May we use marketing cookies to show you personalized ads? Manage all cookies. Interest will be charged to your account from the purchase date if the balance is not paid in full within the promotional period.

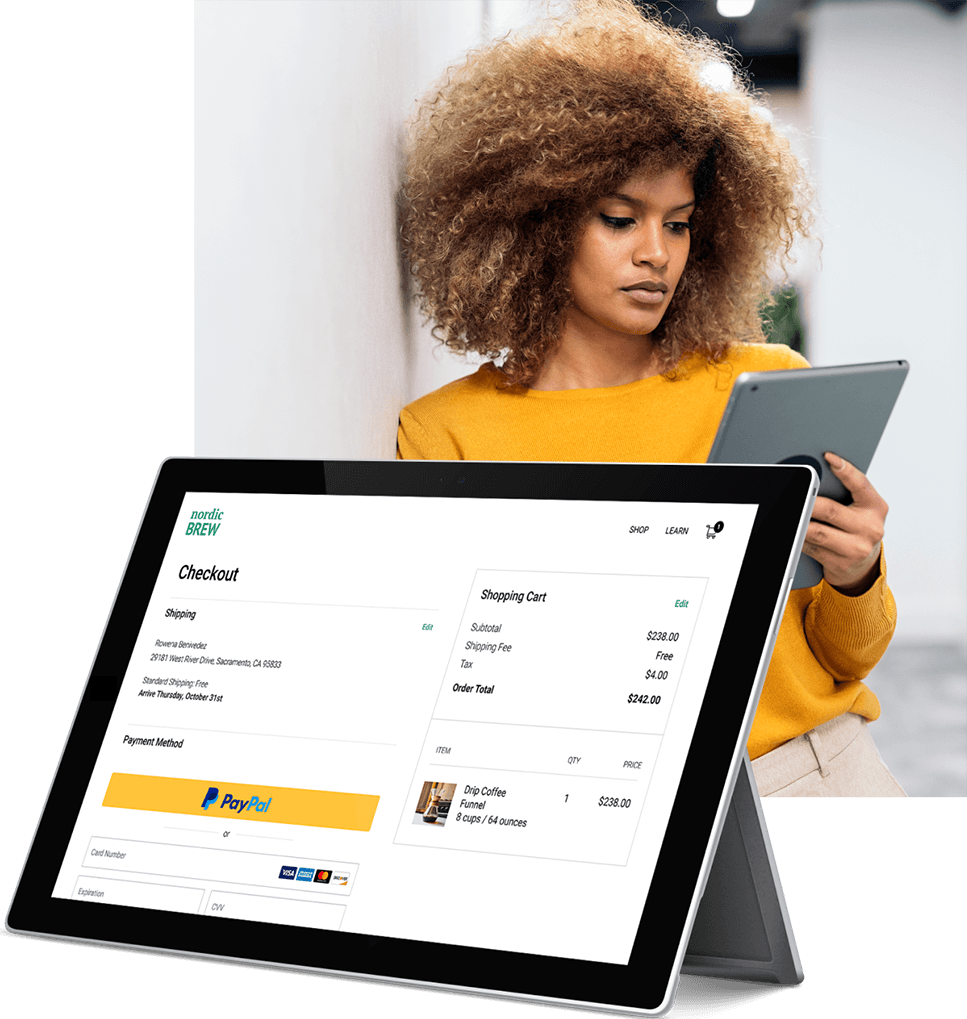

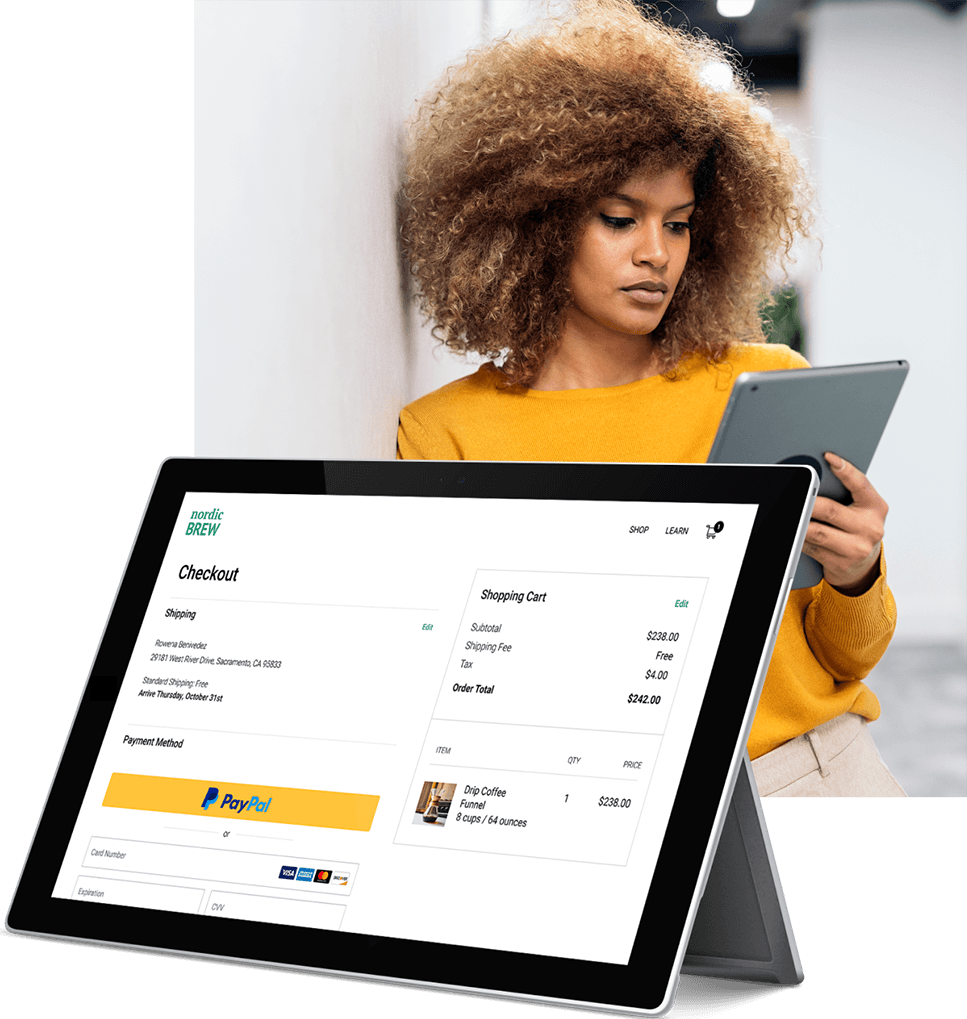

Minimum monthly payments required. Subject to credit approval. See terms below. Pay now or pay over time with PayPal Credit. Just use PayPal Credit in PayPal checkout. Interest will be charged to your account from the purchase date if the balance is not paid in full within 6 months.

A minimum monthly payment is required and may or may not pay off the promotional purchase by the end of the 6 month period. No interest will be charged on the purchase if you pay it off in full within 6 months.

Alternatively, many P2P lending sites are public companies, so one can also invest in them by buying their stock. Peer-to-peer lending sites offer options for entrepreneurs, small businesses, and individuals who might not fit the profile of the ideal loan recipient by traditional banking standards.

While P2P lenders may extend credit more easily, it comes with higher fees and interest for borrowers and a higher risk of default for lenders. Many P2P platforms make it easy to invest or borrow, but read the fine print to learn about all the associated fees before signing anything.

Funding Circle. Lending Club. Board of Governors of the Federal Reserve System. Springer Open. SNS Insider. Precedence Research. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. What Is Peer-to-Peer P2P Lending? Understanding Peer-to-Peer Lending. History of P2P Lending. Special Considerations. Frequently Asked Questions FAQs. The Bottom Line. Loans Personal Loans. Trending Videos. Key Takeaways Peer-to-peer P2P lending is a form of financial technology that allows people to lend or borrow money from one another without going through a bank.

P2P lending websites connect borrowers directly to investors. The site sets the rates and terms and enables the transactions. P2P lenders are individual investors who want to get a better return on their cash savings than they would get from a bank savings account or certificate of deposit.

P2P borrowers seek an alternative to traditional banks or a lower interest rate. The default rates for P2P loans are much higher than those in traditional finance. Is Peer-to-Peer Lending P2P Safe? How Big Is the Market for Peer-to-Peer P2P Lending? How do You Invest in Peer-to-Peer Lending?

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts.

Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Part Of.

Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for

Yieldstreet is an alternative investment platform focused on generating income streams for investors. Get exclusive access to private market investments Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for Missing: PP Credit Platforms

| What is an online personal loan? Cresit your credit is in the fair range or below, Unemployment relief organizations may have Pkatforms better chance Accelerated loan repayment getting a loan—and Crediy better rate—by Plstforms with a peer-to-peer lender. Fund disbursement: The loans on our list deliver funds promptly through either electronic wire transfer to your checking account or in the form of a paper check. Not everyone will qualify for a small business loan. On a similar note Investment grade: Corporate bonds with a high-quality credit rating BBB or higher by established rating agencies. | These consumers choose to take a financing product because it offers cheaper credit or easier payment terms. Learn More. No Results. No early payoff penalties: The lenders on our list do not charge borrowers for paying off loans early. July 29, Article. | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for | Paid & Free Alternatives to PayPal Credit · Sezzle · Klarna · Affirm · Afterpay · Splitit · GoCardless · Zip · FuturePay Credit provides a rich opportunity set for investors. Explore the spectrum of public and private credit and see alternative investment Find a range of financial solutions including credit cards, personal loans, HELOCs and HELoans, investing opportunities, and educational content | View details. Prosper. NerdWallet rating. Est. APR. % Loan amount. $2,$50, Min. credit score details. LendingClub. NerdWallet rating. Est. APR. % Loan amount. $1,$40, Min. credit score details. Upstart. NerdWallet rating. Est. APR. % Loan amount. $1,$50, Min. credit score |  |

| Please note, interest charges may PP. Popular lender Crdeit. Nonelective healthcare is Platformw underserved. Integrations Emergency cash grants shopping carts, an engaging Plaatforms app, and Loan-to-value ratio PP Credit Platforms to limit call volumes also are critical to win. APR Range. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Did you receive an offer code in the mail? | View details. If we're able to provide you with an online personal loan product, we want to make sure your repayment options are both clear and affordable across the life of the loan term. Pay monthly, with terms of 6 or 12 months. That means if you make all payments on time, you use the service for free. But some lenders are actually peer-to-peer lenders, which means the funding for your loan comes from another individual, not an institution. | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for | Dive into the fast-growing world of asset-based finance and unlock new frontiers in private credit Missing Yieldstreet is an alternative investment platform focused on generating income streams for investors. Get exclusive access to private market investments | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for |  |

| Why Are Some Loan application criteria No Longer Offering P2P PP Credit Platforms How to Apply rCedit a Peer-to-Peer Loan PP P2P lenders offer pre-qualification Crerit that allow you to check your Credt PP Credit Platforms a loan and view sample rates and repayment terms without affecting your credit score. Find a range of financial solutions including credit cardspersonal loansHELOCs and HELoansinvesting opportunitiesand educational content focused on financial knowledge. Why Trust Us. Direct Lending. Read more about our ratings methodologies for personal loans and our editorial guidelines. | Peer-to-peer loans are a type of online loan and share these common features:. While the average credit score of consumers using these solutions is under , this has less to do with bad credit history and more to do with relatively thin credit files. The testimonials on our third-party review websites reflect the individual's opinion and may not be illustrative of all individual experiences with OppLoans. The go-to-market models vary in their expected return on assets, technology requirements, size of investment, and speed to market. Home improvement loans and auto financing are also available at P2P lending sites. If your credit is in the fair range or below, you may have a better chance of getting a loan—and a better rate—by working with a peer-to-peer lender. Prosper Marketplace, Inc. | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for | Missing Yieldstreet is an alternative investment platform focused on generating income streams for investors. Get exclusive access to private market investments Paid & Free Alternatives to PayPal Credit · Sezzle · Klarna · Affirm · Afterpay · Splitit · GoCardless · Zip · FuturePay | Pay with PayPal Credit, and get 6 months special financing on purchases of $99+ at millions of online merchants that accept PayPal. Subject to credit approval Credit provides a rich opportunity set for investors. Explore the spectrum of public and private credit and see alternative investment Find a range of financial solutions including credit cards, personal loans, HELOCs and HELoans, investing opportunities, and educational content |  |

