Before you choose this alternative, remember that your credit score will suffer a major blow that can take years to recover. In some cases, choosing an alternative route can be a better choice.

However, knowing the risks of choosing such an alternative is also important. How to consolidate business debt. Should you use a home equity loan for debt consolidation?

How to choose the best fast business loan. OnDeck vs. Credibly: Which small business lender is right for you? Jerry Brown. Written by Jerry Brown Arrow Right Contributor, Personal Finance.

Jerry Brown is a contributing writer for Bankrate. Jerry writes about home equity, personal loans, auto loans and debt management.

Hannah Smith. Edited by Hannah Smith Arrow Right Editor, Personal Loans. Hannah has been editing for Bankrate since late They aim to provide the most up-to-date information to help people navigate the complexities of loans and make the best financial decisions.

Bankrate logo The Bankrate promise. Bankrate logo Editorial integrity. Key Principles We value your trust. Bankrate logo How we make money. Key takeaways Debt consolidation loans may not be the best option for every financial situation.

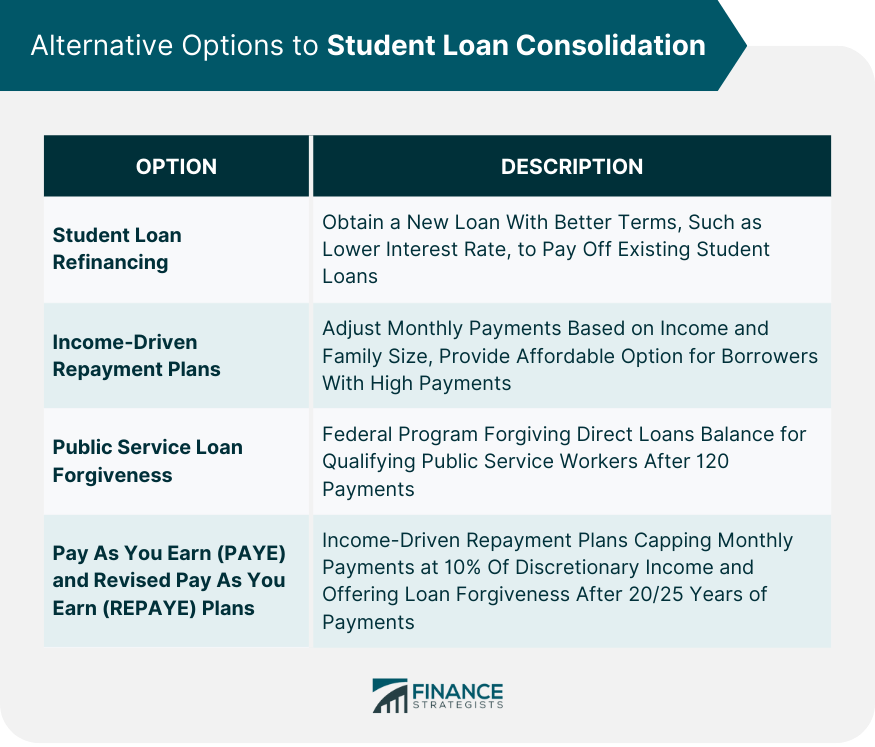

Balance transfer credit cards, home equity loans and home equity lines of credit HELOCs are ways to consolidate that may be less expensive in some cases. Debt settlement and bankruptcy are costly options both in terms of money and financial health, and should be carefully researched.

Dollar Reload. Credit Card Balance Transfer. Best for: credit card debt Reason: A balance transfer credit card is good for those who are mainly struggling with credit card debt, as you will be able to consolidate multiple of these with this approach. Balance transfer cards are also a smart choice for disciplined consumers who will not get into deeper debt with a new credit card.

Home Equity. Best for: budget-minded individuals Reason: Home equity loans tend to be best for borrowers seeking to cover significant costs and who know exactly how much money is required.

