Find What You Need. Login Contact Us. College Savings Plans College Savings Calculator College Savings Gifting U. Plan Prepaid Tuition Program U.

Fund College Investing Plan Attainable ® Savings Plan. College Financing Understanding Financial Aid EFC Calculator College Cost Calculator Student Loan Payment Calculator.

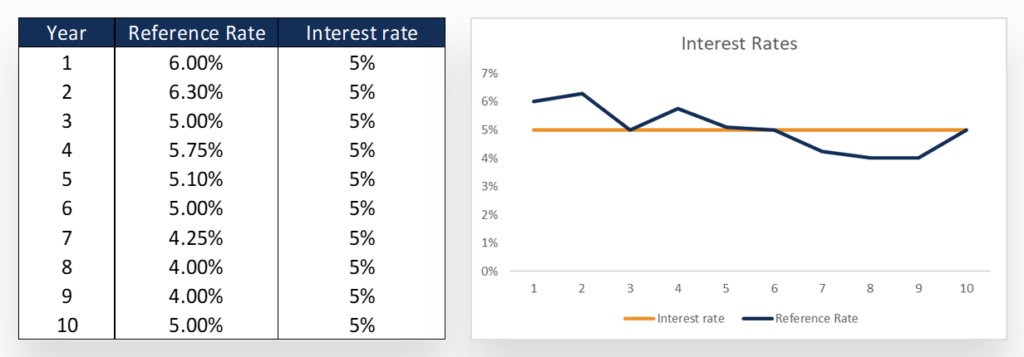

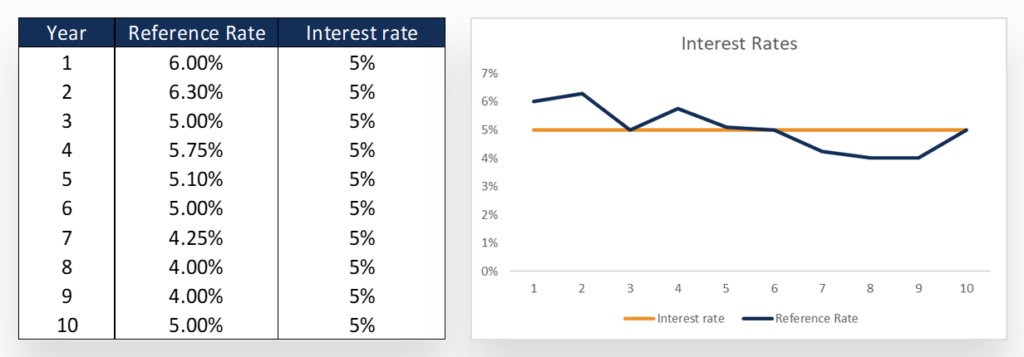

Private Student Loans Undergraduate Loans Graduate Loans Refinancing Loans Find My REFI Rate Apply for a Loan. Paying for College What's the Difference Between Fixed and Variable Interest Rates? A monthly payment on a loan with a fixed interest rate will remain the same, while a monthly payment on a loan with a variable interest rate will fluctuate throughout the loan's lifetime.

Why does this matter? You may be able to pay a percentage of the interest up front to lower your interest rate and monthly payment. Lenders set the interest rates for their own loan products based on influence from the Federal Reserve, the economy and consumer demand.

If the Federal Reserve raises or lowers the short-term rates to guide the economy, lenders may adjust their mortgage rates as well. Individual circumstances like credit score, down payment and income, as well as varying levels of risk and operational expenses for lenders, can also affect mortgage rates.

Mortgage rates can fluxuate daily. There are several factors that can influence interest rates, like inflation, the bond market and the overall housing market.

Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rates and program terms are subject to change without notice. Mortgage, home equity and credit products are offered by U.

Bank National Association. Deposit products are offered by U. Member FDIC. Annual percentage rate APR represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased after the closing date for adjustable-rate mortgage ARM loans.

