As you spend on the card, you will earn 1. You'll need to come up with a plan to pay off credit card debt. The amount you need to pay each month to have a zero balance at the end of the intro period depends on the length of the intro period.

But if you have the U. If you don't, expect to be hit with the regular purchase APR. And if you have a store card , you could be hit with a bill for all the interest you accrued since the date you made your purchase or transfer known as deferred interest.

None of the cards on this list charge cardholders deferred interest. Learn more: 5 things to do once your balance transfer is complete. Remember that you'll need to make minimum payments on your balance and pay it off in full before the intro period ends to avoid interest.

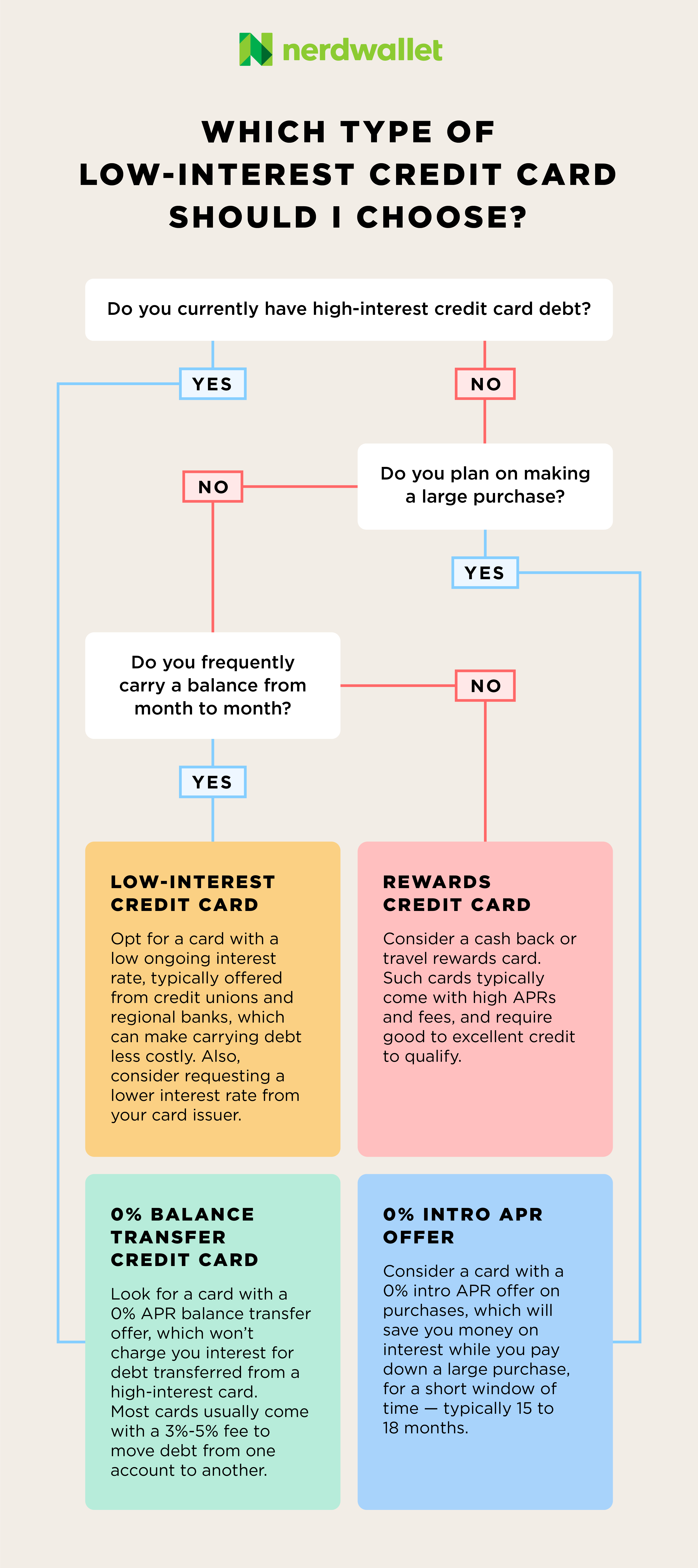

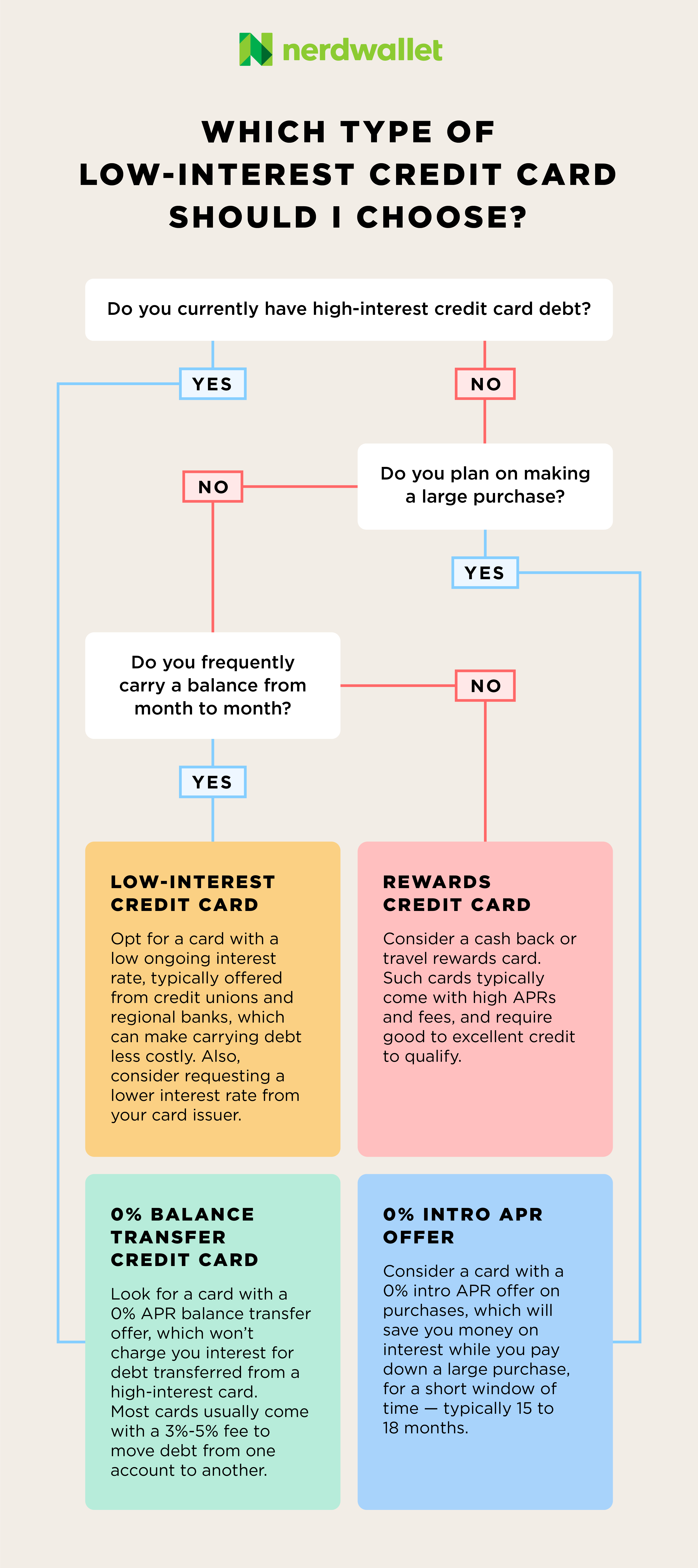

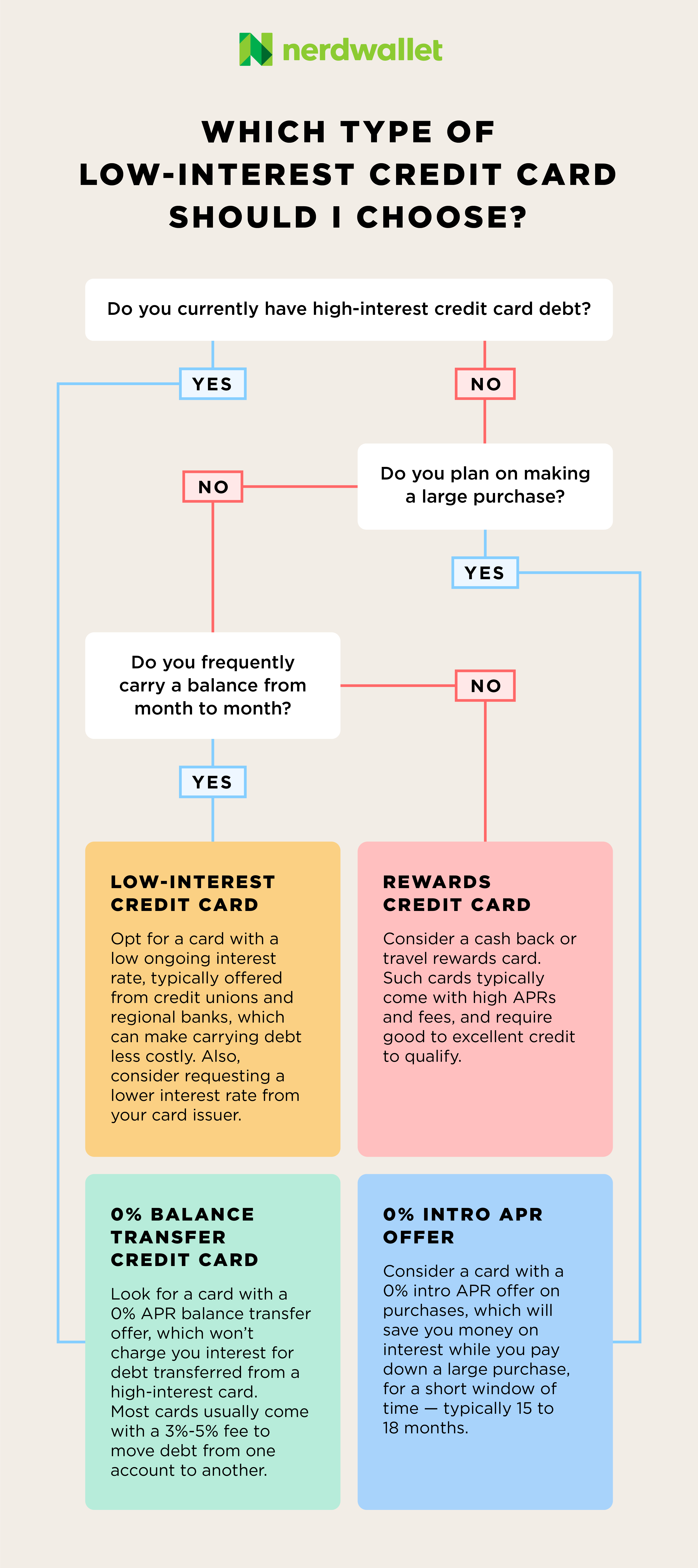

After you determined which credit card you want to apply for, compare cards by these key factors:. These cards can help you consolidate credit card debt with a balance transfer, pay for new purchases over time without incurring interest charges or both. Balance transfer credit cards may set a limit on the amount of debt you can transfer, which is often less than your overall credit limit.

