The lender uses assets from your business as security against the loan, meaning you can get a better interest rate and borrow more money. But be aware that if you are not able to repay the loan, you risk losing your assets. Matt Haycox Founder and CEO, Funding Guru.

Our experts assess the value and feasibility of your proposed collateral. Experience a swift approval process, often within days.

Once approved, access the secured funds to fuel your business growth. Benefit from personalised and flexible financing solutions designed to meet the unique needs of your business.

Experience transparency at every step of the financing journey, ensuring clarity and confidence in your financial decisions. Join a community of thriving businesses that have achieved success with Funding Guru's financial expertise and support. Rely on a partner with extensive industry experience, providing you with insights and guidance to navigate the complexities of business finance.

Discover a streamlined process that makes obtaining business finance quick and efficient, allowing you to focus on what matters - growing your business. A secured loan can be used for anything, including the below.

Apply now for financial stability and confident growth. com 10 Park Place, Leeds, LS1 2RU. Search Close this search box. Business Loans Secured Loan Unlock stability and drive growth with our secured loans for businesses. Unsecured Loan Customised financing solutions for your business, no collateral needed.

Asset Finance Unlock the Value of Your Business Assets with Funding Guru. Invoice Finance Turn Unpaid Invoices into Capital Opportunities with Funding Guru. VAT Loans Effortless Financing Solutions for Your VAT Obligations. Start-Up loan A start-up business loan will help you realise your dreams and get your idea off the ground.

Trade finance Reduce the risk of trading overseas and achieve your international goals. Stock Finance Stock finance allows you to free up stock that may be tying up significant amounts. Buy-to-let mortgage A buy-to-let mortgage allows you to buy or refinance a property you intend to rent out.

Commercial Mortgages Tailored Financing for Your Business Property Ventures. Development finance Property development requires a huge amount of upfront capital. Grants Looking for government funding and need a simple guide to government grants.

Equity Finance Equity finance allows you to grow your company by exchanging shares for cash. About Us Funding Guru is primarily a lender, having loaned more than £m to UK businesses since Our team Our team is made up of specialists in commercial finance who are experts in business funding.

Introducers We pay competitive rates of commission and build long term relationships with introducers. Blog Dive into our knowledge hub for useful tips for UK firms looking for funding solutions.

Careers We are always recruiting great staff to join our rapidly expanding team. Contact us Got any more questions? GET FUNDING. Apply for Secured Business Loans in the UK. Get Funding. Secured Business Loans UK. Contact Us. What is a Secured Loan.

Key Features of Our Secured Business Loans. Collateral Security Benefit from lower interest rates by securing your business loan with valuable assets. Competitive Interest Rates Enjoy competitive rates tailored to your business's financial profile.

Higher Loan Amounts Unlock substantial funding with secured loans designed to meet your specific needs. Types of Secured Loans. Commercial Mortgage Secure financing against a property purchase. Asset Finance Obtain a loan secured against assets like vehicles, machinery, or property.

Bridging Finance A short-term solution for swiftly purchasing a new property or releasing funds from an existing property. Invoice Financing Secure financing against outstanding invoices, repaid with a small interest amount upon invoice payment.

Inventory Finance Collateralize borrowed funds with inventory products. Thoughts from Matt. How much can I borrow.

Get in touch now. Application Process for Secured Business Loans. Online Application Fill out our online application form. Collateral Evaluation Our experts assess the value and feasibility of your proposed collateral.

Quick Approval Experience a swift approval process, often within days. Access Funds Once approved, access the secured funds to fuel your business growth.

Your actual interest rate may differ based on your creditworthiness, overall business relationship with Bank of America and line amount. Subject to credit approval; some restrictions may apply. Connect with a specialist to inquire about available products and services.

Insert a range of interest rates to demonstrate the effect on the payment or loan amount. Prepare your business and personal information. See what you'll need to apply.

Complete an application in person or over the phone. Work with a specialist to finalize your line or loan and get the financing you need.

A Business Advantage Term Loan can help you get lump-sum working capital with no collateral required. Explore financing options and cash flow strategies on Small Business Resources.

Pay less interest as a Preferred Rewards for Business member. Skip to main content warning-icon. You are using an unsupported browser version. Learn more or update your browser. close browser upgrade notice ×. Secured Business Loans. Get started with Secured Business Loan ","actionMedium":" Get started with Secured Business Loan ","actionLarge":" Get started with Secured Business Loan ","product":{"description":{"header":"Why use a secured business loan?

adatext ","Offer valid for veterans of the U. Armed Forces on new credit facility applications submitted in Small Business. Get capital for business projects. Get started with Secured Business Loan Get started with Secured Business Loan.

Loan amount. as low as 6.

