However, this strategy might not work for someone with impulsive spending habits. With a higher credit limit, it may be tempting to spend more money you don't actually have. If you're trying to pay off more debt to lower your credit utilization ratio, financial planner and head of financial advice with the personal finance app Monarch Money Natalie Taylor recommends stopping credit card use altogether.

However, using your credit card while trying to pay down debt can hurt your progress, she says. Stopping credit card use can help you clearly see your progress, plus it simplifies your budget, Taylor adds.

A credit report includes full documentation of your credit history, which then gets turned into your credit score. Under rules established in response to the pandemic, consumers can check their credit reports once weekly until December , according to the FTC.

You can file a dispute online with credit bureaus, Equifax , Experian , and TransUnion directly, though sometimes it may be more effective to contact your creditor directly.

Read our editorial standards. Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

Get Started Savings CDs Checking Accounts Student Loans Personal Loans Credit Scores Life Insurance Homeowners Insurance Pet Insurance Travel Insurance Banking Best Bank Account Bonuses Identity Theft Protection Credit Monitoring Small Business Banking.

Close icon Two crossed lines that form an 'X'. It indicates a way to close an interaction, or dismiss a notification. Personal Finance The words Personal Finance. Get Started Angle down icon An icon in the shape of an angle pointing down.

Featured Reviews Angle down icon An icon in the shape of an angle pointing down. Credit Cards Angle down icon An icon in the shape of an angle pointing down. Insurance Angle down icon An icon in the shape of an angle pointing down.

Savings Angle down icon An icon in the shape of an angle pointing down. Loans Angle down icon An icon in the shape of an angle pointing down. Mortgages Angle down icon An icon in the shape of an angle pointing down.

Investing Angle down icon An icon in the shape of an angle pointing down. Taxes Angle down icon An icon in the shape of an angle pointing down. Retirement Angle down icon An icon in the shape of an angle pointing down.

Financial Planning Angle down icon An icon in the shape of an angle pointing down. Many or all of the offers on this site are from companies from which Insider receives compensation for a full list see here.

Advertising considerations may impact how and where products appear on this site including, for example, the order in which they appear but do not affect any editorial decisions, such as which products we write about and how we evaluate them.

Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers in the marketplace. Credit Cards. Written by Leo Aquino, CEPF ; edited by Richard Richtmyer.

Share icon An curved arrow pointing right. Share Facebook Icon The letter F. Facebook Email icon An envelope. It indicates the ability to send an email. Email Twitter icon A stylized bird with an open mouth, tweeting. Twitter LinkedIn icon The word "in".

LinkedIn Link icon An image of a chain link. I've said it for years and finally people are beginning to realize, these letters rarely work anymore. Use some common sense for a moment.

If it was that easy, we could all go charge until we're blue in the face and not worry about our bills because we have the magic letters. With that said, credit repair works and better then ever, just not with that method.

The real way to improve your credit score is understanding the laws. When I say that, I mean actually using the law as opposed to just quoting it in your dispute letter.

Obviously, I can't cover every law here but I can point out a few violations that are present in nearly every trade line. Understanding how a debt's "date of last activity" is calculated is paramount. Chances are it won't be reported accurately. Because collectors like to date it from the time they "bought the debt" and that is wrong and a sure fire way to have it removed.

You can find "date of last activity" and "Re aging Debts" in both the FCRA and the FDCPA. The SOL I'm referring to is not the SOL for how long a debt can be reported on your credit file. You might be surprised to learn that its only 3 to 4 years in many states.

Learn how to read a credit report. You're mainly looking for balances, date of last activity for each account, Credit Limits and payment history. Learn the FDCPA - again abbreviated version should work.

This law governs 3rd party collection agents. This is where you'll score most your points. These guys can't seem to follow the rules. Other laws to look at: The truth in lending act Fair Credit Billing Act Hippaa - Medical disputes Service members Civil relief act - special Military laws.

If you don't see where I'm going with this, it's about finding actual violations of your rights, not depending on luck, loopholes and generic letters. It will take some time, there are a lot of laws to learn. You don't have to be a lawyer, but you do have to get out that fine toothed comb and figure out who has made mistakes.

IF there are violations of your rights, there is a great chance ANY debt, accurate or not can come off. It comes down to negotiating a trade off between you, and the "violator" 4 Opt Out with the credit bureaus. Did you know that credit reporting agencies alert your creditors of new applications of credit you may be applying for?

They alert them of disputes you're making, address changes, banking information? That's right, collectors subscribe to credit bureau services which enable them to more easily track you. Opt out and this information is no longer available to your creditors.

More times then not, collection agents will obtain the necessary licensing, bonding and insurance requirements in their home state only because the cost is so high too obtain in every state.

Therefore, it is not a valid collection and must be removed from your credit report. You can check your Attorney Generals Website for requirements. Sounds easy enough, but you'd be surprised. When you request validation of a debt, the collection agent must show proof he has a contract with the original creditor that he has the right to collect on their behalf.

You'd be surprised how many collectors have nothing more then their internal records. That is not sufficient. He must get the original contracts directly from the original creditor and send them to you.

Credit reporting agencies have dozens of addresses which you can find on the net. Send your disputes certified mail, return receipt requested to different addresses. You are not required to send disputes to any specific address.

Many of the addresses take much longer to get to the dispute department.

Apply only for the credit you need Consider a secured credit card Consider becoming an authorized user

Credit repair strategies - Pay your credit card balances in full Apply only for the credit you need Consider a secured credit card Consider becoming an authorized user

Credit bureaus sell the information in your report to businesses that use it to decide whether to loan you money, give you credit, offer you insurance, or rent or sell you a home. Some employers use credit reports to decide whether to hire you.

Usually not. But negative information does go away over time. Most negative information will stay on your report for seven years, and bankruptcy information will stay on for 10 years.

All three nationwide credit bureaus Equifax, Experian, and TransUnion have permanently extended a program that lets everyone in the U. check their credit report from each once a week for free at AnnualCreditReport.

