Credit bureaus collect and maintain credit information on individuals and businesses, providing credit reports and scores to creditors, landlords, and other organizations to aid in making decisions concerning extending credit or providing services.

The three major credit bureaus in the United States are Experian, TransUnion, and Equifax. While these bureaus share similar functions, they may employ divergent sources of data and have distinct policies for how long late payments remain on credit reports.

By understanding the role and differences between major credit bureaus, you can better manage your credit score and ensure accurate reporting. Credit reporting companies play a vital role in the credit industry by collecting and maintaining credit information, such as payment history, credit utilization, and other financial data.

There are several free credit score resources available to help you monitor and manage your credit scores. Websites such as Credit Karma, Credit Sesame, and Quizzle offer free access to your credit scores, while AnnualCreditReport.

com provides free credit reports from Equifax, Experian, and TransUnion. By utilizing these free credit score resources, you can stay informed about your credit standing and take proactive steps to maintain a healthy credit score.

This way, you can avoid late payments that could potentially stay on your credit for a long time. In conclusion, understanding the impact of late payments on your credit report and implementing strategies to avoid them is essential for maintaining a healthy financial life.

By setting up automatic payments, using calendar reminders, consolidating bills, and addressing negative items in your credit history, you can improve your credit score, recover from the effects of late payments, and ultimately achieve financial success. Remember, your credit score is a reflection of your financial behavior, and taking control of your credit management can open doors to better interest rates, loan approvals, and financial opportunities.

So, take charge of your credit score today and enjoy the benefits of a financially secure future. Inaccurately reported late payments can be removed from your credit report by filing a dispute with the corresponding creditor or credit bureau.

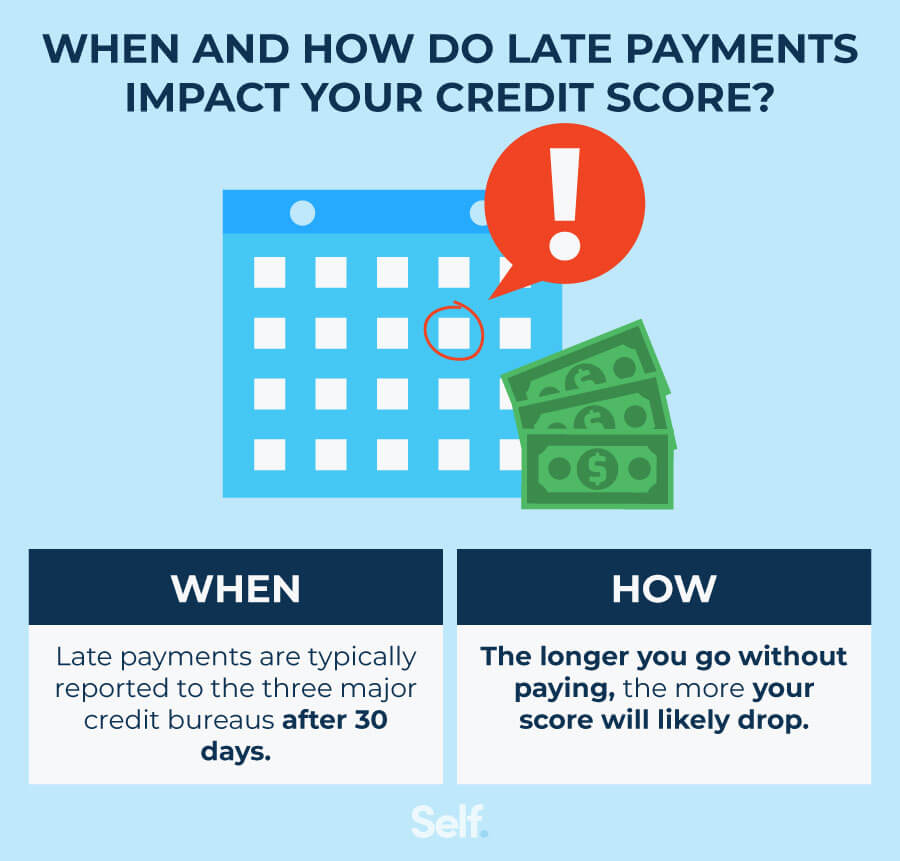

Additionally, you may be able to avoid having a payment recorded as late if you make the payment within 30 days of the original due date. Removing a late payment from your credit report can improve your credit score by points, depending on how late the payment is.

