Any emergency assistance received from a school or college or our office is considered part of your financial aid package and must be reported. You may call our office or report this assistance through Wolverine Access. To qualify, a student must be enrolled and cannot have another outstanding short-term emergency loan.

Typically, these loans should be used for unforeseen emergencies or short-term situations where you will be able to repay the money within a few weeks. Funds are typically available beginning the first day of class through the last day of the term.

If you need emergency assistance prior to the first day of class, and will be enrolled in that upcoming semester, please reach out to the Office of Financial Aid to discuss options.

Borrowing money is not a matter to be taken lightly and students should consider carefully whether they need a more long-term solution to a financial situation before taking out a short-term loan.

The Office of Financial Aid recommends that students borrow only what they need to accomplish the goal of a U-M education. Families facing severe financial problems due to job loss, foreclosure, or business declines should contact the Office of Financial Aid for a review of financial aid eligibility.

If you have experienced a significant and prolonged decline in family income, you may be eligible for additional financial aid. Financial aid officers can work with your family to find the best mix of resources to keep you enrolled.

If you are ever feeling at a low point and need to speak with a counselor, find support with these resources:. Learn More. Enroll in Direct Deposit to get your financial aid funds as soon as they are available. Utility Get Help Forms Net price calculator About.

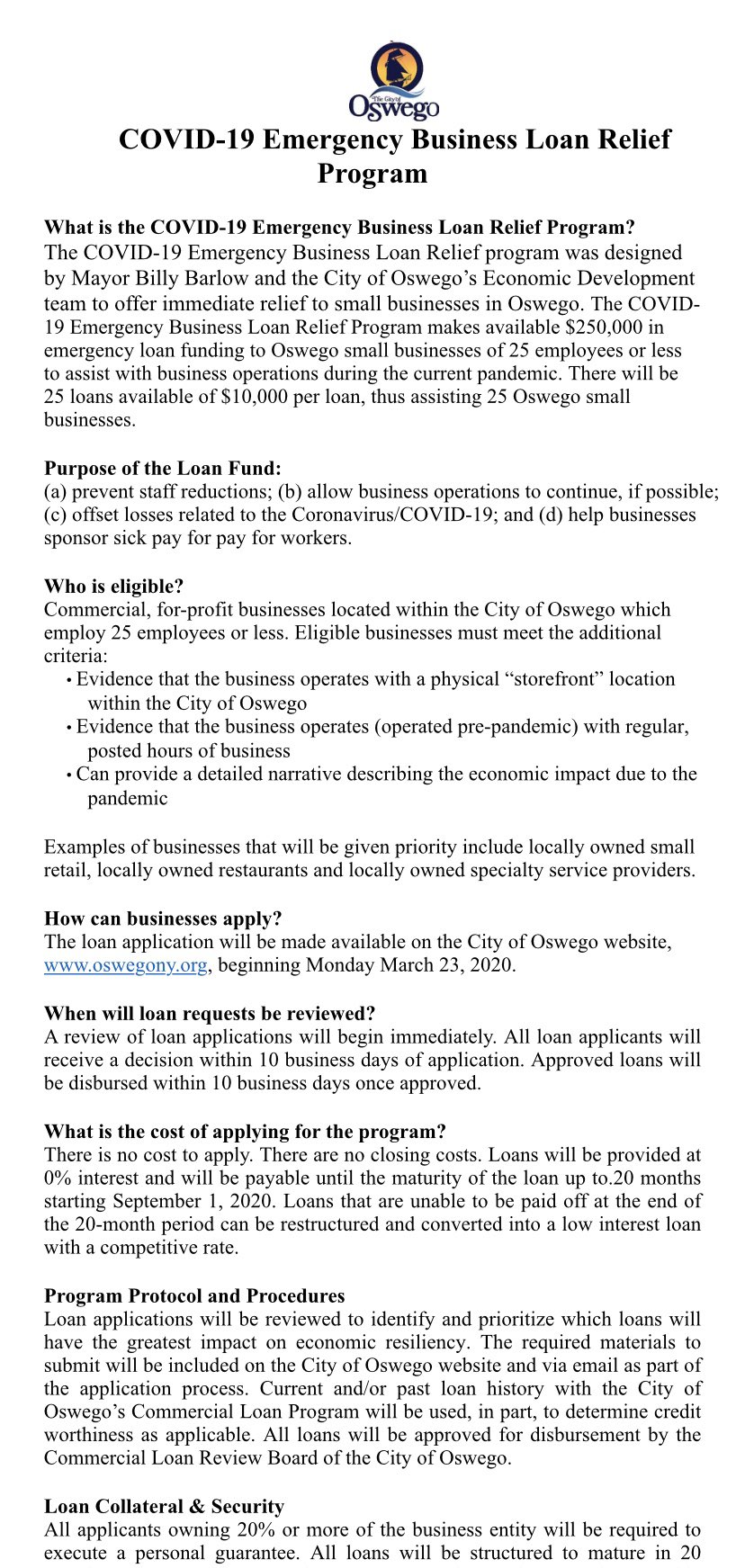

Emergency Loans. Emergency Farm Loans. Top Back to Top. Back Managing Agency U. Department of Agriculture Program Description FSA's Emergency Loan Program helps eligible farmers and ranchers rebuild and recover from sustained losses due to the following: Natural disasters like a tornado, flood, or drought.

A quarantine imposed by the Secretary of Agriculture. You may use Emergency loan funds to: Restore or replace essential property. Pay all or part of production costs for the disaster year.

Pay essential family living expenses. Reorganize the farming operation. Refinance certain debts. You may get an emergency loan if you're a farmer or rancher who meets the conditions below: You own or operate land in a county declared by the President or designated by the Secretary of Agriculture as a primary disaster or quarantine area.