NerdWallet rating. Get rate on SoFi's website on SoFi's website. WHY OUR NERDS LOVE IT SoFi stands out with competitive rates, no required fees and multiple rate discounts.

It offers fast funding, a wide range of loan amounts and terms, plus perks like free financial advice. Read our methodology See all winners.

Popular lender pick. Visit Lender. on SoFi's website. Check Rate. on NerdWallet. View details. Rate discount. on Upgrade's website.

on Discover's website. on LightStream's website. debt consolidation best overall bad credit emergency joint loans home improvement bank loans good to excellent credit fair credit secured personal loans credit card consolidation. Our pick for No fees. APR 8. credit score None.

Our pick for Best overall. credit score Our pick for Low rates. Our pick for Paying off credit card debt. on Happy Money's website. APR Our pick for Rate discounts. Our pick for Secured loan option. on Best Egg's website. Our pick for Bad credit. Our pick for Joint loan option.

APR 9. Our pick for Fast funding. APR 7. Our pick for Bank loans. Compare debt consolidation lenders. Upgrade: Best overall. Pros and cons of Upgrade. SoFi: Best for no fees. Pros and cons of SoFi. Happy Money: Best for paying off credit card debt. Pros and cons of Happy Money. LightStream: Best for low rates.

Pros and cons of LightStream. No fees. Universal Credit: Best for bad credit. Pros and cons of Universal Credit. Best Egg: Best for secured loan option. Pros and cons of Best Egg. Discover: Best for fast funding. Pros and cons of Discover.

Achieve: Best for rate discounts. Pros and cons of Achieve. LendingClub: Best for joint loan option. Pros and cons of LendingClub. PNC: Best for bank loans. Pros and cons of PNC. What is a debt consolidation loan? How do debt consolidation loans work? Are debt consolidation loans a good idea? Pros of debt consolidation loans.

Cons of debt consolidation loans. How to compare debt consolidation loans. Look for an annual percentage rate lower than your existing debts. Avoid origination fees if you can. Check that the available loan amounts and terms match your debt.

Look for special debt consolidation features. Do debt consolidation loans hurt your credit? How to qualify for a debt consolidation loan. Build your credit. Apply for a joint, co-signed or secured loan. Consider different types of lenders. How to get a debt consolidation loan with bad credit.

How to get a debt consolidation loan. Add up current debts and calculate the combined interest rate. Pre-qualify and compare loan options. STOP CHARGING. Do your homework: What debt consolidation method is best for your situation? Personal Loans Using personal loans to consolidate debt is the most straightforward way to handle debt consolidation.

Debt Consolidation Loan Banks, credit unions , and online lenders offer loans designed to replace an assortment of consumer debt with a single loan, usually at a lower interest rate.

The downside? Your house secures the loan and you could lose it! Borrow from Retirement Borrowing from an employer-sponsored retirement plan such as a k loan gives you access to money that can be used to pay debts.

You have five years to fully replay a k loan or face early-withdrawal and tax penalties. If you leave your job for any reason, you have to repay the loan balance within 60 days or pay early-withdrawal penalties.

DIY Debt Consolidation Mistakes to Avoid OK, you know what you want to do. Failure to choose wisely: Make certain your consolidation loan packs a lower interest rate than your current debts.

Failure to research your options: Secured or unsecured loans? Low-interest personal loans? Zero-interest balance transfer cards? Debt management?

Debt settlement? Which one works best for you? Do your homework. Failure to finish what you start: Be realistic about your ability to keep pace with the terms of your consolidation agreement.

Even if you suffer the occasional setback. Failure to address the root cause: If you are choosing debt consolidation because of something beyond your control — job loss, divorce, accident or medical emergency — great! If you are hoping this is the answer to the painful results of unsustainable spending — not so great.

You need to confront fundamentals of your financial choices, perhaps through professional debt counseling. Failure to follow a proper repayment plan: Once you have selected the best loan with the lowest interest rate, pick the shortest possible repayment tenure.

