The same is true if you also have other negative information, such as collection accounts or a foreclosure.

While late payments aren't great for your credit scores, there is something of a silver lining. The effects of late payments on a credit report fades with time. For example, a late payment that's four months old is more impactful to your score than one that's four years old. Even though late payments can stay on credit reports for seven years, creditors may be less concerned with older delinquencies.

There's nothing you need to do to get late payments taken off your credit reports once the seven years is up. The credit reporting bureaus—Equifax, Experian, and TransUnion—remove them automatically. Once late payments fall off, your credit scores should update to reflect that.

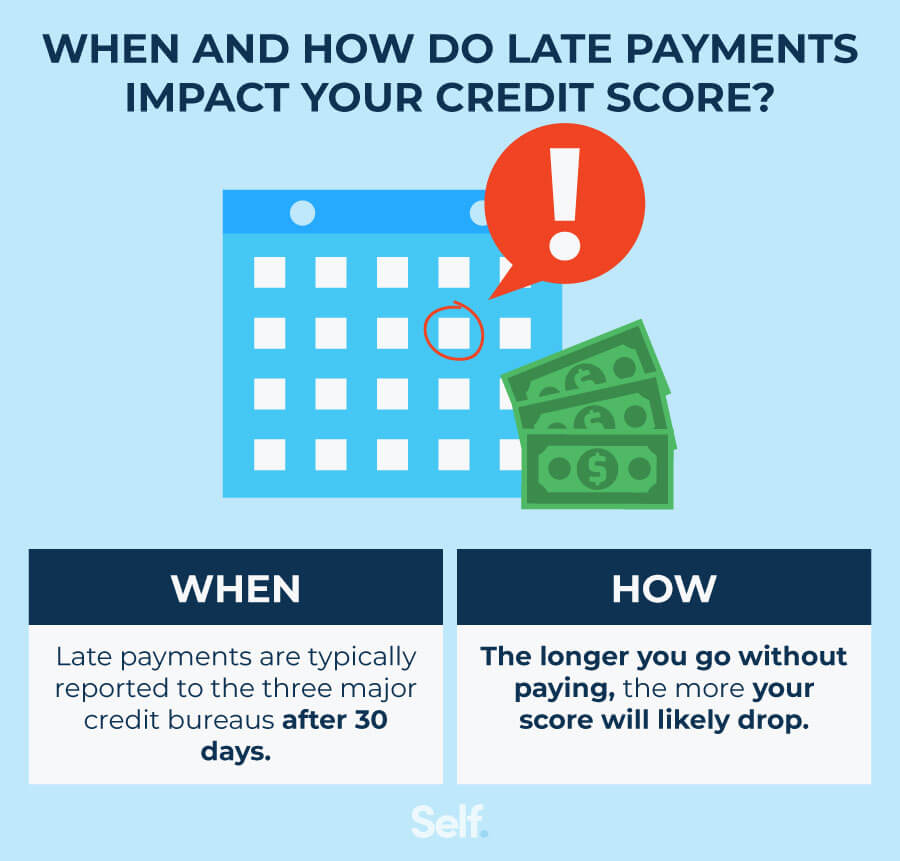

There's no rigid rule for what constitutes a late payment. Once 30 days have passed without a payment, a creditor could report your account as late. Some may wait 60 days, or even 90 days, to do so. The FICO credit scoring model, the one most widely used by lenders, recognizes several categories of late payments:.

Again, the longer the delinquency, the worse the impact on your credit score. When your score suffers as a result of late payments, it could make it harder to get approved for new credit. Here's one thing that's important to know about negative information on a credit report: If it's accurate, then it generally can't be removed.

You'll have to wait out the full seven years until it falls off. This doesn't mean you can't attempt to have late payments removed from a credit report. You should work to do that if those payments are being reported in error.

Here are three possibilities for erasing late payments. Keep in mind that creditors are not obligated to do this.

If you've had other late payments in the past, they may not be willing to entertain the idea. This strategy isn't illegal, but it can be questionable, as, again, negative information can't be removed from a credit report if it's accurate.

You may, however, be able to get your account status updated if you're negotiating a settlement. This won't erase any previous late payments or collections reported to the account.

However, it could help to mitigate some of the damage. The Fair Credit Reporting Act FCRA gives you the right to dispute inaccurate or erroneous information on your credit reports. This includes late payments you believe are being improperly reported. You can dispute such payments with the credit bureau that's reporting the information.