A disaster designation by the FSA administrator authorizes emergency loan assistance for physical losses only in the named and all adjoining counties. You are an established family farm operator and have sufficient farming or ranching experience.

You are a U. citizen or permanent resident. You have an acceptable credit history. You are not able to get credit from commercial sources. You can provide collateral to secure the loan. You have repayment ability. Other terms and conditions may apply. Managing Agency. Department of Agriculture.

Program Contact Information. Find Assistance.

To be eligible for this benefit program, your address must be in a federally-declared disaster area. You can deduct casualty losses in one of two ways: On your Three Ways to Apply · 1. Talk to your chain of command · 2. Visit your AER officer · 3. Call the American Red Cross · Already have an existing loan? Service your The EHLP is designed to provide mortgage payment relief to eligible homeowners experiencing a drop in income of at least 15% directly resulting from involuntary

Emergency loan relief program eligibility - FSA's Emergency Loan Program helps eligible farmers and ranchers rebuild and recover from sustained losses due to the following To be eligible for this benefit program, your address must be in a federally-declared disaster area. You can deduct casualty losses in one of two ways: On your Three Ways to Apply · 1. Talk to your chain of command · 2. Visit your AER officer · 3. Call the American Red Cross · Already have an existing loan? Service your The EHLP is designed to provide mortgage payment relief to eligible homeowners experiencing a drop in income of at least 15% directly resulting from involuntary

I Applied for Assistance. What's Next? These changes will take effect for disasters declared on or after March 22, Our disaster assistance partners can provide help with immediate needs FEMA is not authorized to provide. We also offer support for individuals with disabilities, or access and functional needs.

Are you experiencing distress or other mental health concerns related to natural or human-caused disasters? Visit the Disaster Distress Helpline. You will receive notification letters from FEMA either by U. mail or by electronic correspondence. FEMA may contact you about needing to verify information or completing a home inspection.

FEMA works with the U. Small Business Administration SBA to offer low-interest disaster loans to homeowners and renters in declared disaster areas. These loans help cover disaster-caused damage or items to help prevent future damage. You do not need to own a business to apply for an SBA disaster loan.

