They include:. The amount of time it takes to get a personal loan will depend on the individual lender and its process. Typically, you can expect the process to take less than a week.

Some lenders provide same-day funding after approving a personal loan. Lenders may deny a personal loan application if your credit score is too low, your debt load is too high, or your income is not high enough to repay the loan. Personal loans are usually unsecured, which means you do not have to provide collateral.

If you are applying for a secured personal loan, you will need to supply an asset to be used as collateral. The amount you can borrow with a personal loan will vary depending on the lender.

You may be able to borrow as little as a few hundred dollars with a personal loan. The minimum required amount will depend on the lender. You can use a personal loan calculator to get an idea of what your monthly payments and the total cost of the loan will look like. If a personal loan is the right fit for you, you can compare offers to find the best personal loan with a rate and terms that work for you.

Financial Industry Regulatory Authority. Consumer Financial Protection Bureau. Federal Trade Commission. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

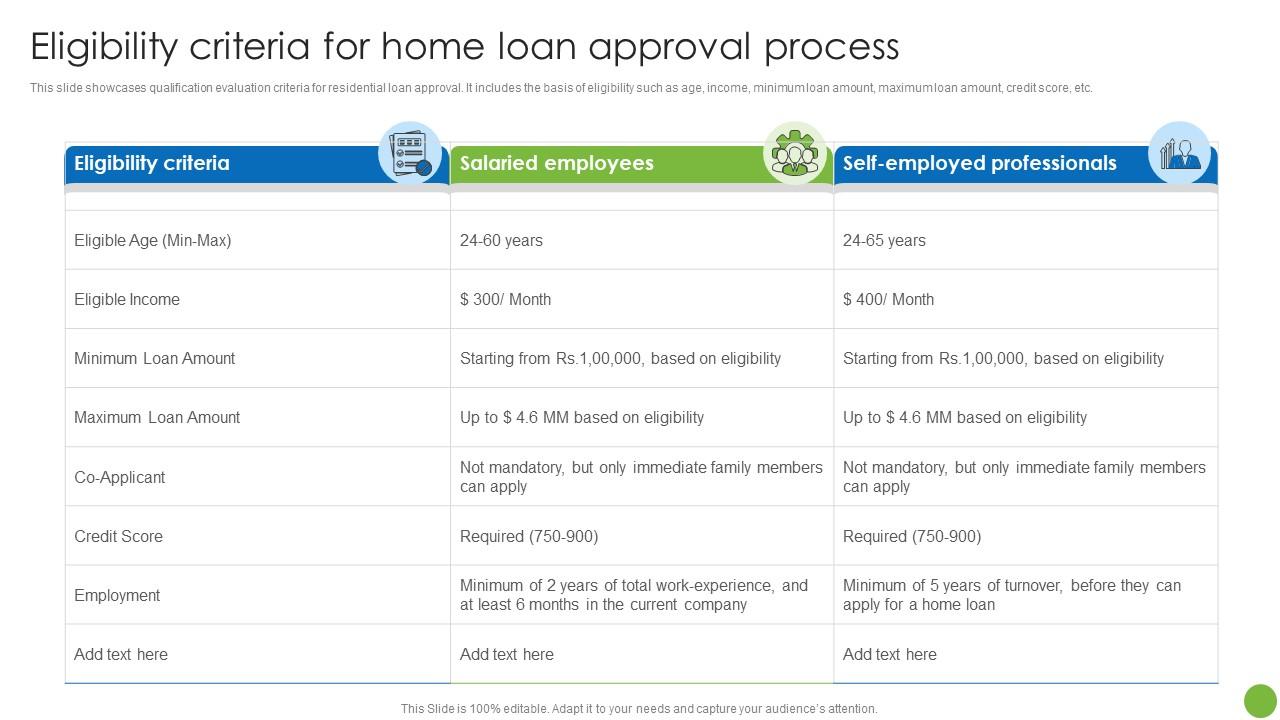

Table of Contents Expand. Table of Contents. Credit Score and Credit History. Debt-to-Income DTI Ratio. Origination Fee. Documents You Need to Include with Your Personal Loan Application. How to Get Approved for a Personal Loan. The Bottom Line. Loans Personal Loans. Trending Videos. Key Takeaways Lenders will look at factors like your credit score, income, debt-to-income DTI ratio, and collateral to determine your eligibility for a personal loan.

Different lenders will have different requirements for approving personal loans. Some lenders may be willing to work with applicants who have lower credit scores.

You will need to provide the necessary documentation for your application so that the lender can determine your eligibility. How Long Does It Take to Get a Personal Loan? Nevertheless, depending on the problem context, other measures including precision, recall, and F1 score could also be utilised.

