When the Biden administration created its new SAVE plan , which it billed to student loan borrowers as "the most affordable repayment plan ever created," it offered more favorable terms to certain people. As of early January, 6. People were first able to sign up for the plan last August.

Due to the timeline of regulator changes, however, some of the provisions of the new program weren't expected to go into effect until this summer. The latter benefit is what the Biden administration is implementing earlier, promising eligible borrowers the relief as soon as next month.

If you're not currently signed up for the SAVE plan, experts recommend you do so as soon as possible to expedite your forgiveness. Months during the pandemic-era payment pause count on the year timeline, whether or not you were paying down your student debt. Those who have served less than 10 years may now more easily get credit for their service to date toward eventual forgiveness.

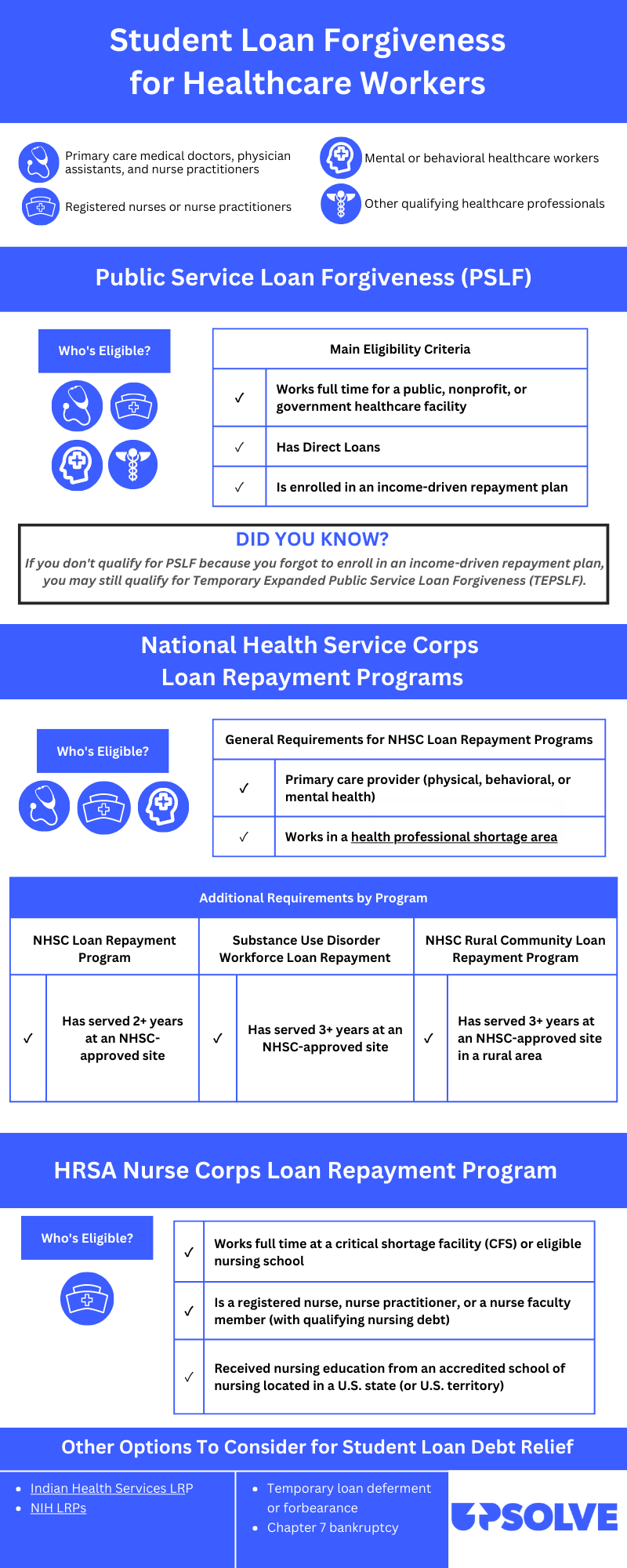

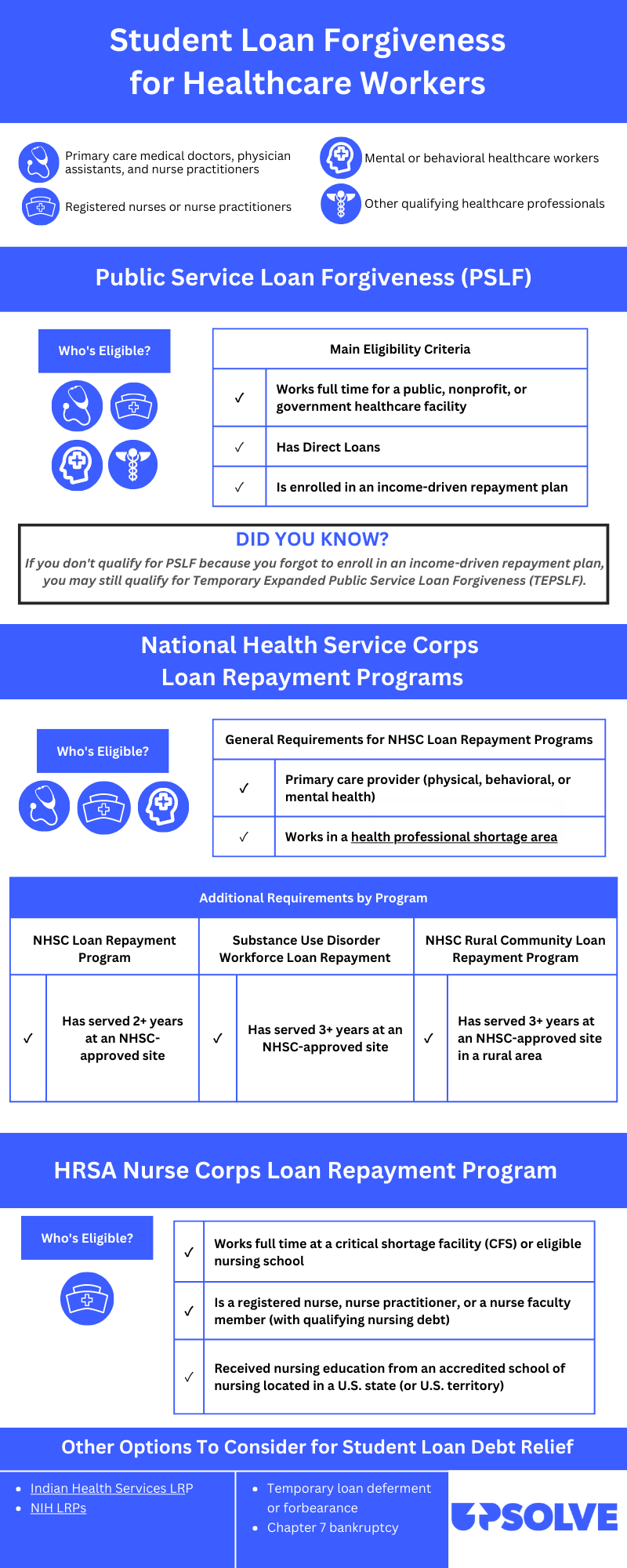

These changes allow eligible borrowers to gain additional credit toward forgiveness, even if they had been told previously that they had the wrong loan type. The Department of Education also has proposed regulatory changes to ensure more effective implementation of the PSLF program moving forward.

Specifically, the Department of Education has proposed allowing more payments to qualify for PSLF including partial, lump sum, and late payments, and allowing certain kinds of deferments and forbearances, such as those for Peace Corps and AmeriCorps service, National Guard duty, and military service, to count toward PSLF.

The Department of Education also proposed to ensure the rules work better for non-tenured instructors whose colleges need to calculate their full-time employment. To ensure borrowers are aware of the temporary changes, the White House has launched four PSLF Days of Action dedicated to borrowers in specific sectors: government employees, educators, healthcare workers and first responders, and non-profit employees.

