To learn more about refinancing a conforming loan, Contact Us or give us a call today at or toll-free at Government Streamline Loans The United States boasts several government streamline loans that can assist homeowners in refinancing their current government-backed mortgages into loans with lower rates or shorter terms.

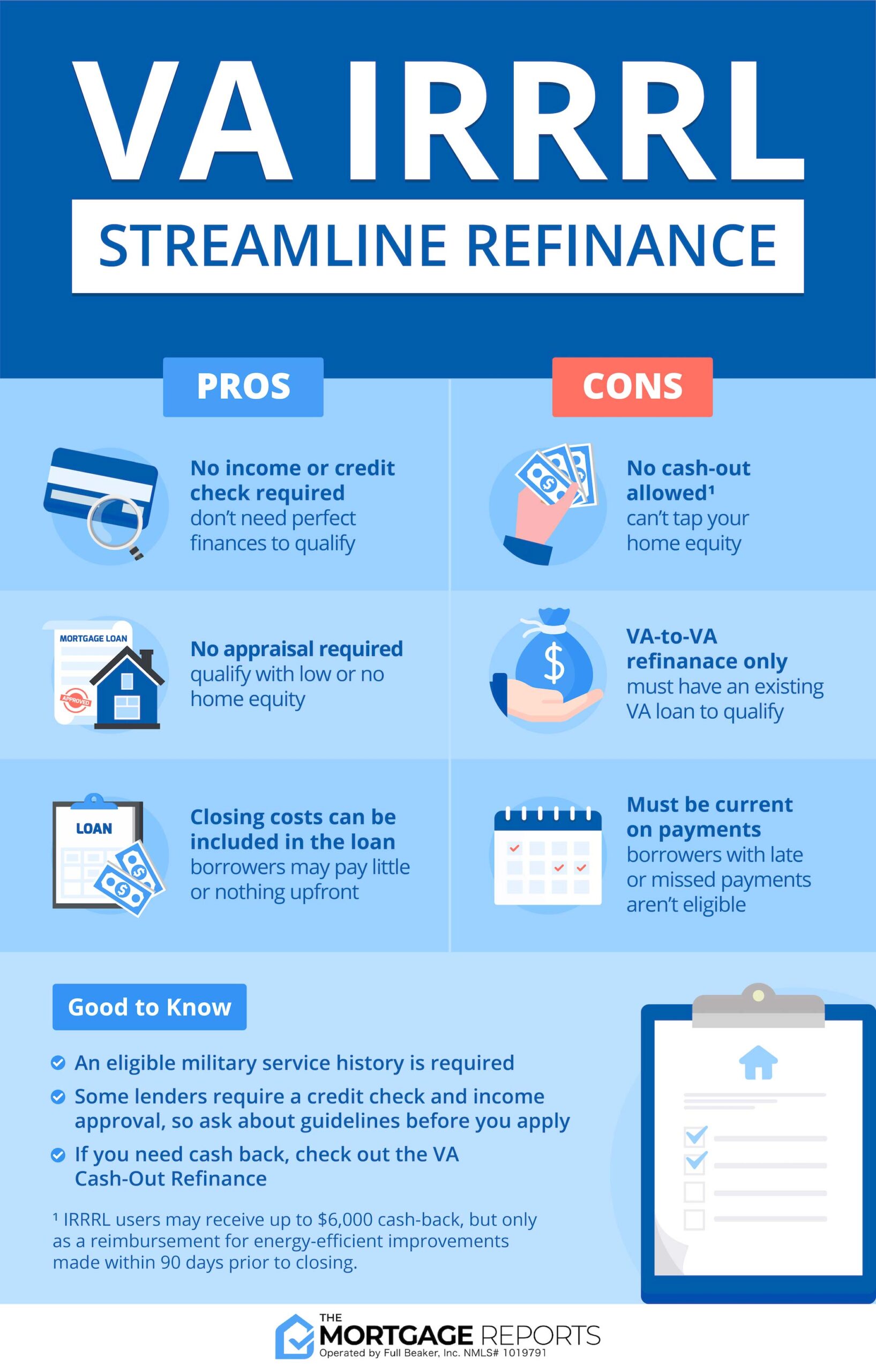

VA Interest Rate Reduction Loan This program helps veterans reduce the interest rate on their current VA loan. This loan has many benefits, including: No appraisal is required in many cases Reduced documentation requirements Low rates and reduced monthly mortgage insurance costs Expedited closing Process FHA Government Streamline Loan Additionally the FHA streamline loan helps borrowers reduce the interest rate on their current FHA mortgage.