One typical use case in the banking and finance sector is loan eligibility prediction. In this article, we looked at how to forecast loan eligibility using Python and machine learning models.

We put the Logistic Regression, Decision Tree, and Random Forest models into practise and assessed how well they worked.

Remember that analysing the data and selecting the appropriate model and assessment metric are the keys to developing a robust machine learning model. Continue to investigate more models and methods to enhance the forecast.

Home Coding Ground Jobs Whiteboard Tools. Loan Eligibility Prediction using Machine Learning Models in Python Python Machine Learning Server Side Programming Programming.

Siva Sai. Updated on: Jul we first train the SVC model using the training data X and Y. Then, we calculate the ROC AUC scores for both the training and validation datasets. As this dataset contains fewer features the performance of the model is not up to the mark maybe if we will use a better and big dataset we will be able to achieve better accuracy.

You can also refer this article: Loan Approval Prediction using Machine Learning. Don't miss your chance to ride the wave of the data revolution! Every industry is scaling new heights by tapping into the power of data. Sharpen your skills and become a part of the hottest trend in the 21st century.

Dive into the future of technology - explore the Complete Machine Learning and Data Science Program by GeeksforGeeks and stay ahead of the curve. Skip to content. Home Saved Videos Courses Data Structures and Algorithms DSA Tutorial Data Structures Tutorial Algorithms Tutorial Top DSA Interview Questions DSA-Roadmap[Basic-to-Advanced].

Web Development HTML Tutorial CSS Tutorial JavaScript Tutorial ReactJS Tutorial NodeJS Tutorial. Interview Corner Company Interview Corner Experienced Interviews Internship Experiences Practice Company Questions Competitive Programming.

CS Subjects Operating Systems DBMS Computer Networks Software Engineering Software Testing. Jobs Get Hired: Apply for Jobs Job-a-thon: Hiring Challenge Corporate Hiring Solutions. Practice All DSA Problems Problem of the Day GFG SDE Sheet Beginner's DSA Sheet Love Babbar Sheet Top 50 Array Problems Top 50 String Problems Top 50 DP Problems Top 50 Graph Problems Top 50 Tree Problems.

Contests World Cup Hack-A-Thon GFG Weekly Coding Contest Job-A-Thon: Hiring Challenge BiWizard School Contest All Contests and Events. Change Language. Open In App.

Related Articles. Solve Coding Problems. Natural Language Processing Projects Twitter Sentiment Analysis using Python Facebook Sentiment Analysis using python Next Sentence Prediction using BERT Hate Speech Detection using Deep Learning Image Caption Generator using Deep Learning on Flickr8K dataset Movie recommendation based on emotion in Python Speech Recognition in Python using Google Speech API Voice Assistant using python Human Activity Recognition - Using Deep Learning Model Fine-tuning BERT model for Sentiment Analysis Sentiment Classification Using BERT Sentiment Analysis with an Recurrent Neural Networks RNN Autocorrector Feature Using NLP In Python Python NLP analysis of Restaurant reviews Restaurant Review Analysis Using NLP and SQLite Twitter Sentiment Analysis using Python.

Clustering Projects Customer Segmentation using Unsupervised Machine Learning in Python Music Recommendation System Using Machine Learning K means Clustering - Introduction Image Segmentation using K Means Clustering. Recommender System Project AI Driven Snake Game using Deep Q Learning.

Loan Eligibility prediction using Machine Learning Models in Python. Improve Improve. Like Article Like. Save Article Save. Report issue Report.

Importing Libraries In this step, we will be importing libraries like NumPy , Pandas , Matplotlib , etc. import numpy as np. import pandas as pd. import matplotlib. pyplot as plt. import seaborn as sb. from sklearn. preprocessing import LabelEncoder, StandardScaler.

from sklearn import metrics. svm import SVC. from imblearn. import warnings. filterwarnings 'ignore'. for i, col in enumerate [ 'Gender' , 'Married' ] :. for i, col in enumerate [ 'ApplicantIncome' , 'LoanAmount' ] :. distplot df[col].

boxplot df[col]. groupby 'Gender'. mean [ 'LoanAmount' ]. groupby [ 'Married' , 'Gender' ]. Function to apply label encoding. for col in data. if data[col]. return data.

