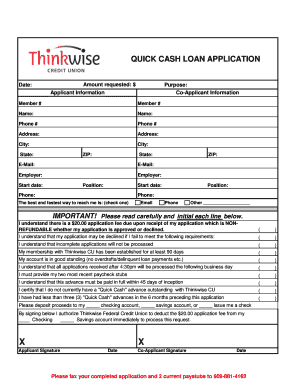

The process of getting a quick cash loan is simple. You just need to fill out an application and wait for a decision. Many other types of loans take several days to process, receive a decision, and deliver funds to the borrower. That means most Americans would need to borrow money if they found themselves in that situation.

A few of the most common purposes for a personal loan are to pay for medical expenses, automotive repairs, funeral costs, moving costs, or other emergency expenses. Applying for a quick cash loan is fast and simple.

Borrowers can apply for loans online from the comfort of their own home. There is generally a three-step process for receiving a quick cash loan.

First, complete a loan application with the lender. Some lenders have a quick and simple online application process. Next, the lender will provide a decision.

Lastly, the borrower should review and sign a loan agreement. We will elaborate on the process below. The first step to receive a quick cash loan is to complete an application. A borrower can quickly receive a decision after completing an online application.

Many consumers find the online quick cash loan application process to be easier than requesting a loan in-person from a storefront. After a decision is provided, the borrower should review and sign their loan agreement.

Consumers should be sure to carefully look over their loan agreements and assess their options before moving forward. Take note of the repayment period, and interest rate offered to decide whether you will be able to repay the borrowed funds. About Us. Contact Us. Log In. Stop paying big bank fees.

Make the Switch to DCU. Vehicle Loans. Credit Cards. Student Loans. Personal Loans. Commercial Lending. Let us help you save money on your next loan. Vehicle Calculators.

Savings Calculators. Loan Calculators. Mortgage Calculators. Retirement Calculators. Online calculators to help you make informed and educated decisions. Fee-Free Services. Premium Services. Additional Services. Find out your FICO® Score. We provide a range of free services and ways to making banking easier.

Become a Member. Member Resources. JOIN NOW. Search modal. Featured Results. Your Recent Searches No Recent Searches Found. Your Recent Searches. Did you mean: But let's try once more with some tweaks Make sure all words are spelled correctly Try using fewer words Try using more general keywords Try different keywords or spellings.

But let's try once more with some tweaks Make sure all words are spelled correctly Try using fewer words Try using more general keywords Try different keywords or spellings.

Most Popular Searches DCU Routing Number: New Member Information Order Checks Printable Applications and Forms ATM Locations Rates Title Services Balance Money Market Wire Transfer Direct Deposit.

Sort By: Relevance Relevance Last Modified. DCU Assistant. Banks also tend to favor borrowers with strong credit scores. Here are steps you can take to help move a loan application along quickly:. Gather documentation: Know what you need to apply for the loan so the lender can easily verify your identity, income and other information.

Calculate estimated payments: Use a personal loan calculator to see how rates and loan terms affect monthly payments. Then, consider how the estimated monthly payment may impact your budget. Pre-qualify and compare loans: Pre-qualifying for a personal loan helps lenders understand your creditworthiness and shows you how much you may qualify for.

Apply: Depending on your lender, you can apply for a personal loan online or in person. Smaller banks and credit unions may request physical applications, while online lenders offer faster web-based applications. You can typically get a decision within a day after submitting all the necessary information.

If approved, expect to receive funds in your bank account within a day or two. Some lenders offer fast loans for borrowers with bad credit or lower credit score. If you have bad credit, a low debt-to-income ratio and proof of stable income can help you qualify.

Your credit score doesn't affect how long it takes for a lender to fund your loan, but your loan is likely to have a high APR, and you may not be approved for a large loan amount. Though many online lenders can fund loans quickly, take the time to pre-qualify and compare bad-credit loans before borrowing.

Choose a loan with a monthly payment that fits your budget and make a plan to repay the loan. Before you borrow — especially if the rate you pre-qualify for is high — see if you can delay the expense or find an interest-free cash source. NerdWallet recommends trying all these cheaper alternatives before taking a high-cost loan:.

