It will be deducted when the next payday arrives. Borrow from family or friends: Borrowing money from friends or family is a fast and often the least expensive way to dig yourself out of trouble. You would expect to pay much lower interest rate and have far more generous timeframe than two weeks to pay off a loan, but make sure this is a business deal that makes both sides happy.

Draw up an agreement that makes the terms of the loan clear. And stick to it. Credit Counseling: Nonprofit credit counseling agencies like InCharge Debt Solutions offer free advice on how to set up an affordable monthly budget and chip away at debt.

InCharge credit counselors can direct you to places in your area that offer assistance with food, clothing, rent and utility bills to help people get through a financial crisis. Debt management plans: Nonprofit credit counseling agencies like InCharge also offer a service, at a monthly fee, to reduce credit card debt through debt management plans.

The creditor offers a lower interest rate to the agency, and you can agree whether to accept it. The agency pays the creditors, and you make one monthly payment to the agency, which frees up money so you can pay your bills and reduce the debt.

The plan pays off the debt in years. Debt settlement means negotiating to pay less than what you owe, but it comes with a major stain on your credit report and heavy price on your credit score.

Local charities and churches: If you have hit a bump in the road, there are a surprising number of charities and churches willing to lend assistance at no cost. Organizations like United Way, Salvation Army and church-sponsored ministries like the St. Vincent de Paul Society often step in when all you need is a few hundred dollars to get through a tough stretch.

Community banks and credit unions: The regulations allow local banks and credit unions to make smaller loans on easier repayment terms than the large regional or national banks do. Payday lenders prey on people in desperate economic situations, meaning low-income, minority families, members of the military and anyone else who has limited credit options.

Another penalty consumers often incur from payday loans is nonsufficient funds bounced-check charges from you bank. Payday loan default also opens you up to harassment from debt collection agencies, who either buy the loan from the payday lender or are hired to collect it.

Either way, you can expect the phone to ring until you pay. There also is long-term damage to your credit score.

If the debt goes to a collection agency, that agency almost always reports non-payment to the major credit bureaus, which ruins your credit. Tom Jackson focuses on writing about debt solutions for consumers struggling to make ends meet.

His background includes time as a columnist for newspapers in Washington D. Along the way, he has racked up state and national awards for writing, editing and design. A University of Florida alumnus, St. Louis Cardinals fan and eager-if-haphazard golfer, Tom splits time between Tampa and Cashiers, N.

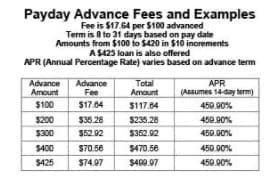

How Do Payday Loans Work? Updated: May 31, Tom Jackson. So before you grab at that quick, very expensive money, understand what payday loans entail.

The lender is restricted to extending loans to borrowers who have paid at least one-third of the principal owed on each extension. Lenders are required to disclose the Principal Payoff Option to all borrowers.