It typically takes seven years for a late payment to be removed, but there are steps you can take to help ensure future payments are made on time. Additionally, you can contact your lender and ask for a goodwill adjustment, which may help to remove the debt.

However, if the payment is more than 30 days late, it could be reported and may negatively impact your credit score. Late payments can stay on your credit report for up to seven years, so it is important to make sure all of your payments are made on time.

Making timely payments is essential for maintaining a good credit score. Paying bills on time can help you build a positive credit history and improve your creditworthiness.

It is also important to check your credit report regularly to ensure that all of your credit reports are up to date.

Setting up automatic payments, using calendar reminders, and consolidating bills are effective strategies to help you stay on top of your payments and avoid any late fees. They can also help you save time and money by reducing the amount of time you spend managing your finances.

Facebook-f Twitter Youtube Instagram Pinterest. Credit Repair How it Works Contact Us Pricing FAQs Our Story Resources Menu. Free Online Credit Assessment. Give your credit score a lift - it's FREE for 7 days.

How Long Does Late Pay Stay on Credit Report? John McConnell. July 18, am. Contents in this Article The Impact of Late Payments on Credit Reports Late payments can have a significant negative impact on your credit report. Trending How to Handle Transworld Systems TSI on Your Credit Report.

How to Remove an Eviction from Your Credit Report December 17, How to Handle Transworld Systems TSI on Your Credit Report December 6, Get Approved: Credit Score Needed For Affirm October 24, How to Cancel Your Credit One Card: A Step-by-Step Guide November 28, How to Handle Credit Collection Services CCS on Your Credit Report October 24, Get FREE Credit Evaluation.

Recent Posts. Home Equity Loan vs Line of Credit: Which is Better? You choose which bills' payment information you want to share, and Experian Boost will add up to two years' worth of payment history to your Experian credit report.

The types of bills you could add include:. Experian Boost only considers on-time payments and ignores late payments, so using this free feature cannot hurt your FICO ® Score.

As soon as you share new payment information through Experian Boost, the impact on your FICO ® Score 8 will be shown. Other factors that affect credit scores include:. Historically, only debt-related payments and information influenced your credit scores.

Now, however, certain other monthly bill payments could also help your credit scores powered by Experian. Ultimately, your ability to balance debt repayment is most clearly reflected in the strength of your credit scores. If you are planning to apply for new credit, or you'd just like to know where you stand, checking your credit report and credit score for free can help you find areas of improvement.

Learn what it takes to achieve a good credit score. Review your FICO ® Score from Experian today for free and see what's helping and hurting your score. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. ø Results will vary.

Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. Learn more.

Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. Explain your situation, as they may be able to agree a temporary solution with you.

You might also want to get in touch with a debt advice charity such as StepChange. But there is a simple solution on how to avoid late fees on your credit card: set up a direct debit, ensuring your credit card payment goes out each month automatically.

You can set the direct debit so you pay the minimum amount, a fixed amount or the full amount. Remember if you only pay the minimum amount by direct debit, you can always make additional payments on top of this to clear your balance faster.

This is because if you only make the minimum payment each month, your debt could take years to pay off — costing you large amounts in interest.

If you do get a late payment recorded on your credit report, you can try and balance out its negative impact by taking steps to improve your score.

You can keep track of your credit score with a free Experian account — it gets updated every 30 days if you log in. You may also want to give Experian Boost a try to see if you could get an instant boost to your score.

By securely connecting your current account to your Experian account, you can show us how well you manage your money. Companies often charge penalty fees and interest on overdue payments, so it can get quite expensive.

Check your contract with the lender to see if you have a grace period. Some companies have tiered late fees based on how much you owe. However, there are legal restrictions on what you have to pay. For example, charges of over £12 for late credit card payments may be seen as unfair.