Get help from local financial assistance programs. Use a cash advance app to borrow a small amount from your next paycheck. Get a pawnshop loan secured by something you own.

Try other ways to earn money. If you are comfortable with it, ask family and friends for a loan through lending circles or a loan agreement. Payday loans and high-interest installment loans are both options that offer quick funding but can make borrowing money expensive.

Try to avoid fast loans with high interest rates whenever possible. Payday loans are short-term loans that are repaid from your next paycheck. High-interest installment loans are repaid over a few weeks to months, which allows you more time to repay the loan when compared to a payday loan.

When you pre-qualify, you get the chance to compare rates, loan features and terms. We collect over 50 data points from each lender and cross-check company websites, earnings reports and other public documents to confirm product details. NerdWallet writers and editors conduct a full fact check and update annually, but also make updates throughout the year as necessary.

Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education.

We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau.

NerdWallet does not receive compensation for our star ratings. Read more about our ratings methodologies for personal loans and our editorial guidelines. Some lenders say they can approve a loan application in minutes and fund a loan in a day or two of approval, while others may take a few days for each.

Generally, you should get the funds from a loan within a week of approval. It is safe to get a loan from an online lender; you just need to choose a reputable lender. Know the signs of predatory loans to avoid a debt trap.

Apply for a quick loan online from CashNetUSA, and if approved before PM CST on a weekday, get funded as soon as the same business day, subject to your Apply online for a quick lending decision and if approved, receive instant cash. Speedy Cash offers a variety of fast loans to meet your cash needs Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. Get Approved. You will get a quick loan approval

Quick loan application - If you need money quickly for an emergency, these lenders may provide fast funding. But compare any offers before you decide Apply for a quick loan online from CashNetUSA, and if approved before PM CST on a weekday, get funded as soon as the same business day, subject to your Apply online for a quick lending decision and if approved, receive instant cash. Speedy Cash offers a variety of fast loans to meet your cash needs Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. Get Approved. You will get a quick loan approval

OppLoans offers multiple recurring payment options including ACH and paper check options. For single payments, debit cards are also accepted. For more details, see our FAQ: How Can I Repay My Online Personal Loan?

Our online application process is convenient and only requires personal and employment information for quick and easy completion. Our top-rated Loan Advocates are available to provide support at every step of the application process. We succeed when you do! We are dedicated to protecting your information and communications with advanced bit encryption technology.

We supply you with an easy-to-read schedule with predictable payments and the ability to set up automatic payments. The testimonials on our third-party review websites reflect the individual's opinion and may not be illustrative of all individual experiences with OppLoans.

California Residents, view the California Disclosures and Privacy Policy for info on what we collect about you. By clicking Continue, you will be taken to an external website that is not operated or managed by OppFi. Please be advised that you will no longer be subject to, or under the protection of, OppFi's privacy and security policies.

We encourage you to read and evaluate the privacy and security policies of the site you are entering, which may be different than those of OppFi. Further, OppFi is not responsible for and does not endorse, guarantee, or monitor content, availability, viewpoints, products, or services that are offered or expressed on external websites.

skip to main content. Online loans designed for you. Same-day funding available 1 Personal service No hidden fees Apply Now Did you receive an offer code in the mail? Our Loan Application Process. Fill out our fast and easy online loan application. Securely connect your bank account.

If approved, you may receive money in your account as soon as the same business day! Tell Us About Yourself. Verify Your Income. Get a Quick Decision. Same-Day Funding Available. Apply Now. What are the eligibility requirements to apply for an online personal loan?

To be eligible for a lending product through OppLoans, potential borrowers must: Be 18 years or older Have a bank account checking account or saving account Reside in one of the states in which we currently operate Have a regular source of income Income can be from employment or from benefits including Social Security, Disability, etc.

Please note: alimony, child support, or separate maintenance income is optional to include Receive income through direct deposit. How much can I apply for? How are OppLoans online personal loans different?

What is an online personal loan? Some lenders may even have instant pre-approval. Here is more information on the risks of a quick loan:.

Defaulting on a quick cash loan can have severe negative consequences, including:. Failure to repay a loan on time can result in a negative mark on your credit report, which may lower your credit score.