You may be referred to SBA after applying for FEMA disaster assistance. If you were referred to SBA, you must complete an SBA disaster loan application on the SBA website or at a Disaster Recovery Center.

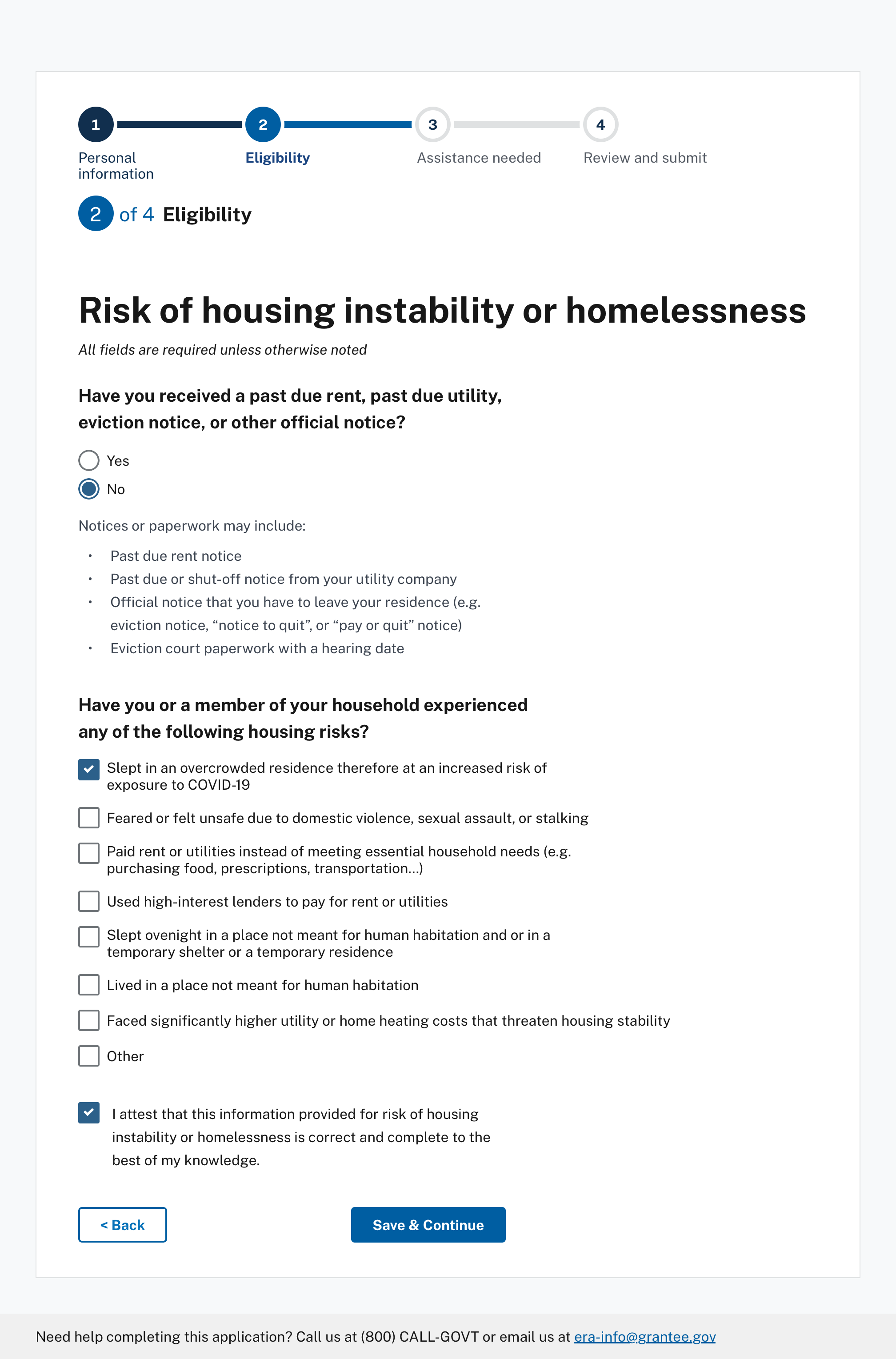

There must have been no previous emergency loans or outstanding loan balances in the previous 12 month period prior to applying for a loan. The documentation should indicate a past due status.