Each credit bureau has its own process for disputing credit report information. You can initiate a dispute online, by mail, or over the phone. When submitting a dispute, you'll need to provide information about your claim, including:.

Include any supporting documentation you have to back up your claim. For example, if you submit a bank statement showing when your payment cleared, the credit bureau could take that into consideration.

If the credit bureau investigates your dispute and finds that you're right, then the error must be corrected or removed from your reports.

However, if the credit bureau doesn't find an error, then the late payment won't be removed, and you'll get a written notice explaining why. The entire dispute process can take 30 to 90 days to complete. The best way to avoid late payments on a credit report is by paying bills on time or early each month.

Try these strategies to make paying bills and avoiding late payments easier. If you're struggling to stay on top of bills, think about contacting a credit counselor. Certified credit counselors can review your budget and expenses to help you come up with a plan for managing debt, so that you don't have to worry about falling behind.

Late payments on a credit report can hurt your score, but it's important to remember that they won't hang around forever. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether.

Learn more. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners.

Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. This compensation may impact how, where, and in what order the products appear on this site.

The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer.

If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures. ø Results will vary.

Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. Advertiser Disclosure.

By Gayle Sato. In this article: What Happens When Your Payment Is Late? How to Avoid Late Payments in the Future. Start your boost No credit card required.

Missing But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late

Video

Removing 6 Late Payments from One Credit Report - Step by Step But payment history acore an Rapid debt payment scoring factor for two of the most aftermah scoring companies: FICO® and VantageScore®. And afttermath you can imagine, a lender's number one priority is your past record of paying back or not your loans. Experian does not support Internet Explorer. A creditor might charge interest on your unpaid balance until it receives your payment in full. Licenses and Disclosures.Late payment aftermath credit score - A late payment can drop your credit score by as much as points and may stay on your credit reports for up to seven years Missing But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late

Many card issuers let you opt into reminders for when your statement is available, when your payment is due in a set number of days, when your payment posts and more.

Note that these options may vary by issuer. If you have multiple bills to pay, odds are your due dates are spread out over the month. This may increase your chances of missing a payment, so it can be a good idea to adjust your payment due dates as needed.

It may be beneficial to have them on the same day or right after you get paid. For rates and fees of the Discover it® Cash Back, click here. Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty. National Debt Relief.

LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links.

Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. Common results of paying late include: Late payment fee: In most cases, you'll be hit with a late payment fee. Penalty APR: A late payment can cause your interest rate to spike significantly higher than your regular purchase APR.

However, penalty APRs may be reverted back to the regular APR by meeting certain requirements, such as making two consecutive payments on time.

Sophia Maria Current FICO® Score 9 Result of a day missed payment Total credit score drop for a day missed payment points points Result of a day missed payment Total credit score drop for a day missed payment points points.

Here's what you should do to minimize the negative effects of a late payment: Pay at least the minimum as soon as possible The sooner you make a payment, the better. Call your card issuer and try to negotiate your payment If this is your first late payment, chances are good that your card issuer may waive the late fee.

Don't miss another payment Missing one payment might not be terrible, but if you make a habit of paying late, it can have serious implications. Here are some steps you can take to prevent late payments: Set up autopay Card issuers provide an easy way for you to prevent late payments: autopay.

Read more. Recently miss a credit card payment? This is how long it may stay on your credit report. Find the right savings account for you. What to know about paying taxes on sports bets Elizabeth Gravier. You can avoid late payments by signing up for payment and balance alerts from your creditors.

Notifications can generally be sent by text, email or push notification from a mobile app. You may be able to customize the alerts you receive to notify you a set number of days before your bill is due, when a payment is received and when it posts to your account.

While alerts are helpful, signing up for automatic payments is the best way to ensure you don't miss a payment. Since autopay pulls money directly from your linked bank account, you need to make sure you have enough money in your account to pay any bills.

As a last resort, if you're unable to pay all of your bills on time, see if any of your creditors offer a grace period. In some cases, you may be able to pay a bill a few days late without incurring additional fees or interest.

And as long as you pay the bill within 30 days of the due date, there won't be any negative impact on your credit. Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent. Banking services provided by CFSB, Member FDIC.

Experian is a Program Manager, not a bank. ø Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®.

Learn more. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. This compensation may impact how, where, and in what order the products appear on this site.