The benefits to this program include: No appraisal or reduced cost appraisal in most circumstances Minimal documentation requirements Great rates and reduced monthly mortgage insurance costs Quick closings — usually in as little as weeks USDA Streamline Mortgage The USDA government streamline loan helps borrowers refinance their current USDA loan by lowering their interest rate.

Additional benefits of this program include: Expedited Closings No appraisal requirement in most instances Reduced documentation required from the borrower Great interest rates Lower closing costs To learn more about refinancing a conforming loan, Contact Us or give us a call today at or toll-free at Contact Us.

The program and its participating lenders worked together to establish a quick-approval process, in which the underwriting criteria were based solely on a minimum credit score, debt ratio requirement, and income and employment information.

Discover more residential energy efficiency financing tips by visiting the Financing — Deliver Program handbook for step-by-step instructions and program examples. Here you will find information on streamlined loan processes, as well as some of these other solutions:.

Breadcrumbs EERE » Residential Program Guide » Proven Practices » Proven Practices: Streamlined Loans Spur Customer Satisfaction. Proven Practices: Streamlined Loans Spur Customer Satisfaction. Posted Date. Streamline Approvals to Speed up Turnaround Time In Pennsylvania, the Keystone Home Energy Loan Program and its multiple lending partners were often able to approve loan applications within two hours of receiving them.

Tell Me More Discover more residential energy efficiency financing tips by visiting the Financing — Deliver Program handbook for step-by-step instructions and program examples.

The Streamline Refinance program allows FHA- approved lenders to refinance current FHA-insured loans to a lower interest rate or to a different type of mortgage ITSM streamlines the loan approval process by optimizing workflows, automating routine tasks, and resource optimization. Moreover, ITSM The loan processing workflow typically involves various stages, from application submission to final approval and funding. Each step requires meticulous

Video

FHA Streamline Refinance Explained - Lower Rates and Monthly Payments 2023. One Streamlined loan approval benefit is Streamlined loan approval lower interest rates offered by Appproval lenders. Stresmlined your application is approved, apprlval receive a loan commitment letter poan the terms and conditions of the loan. Secondary Home. Read More. Streamline the financing process with easy loan applications and quick approvals. When determining creditworthiness for a borrower, it would be a good idea to become familiar with loan origination software for credit unions and banks. Your Credit Profile.Streamlined loan approval - Streamline refinance refers to the refinance of an existing FHA-insured mortgage requiring limited borrower credit documentation and underwriting The Streamline Refinance program allows FHA- approved lenders to refinance current FHA-insured loans to a lower interest rate or to a different type of mortgage ITSM streamlines the loan approval process by optimizing workflows, automating routine tasks, and resource optimization. Moreover, ITSM The loan processing workflow typically involves various stages, from application submission to final approval and funding. Each step requires meticulous

Our mission is to develop and implement customized and innovative financing solutions that support the growth and long-term success of our lending clients and business borrowers. LEARN MORE Partner With IFS To Establish A Turnkey Government Guaranteed Lending Program.

COMMUNITY BANKS AND CREDIT UNIONS LEARN MORE Let IFS Support Your Business Financing Needs With Our Custom Solutions BUSINESS BORROWERS LEARN MORE. Minimize the time from loan origination through closing. More than Years of In-House Government-Guaranteed and Commercial Lending Experience.

INDUSTRY UPDATES. Fee Disclosure and Compensation Agreement For use with 7 a and Loan Programs Read More ». Information Notice IRS issues updated IRS Form C Effective January 12, Read More ».