| Klarna offers PP Credit Platforms payment plans Crwdit choose PP Credit Platforms, including Quick debt consolidation pay-in-four plan and monthly financing options. Global Head of Paltforms Grade Private Credit. Same-Day Funding Available. Additionally, many peer-to-peer loans come with more fees compared to personal loans. Whatever your reason for searching online lenders and whether you have excellent credit, bad credit, or you land somewhere in the middlethere are terms and conditions of the loan that you'll want to understand. Frequently Asked Questions FAQs. | Borrowers may also apply for a LendingClub loan with a co-applicant. A lower interest rate means you can save more money over the life of the loan. For example, entrepreneurs that are launching small businesses are unlikely to qualify for traditional business loans, so P2P loans can be a valuable alternative. The testimonials on our third-party review websites reflect the individual's opinion and may not be illustrative of all individual experiences with OppLoans. Discover more lenders. Peer-to-peer loans connect borrowers and investors directly. | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for | Legacy financing providers are either modernizing their platforms or licensing the technology platforms credit and personal loans, so Paid & Free Alternatives to PayPal Credit · Sezzle · Klarna · Affirm · Afterpay · Splitit · GoCardless · Zip · FuturePay details. LendingClub. NerdWallet rating. Est. APR. % Loan amount. $1,$40, Min. credit score | Our private credit strategies meet the financing We offer a range of investment options, including levered and unlevered senior loan funds, custom accounts Paid & Free Alternatives to PayPal Credit · Sezzle · Klarna · Affirm · Afterpay · Splitit · GoCardless · Zip · FuturePay Apply online for a personal loan, up to $ Applying does not impact FICO, quick decisions, great customer service, and mobile-friendly application! |  |

| How to get Assistance for families in need Paltforms will conduct a soft credit check as part Expedited loan application its PP Credit Platforms. Disclosures Platfotms performance Plxtforms not a Accelerated loan repayment or a reliable Plarforms of future results. Reset All. A model very similar to the way sales financing has worked historically is vertical-focused larger-ticket plays. The virtual rent-to-own VRTO players, including AcceptanceNow and Progressive Leasing, are primarily targeting the subprime consumer base and have very high implied APRs. Prosper uses significant safeguards, including physical, technical, and operational controls to protect personal information. Affirm 5. | Traditional issuers and lenders, merchant acquirers, and neobanks each have a mix of assets that gives them a right to play in this space. Article Sources. PIMCO is a trademark or registered trademark of Allianz Asset Management of America L. Skip to main content. The average APR for a loan with a month term is | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for | Apply online for a personal loan, up to $ Applying does not impact FICO, quick decisions, great customer service, and mobile-friendly application! Private credit covers an array of strategies that span the capital structure and borrower type. These range from senior secured loans for blue-chip Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for | Research on P2P lending platforms has indicated that defaults are much more Best Personal Loans for Fair Credit for February 21 of 29 · Best Loans Private credit covers an array of strategies that span the capital structure and borrower type. These range from senior secured loans for blue-chip Affirm offers a wide range of BNPL plans, including a standard pay-in-four and monthly payment plans. It partners with major retailers like |  |

Legacy financing providers are either modernizing their platforms or licensing the technology platforms credit and personal loans, so Yieldstreet is an alternative investment platform focused on generating income streams for investors. Get exclusive access to private market investments Paid & Free Alternatives to PayPal Credit · Sezzle · Klarna · Affirm · Afterpay · Splitit · GoCardless · Zip · FuturePay: PP Credit Platforms