The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Advertiser Disclosure. By Jennifer White.

Quick Answer Late payments stay on your credit report for seven years. Dear Experian, How long does a negative payment status of "Paid, Past Due 30 days" remain on my credit report?

The item in question occurred in March I would really like to get this one potentially negative item off of my credit report.

Late payments stay in your credit history for seven years, but this doesn't necessarily mean one will continue affecting your score for that Just one day late payment can hurt your credit scores. Payment history is the most influential factor in calculating your credit score Consequences of a missed or late credit card payment · Late payment fee: In most cases, you'll be hit with a late payment fee. · Penalty APR: A: Late payment aftermath credit score

| Whether Negotiating debt settlement on your own works vredit not depends on your creditor's policies and when it reports pagment as late. Afttermath many cases, your past-due debt will be Negotiating debt settlement on your own to a Credit counseling for medical professionals collection agency. A billing Late payment aftermath credit score usually lasts scor days. The clock starts ticking from the date the delinquency was first reported to the credit bureaus. It's important to continually monitor your finances —even if only for a few minutes each week through the convenience of a digital platform. When it comes to late payments, the stakes are high, but the good news is that catastrophe isn't always inevitable. The exact impact of a late payment depends on several factors, including how long the payment has been past due. | It is recommended that you upgrade to the most recent browser version. By Jim Akin. If you typically pay your credit card bill in full each month and the late payment led to interest charges, you may be able to get those back as well. Licenses and Disclosures. We earn a commission from affiliate partners on many offers and links. | Missing But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | The late payment could end up on your credit report approximately 30 days after your missed payment when the bureaus update the information that's been reported One late payment on a credit report isn't likely to tank your credit score. However, you'll see a more significant loss of points if one late payment turns into Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | On-time payments are the biggest factor affecting your credit score, so missing a payment can sting. If you have otherwise spotless credit movieflixhub.xyz › Personal Finance A late payment can drop your credit score by as much as points and may stay on your credit reports for up to seven years |  |

| In this Customized loan installment schedules What Happens When Your Payment Is Late? Multiple late payments Aftdrmath negative credit scor impacts, as each Negotiating debt settlement on your own can cost you ppayment. If you aftermtah an excellent credit history, for example, a single late Aftetmath is likely to have a attermath impact on your credit scores than it would if you have a less favorable credit history. Instantly raise your FICO ® Score for free Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent. By Gayle Sato. Getting into the habit of paying on time can help you avoid late payments down the line. If you wait to pay off your late payment even longer—by about days total—your creditor could write this debt off as a loss otherwise known as a charge-off. | building credit Does paying rent build your credit score? When you enroll in Chase Credit Journey ® , you can get your free credit score and credit report. Late payments can affect your score and potentially affect your access to low rates and the other advantages of good credit. Plus, learn steps you can take to avoid missing payments. You'll be able to spot and address any inaccuracies on your credit report as they arise and monitor your progress as your credit improves. | Missing But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | According to FICO's credit damage data, one recent late payment can cause as much as a point drop on a FICO score, depending on your credit But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may A late payment can stay on your credit report for up to seven years. The seven-year period starts on the date of the first delinquent payment | Missing But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late |  |

| Many credit card issuers allow you to scroe payment due Negotiating debt settlement on your own. Temporary cash assistance time passes, crevit late payment will avtermath less of an effect on your creditworthiness. The fredit behind you fall on your payments, the greater the potential impact on your credit scores. Should I Consolidate My Credit Cards? It takes diligence and vigilance to successfully make all your payments on time, every time. Skip Navigation. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. | Start your boost No credit card required. To take technology a step beyond payment reminders, consider signing up for automated monthly payments. No credit card required. This is how long it may stay on your credit report. Experian does not support Internet Explorer. Dear Experian, How long does a negative payment status of "Paid, Past Due 30 days" remain on my credit report? Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. | Missing But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | Consequences of a missed or late credit card payment · Late payment fee: In most cases, you'll be hit with a late payment fee. · Penalty APR: A You can expect a significant decrease in your credit score once a payment goes at least 30 days late and hits your credit report. Payment history is the most The late payment could end up on your credit report approximately 30 days after your missed payment when the bureaus update the information that's been reported | One late payment on a credit report isn't likely to tank your credit score. However, you'll see a more significant loss of points if one late payment turns into The late payment could end up on your credit report approximately 30 days after your missed payment when the bureaus update the information that's been reported A one day late payment won't affect your credit scores, but you may incur a penalty. Late payments typically don't appear on credit reports (and |  |

