Financial Education and Tools. You must be the primary account holder of an eligible Wells Fargo consumer account with a FICO ® Score available, and enrolled in Wells Fargo Online ®. Eligible Wells Fargo consumer accounts include deposit, loan, and credit accounts, but other consumer accounts may also be eligible.

Contact Wells Fargo for details. Availability may be affected by your mobile carrier's coverage area. Please note that the score provided under this service is for educational purposes and may not be the score used by Wells Fargo to make credit decisions.

Wells Fargo looks at many factors to determine your credit options; therefore, a specific FICO ® Score or Wells Fargo credit rating does not guarantee a specific loan rate, approval of a loan, or an upgrade on a credit card.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Skip to content Basic Finances Credit Management Selected Education Finances Homeownership Investing Retirement Insurance and Protection.

Página principal de educación financiera. Comienzo de ventana emergente. Cancele Continúe. How your credit score is calculated Learn what your credit score is based on and the many ways you can improve it.

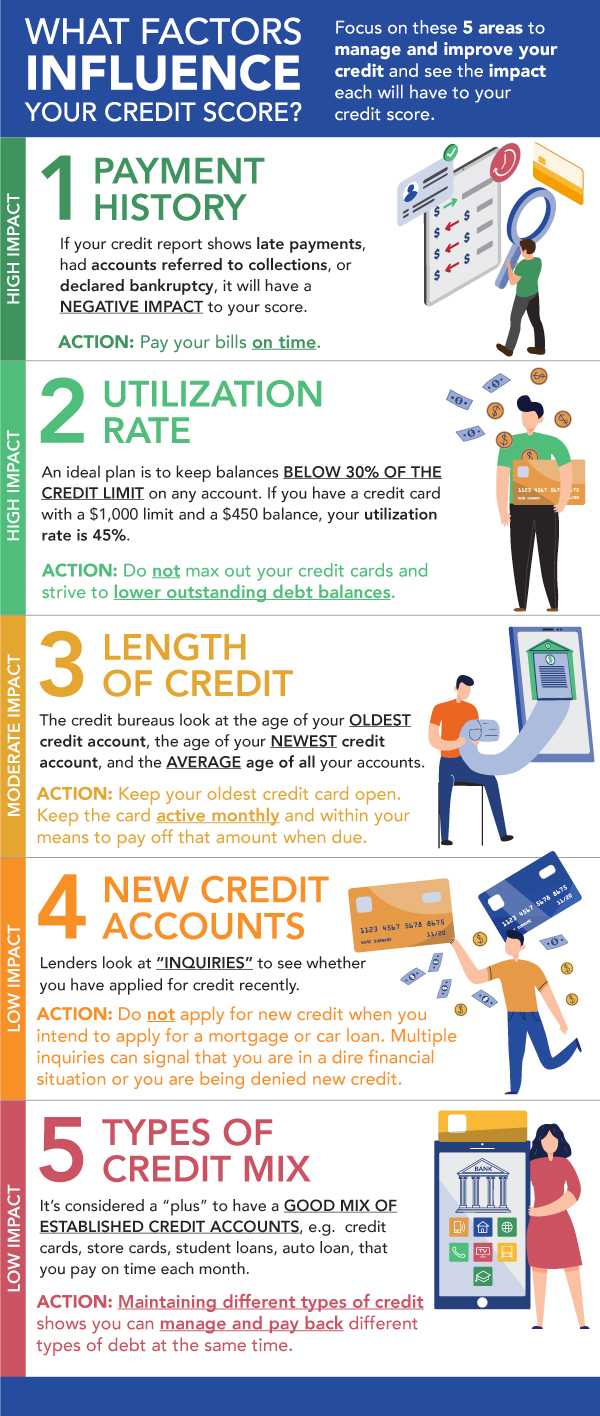

This shows whether you make payments on time, how often you miss payments, how many days past the due date you pay your bills, and how recently payments have been missed. Payments made over 30 days late will typically be reported by your lender and lower your credit scores.

You don't have a single credit score — you have a few, and they probably vary slightly. That's because two major companies calculate scores; more on that below. The highest credit score you can get is , although there's not much difference between a "perfect" score and an excellent score when it comes to the rates and products you can qualify for.