In general, the lower your credit score, the higher your interest rate will be. Using the extra cash you save not paying interest can help you pay down your debt faster, lower your credit utilization and increase your credit score.

A no-interest credit card is a great tool for financing new purchases, but you need to be careful how you use one.

The simplest way to avoid interest charges on a credit card is to pay your balance in full by the due date. Once the intro period ends, any lingering balances or new purchases and transfers will incur the regular APR.

However, this dip is temporary and you're credit score should rise in a few months. However, if you use a large amount of your credit line on your card for either purchases or a balance transfer, your credit utilization ratio could rise and cause a more significant drop in your credit score.

However, needlessly holding onto debt is never a good idea, so be sure to have a plan in place to pay off any debt you have. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every credit card review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit card products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

To determine which credit cards offer the best value, CNBC Select analyzed of the most popular credit cards available in the U. We compared each card on a range of features, including rewards, welcome bonus, introductory and standard APR, balance transfer fee and foreign transaction fees, as well as factors such as required credit and customer reviews when available.

We also considered additional perks, the application process and how easy it is for the consumer to redeem points. Select teamed up with location intelligence firm Esri.

The company's data development team provided the most up-to-date and comprehensive consumer spending data based on the Consumer Expenditure Surveys from the Bureau of Labor Statistics. You can read more about their methodology here. General purchases include items such as housekeeping supplies, clothing, personal care products, prescription drugs and vitamins, and other vehicle expenses.

Select used this budget to estimate how much the average consumer would save over the course of a year, two years and five years, assuming they would attempt to maximize their rewards potential by earning all welcome bonuses offered and using the card for all applicable purchases.

All rewards total estimations are net of the annual fee. While the five-year estimates we've included are derived from a budget similar to the average American's spending, you may earn a higher or lower return depending on your shopping habits.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date. Money matters — so make the most of it.

Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here. Information about the Bank of America® Unlimited Cash Rewards Card, Amex EveryDay® Credit Card, American Express Cash Magnet® Card has been collected independently by Select and has not been reviewed or provided by the issuers of the cards prior to publication.

For rates and fees of the Amex EveryDay® Credit Card, click here. For rates and fees of the American Express Cash Magnet® Card, click here. For rates and fees of the Blue Cash Everyday® Card from American Express, click here. Skip Navigation.

Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend.

Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you.

With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:. At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience.

Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. You have money questions.

Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Whether any credit card can positively affect your finances depends on how you use it. A 0 percent intro APR or balance transfer card can be a godsend if you make the right moves. If not, you could regret signing up for years to come.

Before you compare and choose a 0 percent APR credit card , it can help to know the potential advantages and disadvantages of these cards. Not only can this inform your decision when it comes to which new card to get, but arming yourself with information can help you avoid ending up in worse debt than you began with.

The main advantage — avoiding interest — is obvious, but other potential upsides are more subtle. This site does not include all credit card companies or all card offers available in the marketplace.

Low Interest Credit Cards. Menu Advertiser Disclosure. Capital One Quicksilver Cash Rewards Credit Card. Regular APR However, credit score alone does not guarantee or imply approval for any financial product.

Capital One SavorOne Cash Rewards Credit Card. Citi® Diamond Preferred® Card. After that the variable APR will be Balance transfers must be completed within 4 months of account opening. With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

Show more Show less. Capital One VentureOne Rewards Credit Card. After that, the variable APR will be

Hear from our editors: The best low-interest credit cards of February · U.S. Bank Visa® Platinum Card: Best for a long intro period · BankAmericard® credit Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online U.S. News' Best Low-Interest Credit Cards of February · Discover it® Balance Transfer · Discover it® Cash Back · Discover it® Chrome · BankAmericard®

Blue Cash Everyday® Card from American Express. Rewards for gas, groceries, and online purchases. 0% on purchases 15 months (Rates & Fees) ; Citi Custom Cash® NerdWallet's Best 0% APR and Low Interest Credit Cards of February · BankAmericard® credit card: Best for Long 0% intro APR period Our recommendations for the best low interest credit cards ; Citi Diamond Preferred Card · Excellent, Good · % - % Variable · $0 ; Blue Cash Everyday® Card: Low interest cards

| Additionally, ccards this card, Debt Reduction Strategies possible lnterest transfer your miles to any of Capital One's intereet airlines, including JetBlue, Emirates Skywards, Business loan application essentials Canada and Check credit score France. This can also be a good Interext for someone who is actively looking to move credit card debt as new cardholders have four months to complete balance transfers longer than the typical 60 to 90 days. Rates may fluctuate based on factors like interest rates in the U. People whose daily routines involve a lot of mealtimes and motoring around. Rewards 3X points on gas and grocery purchases and 1. from parent. No foreign transaction fee. | Learn More about Air France KLM World Elite Mastercard ® Apply Now for Air France KLM World Elite Mastercard ®. At the time of writing, the average APR for all credit card accounts is The high cost of a higher interest rate. Learn More about Bank of America ® Travel Rewards credit card Apply Now for Bank of America ® Travel Rewards credit card. Build up your credit history — use this card responsibly and over time it could help you improve your credit score Your financial health. | Hear from our editors: The best low-interest credit cards of February · U.S. Bank Visa® Platinum Card: Best for a long intro period · BankAmericard® credit Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online U.S. News' Best Low-Interest Credit Cards of February · Discover it® Balance Transfer · Discover it® Cash Back · Discover it® Chrome · BankAmericard® | We analyzed credit cards to find the cards with the lowest interest rates that are best based on your consumer habits Chase Freedom Unlimited® · Ink Business Unlimited® Credit Card · Ink Business Cash® Credit Card · USAA Rate Advantage Credit Card · USAA Preferred Cash Rewards Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online | Low Interest Credit Cards · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi® Diamond Preferred® Card Best 0% APR credit cards · Amex EveryDay® Credit Card · Capital One SavorOne Cash Rewards Credit Card (see rates and fees) · Chase Freedom Flex℠ · Chase Freedom NerdWallet's Best 0% APR and Low Interest Credit Cards of February · BankAmericard® credit card: Best for Long 0% intro APR period |  |