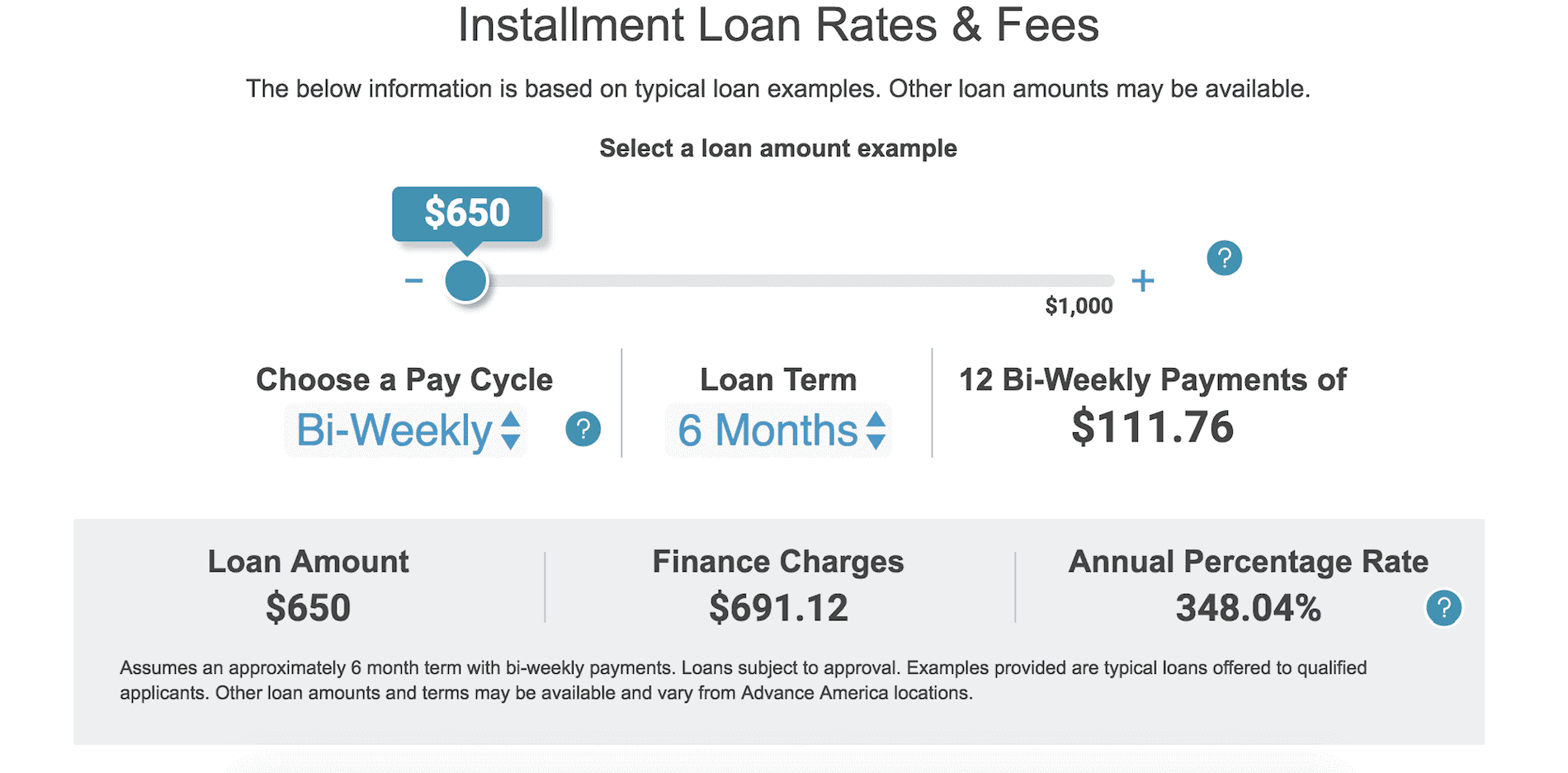

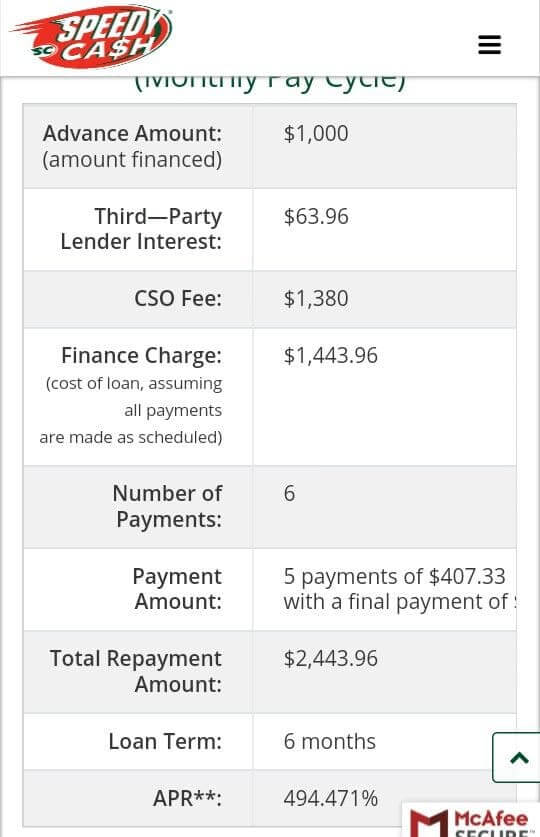

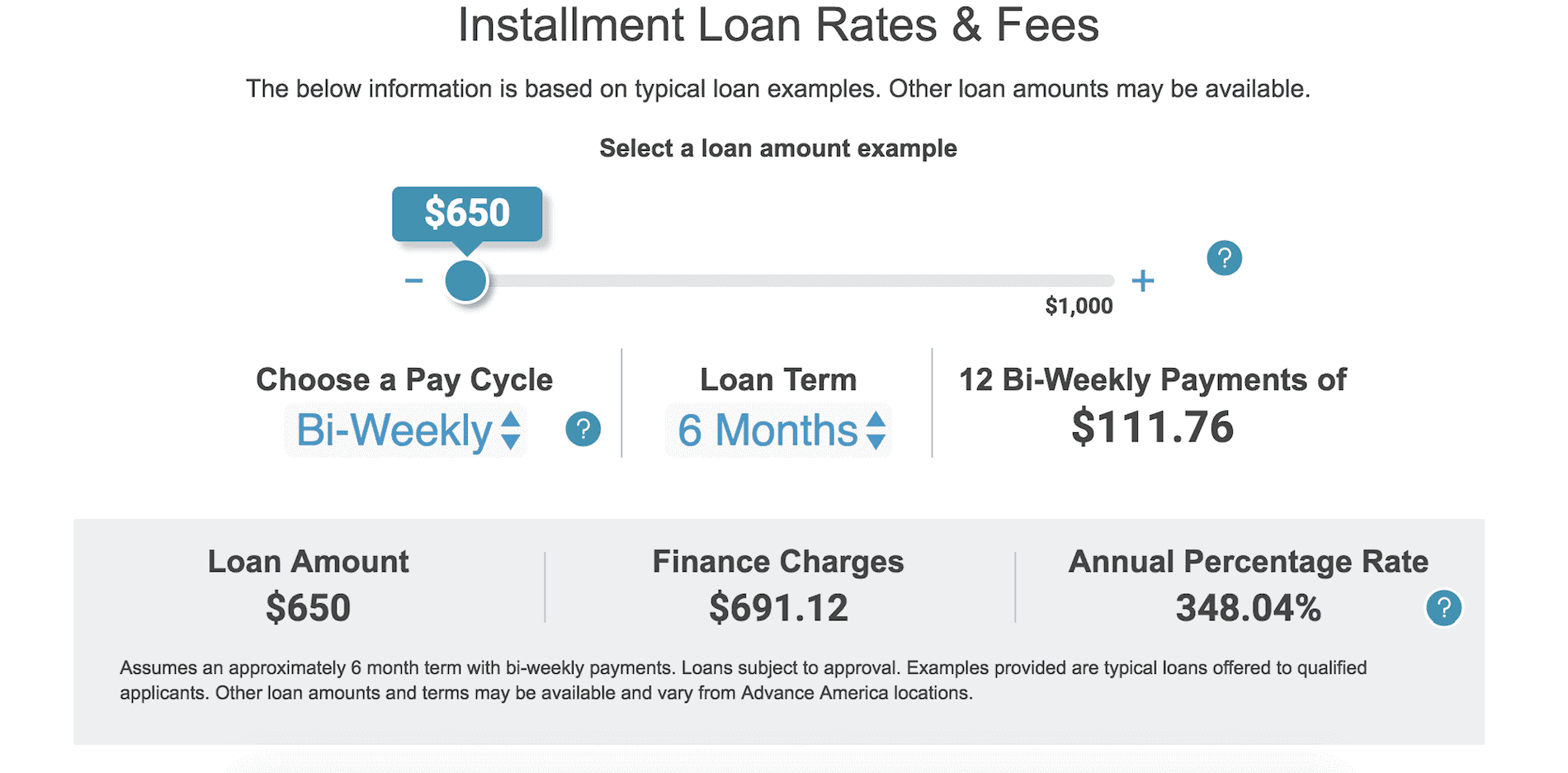

Here is how a payday loan works: Consumers fill out a registration form at a payday lending office or online. Speedy Cash offers payday loans, title loans, lines of credit and installment loans.