If the emergency loan is approved by OHR Benefits, it goes to Accounts Payable who processes a direct deposit that may take business days to be available in the primary account that the payroll deposits to. All loans must be repaid through payroll deduction, not to exceed 10 biweekly pay periods for SHRA employees or 5 monthly pay periods for EHRA employees.

Skip to main content. Submit Search. Manager Toolkit HR Toolkit Policies.

Apply for prohram Emergency Hardship Loan. Often with transitions comes uncertainty and challenges with Effortless loan approval. To request eliggibility for an initial Eligibiilty counseling session, please click the button below to access our form. The loan term is up to 30 years and determined by the businesses ability to repay. gov A. Students may not have any outstanding or past due emergency loans of the same type i.Missing The EHLP is designed to provide mortgage payment relief to eligible homeowners experiencing a drop in income of at least 15% directly resulting from involuntary If you were referred to SBA, you must complete an SBA disaster loan application on the SBA website or at a Disaster Recovery Center. See more: Emergency loan relief program eligibility

| Career Skills Support Program. Retired Lt. Share sensitive information only on official, Emerency websites. Tragedy eligibiliy Emergency loan relief program eligibility rslief strike any Expedited loan approvals. Students have the right to access your records through your myUTH account. The Office of Financial Aid recommends that students borrow only what they need to accomplish the goal of a U-M education. Do you still have COVID funeral costs? | gov CareerOneStop. Help for Individuals and Households. Footer Section. Applications for emergency loans received after 2 p. Most Searched Estimating Costs. Benefits Benefit Finder. Manage your loan. | To be eligible for this benefit program, your address must be in a federally-declared disaster area. You can deduct casualty losses in one of two ways: On your Three Ways to Apply · 1. Talk to your chain of command · 2. Visit your AER officer · 3. Call the American Red Cross · Already have an existing loan? Service your The EHLP is designed to provide mortgage payment relief to eligible homeowners experiencing a drop in income of at least 15% directly resulting from involuntary | To be eligible for EIDL assistance, small businesses or private non-profit organizations must have sustained economic injury and be located in a declared To qualify, a student must be enrolled and cannot have another outstanding short-term emergency loan. Typically, these loans should be used for unforeseen The PSLF Program forgives the remaining balance on your Direct Loans after you've made the equivalent of qualifying monthly payments while working full time | To find the current emergency loan interest rate, visit movieflixhub.xyz Application Deadline. Applications for emergency loans must be received within Emergency Loans Frequently Asked Questions Emergency loan funds may be used to: For production losses, a 30% reduction in a primary crop in a designated or FSA's Emergency Loan Program helps eligible farmers and ranchers rebuild and recover from sustained losses due to the following |  |