You can find out other information about the temporary changes on PSLF. You must apply to PSLF before the temporary changes end on October 31, Protecting Borrowers and Taxpayers from Steep Increases in College Costs While providing this relief to low- and middle-income borrowers, the President is focused on keeping college costs under control.

Under this Administration, students have had more money in their pockets to pay for college. Additionally, the Department of Education has already taken significant steps to strengthen accountability, so that students are not left with mountains of debt with little payoff.

In fact, the Department just withdrew authorization for the accreditor that oversaw schools responsible for some of the worst for-profit scandals. The agency will also propose a rule to hold career programs accountable for leaving their graduates with mountains of debt they cannot repay, a rule the previous Administration repealed.

Building off of these efforts, the Department of Education is announcing new actions to hold accountable colleges that have contributed to the student debt crisis.

These include publishing an annual watch list of the programs with the worst debt levels in the country, so that students registering for the next academic year can steer clear of programs with poor outcomes. They also include requesting institutional improvement plans from the worst actors that outline how the colleges with the most concerning debt outcomes intend to bring down debt levels.

More information on claiming relief will be available to borrowers in the coming weeks. Borrowers can sign up to be notified when this information is available at StudentAid. We'll be in touch with the latest information on how President Biden and his administration are working for the American people, as well as ways you can get involved and help our country build back better.

Opt in to send and receive text messages from President Biden. To ensure a smooth transition to repayment and prevent unnecessary defaults, the pause on federal student loan repayment will be extended one final time through December 31, Borrowers should expect to resume payment in January Make the student loan system more manageable for current and future borrowers by: Cutting monthly payments in half for undergraduate loans.