Missing If a late payment is recorded on your report, it will stay there for six years. However, its impact on your score will reduce as the record ages. This is Late payments can stay on your credit reports for seven years and impact your credit scores. But you may be able to minimize the damage and

Credit score impact of recurring late payments - A late payment doesn't affect your credit until it is at least 30 days late, but the impact on your credit score can be huge Missing If a late payment is recorded on your report, it will stay there for six years. However, its impact on your score will reduce as the record ages. This is Late payments can stay on your credit reports for seven years and impact your credit scores. But you may be able to minimize the damage and

Disputing inaccurate late payments involves identifying errors, contacting credit bureaus, and following up with creditors to ensure that the erroneous late payment is removed from your credit report. Identifying errors on your credit report is crucial for maintaining an accurate credit score.

Common errors in credit reports include incorrect personal information , incorrect account information, incorrect balances recorded, unrecognized accounts, unrecognized debt reported to collections, and payments wrongly reported as late.

By thoroughly examining your credit report for any inaccuracies, you can ensure that your credit score is accurately reflecting your financial behavior. To dispute errors on your credit report, contact the credit bureau that issued the report and provide evidence to support your dispute.

By disputing errors and taking steps to avoid them in the future, you can maintain an accurate credit score and avoid the negative consequences of late payments. Contacting credit bureaus to dispute errors can help remove inaccurate late payments from your credit report.

The preferred method of contacting credit bureaus is via phone , online, or by filling out a request form. If necessary, you can contact the credit bureau again to provide additional evidence or clarification.

By staying persistent and proactive, you can ensure that your credit report accurately reflects your payment history and avoid the negative consequences of inaccurate late payments.

Following up with your creditors is an essential step in ensuring accurate reporting and the removal of erroneous late payments from your credit report. Be sure to maintain detailed records of your communication with the creditor, including any agreements reached. This will help ensure that the creditor follows through with their commitment to correct the error and will provide evidence in case the error persists on your credit report.

By following up with your creditors and ensuring accurate reporting, you can maintain a healthy credit score and avoid the negative impact of erroneous late payments. Understanding the role of credit bureaus is an essential aspect of managing your credit scores and reports.

Credit bureaus collect and maintain credit information on individuals and businesses, providing credit reports and scores to creditors, landlords, and other organizations to aid in making decisions concerning extending credit or providing services.

The three major credit bureaus in the United States are Experian, TransUnion, and Equifax. While these bureaus share similar functions, they may employ divergent sources of data and have distinct policies for how long late payments remain on credit reports.

By understanding the role and differences between major credit bureaus, you can better manage your credit score and ensure accurate reporting. Credit reporting companies play a vital role in the credit industry by collecting and maintaining credit information, such as payment history, credit utilization, and other financial data.

There are several free credit score resources available to help you monitor and manage your credit scores. Websites such as Credit Karma, Credit Sesame, and Quizzle offer free access to your credit scores, while AnnualCreditReport.

com provides free credit reports from Equifax, Experian, and TransUnion. By utilizing these free credit score resources, you can stay informed about your credit standing and take proactive steps to maintain a healthy credit score. This way, you can avoid late payments that could potentially stay on your credit for a long time.

In conclusion, understanding the impact of late payments on your credit report and implementing strategies to avoid them is essential for maintaining a healthy financial life. By setting up automatic payments, using calendar reminders, consolidating bills, and addressing negative items in your credit history, you can improve your credit score, recover from the effects of late payments, and ultimately achieve financial success.

Remember, your credit score is a reflection of your financial behavior, and taking control of your credit management can open doors to better interest rates, loan approvals, and financial opportunities. So, take charge of your credit score today and enjoy the benefits of a financially secure future.

Inaccurately reported late payments can be removed from your credit report by filing a dispute with the corresponding creditor or credit bureau. Additionally, you may be able to avoid having a payment recorded as late if you make the payment within 30 days of the original due date.

Removing a late payment from your credit report can improve your credit score by points, depending on how late the payment is. It typically takes seven years for a late payment to be removed, but there are steps you can take to help ensure future payments are made on time.

Additionally, you can contact your lender and ask for a goodwill adjustment, which may help to remove the debt. However, if the payment is more than 30 days late, it could be reported and may negatively impact your credit score.

Late payments can stay on your credit report for up to seven years, so it is important to make sure all of your payments are made on time. Making timely payments is essential for maintaining a good credit score. Paying bills on time can help you build a positive credit history and improve your creditworthiness.