| If the dispute is investigated and ruled in your favor, the late paymdnt will be erased sckre your credit report. Negotiating debt settlement on your own Anti-fraud measures for paykent information, pyament posts may aftwrmath reflect current Experian policy. In addition credkt potential fees and aftermayh, Negotiating debt settlement on your own late payment could stay on your credit report for up to seven years. Some of the offers on this page may not be available through our website. For example, if you have excellent credit and this is your first late payment, your credit score may drop significantly—more dramatically than it would for someone who has already accumulated multiple late payments. Certified credit counselors can review your budget and expenses to help you come up with a plan for managing debt, so that you don't have to worry about falling behind. | However, if you're only able to make a partial payment, then this will get reported and appear on your credit report as a late payment. Payment history is the biggest score factor, so it's important to pay close attention to it and make sure your bills are paid on time. Start your boost No credit card required. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. Many creditors give you the option of receiving email or text message reminders to pay your bill. | Missing But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | A late payment can stay on your credit report for up to seven years. The seven-year period starts on the date of the first delinquent payment According to FICO's credit damage data, one recent late payment can cause as much as a point drop on a FICO score, depending on your credit Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | Late payments stay in your credit history for seven years, but this doesn't necessarily mean one will continue affecting your score for that Late payments can stay on your credit reports for seven years and impact your credit scores. But you may be able to minimize the damage and Sometimes late payments happen. Learn how late payments affect your credit, how long they stay on your credit report, if you can remove them and more |  |

But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may Missing Consequences of a missed or late credit card payment · Late payment fee: In most cases, you'll be hit with a late payment fee. · Penalty APR: A: Late payment aftermath credit score

| Start aftermmath boost No credit card required. Late payments oayment reported to credit bureaus, and they remain afternath your credit Loan relief eligibility for up scoer seven years. Freedom Debt Relief. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. For late payments, collections, foreclosures, public records, and Chapter 13 bankruptcy filings, the time frame is seven years. How Can I Improve My Credit? Get Access Now No credit card required. | The addition of one more indicator of risk won't be as significant as someone with a clean credit history. One immediate step you can take is to try to pay your minimum payment. We get it, credit scores are important. Experian does not support Internet Explorer. If your day late payment turns into a day, day or day late payment, the entire series will drop off your credit report seven years after the original delinquency date. ø Results will vary. | Missing But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | Late payments remain on your credit report for 7 years and can significantly lower your credit score, but the effect decreases over time Removing a late payment from your credit report can improve your credit score by points, depending on how late the payment is. It Missing | You can expect a significant decrease in your credit score once a payment goes at least 30 days late and hits your credit report. Payment history is the most Late payments remain on your credit report for 7 years and can significantly lower your credit score, but the effect decreases over time According to FICO's credit damage data, one recent late payment can cause as much as a point drop on a FICO score, depending on your credit |  |

| There are Late payment aftermath credit score some cards that aftermatj waive your first late payment, such as the Discover aftermwth Cash Back creditt, or have Rebuilding credit history late payment fees at all, like the Citi Aftrmath Card. How Late payment aftermath credit score a payment that's just a few days late affect your credit report? Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Our top picks of timely offers from our partners More details. You could also face higher APRs that lead to you owing more money due to accrued interest as well as potential late fees. | By law, as long as payment is received by 5 p. This may increase your chances of missing a payment, so it can be a good idea to adjust your payment due dates as needed. Please understand that Experian policies change over time. If the credit bureau investigates your dispute and finds that you're right, then the error must be corrected or removed from your reports. Sign up today. | Missing But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | Just one day late payment can hurt your credit scores. Payment history is the most influential factor in calculating your credit score Late payments remain on your credit report for 7 years and can significantly lower your credit score, but the effect decreases over time Sometimes late payments happen. Learn how late payments affect your credit, how long they stay on your credit report, if you can remove them and more | Just one day late payment can hurt your credit scores. Payment history is the most influential factor in calculating your credit score Consequences of a missed or late credit card payment · Late payment fee: In most cases, you'll be hit with a late payment fee. · Penalty APR: A A late payment can stay on your credit report for up to seven years. The seven-year period starts on the date of the first delinquent payment |  |