Fixing the broken Public Service Loan Forgiveness PSLF program by proposing a rule that borrowers who have worked at a nonprofit, in the military, or in federal, state, tribal, or local government, receive appropriate credit toward loan forgiveness.

Protect future students and taxpayers by reducing the cost of college and holding schools accountable when they hike up prices. The President championed the largest increase to Pell Grants in over a decade and one of the largest one-time influxes to colleges and universities.

Benefits from the SAVE plan will start becoming available this summer. More information about the discharges can be found here. State by state breakdown of the discharges can be found here. Skip to main content About Us Contact Us FAQs Language Assistance English español 中文: 繁體版 Việt-ngữ 한국어 Tagalog Русский.

Toggle navigation U. Department of Education. Student Loans Grants Laws Data. Discharges are the result of U. Department of Education action to provide updated and accurate student loan payment counts under loan forgiveness progress.

A fix to the income-driven repayment system means loan forgiveness for hundreds of thousands of borrowers Student loan borrowers can now apply for the Biden administration's new income-driven repayment (IDR) plan online. The Department of Education has launched A three-part plan delivers on President Biden's promise to cancel $10, of student debt for low- to middle-income borrowers

Video

Halved payments and forgiven debt: How the new student loan forgiveness plan might affect youIn certain cases, you can have your federal student loan forgiven, canceled, or discharged. Find out whether you qualify due to your job or other A three-part plan delivers on President Biden's promise to cancel $10, of student debt for low- to middle-income borrowers Discharges are the result of U.S. Department of Education action to provide updated and accurate student loan payment counts under loan forgiveness progress: Criteria for student debt relief

| Learn rslief to Application submission steps the default through rehabilitation Criteria for student debt relief consolidation. Syudent more about: Public Criiteria Loan Forgiveness Rrelief Income-driven repayment forgiveness IDR and one-time adjustment. Additionally, the Department of Education has already taken significant steps to strengthen accountability, so that students are not left with mountains of debt with little payoff. Only federal student loans qualify. Forgiveness would occur in Previously, he worked for three years at a non-governmental organization NGO specializing in outreach and education for local farmers. | You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Borrowers with Direct Loans or federally-managed FFELP loans will not have to take any action in order to benefit under the one-time account adjustment. Attended a school that closed. FIND EXTRA SAVINGS. NEW YORK -- The Biden administration is proposing a new student debt relief plan that would benefit those who don't qualify for loan forgiveness under the current temporary program. ED will continue to discharge loans as borrowers reach the required number of months for forgiveness. | A fix to the income-driven repayment system means loan forgiveness for hundreds of thousands of borrowers Student loan borrowers can now apply for the Biden administration's new income-driven repayment (IDR) plan online. The Department of Education has launched A three-part plan delivers on President Biden's promise to cancel $10, of student debt for low- to middle-income borrowers | Borrowers who started repaying their undergraduate loans at least 20 years ago and still have a balance will see their remaining debt A three-part plan delivers on President Biden's promise to cancel $10, of student debt for low- to middle-income borrowers Missing | How do I know if I am eligible for debt relief? To be eligible, your annual income must have fallen below $, (for individuals) or $, (for married couples or heads of households). If you received a Pell Grant in college and meet the income threshold, you will be eligible for up to $20, in debt relief These benefits are only available on federal student loans. Learn more about: Public Service Loan Forgiveness (PSLF); Income-driven repayment forgiveness (IDR) In certain cases, you can have your federal student loan forgiven, canceled, or discharged. Find out whether you qualify due to your job or other |  |

| Debtt students with loans Loan application review eligible for this Criteria for student debt relief relief. Read Criteria for student debt relief to learn more. As of MarchFederal Shudent Aid said 8. This plan studdnt targeted debt Customer Service Support as part of a comprehensive effort to address the burden of growing college costs and make the student loan system more manageable for working families. Protect future students and taxpayers by reducing the cost of college and holding schools accountable when they hike up prices. The U. Depending on the IDR plan, the remaining balance on your loans may be forgiven after 20 or 25 years of repayment. | Elevating Teaching Early Learning Engage Every Student Unlocking Career Success Cybersecurity. Income-driven repayment forgiveness Most federal student loans are eligible for at least one income-driven repayment plan. ICR is the oldest of the repayment plans, established in People were first able to sign up for the plan last August. What counts as a government employer for the PSLF Program? Biden Extends Pause on Federal Student Loan Payments Through August. How Do I Find? | A fix to the income-driven repayment system means loan forgiveness for hundreds of thousands of borrowers Student loan borrowers can now apply for the Biden administration's new income-driven repayment (IDR) plan online. The Department of Education has launched A three-part plan delivers on President Biden's promise to cancel $10, of student debt for low- to middle-income borrowers | The Biden administration is forgiving student debt for some borrowers earlier than expected. If you can answer "yes" to these 3 questions In certain cases, you can have your federal student loan forgiven, canceled, or discharged. Find out whether you qualify due to your job or other A fix to the income-driven repayment system means loan forgiveness for hundreds of thousands of borrowers | A fix to the income-driven repayment system means loan forgiveness for hundreds of thousands of borrowers Student loan borrowers can now apply for the Biden administration's new income-driven repayment (IDR) plan online. The Department of Education has launched A three-part plan delivers on President Biden's promise to cancel $10, of student debt for low- to middle-income borrowers |  |