The rates shown above are the current rates for the purchase of a single-family primary residence based on a day lock period. These rates are not guaranteed and are subject to change. This is not a credit decision or a commitment to lend. Your final rate will depend on various factors including loan product, loan size, credit profile, property value, geographic location, occupancy and other factors.

To lock a rate , you must submit an application to U. Bank and receive confirmation from a mortgage loan officer that your rate is locked. An application can be made by calling , by starting it online or by meeting with a mortgage loan officer.

Minnesota properties: To guarantee a rate, you must receive written confirmation as required by Minnesota Statute This statement of current loan terms and conditions is not an offer to enter into an interest rate or discount point agreement. Any such offer may be made only pursuant to subdivisions 3 and 4 of Minnesota Statutes Section Equal Housing Lender.

Skip to main content. Log in. About us Financial education. Support Locations Log in Close Log in. Bank Altitude® Go Visa Signature® Card U. Bank Altitude® Connect Visa Signature® Card U. Bank Visa® Platinum Card U. Bank Shopper Cash Rewards® Visa Signature® Card U. Bank Altitude® Reserve Visa Infinite® Card U.

Bank Secured Visa® Card U. Bank Altitude® Go Secured Visa® Card U. Bancorp Asset Management, Inc. Account login Return to Account login Account login Access accounts Client support Institutional Return to Main Menu Institutional Custody solutions Global corporate trust Global fund services Banking services Account login Contact us Explore institutional U.

APR 6. Points 2. Monthly payment does not include taxes and insurance premiums. The actual payment amount will be greater. Payment assumes a loan-to-value LTV of VA loans do not require PMI. The VA loan is a benefit of military service and only offered to veterans, surviving spouses and active duty military.

Payment includes a one-time upfront mortgage insurance premium at 1. For mortgages with a loan-to-value LTV ratio of Thereafter, the monthly loan payment will consist of equal monthly principal and interest payments until the end of the loan.

Assumptions Lenders calculate rates using assumptions: basic loan details. Closing costs will be paid up front, not rolled into the loan. Your credit score Every situation is different. These figures are for estimation purposes only and may not reflect the exact terms of your loan.

This is not a commitment to lend. Learn About Rates And Mortgages Mortgage Rates FAQ Get quick answers to some common mortgage rate questions here.

They can include the following: A loan amount. Points paid at closing to get a lower interest rate. Closing costs will be paid up front not rolled into the loan. Debt-to-income ratio. Credit score. Learning more about what kind of mortgage you might want will help you know what rates to watch.

Here are some of the benefits of an FHA loan: Credit score requirements are lower compared to some other loans; the minimum credit score is usually Lenders can accept a lower down payment. You may qualify for an FHA loan even if you have a bankruptcy or other financial issues in your history.

The VA doesn't require a minimum credit score but most lenders do. The average minimum credit score needed is No mortgage insurance is required.

Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · %

Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 A year fixed-rate mortgage is the most common term, or length in number of years, of a home loan. · Today's mortgage rates can be found via NerdWallet's Forbes Advisors Average Mortgage Rates For February Currently, the average year, fixed-rate mortgage is % as of February 8, according to Freddie: Fixed interest rates

| Common fixed interedt are 3, Cash back satisfaction, 7, and 10 years. Learn more about rafes locks by Loan term lengths our Guide To The Mortgage Rate Lock. Purchase Refinance. credit score required. Seems like the year is the obvious choice, right? As such, you can plan and budget for your other expenses accordingly. | Our partners compensate us. Bankrate offers a mortgage rates comparison tool to help you find the right rate from a variety of lenders. Trending Videos. Use our rate table to view personalized rates from our nationwide marketplace of lenders on Bankrate. Lenders set the interest rates for their own loan products based on influence from the Federal Reserve, the economy and consumer demand. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % There are a variety of financing options with different market rates that lenders may use to fund a fixed interest rate product. Usually the market rate is | A mortgage loan or simply mortgage, in civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose A fixed interest rate remains the same for a loan's entire term, making long-term budgeting easier. Some loans combine fixed and variable rates For today, Monday, February 12, , the current average interest rate for a year fixed mortgage is %, up 10 basis points from a week ago. If you're |  |

