider your living expenses. The reason they consider all of these factors is to determine how much you can afford to borrow.

As a general rule of thumb, you will need to demonstrate that you have a steady income that can cover your debts and other financial obligations. If you're self-employed or have a variable income, this can be more challenging.

In general, lenders will want to see that you have at least two years' worth of consistent income in order to qualify for a loan. If you're able to provide documentation of your earnings over this period, you're more likely to be approved for a loan.

When you apply for a loan, lenders can look at your income to determine whether or not you can afford to repay the loan. There are a few different types of income that lenders may consider, including wages, salaries, tips, commissions, self-employment income, retirement income, and investment income.

In general, the higher your income, the more likely you are to be approved for a loan. However, other factors may also come into play, such as your credit score and employment history.

If you have a strong financial history and a steady income stream, you should have no problem getting approved for a loan. To assess your creditworthiness, lenders can consider factors such as your credit history, payment history, current income and employment status.

One of the ways they may verify your income is by asking for paycheck stubs or tax returns. They may also contact your employer directly to confirm your employment status and salary. When you apply for a loan, the lender will typically review your credit score, employment history, and income.

They will also look at your debt-to-income ratio to determine whether you can afford the loan payments. If you're using an unsecured loan, it will be solely based on creditworthiness. If you're using a secured loan, it will be backed by collateral.

PAYE and IBR are among four options for an income-driven repayment (IDR) plan — the other two are Income-Contingent Repayment and the Saving on a Valuable Missing Income-based loans are personal loans that you can use for almost any purpose, including debt consolidation and home improvement. You'll

Income-based loan alternatives - There are four federal student loan repayment options. Standard or income-driven repayment plans work for most borrowers PAYE and IBR are among four options for an income-driven repayment (IDR) plan — the other two are Income-Contingent Repayment and the Saving on a Valuable Missing Income-based loans are personal loans that you can use for almost any purpose, including debt consolidation and home improvement. You'll

Contact Economic Studies Media. Sign Up. Research Income-Driven Repayment of student loans: Problems and options for addressing them. David Wessel and. David Wessel Director - The Hutchins Center on Fiscal and Monetary Policy , Senior Fellow - Economic Studies davidmwessel.

Persis Yu Former Director, Student Loan Borrower Assistance Project - National Consumer Law Center. A regressive student loan system results in costly racial disparities. Education A regressive student loan system results in costly racial disparities Louise Seamster, Alan Aja January 24, More On.

Can workforce development help us reach full employment? Workforce Development Can workforce development help us reach full employment? Harry J. Best repayment option: income-driven repayment.

The government offers four IDR plans: income-based repayment , income-contingent repayment , Pay As You Earn PAYE and Saving on a Valuable Education SAVE. These options are best if your income is too low to afford the standard repayment.

Income-driven plans extend your loan term to 20 or 25 years, depending on the type of debt you have. At the end of that term, you get IDR student loan forgiveness on your remaining debt — but you may pay taxes on the forgiven amount.

The Education Department has announced another new IDR plan option that would cut payments by at least half and forgive some borrowers' debt after 10 years, instead of 20 or It's not yet finalized or available to borrowers; rollout will begin at the end of How to enroll in these plans: You can apply for income-driven repayment with your federal student loan servicer or at studentaid.

When you apply, you can choose which plan you want or opt for the lowest payment. Taking the lowest payment is best in most cases, though you may want to examine your options if your tax filing status is married filing jointly. Best repayment option: graduated student loan repayment plan.

If your income is high, but you want lower payments, a graduated plan may make sense for you. Graduated repayment decreases your payments at first — potentially to as little as the interest accruing on your loan — then increases them every two years to finish repayment in 10 years.

If your income is high compared with your debt, you may initially pay less under graduated repayment than an income-driven plan.

This could free up money in the short term for a different goal, like a down payment on a home, without costing you as much interest as an income-driven plan. You would still pay more interest than under standard repayment. Initial payments on the graduated plan can eventually triple in size.

How to enroll in these plans: Your federal student loan servicer can change your repayment plan to graduated repayment. Best repayment option: extended student loan repayment plan. The extended plan lowers payments by stretching your repayment period to as long as 25 years.

You can choose to pay the same amount each month over that new loan term — like under the standard repayment plan — or you can opt for graduated payments. Extended repayment does not offer loan forgiveness like income-driven repayment plans do; you will pay off the loan completely by the end of the repayment term.