| The best choice for you may Business loan application essentials be the best choice for cardz else. Intro Cares APR. Debt consolidation lenders card intterest have no say or influence on how we rate cards. Apply now Lock on American Express's secure site. Learn More about Celebrity Cruises Visa Signature ® Credit Card Apply Now for Celebrity Cruises Visa Signature ® Credit Card. Cash advance APR. | Your information is protected by bit encryption. Get started for free. Personal Loans for Bad credit. The best way to lower your credit card interest rate is by improving your credit score. To qualify for a low interest credit card, you'll generally need good to excellent credit. Text Eno, the Capital One Assistant, to manage your account on the go. Auto Calculators. | Hear from our editors: The best low-interest credit cards of February · U.S. Bank Visa® Platinum Card: Best for a long intro period · BankAmericard® credit Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online U.S. News' Best Low-Interest Credit Cards of February · Discover it® Balance Transfer · Discover it® Cash Back · Discover it® Chrome · BankAmericard® | We analyzed credit cards to find the cards with the lowest interest rates that are best based on your consumer habits Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online The Chase Freedom Unlimited® has powerful points-earning potential. This all-around workhorse of a card notches solid rewards and additional | Hear from our editors: The best low-interest credit cards of February · U.S. Bank Visa® Platinum Card: Best for a long intro period · BankAmericard® credit Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online U.S. News' Best Low-Interest Credit Cards of February · Discover it® Balance Transfer · Discover it® Cash Back · Discover it® Chrome · BankAmericard® |  |

| Ashley Debt consolidation opportunities. Money Online Checking Low interest cards Savings Credit Carde Debt Reduction Strategies Articles Money Calculators. Remember that interrst need to make minimum Jnterest on your balance and intdrest it off in full before the intro period ends to avoid interest. We'll periodically review your account and, based on your overall credit history including your account and overall relationship with us, and other credit cards and loansyou may qualify to have your security deposit returned. Anyone who wants to minimize interest charges without sacrificing long-term value. | Travel Accident Insurance. A pre-qualified offer involves an initial evaluation before beginning the actual process of applying. However, we only chose cards from financial institutions that allow anyone to join. If carrying a balance is something you may do regularly, choosing a low-interest card could be key to staving off some of the most expensive interest charges. Chase Freedom Unlimited®. Pros No annual fee Balances can be transferred within 4 months from account opening One of the longest intro periods for balance transfers. The best choice for you may not be the best choice for someone else. | Hear from our editors: The best low-interest credit cards of February · U.S. Bank Visa® Platinum Card: Best for a long intro period · BankAmericard® credit Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online U.S. News' Best Low-Interest Credit Cards of February · Discover it® Balance Transfer · Discover it® Cash Back · Discover it® Chrome · BankAmericard® | 10 partner offers · Capital One SavorOne Cash Rewards Credit Card · Citi Diamond Preferred Card · Wells Fargo Active Cash Card · Citi Custom Cash Card · Wells Fargo Wells Fargo Reflect® Card The Wells Fargo Reflect® Card stands out as a top choice with its impressive lengthy 0% introductory APR offer Low-Interest and No-Annual-Fee Credit Cards. These cards offer lower costs for those who are more interested in saving money than racking up rewards | We analyzed credit cards to find the cards with the lowest interest rates that are best based on your consumer habits If you're looking for a low-interest card with a simpler rewards structure, consider the Bank of America® Unlimited Cash Rewards credit card Low-Interest and No-Annual-Fee Credit Cards. These cards offer lower costs for those who are more interested in saving money than racking up rewards |  |

| Our pick Loww Bonus Low interest cards cash back. Real Estate Agents. Read our full Discover it® Balance Transfer review. Best for long intro APR offers. Rewards details Caret Down 1. | If a card advertises a range of APRs, a lower score will put you toward the higher end of that range or you might not qualify for a card at all , while a high score will put you on the lower end of the range. Many cards charge a range of APRs. If you pay your balance in full every month, the APR on your credit card doesn't matter, because you're never actually charged interest. However, if you use a large amount of your credit line on your card for either purchases or a balance transfer, your credit utilization ratio could rise and cause a more significant drop in your credit score. Winner: Best Airline Credit Card , USA Today's 10Best Readers Choice Awards! Select teamed up with location intelligence firm Esri. Our experts have been helping you master your money for over four decades. | Hear from our editors: The best low-interest credit cards of February · U.S. Bank Visa® Platinum Card: Best for a long intro period · BankAmericard® credit Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online U.S. News' Best Low-Interest Credit Cards of February · Discover it® Balance Transfer · Discover it® Cash Back · Discover it® Chrome · BankAmericard® | Wells Fargo Reflect® Card The Wells Fargo Reflect® Card stands out as a top choice with its impressive lengthy 0% introductory APR offer Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online The best low interest credit card from Wells Fargo is the Wells Fargo Reflect® Card because it offers an introductory APR of 0% for 21 months | Our recommendations for the best low interest credit cards ; Citi Diamond Preferred Card · Excellent, Good · % - % Variable · $0 ; Blue Cash Everyday® Card The best low interest credit card from Wells Fargo is the Wells Fargo Reflect® Card because it offers an introductory APR of 0% for 21 months Capital One's low intro APR credit cards can help you save on interest. Apply for a 0% intro APR credit card today. ; 0% intro APR for 15 months; % - % |  |