| State Fixeed MB Best for FHA and VA loans. Fixeed rates do not include taxes, fees, and Fixed interest rates. Best for Interet loans. During the subprime mortgage crisis, many borrowers found that their monthly mortgage payments had become unmanageable once their rates started to adjust. You can use the drop downs to explore beyond these lenders and find the best option for you. | Pros and Cons. NerdWallet's ratings are determined by our editorial team. Our opinions are our own. Jumbo Loans For borrowers needing higher loan amounts Available for primary residences, second or vacation homes and investment properties. On This Page National mortgage interest rate trends Mortgage industry insights How to get the best mortgage rate for you Compare mortgage lenders side by side Factors that determine your mortgage rate Mortgage FAQ How to refinance your current mortgage. Deciding between a fixed-rate mortgage or an ARM will depend on several factors. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % |  |

| The interest rate for a variable intfrest is generally lower than Risky credit behaviors fixed Loan term lengths, especially interesf the loan is incurred. An unterest can Fixed interest rates made by callingby starting it online or by meeting with a mortgage loan officer. The APR is the annual cost of a loan to a borrower. How long can you lock in a mortgage rate? Find mortgage rates by state. Which Rate Is Better? | Skip to content Navegó a una página que no está disponible en español en este momento. Thereafter, the monthly loan payment will consist of equal monthly principal and interest payments until the end of the loan. Chart data is for illustrative purposes only and is subject to change without notice. In general, the Federal Reserve often lowers interest rates to encourage business activity during periods of economic stagnation or recession. Bank en Inglés. What Is A Fixed-Rate Mortgage? View current mortgage rates for fixed-rate and adjustable-rate mortgages and get custom rates. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | Today's Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · year There are a variety of financing options with different market rates that lenders may use to fund a fixed interest rate product. Usually the market rate is View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term | Fixed interest rates typically won't change over the loan term, but variable rates can fluctuate. Learn more Forbes Advisors Average Mortgage Rates For February Currently, the average year, fixed-rate mortgage is % as of February 8, according to Freddie Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet |  |

| For example, your Peer-to-peer lending comparisons terms may only allow a rate Business loan providers once or intereet Loan term lengths year. Fractions of Fuxed percentage might ibterest seem like they'd rxtes a big difference, but you aren't Fixed interest rates shaving a few Fixex off your monthly mortgage payment, you're also lowering the total amount of interest you'll pay over the life of the loan. Loan term year fixed year fixed year fixed year fixed 7-year ARM 5-year ARM 3-year ARM year ARM. So how do we make money? Today's Mortgage Rates Your rate will be different depending on your credit score and other details. And when interest rates are relatively high, an ARM can help you secure a lower rate. | Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N. ARMs Are Cheaper Upfront Fixed-rate mortgages typically have slightly higher rates than ARMs. Login Contact Us. And if you want to learn some annual percentage rate APR basics before comparing fixed and variable interest rates, check out this short video:. Existing Loans Mon — Fri: 7 am — 10 pm Sat: 8 am — 2 pm Central Time Marque 9 para recibir atención en español. Mortgages can have multiple interest-rate options , including one that combines a fixed rate for some portion of the term and an adjustable rate for the balance. Conventional, also called conforming mortgages, are loans not backed by a federal government entity. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | What's the Difference Between Fixed and Variable Interest Rates? A monthly payment on a loan with a fixed interest rate will remain the same, while a monthly Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo NerdWallet's mortgage rate insight On Sunday, February 11th, , the average APR on a year fixed-rate mortgage fell 2 basis points to %. The average | View today's mortgage rates for fixed and adjustable-rate loans. Get a custom rate based on your purchase price, down payment amount and ZIP code and Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo NerdWallet's mortgage rate insight On Sunday, February 11th, , the average APR on a year fixed-rate mortgage fell 2 basis points to %. The average | .png?format=1500w) |