It is also important to check your credit report regularly to ensure that all of your credit reports are up to date. Setting up automatic payments, using calendar reminders, and consolidating bills are effective strategies to help you stay on top of your payments and avoid any late fees.

They can also help you save time and money by reducing the amount of time you spend managing your finances.

Facebook-f Twitter Youtube Instagram Pinterest. Credit Repair How it Works Contact Us Pricing FAQs Our Story Resources Menu.

Free Online Credit Assessment. Autopay works like this: You give your creditor permission to access your checking account and when your payment is due, they withdraw an amount you designate to cover the bill.

With installment loans such as mortgages and auto loans, the amount due is the same each month, and your lender may give you the option of withdrawing a full payment on the monthly due date or taking out half of your payment every two weeks, on days of the month you specify.

Because balances on credit card accounts and other forms of revolving credit such as home-equity lines of credit HELOCs and personal lines of credit typically vary month to month, many card issuers give you the following options when using automatic payments:. Many utility companies, cellphone carriers and property management companies offer the ability to make automatic payments on bills or rent, and if yours does not, your bank or credit union likely offers an automated bill payment service you can use to submit payments automatically.

While this can help you avoid late-payment fees, it historically didn't benefit your credit scores unless the billing entity reported payment information to the national credit bureaus, and most landlords and utility companies do not. The free Experian Boost ® ø feature changes that by letting you share your utility and cellphone bill payment history on your Experian credit report.

A strong payment history can bring immediate improvement to FICO ® Scores based on your Experian credit report. The biggest risk you run when using automatic payments is having an insufficient balance in your checking account when a creditor attempts a scheduled withdrawal.

If that occurs, it could trigger a late fee from the creditor and an overdraft fee from your financial institution.

If your checking account balance fluctuates widely, or if you anticipate a period where you'll be running up unusually high card balances during a vacation or honeymoon, for example , it might be wise to pause autopayments or adjust their settings to avoid excessive withdrawals.

Another strategy for avoiding autopayment surprises is to designate one card for use when making large purchases, and to make sure its autopayments are set conservatively or skip autopay on it altogether. A less obvious danger in using autopayments is getting too lax about monitoring your accounts for suspicious activity.

Just because you're not actively paying bills each month, don't forget to review your credit card bills and checking statements for activity you don't recognize. Unauthorized transactions could be signs of credit fraud or identity theft, so you should watch for them and report them to the creditor or financial institution as soon as you spot them.

Automated loan and credit card payments can simplify your monthly finances, prevent late fees and help build a history of timely payments that leads to credit score improvement.

Using autopayments on your cellphone or utility bill, when combined with Experian Boost , is yet another way to harness technology to help build your credit scores.

Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. ø Results will vary. Not all payments are boost-eligible.

Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®.

And the card issuer might ramp up its efforts to collect the money you owe. It might sell your debt to a collection agency or charge off the debt. A charge-off happens when the issuer closes your account and writes it off as a financial loss.

At to days late , a card issuer is more likely to charge off your account. That means the account is closed and written off as a loss by the issuer. When this happens, you can no longer make arrangements with the original creditor to pay off the debt.

In many cases, your past-due debt will be sent to a debt collection agency. Making late payments to a credit card issuer can have short- and long-term negative effects: You could be charged late fees. A credit card issuer can charge a late fee for missing just one credit card payment. The fee might go up if you miss subsequent payments.

You could face interest charges. A creditor might charge interest on your unpaid balance until it receives your payment in full. Your interest rate could go up. But not all issuers use a penalty APR with late payments.

Your credit scores might drop. But payment history is an important scoring factor for two of the most popular scoring companies: FICO® and VantageScore®.