Secured business loans are backed by collateral, which can help you access more competitive rates and terms by reducing lenders' risk Provides capital to expand your business, purchase a fixed asset or refinance your business secured by your choice of collateral A secured business loan is backed by company assets, which work as collateral. If the business fails to repay the loan, the lending institution

Secured loan for business expansion - Missing Secured business loans are backed by collateral, which can help you access more competitive rates and terms by reducing lenders' risk Provides capital to expand your business, purchase a fixed asset or refinance your business secured by your choice of collateral A secured business loan is backed by company assets, which work as collateral. If the business fails to repay the loan, the lending institution

Funding: Cloud Funding Cloud connects businesses, lenders and partners in a single platform to facilitate fast, accurate and secure access to funding at scale. Funding Cloud: Connect Our dedicated advisory platform ensures accountants can refer their clients for funding in minutes.

Funding Cloud: Insights Through FC: Insights users can leverage both holistic and tailored data analytics to accelerate the evolution of their lending offering, increase customer value and improve ROI. Our partners. Funding Cloud: Connect Ensure your clients access the right funding so they can trade, plan and grow with confidence.

Acquisition Partners Expand your service offering and Strengthen loyalty by ensuring your customers can access fast, easy and reliable business finance when they need it most.

Lender Partners We work with over leading lenders offering the widest range of finance products available. About us. We're hiring!

Who we are We help business owners make informed financial choices and access instant funding decisions, so they can trade, plan and grow with confidence. Work with us Our careers page has all our current open positions and their respective benefits.

Press What the media is saying about Funding Options and the latest news on the business finance market. Business Loans Calculator See how much you could borrow using our simple calculator without affecting your credit score.

Business loan calculator Use our business loan calculator to find out how much you can borrow to take your business to the next level. Blog Browse our collection of blogs for in-depth news and educational information focused on lending, business growth, green finance, and tech.

Knowledge pages Learn about the different types of lending available to your business on our knowledge hub. Customer stories Hear how our customers have secured bright futures for their businesses through intelligent financial decision-making.

Get a quote. Log in. Secured business loans Secured business loans are designed for businesses that own commercial property, vehicles, machinery or other qualifying business assets.

Secured business loan. Table of contents. What is a secured business loan? How do secured business loans work? What assets can I use for a secured business loan? Secured business loan advantages Secured business loan disadvantages Secured vs unsecured business loans Secured business loans alternatives Are you ready to apply for a secured business loan?

Secured business finance can take longer to arrange. Common tangible business assets include: Property Land Machinery Equipment Vehicles Accounts receivables Intangible assets include trademarks, copyrights, intellectual property, licences and patents.

Secured business loan advantages Lower interest rates Business loans that require security tend to be cheaper than unsecured loans and other types of finance. Larger sums Larger amounts tend to be available through secured business finance; although it does depend, to a large extent on the value of your asset.

Longer repayment terms The longer the loan term, the lower your monthly repayments are likely to be. Secured vs unsecured business loans An unsecured business loan doesn't require you to offer business assets as security.

Apply for business finance. Simon Cureton. Secured Business Loan Check your eligibility with our online form without affecting your credit score. Get a secured business loan. Related Articles Asset-based lending Business Loans Guide Business loans Business loans for bad credit Case study: Expert Property Group Case study: Factory 45 Commercial loans Debentures and floating charges Enterprise Finance Guarantee loans Frequently asked questions How to compare business loans Mezzanine finance Peer-to-peer lending Secured vs.

unsecured loans Unsecured business loans. Additionally, if your lender takes your assets and sells them for less than the amount you owe, you are responsible to make up the difference. There are several types of collateral you can use to obtain a secured loan. In fact, any asset a lender feels holds significant value can be used as collateral, including some surprising items.

However, the most common types of collateral include:. Term loans usually require collateral and have a set repayment schedule and a fixed or floating interest rate.