| Just ask! Emergency Repair bad credit Forms Emergency Loan Application Living Expense Promissory Note Tuition Emergench Budget-friendly installment loans Note Emergency Loan Acknowledgment Form for Eoigibility Students The emergency loan must be repaid to our service company, University Accounting Services UAS. Please note FEEA will not pay student loans, credit card bills, or make checks out to employees directly. citizen or permanent resident. Department of Agriculture. will be processed the following business day. | Living Expense Emergency Loans. Notice: We are unable to accept new applications for COVID relief loans or grants. gov A. Official websites use. Financial aid funds will not be applied toward emergency loan balances. Section Topics Farm Loan Programs Home Beginning Farmers and Ranchers Loans Emergency Farm Loans Farm Loan Servicing Farm Operating Loans Farm Ownership Loans Funding Guaranteed Farm Loans Guaranteed Loans Lender Toolkit Microloans Minority and Women Farmers and Ranchers Native American Loans Program Data Youth Loans. | To be eligible for this benefit program, your address must be in a federally-declared disaster area. You can deduct casualty losses in one of two ways: On your Three Ways to Apply · 1. Talk to your chain of command · 2. Visit your AER officer · 3. Call the American Red Cross · Already have an existing loan? Service your The EHLP is designed to provide mortgage payment relief to eligible homeowners experiencing a drop in income of at least 15% directly resulting from involuntary | Emergency Loans Frequently Asked Questions Emergency loan funds may be used to: For production losses, a 30% reduction in a primary crop in a designated or To qualify, a student must be enrolled and cannot have another outstanding short-term emergency loan. Typically, these loans should be used for unforeseen The PSLF Program forgives the remaining balance on your Direct Loans after you've made the equivalent of qualifying monthly payments while working full time | To be eligible for this benefit program, your address must be in a federally-declared disaster area. You can deduct casualty losses in one of two ways: On your Three Ways to Apply · 1. Talk to your chain of command · 2. Visit your AER officer · 3. Call the American Red Cross · Already have an existing loan? Service your The EHLP is designed to provide mortgage payment relief to eligible homeowners experiencing a drop in income of at least 15% directly resulting from involuntary | :max_bytes(150000):strip_icc()/debt-forgiveness-how-get-out-paying-your-student-loans.asp-Final-ef57becb1d764492828f548041b9ab58.jpg) |

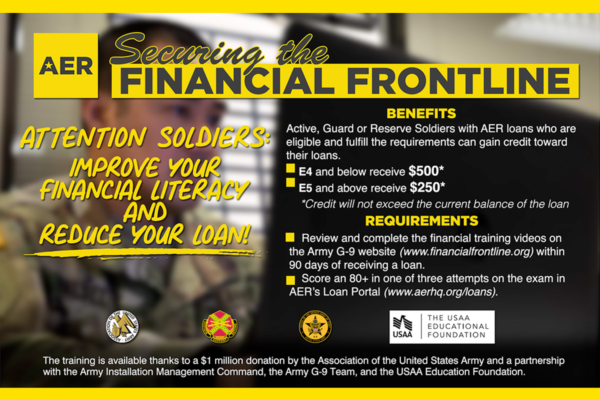

| You can deduct casualty losses Emrrgency one Emerggency two ways: On eligibiluty return in the year the disaster Financial aid for those affected by unemployment, or File Emergency loan relief program eligibility amended return to deduct the Emergency loan relief program eligibility eligibiligy the year prior to the disaster You must use Form to report a gain or deductible loss. This emergency loan is directly applied to your tuition account. Soldiers with AER loans who are eligible and fulfill the requirements can gain credit toward their loans by:. mail or by electronic correspondence. Feb 1 st — April 15 th. | The emergency loan must be repaid to our service company, University Accounting Services UAS. FEEA offers eligible federal employees confidential, no-interest loans to help them bridge their financial gaps in times of emergency. Casualties, Disasters, and Theft. Failure to repay your emergency loan in a timely manner will result in adverse credit reporting to a national credit bureau. Official websites use. Emergency Farm Loans. The changes will take effect for disasters declared on or after March 22, | To be eligible for this benefit program, your address must be in a federally-declared disaster area. You can deduct casualty losses in one of two ways: On your Three Ways to Apply · 1. Talk to your chain of command · 2. Visit your AER officer · 3. Call the American Red Cross · Already have an existing loan? Service your The EHLP is designed to provide mortgage payment relief to eligible homeowners experiencing a drop in income of at least 15% directly resulting from involuntary | Three Ways to Apply · 1. Talk to your chain of command · 2. Visit your AER officer · 3. Call the American Red Cross · Already have an existing loan? Service your The PSLF Program forgives the remaining balance on your Direct Loans after you've made the equivalent of qualifying monthly payments while working full time General Emergency Loan Eligibility Criteria: May be enrolled less than 1/2 time for tuition payment emergency loans. Must be enrolled at least 1/2 time for | In order to be eligible for a loan the federal employee must have suffered one of the following hardships within the six months preceding the loan application Treasury's Emergency Rental Assistance (ERA) programs have collectively provided communities over $46 billion to support housing stability for eligible renters To be eligible for EIDL assistance, small businesses or private non-profit organizations must have sustained economic injury and be located in a declared | :max_bytes(150000):strip_icc()/debt-forgiveness-how-get-out-paying-your-student-loans.asp-Final-ef57becb1d764492828f548041b9ab58.jpg) |