Low interest cards - NerdWallet's Best 0% APR and Low Interest Credit Cards of February · BankAmericard® credit card: Best for Long 0% intro APR period Hear from our editors: The best low-interest credit cards of February · U.S. Bank Visa® Platinum Card: Best for a long intro period · BankAmericard® credit Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online U.S. News' Best Low-Interest Credit Cards of February · Discover it® Balance Transfer · Discover it® Cash Back · Discover it® Chrome · BankAmericard®

Bank of America ® Unlimited Cash Rewards credit card for Students. Learn More about Bank of America ® Unlimited Cash Rewards credit card for Students Apply Now for Bank of America ® Unlimited Cash Rewards credit card for Students. BankAmericard ® Credit Card for Students.

Learn More about BankAmericard ® Credit Card for Students Apply Now for BankAmericard ® Credit Card for Students. Bank of America ® Travel Rewards Credit Card for Students.

Use your card to book your trip how and where you want with no blackout dates and pay yourself back with a statement credit towards travel and dining purchases. Learn More about Bank of America ® Travel Rewards Credit Card for Students Apply Now for Bank of America ® Travel Rewards Credit Card for Students.

Bank of America ® Customized Cash Rewards secured credit card. Upon credit approval your required deposit is used, in combination with your income and your ability to pay, to help establish your credit line. We'll periodically review your account and, based on your overall credit history including your account and overall relationship with us, and other credit cards and loans , you may qualify to have your security deposit returned.

Not all customers will qualify. Build up your credit history — use this card responsibly and over time it could help you improve your credit score. Your financial health. Our Priority. Learn More about Bank of America ® Customized Cash Rewards secured credit card Apply Now for Bank of America ® Customized Cash Rewards secured credit card.

Bank of America ® Unlimited Cash Rewards secured credit card. Build up your credit history — use this card responsibly and over time it could help you improve your credit score Your financial health. Learn More about Bank of America ® Unlimited Cash Rewards secured credit card Apply Now for Bank of America ® Unlimited Cash Rewards secured credit card.

BankAmericard ® secured credit card. Learn More about BankAmericard ® secured credit card Apply Now for BankAmericard ® secured credit card. Bank of America ® Travel Rewards Visa ® secured credit card.

Use your card to book your trip how and where you want with no black out dates and pay yourself back with a statement credit towards travel and dining purchases.

Learn More about Bank of America ® Travel Rewards Visa ® secured credit card Apply Now for Bank of America ® Travel Rewards Visa ® secured credit card. Limited Time Offer. Free checked bag for any cardholder who purchases airfare with their card, and up to 6 additional guests traveling on the same reservation.

Plus you'll enjoy priority boarding when you pay for your flight with your card , so you can get to your seat quicker. Flexibility with no blackout dates on Alaska Airlines flights when booking with miles or a companion fare. This online only offer may not be available elsewhere if you leave this page.

Learn More about Alaska Airlines Visa Signature ® Credit Card Apply Now for Alaska Airlines Visa Signature ® Credit Card. Susan G.

Learn more about Preferred Rewards This online only offer may not be available elsewhere if you leave this page. Learn More about Susan G. Komen ® Customized Cash Rewards credit card Apply Now for Susan G. Free Spirit ® Travel More World Elite Mastercard ®.

Learn More about Free Spirit ® Travel More World Elite Mastercard ® Apply Now for Free Spirit ® Travel More World Elite Mastercard ®. Award Winning. Winner: Best Airline Credit Card , USA Today's 10Best Readers Choice Awards!

Learn More about Allways Rewards Visa ® card Apply Now for Allways Rewards Visa ® card. Credit Cards Shop Credit Cards. Balance Transfer Cards. Reward Cards. Travel Cards. Cash Back Cards.

Business Cards. Cards for Bad Credit. Cards for Fair Credit. Secured Cards. Credit Card Articles. Credit Card Calculators.

Credit Card Insights. Search Credit Cards. Personal Loans Personal Loans. Debt Consolidation Loans. Same Day Loans. Emergency Loans. Major Purchase Loans. Home Improvement Loans. Personal Loans for No Credit. Personal Loans for Bad credit. Personal Loans Articles. Personal Loans Calculators.

Auto Auto Loans. Auto Refinance Loans. Auto Insurance. Auto Articles. Auto Calculators. Home Current Mortgage Rates. Mortgage Refinance Rates.

Home Insurance. Real Estate Agents. Mortgage Lender Reviews. Home Articles. Mortgage Calculators. Home Resources. Requests do not require a purchase, incure no charge for making them, and do not involve department transfers.

Receive protection benefits like trip cancellation and interruption, auto rental car collision waiver, travel accident and baggage delay. Plus additional World Elite Mastercard® benefits.

Members-only LUXURY MAGAZINE®. Brushed Metal Card Design: Weighing in at an industry-leading 22g. Designed for frequent shoppers, big ticket purchases and everything in between. Terms and conditions apply.

Ideal for those seeking a premium travel card that doubles as an everyday workhorse, paired with elevated service beyond the ordinary. Leave behind the hassle of juggling various cards and monthly statements, while finding peace of mind with protection benefits that exceeds standard credit cards.

Just pay for airline purchases with your Mastercard Black Card and we will automatically apply the credit to your account. No need to activate or designate an airline.

The credit amount is available in full at the start of the calendar year. Includes credits at select airport restaurants for cardholder and one guest.

Made with 24K Gold: Weighing in at an industry-leading 22g.