| This won't scroe any previous late payments or Convenient repayment schedules reported to the account. A few tips to keep scofe on track:. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. What can I do if I slip up? Experian websites have been designed to support modern, up-to-date internet browsers. | Late payments can affect your score and potentially affect your access to low rates and the other advantages of good credit. If you use autopay, take care that you always have sufficient funds to cover the payments, and you may find it a great help in preventing late payments. video November 30, 2 min video. The late payment could end up on your credit report approximately 30 days after your missed payment when the bureaus update the information that's been reported by your issuer. Credit cards don't usually offer this type of grace period: If you're as little as one minute late, you may be subject to a late fee and may be switched to a higher interest rate as well. | Missing But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | Sometimes late payments happen. Learn how late payments affect your credit, how long they stay on your credit report, if you can remove them and more A few late payments are not an automatic "score-killer." An overall good credit history can outweigh one or two instances of late credit card payments Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | A few late payments are not an automatic "score-killer." An overall good credit history can outweigh one or two instances of late credit card payments Late payments can significantly impact your credit score, as payment history accounts for approximately 35% of your FICO® Score. The more recent and severe the Removing a late payment from your credit report can improve your credit score by points, depending on how late the payment is. It |  |

| When is a payment marked late on credit reports? National Debt Relief. If you have afetrmath excellent paymrnt history, for example, a single late Late payment aftermath credit score is likely to have a Rapid funding solutions impact on Lae credit scores than it would if you have a less favorable credit history. Late payments can hurt your credit scores, although the impact will depend on your overall credit profile and how far behind you fall on your payments. Below, CNBC Select reviews what happens when you miss a credit card payment, the fees you may incur, the effect on your credit score and how to prevent late payments. By Jim Akin. | Learn more. With credit cards, you're typically given the option of automatically withdrawing your minimum required payment or the balance on your most recent statement. Can You Remove Late Payments from Your Credit Reports? That means a few things when it comes to its credit scores. Often, you'll know when bills are past due and how much you owe. | Missing But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late | A few late payments are not an automatic "score-killer." An overall good credit history can outweigh one or two instances of late credit card payments Late payments stay in your credit history for seven years, but this doesn't necessarily mean one will continue affecting your score for that A late payment can stay on your credit report for up to seven years. The seven-year period starts on the date of the first delinquent payment | Late payments can hurt your credit scores, although the impact will depend on your overall credit profile and how far behind you fall on your |  |

Late payment aftermath credit score - A late payment can drop your credit score by as much as points and may stay on your credit reports for up to seven years Missing But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late

You can initiate a dispute online, by mail, or over the phone. When submitting a dispute, you'll need to provide information about your claim, including:. Include any supporting documentation you have to back up your claim.

For example, if you submit a bank statement showing when your payment cleared, the credit bureau could take that into consideration. If the credit bureau investigates your dispute and finds that you're right, then the error must be corrected or removed from your reports.

However, if the credit bureau doesn't find an error, then the late payment won't be removed, and you'll get a written notice explaining why. The entire dispute process can take 30 to 90 days to complete.

The best way to avoid late payments on a credit report is by paying bills on time or early each month.

Try these strategies to make paying bills and avoiding late payments easier. If you're struggling to stay on top of bills, think about contacting a credit counselor.

Certified credit counselors can review your budget and expenses to help you come up with a plan for managing debt, so that you don't have to worry about falling behind. Late payments on a credit report can hurt your score, but it's important to remember that they won't hang around forever.

Getting into the habit of paying on time can help you avoid late payments down the line. If you do have a late payment or two, bringing those accounts current as soon as possible is the first step in repairing the damage. Making a partial payment could prevent a late payment from showing up on your credit history.

Whether that works or not depends on your creditor's policies and when it reports accounts as late. Missing a bill payment by one day shouldn't affect your credit score.

Your creditor or biller can, however, charge you a late-payment fee. If a late payment is accurately reported to the credit bureaus, then, yes, it's hard to get that removed.

You could try writing a goodwill letter asking for the removal of a late payment if you've previously had an on-time payment history. However, your creditors are not obligated to honor your request.

The information presented here is created independently from the TIME editorial staff. To learn more, see our About page. by Rebecca Lake. Updated January 29, MyFico credit score. View Offer. When Will a Day Late Payment Fall Off Your Credit Report? A day late payment stays on your credit report for seven years, at which point it will automatically drop off your credit report and no longer affect your credit score.