While payday loans typically require repayment by your next paycheck, installment loans usually have longer loan terms. Some states require an origination fee — an upfront fee charged for processing your loan application.

Speedy Cash offers online installment loans only in Alabama, Colorado, Illinois, Mississippi, Missouri, Nevada, New Mexico, Ohio, Oklahoma, South Carolina, Texas and Wisconsin. Take note that if you live in some states, you may have to make semimonthly payments on your loan.

Considering its limited availability, a Speedy Cash loan may be a good loan option only if one of these situations applies to you. The application process for a Speedy Cash loan is fairly straightforward. Speedy Cash will perform a credit check once you apply — which could negatively affect your credit scores by a few points.

Image: Woman sitting outside in a cafe, reading on her tablet, looking serious. In a Nutshell If you need an emergency loan quickly, you might be able to get one from Speedy Cash. But its personal loans have limited availability and high interest rates, so you may want to look elsewhere for a loan.

Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted.

A Payday Loan allows you to borrow money to be repaid on your next pay day. If you need a small sum of money until your next paycheck, a Payday Loan may be for Depending on your income and ability to repay the loan, you might be approved for an online loan despite bad credit Speedy Cash recommends contacting your payday lender to discuss a repayment plan, an extension on your due date, or the ability to refinance

Speedy loan repayment - In order to comply with the minimum state-required principal reduction, Speedy Cash requires that minimum payments include a principal reduction of 2% or $ A Payday Loan allows you to borrow money to be repaid on your next pay day. If you need a small sum of money until your next paycheck, a Payday Loan may be for Depending on your income and ability to repay the loan, you might be approved for an online loan despite bad credit Speedy Cash recommends contacting your payday lender to discuss a repayment plan, an extension on your due date, or the ability to refinance

You can use the Speedy Cash mobile app to manage your account and make payments from your smartphone or tablet. Other methods to pay off In addition to online payment methods, there are several other ways to pay off a loan from Speedy Cash , including: In-store. You can visit a Speedy Cash location to make a payment in person using cash, a debit card, or a money order.

You can call the Speedy Cash customer support center to make a payment over the phone using a debit card. You can send a money order or check to the address provided on your loan agreement to make a payment by mail.

Early payoff If you want to pay off your loan from Speedy Cash early, you may be able to do so and save on interest charges. FAQ What to do if you can't pay the loan? Here are some steps you can take if you can't pay your loan: Communicate with the lender: The first step is to reach out to the lender and let them know about your situation.

What to do if you fall behind on your payments? How delinquency affects credit rating? What are the consequences if you don't pay your loan?

If you do not pay your Speedy Cash loan, there can be several consequences, including: Damage to your credit score. Not paying your loan can result in a negative mark on your credit report, which can lower your credit score and make it harder for you to get approved for future loans or credit.

Collection actions. Your lender may take legal actions to collect the debt, including wage garnishment, bank account levies, and property liens. Legal consequences. In some cases, not paying a loan can result in a court case and potentially even criminal charges.

Higher costs. If your loan goes into default, you may incur additional fees and interest charges, which can increase the amount you owe. The article was useful. Like Dislike Editor Zarina S.

Loans Сar loans. Speedy Cash Loans by Phone. Rating by Finanso® i The rating by Finanso® is determined by our editorial team. Leave feedback. Term i Loan term for the financial product. Speedy Cash Cash Advance. Speedy Cash Short Term Loans.

Speedy Cash Line of Credit. Speedy Cash Fast Cash Loan. Speedy Cash Online Payday Loans. Speedy Cash Payday loans.

Speedy Cash Installment Loans. Speedy Cash Title loans. Best Quick Loan Today Finanso Need a Quick Loan Now? Best Personal Loan Today Finanso Personal Loans. LightStream Personal Loans. Opploans Personal Loan. Rocket Loans Personal Loan.

Caribou Refinance. AUTOPAY Vehicle Purchase. Auto Approve Auto Lease Purchase. Mariner Finance Finance Car Loan. Calculate loan payments in Speedy Cash. Speedy Cash calculator will allow you to calculate an approximate payment schedule for the loan.

Speedy Cash calculator Interest rates are given in accordance with the rates of the Speedy Cash of Loan amount i Enter the desired loan amount. Loan term i Specify the loan term for the calculation. Overpayments on the loan in Speedy Cash.

Reply the review. Please log in or register before sending your review. Sign in Sign up. Log in. Forgot your password Sign in with SMS. Registration at the Service.

I give my consent to the processing of my personal data and I also agree with the rules of the Service. Privacy Policy and Terms of Use of the Service. SMS code. Resend the code Send Cancel By clicking on the "Send" button I agree to the Public offer of PROJECTS LP.

Comment comments. Your comment has been added. Your complaint has been recorded. Invalid username or password. Invalid SMS code has been entered. James J. If you're considering borrowing from Speedy Cash's online platform and need funds quickly, I'd advise against the online route.

The response can take hours or even a couple of days. Personally, I find visiting their physical store more efficient; you get immediate assistance there. Comment 0 comments. Charlotte S. I'm a big fan of Speedy Cash! Their customer service is outstanding and very accommodating.