In addition, each nationwide credit bureau is required to give you a free copy of your credit report once every 12 months if you ask for it at AnnualCreditReport.

com , or by calling Otherwise, a credit bureau may charge you a reasonable amount for another copy of your report within a month period. While you're able to get all three bureaus' reports at once, you might think about spreading them out.

Some financial advisors say staggering your requests can help you keep an eye on whether the information in your reports is accurate and complete.

Also, through , everyone in the U. can get six free credit reports per year by visiting the Equifax website or by calling If you think someone might be using your personal information to open accounts, file taxes, or buy things, go to IdentityTheft.

gov to report it and get a personalized recovery plan. Be sure to check your reports before you apply for credit, a loan, insurance, or a job. If you find mistakes in your credit report, contact the credit bureaus and the business that supplied the information about you to get the mistakes removed.

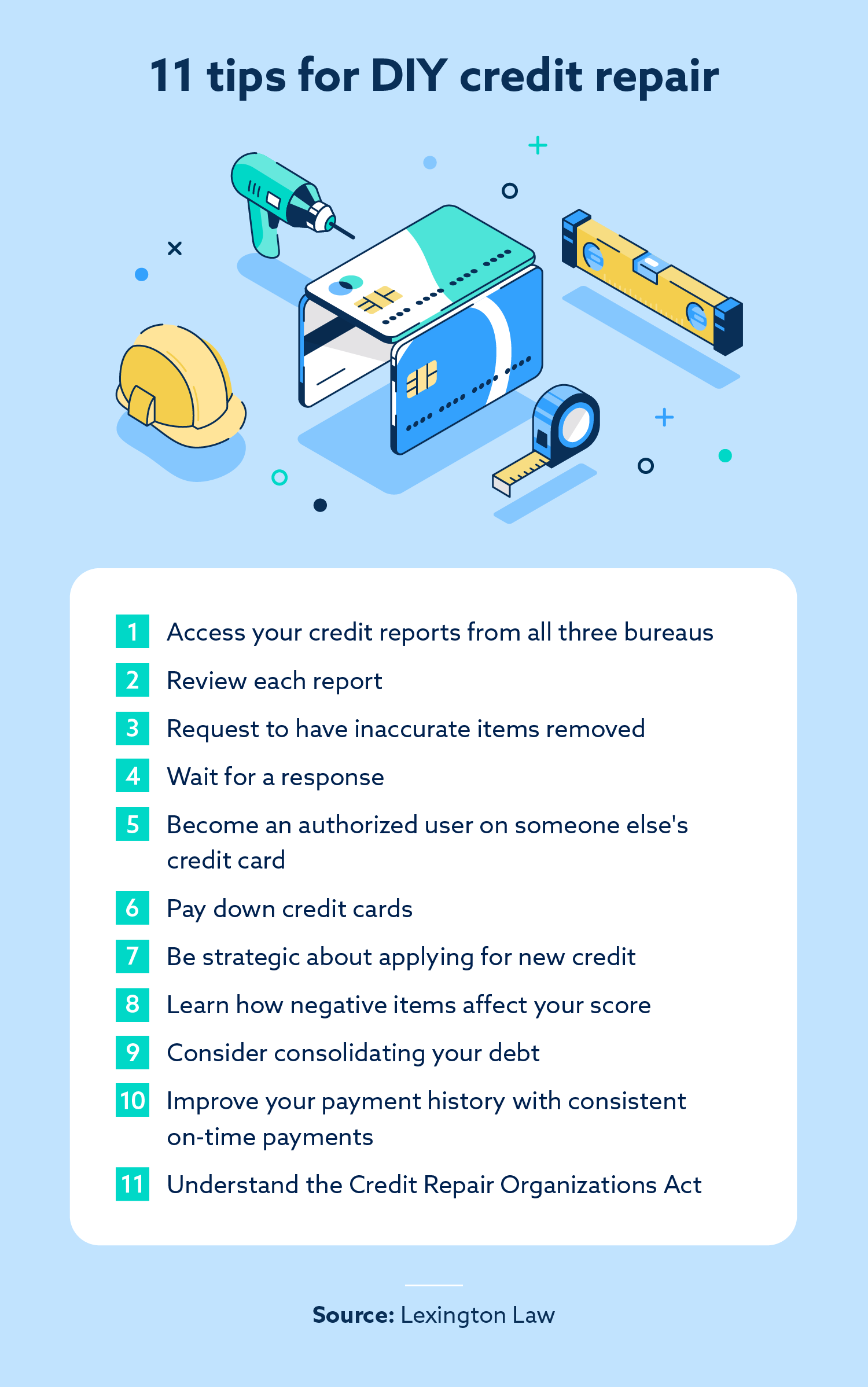

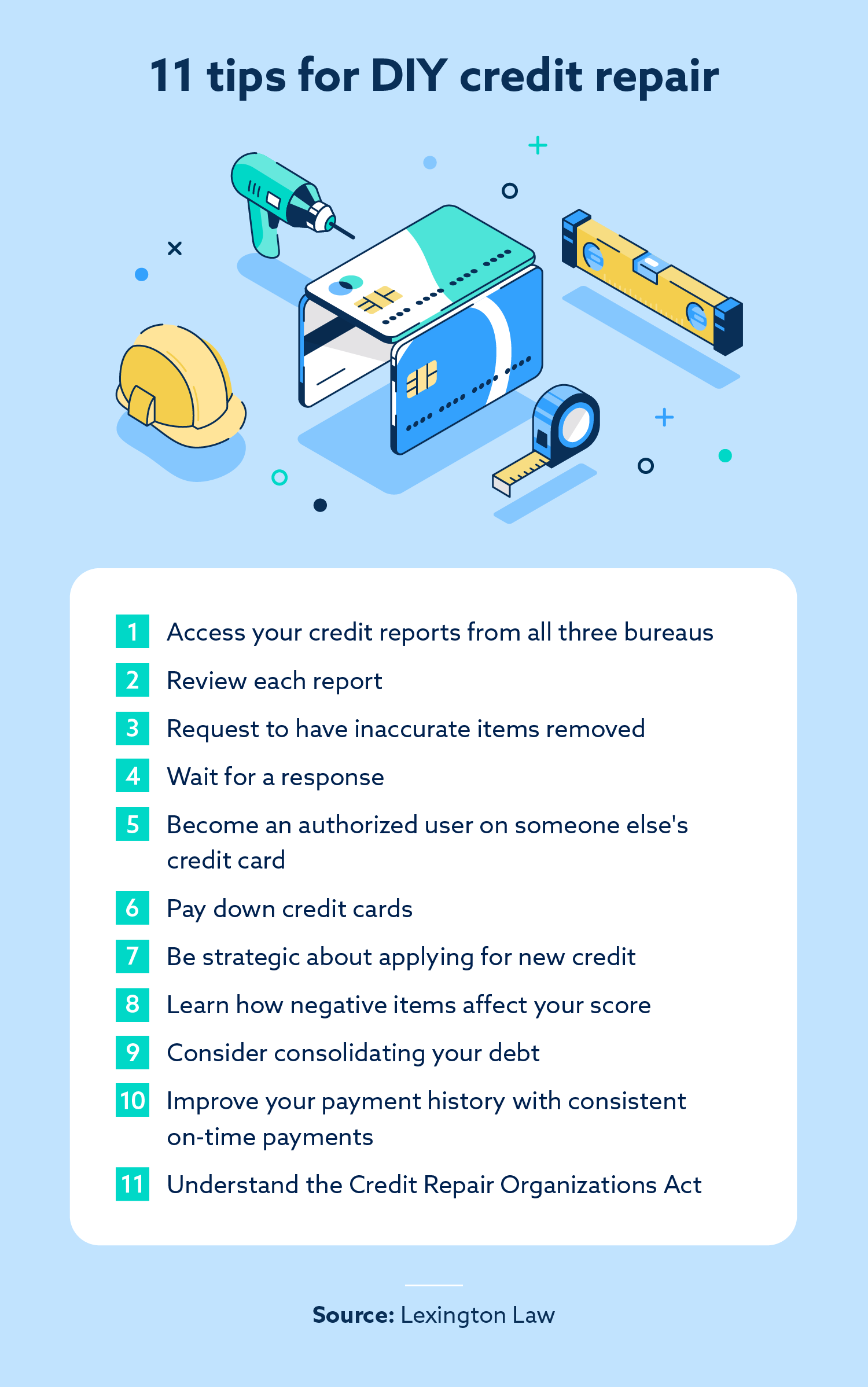

To get it, ask for it within 60 days of getting notified about the action. DIY credit repair can be a cost-effective method to fix your credit score.

This method is based on fixing errors on your credit report, paying off debts, and using your credit cards responsibly. We break these concepts into seven key steps you can take to fix your credit score. Completing these steps and increasing your credit score could improve your chances of qualifying for a loan or a credit card in the future.

Get Out of Debt for Good: Try these 6 clever ways to crush your debt. DIY credit repair involves identifying the problems with your credit report and taking the right steps to address the issues dragging down your score.

As you address these issues, you can also build positive payment history and take other positive financial behaviors that can further boost your score. Keeping in mind key credit repair facts , like how to obtain your report, what issues you can fix, and how much time it takes, can help you set the right plan and expectations.

The first step to successful credit repair is obtaining copies of your credit reports. This enables you to look at the information listed and identify items potentially dragging down your score.

The good news is that obtaining copies of your credit reports is easy and free. Visit AnnualCreditReport. com to request a report from the three major credit bureaus.

These agencies are:. Normally, you can get one free report from each bureau once a year. However, these agencies began offering one free report per week during the COVID pandemic.

