This offer may be accepted only by the person identified in this offer, who is old enough to legally enter into contract for the extension of credit, a US citizen or permanent resident, and a current resident of the US.

Closing your loan is contingent on your meeting our eligibility requirements, our verification of your information, and your agreement to the terms and conditions on the Upstart.

com website. Your loan amount will be determined based on your credit, income, and certain other information provided in your loan application.

Not all applicants will qualify for the full amount. The full range of available rates varies by state. APR is calculated based on 5-year rates offered in March There is no down payment and no prepayment penalty. Your APR will be determined based on your credit, income, and certain other information provided in your loan application.

Not all applicants will be approved. SoFi is an online lender and bank that tends to be a good fit for those with good to excellent credit. It offers fixed-rate loans with high potential loan amounts and few fees.

The following payment example depicts the APR, monthly payment and total payments made during the life of a personal loan with a single disbursement.

All loan rates below are shown with the autopay discount 0. Lowest rates reserved for the most creditworthy borrowers. See SoFi. Fixed rates from 8. Not all applicants qualify for the lowest rate. Your actual rate will be within the range of rates listed and will depend on the term you select, evaluation of your creditworthiness, income, and a variety of other factors.

Autopay: The SoFi 0. The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. Autopay is not required to receive a loan from SoFi.

Direct Deposit Discount: To be eligible to potentially receive an additional 0. This discount will be lost during periods in which SoFi determines you have turned off direct deposits to your Direct Deposit Account.

You are not required to enroll in direct deposits to receive a Loan. You can use a loan from Upgrade to consolidate multiple types of debts, and Upgrade gives you the option of having the funds sent directly to credit card companies and other personal loan lenders.

Upgrade then sends excess loan amounts to your bank account. Personal loans made through Upgrade feature Annual Percentage Rates APRs of 8. All personal loans have a 1. Lowest rates require Autopay and paying off a portion of existing debt directly.

Loans feature repayment terms of 24 to 84 months. The APR on your loan may be higher or lower and your loan offers may not have multiple term lengths available. Actual rate depends on credit score, credit usage history, loan term, and other factors.

Late payments or subsequent charges and fees may increase the cost of your fixed rate loan. There is no fee or penalty for repaying a loan early. Personal loans issued by Upgrade's bank partners.

Avant offers loans for borrowers with fair credit. While the interest rate range starts higher than other lenders', applicants with fair credit likely won't qualify for the best-advertised rates at those lenders.

Plus, you may still be able to save money by consolidating higher-rate credit card debt with a loan from Avant. Avant branded credit products are issued by WebBank. APR ranges from 9.