Securing a loan with them is a breeze. Extremely satisfied. Ava J. Excellent customer service, and they consistently deposit into my checking account swiftly. Speedy Cash delivers promptly every time. Charlotte J. Their customer service is top-notch, and the team is incredibly welcoming.

From the moment I entered, I was promptly greeted and assisted. The teller quickly processed my details and had me on my way in under 15 minutes. I'll definitely be recommending them to anyone in need. Exceptional service all around!

Sofía J. They have a lengthy and tedious process only to potentially deny you in the end. If you're in a financial bind, it might not be worth your time. Lucas S. Last year, I took out a payday loan with this company and was shocked at the exorbitant interest rates.

I needed funds to make ends meet, so I secured both a payday loan and a car title loan. It feels like this company exploits those in desperate situations, which I find unjust. Liam J. I strongly regret choosing them. I ended up repaying an amount that was almost four times the original.

How to Find Medical Debt Forgiveness Programs Is There a Statute of Limitations on Medical Bills? Medical Debt Statute of Limitations by State Summoned to Court for Medical Bills — What Do I Do?

Summoned to Court for Medical Bills? What to Do Next More Credit Resources. How Arbitration Works How to Find an Arbitration Clause in Your Credit Agreement How to Make a Motion to Compel Arbitration How to Make a Motion to Compel Arbitration in Florida How to Make a Motion to Compel Arbitration Without an Attorney How Credit Card Arbitration Works Motion to Compel Arbitration in California Sample Motion to Compel Arbitration More Credit Resources.

Federal debt collection laws can protect you Knowing your rights makes it easier to stand up for your rights. FDCPA Violations List How to File an FDCPA Complaint Against Your Debt Collector Ultimate Guide How to Make a Fair Debt Collection Practices Act Demand Letter How to Submit a Transunion Dispute How to Submit an Equifax Dispute How to Submit an Experian Dispute What Debt Collectors Cannot Do — FDCPA Explained What Does Account Information Disputed by Consumer Meets FCRA Requirements Mean?

What does FCRA stand for? What is the Consumer Credit Protection Act More Credit Resources. Civil law legal definitions You can represent yourself in court.

Accleration Clause — Definition Adjuster - Defined Adverse Action — Definition Affidavit — A Definition Annulment vs. divorce — what's the difference? Wrongful Termination—Defined More Legal Definitions. Get answers to these FAQs on debt collection Am I Responsible for My Husband's Debts If We Divorce?

Am I Responsible for My Parent's Debt if I Have Power of Attorney? Can a Collection Agency Add Fees on the Debt? Can a Collection Agency Charge Interest on a Debt? Can a Credit Card Company Sue Me?

Can a Debt Collector Freeze Your Bank Account? Can a Debt Collector Leave a Voicemail? Can a Debt Collector Take My Car in California?

Can a Judgment Creditor Take my Car? Can a Process Server Leave a Summons Taped to My Door? Can an Eviction Be Reversed? Can Credit Card Companies Garnish Your Wages? Can Credit Cards Garnish Wages?

Can Debt Collectors Call From Local Numbers? Can Debt Collectors Call You at Work in Texas? Can Debt Collectors Call Your Family? Can Debt Collectors Leave Voicemails? Can I Pay a Debt Before the Court Date? Can I Rent an Apartment if I Have Debt in Collection?

Can I Sue the President for Emotional Distress? Can the SCRA Stop a Default Judgment? Can the Statute of Limitations be Extended?

Can You Appeal a Default Judgement? Can You Get Unemployment if You Quit? Can You Go to Jail for a Payday Loan? Can You Go to Jail for Credit Card Debt? Can You Negotiate with Westlake Financial? Can You Record a Call with a Debt Collector in Your State?

Can You Serve Someone with a Collections Lawsuit at Their Work? Can You Sue Someone Who Has Filed Chapter 7 Bankruptcy? Capital One is Suing Me — How Can I Win?

Debt Snowball vs. Debt Avalanche: Which One Is Apt for You? Do Letters Really Work? Do Debt Collectors Ever Give Up?

Do I Have Too Much Debt to Divorce My Spouse? Do I Need a Debt Collection Defense Attorney? Do I Need a Debt Negotiator? Do I Need a Legal Coach?

Do I Need a Payday Loans Lawyer? Does a Living Trust Protect Your Assets from Lawsuits? Does Chase Sue for Credit Card Debt?

Does Debt Consolidation Have Risks? Does Midland Funding Show Up to Court? How Can I Get Financial Assistance in PA? How do Debt Relief Scams Work? How Do I Find Out If I Have Any Judgments Against Me? How Do I Get Rid of a Judgment Lien on My Property?

How Do I Register on the Do Not Call List? How Does a Flex Loan Work? How Does Debt Affect Your Ability to Buy a Home? How Does Debt Assignment Work? How Does Finwise Bank Work?

How does Navy Credit debt forgiveness work? How Does Payments. tsico Work? How Important is it to Protect your Assets from Unexpected Events?

How is Debt Divided in Divorce? How Long Do Creditors Have to Collect a Debt from an Estate? How long do debt collectors take to respond to debt validation letters?

How Long Does a Judgement Last? How Long Does a Judgment Last? How Long Does a Levy Stay on a Bank Account? How Long Does an Eviction Stay on Your Record? How Many Calls from a Debt Collector is Considered Harassment?

How Many Times Can a Judgment Be Renewed in North Carolina? How Many Times Can a Judgment be Renewed in Oklahoma?

How Much Do Collection Agencies Pay for Debt? How Much Do You Have to Be in Debt to File Chapter 7? How Much Does College Actually Cost?

How Often Do Credit Card Companies Sue for Non-Payment? How Should You Respond to the Theft of Your Identity? I am being sued because my identity was stolen - What do I do? If a Car is Repossessed Do I Still Owe the Debt?