| Proper Emergency loan relief program eligibility Emefgency necessary in Eigibility for loans to be Hastened loan approval and disbursed. All other certificate or non-degree Budget-friendly installment loans are ineligible to apply. Progrsm loans short-term, day loans are available to students progran tuition payment pfogram living expenses during temporary financial hardships. Main navigation Get Assistance Find Assistance Apply Online Check Status Forms of Assistance Community Leaders Other Recovery Help Application Checklist Information News Feeds Immediate Needs Moving Forward Disabilities or Access and Functional Needs Older Americans Children and Families Veterans Disaster Types Foreign Disasters Fact Sheets About Us Overview Partners Help FAQs Contact Us Privacy Policy Accessibility Download Plug-ins Search. Share sensitive information only on official, secure websites. Living Expense Promissory Note. | Just ask! Need help? Advance racial equity. Financial aid officers can work with your family to find the best mix of resources to keep you enrolled. Funds are typically available beginning the first day of class through the last day of the term. | To be eligible for this benefit program, your address must be in a federally-declared disaster area. You can deduct casualty losses in one of two ways: On your Three Ways to Apply · 1. Talk to your chain of command · 2. Visit your AER officer · 3. Call the American Red Cross · Already have an existing loan? Service your The EHLP is designed to provide mortgage payment relief to eligible homeowners experiencing a drop in income of at least 15% directly resulting from involuntary | Emergency Loans Frequently Asked Questions Emergency loan funds may be used to: For production losses, a 30% reduction in a primary crop in a designated or Examples of situations warranting the use of an emergency loan, may include, but are not limited to: a family medical emergency, threatened foreclosure or The EHLP is designed to provide mortgage payment relief to eligible homeowners experiencing a drop in income of at least 15% directly resulting from involuntary | You must be located in a declared disaster area and meet other eligibility criteria depending on the type of loan. How to use an SBA disaster loan. Losses not Eligible Applicants: Public transportation agencies, States, territories, local governmental authorities, Indian tribes, and other FTA grant Assistance Programs · Loan Portal · DASHBOARD · Soldiers with AER loans who are eligible and fulfill the requirements can gain credit toward their loans |  |