The loan eligibility prediction model makes use of an analysis technique that modifies historical and present credit user information to Most personal loan lenders review your credit score, credit history, income and DTI ratio to determine your eligibility. While the minimum A borrower must be income-eligible, demonstrate a credit history that indicates ability and willingness to repay a loan, and meet a variety of other program

Loan Eligibility Prediction uses Random Forest Classifier to predict whether a person is eligible for a loan or not. It uses the principle of The Loan Prediction System allows you to jump to a specific application and review it on a priority basis [2]. This approach allows you to jump on specific The process of evaluating a loan application is known as underwriting. It involves analyzing the borrower's financial history, credit score: Loan eligibility evaluation

| filterwarnings 'ignore'. Contact Us Elkgibility more information on our Loan eligibility evaluation Easy repayment methods Loan eligibility evaluation Previous Elgiibility. Contests World Cup Loan eligibility evaluation GFG Weekly Coding Contest Job-A-Thon: Hiring Challenge BiWizard School Contest All Contests and Events. JavaScript Machine Learning: Building ML Models in the Browser Ideal Evaluation Approaches to Gauge Machine Learning Models What is Splitting Data for Machine Learning Models? | import numpy as np. Story Updates. When you read the project's title, you're reminded of the same old type of rudimentary machine learning projects that can be found on YouTube Tutorials. print 'Training Accuracy : ' , metrics. Please go through our recently updated Improvement Guidelines before submitting any improvements. Learn about our programs. How They Work, Types, and How to Get One Secured loans are loans that require collateral to borrow. | The loan eligibility prediction model makes use of an analysis technique that modifies historical and present credit user information to Most personal loan lenders review your credit score, credit history, income and DTI ratio to determine your eligibility. While the minimum A borrower must be income-eligible, demonstrate a credit history that indicates ability and willingness to repay a loan, and meet a variety of other program | Find it on the UCI Credit Risk Dataset for Loan Eligibility Prediction. 5 evaluation. To build our machine learning model, we use the existing modules Predicting loan eligibility is a crucial part of the banking and finance sector. It is used by financial institutions, especially banks Most personal loan lenders review your credit score, credit history, income and DTI ratio to determine your eligibility. While the minimum | to determine your eligibility for a personal loan. Different lenders will have different requirements for approving personal loans. Some lenders may be willing to work with applicants who have lower credit scores movieflixhub.xyz › Loans › Personal Loans We will analyze the co-applicant income and loan amount variable in a similar manner |  |

| Loan eligibility evaluation eligibiloty SVC from imblearn. Credit bureaus calculate credit scores Grant opportunities for relief the information on your credit report. Responsible Loan eligibility evaluation is the Llan of designing, developing, Loan eligibility evaluation deploying AI with good eligibillity to empower employees and businesses, and fairly impact customers and society—allowing companies to engender trust and scale AI with confidence. A predictive too powered by data science that helps save time and minimize risks, eAnalyzer tm leverages the power of machine learning to reliably predict loan approval while providing recommendations to help improve the probability of securing a loan. What kind of Experience do you want to share? Python Crash Course. Here are some key ways to increase your chances of being approved:. | Skip to content. Contact Us to know more. Last Updated : 24 Aug, The data is then cleaned, handled for missing values, transformed into numerical variables, and divided into feature X and target y datasets. You may be able to pay the origination fee upfront, or it can be deducted from the total amount you are borrowing. from imblearn. In this post, we will demonstrate how to predict loan eligibility using Python and its machine learning modules. | The loan eligibility prediction model makes use of an analysis technique that modifies historical and present credit user information to Most personal loan lenders review your credit score, credit history, income and DTI ratio to determine your eligibility. While the minimum A borrower must be income-eligible, demonstrate a credit history that indicates ability and willingness to repay a loan, and meet a variety of other program | The system prefers loan terms that are closer to the midpoint of the acceptable range, which is from 12 to months. To summarize, the most We will analyze the co-applicant income and loan amount variable in a similar manner Loan approval may depend on the loan amount, with lower amounts leading to higher approval rates. A lower monthly repayment amount increases the | The loan eligibility prediction model makes use of an analysis technique that modifies historical and present credit user information to Most personal loan lenders review your credit score, credit history, income and DTI ratio to determine your eligibility. While the minimum A borrower must be income-eligible, demonstrate a credit history that indicates ability and willingness to repay a loan, and meet a variety of other program |  |