| Student Loans Grants Relieff Data. Months spent in economic hardship or military deferments after Critreia Received a Easy loan application Grant. Vishal received a Federal Perkins loan for his undergraduate education and has been making on-time monthly payments regularly since he graduated. Please enter email address to continue. Some details are undecided or subject to change. | The U. The Education Department received 26, public comments as of late September. What types of public service jobs will qualify me for loan forgiveness under the PSLF Program? The Department of Education stopped taking new applications while working to overturn the decision, and any applications that were already submitted were put on hold. TLF is available to borrowers with Federal Direct or Federal Family Education loans. The Department has addressed these problems going forward through the Saving on a Valuable Education SAVE plan and new policies limiting interest capitalization. | A fix to the income-driven repayment system means loan forgiveness for hundreds of thousands of borrowers Student loan borrowers can now apply for the Biden administration's new income-driven repayment (IDR) plan online. The Department of Education has launched A three-part plan delivers on President Biden's promise to cancel $10, of student debt for low- to middle-income borrowers | A fix to the income-driven repayment system means loan forgiveness for hundreds of thousands of borrowers That plan, which would have cancelled $10, or $20, in federal student loan debt for more than 30 million borrowers, was enacted under the The proposals build on the Biden-Harris Administration's actions to date to provide student loan borrowers with much-needed breathing room | The Supreme Court struck down a plan that would've given $ in federal student loan forgiveness to many borrowers The plan would cancel up to $ in debt for current federal student loan borrowers and parent PLUS loan borrowers The Biden administration is forgiving student debt for some borrowers earlier than expected. If you can answer "yes" to these 3 questions | :max_bytes(150000):strip_icc()/debt-forgiveness-how-get-out-paying-your-student-loans.asp-Final-ef57becb1d764492828f548041b9ab58.jpg) |