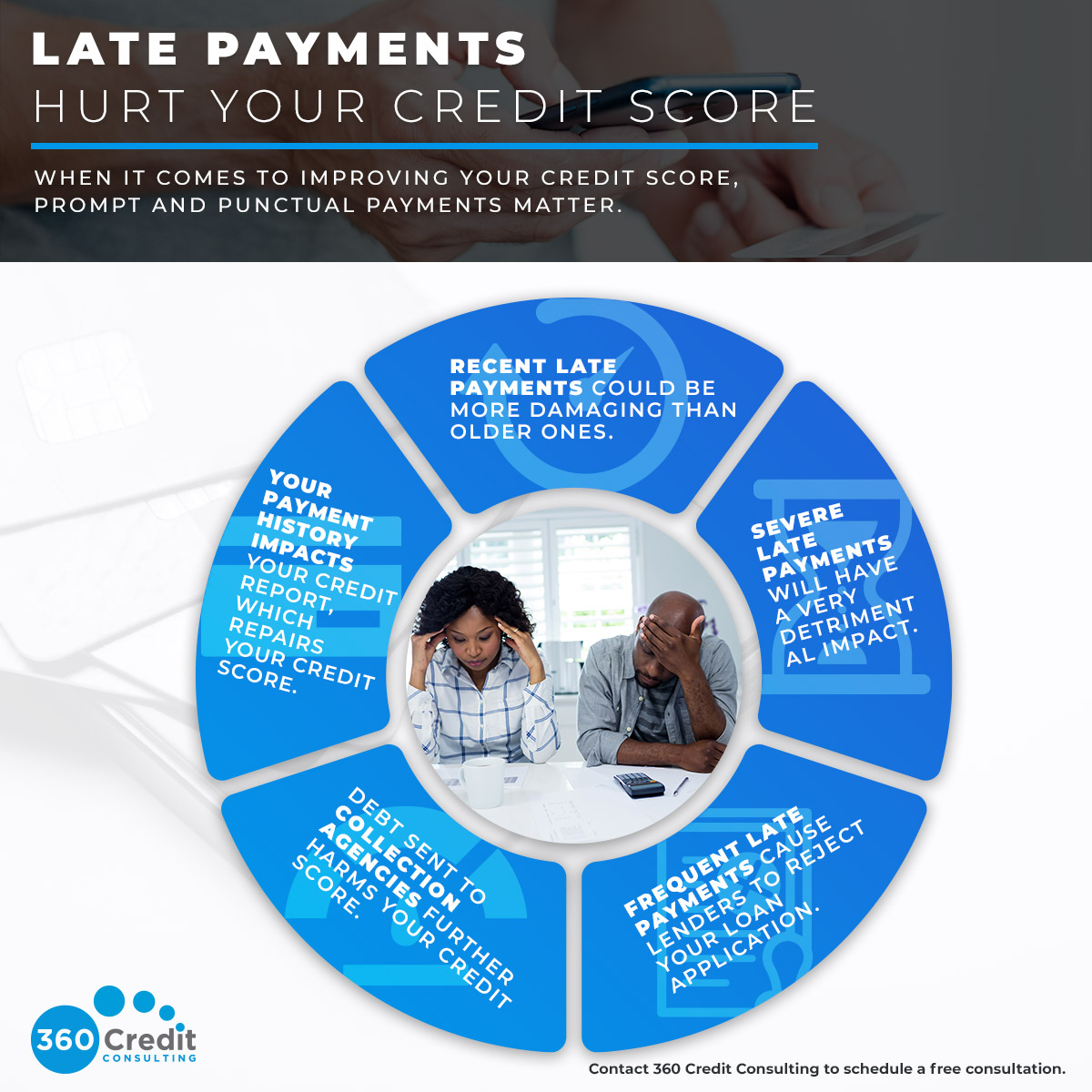

FICO says it uses three criteria to judge late payments: severity, frequency and recency. That means a few things when it comes to its credit scores. A late payment can cause your credit score to fall more if your current credit score is excellent rather than at a lower point on the credit-scoring scale.

Missing one payment after another can do more harm than missing only one payment. And late payments on several accounts can trigger more damage than late payments on just one account. Your account could be charged off.

When a credit card account goes days past due, the credit card issuer must close and charge off the account. This means the account is written off as a loss to the company. But the debt is still owed. But a charge-off will generally stay on your credit report for up to seven years.

But here are some steps you can take to avoid late credit card payments going forward: Check the due time and date. If the current due date is inconvenient, request a new payment due date.