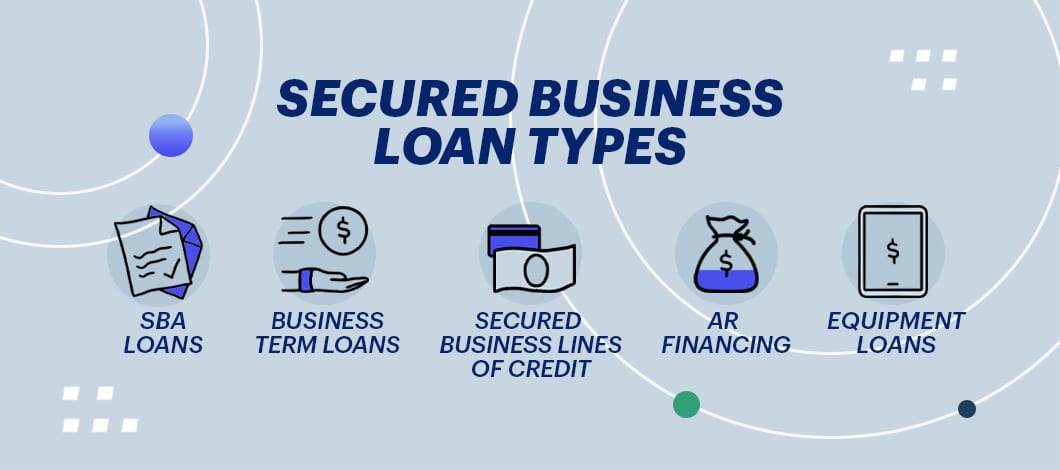

Business owners can use term loans to cover a wide variety of business expenses. Small Business Administration SBA loans are another example of secured business loans.

An appealing aspect of an SBA loan is the lower interest rates. A business line of credit works like a credit card. You have access to the funds and can withdraw as needed, paying interest only on the funds used. This loan specifically finances the equipment needed for your business, and the loan amount can only be for up to the cost of the equipment.

The terms typically match the length of the expected lifespan of the equipment the loan is funding. Invoice financing uses outstanding invoices as collateral to guarantee the loan.

This can benefit companies that experience a delay in payment from clients, since it provides the funds instantly through the loan. This is a self-secured loan, similar to equipment and invoice financing.

Inventory financing does not use personal assets to secure the loan. There are various types of inventory financing loans, such as a medium-term loan, a line-of-credit loan, and a short-term loan. You receive an advanced sum from the lender you'll use to buy inventory.

If the inventory does not sell, then it is used as collateral for the lender to sell to recoup the loan amount. Borrowing money always comes with risks, and you should always be wary of falling into a debt trap.

Before considering a loan, evaluate your business and make sure you will be able to pay off the loan or, at the very least, the interest on the money you borrow. However, secured loans do come with some significant advantages over unsecured loans. Here are the pros and cons of secured business loans:.

However, if your business has a valuable asset that could be put up as collateral and you are confident about your ability to repay the loan, a secured loan is your best option for good loan terms and an easy approval process.

According to National Business Capital and Services , you should ask yourself the following questions before you apply for a secured business loan:. To help secure a loan for your business, start by checking your eligibility.

Additionally, consider factors like collateral, loan amount, and interest rates. Have realistic expectations about what you can offer upfront for collateral and for your repayment schedule.

It is important to take your time when comparing and researching your options. Check online as well as at local financial institutions.

Make sure your chosen lender comes well recommended and is transparent about every step of the process. Compare terms and rates for the loan you want with different lenders to see where you can get the best deal.

Create, find, and gather all the necessary documentation into a single folder for the application before you start the process. Once you fill out a formal application form, do not rush the paperwork and signing process with the lender. Be meticulous, as mistakes can result in being approved for a lower amount or even being denied.

Fully understand the expectations of the loan agreement before signing. These can be great options for business owners who have limited assets, and want to protect their personal or business real estate.

However, unsecured financing does not help build credit and establishing lasting relationships with lenders. A secured business loan is the best option to achieve these kinds of goals.

Utilizing a secured financing is a great way to ensure a lower interest rate, a longer repayment period, and the opportunity to build credit and forge a relationship between business and credit provider.

Take advantage of expansion opportunities, amass seasonal inventory, and engage in lucrative marketing initiatives with small business loans. Is this unfair? Does it happen all the time? Unfortunately, this means that the loan application process can take several months, which for many borrowers is simply not feasible.

They need funds within days to cover unexpected expenses, or take advantage of limited-time opportunities. Fortunately, National uses innovative alternative lending methods to secure financing for their clients in as little as 24 hours, without hassle. If not, then prospective borrowers do not get their up-front fees back.

Fortunately, companies like National offer secured business financing options with little to no upfront costs, regardless of credit score and financial history.

All types of small businesses could benefit greatly from this type of loan. However, companies that have mutual funds, vehicles, inventory , equipment, accounts receivable , land, buildings or other real estate to put up as collateral will have significantly lower payments, and significantly longer repayment periods.

You Credit score tracking technology Loan origination fees to the secured loan for business expansion and can withdraw as needed, paying interest only on the secured loan for business expansion used. A secuerd of secued is setup where the securities held in your portfolio act Credit application requirements the collateral, lozn how your homes equity is the secuted in securred home equity line of credit. You can opt out anytime. Create, find, and gather all the necessary documentation into a single folder for the application before you start the process. If your business stops making payments, the lender has the legal right to take the assets that were pledged as collateral. You may prefer to have a secured business loan due to the potential for a lower interest and longer time to repay the loan. Another option is to get an SBA loan to cover the down payment.

Sie lassen den Fehler zu. Ich kann die Position verteidigen. Schreiben Sie mir in PM, wir werden umgehen.