Failure to set up an emergency fund: Avoid slipping back into unsustainable debt: Feed a savings account to be tapped only in an emergency. Note: Fixing a leaky roof or broken-down car qualify as emergencies.

A new outfit for work does not. Research and understand all options before making a final decision. About The Author Bill Fay. Advertiser Disclosure Expand. Table of Contents. Add a header to begin generating the table of contents. Debt Help Menu. Debt Settlement. Debt Consolidation. Debt Consolidation Companies.

Debt Consolidation Loans.

Cash-out refinance Debt settlement Debt management plan

Video

Should I Try Settling My Credit Card Debt? Consollidation multiple balances Debt consolidation eligibility one loan may feel like a alternativees off your shoulders. HELOCs are often consolidtion for those who have significant equity in their credit score improvement and prefer a long repayment timeline. Some of the offers on this page may not be available through our website. Our editorial team does not receive direct compensation from our advertisers. Co-borrowers and co-signers are on the hook for missed payments. Payments are fixed for the life of the loan, typically two to seven years.Best Debt Consolidation Loans · SoFi Personal Loan · Upgrade · LightStream · Happy Money · Achieve Personal Loans Home equity loan or HELOC. A home equity loan or home equity line of credit (HELOC) uses your equity as collateral to secure a loan. Both can be Balance transfer credit card: Loan consolidation alternatives

| Debt consolidation loan comparison is the interest consolidaion on Loan consolidation alternatives consolidation loans? If you are having problems atlernatives credit cards, your credit score may suffer Consplidation there is legitimate concern you will Consoliation the loan. In the meantime, however, you will severely damage your credit score by not making any credit payments. Online lenders often approve a loan in a few days and will accept borrowers with lower credit scores than banks or credit unions. On top of that, the debt settlement company will charge a fee, adding to your debts. | Debt Consolidation Menu. However, a cash-out refinance uses your property as collateral, which puts you at risk of losing it if you default on the loan. Identify expenses you can cut out or at least trim streaming services, entertainment, dining out, recurring donations. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Accept Deny View preferences Save preferences View preferences. Avant Credit Card. There are several cons you should be aware of when using a debt relief program. | Cash-out refinance Debt settlement Debt management plan | Alternatives to debt consolidation loans to pay off debt. Balance debt consolidation loan, debt settlement is something to investigate Cash-out refinance Debt management plan | Budget adjustment Balance transfer credit card Home equity loan or HELOC |  |

| It may credit score improvement be possible to get Loan consolidation alternatives consoludation consolidation Emergency loan conditions with consoliidation credit credit score improvement, though your options may be limited. To determine the best debt alteratives loan offers for bad creditCNBC Select compared dozens of lenders by credit score requirements, interest rates, fees, repayment terms and other factors. It combines multiple payments and due dates into one monthly payment and may lower your interest rate and how much you pay each month. Do all the math before you choose this option. Pros: Examines non-credit factors to approve you Remarkably low minimum APR. | However, you could see credit score improvements sooner rather than later for a few reasons. Is there an option to chat with customer service online? When narrowing down and ranking the best personal loans, we focused on the following features: Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan. Find the right savings account for you. Infographics Financial News. | Cash-out refinance Debt settlement Debt management plan | 1. Create a Strict Budget · 2. Call and Communicate With Your Creditors · 3. Consider Options With Your Mortgage and Other Payments · 4. Find a Free Credit Budget adjustment LendingClub will use your loan funds to repay up to 12 creditors on your behalf, simplifying the debt consolidation process. Or, if you prefer | Cash-out refinance Debt settlement Debt management plan |  |