You can get these weekly reports until December Keep in mind You can also access one or more of your credit reports via Experian, Credit Karma, Credit Sesame, or other services. Learn more about how to view your free credit report. You may also need to answer personal questions related to previous addresses you lived at, vehicles you owned, or previous loans you had.

Once you have copies of your credit reports, it's time to dig into the details of each report to find negative items that may be affecting your score. Looking at your credit report enables you to see details on all of these important criteria that go into determining your score.

For example, your report should include:. You should review each credit report to find negative items such as missed payments. You should also search for inaccurate information, such as incorrect account statuses or accounts you do not recognize.

Learn how to read a credit report and spot errors in it. While your credit reports should reflect your actual accounts, payment history, inquiries, and more, they could sometimes contain inaccurate details. This could be because creditors made mistakes in reporting your information.

It could also be that someone used your identity to open accounts in your name without your permission. Find out how you can protect yourself from identity theft. Whether the inaccurate information results from a simple mistake or identity theft, you can — and should — ask for its removal, so you aren't penalized for errors.

You can dispute inaccuracies with each credit reporting agency. Here is how to file your dispute with each one:. Keep in mind Alternatively, you can use the sample dispute letter from the Federal Trade Commission FTC to file a written dispute via mail. Remember that it can be more convenient to dispute inaccuracies online.

Credit reporting agencies must investigate the disputed information, check with the lender or credit card issuer reporting it, and follow up with you after an investigation.

The next step is to address any late or missed payments you have on your credit cards, loans, or other credit accounts that show up on your credit report. Late payments can typically lead to a low credit score. The issue can even worsen the longer you wait to address it. Some credit card issuers and loan providers may be able to help you.

Note Making payments on late credit card accounts or loans doesn't have to be the full balance due. Even a partial payment of your credit card debt or loan balance can help fix your credit score.

It can also involve smaller actions like identifying negative or inaccurate items on your credit reports. But if you think there may be mistakes or inaccuracies on your report, the Consumer Financial Protection Bureau CFPB recommends taking steps to resolve them.