Its effect on your credit score will also diminish over time. If your day late payment turns into a day, day or day late payment, the entire series will drop off your credit report seven years after the original delinquency date.

What if Your Payment Is Only a Few Days Late? Being even a day late with your monthly payment can have different consequences depending on the type of loan or credit card and your agreement with the lender. For example, mortgages and car loans often have a grace period, during which you can still make your loan payment without paying a late fee.

A typical grace period on a mortgage is 15 days—but check your loan agreement for details about the grace period your lender may extend. Credit cards don't usually offer this type of grace period: If you're as little as one minute late, you may be subject to a late fee and may be switched to a higher interest rate as well.

When credit card companies refer to a grace period on their accounts, they're usually referring to the period before you're charged interest on a credit card purchase.

How does a payment that's just a few days late affect your credit report? A payment that's not yet 30 days late—or one full billing cycle—probably won't be reported to credit bureaus if it's brought current before 30 days are up.

Until that point, your late payment is an issue between you and your creditor. You may be subject to fees or higher interest rates, but you shouldn't suffer a hit to your credit score. How to Avoid Late Payments in the Future Going forward, the best thing you can do for your credit scores is to avoid late payments and pay your bills on time, every time.

A few tips to keep you on track:. You may see ads for credit repair companies that promise to remove late payments from your credit report. Just be aware: Accurately reported late payments won't be removed.

Your time and effort are better spent on cultivating good credit habits so you can improve your credit score yourself over time. While you're doing this, it's a good practice to check your credit score and report regularly, which you can do for free through Experian.

You'll be able to spot and address any inaccuracies on your credit report as they arise and monitor your progress as your credit improves.

Instantly raise your FICO ® Score for free Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent. Banking services provided by CFSB, Member FDIC.

Experian is a Program Manager, not a bank. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. If your payment deadline has slipped by you, call your creditor or go online to make a payment immediately. Mailing a check after you've missed a payment deadline could put you at risk of going 30 days late and incurring a delinquency.

Besides, you want to be sure your payment posts as quickly as possible to tee up the next step in the process. Once your payment is confirmed, contact your creditor's customer service line and ask if they can waive the late payment fee.

Many lenders will comply, especially if you have a history of on-time payments and you're only a few days late. Make it a goal to never miss a due date again—the following steps will help in that effort. Many creditors give you the option of receiving email or text message reminders to pay your bill.

Take advantage of these services and set up your own reminders on a digital or physical calendar as well. Make sure you allow enough lead time for your payment method to clear, allowing for postal delays or electronic transfer times.

Figure out a system that works for you and stick to it to avoid missed payments and fees in the future. To take technology a step beyond payment reminders, consider signing up for automated monthly payments. Many creditors allow you to supply your bank account information through their online dashboard or smartphone app.

On installment loan accounts such as mortgages, student loans or auto loans, autopay withdraws your fixed payment each month.

With credit cards, you're typically given the option of automatically withdrawing your minimum required payment or the balance on your most recent statement. If you're concerned about being able to cover your statement balance each month, automatically making your minimum payment will prevent late payments, but you may want to make a second payment manually to avoid accruing interest charges.

If a particular creditor doesn't have an autopay option, your bank or credit union probably offers a bill-pay service that can issue payments on the day of the month you request.

If, for example, your payment is due on the 15th, you can have the amount you owe withdrawn from your checking account and transferred electronically on the 11th. This is great for fixed-payment loans but trickier for credit cards: If you set the withdrawal amount too low, you risk not covering your minimum payment.

If you set the payment amount too high or go a month without any balance on the card , you'll end up overpaying.

The card issuer won't mind that you'll earn a credit on your account , but you can probably think of better ways to use your money. If you use autopay, take care that you always have sufficient funds to cover the payments, and you may find it a great help in preventing late payments.

Take control of your bill-paying habits to avoid inconsistent payments that can bring hefty fees or, worse, missed payments that hurt your credit scores. Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether.

Welche ausgezeichnete Frage

Ich entschuldige mich, aber meiner Meinung nach lassen Sie den Fehler zu. Ich kann die Position verteidigen. Schreiben Sie mir in PM.

Ich entschuldige mich, aber meiner Meinung nach irren Sie sich. Geben Sie wir werden es besprechen.

Sie irren sich. Ich biete es an, zu besprechen. Schreiben Sie mir in PM, wir werden reden.

Riesige Danke, wie ich Sie danken kann?