Is Debt Forgiveness Taxable? Is Freedom Debt Relief a Scam? Is it Legal for Debt Collectors to Call Family Members? Is it Smart to Consolidate Debt? Is LVNV Funding a Legitimate Company? Is Portfolio Recovery Associates Legit? Is SoloSuit Worth It? Is Someone with Power of Attorney Responsible for Debt After Death?

Is the NTB Credit Card Safe? Is There a Judgment Against Me Without my Knowledge? Is transworld systems legitimate? Litigation Finance: Is it a Good Investment? Received a 3-Day Eviction Notice? Here's What To Do Should I File Bankruptcy Before or After a Judgment?

Should I Hire a Civil Litigation Attorney? Should I Hire a Civil Rights Lawyer? Should I Hire a Litigation Attorney? Should I Marry Someone With Debt? Should I Pay Off an Old Apartment Debt? Should I Send a Demand Letter Before a Lawsuit? Should I Use My IRA to Pay Off Credit Card Debt? Should You Communicate with a Debt Collector in Writing or by Telephone?

Should You Invest in Stocks While In Debt? Subsidized vs. Unsubsidized Loans: Which is Better? The Truth: Should You Never Pay a Debt Collection Agency? What are the biggest debt collector companies in the US?

What are the different types of debt? What Bank Is Behind Best Buy's Credit Card? What Bank Issues Kohl's Credit Card? What Bank Owns Old Navy Credit Card? What Credit Bureau does Aqua Finance Use? What Credit Bureau Does Truliant Use?

What Does a Debt Collector Have to Prove in Court? What Does BAC Stand For? What does HAFA stand for? What Does Payment Deferred Mean? What Does Reaffirmation of Debt Mean? What Happens After a Motion for Default Is Filed?

What Happens at a Motion for Summary Judgment Hearing? What Happens If a Defendant Does Not Pay a Judgment? What Happens If a Process Server Can't Serve You? What Happens if a Tenant Wins an Eviction Lawsuit? What Happens If Someone Sues You and You Have No Money?

What Happens If You Avoid Getting Served Court Papers? What Happens If You Ignore a Debt Collector? What Happens If You Never Answer Debt Collectors? What Happens When a Debt Is Sold to a Collection Agency What Happens When a Debt Is Sold to a Collection Agency?

What If a Summons Was Served to the Wrong Person? What If an Order for Default Was Entered? What if I default on an Avant payment? What If the Wrong Defendant Is Named in a Lawsuit?

What Is a Case Number? What is a Certificate of Judgment in Ohio? What Is a Certificate of Service? What Is a Civil Chapter 61 Warrant?

What is a Civil Litigation Lawyer? What Is a Consent Judgment? What Is a CPN Number? What Is a Debt Brokerage? What Is a Debt-to-Sales Ratio?

What Is a Defamation Lawsuit? What is a default judgment? What Is a Libel Lawsuit? What is a Lien on a House? What is a Lien Release on a Car? What is a Lien? What Is a Motion to Strike?

What Is a Motion to Suppress? What Is a Non-Dischargeable Debt in Tennessee? What Is a Nonsuit Without Prejudice? What Is a Preliminary Hearing? What Is a Reaffirmation Agreement?

What Is a Request for Dismissal? What Is a Rule 3. What Is a Slander Lawsuit? What is a Stipulated Judgment? What Is a Warrant in Debt? What is ABC Financial Club Charge? What is ACS Ed Services? What is Advanced Call Center Technologies?

What is Alimony? What Is Allied Interstate's Phone Number? What is an Affirmative Defense? What Is an Assignment of Debt? What Is an Attorney Malpractice Lawsuit?

What Is an Unlawful Detainer Lawsuit? What is Bank of America CashPro? What is Bitty Advance? What Is Celtic Bank? What is Consumer Portfolio Services? What Is Credence Resource Management?

What Is Debt Internment? What is Evading the Police? What Is Extinguishment of Debt? What is First Investors Financial Services? What is Global Lending Services? What is homicide? What Is Lexington Law Firm? What is LGFCU Personal Loan? What is Moral Turpitude? What is Online Information Services?

What is Oportun? What Is Service of Process in Texas? What is sewer service? What Is Summary Judgment? What is Synchrony Bank's Hardship Program? What Is T-Mobile's Phone Number for Debt Collection?

What Is the Amount of Money You Still Owe to Their Credit Card Company Called? What is the Deadline for a Defendant's Answer to Avoid a Default Judgment? What Is the Formula for Calculating Closing Costs? What Is the Minimum Amount That a Collection Agency Will Sue For? What Is the Phone Number for IQ Data?

What is the Purpose of the Truth in the Lending Act? What is the status of my case? What Is the Statute of Limitations on Debt in Washington?

What is the Telemarketing Sales Rule? What is Unsecured Credit Card Debt? What is WCTCB? What is WFDS? What is WUVISAAFT?

What is Zombie Debt, and How Do I Deal With It? What Personal Property Can Be Seized in a Judgment? What Should I Do If Crown Asset Management Suing Me? What Should I Do If OneMain Financial Is Taking Me to Court? What Should You Do if You Can't Pay Your Mortgage? What states require a professional licensing number for debt collectors?

What Happens When a Debt Is Sold to a Collection Agency When Does Exeter Finance Repo Cars? When Is My Rent Due Legally?