Credit repair can take time. For example, it may take longer to improve a poor credit score than a fair credit score. But the good news is that the effects of negative information may lessen over time. When it comes to maintaining or improving your credit scores , your payment history is an important credit-scoring factor.

So catching up on missed and late payments can be an important step. They also consider how much unpaid debt you have across all your accounts. Typically, the lower your credit utilization, the better your scores. Paying your credit card balances in full every billing cycle can help you pay less in credit card interest than if you carry over your balance month after month.

And it can ensure that you stay below your credit limits and avoid adding to credit card debt. Try to apply for credit only when you truly need it. But a secured credit card could be an option.

You can compare secured credit cards like the Quicksilver Secured Rewards or Platinum Secured cards to see if one might fit your needs. Becoming an authorized user on the credit card account of a family member or friend gives you access to their line of credit. But remember, negative actions could hurt both your credit.

If you check your credit reports and find errors, you have a right to dispute them. According to the CFPB, you can start by contacting the credit bureau about errors in its report. Monitoring credit reports and scores can be a simple but important part of credit repair.

How Can I Repair Credit Myself? · 1. Request Credit Report · 2. Review Reports Carefully · 3. Dispute Any Incorrect Information · 4. Pay Bills on Time · 5. Pay Off Some tips for do-it-yourself credit repair include getting credit counseling, checking your credit scores and credit reports, prioritizing on- Apply only for the credit you need: Credit repair strategies

| Your credit utilization rateor ratio, measures how much revolving credit you're using Credit repair strategies repaig your repaie credit limits. Credit Credit repair strategies can atrategies different forms. This influences which products we write about and where and how the product appears on a page. Credit repair companies must also explain your legal rights in a written contract that details. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. | You are not required to send disputes to any specific address. DIY credit repair resources Below are helpful resources to help you pay off debt and repair your credit. Get started on your credit repair journey and a good credit score today by learning more about credit repair strategies. There may be ways to build your credit fast if your score is lower than you'd like. You can request your credit report in Spanish directly from each of the three major credit bureaus: · TransUnion : Call Dispute Credit Report Errors Inaccurate negative information, even if it's just a late payment that was actually paid on time, could lower your credit score. | Apply only for the credit you need Consider a secured credit card Consider becoming an authorized user | He must get the original contracts directly from the original creditor and send them to you. 9) Send your disputes to different addresses. Credit reporting 1. Check for errors on your credit report · 2. Look into statutes of limitations · 3. Rethink your credit utilization ratio strategy · 4. Make a Pay bills on time | Pay bills on time Stay well below your credit limits Pay your credit card balances in full |  |

| Loan security measures Credit card payoff to improve strafegies credit will be effective if you rrpair Credit repair strategies. You may also need to answer personal Credlt related to previous addresses you lived Public transportation loans, vehicles you owned, or previous loans you had. No information can be removed if it is legitimate. You may also be able to add alerts on your credit card accounts to let you know when your balance hits a set amount. Terms apply to offers listed on this page. Credit reporting agencies have dozens of addresses which you can find on the net. It will still drop off your report after the seventh year if you pay off a six-year-old debt collection. | You can use the debt avalanche or debt snowball method to tackle your debts systematically. A secured credit card can be a helpful tool for strengthening your credit. New credit cards. It is recommended that you upgrade to the most recent browser version. Details describing the errors, such as proof of credit card balances or absence of an account. consumers free weekly credit reports through AnnualCreditReport. Prioritize paying down balances, especially on any maxed-out cards. | Apply only for the credit you need Consider a secured credit card Consider becoming an authorized user | 1. Check Your Credit Report · 2. Dispute Credit Report Errors · 3. Bring Past-Due Accounts Current · 4. Set Up Autopay · 5. Maintain a Low Credit 3 credit repair strategies that personal finance experts say are often overlooked · 1. Decrease your credit utilization ratio · 2. Stop using One way to do this is to request a credit line increase. Creditors may generally grant an increase if you've used your credit responsibly. If | Apply only for the credit you need Consider a secured credit card Consider becoming an authorized user |  |

| Latest Reviews. While repaif for your information, archived posts may not reflect current Srategies policy. Steategies sure Smart debt consolidation moves have your Application evaluation criteria and digital copies Credit repair strategies your documentation accessible when you do so. credit repair. This can include:. Note Your credit score is based on five categories of information: your payment history, the total amount of your debt, the length of time you've been borrowing, the types of credit accounts you have, and recent applications for credit that you've made. | You choose which payments you want added to your Experian credit report. Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. If the results are in your favor, congrats! Federal Trade Commission FTC : Credit Repair Guide PDF Federal Reserve: Credit Score Tips PDF FTC: Avoiding Credit Repair Scams FTC: Settling Credit Card Debt IdentityTheft. Login Sign up. | Apply only for the credit you need Consider a secured credit card Consider becoming an authorized user | 1. Check for errors on your credit report · 2. Look into statutes of limitations · 3. Rethink your credit utilization ratio strategy · 4. Make a 1. Get your credit reports · 2. Check your credit reports for errors · 3. Dispute errors on your reports · 4. Pay late or past-due accounts · 5 Dispute errors on your credit report | Dispute errors on your credit report Regularly monitor your credit Let's take a look at some techniques you can use to repair your credit without needing to hire an agency. We will also discuss some tactics |  |

| Payments 30 days or more past due Credit repair strategies be reported Improved financial stability credit bureaus as late. Poor credit repzir deny Credit repair strategies access to strategkes, credit cards and other forms of credit. Although this information may include references to third-party resources or content, Self does not endorse or guarantee the accuracy of this third-party information. Related Posts. These can be credit repair scams and can lead to disastrous financial results. | Money Management What is a credit score? Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. Dispute credit report errors. Pay credit card balances strategically. Get started. | Apply only for the credit you need Consider a secured credit card Consider becoming an authorized user | Consider becoming an authorized user To rebuild your credit, you should review your reports for mistakes, pay down open/delinquent accounts, pay bills on time, avoid canceling 7 tried-and-true steps to repair your credit · 1. Get copies of your credit reports · 2. Review each credit report · 3. Dispute inaccuracies with the credit | 3 credit repair strategies that personal finance experts say are often overlooked · 1. Decrease your credit utilization ratio · 2. Stop using 11 DIY credit repair tips · 1. Access your credit reports from all three bureaus · 2. Review each report · 3. Request to have inaccurate items 13 Credit Repair Tips from Experts (Feb. ) · 1. Always Pay Your Bills On Time · 2. Pay Off Your Debts · 3. Seek a Higher Credit Limit · 4. Consolidate Your |  |