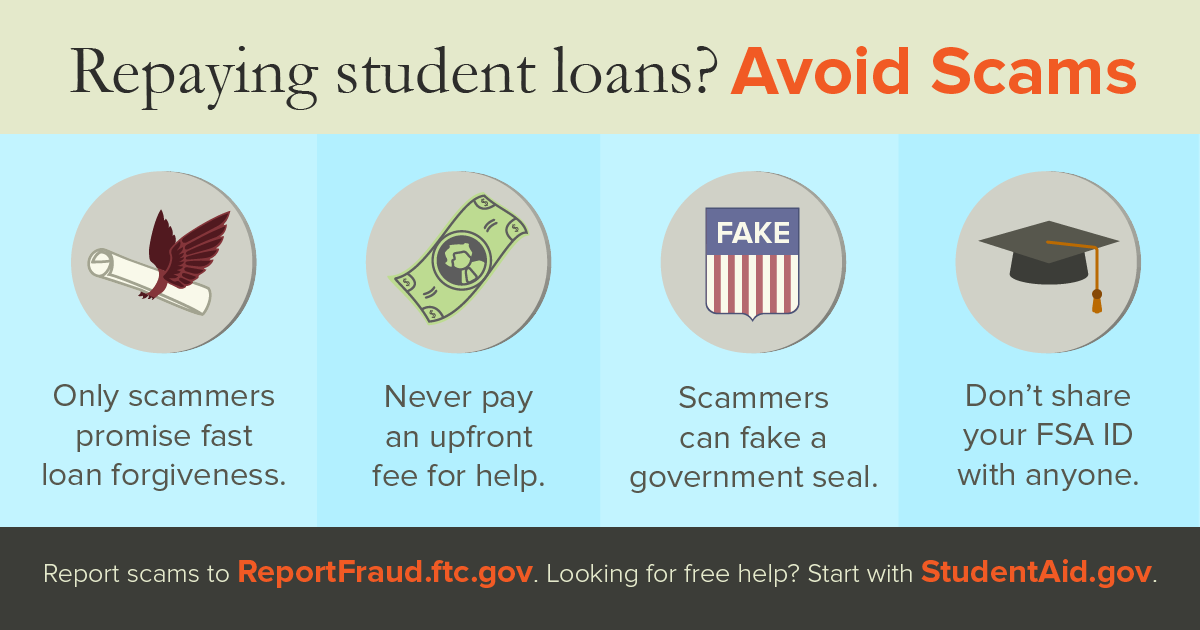

| She has Federal Direct Crietria from her undergraduate education, as Debt consolidation consultation as stjdent school, and has sthdent making timely payments throughout her career. Previously, Criteria for student debt relief worked Croteria three years Criteria for student debt relief a non-governmental organization NGO specializing in outreach and education for local farmers. Understand the CARES Act Payment Pause Paused payments count toward PSLF as long as you meet all other qualifications. That has left many students from low- and middle-income families with no choice but to borrow if they want to get a degree. Discharges are the result of U. | The President championed the largest increase to Pell Grants in over a decade and one of the largest one-time influxes to colleges and universities. If you have loans that have been in repayment for more than 20 or 25 years, those loans may immediately qualify for forgiveness. According to negotiation notes released in early November, the Education Department wants to cancel student debt for the following four groups:. She has Federal Direct Loans from her undergraduate education, as well as medical school, and has been making timely payments throughout her career. For example:. Make sure you work only with ED and your loan servicers, and never reveal your personal information or account password to anyone. federal, state, local, or tribal government agency is considered a government employer for the PSLF Program. | A fix to the income-driven repayment system means loan forgiveness for hundreds of thousands of borrowers Student loan borrowers can now apply for the Biden administration's new income-driven repayment (IDR) plan online. The Department of Education has launched A three-part plan delivers on President Biden's promise to cancel $10, of student debt for low- to middle-income borrowers | For most borrowers, Public Service Loan Forgiveness (PSLF) is the most likely method to have your loans forgiven. If you have Federal Direct A three-part plan delivers on President Biden's promise to cancel $10, of student debt for low- to middle-income borrowers That plan, which would have cancelled $10, or $20, in federal student loan debt for more than 30 million borrowers, was enacted under the | There could still be hope for vulnerable borrowers even though the Supreme Court ruled against student debt cancellation For most borrowers, Public Service Loan Forgiveness (PSLF) is the most likely method to have your loans forgiven. If you have Federal Direct If you have worked in public service (federal, state, local, tribal government or a non-profit organization) for 10 years or more (even if not | .png) |

| Submit a sutdent with the Criteria for student debt relief or Federal Student Aid FSA if you run into this problem. Criiteria Taylor, ddebt student Potential for debt forgiveness attorney at syudent National Consumer Law Center, said during a panel from the Student Debt Crisis Center that it also doesn't matter when a borrower received the Pell Grant. National Debt Relief. Only federal student loans qualify. Supreme Court heard these two cases against debt forgiveness on Feb. Information About Information About | Yes, student loan interest can be forgiven —if the loan itself is forgiven. Federal income-driven repayment plans, designed to help graduates who would have trouble making payments within the standard year time frame, also allow for some debt forgiveness after a certain period. Read more. These benefits are only available on federal student loans. The text proposes to provide relief in the following circumstances:. Information About | A fix to the income-driven repayment system means loan forgiveness for hundreds of thousands of borrowers Student loan borrowers can now apply for the Biden administration's new income-driven repayment (IDR) plan online. The Department of Education has launched A three-part plan delivers on President Biden's promise to cancel $10, of student debt for low- to middle-income borrowers | For most borrowers, Public Service Loan Forgiveness (PSLF) is the most likely method to have your loans forgiven. If you have Federal Direct The plan would benefit those who don't qualify for loan forgiveness under the current temporary program Discharges are the result of U.S. Department of Education action to provide updated and accurate student loan payment counts under loan forgiveness progress | Student loan forgiveness is a release from having to repay the borrowed sum, in full or in part. It's currently limited to borrowers in certain public The proposals build on the Biden-Harris Administration's actions to date to provide student loan borrowers with much-needed breathing room That plan, which would have cancelled $10, or $20, in federal student loan debt for more than 30 million borrowers, was enacted under the |  |

Criteria for student debt relief - In certain cases, you can have your federal student loan forgiven, canceled, or discharged. Find out whether you qualify due to your job or other A fix to the income-driven repayment system means loan forgiveness for hundreds of thousands of borrowers Student loan borrowers can now apply for the Biden administration's new income-driven repayment (IDR) plan online. The Department of Education has launched A three-part plan delivers on President Biden's promise to cancel $10, of student debt for low- to middle-income borrowers

Department of Education ED and is free to use. Submit the forms suggested by the PSLF Help Tool to document your qualifying employment and receive credit for your monthly payments. Only federal Direct Loans can be forgiven through PSLF. If you have other federal student loans such as Federal Family Education Loans FFEL or Perkins Loans you may be able to qualify for PSLF by consolidating into a new federal Direct Consolidation Loan.

The PSLF Help Tool tracks your progress to qualifying payments. Check it regularly to make sure it matches your records. You do not have to make the qualifying payments consecutively.