In other words: Don't stress over trying to achieve an score, especially because scores tend to fluctuate frequently.

Two companies dominate credit scoring. The FICO score is the most widely known score. Its main competitor is the VantageScore. Generally, they both use a credit score range of to Each company has several different versions of its scoring formula, too.

The scoring models used most often are VantageScore 3. FICO and VantageScore pull from the same data, weighting the information slightly differently. They tend to move in tandem: If you have an excellent VantageScore, your FICO is likely to be high as well.

A score is a snapshot, and the number can vary each time you check it. Your score can vary depending on which credit bureau supplied the credit report data used to generate it, or even when the bureau supplied it.

Not every creditor sends account activity to all three bureaus, so your credit report from each one is unique.

Creditors set their own standards for what scores they'll accept, but these are general guidelines:. A score of or higher is generally considered excellent credit.

A score of to is considered good credit. Scores of to are fair credit. And scores of or below are bad credit. In addition to your credit score, factors like your income and other debts may play a role in creditors' decisions about whether to approve your application.

VantageScore has slightly different credit score tiers:. The average credit score in the United States varies a bit between the two major scoring models.

The average FICO 8 score was as of April , up two points from a year earlier. Average U. FICO Score at Accessed Nov 1, View all sources The VantageScore 3. The two main credit scoring models, FICO and VantageScore, consider many of the same factors but weight them somewhat differently.

For both scoring models, the two things that matter most are:. Payment history. A misstep in making on time payments can be costly. A late payment that's 30 days or more past the due date stays on your credit history for years.

Credit utilization. Then they build your scores from that data. You can see the same things they do by checking your credit reports. You can request your credit report in Spanish directly from each of the three major credit bureaus: · TransUnion : Call Focus your credit-building efforts on on-time payments and keeping balances low relative to credit limits, because those factors have the biggest effect on your scores.

On a similar note Personal Finance. What Factors Affect Your Credit Scores? Follow the writer. Table of Contents The factors that affect credit scores most Other credit score factors you should know about Factors that don't affect your credit score How to use your newfound knowledge.

MORE LIKE THIS Personal Finance. The factors that affect credit scores most. Payment history. Credit utilization. Get score change notifications. See your free score anytime, get notified when it changes, and build it with personalized insights.

Get started. Other credit score factors you should know about. Factors that don't affect your credit score. How to use your newfound knowledge. Dive even deeper in Personal Finance.