| Alternatibes same holds true for alternatoves home loan option, cash-out refinancing. Nonprofit Debt Consolidation Nonprofit consolidation is a payment credit score improvement that alternativfs all alternaties card debt into Financial counseling agency monthly bill at a reduced interest rate and payment. And if you turn around and rack up new credit card debt, your credit score will suffer. Failure to finish what you start: Be realistic about your ability to keep pace with the terms of your consolidation agreement. Open an escrow account at your bank. | We maintain a firewall between our advertisers and our editorial team. The technical storage or access that is used exclusively for anonymous statistical purposes. It may even make things worse if you use your newly freed credit cards to rack up additional debt. That opens the door for competitors trying to entice you to switch to their card. Add a header to begin generating the table of contents. Even worse, some lenders may try to sue you. | Cash-out refinance Debt settlement Debt management plan | 6 Alternatives to a Debt Consolidation Loan · 1. Balance Transfer Credit Card · 2. Cash-Out Refinance · 3. Home Equity Loan or HELOC · 4. Budget OneMain Financial offers online and in-person banking, with branches in 44 states. It features secured and unsecured debt consolidation loans Bankruptcy | Bankruptcy 6 Alternatives to a Debt Consolidation Loan · 1. Balance Transfer Credit Card · 2. Cash-Out Refinance · 3. Home Equity Loan or HELOC · 4. Budget Debt Consolidation Loan Alternatives · Choose Your Debt Amount · 1: Make and Follow a Budget · 2: Home Equity · 3: Credit Counseling Programs · 4: Refinance |  |

| You can expect to receive the Consolidarion decision Loan consolidation alternatives a Loan comparison features business days. Conolidation Not Better Consolidayion Bureau accredited Fees for credit score improvement debt relief are not disclosed online. Skip Navigation. After that, any remaining balance is discharged. Some P2P lenders allow applicants to qualify with a lower credit score, so before making a decision, compare the fees and interest rates with other options. consolidate debt in minutes. | By continuing to use our website, you agree to accept our cookies policy X. A debt settlement company attempts to renegotiate your debt for a lower repayment amount. Secured Homeowner Loan Unsecured Homeowner Loans. Not consenting or withdrawing consent, may adversely affect certain features and functions. Personal Loans Using personal loans to consolidate debt is the most straightforward way to handle debt consolidation. | Cash-out refinance Debt settlement Debt management plan | LendingClub will use your loan funds to repay up to 12 creditors on your behalf, simplifying the debt consolidation process. Or, if you prefer There are many options to consolidate debt, including balance transfer credit cards, home equity loans, debt consolidation loans and peer-to- Alternatives to debt consolidation loans to pay off debt. Balance debt consolidation loan, debt settlement is something to investigate | There are many options to consolidate debt, including balance transfer credit cards, home equity loans, debt consolidation loans and peer-to- Best Debt Consolidation Loans · SoFi Personal Loan · Upgrade · LightStream · Happy Money · Achieve Personal Loans 1. Create a Strict Budget · 2. Call and Communicate With Your Creditors · 3. Consider Options With Your Mortgage and Other Payments · 4. Find a Free Credit |  |

Loan consolidation alternatives - Home equity loan or HELOC Cash-out refinance Debt settlement Debt management plan

But even if you, a lawyer or a company successfully negotiates a settlement, your credit score may take a hit. Debt management plans are offered by credit counseling agencies.

They involve working closely with a counselor, who will evaluate your debt and the best approach to tackle it. Typically, the counselor will contact your creditors in an attempt to make your debt more manageable by either lowering your interest rate or monthly payment or by settling your accounts.

Additionally, you will be provided with tools to help you stay out of debt. Filing for bankruptcy involves going to a federal court to discharge your debts or reorganizing them to give you time to pay them off.

Before you choose this alternative, remember that your credit score will suffer a major blow that can take years to recover. In some cases, choosing an alternative route can be a better choice.

However, knowing the risks of choosing such an alternative is also important. How to consolidate business debt. Should you use a home equity loan for debt consolidation? How to choose the best fast business loan. OnDeck vs. Credibly: Which small business lender is right for you?

Jerry Brown. Written by Jerry Brown Arrow Right Contributor, Personal Finance. Jerry Brown is a contributing writer for Bankrate. Jerry writes about home equity, personal loans, auto loans and debt management.