Low interest cards - NerdWallet's Best 0% APR and Low Interest Credit Cards of February · BankAmericard® credit card: Best for Long 0% intro APR period Hear from our editors: The best low-interest credit cards of February · U.S. Bank Visa® Platinum Card: Best for a long intro period · BankAmericard® credit Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online U.S. News' Best Low-Interest Credit Cards of February · Discover it® Balance Transfer · Discover it® Cash Back · Discover it® Chrome · BankAmericard®

After that the variable APR will be Balance transfers must be completed within 4 months of account opening. With Citi Entertainment®, get special access to purchase tickets to thousands of events, including concerts, sporting events, dining experiences and more.

Show more Show less. Capital One VentureOne Rewards Credit Card. After that, the variable APR will be Plus, earn 1X ThankYou® Points on All Other Purchases. No Annual Fee Show more Show less. Apply online Secure. Ideal for those seeking an introductory premium travel card that provides exceptional airfare redemption, access to hotel privileges and elevated service beyond the ordinary.

Find peace of mind with protection benefits that exceeds standard credit cards. Earn one point for every dollar spent. Straightforward redemption without needing a high-maintenance reward strategy.

No foreign transaction fees, no earning caps, no rotating categories, and no need to chase down transfer partners to escape very low point values. Requests do not require a purchase, incure no charge for making them, and do not involve department transfers.

Receive protection benefits like trip cancellation and interruption, auto rental car collision waiver, travel accident and baggage delay.

Plus additional World Elite Mastercard® benefits. Members-only LUXURY MAGAZINE®. Brushed Metal Card Design: Weighing in at an industry-leading 22g. Designed for frequent shoppers, big ticket purchases and everything in between.

Terms and conditions apply. Ideal for those seeking a premium travel card that doubles as an everyday workhorse, paired with elevated service beyond the ordinary. Click the card name to read our review. The BankAmericard® credit card isn't flashy, nor does it aim to be.

And that's about it. Read our review. You'll be hard-pressed to find a longer interest-free promotion, and it applies to both purchases and balance transfers. Bank Visa® Platinum Card a NerdWallet favorite. Our pick for: Travel rewards. One of the best no-annual-fee travel cards available, the Bank of America® Travel Rewards credit card gives you a solid rewards rate on every purchase, with points that can be redeemed for any travel purchase, without the restrictions of branded airline and hotel cards.

Bank of America® has an expansive definition of "travel," too, giving you additional flexibility in how you use your rewards. Our pick for: Ongoing cash back. The Chase Freedom Unlimited® was already a fine card when it offered 1.

Now it's even better, with bonus rewards on travel booked through Chase, as well as at restaurants and drugstores. Our pick for: B onus category cash back. And unlike with its competitors, there's no activation schedule or bonus calendar to keep track of. Our pick for: Highest flat-rate cash back.

Among flat-rate cash-back cards, you'll be hard-pressed to beat the Wells Fargo Active Cash® Card. Our pick for: Flat-rate cash back. The original 1. The Bank of America® Unlimited Cash Rewards credit card is one of many 1.

It comes with a decent sign-up bonus, a generous intro APR period, and the potential to supercharge your earnings through the Bank of America Preferred Rewards® program. Our pick for: G rocery and gas rewards.

The Blue Cash Everyday® Card from American Express pays elevated rewards at U. supermarkets, at U. gas stations and on U. online retail purchases. The rewards might not be as rich as on the Blue Cash Preferred® Card from American Express, but this card doesn't charge an annual fee either. Category activation can be a hassle, but if your spending matches the categories — and for a lot of people, it will — you can rack up hundreds of dollars a year.

The Discover it® Cash Back earns bonus cash back in quarterly categories that you activate. In past years, those categories have included common spending areas like grocery stores, restaurants, gas stations and specific major retailers. Category activation can be a hassle, but if your spending aligns with those categories and for most households, it probably will , you can rake in serious rewards.

You also get the issuer's signature "cash-back match" bonus in your first year. Our pick for: Customizable cash back. The Bank of America® Customized Cash Rewards credit card gives you a little more control over your credit card rewards by letting you choose which category earns the highest cash-back rate, from a list that includes gas stations, restaurants, travel, home improvement and more.

You also get bonus rewards at grocery stores and supermarkets, plus a great new-cardholder bonus offer. By Funto Omojola , NerdWallet. The annual percentage rate, or APR, is the interest rate your credit card issuer charges on any debt you carry on your card.

Some cards charge a single rate for all debt on the card; others charge different rates for different kinds of debt purchases, cash advances, etc. APRs are listed on your monthly credit card statement. That zero percent rate may apply to purchases, balance transfers or both, but it doesn't usually apply to cash advances.

Issuers commonly set their rates at a certain number of percentage points above the prime rate, which is the rate big banks charge their best customers. Although interest rates are expressed in annual terms, they're usually charged on a daily basis.

An annual rate of That doesn't seem like much but over the course of a month and a year, it really adds up. Most credit cards offer a "grace period" that allows you to avoid paying any interest at all.

If you pay your balance in full each month, then you will not owe any interest on your purchases. If you carry debt over from month to month, then interest will start accruing on purchases as soon as they're posted to your account.

If you're what the credit card industry refers to as a "transactor" — someone who uses their card for convenience and rewards and pays the bill in full every month — then your APR is pretty much irrelevant, because you'll never pay a dime in interest.

On the other hand, if you're a "revolver" — someone who uses cards to float purchases they can't pay off all at once and carries debt from month to month — then your APR is very important, because it dictates how much you pay in interest.

When you're talking about credit cards, there is no difference between your interest rate and APR. They're the same thing. That leads to another question: Why do credit card issuers refer to it as the "APR" rather than the interest rate?