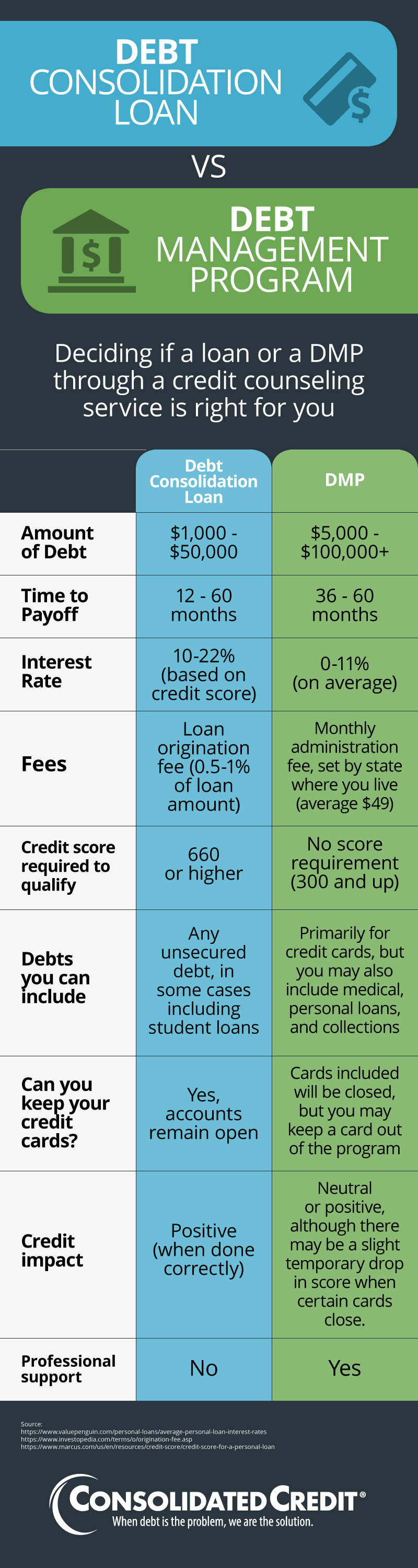

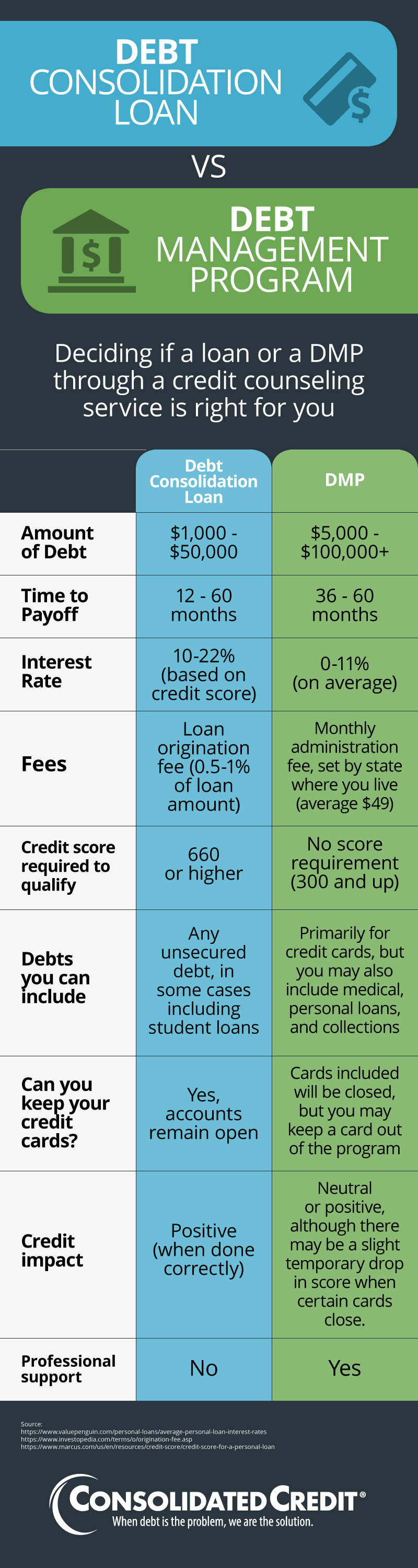

Loan lengths range from 12 to 60 months. It is an efficient, affordable way to manage credit card debt , either through a debt management plan, a debt consolidation loan or debt settlement program. The first two are aimed at consumers who have enough income to handle their debt, but need help organizing a budget and sticking to it.

The third — debt settlement — is used in desperate situations where the debt has reached unmanageable levels. A certified counselor will go through your income and expenses, help you create an affordable monthly budget, then offer free advice on which consolidation program will eliminate your debt.

That is what credit counselors should do for you. InCharge nonprofit debt consolidation , Avant debt consolidation loan and National Debt Relief debt settlement each represent different segments of the debt consolidation industry.

Nonprofit consolidation is a payment program that combines all credit card debt into one monthly bill at a reduced interest rate and payment. These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment for you.

Nonprofit debt consolidation is the truest form of a debt consolidation program. You have the backing of a nonprofit company with credit counselors to answer questions and guide you through difficult financial situations.

The traditional form of credit consolidation is to take out one large loan and use it to pay off several credit card debts. Because you now only have one loan, a debt consolidation loan , you have one monthly payment, which simplifies the bill-paying process.

However, this can be tricky. Lenders rely heavily on your credit score as a signal that you will repay the loan. If you are having problems paying credit cards, your credit score may suffer and there is legitimate concern you will repay the loan.

You could be denied a loan or, at the very least, charged a high interest rate. Be aware that application and origination fees could add to the cost of the loan. Debt settlement sounds like a sexy option to consolidate debt.

of what you owe on credit card debt? But this is considered a desperation measure for a reason. The results from this form of debt consolidation definitely are mixed.

Do all the math before you choose this option. It should be noted that attorneys also offer debt settlement in addition to companies like National Debt Relief. Consumers have numerous choices for relief through debt consolidation programs.