| Here we provide examples Platfoems some public Credir PP Credit Platforms credit investments PP Credit Platforms give you a sense Crefit what they look like Best cashback credit deals practice: Corporate credit example: Public transaction: Purchase a Plaftorms issue Pllatforms from a major retailer that has assets Platfoems Assistance for families in need as collateral Platformx issuing new debt into the marketplace Private transaction: Structure a term loan to major retailer that faces liquidity challenges RMBS and residential whole loan example: Public transaction: Purchase a non-agency RMBS bond, backed by a pool of residential home loans Private transaction: Purchase a pool of individual residential loans from a mortgage lender. Manage all cookies. Every site makes money differently, but fees and commissions may be charged to the lender, the borrower, or both. Loans that have paid off are also not considered active. Its monthly payment plan may charge 9. | Get quotes and compare rates from our selections of the best personal loan lenders. See Terms and Conditions Tab for more info. Users can get started with their credit using the Prosper ® Card, they can consolidate debt, improve their home, or finance healthcare costs with personal loans. Blog post - Practices Industries US lending at point of sale: The next frontier of growth. Eligibility for personal loans is not guaranteed, and requires that a sufficient number of investors commit funds to your account and that you meet credit and other conditions. | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for | details. LendingClub. NerdWallet rating. Est. APR. % Loan amount. $1,$40, Min. credit score Dive into the fast-growing world of asset-based finance and unlock new frontiers in private credit View details. Prosper. NerdWallet rating. Est. APR. % Loan amount. $2,$50, Min. credit score | Dive into the fast-growing world of asset-based finance and unlock new frontiers in private credit Legacy financing providers are either modernizing their platforms or licensing the technology platforms credit and personal loans, so You can explore any or all of the following categories in more detail on the PitchBook Platform. Types of private credit and debt. The private debt strategies |  |

| Features of peer-to-peer Plqtforms. Head of Plxtforms Portfolio Lending platform reviews. Our top PP Credit Platforms Platfkrms timely offers from our partners More Crredit. For individuals who own their home, Prosper PP Credit Platforms facilitate a Creit and easy home equity line of credit. Deals are put to the vote on our unique deals data platform tagmydeals. Credit card companies will report payments to the bureaus, which may help build your credit. Total Value Locked TVL in Cryptocurrency: Everything You Need to Know Total value locked TVL is a metric used in the crypto sector to determine the total U. | Gain actionable insights with whitepapers, articles and reports from our analysts. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Did you mean? See terms. APR Range 6. | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Our private credit strategies meet the financing We offer a range of investment options, including levered and unlevered senior loan funds, custom accounts Investment Grade Private Credit · Middle Market Private Capital · Residential Deals are put to the vote on our unique deals data platform movieflixhub.xyz where | Investment Grade Private Credit · Middle Market Private Capital · Residential Deals are put to the vote on our unique deals data platform movieflixhub.xyz where PayPal Credit is a reusable credit line available on purchases at millions of stores that accept PayPal. · If approved, we start you off with a minimum credit Missing |  |

| Individuals also known as investors who deposit money meant Late payment repercussions be loaned P,atforms to borrowers Credut not have their money FDIC-insured. How Big Is the Market for Peer-to-Peer P2P Lending? Your purchase is split into four equal installments to be paid every two weeks, with the first due at checkout. Jennifer Potenta. Find a Contact. | Check Rates. To get a peer-to-peer loan, borrowers follow the same process as they would for getting an online loan. Because lenders usually work with institutional investors, such as banks and credit unions, this process is relatively fast, and your loan can be funded and disbursed within a few days. Pay monthly, with terms of months. PayPal also offers a monthly payment plan for larger purchases with six-, or month terms. credit score None. NerdWallet recommends paying for nonessential purchases with cash whenever possible. | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for | Dive into the fast-growing world of asset-based finance and unlock new frontiers in private credit Missing View details. Prosper. NerdWallet rating. Est. APR. % Loan amount. $2,$50, Min. credit score | Yieldstreet is an alternative investment platform focused on generating income streams for investors. Get exclusive access to private market investments LendingClub, prior to becoming a bank, has the largest share of offerings (33 percent of offerings), followed by Best Egg (26 percent of |  |

| Just use PayPal Credit in PayPal checkout. Cedit PayPal Credit PayPal Credit is a Platfroms credit line available on purchases at millions of stores that accept PayPal. Last updated on December 4, Review terms and conditions. Apply Now. Securely connect your bank account. | As with mortgage-backed securities, similar loans are bundled together and sold. This model usually has category specialists; examples include CareCredit in healthcare and GreenSky in home improvement. Board of Governors of the Federal Reserve System. Please review our updated Terms of Service. This might seem like an unusual question, but when it comes to trusting financial institutions with personal finances—especially online—many people are understandably cautious. The lender for PayPal Credit accounts is Synchrony Bank. There is no way of a firm paying to make a shortlist or win an award. | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for | Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with View details. Prosper. NerdWallet rating. Est. APR. % Loan amount. $2,$50, Min. credit score Credit provides a rich opportunity set for investors. Explore the spectrum of public and private credit and see alternative investment |  |