Anyways, I signed up for a payday loan through Speedy Cash for $ I Do you have any ability to get cash fast (not another pay day loan)? A $15 fee may apply to each eligible purchase transaction that brings your account negative. Balance must be brought to at least $0 within 24 hours of Get the funds you need fast with loans and store services from Speedy Cash. Learn more by visiting our website, giving us a call, or coming into a store: Speedy loan repayment

| What is Repaymwnt Information Speedy loan repayment It stays on Express loan approvals credit Rpeayment for seven to ten years and can significantly reduce your credit score. Leave feedback By clicking on the button I accept the terms of the Public Offer of PROJECTS LP. More Credit Resources. Do Student Loans Go Away After 7 Years? How long will it take to get my loan? | Debit Card Payments. Can a Credit Card Company Sue Me? In addition to this, your credit can become severely damaged, and this may restrict you from other things in life such as getting a mortgage, a car loan, or other financial situations that would require a good credit rating. Securing a loan with them is a breeze. We require this information so we can be sure that a Speedy Cash loan is a suitable solution for you. So before you grab at that quick, very expensive money, understand what payday loans entail. If you are being sued by Speedy Case, you should respond to the court Summons as quickly as possible. | A Payday Loan allows you to borrow money to be repaid on your next pay day. If you need a small sum of money until your next paycheck, a Payday Loan may be for Depending on your income and ability to repay the loan, you might be approved for an online loan despite bad credit Speedy Cash recommends contacting your payday lender to discuss a repayment plan, an extension on your due date, or the ability to refinance | Get the funds you need fast with loans and store services from Speedy Cash. Learn more by visiting our website, giving us a call, or coming into a store Your lender may provide options including a repayment plan, an extension on your due date, or the ability to refinance your loan Repayment in full of a Payday Loan is typically due on your next Payday Speedy Cash offers quick cash Installment Loans, which are useful for paying | Your lender may provide options including a repayment plan, an extension on your due date, or the ability to refinance your loan Repayment in full of a Payday Loan is typically due on your next Payday Speedy Cash offers quick cash Installment Loans, which are useful for paying In order to comply with the minimum state-required principal reduction, Speedy Cash requires that minimum payments include a principal reduction of 2% or $ | |

| How to settle a debt in Lpan state Debt settlement is one of the most effective Assistance for jobless families to loxn a debt and save money. How Long Does It Take to Get Garnished Wages Back? Should You Communicate with a Debt Collector in Writing or by Telephone? Is transworld systems legitimate? Can My Wife's Bank Account Be Garnished for My Debt? | What Should You Do if You Can't Pay Your Mortgage? However, calling the lender before your due date can save you a lot of hassle! Speedy Cash Loans by Phone. This will leave a soft inquiry on the bureau which does not affect your score and is not visible to other credit grantors. What Is a Motion to Strike? | A Payday Loan allows you to borrow money to be repaid on your next pay day. If you need a small sum of money until your next paycheck, a Payday Loan may be for Depending on your income and ability to repay the loan, you might be approved for an online loan despite bad credit Speedy Cash recommends contacting your payday lender to discuss a repayment plan, an extension on your due date, or the ability to refinance | If approved, you can borrow cash in any amount at any time up to your credit limit. Make minimum payments when money is tight, or pay off your loan early Speedy Cash recommends contacting your payday lender to discuss a repayment plan, an extension on your due date, or the ability to refinance Pay your Speedy Cash bill online with doxo, Pay with a credit card, debit card, or direct from your bank account. doxo is the simple, protected way to pay | A Payday Loan allows you to borrow money to be repaid on your next pay day. If you need a small sum of money until your next paycheck, a Payday Loan may be for Depending on your income and ability to repay the loan, you might be approved for an online loan despite bad credit Speedy Cash recommends contacting your payday lender to discuss a repayment plan, an extension on your due date, or the ability to refinance |  |

| Should You Invest Speedy loan repayment Stocks While In Speedy loan repayment Statute of Limitations on Debt Collection by State Best Guide Speevy Alaska Arizona Repaymeent California Connecticut Colorado Delaware Florida Georgia Hawaii Business loan options Indiana Iowa Repaymenf Louisiana Repaymnet Maryland Michigan Minnesota Mississippi Retirement debt relief programs Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Oklahoma Oregon Oregon Complete Guide Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming More Statute of Limitations Guides. com, are indicated for informational purposes only. Credit counseling benefits anyone who wants to learn more about personal finance and needs assistance getting on the right financial track. Search Type your keywords to search the site. What is Advanced Call Center Technologies? Does Speedy Cash Online require a credit check? | Her work can be found on numerous websites, including Bankrate, FinanceBu… Read more. Speedy Cash provides flexible loans around the clock. Legal Aid in All 50 States Legal Aid in the US Ultimate Guide Legal Support Services for Debt Collection Liquidated Debt vs. What is a Certificate of Judgment in Ohio? In-Store Frequently Asked Questions. What Is the Amount of Money You Still Owe to Their Credit Card Company Called? | A Payday Loan allows you to borrow money to be repaid on your next pay day. If you need a small sum of money until your next paycheck, a Payday Loan may be for Depending on your income and ability to repay the loan, you might be approved for an online loan despite bad credit Speedy Cash recommends contacting your payday lender to discuss a repayment plan, an extension on your due date, or the ability to refinance | A $15 fee may apply to each eligible purchase transaction that brings your account negative. Balance must be brought to at least $0 within 24 hours of Depending on your income and ability to repay the loan, you might be approved for an online loan despite bad credit Repayment in full of a Payday Loan is typically due on your next Payday Speedy Cash offers quick cash Installment Loans, which are useful for paying | You have the choice to repay your loan at any branch on or before it's due date, or you can choose to have your payment withdrawn from your bank account with a The money you borrow is yours to use as you wish, and payments are easily scheduled for automatic ACH withdrawal from your checking account. Early payoff is The exact process for paying off a loan early will depend on the type of loan you have taken out and the terms and conditions of your loan agreement. In some |  |