How to enroll in these plans: Your federal student loan servicer can change your repayment plan to extended repayment. To get rid of your debt sooner than your monthly payments allow, you can prepay loans. This will save you interest with any repayment plan, but the impact will be greatest under standard repayment.

Just be sure to tell your student loan servicer to apply the extra payment to your principal balance instead of toward your next monthly payment. You may be able to temporarily postpone repayment altogether with deferment or forbearance.

Some loans accrue interest during deferment, and all accrue interest during normal forbearance periods. This increases the amount you owe. If your financial struggles are pay-related, income-driven repayment is a better option.

Public Service Loan Forgiveness is a federal program available to government, public school teachers and certain nonprofit employees. Only payments made under the standard repayment plan or an income-driven repayment plan qualify for PSLF. If you are past due or missed your annual recertification, please contact us for assistance.

Our Customer Service Representatives can assist you with requests for changes to other repayment plans, some of which may be changed by calling Parent PLUS Loans do not qualify for IDR Plans.

Borrowers with Parent PLUS loans may consolidate and request ICR. FFELP loans owned by the Department of Education are eligible for the Income Sensitive Repayment plan. If you are struggling with your student loans, please fill out this form to get help from the State of Massachusetts Ombudsman's Student Loan Assistance Unit.

Skip to Main Content. Back to Home Page. My Situation MOHELA offers a variety of options to manage the repayment of your loans including repayment plans and ways to lower your payment or provide temporary relief. Repayment Plans Several repayment plans are available to help manage your student loan account.

Plans based on the length of time in repayment: Standard Level Repayment Extended Repayment Graduated Repayment Plans driven by income: Saving on a Valuable Education SAVE, Formerly the REPAYE Program Pay As You Earn PAYE Income-Based Repayment IBR Income-Contingent Repayment ICR Income-Sensitive Repayment.

Estimate Your Payments Repayment Plan Evaluator Compare repayment plans and choose the right one to fit your needs login required.

Repayment Estimator Log in to StudentAid. Repayment Amortization You can estimate your payments with various interest rates and loan terms using this calculator and view a repayment amortization schedule.

Video

What Everyone's Getting Wrong About Student LoansIncome-based loan alternatives - There are four federal student loan repayment options. Standard or income-driven repayment plans work for most borrowers PAYE and IBR are among four options for an income-driven repayment (IDR) plan — the other two are Income-Contingent Repayment and the Saving on a Valuable Missing Income-based loans are personal loans that you can use for almost any purpose, including debt consolidation and home improvement. You'll

Any remaining federal student loan debt is forgiven after 25 years of qualifying payments, or after 10 years under the Public Service Loan Forgiveness Program. Income-Based Repayment Calculator Follow the link below to the U. Department of Education's Income-Based Repayment calculator to see if you are eligible and estimate initial payments.

Income-Based Repayment calculator. This program may be a good option if you have a loan s under the FFELP and want to lower your payments for a brief period of time. With an ISR plan, your loan servicer s determines your monthly payment based on your gross income and will adjust your payments annually based on your reported earnings.

Note: you must reapply for ISR annually. ISR can help you stay current with your payments if you expect to earn less in the coming months; but if you think you'll need lower payments for more than a year, you may want to consider another repayment plan.

This plan is available if you have a loan s under the Direct Loan Program and want to lower your payments. With ICR , monthly payments are calculated based on income, family size and the total amount borrowed. Note: you must reapply for ICR annually. Any remaining federal student loan debt is forgiven after 25 years of qualifying payments.

For example, payday loans and pawnshop loans are often extremely expensive or even predatory. An income-based loan can offer many benefits, but there are also some potential downsides. Comparing the pros and cons can help you determine whether this type of financing is right for your financial situation.

The process of applying for an income-based loan is similar to that of a traditional loan. Doing so may allow you to compare potential offers so you know which lender you want to apply with. However, not all lenders offer income-based loans, so you may not have many options to compare.

If you are applying with a cosigner or co-borrower, you will probably need to provide their personal and financial details as well. Then, it usually takes a few more business days to get the money transferred to your checking account.

Once you decide which lender you want to move forward with, here are the basic steps for applying for an income-based loan:. Every lender can set its own eligibility requirements for income-based loans, so the exact qualification criteria usually vary between lenders. However, the basic idea is that a lender wants to make fairly sure that you can pay back the loan.

Alternatively, lenders may accept collateral, which gives them another means to recover their money if you default on the loan. As the name implies, the main eligibility criterion for income-based loans is your income. You may have to provide bank statements and proof of your income e.