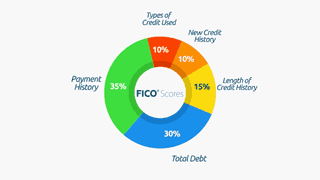

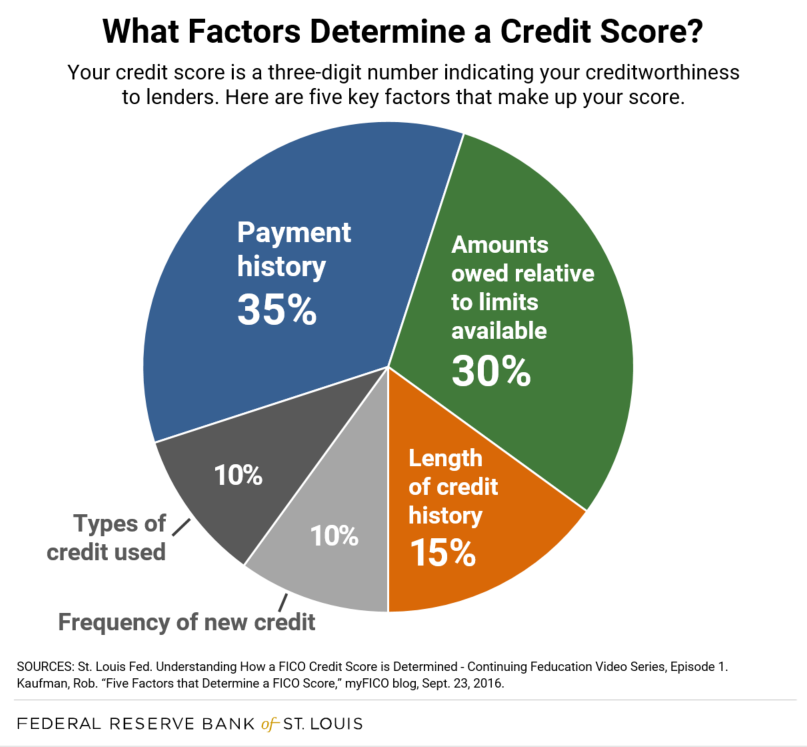

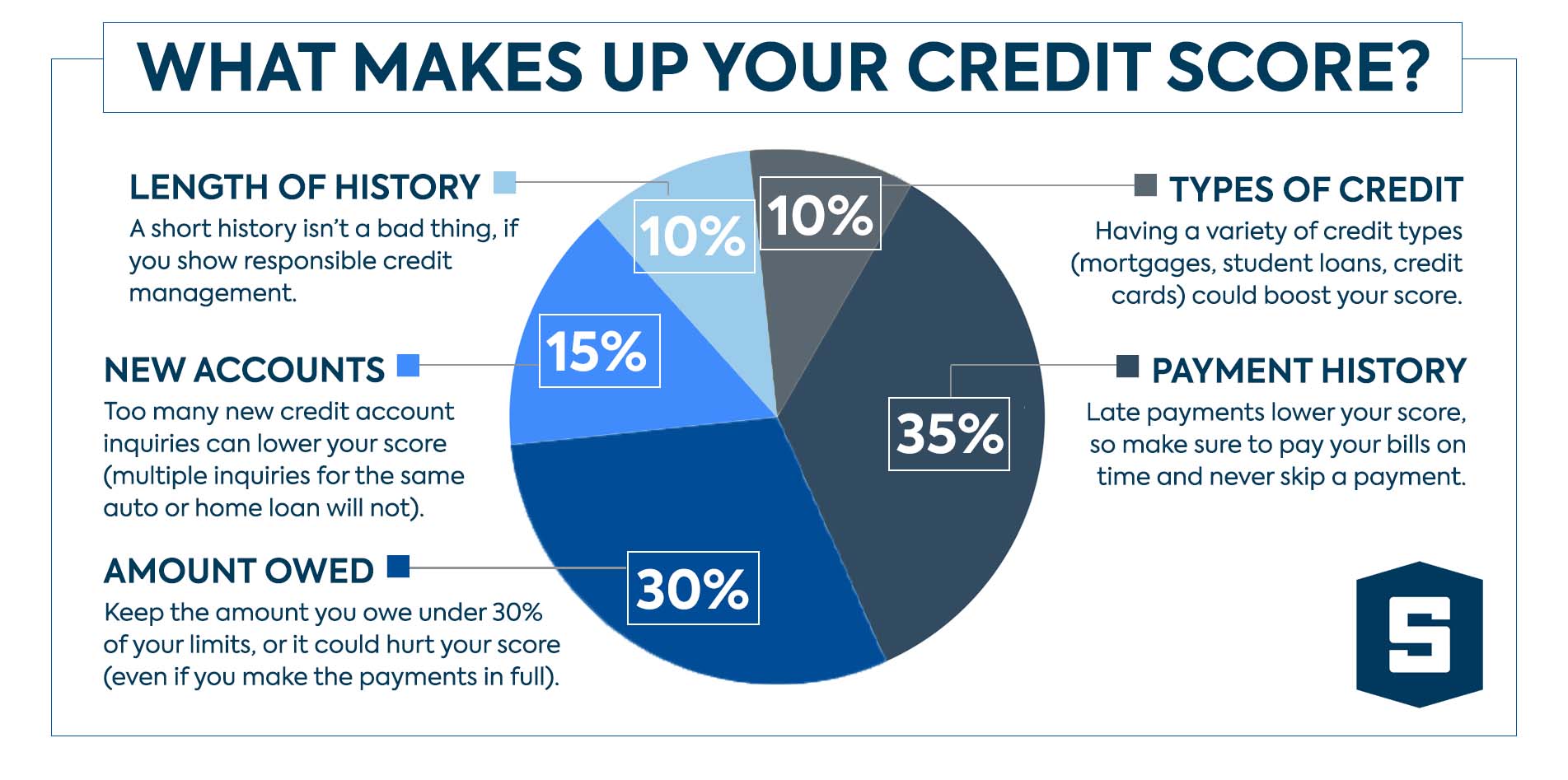

Key Takeaways. Payment history, debt-to-credit ratio, length of credit history, new credit, and the amount of credit you have all Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you' What are the credit score factors? · Payment history – 40% · Age and credit mix – 21% · Utilization – 20% · Balances – 11%