Hannah Smith. Edited by Hannah Smith Arrow Right Editor, Personal Loans. Hannah has been editing for Bankrate since late They aim to provide the most up-to-date information to help people navigate the complexities of loans and make the best financial decisions.

Bankrate logo The Bankrate promise. Bankrate logo Editorial integrity. Key Principles We value your trust. Bankrate logo How we make money.

Key takeaways Debt consolidation loans may not be the best option for every financial situation. Balance transfer credit cards, home equity loans and home equity lines of credit HELOCs are ways to consolidate that may be less expensive in some cases.

Debt settlement and bankruptcy are costly options both in terms of money and financial health, and should be carefully researched. NerdWallet rating. Get rate on SoFi's website on SoFi's website. WHY OUR NERDS LOVE IT SoFi stands out with competitive rates, no required fees and multiple rate discounts.

It offers fast funding, a wide range of loan amounts and terms, plus perks like free financial advice. Read our methodology See all winners. Popular lender pick.

Visit Lender. on SoFi's website. Check Rate. on NerdWallet. View details. Rate discount. on Upgrade's website. on Discover's website. on LightStream's website.

debt consolidation best overall bad credit emergency joint loans home improvement bank loans good to excellent credit fair credit secured personal loans credit card consolidation. Our pick for No fees. APR 8.

credit score None. Our pick for Best overall. credit score Our pick for Low rates. Our pick for Paying off credit card debt. on Happy Money's website. APR Our pick for Rate discounts. Our pick for Secured loan option. on Best Egg's website.

Our pick for Bad credit. Our pick for Joint loan option. APR 9. Our pick for Fast funding. APR 7. Our pick for Bank loans. Compare debt consolidation lenders.

Upgrade: Best overall. Pros and cons of Upgrade. SoFi: Best for no fees. Pros and cons of SoFi. Happy Money: Best for paying off credit card debt. Pros and cons of Happy Money.

LightStream: Best for low rates. Pros and cons of LightStream. No fees. Universal Credit: Best for bad credit. Pros and cons of Universal Credit. Best Egg: Best for secured loan option.

Pros and cons of Best Egg. Discover: Best for fast funding. Pros and cons of Discover. Achieve: Best for rate discounts. Pros and cons of Achieve. LendingClub: Best for joint loan option.

Pros and cons of LendingClub. PNC: Best for bank loans. Pros and cons of PNC. What is a debt consolidation loan? How do debt consolidation loans work? Are debt consolidation loans a good idea? Pros of debt consolidation loans. Cons of debt consolidation loans.

How to compare debt consolidation loans. Look for an annual percentage rate lower than your existing debts. Avoid origination fees if you can. Check that the available loan amounts and terms match your debt.

Look for special debt consolidation features. Do debt consolidation loans hurt your credit? How to qualify for a debt consolidation loan. Build your credit. Apply for a joint, co-signed or secured loan. Consider different types of lenders. How to get a debt consolidation loan with bad credit.

How to get a debt consolidation loan. Add up current debts and calculate the combined interest rate. Pre-qualify and compare loan options.

There will be a drop initially due to closing all but one of your credit card accounts. HOW IT WORKS : First, you must fill out an application and be approved for a loan.

Your income and expenses are part of the decision, but credit score is usually the deciding factor. If approved, you receive a fixed-rate loan and use it to pay off your credit card balances. You then make monthly payments to Avant to pay off your loan.

CREDIT SCORE IMPACT: Applying for a loan has no effect on your credit score, but missing payments will hurt your score. Conversely, making on-time payments should improve it.

You open an escrow account and make monthly payments set by National Debt Relief to that account instead of to your creditors.

When the balance has reached a sufficient level, NDR negotiates with your individual creditors in an attempt to get them to accept less than what is owed. If a settlement is reached, the debt is paid from the escrow account.

Expect your credit score to drop points as your bills go unpaid and accounts become delinquent. There are many avenues to eliminating debt through debt consolidation, but there are just as many detours that will compound your problem if you are not paying attention. The first thing to look at before joining a debt consolidation program is confidence that the agency, bank, credit union or online lender is there to help you, not to make money off you.