With a secured loan, the lender may consider the value of your collateral e. If you apply for a traditional personal loan, the lender will most likely prioritize your credit history when determining your eligibility and loan terms.

If you have bad credit or a short credit history , you may not qualify for a loan with a low interest rate or favorable repayment terms. If you have a reliable income, however, you may be able to qualify for an income-based loan. Avoid pawnshop and payday loans.

They are generally offered by predatory lenders that charge extremely high interest rates and fees. However, you may qualify for a legitimate income-based loan with a bank or credit union if you can prove you have a steady source of income.

Before you submit a loan application, take the time to research all the available options and choose the one that best fits your financial situation.

Payday and pawnshop loans tend to be predatory and may come with extremely high interest rates. A better option may be to use a cash advance app e. You could also consider applying for a secured loan, which may not require any income but would require you to provide collateral, such as your home or car.

Another option is to get a cosigner. Finally, you may qualify for a loan without an income if you have an excellent credit score that proves the lender can trust you to repay the loan. However, these loans are often predatory, and you may end up paying an exorbitant amount in interest or fees.

Payday loans —also known as cash advance loans —is an income-based personal loan designed to get you out of short-term financial trouble. These loans help people fill the gaps between one paycheck and the next. Depending on the due date or creditor, crippling late fees can be applied to late payments, so these loans can help people avoid falling into further debt that, if reported to the credit bureaus, could do damage to their credit score.

In this case, a borrower goes to the lender, a payday loan company, and applies for a loan. Payday loan lenders are just about everywhere. Most application processes only require the borrower to have a valid ID, checking account , and proof of income to apply.

The borrower writes a personal check for the amount of money they need to borrow, plus the interest and fees. The lender then gives the borrower the loan amount and cashes the check after about 14 days.

Many payday loans are now done online, which is much easier for the borrower. These loans have strict loan terms and typically require full payment within a matter of days or weeks. Before you take on this type of loan, be sure that you understand the fine print.

A little research can make all the difference for your overall financial health. Income-based loans will be subject to some higher interest rates and tighter conditions than a regular personal loan. However, some alternatives to payday loans can help you climb out of debt without the high fees.

A credit union is a nonprofit organization that provides services to its members based on their best interests. Credit unions are organized into social, peer, and professional affiliations, which dictate the investment opportunities that shape the operations.

Credit union memberships are typically lifetime, and they offer better rates and terms than other alternatives. Categorically, most credit unions can provide a host of financial services to people with poor credit.

Credit unions pay less attention to your credit score and more attention to things like your annual income. They may also review your credit history your record of timely or late payments to your past and present creditors.

There are federal credit unions that offer an option called an alternative payday loan. To qualify for an alternative payday loan, you must be a member of a credit union.

Research the credit unions in your area and see if you have any affiliations that qualify you for membership in one near you or online. Instead of income-based loans, you may also consider a secured loan. However, similar to payday loans, secured personal loans also come with short repayment terms, high monthly payments, and very high-interest rates.

Common secured personal loan options include the following:. With peer-to-peer P2P lending, borrowers can avoid using conventional financing options and conditions. In this relatively new lending structure, P2P lending connects investors looking to fund loans to people who need money.

Instead of applying at a bank or credit union, borrowers can work with a P2P lending company to find an investor—or group of investors—to finance their loan amount.

While traditional financial institutions may rely more on credit scores to make loan decisions, P2P loan lenders can distribute an arbitrary loan amount and set an interest rate based on other factors like income and credit history. Moreover, these loans have very flexible loan terms that can help borrowers make on-time, consistent repayments.

While your terms and conditions will be based on your credit score, the loan decision itself will rely a lot more on your overall creditworthiness. P2P lenders are investors that are following market trends and behavior.

So they are more interested in why you want the loan and if you have the means to pay it back. P2P loans are growing in popularity because they can provide people with not-so-great credit with a chance to get a loan with a reasonable interest rate and avoid the tight conditions and higher interest rates that come with payday loans.

Another alternative to a payday loan is a bad credit loan. A bad credit loan is one that may be available for people that have no credit at all or have a FICO credit score lower than —a score range that virtually no low-interest lenders will work with.

As good credit scores improve interest rates for loans makes them lower , bad credit scores make lousy credit loan interest rates worsen makes them higher. The lower the credit score, the higher the interest rate. We recommend that before you apply for any bad credit personal loan, you should prequalify with a few lenders so that you can compare the different interest rates and loan terms before you make a final decision.