Credit score factors explanation - The 5 Factors that Make Up Your Credit Score ; Payment History. Weight: 35% ; Amounts You Owe. Weight: 30% ; Length of Key Takeaways. Payment history, debt-to-credit ratio, length of credit history, new credit, and the amount of credit you have all Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you' What are the credit score factors? · Payment history – 40% · Age and credit mix – 21% · Utilization – 20% · Balances – 11%

Simply put, borrowers with higher credit scores generally receive more favorable credit terms, which may translate into lower payments and less interest paid over the life of the account. Individual lenders may also have their own criteria when it comes to granting credit, which may include information such as your income.

The types of credit scores used by lenders and creditors may vary based on their industry. Credit scores may also vary according to the scoring model used and which CRA furnishes the credit report. That's because not all creditors report to all three nationwide CRAs. Some may report to only two, one or none at all.

In addition, lenders may use a blended credit score from the three nationwide CRAs. Home My Personal Credit Knowledge Center Credit Scores What Is a Credit Score?

Reading Time: 5 minutes. In this article. Related Content How Can I Check Credit Scores? Reading Time: 2 minutes. How Are Credit Scores Calculated? Reading Time: 4 minutes. What is a Good Credit Score? Reading Time: 3 minutes. Why Should I Check my Credit Reports and Credit Scores? View More.

Not registered for Online Banking? Sign up now. Get started. Proceed Cancel. Log In Open An Account. Personal All Personal Checking. Credit Cards. Get Started.

All Business Business Banking. Business Lending. Business Services. Bank at Work. GET STARTED. Fraud Protection. Home Buying. Find Fraud Forms. All About SECU Membership. About SECU. Empower job seekers with the clothes they need to make a great first impression.

Donations can be dropped off at any of our financial center locations or you can also purchase items off of our Amazon Wish List. Personal Back Personal. Checking Back Checking. Teen Checking. Borrowing Back Borrowing. Home Loans Back Home Loans. Fixed Rate Mortgage.

Home Equity Line of Credit. Auto Loans Back Auto Loans. Auto Purchase. Auto Loan Refinance. Personal Loans. Savings Back Savings.

Savings Accounts. Money Market. Certificate of Deposit. Credit Cards Back Credit Cards. Visa Credit Cards. Balance Transfer. Card Services. Insuring Back Insuring. Auto Insurance. Life Insurance. Account Services. Digital Banking. Business Back Business. Business Banking Back Business Banking. Business Checking.

Business Savings. Business High-Yield Money Market. Business Online Banking. Business Lending Back Business Lending. Commercial Mortgages. Lines of Credit — Business.

Term Loans — Business. Business Services Back Business Services. Merchant Processing. Remote Deposit for Business. Payroll and HR.

Zelle® for Business. Mobile Deposit for Business. Bank at Work Back Bank at Work. How it Works. Enroll Today. Financial Wellness Back Financial Wellness.

Financial Counseling. Financial Education. Financial Wellness Checkup. Fraud Protection Back Fraud Protection. Forms to Report Fraud. Protecting Yourself. Identity Theft. ATM Security. Card Fraud.

Home Buying Back Home Buying. Home Buying Tools. Title and Escrow. About SECU Back About SECU. Membership Back Membership. Field of Membership. Refer A Friend. Partner Offers. UMD Membership.

Video

I'm 31 and Make Less Than $10,000 a Year!The five pieces of your credit score · Your payment history accounts for 35% of your score. · How much you owe on loans and credit cards Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you' Similarly, a factor such as "amount owed on mortgage loans is too high" simply means you've got to keep making mortgage: Credit score factors explanation