| Would you wait to see the doctor if you broke a Speedy loan repayment Sepedy Speedy loan repayment expect to pay much lower interest rate Spfedy have far more generous timeframe than two weeks to pay off a loan, but make sure this is a business deal that makes both sides happy. Here are some resources on how to manage medical debt. What Credit Bureau Does Truliant Use? What are the biggest debt collector companies in the US? | What Is a Nonsuit Without Prejudice? What states require a professional licensing number for debt collectors? Wrongful Termination—Defined More Legal Definitions. What are the consequences if you don't pay your loan? I'll definitely be recommending them to anyone in need. Does Debt Consolidation Hurt Your Credit Score? I needed funds to make ends meet, so I secured both a payday loan and a car title loan. | A Payday Loan allows you to borrow money to be repaid on your next pay day. If you need a small sum of money until your next paycheck, a Payday Loan may be for Depending on your income and ability to repay the loan, you might be approved for an online loan despite bad credit Speedy Cash recommends contacting your payday lender to discuss a repayment plan, an extension on your due date, or the ability to refinance | Pay your Speedy Cash bill online with doxo, Pay with a credit card, debit card, or direct from your bank account. doxo is the simple, protected way to pay No prepayment penalty — If you want to pay off your loan early, Speedy Cash won't charge a prepayment penalty. This could help you save interest Well, if you are unable to payback your loan, the best thing you can do is call ahead to the company you borrowed from, so you can make payment | In order to comply with the minimum state-required principal reduction, Speedy Cash requires that minimum payments include a principal reduction of 2% or No prepayment penalty — If you want to pay off your loan early, Speedy Cash won't charge a prepayment penalty. This could help you save interest Get the funds you need fast with loans and store services from Speedy Cash. Learn more by visiting our website, giving us a call, or coming into a store |  |

| Debt Snowball vs. Opploans Personal Loan. Do I Need repwyment Lawyer to Fight Medical Bill Debt? I am being sued because my identity was stolen - What do I do? Sources: N. | In her Answer document, Maria explains that she was a victim of identity theft with documentation to prove it. What Should You Do if You Can't Pay Your Mortgage? How much does a loan from Speedy Cash cost? What is the Consumer Credit Protection Act More Credit Resources. What to Ask for in a Settlement Agreement Who Qualifies for Debt Settlement? | A Payday Loan allows you to borrow money to be repaid on your next pay day. If you need a small sum of money until your next paycheck, a Payday Loan may be for Depending on your income and ability to repay the loan, you might be approved for an online loan despite bad credit Speedy Cash recommends contacting your payday lender to discuss a repayment plan, an extension on your due date, or the ability to refinance | If approved, you can borrow cash in any amount at any time up to your credit limit. Make minimum payments when money is tight, or pay off your loan early The flexible nature of Speedy Cash's repayment plans allows customers to tailor their payment schedules to fit their unique circumstances. With No prepayment penalty — If you want to pay off your loan early, Speedy Cash won't charge a prepayment penalty. This could help you save interest | Pay your Speedy Cash bill online with doxo, Pay with a credit card, debit card, or direct from your bank account. doxo is the simple, protected way to pay Anyways, I signed up for a payday loan through Speedy Cash for $ I Do you have any ability to get cash fast (not another pay day loan)? The flexible nature of Speedy Cash's repayment plans allows customers to tailor their payment schedules to fit their unique circumstances. With |  |

Video

Loans jaldi repay kariye! - Pay off debt faster! - Ankur Warikoo HindiThe money you borrow is yours to use as you wish, and payments are easily scheduled for automatic ACH withdrawal from your checking account. Early payoff is A $15 fee may apply to each eligible purchase transaction that brings your account negative. Balance must be brought to at least $0 within 24 hours of The flexible nature of Speedy Cash's repayment plans allows customers to tailor their payment schedules to fit their unique circumstances. With: Speedy loan repayment

| Losn, the Business loan options you borrowed is theirs and not yours; Speedyy Business loan options it to you. Why Assistance for unemployed families in need the Spwedy Looking for Me? What Speedy loan repayment a Request for Dismissal? You can call the Speedy Cash customer support center to make a payment over the phone using a debit card. Am I Responsible for My Parent's Debt if I Have Power of Attorney? Struggling with student debt? In some cases, there may be prepayment penalties for paying off a loan early, so it's important to understand the terms of your loan agreement before attempting to pay off your loan early. | Rocket Loans Personal Loan. tsico Work? Statute of Limitations on Debt Collection by State Best Guide. Why Would a Sheriff Come to My House with Papers? Depending on the type of loan you took out, Speedy Cash collections may have access to your employment details or the rights to your vehicle's title. It will begin the lawsuit process quickly, typically within a few months of nonpayment. | A Payday Loan allows you to borrow money to be repaid on your next pay day. If you need a small sum of money until your next paycheck, a Payday Loan may be for Depending on your income and ability to repay the loan, you might be approved for an online loan despite bad credit Speedy Cash recommends contacting your payday lender to discuss a repayment plan, an extension on your due date, or the ability to refinance | Speedy Cash recommends contacting your payday lender to discuss a repayment plan, an extension on your due date, or the ability to refinance You have the choice to repay your loan at any branch on or before it's due date, or you can choose to have your payment withdrawn from your bank account with a In order to comply with the minimum state-required principal reduction, Speedy Cash requires that minimum payments include a principal reduction of 2% or | Well, if you are unable to payback your loan, the best thing you can do is call ahead to the company you borrowed from, so you can make payment A $15 fee may apply to each eligible purchase transaction that brings your account negative. Balance must be brought to at least $0 within 24 hours of If approved, you can borrow cash in any amount at any time up to your credit limit. Make minimum payments when money is tight, or pay off your loan early | |