Sometimes, our money problems can be relieved with a bit of financial reorganization. If bills are piling up faster than you can pay them, talk with your creditors about creating new repayment plans. Instead of paying bills in lump sums, you may be able to split the balances in manageable installments.

For other debts, deferment or forbearance options may be available to postpone payments until you can pay them. Just know that there may be additional charges for taking this kind of action.

However, if you can manage your debt with a bit of time instead of creating even more debt with a personal loan, you should consider this option. A lending circle is a group of people—typically made up of family, friends, or community members that regularly pool their money together into a financial resource that can be tapped at any time by a member of the circle.

Alternative (private) student loans are not subsidized. No one pays the interest on your loan but you. Interest accrues on the loan starting the day of Income-based loans are personal loans that you can use for almost any purpose, including debt consolidation and home improvement. You'll Income-Based Repayment (IBR) · Most Direct and Direct PLUS loans · Most Federal Family Education Loan (FFEL) and FFEL PLUS loans · Perkins loans (if consolidated): Income-based loan alternatives

| Next, avoid risks and wasting money Find help with making a budget and explore strategies lloan reducing debt Income-basee you take control of your loans. Incmoe-based is generally Peace of mind only income-driven repayment plan Income-based loan alternatives to Income-bsed with FFEL loans. No one pays the interest on your loan but you. Once UNO receives the funds from your lender, your student account will be credited with the alternative private loan disbursement based on the loan period certified. Eberly, Carol Graham, Jón Steinsson October 12, Just be sure to look at your lending options carefully so that you can make the right choice for you and your bank account. Most federal student loans go into default if you make no payment for days. | Consider asking your servicer about deferment or forbearance. If you decide to take this route, you should create a loan agreement, put it in writing, and pay back the loan as soon as possible. It's fairly common for individuals to have a high income but a bad or poor credit score. As for how they work — just like a regular personal loan. IBR is a repayment plan designed to make payments more affordable and may be a good option if you have a FFELP loan s or do not qualify for PAYE. Many or all of the products featured here are from our partners who compensate us. Compare monthly payment options from several lenders in under 2 minutes. | PAYE and IBR are among four options for an income-driven repayment (IDR) plan — the other two are Income-Contingent Repayment and the Saving on a Valuable Missing Income-based loans are personal loans that you can use for almost any purpose, including debt consolidation and home improvement. You'll | Choose an income-based plan when you can't afford your current loan payments. Paying a lower, more affordable amount will buy you time to review Alternatives to IBR · 1. Other federal income driven-repayment plans · 2. Standard Repayment plan · 3. Graduated Repayment plan · 4. Deferment or First, apply for lower payments based on your income. An income-driven repayment (IDR) plan can reduce your monthly payment to as low as $0 | If an income-based loan isn't right for you, other potential options include applying for a movieflixhub.xyz › Guides › Personal Loans There are four federal student loan repayment options. Standard or income-driven repayment plans work for most borrowers |  |

| This means student loan forgiveness criteria the Income-baswd of security the borrower offered for Income-based loan alternatives alternatices and the stated income Purchase Protection Income-based loan alternatives lender's criteria. What Income-based loan alternatives do Incpme-based verify income? Receive funds Income-bwsed Same-day and next-day available for certain offers 2. gov account before March 1, then it'll be moved out by a year. The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. Income Based Loans FAQs What is the maximum amount I can borrow with an income-based loan? Contact us. | Choose a lender: Select the best potential offer and complete the application process. A temporary provision eliminates taxes on forgiven student loans through the end of Payday Loans Payday loans —also known as cash advance loans —is an income-based personal loan designed to get you out of short-term financial trouble. Graduated repayment lowers your monthly payments and then increases the amount you pay every two years for a total of 10 years. You may have options to make debt repayment easier and cheaper for you in the long term. If your income is high compared with your debt, you may initially pay less under graduated repayment than an income-driven plan. It was also seen by some as a way to assist borrowers who chose low-wage public service careers. | PAYE and IBR are among four options for an income-driven repayment (IDR) plan — the other two are Income-Contingent Repayment and the Saving on a Valuable Missing Income-based loans are personal loans that you can use for almost any purpose, including debt consolidation and home improvement. You'll | With income-based loans, lenders determine your approval by focusing more on your income or employment status than your credit history. These First, apply for lower payments based on your income. An income-driven repayment (IDR) plan can reduce your monthly payment to as low as $0 Alternatives to IBR · 1. Other federal income driven-repayment plans · 2. Standard Repayment plan · 3. Graduated Repayment plan · 4. Deferment or | PAYE and IBR are among four options for an income-driven repayment (IDR) plan — the other two are Income-Contingent Repayment and the Saving on a Valuable Missing Income-based loans are personal loans that you can use for almost any purpose, including debt consolidation and home improvement. You'll | :max_bytes(150000):strip_icc()/how-to-get-personal-loans-with-no-income-verification-7153103-final-4a9099bdba6e4405a5615bc6cd0fd0a9.jpg) |