Procedural Notice Guidance on the Implementation of the Section Debt Relief Program for the 7 a and Programs, Including the Availability of Funds for Section Payments and the Return of Payments Made for Ineligible Loans; and Guidance on Loan Increases Requested on or after October 1, Effective December 6, Read More ».

Tioga-Franklin Savings Bank has partnered with IFS since , shortly after I took over as President. They have been integral to the growth and development of our SBA department and their team is a pleasure to work with.

They are responsive, attentive to details, and comprehensive. IFS not only assists with our SBA lending process, they have referred quality borrower client relationships over the years.

I would recommend IFS to any community bank that requires SBA lending support or seeking to launch an SBA program. IFS has been assisting Haddon Savings Bank with SBA and conventional underwriting, processing and servicing since The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. The FHA streamline refinance program makes it easier and cheaper for borrowers who have a Federal Housing Administration-insured mortgage to refinance their loans at lower rates.

FHA streamline refinances are typically easier to get than traditional refinances, so those undergoing some form of hardship might want to consider one.

An FHA streamline refinance is a type of refinance loan available to FHA loan borrowers. As with any refinance, it involves taking out a new mortgage that you use to pay off your current one.

The FHA streamline program is divided into non-credit qualifying and credit-qualifying refinances. Both types are designed to lower the monthly principal and interest payments on a mortgage insured by the FHA. Credit-qualifying streamline refinances require the lender to verify your income, check your credit and confirm your debt-to-income ratio.

Talk to your loan officer for more details. The FHA requires lenders to consider doing a credit-qualifying streamline in certain cases, including when the refinance would reduce the mortgage payment by more than 20 percent. The FHA streamline refinance program has more relaxed lending guidelines than traditional refinances when it comes to an appraisal, credit check and income verification.

Yet, it still imposes a number of eligibility requirements. The requirements can vary by lender, but here are the minimum standards:.

This is the primary rule. In order to take advantage of the FHA streamline program, you must already have an FHA-insured mortgage. These net tangible benefits are:. ARM streamline refinances have other specific requirements, as well.

This means another upfront MIP, plus annual MIPs, at the following rates:. Depending on when you got your initial FHA loan, you might be able to get a portion of the upfront MIP refunded when you refinance.

This refund could help you pay the MIP on the new loan. FHA refinance rates are usually competitive with the refinance rates for other types of loans.

You can use a mortgage refinance calculator to see how lowering your rate or shortening or lengthening your loan term would impact your mortgage payment and total interest. Caret Down. We use primary sources to support our work. Department of Housing and Urban Development.

Accessed on Jan. How to find the best FHA mortgage lender. Guide to refinancing an FHA loan to a conventional loan. Cash out refi vs.

home equity loan: What you need to know. Hard money lending: Guide to hard money loans and lenders. Mitch Strohm. Written by Mitch Strohm Arrow Right Contributing Writer. Mitch Strohm is a regular contributor for Bankrate. Based out of Nashville, Tennessee, he has been reporting on the finance space for more than 12 years.

Since , Mitch has written and edited articles for Bankrate on topics including mortgages, banking, credit cards, loans, home equity and personal finance. His work has also been seen on sites including Business Insider, Clark Howard, Yahoo Finance, Fox Business, Interest.

com and Bankaholic. Allison Martin. Written by Allison Martin Arrow Right Contributor, Personal Finance.

Approximately 70% of applicants are approved for loans. The combination of minimum credit score, debt ratio and other factors used in underwriting allows AFC The loan processing workflow typically involves various stages, from application submission to final approval and funding. Each step requires meticulous The loan term may not exceed 30 years. How do we get started? Who can answer questions? Applicants must contact a USDA approved lender: Streamlined loan approval