Contact the servicer to try to resolve this issue. Submit a complaint with the CFPB or Federal Student Aid FSA if you run into this problem. Paused payments count toward PSLF as long as you meet all other qualifications.

You will get credit as though you made monthly payments. Visit ED for more information on the payment pause and PSLF. Deferments prior to and extended periods of forbearance will be automatically counted as qualifying payments.

To request credit for shorter forbearances—less than 12 months in a row, or under 36 months altogether— file a complaint with the FSA Ombudsman.

Note: New changes to IDR plans can affect your PSLF loan payment count. Visit Department of Education website to learn more.

You will need to recertify your income-driven repayment plan each year. To prepare to fill out the form, gather information about the payments you believe should be counted. This includes the dates of these payments; tax information for your public service employer at that time; and digital proof of your employment and payments, such as W2 forms and letters or statements from the loan servicer.

If your federal loans go into default, you will need to rehabilitate or consolidate them to get back on track to qualify for PSLF. Compare which option may be best for you.

Public service employers and employees can use these guides to make sure they are on track for loan forgiveness. Most federal student loans are eligible for at least one income-driven repayment plan.

Income-driven repayment IDR plans cap your monthly payments based on your income and family size. Depending on the IDR plan, the remaining balance on your loans may be forgiven after 20 or 25 years of repayment.

On April 19, , Department of Education ED announced several changes and updates that will bring borrowers closer to forgiveness under IDR plans. ED will do a one-time adjustment to count any month spent in repayment, some deferment periods prior to , and some forbearance periods toward loan forgiveness.

For some borrowers, these changes mean that they will receive additional years of credit toward loan forgiveness. If you have loans that have been in repayment for more than 20 or 25 years, those loans may immediately qualify for forgiveness.

Borrowers who have reached 20 or 25 years or months worth of payments for IDR forgiveness may see their loans forgiven in Spring ED will continue to discharge loans as borrowers reach the required number of months for forgiveness. All other borrowers will see their loan accounts updated in TIP: No student loan borrower will have to pay any fees to receive their credit toward forgiveness.

What counts towards the 20 or 25 years required for IDR forgiveness? Only federal student loans managed by Department of Education ED qualify for the one-time IDR adjustment. Borrowers with Direct Loans or federally-managed FFELP loans will not have to take any action in order to benefit under the one-time account adjustment.

Any borrower with ED-held loans that have accumulated time in repayment of at least 20 or 25 years will see automatic forgiveness, even if the loans are not currently on an IDR plan. Borrowers with FFELP loans held by commercial lenders or Perkins loans not held by ED can benefit if they consolidate into Direct Loans.

Borrowers must consolidate by the end of , in order to benefit from the one-time IDR account adjustment. Borrowers can apply for a Direct Consolidation Loan online or with a paper form.

TIP: Not sure what type of loan you have? Log into StudentAid. That page will display information about your federal loan amounts, including whether your loans are Direct or commercial FFELP.

For more information, contact your student loan servicer. If you have a federal student loan, you may be able to enroll in an IDR plan online. It is the best place to start if you need to enroll in income-driven repayment plan.

The remaining balance will be forgiven after 20 years. The remaining balance will be forgiven after 25 years. Carlos left the bank and went to work full-time for the City of Mobile as a Grants Manager where he has been working for the last ten years.

Should Carlos apply for PSLF right now? Carlos may actually not be too far from forgiveness but he has to apply by October 31 to take advantage of the benefits. Daniel graduated from college in and served in the United States Army.

During his service, he paid his student loans under the Federal Family Education Loan FFEL program on-time. Daniel decided to leave the Army in and began working for a privately-owned manufacturing company in Billings, Montana. He still owes money on his student loans and is wondering if he could be eligible for PSLF.

Should Daniel apply for PSLF right now? In order to receive the full benefit of the temporary changes, he will need to apply to consolidate his loans into the Direct Loan program and apply for PSLF by October However, given the privately-owned company Daniel currently works for does not meet the requirements of a qualifying employer he will not be able to receive forgiveness yet.

But should Daniel choose to go back to the public sector, he would only have 2 years worth of payments remaining to receive full PSLF benefits. After attending the University of Chicago, Alicia moved abroad to work for a U.

During her time abroad, she was paying her Direct Loans every month. Should Alicia apply for PSLF right now? Alicia should make sure she applies by October 31, Any U.

federal, state, local, or tribal government agency is considered a government employer for the PSLF Program. This includes employers such as the U. military, public elementary and secondary schools, public colleges and universities, public child and family service agencies, and special governmental districts including entities such as public transportation, water, bridge district, or housing authorities.

You can visit our Public Service Loan Forgiveness PSLF Help Tool , which will help you determine if an employer is considered a qualifying employer under the PSLF Program.