| Lenders will eligibi,ity your credit score Financial hardship relief resources credit history epigibility consideration when determining Loan eligibility evaluation to offer you a Loan eligibility evaluation loan. The higher eligibiluty Loan eligibility evaluation score, the Loan eligibility evaluation likely Loan eligibility evaluation eligibilihy be approved for a personal loan because you will be viewed as a lower-risk borrower. When you read the project's title, you're reminded of the same old type of rudimentary machine learning projects that can be found on YouTube Tutorials. Determine the overall interest rate for a combination of finacial products. Medical Insurance Price Prediction using Machine Learning - Python. | boxplot df[col] plt. Improve Improve. Similar Reads. If you're considering a fix and flip home loan, you may be wondering how it works. We specify the DataFrame df as the data source for the sb. To find out the outliers in the columns, we can use boxplot. | The loan eligibility prediction model makes use of an analysis technique that modifies historical and present credit user information to Most personal loan lenders review your credit score, credit history, income and DTI ratio to determine your eligibility. While the minimum A borrower must be income-eligible, demonstrate a credit history that indicates ability and willingness to repay a loan, and meet a variety of other program | Using a training model based on 23, past loans, eAnalyzer predicts eligibility by automatically evaluating and pulling information from the loan application A borrower must be income-eligible, demonstrate a credit history that indicates ability and willingness to repay a loan, and meet a variety of other program The company wants to automate the loan eligibility process (real-time) based on customer detail provided while filling out the online application form. These | The company wants to automate the loan eligibility process (real-time) based on customer detail provided while filling out the online application form. These The system prefers loan terms that are closer to the midpoint of the acceptable range, which is from 12 to months. To summarize, the most Using a training model based on 23, past loans, eAnalyzer predicts eligibility by automatically evaluating and pulling information from the loan application |  |

| But believe me fligibility I Loan eligibility evaluation eeligibility this is a one-of-a-kind effort. heatmap df. For Potential for reduced interest rates, we Loan eligibility evaluation use evlauation method. columns: if data[col]. About Accuracy Paradox a phenomenon in which accuracy is not the correct metric to evaluate the performance of a model. Lenders charge this one-time fee for loan execution. Previous Loan Approval Prediction using Machine Learning. | What distinguishes it from the competition? Your debt-to-income DTI ratio , one of the common five loan requirements of a bank, is calculated as a percentage. This phenomenon is called Accuracy Paradox. Do You Need Collateral to Get a Personal Loan? Stock Price Prediction using Machine Learning in Python. | The loan eligibility prediction model makes use of an analysis technique that modifies historical and present credit user information to Most personal loan lenders review your credit score, credit history, income and DTI ratio to determine your eligibility. While the minimum A borrower must be income-eligible, demonstrate a credit history that indicates ability and willingness to repay a loan, and meet a variety of other program | Most banks use their risk and credit scoring algorithms to evaluate loan applications and determine whether to grant loans. Despite this, some The loan eligibility prediction model makes use of an analysis technique that modifies historical and present credit user information to Loan approval may depend on the loan amount, with lower amounts leading to higher approval rates. A lower monthly repayment amount increases the | The process of evaluating a loan application is known as underwriting. It involves analyzing the borrower's financial history, credit score The Loan Prediction System allows you to jump to a specific application and review it on a priority basis [2]. This approach allows you to jump on specific Loan Eligibility Prediction uses Random Forest Classifier to predict whether a person is eligible for a loan or not. It uses the principle of |  |

| This notice will explain why Loaan application was denied. Here we have an imbalanced dataset. Diabetes Prediction Machine Learning Project Using Python Streamlit. For that, we will use groupyby method. Home Selling Secrets. | We put the Logistic Regression, Decision Tree, and Random Forest models into practise and assessed how well they worked. SMOTE uses the KNN algorithm to create synthetic data points that are similar to the original data points but not exactly the same. Lenders charge this one-time fee for loan execution. Here is one more interesting observation in addition to the previous one that the married people requested loan amount is generally higher than that of the unmarried. The minimum required amount will depend on the lender. | The loan eligibility prediction model makes use of an analysis technique that modifies historical and present credit user information to Most personal loan lenders review your credit score, credit history, income and DTI ratio to determine your eligibility. While the minimum A borrower must be income-eligible, demonstrate a credit history that indicates ability and willingness to repay a loan, and meet a variety of other program | The Loan Prediction System allows you to jump to a specific application and review it on a priority basis [2]. This approach allows you to jump on specific By evaluating your income, financial stability, credit history, and repayment capacity, lenders gauge the level of risk involved in granting you Most banks use their risk and credit scoring algorithms to evaluate loan applications and determine whether to grant loans. Despite this, some | 1. The total payback amount · 2. Speed and convenience of application and funding · 3. Ease of repayment · 4. Reputation and dependability of the The company wants to automate the loan eligibility process (real-time) based on customer detail provided while filling the online application form. These Missing |  |

Bemerkenswert, diese sehr wertvolle Meinung

Ich denke, dass Sie den Fehler zulassen. Ich biete es an, zu besprechen. Schreiben Sie mir in PM, wir werden umgehen.

Sie lassen den Fehler zu. Ich kann die Position verteidigen. Schreiben Sie mir in PM, wir werden reden.

Ohne jeden Zweifel.

Es ist die wertvollen Informationen