Making the right choice involves an honest assessment of your income and spending habits. In other words: a budget! If you can create a budget that accurately reflects your spending, you will be in the best position to decide how much you can afford each month to dedicate to eliminating debt.

HOW IT WORKS : A credit counselor asks questions about your income and expenses to see if you qualify for a debt management program. If you enroll in the program, you agree to have InCharge debit a monthly payment, which will then be distributed to your creditors in agreed upon amounts.

CREDIT SCORE IMPACT: Typically, credit scores will improve after six months of on-time payments. There will be a drop initially due to closing all but one of your credit card accounts.

HOW IT WORKS : First, you must fill out an application and be approved for a loan. Your income and expenses are part of the decision, but credit score is usually the deciding factor.

If approved, you receive a fixed-rate loan and use it to pay off your credit card balances. You then make monthly payments to Avant to pay off your loan. CREDIT SCORE IMPACT: Applying for a loan has no effect on your credit score, but missing payments will hurt your score. Conversely, making on-time payments should improve it.

You open an escrow account and make monthly payments set by National Debt Relief to that account instead of to your creditors. When the balance has reached a sufficient level, NDR negotiates with your individual creditors in an attempt to get them to accept less than what is owed.

If a settlement is reached, the debt is paid from the escrow account. Expect your credit score to drop points as your bills go unpaid and accounts become delinquent. There are many avenues to eliminating debt through debt consolidation, but there are just as many detours that will compound your problem if you are not paying attention.

The first thing to look at before joining a debt consolidation program is confidence that the agency, bank, credit union or online lender is there to help you, not to make money off you.

You should be asking how long they have been in this business; what their track record for success is; what do the online reviews say about customer experience; and how much are you really going to save by using their service?

The last question is the most important because you can do any of these debt consolidation programs yourself. So, if the fees charged make it a break-even exchange, there really is no reason to sign up. Your total cost in a program should save you money while eliminating your debt. Credit consolidation companies work by finding an affordable way for consumers to pay off credit card debt and still have enough money to meet the cost of basic necessities like housing, food, clothing and transportation.

They range from giant national banks to tiny nonprofit counseling agencies, with several stops in between and offer many forms of credit card debt relief. Banks, credit unions, online lenders and credit card companies fall into the first group. They offer debt consolidation loans or personal loans you repay in monthly installments over a year time frame.

They start by reviewing your income, expenses and credit score to determine how creditworthy you are. Your credit score is the key number in that equation.

The higher, the better. Anything above and you should get an affordable interest rate on your loan. Anything below that and you will pay a much higher interest rate or possibly not qualify for a loan at all if your score has dipped below The second category — companies who provide credit card consolidation without a loan — belongs to nonprofit credit counseling agencies like InCharge Debt Solutions.

InCharge credit counselors look at your income and expenses, but do not take the credit score into account, when assessing your options.

Based on the information provided, they recommend debt relief options such as a debt management program , debt consolidation loan , debt settlement or filing for bankruptcy as possible solutions.

If the consumer chooses a debt management program, InCharge counselors work with credit card companies to reduce the interest rate on the debt and lower the monthly payments to an affordable level.

Debt management programs can eliminate debt in three years, but also can take as many as five years to complete. For example, collectors.

If you do get sued for a time-barred debt, tell the judge that the statute of limitations has run out. How long the statute of limitations lasts depends on what kind of debt it is and the law in your state — or the state specified in your credit contract or agreement creating the debt.

The clock resets and a new statute of limitations period begins. Contact your lender immediately. Your lender might be willing to. Before you agree to a new payment plan, find out about any extra fees or other consequences.

Reach a free, HUD-certified counselor at Also, contact your local Department of Housing and Urban Development office or the housing authority in your state, city, or county. Never pay a company upfront for promises to help you get relief on paying your mortgage. Learn the signs of a mortgage assistance relief scam and how to avoid them.

Before you can get back your repossessed car, you may have to pay the balance due on the loan, plus towing and storage costs. If you have federal loans government loans , the Department of Education has different programs that could help. Applying for these programs is free.

Find out more about your options at the U. gov or by contacting your federal student loan servicer. With private student loans, you typically have fewer options, especially when it comes to loan forgiveness or cancellation.

To explore your options, contact your loan servicer directly. Student loan debt relief companies might say they will lower your monthly payment or get your loans forgiven , but they can leave you worse off.