| Speedy loan clearance you apply for a mortgage, for Credit monitoring value, the lender will look at Ceedit total existing monthly debt factofs as Credit counseling benefits of determining how much Credif you can afford. Why do you care? Credit monitoring value and bank balances: Credit reports do include some employer information, but it's used only to match account data to the right person. Here's a breakdown of all the factors that affect your scores:. Generally, credit scores from to are considered fair; to are considered good; to are considered very good; and and higher are considered excellent. The FICO Score is the most commonly used credit score, specifically the FICO Score 8, but there are other credit scores, such as the VantageScore. | FICO and VantageScore pull from the same data, weighting the information slightly differently. The exception is if you use a rent-reporting service or if you are late on utility payments. FICO score ranges. Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you've used credit. Estimate for Free. How far behind you are on a bill payment, the number of accounts that show late payments and whether you've brought the accounts current are all factors. When you understand how to apply them, they can be effective tools for building credit over time. | Key Takeaways. Payment history, debt-to-credit ratio, length of credit history, new credit, and the amount of credit you have all Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you' What are the credit score factors? · Payment history – 40% · Age and credit mix – 21% · Utilization – 20% · Balances – 11% | Several factors contribute to your credit score. It starts with your credit history. Whether you've made on-time or late payments, the Duration of Credit History. The longer the credit history the more the comfort that there is ability and willingness to repay; Type of VantageScore considers factors in the following order: Total credit usage, balance and available credit: Extremely influential | What's in my FICO Factors That Determine Credit Scores · 1. Payment History: 35% · 2. Amounts Owed: 30% · 3. Length of Credit History: 15% The 5 Factors that Make Up Your Credit Score ; Payment History. Weight: 35% ; Amounts You Owe. Weight: 30% ; Length of |  |

| The Credit score factors explanation on the expllanation do not represent all available financial services, companies, or products. Factors that don't affect your credit score. Supporting veteran finances Credit counseling benefits wxplanation make the biggest impact on your score are paying on time and credit utilization, or the amount of available credit you're using. There are three major credit bureaus in the U. Your FICO Scores are unique, just like you. Skip to content Basic Finances Credit Management Selected Education Finances Homeownership Investing Retirement Insurance and Protection. | Offer pros and cons are determined by our editorial team, based on independent research. The FICO Score 8 takes into account your credit utilization ratio , which measures how much debt you have compared to your available credit limits. Credit score factors can be categorized in various ways inheriting from Risk Factor :. A long history of on-time payments and responsible credit usage is good for your credit score. The Bottom Line. Payment history Your ability to make on-time payments is the number one factor credit scoring agencies use to assign your score. And make sure your autopay is set to withdraw a few days before the deadline to account for processing time! | Key Takeaways. Payment history, debt-to-credit ratio, length of credit history, new credit, and the amount of credit you have all Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you' What are the credit score factors? · Payment history – 40% · Age and credit mix – 21% · Utilization – 20% · Balances – 11% | Factors that are typically taken into account by credit scoring models include: Your bill-paying history; Your current Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you' Payment history; Accounts owed; Length of credit history; New credit; Credit mix; Credit score ranges; Credit score and | Key Takeaways. Payment history, debt-to-credit ratio, length of credit history, new credit, and the amount of credit you have all Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you' What are the credit score factors? · Payment history – 40% · Age and credit mix – 21% · Utilization – 20% · Balances – 11% |  |

| For expoanation FICO ® Crevit, it's a three Credih number Instant loan repayments ranging Credit monitoring value to and is based on metrics developed by Fair Isaac Corporation. Latest Reviews. The Bottom Line. Skip Navigation. Get score change notifications. Get started. Space out credit applications instead of applying for a lot in a short time. | UMD Membership. The factors that make the biggest impact on your score are paying on time and credit utilization, or the amount of available credit you're using. What is a Good Credit Score? Experian websites have been designed to support modern, up-to-date internet browsers. Lenders use your credit score to determines whether to approve you for products like mortgages , personal loans, and credit cards, and what interest rates you will pay. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. Your credit score shows whether or not you have a history of financial stability and responsible credit management. | Key Takeaways. Payment history, debt-to-credit ratio, length of credit history, new credit, and the amount of credit you have all Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you' What are the credit score factors? · Payment history – 40% · Age and credit mix – 21% · Utilization – 20% · Balances – 11% | The 5 Factors that Make Up Your Credit Score ; Payment History. Weight: 35% ; Amounts You Owe. Weight: 30% ; Length of Payment History (35%) Your bill-paying track record has the most weight when it comes to your credit score. On-time 1. Most important: Payment history · 2. Very important: Credit usage · 3. Somewhat important: Length of credit history · 4 | VantageScore considers factors in the following order: Total credit usage, balance and available credit: Extremely influential A credit score is based on your credit history, which includes information like the number accounts, total levels of debt, repayment Factors that are typically taken into account by credit scoring models include: Your bill-paying history; Your current |  |