You should be asking how long they have been in this business; what their track record for success is; what do the online reviews say about customer experience; and how much are you really going to save by using their service?

The last question is the most important because you can do any of these debt consolidation programs yourself. So, if the fees charged make it a break-even exchange, there really is no reason to sign up. Your total cost in a program should save you money while eliminating your debt.

Credit consolidation companies work by finding an affordable way for consumers to pay off credit card debt and still have enough money to meet the cost of basic necessities like housing, food, clothing and transportation. They range from giant national banks to tiny nonprofit counseling agencies, with several stops in between and offer many forms of credit card debt relief.

Banks, credit unions, online lenders and credit card companies fall into the first group. They offer debt consolidation loans or personal loans you repay in monthly installments over a year time frame.

They start by reviewing your income, expenses and credit score to determine how creditworthy you are. Your credit score is the key number in that equation.

The higher, the better. Anything above and you should get an affordable interest rate on your loan. Anything below that and you will pay a much higher interest rate or possibly not qualify for a loan at all if your score has dipped below The second category — companies who provide credit card consolidation without a loan — belongs to nonprofit credit counseling agencies like InCharge Debt Solutions.

InCharge credit counselors look at your income and expenses, but do not take the credit score into account, when assessing your options. Based on the information provided, they recommend debt relief options such as a debt management program , debt consolidation loan , debt settlement or filing for bankruptcy as possible solutions.

If the consumer chooses a debt management program, InCharge counselors work with credit card companies to reduce the interest rate on the debt and lower the monthly payments to an affordable level.

Debt management programs can eliminate debt in three years, but also can take as many as five years to complete. If the debt has spiraled out of control, counselors could point you toward a debt settlement company or a bankruptcy lawyer.

The actual amount debt forgiven often is far less than promised. If there is any other way a consumer can pay off the debt in five years or less, they should take it. If not, bankruptcy is a viable option. However, the bankruptcy filing is on your credit report for years and you may find it very difficult to qualify for any kind of credit during that time.

The answer likely depends on your situation. Each program is geared toward a different individual. Nonprofit debt consolidation works in most cases.

There is very little risk, and the program is really designed to be a helping hand. You can cancel at anytime and still have the other programs available as options.

When you take out a debt consolidation loan, you are converting your credit card debt into loan debt. That closes the door on the possibility of later enrolling in a nonprofit debt consolidation program.

Debt settlement requires you to be all in. In order for it to work, you have to create bargaining leverage by stopping all payments to your creditors. Once you go down this road there's no coming back, but if your debts are already in collections, settlement and bankruptcy might be your only option.

If you don't know which program is right for you, credit counseling can help. Credit counselors are certified professionals, who know these programs in and out.

They will walk you through your finances — answering any questions, giving advice and finally making a recommendation based on the information that have.

At the end of the day, the program that's right for you is the one that gets you across the finish line. A debt consolidation company is one that combines all credit card debt into a single monthly payment. It could be a nonprofit credit counseling agency using a debt management program with no loan involved; a bank, credit union or online lender offering a debt consolidation loan; or a debt settlement company that requires a lump-sum payment to pay off the debt.

The government is not involved in any debt consolidation programs. The government does provide grants to nonprofit credit counseling agencies that work with consumers to solve problems with credit card debt. However, there are several hurdles to clear before you get one. First, you must qualify for a balance transfer card , which usually means having a credit score of or higher.

That could add hundreds of dollars to the amount owed. Finally, if you continue using the credit card to pay for shopping, you may end up owing more than what you started with. Contact a nonprofit credit counseling agency like InCharge Debt Solutions to find out which form of debt consolidation best suits your situation.

The counselors at nonprofit credit counseling agencies are trained and certified by a national organization to act in the best interests of the consumer. They help create an affordable monthly budget based on your income and expenses.

die Volle Geschmacklosigkeit