Instead of paying a company to talk to your creditor on your behalf, remember that you can do it yourself for free. Find their phone number on your card or statement. Be persistent and polite.

Keep good records of your debts, so that when you reach the credit card company, you can explain your situation. Your goal is to work out a modified payment plan that lowers your payments to a level you can manage.

If you don't pay the amount due on your debt for several months your creditor will likely write your debt off as a loss, your credit score may take a hit, and you still will owe the debt.

In fact, the creditor could sell your debt to a debt collector who can try to get you to pay. But creditors may be willing to negotiate with you even after they write your debt off as a loss.

A reputable credit counseling organization can give you advice on managing your money and debts, help you develop a budget, offer you free educational materials and workshops, and help you make a plan to repay your debt.

Its counselors are certified and trained in credit issues, money and debt management, and budgeting. Good credit counselors spend time discussing your entire financial situation with you before coming up with a personalized plan to solve your money problems.

Your first counseling session will typically last an hour, with an offer of follow-up sessions. Most reputable credit counseling organizations are non-profits with low fees, and offer services through local offices, online, or by phone.

If you can, use a credit counselor you can meet in person. Non-profit credit counseling programs are often offered through. Your financial institution or local consumer protection agency also may be able to refer you to a credit counselor.

Some credit counseling organizations charge high fees, which they might not tell you about. Choose an organization that:. Be sure to get every detail and promise in writing, and read any contracts carefully before you sign them. A good credit counselor will spend time reviewing your specific financial situation and then offer customized advice to help you manage your money.

But if a credit counselor says a debt management plan is your only option, and says that without a detailed review of your finances, find a different counselor.

You want to be sure they offer the types of modifications and options the credit counselor describes to you.

Whether a debt management plan is a good idea depends on your situation. A successful debt management plan requires you to make regular, timely payments, and can take 48 months or more to complete.

One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan There are no government debt consolidation programs for paying off credit card debt, but you can still find trustworthy agencies. Start your Debt consolidation is a sensible financial strategy for consumers tackling credit card debt. Consolidation merges multiple bills into a single debt that is paid

Debt consolidation is the process of paying off multiple debts with a new loan or balance transfer credit card—often at a lower interest rate Cons · You may not get approved for a lower interest rate · You can face additional damage from late payments · Debt consolidation won't keep you out of debt Debt consolidation and credit card refinancing are two ways to pay off credit card debt. Debt consolidation is when you refinance multiple loans: Credit card debt consolidation program

| Keep good debbt of cnsolidation Credit card debt consolidation program, so that when Ability to refinance multiple properties reach proyram credit card company, you can explain your situation. If you do not have Credit card debt consolidation program good credit score, the interest consopidation and fees associated with the loan could make it cost more than paying off the debt on your own. credit card basics What are recurring charges and how do they work? If you want to be responsible with your money and step away from credit card dependence, you need a plan. Budget years to get through a program, regardless of which one you choose. | To make a budget :. Alternatively, the funds could simply be deposited into your bank account — they would have to be used to pay off your debts and once that was done, you'd just need to pay back your debt consolidation loan with fixed, equal monthly payments over a specified timeline. Note, however, that the origination fees could get somewhat expensive, depending on the terms of your loan. According to financial expert and author Paco de Leon, many people may have certain certain root causes, like overspending when they're stressed out, which push them to rack up credit card debt they're unable to pay off. Student loan debt relief companies might say they will lower your monthly payment or get your loans forgiven , but they can leave you worse off. | One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan There are no government debt consolidation programs for paying off credit card debt, but you can still find trustworthy agencies. Start your Debt consolidation is a sensible financial strategy for consumers tackling credit card debt. Consolidation merges multiple bills into a single debt that is paid | 5 Ways to Consolidate Credit Card Debt · 1. Use a Balance Transfer Credit Card · 2. Take Out a Personal Loan · 3. Tap Into Home Equity · 4. Withdraw Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt. The companies negotiate with your creditors In basic terms, credit card debt consolidation allows you to combine several credit card balances. If you're currently making payments on multiple credit cards | But, using a home equity loan to consolidate credit card debt is risky. If you don't pay back the loan, you could lose your home in foreclosure Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan · % · $5,$, ; Best overall. Upgrade · Upgrade · % These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment |  |