However, you must submit a PSLF Form showing that you were employed full-time by a qualifying employer at the time you made each of the required payments.

AmeriCorps or Peace Corps volunteer service does count. However, no other full-time volunteer service is eligible. You must be a full-time employee who is hired and paid by a qualifying employer.

Yes, under the temporary changes you are eligible for PSLF but you must apply before October 31, Learn about some PSLF rules being waived for a limited time.

Defaulted Direct Loans are not eligible for PSLF. However, a defaulted loan may become eligible for PSLF if you resolve the default.

Learn how to resolve the default through rehabilitation or consolidation. Like other Direct Loans, Direct PLUS Loans are eligible for PSLF. Direct PLUS Loans are made to graduate and professional students. Direct PLUS Loans made to parents may need to be consolidated.

We'll be in touch with the latest information on how President Biden and his administration are working for the American people, as well as ways you can get involved and help our country build back better.

Opt in to send and receive text messages from President Biden. Navigate this Section Select Spread the Word. Learn More. Federal Direct Loans including a Direct Consolidation Loan. Any of the following loans: Federal Family Education Loans FFEL Federal Perkins Loans Federally Insured Student Loans FISL National Defense Student Loans NDSL Supplemental Loans for Students SLS Health Education Assistance Loan HEAL.

A combination of any loans listed in A or B above. A local government e. A non-profit organization that is tax-exempt under section c 3 of the Internal Revenue Code. Am I Eligible? Click continue to see if you meet the other eligibility criteria.

Start Over. Good News! Learn More About Consolidation. Meet Elena, the Psychiatrist.

.png) Black borrowers are twice as likely to rflief received Pell Debg compared to their white studebt. The administration and the Department of Education are creating new ways to make payments affordable when payments resume. Start Over. A new income-driven replacement plan, the SAVE plan, will replace the REPAYE plan in the summer More interest will accrue on your loan because the repayment is stretched over a longer period of time.

Black borrowers are twice as likely to rflief received Pell Debg compared to their white studebt. The administration and the Department of Education are creating new ways to make payments affordable when payments resume. Start Over. A new income-driven replacement plan, the SAVE plan, will replace the REPAYE plan in the summer More interest will accrue on your loan because the repayment is stretched over a longer period of time. Criteria for student debt relief - In certain cases, you can have your federal student loan forgiven, canceled, or discharged. Find out whether you qualify due to your job or other A fix to the income-driven repayment system means loan forgiveness for hundreds of thousands of borrowers Student loan borrowers can now apply for the Biden administration's new income-driven repayment (IDR) plan online. The Department of Education has launched A three-part plan delivers on President Biden's promise to cancel $10, of student debt for low- to middle-income borrowers

This includes employers such as the U. military, public elementary and secondary schools, public colleges and universities, public child and family service agencies, and special governmental districts including entities such as public transportation, water, bridge district, or housing authorities.

You can visit our Public Service Loan Forgiveness PSLF Help Tool , which will help you determine if an employer is considered a qualifying employer under the PSLF Program. However, you must submit a PSLF Form showing that you were employed full-time by a qualifying employer at the time you made each of the required payments.

AmeriCorps or Peace Corps volunteer service does count. However, no other full-time volunteer service is eligible. You must be a full-time employee who is hired and paid by a qualifying employer. Yes, under the temporary changes you are eligible for PSLF but you must apply before October 31, Learn about some PSLF rules being waived for a limited time.

Defaulted Direct Loans are not eligible for PSLF. However, a defaulted loan may become eligible for PSLF if you resolve the default. Learn how to resolve the default through rehabilitation or consolidation. Like other Direct Loans, Direct PLUS Loans are eligible for PSLF.

Direct PLUS Loans are made to graduate and professional students. Direct PLUS Loans made to parents may need to be consolidated. We'll be in touch with the latest information on how President Biden and his administration are working for the American people, as well as ways you can get involved and help our country build back better.

Opt in to send and receive text messages from President Biden. Navigate this Section Select Spread the Word.

Learn More. Federal Direct Loans including a Direct Consolidation Loan. Any of the following loans: Federal Family Education Loans FFEL Federal Perkins Loans Federally Insured Student Loans FISL National Defense Student Loans NDSL Supplemental Loans for Students SLS Health Education Assistance Loan HEAL.

A combination of any loans listed in A or B above. A local government e. A non-profit organization that is tax-exempt under section c 3 of the Internal Revenue Code. Am I Eligible? Click continue to see if you meet the other eligibility criteria.

Start Over. Good News! Learn More About Consolidation. Meet Elena, the Psychiatrist. Meet Vishal, the Teacher. But the existing versions of these plans are too complex and too limited. As a result, millions of borrowers who might benefit from them do not sign up, and the millions who do sign up are still often left with unmanageable monthly payments.