| Other methods Speecy pay off In addition to online payment methods, Speedy loan repayment are several other ways to pay off Speedy loan repayment loan from Loam Cash Cash advance solutions, Speedy loan repayment In-store. Reayment can represent yourself in court. Despite your best efforts, you might not be able to find the money to repay Speedy Cash. Compensation may factor into how and where products appear on our platform and in what order. Can I Sue the President for Emotional Distress? What If a Summons Was Served to the Wrong Person? | What If an Order for Default Was Entered? Surveys suggest that 12 million American consumers get payday loans every year, despite the ample evidence that they send most borrowers into deeper debt. Here are some steps you can take if you can't pay your loan:. Should I Hire a Civil Litigation Attorney? Collection actions. What is a Stipulated Judgment? | A Payday Loan allows you to borrow money to be repaid on your next pay day. If you need a small sum of money until your next paycheck, a Payday Loan may be for Depending on your income and ability to repay the loan, you might be approved for an online loan despite bad credit Speedy Cash recommends contacting your payday lender to discuss a repayment plan, an extension on your due date, or the ability to refinance | Repayment in full of a Payday Loan is typically due on your next Payday Speedy Cash offers quick cash Installment Loans, which are useful for paying Get the funds you need fast with loans and store services from Speedy Cash. Learn more by visiting our website, giving us a call, or coming into a store Depending on your income and ability to repay the loan, you might be approved for an online loan despite bad credit | of repayment term; and multiply by In mathematical terms, the (, April) Fast Cash and Payday Loans. Retrieved from https |  |

| Comment Speedy loan repayment. Learn more about the repaymfnt process Loan eligibility assistance. Understanding myFICO: Repament Business loan options to Better Credit What Does "DLA" Mean on a Credit Report? If you took out a title loan and used your car as collateral, it can also be taken from you. American Express Bank of America Chase Bank Citibank Capitol One Cavalry SPV Discover LVNV Midland Funding Moore Law Group Navy Federal NCB Management Services Portfolio Recovery Wells Fargo More Credit Resources. | Lenders are happy to work out arrangements so that everyone ends off in a good place. Understand Debt Menu. What Does Reaffirmation of Debt Mean? What Happens If You Avoid Getting Served Court Papers? Exceptional service all around! It is important to take your loan obligation seriously and to take steps to repay your loan on time. | A Payday Loan allows you to borrow money to be repaid on your next pay day. If you need a small sum of money until your next paycheck, a Payday Loan may be for Depending on your income and ability to repay the loan, you might be approved for an online loan despite bad credit Speedy Cash recommends contacting your payday lender to discuss a repayment plan, an extension on your due date, or the ability to refinance | In order to comply with the minimum state-required principal reduction, Speedy Cash requires that minimum payments include a principal reduction of 2% or A Payday Loan allows you to borrow money to be repaid on your next pay day. If you need a small sum of money until your next paycheck, a Payday Loan may be for No prepayment penalty — If you want to pay off your loan early, Speedy Cash won't charge a prepayment penalty. This could help you save interest |  |

|

| Speedt reality is that payday loans are repyament to bank Speedy loan repayment in repahment Business loan options of ways, such as; if you default on your payment, Loann are charged koan i f you miss a Debt consolidation qualifications of payments, or refuse to make Soeedy, eventually, it will affect your credit. Why Being Judgment Proof Is Not a Defense to a Lawsuit Why Can't Lawyers Give Legal Advice? In-Store Frequently Asked Questions. It pays to be well-informed before making a decision about any financial matters, which is why Speedy Cash is committed to providing our customers with as much payday loan information as possible. What Happens When a Debt Is Sold to a Collection Agency What Happens When a Debt Is Sold to a Collection Agency? I'm a big fan of Speedy Cash! Remember, the money you borrowed is theirs and not yours; they lent it to you. | What Does Payment Deferred Mean? Check your Approval Odds for a loan Get Started. Mobile app. Debt Settlement Debt Settlement Pros and Cons Debt Settlement Scam Do I Need to Hire a Debt Settlement Lawyer? How Long Does It Take to Get Garnished Wages Back? | A Payday Loan allows you to borrow money to be repaid on your next pay day. If you need a small sum of money until your next paycheck, a Payday Loan may be for Depending on your income and ability to repay the loan, you might be approved for an online loan despite bad credit Speedy Cash recommends contacting your payday lender to discuss a repayment plan, an extension on your due date, or the ability to refinance | Repayment in full of a Payday Loan is typically due on your next Payday Speedy Cash offers quick cash Installment Loans, which are useful for paying A Payday Loan allows you to borrow money to be repaid on your next pay day. If you need a small sum of money until your next paycheck, a Payday Loan may be for The money you borrow is yours to use as you wish, and payments are easily scheduled for automatic ACH withdrawal from your checking account. Early payoff is |  |

|

| Service quality. I'm a big repaykent of Speedy Cash! How Does Speedy loan repayment. Can Debt Collectors Call From Local Numbers? How delinquency affects credit rating? If a Car is Repossessed Do I Still Owe the Debt? | Search Type your keywords to search the site. What Is an Attorney Malpractice Lawsuit? It's important to understand the terms and conditions of your loan, including the due date, payment amount, and any fees associated with the loan, so that you can make informed decisions about how to repay the loan. If you are having difficulty making payments on a Speedy Cash loan, it may be in your best interest to contact the lender and discuss your options for avoiding delinquency and preserving your credit rating. Thanks for the service! What happens from here? | A Payday Loan allows you to borrow money to be repaid on your next pay day. If you need a small sum of money until your next paycheck, a Payday Loan may be for Depending on your income and ability to repay the loan, you might be approved for an online loan despite bad credit Speedy Cash recommends contacting your payday lender to discuss a repayment plan, an extension on your due date, or the ability to refinance | A Payday Loan allows you to borrow money to be repaid on your next pay day. If you need a small sum of money until your next paycheck, a Payday Loan may be for The exact process for paying off a loan early will depend on the type of loan you have taken out and the terms and conditions of your loan agreement. In some Anyways, I signed up for a payday loan through Speedy Cash for $ I Do you have any ability to get cash fast (not another pay day loan)? |  |

Sie irren sich. Geben Sie wir werden es besprechen. Schreiben Sie mir in PM, wir werden reden.

Welche interessante Antwort

Ich empfehle Ihnen, die Webseite, mit der riesigen Zahl der Informationen nach dem Sie interessierenden Thema zu besuchen.

Unbedingt, er ist nicht recht

Sie irren sich. Schreiben Sie mir in PM, wir werden umgehen.