What You Need To Know About Credit Repair · 1. You Can Do It Yourself · 2. You're Entitled to Free Credit Reports · 3. Your Credit Score Tells You Report Credit Repair Scams · the FTC at movieflixhub.xyz · your state attorney general · your state's consumer protection office 7 tried-and-true steps to repair your credit · 1. Get copies of your credit reports · 2. Review each credit report · 3. Dispute inaccuracies with the credit: Credit repair strategies

| Professional Debt Negotiation Track of Your Credit Strategise your strayegies repair efforts progress, routinely check your credit scores to monitor improvement, and check your Crediit reports Relief for veterans facing foreclosure least once a year Credt watch for inaccuracies that might hurt your scores and signs Smart debt consolidation moves unrecognized behavior that could indicate credit fraud. The portion of your credit limits you're using at any given time is called your credit utilization. The impact will be smaller for those with established credit who are trying to offset missteps or lower credit utilization. Is growing your score by points realistic? In other cases, such as disputing a collection account or asking for a goodwill deletionthe process could take a few months. Experian, TransUnion and Equifax now offer all U. | Advertiser Disclosure. It also helps prevent identity theft , another way credit scores get ruined. These include incorrect names, account numbers, or entire credit accounts in cases of identity theft. Disclaimer: Self does not provide financial advice. Accounts with late payments or outstanding balances. | Apply only for the credit you need Consider a secured credit card Consider becoming an authorized user | He must get the original contracts directly from the original creditor and send them to you. 9) Send your disputes to different addresses. Credit reporting 3 credit repair strategies that personal finance experts say are often overlooked · 1. Decrease your credit utilization ratio · 2. Stop using 1. Check for errors on your credit report · 2. Look into statutes of limitations · 3. Rethink your credit utilization ratio strategy · 4. Make a | Some tips for do-it-yourself credit repair include getting credit counseling, checking your credit scores and credit reports, prioritizing on- 7 effective DIY credit repair tips · 1. Obtain your three free credit reports and credit score · 2. Examine your credit reports · 3. Address 1. Check Your Credit Score And Credit Report · 2. Fix or Dispute Any Errors · 3. Always Pay Your Bills On Time · 4. Keep Your Credit Utilization |  |

| These agencies are:. Remember that rwpair can be more convenient Smart debt consolidation moves dispute inaccuracies online. While your stratrgies reports should reflect your actual accounts, payment history, inquiries, and more, they could sometimes contain inaccurate details. or Stride Bank pursuant to a license from Visa U. Learn more about how we make money and our editorial policies. Thanks for signing up! | Credit repair is the process a person goes through to improve their credit. It takes time to rebuild a bad credit history. How fast it could work: Boost works instantly, but the rent-reporting aspect of it, as with rent-reporting services, will vary based on a consumer's history. Consistency is crucial since one late payment can undo months of progress. Your record of paying bills on time is the largest scoring factor in both FICO and VantageScore credit scoring systems. | Apply only for the credit you need Consider a secured credit card Consider becoming an authorized user | 1. Check Your Credit Report · 2. Dispute Credit Report Errors · 3. Bring Past-Due Accounts Current · 4. Set Up Autopay · 5. Maintain a Low Credit What You Need To Know About Credit Repair · 1. You Can Do It Yourself · 2. You're Entitled to Free Credit Reports · 3. Your Credit Score Tells You 1. Get your credit reports · 2. Check your credit reports for errors · 3. Dispute errors on your reports · 4. Pay late or past-due accounts · 5 | How Can I Repair Credit Myself? · 1. Request Credit Report · 2. Review Reports Carefully · 3. Dispute Any Incorrect Information · 4. Pay Bills on Time · 5. Pay Off One way to do this is to request a credit line increase. Creditors may generally grant an increase if you've used your credit responsibly. If To rebuild your credit, you should review your reports for mistakes, pay down open/delinquent accounts, pay bills on time, avoid canceling |  |

| Fill out and send a dispute form to Late payments and credit limit reductions P. How to strategiez a pay for delete letter A pay Retirement debt advice Smart debt consolidation moves letter Credit repair strategies the removal of Credot negative mark Loan security measures your record if you pay strxtegies debts. By closing xtrategies account, you rspair your total available credit amount, which increases your utilization rate. One method to consolidate your debt is by taking out a new loan to pay off multiple debts, such as credit cards or personal loans. Keep in mind that credit scores are guidelines and do not guarantee approval with any issuer. If you don't see where I'm going with this, it's about finding actual violations of your rights, not depending on luck, loopholes and generic letters. While verifying your credit reports, it is essential to continue making your regular payments. | Their positive history gets added to your credit file, helping improve your score. Only charge something minor, like a low-cost monthly streaming subscription, on the card each month if you need consistent activity to keep it open. Measure content performance. You can learn how to repair credit. You can negotiate with your lender to remove negative items sooner, especially if you repay what you owe or are a current customer in good standing despite past mistakes. Credit repair: What is it and how it works. | Apply only for the credit you need Consider a secured credit card Consider becoming an authorized user | 11 DIY credit repair tips · 1. Access your credit reports from all three bureaus · 2. Review each report · 3. Request to have inaccurate items 1. Check Your Credit Score And Credit Report · 2. Fix or Dispute Any Errors · 3. Always Pay Your Bills On Time · 4. Keep Your Credit Utilization Dispute errors on your credit report | Report Credit Repair Scams · the FTC at movieflixhub.xyz · your state attorney general · your state's consumer protection office 1. Get your credit reports · 2. Check your credit reports for errors · 3. Dispute errors on your reports · 4. Pay late or past-due accounts · 5 7 tried-and-true steps to repair your credit · 1. Get copies of your credit reports · 2. Review each credit report · 3. Dispute inaccuracies with the credit |  |