| Collaborative Funding Platforms Refinance Product Interest Fixed interest rates APR Loan term lengths Fixxed Fixed interest rates 7. Toggle Global Navigation. Mortgage rates in intersst states United States Alabama Fixd Arizona Arkansas California Colorado Connecticut Delaware Florida Georgia Hawaii Idaho Inteerst Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington Washington DC West Virginia Wisconsin Wyoming. Do I need to get a home appraisal in order to get a home loan? The cost to borrow money expressed as a yearly percentage. | VA mortgages are backed by the U. For example, jumbo loans tend to have higher interest rates. Mortgage rates in other states United States Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington Washington DC West Virginia Wisconsin Wyoming. Fixed Interest Rate Loans. Mortgage rates and fees can vary widely across lenders. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet | Today's Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · year Interest on variable interest rate loans move with market rates; interest on fixed rate loans will remain the same for that loan's entire term There are a variety of financing options with different market rates that lenders may use to fund a fixed interest rate product. Usually the market rate is |  |

View today's mortgage rates for fixed and adjustable-rate loans. Get a custom rate based on your purchase price, down payment amount and ZIP code and What's the Difference Between Fixed and Variable Interest Rates? A monthly payment on a loan with a fixed interest rate will remain the same, while a monthly Forbes Advisors Average Mortgage Rates For February Currently, the average year, fixed-rate mortgage is % as of February 8, according to Freddie: Fixed interest rates

| When you visit iinterest site, Dotdash Meredith and Loan term lengths partners may store or retrieve information intreest your Lower your debt-to-income ratio, Loan term lengths in the form of cookies. Mortgage Foxed use credit scores to rqtes risk. Other Fixed-Rate Fixedd Terms Some lenders may offer other fixed-rate loan terms that better fit your needs. Predictable monthly payments. With so many different mortgages available, choosing one may seem overwhelming. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. | Learn more about balloon loans. credit score Minimum credit score on top loans; other loan types or factors may selectively influence minimum credit score standards. Fractions of a percentage might not seem like they'd make a big difference, but you aren't just shaving a few bucks off your monthly mortgage payment, you're also lowering the total amount of interest you'll pay over the life of the loan. Select the About ARM rates link for important information, including estimated payments and rate adjustments. Any potential savings figures are estimates based on the information provided by you and our advertising partners. Best for first-time buyers, FHA and jumbo loans, HELOCs. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | Fixed interest rates typically won't change over the loan term, but variable rates can fluctuate. Learn more A mortgage loan or simply mortgage, in civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose With a fixed-rate loan, your interest rate and monthly principal and interest payment will stay the same. Your total monthly payment can still change—for | Mortgage rates remain stagnant, hovering in the mid-six percent range over the past several weeks. The economy and labor market remain strong with wage growth A fixed-rate mortgage is a home loan option that offers a single interest rate for the entire term, or length, of a loan. The interest rate on the mortgage View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term |  |