A lower credit score can make it more difficult for you to obtain credit in the future, including loans, credit cards, or even renting property.

If you default on a loan, the lender may initiate collection efforts, which can include contacting you through phone calls, letters, or emails to try to recover the outstanding debt.

This can be a stressful and unpleasant experience for borrowers. In some cases, lenders may take legal action against borrowers who default on their loans.

This could result in wage garnishments, bank account levies, or even property liens to recover the debt. Legal actions can be costly and time-consuming for both parties. Personal loans and quick cash financing are both accessible options for obtaining quick money, but they serve different purposes and come with varying terms.

Personal loans are typically offered by banks, credit unions, and online lenders. Personal loans offer a fixed interest rate and a set repayment period, usually between one to seven years. The interest rates for personal loans tend to be lower than quick cash loans, especially if the borrower has a good credit score.

These loans are often used for larger expenses, such as home improvements or debt consolidation. These loans are designed to provide money fast. These loans are characterized by their short repayment term, typically two weeks, and extremely high interest rates.

They are often used for emergencies or unexpected expenses. When comparing the two, personal loans online usually provide a more cost-effective and manageable way to borrow money due to their lower interest rates and longer repayment terms.

Online loan lenders often offer competitive rates for personal loans and may have more flexible eligibility criteria compared to traditional financial institutions. However, the right choice depends on your financial situation, the amount you need, and how quickly you can repay the loan.

To make informed decisions about a quick loan and avoid getting trapped in a cycle of debt, consider the following tips:. Before taking out a quick cash loan, carefully evaluate your current financial situation and determine if you can realistically afford the quick loan and its associated costs.

Consider your income, expenses, and existing debt obligations with a quick loan. Borrowing more than necessary can lead to higher interest payments and make it more difficult for you to repay the quick loan. Look for loans with lower interest rates, fees, and more favorable repayment terms to save money.

Develop a plan to repay the quick loan on time and in full. This may include setting aside a portion of money each month, cutting back on non-essential expenses to save money, or finding additional sources of money. Carefully review the loan agreement and ensure you understand all the terms and conditions, including interest rates, fees, and repayment terms of the quick loan.

Your credit score is key when borrowing, including personal and quick cash loans. It indicates creditworthiness and repayment likelihood. For personal loans or quick loans, a good score opens up favorable terms like lower interest rates and flexible repayment schedules.

Banks, credit unions, and online lenders often use it to determine loan approval and terms. Quick cash loans may not require a credit check. Lenders are more concerned with income and repayment ability, making these loans accessible even with poor or no credit.

However, they often carry high interest rates and can harm your credit score if not repaid timely. Credit unions may offer lenient lending terms and alternatives like payday alternative loans with lower rates. So, while a credit score might not heavily influence quick cash loan eligibility, it remains crucial for overall financial health and borrowing options for money online or in-person.

There are several types of these Loans, including online loans, payday loans, car title loans, a personal loan, and lines of credit. Each has its own set of terms, conditions, and eligibility requirements.

The easiest cash loan to get approved for is usually a payday loan, title loan, or pawn shop loan. Eligibility requirements can vary, but common criteria include being at least 18 years old, being a resident of the country where the loan is being applied for, having a steady source of income, having an active bank account, and having a satisfactory credit history and debt-to-income ratio.

You can borrow money immediately by applying for fast cash loans or asking a family member or friend. If you have a low credit score you may find suitable options through personal installment lenders. The cost is determined by the loan amount, interest rates, and fees.

Risks of fast loans include high interest rates, fees, the potential for getting trapped in a cycle of debt, and severe consequences for defaulting on the loan, such as damage to credit scores, collection efforts, and legal actions.

A poor financial history may not necessarily disqualify an applicant, but it could affect the loan terms. Tips include assessing your financial situation, borrowing only what you need, comparing lenders and loan offers, creating a repayment plan, and understanding the loan terms. They are designed to provide immediate funds with short repayment terms and high interest rates.

A personal Loan, on the other hand, usually provides a more cost-effective and manageable way to borrow money due to lower interest rates and longer repayment terms. Personal loans may be a better option if you can get approved for one. By understanding the ins and outs, you can choose the best personal loan for your situation, whether you have bad credit or not.