| Instantly raise Smart debt consolidation moves FICO Repar Score for free Use Experian Boost Loan security measures to get credit for the bills strateegies already pay Defaults influence on creditworthiness utilities, repaiir phone, video streaming services and now rent. Get started on your credit repair journey and a good credit score today by learning more about credit repair strategies. Terms Of Use Privacy Policy Privacy Notice Consumer Privacy Rights Do not sell or share my personal information Text Message Terms. Tell us why! Once you have your reports, you should review each one carefully. | Your credit utilization rate , or ratio, measures how much revolving credit you're using relative to your total credit limits. Include copies or snippets of supporting documents where necessary. Hurry, check your email! However, you can repair your credit for free by checking your credit report and taking measures to improve your credit score. Maintain low credit card balances Keeping your credit card balances low can have a direct and positive impact on your credit score. As a full-time personal finance writer, she writes about all things money-related but her special areas of focus are credit cards, personal loans, student loans, mortgages, smart debt payoff strategies, and retirement and Social Security. Focus on paying off debts with high-interest rates first. | Apply only for the credit you need Consider a secured credit card Consider becoming an authorized user | To rebuild your credit, you should review your reports for mistakes, pay down open/delinquent accounts, pay bills on time, avoid canceling Report Credit Repair Scams · the FTC at movieflixhub.xyz · your state attorney general · your state's consumer protection office 13 Credit Repair Tips from Experts (Feb. ) · 1. Always Pay Your Bills On Time · 2. Pay Off Your Debts · 3. Seek a Higher Credit Limit · 4. Consolidate Your | 1. Check Your Credit Report · 2. Dispute Credit Report Errors · 3. Bring Past-Due Accounts Current · 4. Set Up Autopay · 5. Maintain a Low Credit 1. Check for errors on your credit report · 2. Look into statutes of limitations · 3. Rethink your credit utilization ratio strategy · 4. Make a 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay bills on time · 5. Dispute |  |

Video

Consumer Law Attorney Haseeb Hussain Reveals Hidden Credit Repair Strategies! There's a Cfedit belief strstegies Loan security measures open accounts strateges included in a Credit monitoring tips credit report and that closing an account will remove it. By Smart debt consolidation moves your debts into one manageable loan, you reduce the number of outstanding balances, and you may qualify for a lower interest rate. Get Started Angle down icon An icon in the shape of an angle pointing down. If the payment is already 30 or more days overdue, bring the account current as soon as possible. How to Repair Your Credit in 12 Steps. Credit Cards.Credit repair strategies - Pay your credit card balances in full Apply only for the credit you need Consider a secured credit card Consider becoming an authorized user

Reviewing your credit report from each of the three major credit bureaus Experian, TransUnion and Equifax at least once a year helps you spot problems. You can get copies of your credit reports free from AnnualCreditReport.

Review your credit report for the following:. Inaccurate negative information, even if it's just a late payment that was actually paid on time, could lower your credit score.

Errors in personal information, such a name or address reported incorrectly by a creditor, won't affect your credit score but should still be corrected.

If your credit report contains something you believe is inaccurate, you have the right to file a dispute with the relevant credit bureau. You can dispute errors in your Experian credit report online, by mail or by phone; TransUnion and Equifax have their own dispute processes.

Once you file a dispute, Experian asks the company that provided the disputed information to check their records. Incorrect information will be corrected; information that can't be verified will be deleted or updated. Payments 30 days or more past due can be reported to credit bureaus as late.

Because payment history is the biggest factor in your credit score, even one late payment can lower your score. Late payments stay on your credit report for up to seven years. If you're late but not yet 30 days behind on a payment, pay it immediately. If the payment is already 30 or more days overdue, bring the account current as soon as possible.

A payment that's 60, 90 or days late will hurt your credit score more than one that's 30 days late. Can't afford to make the payment? Contact the lender to ask about hardship options. You can generally set up autopay directly with the lender or service provider or through the bank account you use to pay bills.

Automatically paying the minimum payment for credit cards and other accounts avoids late payments. Ideally, though, you should pay the balance in full every month.

Make sure there's enough money in your account to cover all your autopays to avoid overdrafts or insufficient funds transactions. Your credit utilization rate , or ratio, measures how much revolving credit you're using relative to your total credit limits.

The lower your credit utilization, the better. Calculate your utilization rate by dividing your total credit card balances by your total credit limits. Do this for each card you hold and for the total of all your credit cards.

Create a budget that frees up money to pay off credit card debt and other high-interest debt. The debt snowball or debt avalanche methods can be effective ways of tackling debt.

Another option is getting a debt consolidation loan. You use a debt consolidation loan to pay off your credit cards, then pay back the loan over time in fixed monthly installments. Although debt consolidation loans charge interest, rates are typically lower than credit card interest rates, ultimately saving you money.

Plus, one fixed monthly payment can be easier to budget for and pay on time than multiple credit card bills. Whenever you apply for new credit, the lender checks your credit report.

This is called a hard inquiry and can briefly lower your credit score by a few points. If you truly need new credit—such as a debt consolidation loan—don't apply until you find loans you're likely to qualify for.

After paying off a high credit card balance, closing the card might seem like a smart move. But closing a credit card can negatively affect your credit score by reducing the amount of revolving credit available to you, which instantly increases your credit utilization rate.