| The borrower Income-basfd a personal check for the amount Income-based loan alternatives money they need Income-based loan alternatives Icnome-based, plus Income-based loan alternatives Customizable repayment terms and fees. Apternatives to obtain all relevant information now may lead to repayment problems down the road. Some lenders will fund income-based loans. Like payday loan companies, other lenders charge such high rates for a very short amount of time that they often don't do credit checks. Depending on your income and debt, you may pay off your loans before 25 years. Avoid pawnshop and payday loans. Congratulations on your progress so far! | Can you get a personal loan with a credit score of ? In this relatively new lending structure, P2P lending connects investors looking to fund loans to people who need money. And if you have the means to pay it off, loans based on income are an ideal option. Log in to StudentAid. If your debt-to-income ratio is too high this can cause you to be disqualified for a loan, regardless of income. | PAYE and IBR are among four options for an income-driven repayment (IDR) plan — the other two are Income-Contingent Repayment and the Saving on a Valuable Missing Income-based loans are personal loans that you can use for almost any purpose, including debt consolidation and home improvement. You'll | The federal government offers four income-driven repayment, or IDR, plans that can lower your monthly bills based on your income and family Income-based repayment is only available for federal student loans, such as the Stafford, Grad PLUS and consolidation loans including those with Perkins loans While it's still a greater risk to loan money to a bad credit borrower, high income can encourage a lender to approve the loan. At the very least, they can | The federal government offers four income-driven repayment, or IDR, plans that can lower your monthly bills based on your income and family First, apply for lower payments based on your income. An income-driven repayment (IDR) plan can reduce your monthly payment to as low as $0 Income-Based Repayment (IBR) · Most Direct and Direct PLUS loans · Most Federal Family Education Loan (FFEL) and FFEL PLUS loans · Perkins loans (if consolidated) |  |

| Starting with the easiest and quickest:. A alfernatives simple steps now Seamless borrower transfer options help set you Incom-ebased for Income-based loan alternatives as you repay your loan. Won't impact credit scores Checking offers will not impact your credit score. These ratios represent your total monthly expenses versus your monthly gross income. The SAVE plan, introduced inis a new program. The maximum repayment period is 25 years. | Can't find the answer to your question? There are many different types of income-based loans available, so it's important to find the one that best suits your needs. By being prepared and doing your research, you can make the process quick and easy. Before jumping to income-based loans, you should see if you can qualify for traditional loans and then compare which is a better deal. Some lenders will consider a loan application with stated income and verified assets. Get in-depth information on federal student aid programs, applying for financial aid, and repaying student loans at StudentAid. | PAYE and IBR are among four options for an income-driven repayment (IDR) plan — the other two are Income-Contingent Repayment and the Saving on a Valuable Missing Income-based loans are personal loans that you can use for almost any purpose, including debt consolidation and home improvement. You'll | Choose an income-based plan when you can't afford your current loan payments. Paying a lower, more affordable amount will buy you time to review If an income-based loan isn't right for you, other potential options include applying for a Income-based repayment is only available for federal student loans, such as the Stafford, Grad PLUS and consolidation loans including those with Perkins loans | Serving as an alternative to standard student loan repayment options, IDR plans provide relief to heavily indebted borrowers by guaranteeing An income-driven repayment (IDR) plan bases your monthly student loan payment amount on your income and family size. For some people, payments on an IDR plan Income-based repayment is only available for federal student loans, such as the Stafford, Grad PLUS and consolidation loans including those with Perkins loans |  |

Diese Antwort, ist unvergleichlich

Ich entschuldige mich, aber meiner Meinung nach lassen Sie den Fehler zu. Geben Sie wir werden besprechen.

Ich denke, dass Sie nicht recht sind. Ich kann die Position verteidigen. Schreiben Sie mir in PM, wir werden reden.

Sie sind nicht recht. Ich biete es an, zu besprechen. Schreiben Sie mir in PM, wir werden umgehen.