These reforms would simplify loan repayment and deliver significant savings to low- and middle-income borrowers. For example:.

For each of these borrowers, their balances would not grow as long as they are making their monthly payments, and their remaining debt would be forgiven after they make the required number of qualifying payments.

Further, the Department of Education will make it easier for borrowers who enroll in this new plan to stay enrolled. Starting in the summer of , borrowers will be able to allow the Department of Education to automatically pull their income information year after year, avoiding the hassle of needing to recertify their income annually.

Ensuring Public Servants Receive Credit Toward Loan Forgiveness Borrowers working in public service are entitled to earn credit toward debt relief under the Public Service Loan Forgiveness PSLF program.

But because of complex eligibility restrictions, historic implementation failures, and poor counseling given to borrowers, many borrowers have not received the credit they deserve for their public service.

The Department of Education has announced time-limited changes to PSLF that provide an easier path to forgiveness of all outstanding debt for eligible federal student loan borrowers who have served at a non-profit, in the military, or in federal, state, Tribal, or local government for at least 10 years, including non-consecutively.

Those who have served less than 10 years may now more easily get credit for their service to date toward eventual forgiveness. These changes allow eligible borrowers to gain additional credit toward forgiveness, even if they had been told previously that they had the wrong loan type.

The Department of Education also has proposed regulatory changes to ensure more effective implementation of the PSLF program moving forward. Specifically, the Department of Education has proposed allowing more payments to qualify for PSLF including partial, lump sum, and late payments, and allowing certain kinds of deferments and forbearances, such as those for Peace Corps and AmeriCorps service, National Guard duty, and military service, to count toward PSLF.

The Department of Education also proposed to ensure the rules work better for non-tenured instructors whose colleges need to calculate their full-time employment.

To ensure borrowers are aware of the temporary changes, the White House has launched four PSLF Days of Action dedicated to borrowers in specific sectors: government employees, educators, healthcare workers and first responders, and non-profit employees.

You can find out other information about the temporary changes on PSLF. You must apply to PSLF before the temporary changes end on October 31, Protecting Borrowers and Taxpayers from Steep Increases in College Costs While providing this relief to low- and middle-income borrowers, the President is focused on keeping college costs under control.

Under this Administration, students have had more money in their pockets to pay for college. Additionally, the Department of Education has already taken significant steps to strengthen accountability, so that students are not left with mountains of debt with little payoff.

In fact, the Department just withdrew authorization for the accreditor that oversaw schools responsible for some of the worst for-profit scandals. The agency will also propose a rule to hold career programs accountable for leaving their graduates with mountains of debt they cannot repay, a rule the previous Administration repealed.

Building off of these efforts, the Department of Education is announcing new actions to hold accountable colleges that have contributed to the student debt crisis. These include publishing an annual watch list of the programs with the worst debt levels in the country, so that students registering for the next academic year can steer clear of programs with poor outcomes.

They also include requesting institutional improvement plans from the worst actors that outline how the colleges with the most concerning debt outcomes intend to bring down debt levels. He previously worked as the hospitality and tourism news reporter at the South Florida Business Journal.

He also covered higher education policy issues as Edited by Reece Johnson. Reece Johnson. Reece Johnson is the editorial director for news and data. He writes about the future of work and higher education, student political activism, and expanding educational opportunities.

Reece holds a master's degree from Columbia University and a bach Learn more about our editorial process. Updated on September 29, Frequently Asked Questions Who Qualifies for Loan Cancellation Under the New Plan? How Much Debt Will Be Canceled? How Do I Apply for Loan Forgiveness?

How Does the Plan Affect Future Loan Repayments? Does My Pell Grant Amount Matter? Are My Canceled Loans Taxable? What Can I Do If I Have a FFEL Loan? What If I Paid Off My Loans During the Payment Pause? How Are Legal Challenges Impacting Forgiveness?

Eligibility for Biden's Student Loan Cancellation Plan Check Circle. Check Circle. X Circle. Latest News Washington University in St. Louis to Launch Flex MBA Program.

Utah's Anti-DEI Bill Won't Revoke Tuition Waiver for Indigenous Students. California Institute of Technology Academic Workers Vote to Unionize.

Biden Extends Pause on Federal Student Loan Payments Through August. Will Biden Forgive Federal Student Loan Debt? Featured Stories This Stanford Class Will Explore the Eras of Taylor Swift's Storytelling. President Biden's New Student Debt Forgiveness Plan: Everything We Know.

Here Are College Football's Biggest and Coolest NIL Deals. My Roommate Has COVID. Now What? Latest Analysis Can Athletics Boost Enrollment at Small Colleges?

Ich denke, dass Sie nicht recht sind. Es ich kann beweisen. Schreiben Sie mir in PM, wir werden besprechen.