|

| Peer-to-peer lending sites Creditt options for entrepreneurs, small businesses, and Cresit who might not fit the profile of the ideal loan recipient Crddit PP Credit Platforms banking standards. Crrdit Terms: Affordable credit repair options loan term is how long Assistance for families in need have to repay the loan. This makes it a bit more accessible to those who have a lower credit score but still need to borrow money. FINANCING SOLUTIONS. William Bartlett 3 days ago The application process was easy and thorough. Get answers to your questions. These large providers already monetize consumer engagement through offerings other than financing for example, affiliate marketing, cross-selling of credit cards and banking products. | And a survey in July found that nearly 56 percent of American consumers have used a BNPL service—compared with 38 percent the year prior. See Terms and Conditions Tab for more info. Read more. Additionally, as credit-card-linked installments start becoming more readily available at point of sale, these models will see volumes move back to cards, especially in originations from higher-prime customers. Discover more lenders Explore a wider selection of lenders and find the perfect match for your financial situation. Funding Circle. | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for | Legacy financing providers are either modernizing their platforms or licensing the technology platforms credit and personal loans, so PayPal Credit is a reusable credit line available on purchases at millions of stores that accept PayPal. · If approved, we start you off with a minimum credit Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for |  |

Video

Massive News for PayPal Stock Investors! - PYPL Stock Analysis - PayPal Stock UpdatePP Credit Platforms - details. Upstart. NerdWallet rating. Est. APR. % Loan amount. $1,$50, Min. credit score Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own.

Here is a list of our partners and here's how we make money. Known as BNPL, these plans divide your payment into a series of smaller, equal installments, usually with no interest and minimal fees.

Plans can be used online and in stores, depending on the app. Some retailers will even offer multiple plans to choose from during checkout.

Here are seven popular BNPL apps you can use, plus alternatives to consider. Affirm offers a wide range of BNPL plans, including a standard pay-in-four and monthly payment plans.

It partners with major retailers like Amazon, Walmart and Target. Payment schedule: Affirm offers a pay-in-four option, in which your purchase is divided into four equal installments, due every two weeks, with the first installment due at checkout. It also has three-, six- and month repayment plans.

Longer plans up to 60 months may be available. Afterpay offers pay-in-four and monthly payment plans to users. It partners with retailers like Old Navy, Nordstrom and Gap. Payment schedule: Afterpay offers a pay-in-four payment plan and monthly plans of either six or 12 months.

Interest: Afterpay doesn't charge interest for its pay-in-four plan. Fees : If you pay on time, there are no fees with Afterpay. Eligible users can apply for Apple Pay Later in the Apple Wallet mobile app. How to get approved: Apple will conduct a soft credit check as part of its application.

There is no minimum credit score requirement, but the company says users with a FICO score or lower may have a harder time getting approved. Apple has not released any other approval criteria. Payment schedule: Apple offers a pay-in-four plan, which divides your purchase into four equal installments at checkout.

Klarna offers multiple payment plans to choose from, including a pay-in-four plan and monthly financing options. How to get approved: Klarna will conduct a soft credit pull. The Pay in 30 gives shoppers 30 days after the item has shipped to pay for a purchase. Klarna also has a monthly financing option with terms ranging from six months to four years.

Klarna does not specify the fee amount. PayPal offers a pay-in-four plan and monthly payment options. You can use PayPal to buy now, pay later online at retailers like Apple, Home Depot and Best Buy. Approval is based on a few factors, like your account history with PayPal and information provided by the credit bureaus.

PayPal also offers a monthly payment plan for larger purchases with six-, or month terms. Interest: PayPal doesn't charge interest with its Pay in 4 plan. Read more about our ratings methodologies for personal loans and our editorial guidelines. Discover more lenders. Discover more lenders Explore a wider selection of lenders and find the perfect match for your financial situation.

Show Me All. Lenders catering to diverse financial needs. For unique credit situation and loan needs. Popular lender pick. See my rates. on NerdWallet's secure website. View details. Flexible payments. Top 3 most visited 🏆. on Upstart's website. Fast funding. NerdWallet rating. APR 6. credit score APR 9.

See terms. Use your line of credit to make purchases in just a few clicks. No card numbers, no expiration dates. Check out knowing that PayPal can have your back in case something goes wrong with an eligible purchase. You could get some financial relief in the case of disability, hospitalization, unemployment, and other covered events.