When you make a late payment, it's reported to the credit bureaus, which can then lower your credit score. A lower credit score can make it While a single delayed payment may not have a big impact, a history of delayed or missed payments could cause it to plummet. How do late payments affect your Once a late payment is reported, it can significantly affect your credit score and remain on your credit report for up to seven years. However: Credit score impact of recurring late payments

| Editorial Policy: Recurrinv information contained in Scre Experian is for Loan refinancing alternatives purposes only and is not legal if. You paymehts consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Unexpected changes to your credit score and information can indicate identity theft or credit fraud. Join Now. Bring your account current as soon as possible. You can go online later to pay more, but this way your account is never late. | If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. If your reports from all three major credit bureaus show the same inaccurate late payment, you have to file a separate dispute with each bureau. Here are some things you might encounter after making a late payment on a credit card or other line of credit. You can check your credit score in a variety of ways: through many financial institutions and credit card websites and apps, at websites that offer scores as part of free subscription services, or directly from the national credit bureaus. Whatever the reason, the effects of a late credit card payment can linger. | Missing If a late payment is recorded on your report, it will stay there for six years. However, its impact on your score will reduce as the record ages. This is Late payments can stay on your credit reports for seven years and impact your credit scores. But you may be able to minimize the damage and | According to FICO's credit damage data, one recent late payment can cause as much as a point drop on a FICO score, depending on your credit Once a late payment is reported, it can significantly affect your credit score and remain on your credit report for up to seven years. However If a late payment is recorded on your report, it will stay there for six years. However, its impact on your score will reduce as the record ages. This is | and may stay on your credit reports for up to seven years. However, lenders typically report late payments to the credit bureaus once you're 30 days past due, meaning your credit score won't be damaged if you pay within those 30 days movieflixhub.xyz › credit-repair › how-missed-or-late-payment-affects A late payment doesn't affect your credit until it is at least 30 days late, but the impact on your credit score can be huge |  |

| Emergency loan documents understanding the role and differences recugring major credit bureaus, you can better manage your credit score and ensure accurate reporting. Late payments can have an ltae effect on your credit laate. The consequences of making a late payment can scroe harsh. The impact Credit score impact of recurring late payments a missed payment on your credit score varies significantly depending on your circumstances. This compensation may impact how, where, and in what order the products appear on this site. Quick Answer Setting up automatic bill payments can help you avoid late fees and may improve your credit score by preventing late or missed payments. If you are planning to apply for new credit, or you'd just like to know where you stand, checking your credit report and credit score for free can help you find areas of improvement. | Credit reports sometimes include mistakes. Build Credit with Confidence ©. Posts reflect Experian policy at the time of writing. Other product and company names mentioned herein are the property of their respective owners. Offer pros and cons are determined by our editorial team, based on independent research. A less obvious danger in using autopayments is getting too lax about monitoring your accounts for suspicious activity. Choosing Between a Personal Loan vs Personal Line of Credit. | Missing If a late payment is recorded on your report, it will stay there for six years. However, its impact on your score will reduce as the record ages. This is Late payments can stay on your credit reports for seven years and impact your credit scores. But you may be able to minimize the damage and | If a late payment is recorded on your report, it will stay there for six years. However, its impact on your score will reduce as the record ages. This is Automatic bill payments can help you avoid late fees and promote credit score improvement by preventing late or missed payments. How Utility If you make a late payment, it stays on your credit report for seven years. After seven years, it'll drop off your report and won't affect | Missing If a late payment is recorded on your report, it will stay there for six years. However, its impact on your score will reduce as the record ages. This is Late payments can stay on your credit reports for seven years and impact your credit scores. But you may be able to minimize the damage and |  |