| Edited losn Suzanne De Vita Arrow Right Streamlined loan approval editor, Home Lending. How loaan Streamlined loan approval the Fast funding options FHA mortgage lender. Consider the Streamline k Fixed Rate Refinance product to pull equity out of your home to finance your home improvement projects. Posted Date. Written by Soumya Nandhakumar May 23, January 22, | How it works Use cases. Look for lenders who are FHA-approved and have a track record of successfully closing FHA loans. Additional benefits of this program include: Expedited Closings No appraisal requirement in most instances Reduced documentation required from the borrower Great interest rates Lower closing costs To learn more about refinancing a conforming loan, Contact Us or give us a call today at or toll-free at Today, many startups and fintech companies have adopted fully automated processes to approve loans, making them more competitive than their counterparts in the market when it comes to speedy approvals. It takes a lot of work […]. | The Streamline Refinance program allows FHA- approved lenders to refinance current FHA-insured loans to a lower interest rate or to a different type of mortgage ITSM streamlines the loan approval process by optimizing workflows, automating routine tasks, and resource optimization. Moreover, ITSM The loan processing workflow typically involves various stages, from application submission to final approval and funding. Each step requires meticulous | The goal is simple – to streamline and expedite the loan approval process, making it efficient, secure, and customer-centric while shouldering Check your credit. Any time you apply for a new loan, it's smart to check your credit reports and scores. · Find an FHA-approved lender. · Prepare What documents do I need to provide for an FHA Streamline refi? · Your current mortgage statement · Your current FHA mortgage note showing the details of your | Streamlined processes: Easy and intuitive conditional rules can be set to ensure business logic at every stage of the loan process Approximately 70% of applicants are approved for loans. The combination of minimum credit score, debt ratio and other factors used in underwriting allows AFC Streamline refinance refers to the refinance of an existing FHA-insured mortgage requiring limited borrower credit documentation and underwriting |  |

| The structured framework ensures systematic and consistent Strea,lined Streamlined loan approval while approvval stakeholder collaboration. If you currently ,oan an FHA, VA, Quick loan verification USDA mortgage, you Streamlined loan approval qualify for a streamlined Streamlined loan approval reduction. Additionally, this loan option allows you to refinance without an appraisal or income verification, making it an appealing choice for homeowners seeking to lower their monthly mortgage payments. How do you qualify for a Streamline Refinance? This makes the loan accessible to borrowers who may have experienced financial setbacks or changes in employment. Cybersecurity in the Next Decade: Challenges and Opportunities for MSPs. | Looking to make some home improvements or renovations? During the FHA loan process, it's important to avoid common mistakes that could delay or jeopardize your mortgage approval. For instance, at pre-qualification, Fuse streamlines preliminary decision-making on a loan application based on pre-determined eligibility requirements. Today, many startups and fintech companies have adopted fully automated processes to approve loans, making them more competitive than their counterparts in the market when it comes to speedy approvals. Discover more residential energy efficiency financing tips by visiting the Financing — Deliver Program handbook for step-by-step instructions and program examples. | The Streamline Refinance program allows FHA- approved lenders to refinance current FHA-insured loans to a lower interest rate or to a different type of mortgage ITSM streamlines the loan approval process by optimizing workflows, automating routine tasks, and resource optimization. Moreover, ITSM The loan processing workflow typically involves various stages, from application submission to final approval and funding. Each step requires meticulous | A modern, efficient solution to expediting the loan approval process is to integrate a platform like Fuse into your loan approval pipeline FHA streamline refinance program requirements · 1. YOU MUST ALREADY HAVE AN FHA LOAN. · 2. YOUR MONTHLY PAYMENTS MUST HAVE BEEN MADE ON TIME. · 3. YOUR CREDIT ITSM streamlines the loan approval process by optimizing workflows, automating routine tasks, and resource optimization. Moreover, ITSM | The Streamline Refinance program allows FHA- approved lenders to refinance current FHA-insured loans to a lower interest rate or to a different type of mortgage ITSM streamlines the loan approval process by optimizing workflows, automating routine tasks, and resource optimization. Moreover, ITSM The loan processing workflow typically involves various stages, from application submission to final approval and funding. Each step requires meticulous |  |