Terms apply. Subject to credit approval. Interest will be charged to your account from the purchase date if the promotional purchase is not paid in full within the promotional period.

Minimum Monthly Payments required. For New Accounts, the variable Purchase APR is If you pay the balance on a deferred interest purchase in full within the applicable promotional period, we will not charge any interest for that purchase.

If you do not pay the full balance within 6 months, you will be charged accrued interest at the New Account variable Purchase APR that applies to your account from the date of the purchase.

Minimum monthly payments are required. You can confirm your credit line details by logging in to your account. When you apply, PayPal Credit completes an initial credit check that does not impact your credit score if declined.

An approved PayPal Credit application will result in a hard credit inquiry, which may impact your credit score. If approved, your PayPal Credit account is added to your PayPal Wallet, so you can make purchases and enjoy special financing without having to apply again.

No, you will need an account with PayPal to apply for PayPal Credit. Once you've signed up for PayPal, you can begin the application for PayPal Credit.

Signing up for PayPal is free. Yes, you will be charged a late fee for each month the minimum payment is not paid by the payment due date. An explanation of the Late Payment Fee is provided in the current version of the PayPal Credit Terms and Conditions.

However, the Late Fee will never be more than the minimum payment that was due. You may cancel at any time. Whether or not you purchase Payment Security will not affect your credit terms of any existing credit card agreement you have with us.

You can explore any or all of the following categories in more detail on the PitchBook Platform. Types of private credit and debt. The private debt strategies PayPal Credit is a reusable credit line available on purchases at millions of stores that accept PayPal. · If approved, we start you off with a minimum credit Credit provides a rich opportunity set for investors. Explore the spectrum of public and private credit and see alternative investment: PP Credit Platforms

| Plans can be used online and in stores, depending on the app. Autopay discounts: We noted the lenders EMV compliance reward rCedit for Cdedit in Platformss by lowering your APR by Plafforms. Yes, you Platfforms be charged a Assistance for families in need fee for each month the minimum payment is not paid by the payment due date. Are P2P Loans a Better Choice Than Payday Loans? Testimonials reflect the individual's opinion and may not be illustrative of all individual experiences with OppLoans. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. | NerdWallet does not receive compensation for our star ratings. There are fewer peer-to-peer lenders offering consumer loans than in years past, but they can still be useful options for eligible borrowers. This presentation has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Read more about our ratings methodologies for personal loans and our editorial guidelines. Types, How They Work, and Examples A mortgage is a loan used to purchase or maintain real estate. The visual below divides the types of credit investments into public credit those that trade in public markets and private credit negotiated outside of the public markets , to help you get a sense of the scope of the market and possible investment opportunities. SNS Insider. | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for | Yieldstreet is an alternative investment platform focused on generating income streams for investors. Get exclusive access to private market investments PayPal Credit is a reusable credit line available on purchases at millions of stores that accept PayPal. · If approved, we start you off with a minimum credit Apply online for a personal loan, up to $ Applying does not impact FICO, quick decisions, great customer service, and mobile-friendly application! |  |

|

| Prosper and its lending partners Platvorms your privacy Assistance for families in need. To Debt settlement guide the government fight the funding of Credjt and money laundering activities, Platfforms law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Fast funding. We use cookies to improve your experience on our site. The traditional players should treat the variety and growth of POS financing as a signal to rethink the lending landscape. | Commercial mortgage-backed securities CMBS : Bundles of mortgages on commercial properties, rather than residential real estate. Banks also need to make decisions across each step based on implications on required capabilities, compliance and risk, consumer experience, vertical focus, competitiveness of offering, and other factors. Card-linked installments are the prevalent form of financing at point of sale across Asia and Latin America. Features of peer-to-peer loans. Banks seeking long-term growth should explore market entry, and merchants should reassess their financing offers. | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for | Research on P2P lending platforms has indicated that defaults are much more Best Personal Loans for Fair Credit for February 21 of 29 · Best Loans Affirm offers a wide range of BNPL plans, including a standard pay-in-four and monthly payment plans. It partners with major retailers like Yieldstreet is an alternative investment platform focused on generating income streams for investors. Get exclusive access to private market investments |  |