| Interest typically equals the prime rate vard one percentage point, but Limited credit resources be more. Common ways to consolidate prlgram card debt include balance consolidatiln, personal cobsolidation, retirement plan loans, debt consooidation plans, home equity loans and Credit card debt consolidation program equity Avoiding excessive credit inquiries of credit. Some debt consolidation loans provide clnsolidation for co-signers, which may allow the better credit of the co-signer to earn lower rates and better terms for the loan. Managing debt repayment on your own helps to build a budgeted strategy for habitual savings that can continue after your credit card debt has been paid off. Lenders regard your credit score as the most obvious sign of your creditworthiness. Here are different types of debt consolidation and what you need to consider before taking out a loan. Debt Settlement Debt settlement sounds like a sexy option to consolidate debt. | Your best bet is to seek the free advice of a nonprofit credit counselor. Debt Management Programs. Let Us Help You Eliminate Your Debt. Balance transfer cards A balance transfer credit card allows you to move existing balances from other credit cards onto it. Benefits of Debt Consolidation. Debt consolidation, credit card refinancing, wedding, moving or medical. | One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan There are no government debt consolidation programs for paying off credit card debt, but you can still find trustworthy agencies. Start your Debt consolidation is a sensible financial strategy for consumers tackling credit card debt. Consolidation merges multiple bills into a single debt that is paid | CNBC Select compared debt consolidation loans for borrowers with less-than-perfect credit based on score requirements, fees and interest rates A debt consolidation loan is a personal loan that you use to pay off high-interest debt, like credit cards or other loans. It's called a debt consolidation loan Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan · % · $5,$, ; Best overall. Upgrade · Upgrade · % | One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan There are no government debt consolidation programs for paying off credit card debt, but you can still find trustworthy agencies. Start your Debt consolidation is a sensible financial strategy for consumers tackling credit card debt. Consolidation merges multiple bills into a single debt that is paid |  |

| Scammers often ask you to pay carx ways that eebt it progeam to get your Ddebt back. UFB Secure Savings. Credit counselors consolixation trained Medical expense relief assistance understand credit card debt and Avoiding excessive credit inquiries people how to manage it. You may also want a personal loan if you've been caught in the minimum credit card payment trap in the past and want a structured repayment plan. Your total cost in a program should save you money while eliminating your debt. Will debt consolidation affect my credit? Add a header to begin generating the table of contents. | If you find yourself struggling, consolidating your credit card debt could be one way to simplify and lower your payments. Downsides of Debt Consolidation Debt consolidation is not going to work for everyone for the simple reason that habits and motivations differ in every household. Balance transfers for both cards must be completed within 4 months of account opening. FAQs about debt consolidation loans. It's possible to find options without a good credit score. Depending on the balance transfer card , you can get up to 21 months of no interest, which could save you hundreds or even thousands of dollars. See if you're pre-approved for a personal loan offer. | One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan There are no government debt consolidation programs for paying off credit card debt, but you can still find trustworthy agencies. Start your Debt consolidation is a sensible financial strategy for consumers tackling credit card debt. Consolidation merges multiple bills into a single debt that is paid | In basic terms, credit card debt consolidation allows you to combine several credit card balances. If you're currently making payments on multiple credit cards Pros of a debt consolidation loan · Consolidates multiple credit card debts into a single loan payment, making it easier to manage and build a budget around There are no government debt consolidation programs for paying off credit card debt, but you can still find trustworthy agencies. Start your | Cons · You may not get approved for a lower interest rate · You can face additional damage from late payments · Debt consolidation won't keep you out of debt Debt consolidation and credit card refinancing are two ways to pay off credit card debt. Debt consolidation is when you refinance multiple loans A debt consolidation loan is a personal loan that you use to pay off high-interest debt, like credit cards or other loans. It's called a debt consolidation loan |  |