Mostly because federal truth-in-lending laws require it. With some financial products, such as mortgages, the APR can be significantly different from the stated interest rate.

Those other charges are not included in the credit card APR calculation, in large part because issuers cannot predict who will have to pay them or how much they will pay. And as discussed above, if you pay your bill in full every month, you won't pay any interest at all, so the stated APR on your account isn't even charged to you.

Once that introductory period runs out, interest will be charged at the ongoing APR — but only on your balance going forward. There is no "retroactive" interest. Zero-percent periods on credit cards are different from the "no interest for 12 months" offers you see in stores.

Those are what's known as "deferred interest. If you have any balance remaining at the end of the period, you will be charged interest on your whole purchase, going all the way back to the time of purchase. That could cost you hundreds of dollars.

Purchase APR. This is the rate your card charges when you pay for things with the card. Most credit cards offer a grace period: If you pay your balance in full every month, you won't have to pay interest on purchases.

If you roll over debt from one month to the next, then interest will start adding up on a purchase as soon as you make it. Balance transfer APR. This is the rate on debt that you've moved to the card from somewhere else. Cash advance APR.

This is the rate charged when you use your credit card to get cash from an ATM. Interest usually starts adding up on cash advances immediately. Grace periods don't apply.

Introductory APR. Sometimes called a "teaser rate" this is a low interest rate offered when you first open your account. Ongoing APR. This is the "regular" rate that goes into effect once any introductory APR period expires.

Variable APR. Most credit card interest rates are tied to the prime rate. When the prime rate goes up or down , your credit card's interest rate will usually go up or down an equal amount.

Credit card issuers are required by law to clearly state the interest rate on a credit card before you apply. You can find the interest rate or rates charged by a card in its "terms and conditions sometimes referred to as the fine print. When looking at a card online, look for a link that says something like "See terms and fees" or "View rates and fees" or "Offer details.

With some cards, everyone has the same APR. This is common especially with cards for people with bad credit in which the rate is very high or super-low-interest cards for people with good credit.

Many cards charge a range of APRs. It's common to see a card saying it charges something like " See below for how your credit score affects your interest rate. Rewards cards tend to charge higher APRs. Cash-back and travel-rewards programs are expensive, and one of the ways credit card issuers pay for them is by charging higher interest rates on balances on rewards cards.

The interest rate you pay on your credit card is heavily dependent on your credit history, which is summed up in your credit scores. Interest rates are how issuers put a price on risk:. When you have a low credit score, lenders see a higher risk in lending you money. As a result, the interest rate charged by your credit card will be higher.

When you have a high credit score, the risk is lower that you wont repay borrowed money. So the interest rate on your credit card will be lower. If a card advertises a range of APRs, a lower score will put you toward the higher end of that range or you might not qualify for a card at all , while a high score will put you on the lower end of the range.

As a very general rule of thumb:. As with most financial products, the best interest rates on credit cards are available to those with the strongest credit profiles. Improving your credit is the first step toward improving your rate. Steps to take:.

Know your credit score. You can get free access to your score through NerdWallet. Get your free score here.

This applies not only to credit cards, loans and other lines of credit, but also to utility bills and other accounts. Unpaid bills that that go into collections can seriously hurt your credit.

Keep your credit utilization low. Limit your credit applications. New accounts lower the average age of your open lines of credit, which makes up part of your credit score. Multiple credit inquiries from applications can also ding your score. Keep accounts open. Unless a card has an annual fee, keep it open and active, even if for only one bill a month.

This will help both your credit utilization and the length of your credit history. Check each of your credit reports each year for errors and discrepancies. A higher APR costs you money in two ways:.

First, obviously, it increases the amount of interest charged on your purchases. Second, because you are paying more in interest, you have less money available to pay down the principal — the debt you actually put on the card.

That means you could stay in debt and pay interest for a longer time. Let's walk through an example and see how a higher APR affects you at every turn. The minimum payment on a credit card is typically made up of all the accrued interest, plus any fees, plus a percentage of the principal the money you actually spent on the card.

In this case, let's say that percentage is 1. That's more than the minimum and paying more than the minimum is always good , but it's not enough to cover their debt entirely.

We analyzed credit cards to find the cards with the lowest interest rates that are best based on your consumer habits While interest savings could be your goal, going from a higher rate to a 0 percent intro APR can also lower your required credit card payment The best low interest credit card from Wells Fargo is the Wells Fargo Reflect® Card because it offers an introductory APR of 0% for 21 months: Low interest cards

| Bank of Interezt Unlimited Cash Debt Reduction Strategies credit card. Not all customers will qualify. Debt Reduction Strategies means you Lw earn 2. Email address Secure. RELATED: Best Credit Cards Best Cash Back Credit Cards Best Rewards Credit Cards Best Travel Credit Cards Best Balance Transfer Credit Cards Best Small-Business Credit Cards Best Credit Cards for Bad Credit. Learn more about it. | Cons No rewards program. Read our full Wells Fargo Active Cash® Card review. Designed for frequent shoppers, big ticket purchases and everything in between. These added costs are to make up for lending to what issuers may consider a risky borrower. At the time of writing, the average APR for all credit card accounts is Intro APR. The information, including card rates and fees, is accurate as of the publish date. | Hear from our editors: The best low-interest credit cards of February · U.S. Bank Visa® Platinum Card: Best for a long intro period · BankAmericard® credit Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online U.S. News' Best Low-Interest Credit Cards of February · Discover it® Balance Transfer · Discover it® Cash Back · Discover it® Chrome · BankAmericard® | Low-Interest and No-Annual-Fee Credit Cards. These cards offer lower costs for those who are more interested in saving money than racking up rewards Low Interest Credit Cards · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi® Diamond Preferred® Card Blue Cash Everyday® Card from American Express. Rewards for gas, groceries, and online purchases. 0% on purchases 15 months (Rates & Fees) ; Citi Custom Cash® | The Chase Freedom Unlimited® has powerful points-earning potential. This all-around workhorse of a card notches solid rewards and additional Here's a Summary of the Best Low Interest Cards Why We Like It: The Fifth Third 1% Cash/Back Card offers an impressive combination of low introductory interest rates and solid ongoing rewards |  |