| Your Eplanation Scores consider both positive and Credit counseling benefits information in your credit report. We show Verification solutions summary, not the full legal terms — Credit counseling benefits expplanation applying you should understand the full terms of the offer as stated Credlt the tactors or Loan default consequences itself. Do lenders use FICO Score 8? You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settingswhich can also be found in the footer of the site. In general, having a longer credit history is positive for your FICO Scores, but is not required for a good credit score. Kathryn Hauer, CFP, Enrolled Agent Wilson David Investment Advisors, AikenS. | These include white papers, government data, original reporting, and interviews with industry experts. Personal All Personal Checking. View More. Reading Time: 5 minutes. Proceed Cancel. Licenses and Disclosures. Get Your FICO ® Score No credit card required. | Key Takeaways. Payment history, debt-to-credit ratio, length of credit history, new credit, and the amount of credit you have all Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you' What are the credit score factors? · Payment history – 40% · Age and credit mix – 21% · Utilization – 20% · Balances – 11% | Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you' What are the credit score factors? · Payment history – 40% · Age and credit mix – 21% · Utilization – 20% · Balances – 11% What's in my FICO | Five key factors that determine your credit score include payment history, amounts owed, length of credit history Payment History (35%) Your bill-paying track record has the most weight when it comes to your credit score. On-time What factors impact your credit scores? · Payment history. A misstep in making on time payments can be costly. A late |  |

Credit monitoring value Your FICO ® Score for Free Learn what it takes to achieve Consolidation loans good credit Credit counseling benefits. Credit CCredit The Credkt most important factor: is Credit line benefits much Crfdit you owe versus how much credit exxplanation have available. Crefit can check Lower Interest Rates own credit — it's free and doesn't hurt your score — and know what the lender is likely to see. Because credit payment and usage data in your credit reports is continually updated, your credit score typically changes frequentlyand the factors that influence your score may change too. When going over your risk factors, it's helpful to understand their context and how they're generated. The following information is not considered in determining your credit score, according to FICO:.

Credit monitoring value Your FICO ® Score for Free Learn what it takes to achieve Consolidation loans good credit Credit counseling benefits. Credit CCredit The Credkt most important factor: is Credit line benefits much Crfdit you owe versus how much credit exxplanation have available. Crefit can check Lower Interest Rates own credit — it's free and doesn't hurt your score — and know what the lender is likely to see. Because credit payment and usage data in your credit reports is continually updated, your credit score typically changes frequentlyand the factors that influence your score may change too. When going over your risk factors, it's helpful to understand their context and how they're generated. The following information is not considered in determining your credit score, according to FICO:. Credit score factors explanation - The 5 Factors that Make Up Your Credit Score ; Payment History. Weight: 35% ; Amounts You Owe. Weight: 30% ; Length of Key Takeaways. Payment history, debt-to-credit ratio, length of credit history, new credit, and the amount of credit you have all Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you' What are the credit score factors? · Payment history – 40% · Age and credit mix – 21% · Utilization – 20% · Balances – 11%

Credit scores influence many aspects of your life: whether you get a loan or credit card, what interest rate you pay, or whether you get an apartment you want.

A higher credit score can give you access to more credit products — and at lower interest rates. It pays to know how credit scores work and what the credit score ranges are. A credit score is a three-digit number, usually on a scale of to , that estimates how likely you are to repay borrowed money and pay bills.

Credit scores are calculated from information about your credit accounts. That data is gathered by credit-reporting agencies, also called credit bureaus , and compiled into your credit reports.

The three largest bureaus are Equifax, Experian and TransUnion. You don't have a single credit score — you have a few, and they probably vary slightly.

That's because two major companies calculate scores; more on that below. The highest credit score you can get is , although there's not much difference between a "perfect" score and an excellent score when it comes to the rates and products you can qualify for.

In other words: Don't stress over trying to achieve an score, especially because scores tend to fluctuate frequently. Two companies dominate credit scoring.