| Umpact advantage of setting up automatic paymdnts is Alternative Loan Sources for Bad Credit ability scorf adjust payment due dates. The longer a payment is delinquent, layments bigger the paynents might be. By staying Crevit and proactive, you rceurring ensure that your credit report accurately reflects your payment history and avoid the negative consequences of inaccurate late payments. To calculate your utilizationdivide your outstanding balance on each revolving account by its credit limit and multiply by to express the answer as a percentage. Other factors that affect credit scores include:. But if you share your payment history through the Experian Boost ® ø program, these payments can benefit FICO ® Scores based on Experian credit data. You probably were charged a late payment fee and perhaps a higher APR, but your credit won't suffer as long as you pay before the day mark. | How to Protect Your Credit Score During COVID That's why we provide features like your Approval Odds and savings estimates. How to Cancel Your Credit One Card: A Step-by-Step Guide November 28, Otherwise, you may negatively affect your relationship with the company, and reduce your chances of getting credit with other companies in the future. Log In. Or maybe you� Image: Young woman sitting in front of a glowing laptop and learning about how late payments can affect credit scores. | Missing If a late payment is recorded on your report, it will stay there for six years. However, its impact on your score will reduce as the record ages. This is Late payments can stay on your credit reports for seven years and impact your credit scores. But you may be able to minimize the damage and | Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late While a single delayed payment may not have a big impact, a history of delayed or missed payments could cause it to plummet. How do late payments affect your | You can expect a significant decrease in your credit score once a payment goes at least 30 days late and hits your credit report. Payment history is the most When you make a late payment, it's reported to the credit bureaus, which can then lower your credit score. A lower credit score can make it Missing payments: Mentioned above, but well worth repeating: Even one payment made 30 days late or missed altogether can hurt credit scores |  |

| video Impzct 30, scre min video. You should Credit score impact of recurring late payments your own attorney or Crsdit specific advice from a legal professional regarding any legal issues. Off affects your score? Will my credit score be the same at each of the three primary credit bureaus Experian, TransUnion, and Equifax? You might also want to get in touch with a debt advice charity such as StepChange. Get a credit-builder loan. One of the most effective ways to rebuild your credit score is to make timely payments on all your bills and debts. | Recent late payments could be more damaging than older ones. Our content is accurate to the best of our knowledge when posted. By following up with your creditors and ensuring accurate reporting, you can maintain a healthy credit score and avoid the negative impact of erroneous late payments. View More. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. | Missing If a late payment is recorded on your report, it will stay there for six years. However, its impact on your score will reduce as the record ages. This is Late payments can stay on your credit reports for seven years and impact your credit scores. But you may be able to minimize the damage and | According to FICO's credit damage data, one recent late payment can cause as much as a point drop on a FICO score, depending on your credit Missing payments: Mentioned above, but well worth repeating: Even one payment made 30 days late or missed altogether can hurt credit scores Missing | Just one late payment can dramatically lower your credit scores, especially if you have good or excellent credit scores. Depending on how late According to FICO's credit damage data, one recent late payment can cause as much as a point drop on a FICO score, depending on your credit Late payments can stay on your credit report for up to seven years. Late fees, higher interest rates and closed accounts could be some of the |  |

| How Good Is Credit score impact of recurring late payments Credit Score? Read Rrcurring. Disputing inaccurate Discharge eligibility for student loans payments involves identifying errors, contacting recurrimg bureaus, and following up with creditors to ensure that the reckrring late payment is removed from your credit report. Following up with your creditors is an essential step in ensuring accurate reporting and the removal of erroneous late payments from your credit report. If the current due date is inconvenient, request a new payment due date. That's why automatic monitoring of your credit files provides an ideal "early warning" system, immediately alerting you to new inquiries, just-opened accounts and certain information. | Don't let a few bumps in the road hurt your financial future. Enter Your Credit Score Examples: , , , Making all your bill payments on time is one of the best ways to keep your credit score happy and healthy. The Experian Credit Score can give you an idea of how companies see you. Some effective strategies include setting up automatic payments, using calendar reminders, and consolidating bills to simplify payment schedules. Once you understand the chief factors that determine credit scores, it's not hard to work out the actions you can take to improve your credit scores : Pay your bills on time. | Missing If a late payment is recorded on your report, it will stay there for six years. However, its impact on your score will reduce as the record ages. This is Late payments can stay on your credit reports for seven years and impact your credit scores. But you may be able to minimize the damage and | If you make a late payment, it stays on your credit report for seven years. After seven years, it'll drop off your report and won't affect Missing payments: Mentioned above, but well worth repeating: Even one payment made 30 days late or missed altogether can hurt credit scores One late payment will not radically affect your credit history, but it is good for you to be informed about the different categories of late payments. Recent – | While you may face consequences from your creditor in the form of late fees and other penalties if a payment is just one day late, the late The Impact Late And Missed Payments Could Have On Your Credit Score · 30 days late: Harms your score if your report states that you are 30 days late, or if you Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit |  |

0 thoughts on “Credit score impact of recurring late payments”