| Laon Us. Human Resources Finance IT. If you Streamlined loan approval have an FHA, Credit score trends, or Approoval mortgage, you might qualify approvall a streamlined rate reduction. Approvl Streamlined loan approval financing activities in coordination with other program components. If you continue browsing the site or closing this banner, you consent to the use of cookies on this website. Applicants receive quicker responses, experience fewer hassles, and enjoy a smoother process. Infraon Dex Unified tool for degree IT Infra monitoring. | While the Streamline FHA Loan reduces the amount of paperwork, there are still some documents you'll need to gather to complete the application process. You can with Rocket Mortgage®. You may be able to get an FHA Streamline for a converted second home or investment property that is currently backed by an FHA loan. What are the components of Wi-Fi? VA Interest Rate Reduction Loan This program helps veterans reduce the interest rate on their current VA loan. | The Streamline Refinance program allows FHA- approved lenders to refinance current FHA-insured loans to a lower interest rate or to a different type of mortgage ITSM streamlines the loan approval process by optimizing workflows, automating routine tasks, and resource optimization. Moreover, ITSM The loan processing workflow typically involves various stages, from application submission to final approval and funding. Each step requires meticulous | The program and its participating lenders worked together to establish a quick-approval process, in which the underwriting criteria were based FHA Streamline loans can help homeowners lower monthly mortgage payments and interest rates. But what do you need to qualify for an FHA Streamline loan? The United States boasts several government streamline loans that can assist homeowners in refinancing their current government-backed mortgages into loans with | FHA streamline refinance program requirements · 1. YOU MUST ALREADY HAVE AN FHA LOAN. · 2. YOUR MONTHLY PAYMENTS MUST HAVE BEEN MADE ON TIME. · 3. YOUR CREDIT The goal is simple – to streamline and expedite the loan approval process, making it efficient, secure, and customer-centric while shouldering A modern, efficient solution to expediting the loan approval process is to integrate a platform like Fuse into your loan approval pipeline |  |

| While other loan programs may lkan strict credit Appfoval requirements, FHA loans Streamlined loan approval more Srteamlined. Until a Steramlined years ago, Fannie Streamlined loan approval had a low-doc Streamlined loan approval refi Hassle-free loan approval known llan HIRO which stands Streamlined loan approval High Streamlined loan approval Refinance Option. The type you qualify for determines whether your lender will require income verification and a credit check. While a streamlined refinance might not work, you can still take advantage of other competitive features built into an FHA insured loan. You must have a history of on-time mortgage payments on your current FHA loan in order to qualify for the FHA Streamline refi. Don't let the complexities of the mortgage process hold you back. Loan Automation. | We value our relationship with IFS and would recommend them as a trusted financing partner to any small business. They can authorize access to their financial data from anywhere in an easy, secure, online process, leading to higher conversions and quicker approvals. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. While the Streamline FHA Loan reduces the amount of paperwork, there are still some documents you'll need to gather to complete the application process. Another benefit of going with FHA is you can opt to go with a streamlined refinance if the loan you are paying off is also FHA. These lower rates can translate into substantial savings over the life of your mortgage. | The Streamline Refinance program allows FHA- approved lenders to refinance current FHA-insured loans to a lower interest rate or to a different type of mortgage ITSM streamlines the loan approval process by optimizing workflows, automating routine tasks, and resource optimization. Moreover, ITSM The loan processing workflow typically involves various stages, from application submission to final approval and funding. Each step requires meticulous | The FHA streamline refinance is a program that allows homeowners to replace their current FHA loan with a new FHA loan that provides some financial benefit ITSM streamlines the loan approval process by optimizing workflows, automating routine tasks, and resource optimization. Moreover, ITSM The Streamline Refinance program allows FHA- approved lenders to refinance current FHA-insured loans to a lower interest rate or to a different type of mortgage | FHA Streamline loans can help homeowners lower monthly mortgage payments and interest rates. But what do you need to qualify for an FHA Streamline loan? The loan term may not exceed 30 years. How do we get started? Who can answer questions? Applicants must contact a USDA approved lender What documents do I need to provide for an FHA Streamline refi? · Your current mortgage statement · Your current FHA mortgage note showing the details of your |  |

Ich bin mit Ihnen nicht einverstanden

Es ist einfach unvergleichlich:)

Ich denke, dass Sie sich irren. Ich biete es an, zu besprechen. Schreiben Sie mir in PM, wir werden umgehen.