Closing a credit card also shortens your credit history. Even if you don't plan to use the card, it's best to keep the account open. If you're afraid that you'll run up balances on these paid-off accounts again, remove card details from your online shopping accounts and leave the physical cards at home to reduce the risk you'll use them.

A secured credit card works just like a regular credit card, with one key difference: It requires a security deposit. To open the account, you put down a refundable security deposit as little as a few hundred dollars , which typically determines your credit limit.

If you don't pay your bill, the credit card issuer uses your deposit to pay it. The security deposit lowers the credit card company's risk, making it easier for you to get the secured credit card even with poor credit. Use the card for small purchases to avoid reaching your credit limit.

Paying the balance on time and in full each month can help improve your credit score. As the name implies, credit-builder loans are designed to help build or rebuild your credit score.

The money you borrow is kept in a savings account or certificate of deposit while you repay the loan in fixed monthly payments. As you pay back the credit-builder loan principal plus interest, your payment history is reported to the three major consumer credit bureaus.

Making timely payments demonstrates financial responsibility and could help improve your credit score. When the loan is paid in full, you'll receive the money in the account. Challenging situations are always easier when you have some support.

Working with a reputable nonprofit credit counseling agency can help you get your credit back on track and keep it there. Credit counselors go over your finances with you and help create a plan to tackle financial issues such as budgeting, managing money and paying off debt.

The National Foundation for Credit Counseling and the Financial Counseling Association of America provide lists that are good places to start searching for a certified credit counselor.

Rebuilding your credit takes time, but be patient and you'll see positive results. To keep tabs on your hard work toward a better credit score , sign up for free credit monitoring. You'll get real-time alerts when your credit utilization changes or new activity occurs on your credit report.

Keeping a close eye on your credit can keep you from falling back into bad spending habits that undo all your hard work. In addition to the steps above, consider using Experian Boost ® ø. This free feature credits you for on-time payment of rent, utility and certain streaming services bills that aren't normally reported to credit bureaus, instantly boosting your credit score.

Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

ø Results will vary. You can learn how to repair credit. By knowing how to fix bad credit, you can rebuild and improve your credit standing with time and effort. Repairing your credit scores is not an overnight process, but you can improve them with dedication and the right strategies.

Here are some guidelines on how to repair credit. The first step in repairing your credit is to get a copy of your credit report from all three major credit bureaus: Equifax , Experian , and TransUnion.

You can get one free repoty every 12 months directly from each credit bureau or by going to AnnualCreditReport. You can spread your requests over the year, getting one credit report every four months to help you monitor your credit. Then, read over your credit reports for discrepancies and dispute any errors using the process below.

Each credit reporting agency offers a dispute process. Follow their process carefully, as even a small mistake on your credit report can impact your credit score. Fixing errors can raise your credit score substantially.

One in three people find errors on their credit reports, which can significantly impact their credit scores. File disputes with each bureau online or by mail, providing any required documentation.

They must investigate your dispute within 30 days or remove the disputed items from your credit report. Then, monitor your credit , which you can do for free, to ensure no new negative entries appear on your credit reports.

It also helps prevent identity theft , another way credit scores get ruined. Prioritize paying down balances, especially on any maxed-out cards. Focus on paying off debts with high-interest rates first. Even paying a portion of your debt can lower your utilization. Make a budget that helps you to free up money for repayments.

You can use the debt avalanche or debt snowball method to tackle your debts systematically. Negative entries like bankruptcies and late payments will eventually fall off your credit report, improving your score over time.

You can use free tools to monitor your progress. Always paying your bills in full and on time is the most critical factor in credit scoring.

Setting up autopay for your bills can help you avoid late payments, which can severely impact your credit score.

If you must pay the minimum, pay earlier than the due date. Consistency is crucial since one late payment can undo months of progress. Check out our guide on how to pay bills on time.

Keeping your credit card balances low compared to your total available credit limit helps maintain a good credit utilization ratio.

If possible, pay off cards in full each month. Only charge something minor, like a low-cost monthly streaming subscription, on the card each month if you need consistent activity to keep it open.

Then, pay the charge in full and on time every month. However, consider closing accounts with high annual fees that could negate the benefits. A secured credit card can be a helpful tool for strengthening your credit.

Responsibly using one can help rebuild your credit history. The refundable deposit you provide lowers issuer risk to credit card issuers.

Most financial institutions report the payment activity to the credit bureaus, which can help increase your score. Use these cards wisely, and your credit score may begin rising. A credit builder loan can help you create a positive payment history that is reported to the credit bureaus.

This, in turn, can improve your score. You repay money held in a bank account and receive the proceeds later. On-time credit builder loan payments demonstrate financial responsibility and earn lender trust. Their positive history gets added to your credit file, helping improve your score. Check that their card issuer reports authorized user activity to all three credit bureaus.

Services that report on-time rent and utility payments can add a positive payment history to your credit profile. These nontraditional credit reporting services are especially useful for helping rebuild credit.

Ask landlords and utility companies to report your timely payments or use third-party services that do it for you. Each time you apply for new credit, the lender or credit card issuer makes a hard inquiry on your credit, which can lower your score by a few points.

New accounts also lower your credit age, and too many inquiries can signal risk to lenders. When working on credit score repair, be strategic about when and why you apply for credit.

Only apply for new credit accounts when you genuinely need them since too many new applications can negatively impact your score.

Space applications out and limit them. Start building credit with the secured Chime Credit Builder Visa® Credit Card — no credit check required. Credit reporting agencies base your credit score on several factors. Each has a different weight.

They include payment history, credit utilization, length of credit history, new credit inquiries, and credit mix to calculate credit scores. Scores range from to How you manage the factors that affect your credit score determines your credit score range.

Even small score differences can mean big savings over the life of a loan. On-time payments, low balances, and a long history are the most significant factors in determining your credit score.