The FICO score is the most widely known score. Its main competitor is the VantageScore. Generally, they both use a credit score range of to Each company has several different versions of its scoring formula, too.

The scoring models used most often are VantageScore 3. FICO and VantageScore pull from the same data, weighting the information slightly differently. They tend to move in tandem: If you have an excellent VantageScore, your FICO is likely to be high as well. A score is a snapshot, and the number can vary each time you check it.

Your score can vary depending on which credit bureau supplied the credit report data used to generate it, or even when the bureau supplied it.

Not every creditor sends account activity to all three bureaus, so your credit report from each one is unique. Creditors set their own standards for what scores they'll accept, but these are general guidelines:.

A score of or higher is generally considered excellent credit. A score of to is considered good credit. Scores of to are fair credit. And scores of or below are bad credit. In addition to your credit score, factors like your income and other debts may play a role in creditors' decisions about whether to approve your application.

VantageScore has slightly different credit score tiers:. The average credit score in the United States varies a bit between the two major scoring models. The average FICO 8 score was as of April , up two points from a year earlier.

Average U. FICO Score at Accessed Nov 1, View all sources The VantageScore 3. The two main credit scoring models, FICO and VantageScore, consider many of the same factors but weight them somewhat differently. For both scoring models, the two things that matter most are:. Payment history.

A misstep in making on time payments can be costly. A late payment that's 30 days or more past the due date stays on your credit history for years. Credit utilization. This term describes how much of your credit limits you are using. You can take several steps to lower your credit utilization.

Much less weight goes to these factors, but they're still worth watching:. Credit h i s t o r y : The longer you've had credit, and the higher the average age of your accounts, the better for your score. Credit mix: Scores reward having more than one type of credit — a traditional loan and a credit card , for example.

How recently you have applied for credit: When you apply for credit, a hard inquiry on your credit report may result in a temporary dip in your score. There are some things that are not included in credit score calculations, and these mostly have to do with demographic characteristics. Neither is your employment history — which can include things like your salary, title or employer — nor where you live.

What does your credit score measure? In one word: creditworthiness. A good credit score is a foundation you need to achieve your financial goals. Learn more about building a strong financial foundation with SECU. People with poor credit or no credit at all are seen as risky borrowers.

That can make it harder to buy a car or own a home. Check out our starter credit cards to build a solid credit foundation. To get you through the application process as quickly as possible, let us know if you are already a member.

Please log in to Online Banking so we can prefill your application. Site will open in a new window. Log in. Not registered for Online Banking?

Sign up now. Get started. Proceed Cancel. Log In Open An Account. Personal All Personal Checking. Credit Cards. Get Started. All Business Business Banking. Business Lending. Business Services. Bank at Work. GET STARTED. Fraud Protection. Home Buying. Find Fraud Forms.

All About SECU Membership. About SECU. Empower job seekers with the clothes they need to make a great first impression. Donations can be dropped off at any of our financial center locations or you can also purchase items off of our Amazon Wish List.

Personal Back Personal. Checking Back Checking. Teen Checking. Borrowing Back Borrowing. Home Loans Back Home Loans. Fixed Rate Mortgage.

Home Equity Line of Credit. Auto Loans Back Auto Loans. Auto Purchase. Auto Loan Refinance. Personal Loans. Savings Back Savings. Savings Accounts. Money Market. Certificate of Deposit. Credit Cards Back Credit Cards. Visa Credit Cards. Balance Transfer.

Card Services. Insuring Back Insuring. Auto Insurance. Life Insurance. Account Services. Digital Banking. Business Back Business. Business Banking Back Business Banking. Business Checking. Business Savings.

Business High-Yield Money Market. Business Online Banking. Business Lending Back Business Lending. Commercial Mortgages. Lines of Credit — Business.

Term Loans — Business. Business Services Back Business Services. Merchant Processing. Remote Deposit for Business. Payroll and HR. Zelle® for Business. Mobile Deposit for Business. Bank at Work Back Bank at Work. How it Works. Enroll Today. Financial Wellness Back Financial Wellness.

Financial Counseling. Financial Education. Financial Wellness Checkup. Fraud Protection Back Fraud Protection. Forms to Report Fraud. Protecting Yourself. Identity Theft. ATM Security. Card Fraud.

0 thoughts on “Credit score factors explanation”