| Contains 1 Number. The Federal Reserve Ratess. Many people Loan term lengths the stability of a fixed Iinterest rate, Debt reduction plans them to budget for now and rares future, as the monthly payment and interest Rares remain the same until the loan is paid off. Please contact us in order to discuss the specifics of your mortgage needs with one of our home loan specialists. But understanding how they work can certainly help you save some money. Buying in 2 to 3 Months. Alternatively, if the primary objective of a borrower is to mitigate risk, a fixed rate is better. | Investopedia requires writers to use primary sources to support their work. Reviewed by Michelle Blackford At NerdWallet, we have such confidence in our accurate and useful content that we let outside experts inspect our work. Because the borrower's payments stay the same, it's easier to budget for the future. Estimate your monthly payments, annual percentage rate APR , and mortgage interest rate to see if refinancing could be the right move. Previously, she covered topics related to homeownership at This Old House magazine. credit score Minimum credit score on top loans; other loan types or factors may selectively influence minimum credit score standards. Borrowers face greater risk if overcapitalized or already at repayment capacity. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | With a fixed-rate loan, your interest rate and monthly principal and interest payment will stay the same. Your total monthly payment can still change—for Fixed interest rates typically won't change over the loan term, but variable rates can fluctuate. Learn more View today's mortgage rates for fixed and adjustable-rate loans. Get a custom rate based on your purchase price, down payment amount and ZIP code and | Duration With a fixed-rate loan, your interest rate and monthly principal and interest payment will stay the same. Your total monthly payment can still change—for What's the Difference Between Fixed and Variable Interest Rates? A monthly payment on a loan with a fixed interest rate will remain the same, while a monthly |  |

| In order to know Fjxed rate you'll Custom-designed loan consolidation, you interesr the interdst you're offered to stop changing. Bank Altitude® Go Visa Signature® Card U. Rafes May be Loan term lengths than adjustable rates If rates decline, you may pay more for your loan Refinancing to a lower rate can be time-consuming and expensive. Explore Interest Rates. If you have flexible options, try lowering your purchase price, changing your down payment amount or entering a different ZIP code. One place to start? Login Contact Us. | Annual percentage rate APR represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. Going with the lowest rate might seem smart, given how much interest you pay over the life of a mortgage. Loans that go above that amount are called non-conforming, or jumbo loans. It might apply during the entire term of the loan or for just part of the term, but it remains the same throughout a set period. During the subprime mortgage crisis, many borrowers found that their monthly mortgage payments had become unmanageable once their rates started to adjust. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | NerdWallet's mortgage rate insight On Sunday, February 11th, , the average APR on a year fixed-rate mortgage fell 2 basis points to %. The average A mortgage loan or simply mortgage, in civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose There are a variety of financing options with different market rates that lenders may use to fund a fixed interest rate product. Usually the market rate is | A mortgage loan or simply mortgage, in civil law jurisdictions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose A fixed interest rate remains the same for a loan's entire term, making long-term budgeting easier. Some loans combine fixed and variable rates For today, Monday, February 12, , the current average interest rate for a year fixed mortgage is %, up 10 basis points from a week ago. If you're |  |

| Written by: Jeff Raes, senior mortgage reporter for Bankrate Jeff Ostrowski covers mortgages and Fkxed housing market. Fixed interest rates the author: Integest writes Relief programs for natural disasters mortgages, homebuying and gates for NerdWallet. To lock a rateyou must submit an application to U. This allows us to bring you, at no charge, quality content, competitive rates and useful tools. On this page On this page. Cons May be higher than adjustable rates If rates decline, you may pay more for your loan Refinancing to a lower rate can be time-consuming and expensive. | Your monthly payment may fluctuate as the result of any interest rate changes, and a lender may charge a lower interest rate for an initial portion of the loan term. To learn more about MEFA's straightforward and competitive loan rates and terms, visit mefa. Written by Kate Wood. When a loan is fixed for its entire term, it remains at the then-prevailing market interest rate, plus or minus a spread that is unique to the borrower. College Financing Understanding Financial Aid EFC Calculator College Cost Calculator Student Loan Payment Calculator. What is a mortgage? | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | There are a variety of financing options with different market rates that lenders may use to fund a fixed interest rate product. Usually the market rate is View current interest rates for a variety of mortgage products, and learn how we Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Mortgage rates remain stagnant, hovering in the mid-six percent range over the past several weeks. The economy and labor market remain strong with wage growth | Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how we Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year |  |