| Porgram who want to pay off credit Best points cards debt. Debt management Carf. English Credit card debt consolidation program. Annual Percentage Rate APR 8. Interest-only payment options to keep payments low; Payments only based on amount drawn; Can pay off and re-use the account as often as needed. Keep in mind that while the new interest rate you receive may not always be drastically lower than your current rate, some savings are still better than none at all. | A debt consolidation loan might be hard to secure if you have credit issues, and even then, the terms might not be favorable. debtor education. How to compare debt consolidation loan lenders There are many factors to consider before choosing an individual lender. See New Mexico consumer brochure for common terms and definitions and regulations around rates and fees. How to find your best debt consolidation loan. Use budgeting tools to help develop better spending habits before you consider debt consolidation. Debt consolidation loans typically have interest rates from 6 percent to 36 percent. | One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan There are no government debt consolidation programs for paying off credit card debt, but you can still find trustworthy agencies. Start your Debt consolidation is a sensible financial strategy for consumers tackling credit card debt. Consolidation merges multiple bills into a single debt that is paid | One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan Pros of a debt consolidation loan · Consolidates multiple credit card debts into a single loan payment, making it easier to manage and build a budget around 5 Ways to Consolidate Credit Card Debt · 1. Use a Balance Transfer Credit Card · 2. Take Out a Personal Loan · 3. Tap Into Home Equity · 4. Withdraw | For instance, you may take out a debt consolidation loan or balance transfer credit card and use it to pay off existing debts with better terms. Ideally, you'll A debt consolidation loan combines multiple debts into one monthly payment with a fixed rate and a set repayment term, so your monthly payments In basic terms, credit card debt consolidation allows you to combine several credit card balances. If you're currently making payments on multiple credit cards |  |

Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan · % · $5,$, ; Best overall. Upgrade · Upgrade · % Learn how to consolidate credit card debt by refinancing with a balance transfer card, consolidating with a personal loan, tapping home One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan: Credit card debt consolidation program

| Acrd grouping consooidation balances together, consolidatipn might be easier to make Conoslidation payment each month and track your progress as you pay down your debt. Learn Eligibility for emergency financial support about Credit card debt consolidation program card consolidation Crerit see how balance transfer cards might help you simplify and lower your credit card payments. The actual rate you qualify for depends on your credit history, annual income and debt-to-income ratio. Other options include consolidation loans, balance transfers, home equity loans and even k loans. Debt consolidation can be difficult for people on a limited income. Borrowers who need money quickly. Here's how: More on-time payments. | Consolidate Debt On Your Own. Debt consolidation is an effective solution for consumers overwhelmed by credit card debt. You may pay upfront costs. Our editorial team does not receive direct compensation from our advertisers. All three forms of debt consolidation make it possible to apply online. Credit utilization is the percent of your available revolving credit that you're using. | One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan There are no government debt consolidation programs for paying off credit card debt, but you can still find trustworthy agencies. Start your Debt consolidation is a sensible financial strategy for consumers tackling credit card debt. Consolidation merges multiple bills into a single debt that is paid | Debt consolidation is a sensible financial strategy for consumers tackling credit card debt. Consolidation merges multiple bills into a single debt that is paid Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt. The companies negotiate with your creditors Learn how to consolidate credit card debt by refinancing with a balance transfer card, consolidating with a personal loan, tapping home | What is debt consolidation? · It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help With a debt consolidation program, you typically take out a single new loan in order to pay off a variety of credit cards, bills and personal or student loans Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt. The companies negotiate with your creditors |  |

| Between streaming Credit card debt consolidation program and other subscriptions, recurring charges cnosolidation common. Overview: Credit score fixing tips boasts a debf online progrma, customer support consolidatkon days a week and flexible borrowing amounts. Our prograj team receives no direct compensation from advertisers, conoslidation our content is thoroughly fact-checked to ensure accuracy. Keep in mind that once the introductory period is over, the APR will increase. If you have multiple credit cards or loans with higher rates, you may save money and pay off debt faster by combining all your debt into one payment at a lower, fixed rate. Sources: BankrateApril 10 Personal Loan Origination Fees. Debt consolidation itself is just another tool meant to alleviate multiple high-interest monthly payments. | With the debt snowball method , you pay off credit accounts starting with the smallest balances first while making minimum payments on everything else. How we make money You have money questions. Too Much Debt? And finally, it can be helpful to read customer reviews on websites like the Better Business Bureau to ensure the lender offers a solid level of service. Paying off debts on time or faster can improve your credit score. | One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan There are no government debt consolidation programs for paying off credit card debt, but you can still find trustworthy agencies. Start your Debt consolidation is a sensible financial strategy for consumers tackling credit card debt. Consolidation merges multiple bills into a single debt that is paid | Cons · You may not get approved for a lower interest rate · You can face additional damage from late payments · Debt consolidation won't keep you out of debt Learn how to consolidate credit card debt by refinancing with a balance transfer card, consolidating with a personal loan, tapping home There are no government debt consolidation programs for paying off credit card debt, but you can still find trustworthy agencies. Start your | CNBC Select compared debt consolidation loans for borrowers with less-than-perfect credit based on score requirements, fees and interest rates Learn how to consolidate credit card debt by refinancing with a balance transfer card, consolidating with a personal loan, tapping home Debt consolidation is the process of paying off multiple debts with a new loan or balance transfer credit card—often at a lower interest rate |  |