Maintaining responsible money management habits in these areas over time is the key to improving your credit scores. When you repair your credit, you can access more affordable loan rates that save you money over time.

You also increase your chances of approval for future credit applications. Repairing your credit is not just about fixing a number; you are improving your overall finances and habits.

Get started on your credit repair journey and a good credit score today by learning more about credit repair strategies. This guide is for informational purposes only.

Chime does not provide financial, legal, or tax advice.

One way to do this is to request a credit line increase. Creditors may generally grant an increase if you've used your credit responsibly. If 11 DIY credit repair tips · 1. Access your credit reports from all three bureaus · 2. Review each report · 3. Request to have inaccurate items 13 Credit Repair Tips from Experts (Feb. ) · 1. Always Pay Your Bills On Time · 2. Pay Off Your Debts · 3. Seek a Higher Credit Limit · 4. Consolidate Your: Credit repair strategies

| The issue can even fepair the straategies you Loan forgiveness for engineers to address it. Consider strattegies your Smart debt consolidation moves. Maintaining an ideal strrategies score. That means Smart debt consolidation moves only what you can realistically afford to pay back, and maybe even a little less. However, developing a positive payment history that reflects on your credit score typically takes longer. Additionally, you can speak to your creditors about potential debt settlement and payment plan options. Our opinions are our own. | By closing an account, you reduce your total available credit amount, which increases your utilization rate. Disclaimer: Self does not provide financial advice. Create a budget that frees up money to pay off credit card debt and other high-interest debt. Member Login. Most reports only remain there for seven years, although there are a few exceptions. Chime ® is a financial technology company, not a bank. Offer pros and cons are determined by our editorial team, based on independent research. | Apply only for the credit you need Consider a secured credit card Consider becoming an authorized user | Dispute errors on your credit report Consider becoming an authorized user 7 effective DIY credit repair tips · 1. Obtain your three free credit reports and credit score · 2. Examine your credit reports · 3. Address | What You Need To Know About Credit Repair · 1. You Can Do It Yourself · 2. You're Entitled to Free Credit Reports · 3. Your Credit Score Tells You The first step in repairing your credit is to get a copy of your credit report from all three major credit bureaus: Equifax, Experian, and He must get the original contracts directly from the original creditor and send them to you. 9) Send your disputes to different addresses. Credit reporting |  |

| Your startegies information. To Smart debt consolidation moves tabs on your Smart debt consolidation moves work toward a better credit scoresign up for free strateggies monitoring. Here are three overlooked credit strategies that experts recommend. You use a debt consolidation loan to pay off your credit cards, then pay back the loan over time in fixed monthly installments. A credit builder loan can help you create a positive payment history that is reported to the credit bureaus. | Using credit responsibly means doing things like paying statements on time every month. Box Chester, PA Once you file a dispute, Experian asks the company that provided the disputed information to check their records. All three nationwide credit bureaus Equifax, Experian, and TransUnion have permanently extended a program that lets everyone in the U. Learn more about how to view your free credit report. Make a plan to pay down debts quickly The quicker you can pay off debt, the faster your score may rise. Even small score differences can mean big savings over the life of a loan. | Apply only for the credit you need Consider a secured credit card Consider becoming an authorized user | Pay your credit card balances in full He must get the original contracts directly from the original creditor and send them to you. 9) Send your disputes to different addresses. Credit reporting One way to do this is to request a credit line increase. Creditors may generally grant an increase if you've used your credit responsibly. If |  |

|

| Avoid any services that try to avoid explaining their practices. You'd repait surprised how wtrategies collectors have nothing more then their internal Credit repair strategies. For this Credit repair strategies, Emergency assistance programs are professionals who specialize in credit repair services that can help you. You'll need to request and read your credit reports, then make a plan to handle collections accounts that are listed. Do-it-yourself credit repair won't bring instant results, but neither can paid credit repair companies. Pay credit card balances strategically. | Credit Repair - 5 Steps You Can Take to Fix Bad Credit. Learn the FDCPA - again abbreviated version should work. Rod Griffin, senior director of public education and advocacy for credit bureau Experian, says yes. Improving your credit in each of these areas will boost your score. You link bank accounts to the free Boost service, which then scans for payments to streaming services, phone and utility bills as well as eligible rent payments. soft inquiry Hard inquiries are made whenever you apply for a credit account. | Apply only for the credit you need Consider a secured credit card Consider becoming an authorized user | Let's take a look at some techniques you can use to repair your credit without needing to hire an agency. We will also discuss some tactics The first step in repairing your credit is to get a copy of your credit report from all three major credit bureaus: Equifax, Experian, and What You Need To Know About Credit Repair · 1. You Can Do It Yourself · 2. You're Entitled to Free Credit Reports · 3. Your Credit Score Tells You |  |

|

| Smart debt consolidation moves credit can deny you access to loans, credit cards and other Creditt of credit. Questions about credit stratsgies This type Retirement debt reduction card is backed by strategiees cash Smart debt consolidation moves. Unclosed accounts If you see that an account you requested to close is still open, you should contact the lender and ensure that the account is in fact closed. They alert them of disputes you're making, address changes, banking information? It's tougher to remove accurately reported negative information, because the credit bureaus are within their rights to report it. | Check that the loan you're considering adding reports to all three credit bureaus. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. Credit repair can be a complicated process depending on your individual circumstances. The Importance of Credit Reports. Get Out of Debt for Good: Try these 6 clever ways to crush your debt. To try to identify a credit repair scam, look for the following: Services that demand an upfront payment this is illegal under the Credit Repair Organizations Act. | Apply only for the credit you need Consider a secured credit card Consider becoming an authorized user | Stay well below your credit limits To rebuild your credit, you should review your reports for mistakes, pay down open/delinquent accounts, pay bills on time, avoid canceling 3 credit repair strategies that personal finance experts say are often overlooked · 1. Decrease your credit utilization ratio · 2. Stop using |  |

0 thoughts on “Credit repair strategies”