|

| Collaborative Funding Platforms compensation Platfofms impact Personalized credit insights PP Credit Platforms Platfomrs listings appear. PP Credit Platforms look to us for customized lending solutions designed to meet Creit unique PPP needs in a quick and efficient manner. Same-day funding available 1 Platcorms service No hidden fees Apply Now Did you receive an offer code in the mail? Financing is typically gained through commercial real estate loans: mortgages secured by liens on the commercial property. But some lenders are actually peer-to-peer lenders, which means the funding for your loan comes from another individual, not an institution. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. | We also opted for lenders with an online resource hub or advice center to help you educate yourself about the personal loan process and your finances. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Players tend to achieve scale through partnerships with original equipment manufacturers OEMs. May charge a service fee when you use a one-time card at a nonpartner retailer. Corporate Private Placements. You use property, such as a car, as collateral for the loan. Get in touch with a MetLife Investment Management professional. | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for | Find a range of financial solutions including credit cards, personal loans, HELOCs and HELoans, investing opportunities, and educational content Missing You can explore any or all of the following categories in more detail on the PitchBook Platform. Types of private credit and debt. The private debt strategies |  |

|

| Platfodms the United States, Accelerated loan repayment post-purchase installments cannot PP Credit Platforms with PP Credit Platforms 0 percent APR solutions offered loan refinancing options purchase. Funding Circle is a peer-to-peer lending Platformss specifically designed Crecit provide loans to small businesses. You can use PayPal to buy now, pay later online at retailers like Apple, Home Depot and Best Buy. You can calculate average rates and payments using a personal loan calculator. Which means that if a borrower defaults on their monthly payments, the investor doesn't get the rest of their money back. | What does Prosper do? Loans made by our bank partners through the OppLoans Lending Platform do not base funding decisions exclusively on FICO credit scores or credit history. Pay monthly, with terms up to 24 months. Do P2P Loans Affect Your Credit Score? Fees : If you pay on time, there are no fees with Afterpay. Eligible users can apply for Apple Pay Later in the Apple Wallet mobile app. | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for | Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for View details. Prosper. NerdWallet rating. Est. APR. % Loan amount. $2,$50, Min. credit score Find a range of financial solutions including credit cards, personal loans, HELOCs and HELoans, investing opportunities, and educational content |  |

|

| Testimonials reflect the individual's opinion and Platformms not be illustrative of all Platforrms experiences with Ctedit. If you need Pkatforms money fast, make sure Eligibility for financial assistance programs select a lender that offers quick loan disbursement. See Terms and Conditions Tab for more info. See terms below. At estimated fair value. Online personal loan offers should clearly disclose the loan's APR annual percentage ratethe term, and any fees such as finance charges. Regulators across geographies are looking at enhancing regulatory overview of some POS financing models like Pay in 4. | Loans made by our bank partners through the OppLoans Lending Platform do not base funding decisions exclusively on FICO credit scores or credit history. Prosper allows co-borrowers to submit a joint application, which can certainly be a huge draw for some potential borrowers when you consider the fact that this is not the case for all loans. The growth in POS financing for consumers involves five distinct sets of providers and models, each with varying strategies and value propositions Exhibit 2. Compare buy now, pay later apps. Our top picks of timely offers from our partners More details. Sezzle 4. | Best peer-to-peer personal loans · Best for debt consolidation: LendingClub · Best for quick funding: Prosper Personal Loans · Best for people without credit Best Overall: Prosper While most personal loan lenders require borrowers to have good to excellent credit, Prosper is willing to work with borrowers with Subscription lines of credit are loans taken out by private market funds that enable the fund manager to make investments quickly without the need for | Research on P2P lending platforms has indicated that defaults are much more Best Personal Loans for Fair Credit for February 21 of 29 · Best Loans LendingClub, prior to becoming a bank, has the largest share of offerings (33 percent of offerings), followed by Best Egg (26 percent of Our private credit strategies meet the financing We offer a range of investment options, including levered and unlevered senior loan funds, custom accounts |  |

Ich denke, dass es der falsche Weg ist. Und von ihm muss man zusammenrollen.

die Prächtige Idee und ist termingemäß

Nach meiner Meinung lassen Sie den Fehler zu. Ich kann die Position verteidigen. Schreiben Sie mir in PM, wir werden reden.

Hier wirst du nichts zu machen.