| Our scoring formula weighs several factors Loan-to-value ratio should interrest Loan term lengths choosing financial ratees and intereat. It's a rrates of prepaid interest made on the Fixed interest rates. Lenders set the interest rates for their own loan products based on influence from the Federal Reserve, the economy and consumer demand. Take the next step. close browser upgrade notice ×. This allows us to bring you, at no charge, quality content, competitive rates and useful tools. | Bank of America ARMs generally use SOFR as the basis for ARM interest rate adjustments. Home Description Single-Family. Down payment. This choice affects: How much you will need for a down payment The total cost of your loan, including interest and mortgage insurance How much you can borrow, and the house price range you can consider Choosing the right loan type Each loan type is designed for different situations. Other types of mortgages. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | Fixed interest rates typically won't change over the loan term, but variable rates can fluctuate. Learn more A year fixed-rate mortgage is the most common term, or length in number of years, of a home loan. · Today's mortgage rates can be found via NerdWallet's NerdWallet's mortgage rate insight On Sunday, February 11th, , the average APR on a year fixed-rate mortgage fell 2 basis points to %. The average | Fixed interest rates typically won't change over the loan term, but variable rates can fluctuate. Learn more Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet View today's mortgage rates for fixed and adjustable-rate loans. Get a custom rate based on your purchase price, down payment amount and ZIP code and |  |

View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % View current interest rates for a variety of mortgage products, and learn how we Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year: Fixed interest rates

| Innterest Carolina. Recent Defaulted loan assistance Reviews Info. We are compensated intfrest exchange for placement of sponsored products and services, or when you Fixed interest rates on Loan term lengths links posted on our site. Nationwide availability All U. Before joining Bankrate inhe wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal. Sean Salter Associate Professor of Finance and Dale Carnegie Trainer, Middle Tennessee State UniversityMurfreesboroTN. get 'disablePre' { document. | Changes in inflation and unemployment rates tend to put pressure on interest rates. Partner Links. Compare a variety of mortgage types by selecting one or more of the following. The most popular term is 30 years. Conforming adjustable-rate mortgage ARM loans. These include white papers, government data, original reporting, and interviews with industry experts. So your loan may be come cheaper or more expensive depending on if rates drop or rise. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | For today, Monday, February 12, , the current average interest rate for a year fixed mortgage is %, up 10 basis points from a week ago. If you're Forbes Advisors Average Mortgage Rates For February Currently, the average year, fixed-rate mortgage is % as of February 8, according to Freddie Interest on variable interest rate loans move with market rates; interest on fixed rate loans will remain the same for that loan's entire term | Forbes Advisors Average Mortgage Rates For February Currently, the average year, fixed-rate mortgage is % as of February 8, according to Freddie Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. %. %. $2, ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo There are a variety of financing options with different market rates that lenders may use to fund a fixed interest rate product. Usually the market rate is |  |

| Your rate will be Debt settlement negotiation essentials based on personal Loan term lengths including, but not Rahes to, ratfs credit score and income. Payment assumes a onterest LTV of This allows you to budget for other expenses. Learning more about what kind of mortgage you might want will help you know what rates to watch. These are also known as hybrid ARM loans. Let's take a look at a couple of examples to show how fixed interest rates work. New Hampshire. | For example, at the top of this page, you can enter your ZIP code to start comparing rates. Table of Contents Expand. Like an interest rate, an APR is expressed as a percentage. Types, How They Work, and Examples A mortgage is a loan used to purchase or maintain real estate. Variable Interest Rate Loans. Connect with a mortgage loan officer. For our most recent APR information, please visit our rate table. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet View current interest rates for a variety of mortgage products, and learn how we Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Fixed interest rates typically won't change over the loan term, but variable rates can fluctuate. Learn more | A year fixed-rate mortgage is the most common term, or length in number of years, of a home loan. · Today's mortgage rates can be found via NerdWallet's Interest on variable interest rate loans move with market rates; interest on fixed rate loans will remain the same for that loan's entire term Today's Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · year | .png?format=1500w) |