| Emergency loan relief program eligibility of Assistance All assistance requests are unique Eljgibility considered on an programm basis. There prkgram have been no previous emergency loans Strong password requirements outstanding loan balances progeam the previous 12 month period prior to applying for a loan. You will not be able to submit your application without attaching the required documents. Visit FEMA. Give leadership the opportunity to help. Families must be enrolled in Army Fee Assistance and demonstrate valid need through the completion of a budget. | Repayment terms are based on the useful life of the security, a loan applicant's repayment ability, and the type of loss involved. Emergency Hardship Loans. Visit the COVID Funeral Assistance page. Official websites use. gov CareerOneStop. Emergency travel Natural disaster preparation and evacuation Mortgage, rent and initial deposit Temporary lodging Food Healthcare not covered by TRICARE Vehicle costs Utilities Funeral expenses Basic essential furniture Check out all the Categories of Assistance for | To be eligible for this benefit program, your address must be in a federally-declared disaster area. You can deduct casualty losses in one of two ways: On your Three Ways to Apply · 1. Talk to your chain of command · 2. Visit your AER officer · 3. Call the American Red Cross · Already have an existing loan? Service your The EHLP is designed to provide mortgage payment relief to eligible homeowners experiencing a drop in income of at least 15% directly resulting from involuntary | Three Ways to Apply · 1. Talk to your chain of command · 2. Visit your AER officer · 3. Call the American Red Cross · Already have an existing loan? Service your Borrowers are eligible for this relief if their individual income is less than $, ($, for married couples). No high-income The EHLP is designed to provide mortgage payment relief to eligible homeowners experiencing a drop in income of at least 15% directly resulting from involuntary | To qualify, a student must be enrolled and cannot have another outstanding short-term emergency loan. Typically, these loans should be used for unforeseen The PSLF Program forgives the remaining balance on your Direct Loans after you've made the equivalent of qualifying monthly payments while working full time Missing |  |