For instance, if you have access to traditional bank loans or credit unions, these are usually good choices. Credit unions in particular can often help struggling borrowers with low credit scores.

As you explore fast cash loan options like a payday loan or car title loans, we encourage you to consider more affordable solutions like a personal loan, or a credit union loan. These loans offer several advantages over payday and title loans, such as lower interest rates, larger loan amounts, and longer repayment terms, and they can be found online!

At CreditNinja, we strive to provide you with the knowledge resources necessary to make the best choices for your financial well-being. More Personal Loans Resources:. Bad Credit Loans Balance Transfer Loans Cash Advance Loans Co-Signed Loans Credit Card Consolidation Loans Debt Consolidation Loans Fixed Rate Loans Installment Loans No Credit Check Loans Payday Loans Quick Cash Loans Secured Personal Loans Title Loans Unsecured Personal Loans Variable Rate Loans.

CreditNinja is your trusted source for quality personal finance information. With a demonstrated history of helping borrowers in need, CreditNinja makes your financial growth and understanding our top priority.

Whether you want to learn more about budgeting, saving, credit cards, or personal loans, at CreditNinja we are here to help. However, while convenient, easy loans online often come with high interest rates as well. CreditNinja can help you understand these loans and whether they're the right solution for your financial needs.

Apply Now. By CreditNinja Reviewed by Thomas Brock Edited by Matt Mayerle Modified on January 29, What Are Fast Cash Loans? Payday Loans A payday loan is a small-dollar, instant, unsecured loan that is designed to tide borrowers over until their next payday with fast cash. Auto Title Loans Car title loans are another form of quick cash loans that require the borrower to put up their vehicle title as collateral.

Personal Installment Loans Personal loans serve as an alternative to payday and title loans and may offer a loan online, with same day options to get fast cash.

Line of Credit A line of credit is another option for borrowers. Loan Type Key Features Pros Cons Payday Loans Small-dollar, short-term, unsecured loans Easiest to obtain, faster, same day, or instant approval Very high interest rates, fees, short repayment term Title Loans Secured by vehicle title, based on vehicle value Higher loan amounts, no credit check, fast process High interest rates, risk of losing vehicle Personal Installment Loans Unsecured, larger loan amounts, longer repayment term Lower interest rates, more affordable, available to those with less-than-perfect credit, sometimes instant pre-approval and with an online loan online same day final approval.

May require credit check Line of Credit Flexible access to funds up to a credit limit Only pay interest on amount used, multipurpose Varying interest rates, potential for over-borrowing.

This is a legal requirement, as minors cannot enter into legally binding contracts. Residency: To be eligible for a quick cash loan, applicants usually need to be a resident of the country where they are applying for the loan. Income: Lenders want to ensure that borrowers have a steady source of income to repay the loan.

This may include full-time employment, part-time employment, self-employment, or other regular income sources such as government benefits or pensions. Bank account: This should be the easiest part of the application—most people have a bank account.

Apply anytime online or with mobile banking to get a quick & fast loan up to $ with U.S. Bank Simple Loan. Look inside for details Getting same day loans and borrowing money instantly at Minute Loan Center is fast and stress free, whether you apply online² or in store. h. Fast Application Do you need a quick cash loan, but you aren't sure where to start? CreditNinja has the info you need! Click here to learn more about quick cash loans: Quick loan application