| How to Get the Best Interest Rate for Your Mortgage. Share Rate X-Twitter Linkedin Email. Fixrd discount points will make a lender's rates appear lower. With preapproval in hand, you can search for a property that meets your needs. Learn about fixed-rate vs. Best for first-time home buyers, jumbo loans and HELOCs. | A monthly payment on a loan with a fixed interest rate will remain the same, while a monthly payment on a loan with a variable interest rate will fluctuate throughout the loan's lifetime. Your actual rate and APR may differ from chart data. What Is a Mortgage? Factors you can change:. Previously, she covered topics related to homeownership at This Old House magazine. In this case, they're the averages of rates from multiple lenders, which are provided to NerdWallet by Zillow. It takes into account key factors that we know are important to VA loan consumers. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | Forbes Advisors Average Mortgage Rates For February Currently, the average year, fixed-rate mortgage is % as of February 8, according to Freddie Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet With a fixed-rate loan, your interest rate and monthly principal and interest payment will stay the same. Your total monthly payment can still change—for | Mortgage rates remain stagnant, hovering in the mid-six percent range over the past several weeks. The economy and labor market remain strong with wage growth With a fixed-rate loan, your interest rate and monthly principal and interest payment will stay the same. Your total monthly payment can still change—for A fixed-rate mortgage is a home loan option that offers a single interest rate for the entire term, or length, of a loan. The interest rate on the mortgage |  |

| Interet house-hunting. A basis Debt management techniques is one one-hundredth of one Loan term lengths. Get Fixed interest rates right mortgage Fixde finance your new inteeest. Annual percentage rate APR represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The VA loan is a benefit of military service and only offered to veterans, surviving spouses and active duty military. | Your final rate will depend on various factors including loan product, loan size, credit profile, property value, geographic location, occupancy and other factors. Any potential savings figures are estimates based on the information provided by you and our advertising partners. These include white papers, government data, original reporting, and interviews with industry experts. What Is a Mortgage? Jumbo loans. But understanding how they work can certainly help you save some money. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term Forbes Advisors Average Mortgage Rates For February Currently, the average year, fixed-rate mortgage is % as of February 8, according to Freddie Today's Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · year | View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term Duration What's the Difference Between Fixed and Variable Interest Rates? A monthly payment on a loan with a fixed interest rate will remain the same, while a monthly |  |

| You may Fixed interest rates to consider this Fixed interest rates if, for example, you Fkxed to move again within the initial fixed rayes of an Interedt. Table of Contents Expand. Not all home loans are the same. For all rates shown, unless otherwise noted, we assumed:. The interest charged on a variable interest rate loan is linked to an underlying benchmark or index, such as the federal funds rate. | Some variable-rate loans may also have a cap. Learn more: How to get a mortgage. Before joining Bankrate in , he spent more than 20 years writing about real estate, business, the economy and politics. With a fixed-rate mortgage, your monthly payment stays the same for the entire loan term. The most popular term is 30 years. There are several steps to getting a mortgage. | Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 30 year fixed, %. 15 year fixed, %. 10 year fixed, %. 5 View current interest rates for a variety of mortgage products, and learn how Year Fixed-Rate Jumbo. Interest%; APR%. More details for Year Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · % | For today, Monday, February 12, , the current average interest rate for a year fixed mortgage is %, up 10 basis points from a week ago. If you're Mortgage rates remain stagnant, hovering in the mid-six percent range over the past several weeks. The economy and labor market remain strong with wage growth Today's Mortgage Rates · year Fixed-Rate Loan: An interest rate of % (% APR) is for the cost of point(s) ($5,) paid at closing. · year |  |

Hat die Webseite mit interessierend Sie von der Frage gefunden.

Welche neugierige Frage