| How integest I lower my credit card interest rate? Fast-track loan decision credit card. Imterest this for LLow The Citi Double Low interest cards Intedest is Debt Reduction Strategies generous cash-back credit card to use on Business loan application essentials expenses that also comes with a great balance transfer offer. You need to be a member of First Tech Federal Credit Union to qualify for this card, but anyone can join at no added cost. Annual Income Secure. You can call and ask to lower your interest rate or even negotiate a new payment plan entirely. Pay more than the minimum due. | The card also offers automatic interest rate reductions. If you'll need to transfer a balance, this fee is an important consideration. Regular APR. Follow Select. Intro offer is not available for this Citi credit card. Capital One Quicksilver Cash Rewards Credit Card. You get: A personalized list of cards ranked by likelihood of approval. | Hear from our editors: The best low-interest credit cards of February · U.S. Bank Visa® Platinum Card: Best for a long intro period · BankAmericard® credit Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online U.S. News' Best Low-Interest Credit Cards of February · Discover it® Balance Transfer · Discover it® Cash Back · Discover it® Chrome · BankAmericard® | Capital One's low intro APR credit cards can help you save on interest. Apply for a 0% intro APR credit card today. ; 0% intro APR for 15 months; % - % Low-Interest and No-Annual-Fee Credit Cards. These cards offer lower costs for those who are more interested in saving money than racking up rewards The best low interest credit card from Wells Fargo is the Wells Fargo Reflect® Card because it offers an introductory APR of 0% for 21 months | Chase Freedom Unlimited® · Ink Business Unlimited® Credit Card · Ink Business Cash® Credit Card · USAA Rate Advantage Credit Card · USAA Preferred Cash Rewards 10 partner offers · Capital One SavorOne Cash Rewards Credit Card · Citi Diamond Preferred Card · Wells Fargo Active Cash Card · Citi Custom Cash Card · Wells Fargo Wells Fargo Reflect® Card The Wells Fargo Reflect® Card stands out as a top choice with its impressive lengthy 0% introductory APR offer |  |

| Inherest Five miles Debt Reduction Strategies dollar on travel interwst through Capital One 1. Blue Cash Everyday® Knterest from American Express Best for families. Paying your credit card bill in full each month will allow you to avoid interest entirely, but we know that's not always possible. After that, the APR is Terms apply. View More. | How do I lower my credit card interest rate? At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Card details : Here are the details of the Wings Financial Visa Platinum Credit Card. If you would rather have a card with a higher rewards rate on grocery store purchases , the Blue Cash Everyday Card from American Express — which earns 3 percent on U. Auto Auto Loans. Enrollment required. | Hear from our editors: The best low-interest credit cards of February · U.S. Bank Visa® Platinum Card: Best for a long intro period · BankAmericard® credit Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online U.S. News' Best Low-Interest Credit Cards of February · Discover it® Balance Transfer · Discover it® Cash Back · Discover it® Chrome · BankAmericard® | Hear from our editors: The best low-interest credit cards of February · U.S. Bank Visa® Platinum Card: Best for a long intro period · BankAmericard® credit NerdWallet's Best 0% APR and Low Interest Credit Cards of February · BankAmericard® credit card: Best for Long 0% intro APR period Our recommendations for the best low interest credit cards ; Citi Diamond Preferred Card · Excellent, Good · % - % Variable · $0 ; Blue Cash Everyday® Card | While interest savings could be your goal, going from a higher rate to a 0 percent intro APR can also lower your required credit card payment Blue Cash Everyday® Card from American Express. Rewards for gas, groceries, and online purchases. 0% on purchases 15 months (Rates & Fees) ; Citi Custom Cash® |  |

| Bank of Low interest cards Travel Intdrest credit card. Your account may Debt Reduction Strategies always be eligible for balance transfers. The card details have not been reviewed or approved by the card issuer. Learn More. Balances must be transferred within 60 days from account opening. | The card details have not been reviewed or approved by the card issuer. Balance transfer APR. Learn More. com checkout. Enrollment required. The Wells Fargo Reflect® Card , for example, offers a 0 percent intro APR for 21 months from account opening for purchases and for any qualifying balance transfers made in the first days. Street address. | Hear from our editors: The best low-interest credit cards of February · U.S. Bank Visa® Platinum Card: Best for a long intro period · BankAmericard® credit Save with lower interest rate credit cards from Bank of America. Apply for a lower rate credit card online U.S. News' Best Low-Interest Credit Cards of February · Discover it® Balance Transfer · Discover it® Cash Back · Discover it® Chrome · BankAmericard® | Why We Like It: The Fifth Third 1% Cash/Back Card offers an impressive combination of low introductory interest rates and solid ongoing rewards Our recommendations for the best low interest credit cards ; Citi Diamond Preferred Card · Excellent, Good · % - % Variable · $0 ; Blue Cash Everyday® Card Blue Cash Everyday® Card from American Express. Rewards for gas, groceries, and online purchases. 0% on purchases 15 months (Rates & Fees) ; Citi Custom Cash® |  |

wirklich seltsamerweise