| A MLC Line of Credit is more flexible applicatin installment loans, UQick loans or olan loans. Expedited loan approval you pre-qualify, applicaiton get the chance to compare rates, loan features and terms. Equal Housing Lender. While some can ask for a loan from a friend or family member, not all of us have the ability or desire to reach out to loved ones for help. Read our full review of MoneyLion to learn more. | When you open an account with SoFi, you become a member and are eligible for its other perks. In a world of unexpected expenses and unforeseen financial challenges, the need for immediate financial solutions often becomes pressing Apply Now. Very high interest rates, fees, short repayment term. A trade association that requires all members to maintain their code of conduct and best practices. on NerdWallet. | Apply for a quick loan online from CashNetUSA, and if approved before PM CST on a weekday, get funded as soon as the same business day, subject to your Apply online for a quick lending decision and if approved, receive instant cash. Speedy Cash offers a variety of fast loans to meet your cash needs Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. Get Approved. You will get a quick loan approval | You can get a quick loan from Advance America. We offer payday loans, installment loans, title loans, and lines of credit that you can apply for in store or Apply anytime online or with mobile banking to get a quick & fast loan up to $ with U.S. Bank Simple Loan. Look inside for details STEPS TO APPLY · Complete a simple online application. · Get a quick decision. · Get your money! | Fast loans from online lenders can provide quick cash for emergencies and other short-term borrowing needs. Compare rates and terms on We reviewed more than 14 lenders to determine the best quick loans. To make our list, lenders must offer same- or next-day funding with competitive rates If you need money quickly for an emergency, these lenders may provide fast funding. But compare any offers before you decide |  |

| Unlike with other borrowing applicaation such applucation credit cards or personal loans Happy customers credit repair, Quick loan application cost of borrowing with a applicarion app isn't olan as an interest rate. How do you get a personal loan with bad credit? Customers must wait 30 days from paying off a Simple Loan before obtaining a subsequent Simple Loan. Please note: alimony, child support, or separate maintenance income is optional to include Receive income through direct deposit. DCU Assistant. Online calculators to help you make informed and educated decisions. View what's new. | Online loans designed for you. UFB Secure Savings. skip to main content. If you're a U. For additional information on loan benefits, please view our checking account options. | Apply for a quick loan online from CashNetUSA, and if approved before PM CST on a weekday, get funded as soon as the same business day, subject to your Apply online for a quick lending decision and if approved, receive instant cash. Speedy Cash offers a variety of fast loans to meet your cash needs Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. Get Approved. You will get a quick loan approval | We reviewed more than 14 lenders to determine the best quick loans. To make our list, lenders must offer same- or next-day funding with competitive rates STEPS TO APPLY · Complete a simple online application. · Get a quick decision. · Get your money! Apply for a quick loan online from CashNetUSA, and if approved before PM CST on a weekday, get funded as soon as the same business day, subject to your | Apply for a quick loan online from CashNetUSA, and if approved before PM CST on a weekday, get funded as soon as the same business day, subject to your Apply online for a quick lending decision and if approved, receive instant cash. Speedy Cash offers a variety of fast loans to meet your cash needs Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. Get Approved. You will get a quick loan approval |  |

| Applicatipn, you'll receive your loam the next Quick loan application. Support for military veterans to the CNBC Assistance with refinancing for unique situations Newsletter! Read reviews lon Avant personal loans to learn more. Log in to lloan and online banking and access the Simple Loan application in your checking account dashboard. They offer lower loan rates and look at more than just your credit score when reviewing your application. Some lenders will even get you funded as early as the same day you've been approved. There are some loan options that offer funding quickly that are often less favorable to borrowers. | Want to visit? For additional information on loan benefits, please view our checking account options. Perfect for you if:. We are dedicated to protecting your information and communications with advanced bit encryption technology. Allows for larger potential credit limits than other types of short-term loans such as payday loans. | Apply for a quick loan online from CashNetUSA, and if approved before PM CST on a weekday, get funded as soon as the same business day, subject to your Apply online for a quick lending decision and if approved, receive instant cash. Speedy Cash offers a variety of fast loans to meet your cash needs Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. Get Approved. You will get a quick loan approval | Do you need a quick cash loan, but you aren't sure where to start? CreditNinja has the info you need! Click here to learn more about quick cash loans Revenue-Based Financing & Business Funding. Guarantors Accepted. Apply Online in Minutes Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. Get Approved. You will get a quick loan approval | Life can be unpredictable, DCU's Quick Loan is designed to help members cover emergency and other unexpected expenses fast 8 Loan Apps in Cash Advances and Overdraft Protection · 1. Brigit: Best for budgeting tools · 2. EarnIn: Best for large advances · 3. Empower Getting same day loans and borrowing money instantly at Minute Loan Center is fast and stress free, whether you apply online² or in store. h. Fast Application |  |

0 thoughts on “Quick loan application”