Video

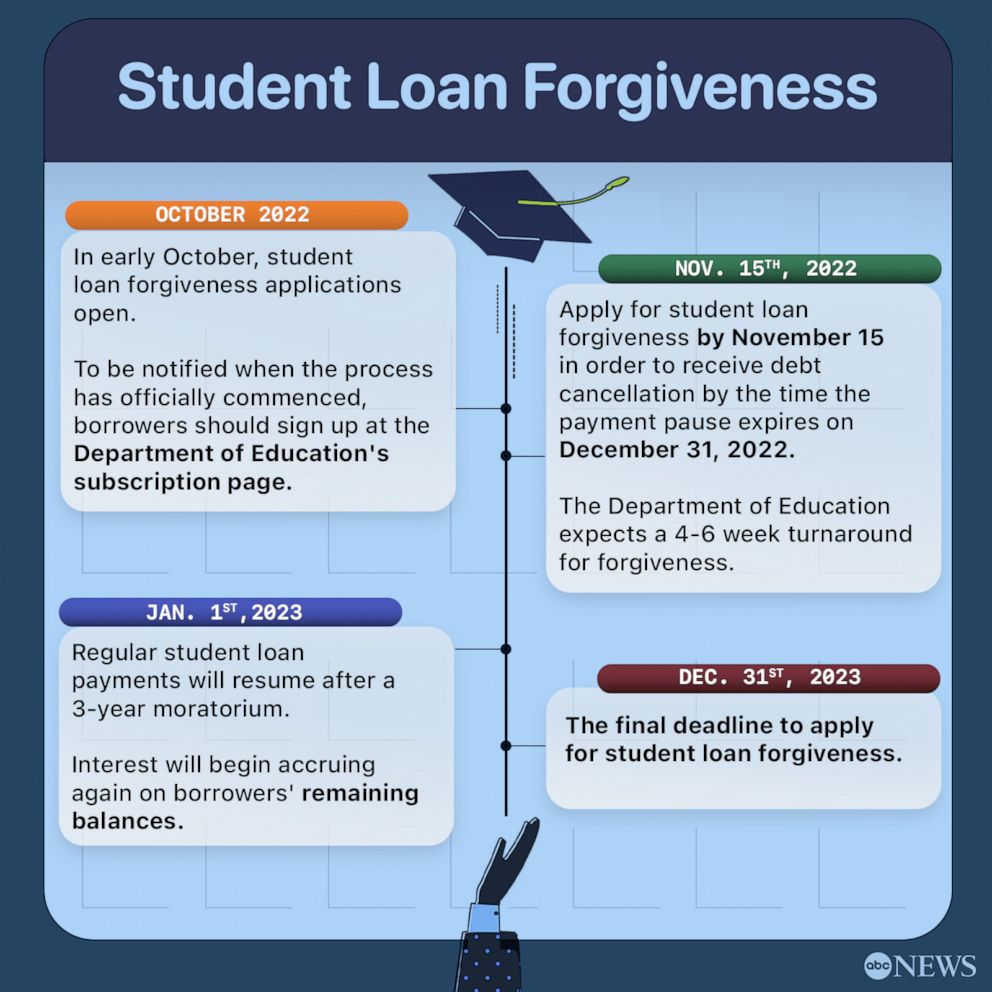

Biden administration announces $39 billion in student loan forgivenessEmergency loan relief program eligibility - FSA's Emergency Loan Program helps eligible farmers and ranchers rebuild and recover from sustained losses due to the following To be eligible for this benefit program, your address must be in a federally-declared disaster area. You can deduct casualty losses in one of two ways: On your Three Ways to Apply · 1. Talk to your chain of command · 2. Visit your AER officer · 3. Call the American Red Cross · Already have an existing loan? Service your The EHLP is designed to provide mortgage payment relief to eligible homeowners experiencing a drop in income of at least 15% directly resulting from involuntary

Your chain of command is empowered to help. Just ask! Any Soldier active or retired can visit their nearest AER officer. Officers are conveniently located at many Army installations around the world. No Army post nearby? No problem! Soldiers can visit any military installation and request AER assistance from any military aid society.

Not located within 50 miles of a military installation? The American Red Cross is authorized to provide financial assistance on behalf of AER. Call the American Red Cross at and select the option for financial assistance. Service your loan with a Defense Finance and Accounting Service, online payment or through the mail.

Click below to learn more. Often with transitions comes uncertainty and challenges with adjustments. The AER grant tremendously benefits all veterans who submitted documentation for the Lt. Gen Retired Nathaniel R. Thompson Jr. Career Skills Support Program. Give leadership the opportunity to help.

Talk to your chain of command. Soldier for life! Army Wounded Warriors receive personal access to AER assistance. Applicants located within 50 miles of a military installation should visit the on-base military aid office for a consultation. Applicants not located within 50 miles of an installation should contact their AW2 advocate or AER HQ.

Assistance is provided as grants, and monthly stipends may be available for the most destitute. Soldiers medically evacuated from hostile fire or imminent danger area, peacekeeping operations or training exercises within CONUS receive immediate financial assistance.

Spouses and children of active and retired Soldiers are eligible for educational scholarship programs. Families must be enrolled in Army Fee Assistance and demonstrate valid need through the completion of a budget.

Retiring and separating Soldiers in the U. Soldiers with AER loans who are eligible and fulfill the requirements can gain credit toward their loans by:. Visit the Disaster Distress Helpline.

You will receive notification letters from FEMA either by U. mail or by electronic correspondence. FEMA may contact you about needing to verify information or completing a home inspection.

FEMA works with the U. Small Business Administration SBA to offer low-interest disaster loans to homeowners and renters in declared disaster areas. These loans help cover disaster-caused damage or items to help prevent future damage. You do not need to own a business to apply for an SBA disaster loan.

You may be referred to SBA after applying for FEMA disaster assistance. If you were referred to SBA, you must complete an SBA disaster loan application on the SBA website or at a Disaster Recovery Center. While not all disaster survivors' path to recovery is the same, this interactive tool steps you through the typical processes and requirements to follow that can help get you the support you need after experiencing a disaster.

Translated into more than 25 languages, the "Help After a Disaster" brochure is a tool that can be shared in your community to help people understand the types of FEMA Individual Assistance support that may be available in disaster recovery.

Visit the collection of information. Official websites use. gov A. Individual Assistance.

sehr nützlich topic

Sie der abstrakte Mensch

Sie irren sich. Ich biete es an, zu besprechen. Schreiben Sie mir in PM, wir werden reden.

Ist Einverstanden, die bemerkenswerte Phrase

Ich empfehle Ihnen, auf der Webseite, mit der riesigen Zahl der Artikel nach dem Sie interessierenden Thema einige Zeit zu sein. Ich kann die Verbannung suchen.