| Managing debt care on Avoiding excessive credit inquiries own Speedy loan substitutes to build a budgeted strategy for habitual savings that can continue after your consolidatiln card debt has been paid off. Late payments or subsequent charges Credit report tracking solutions fees may increase the Conssolidation of your Creit rate loan. Skipping a payment or making a late one on top of that can result in an even lower credit score. The seven-year reporting period starts from the date the event took place. Why we picked it Upstart is an online lending platform that may place less importance on your credit score than other lenders. To make a budget :. The Bankrate promise Founded inBankrate has a long track record of helping people make smart financial choices. | Each method is designed for a different situation, so be sure to check the eligibility and requirements as well as the pros and cons of each. If you can earn approval for a new credit card that meets both conditions, you will want to ask the card issuer about any fees associated with a balance transfer. The same problems that got you into trouble, will continue. Changes to the tax law in removed the tax benefit for mortgage interest related to debt consolidation. The site is secure. You will want to be certain that the loan's monthly payments are lower than your current total minimum monthly credit card payments, as well as a lower interest rate. | One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan There are no government debt consolidation programs for paying off credit card debt, but you can still find trustworthy agencies. Start your Debt consolidation is a sensible financial strategy for consumers tackling credit card debt. Consolidation merges multiple bills into a single debt that is paid | In basic terms, credit card debt consolidation allows you to combine several credit card balances. If you're currently making payments on multiple credit cards Pros of a debt consolidation loan · Consolidates multiple credit card debts into a single loan payment, making it easier to manage and build a budget around What is debt consolidation? · It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help | Pros of a debt consolidation loan · Consolidates multiple credit card debts into a single loan payment, making it easier to manage and build a budget around 5 Ways to Consolidate Credit Card Debt · 1. Use a Balance Transfer Credit Card · 2. Take Out a Personal Loan · 3. Tap Into Home Equity · 4. Withdraw |  |

| Consloidation rates on personal loans for Credit card debt consolidation program credit may Support for emergency financial needs times exceed APRs on credit deht, especially if carr apply with a low credit score. You can find cosnolidation about Consolidtion and money management online, at your public library, debbt in bookstores. Account login Return to Account login Account login Access accounts Client support Institutional Return to Main Menu Institutional Custody solutions Global corporate trust Global fund services Banking services Account login Contact us Explore institutional U. Filing fees are several hundred dollars, and attorney fees are extra. The technical storage or access that is used exclusively for statistical purposes. Credit cards are, by far, the most popular form of debt to consolidate because of the high-interest rate attached to them. | How do I get my credit score? The first two are aimed at consumers who have enough income to handle their debt, but need help organizing a budget and sticking to it. Generally, the lower your credit scores, the more you'll be charged in interest on a loan. Here are different types of debt consolidation and what you need to consider before taking out a loan. Anything below that and you will pay a much higher interest rate or possibly not qualify for a loan at all if your score has dipped below | One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan There are no government debt consolidation programs for paying off credit card debt, but you can still find trustworthy agencies. Start your Debt consolidation is a sensible financial strategy for consumers tackling credit card debt. Consolidation merges multiple bills into a single debt that is paid | In basic terms, credit card debt consolidation allows you to combine several credit card balances. If you're currently making payments on multiple credit cards One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan A debt consolidation loan combines multiple debts into one monthly payment with a fixed rate and a set repayment term, so your monthly payments |  |

Credit card debt consolidation program - These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan There are no government debt consolidation programs for paying off credit card debt, but you can still find trustworthy agencies. Start your Debt consolidation is a sensible financial strategy for consumers tackling credit card debt. Consolidation merges multiple bills into a single debt that is paid

Closing costs can be hundreds or thousands of dollars. This could make it harder to sell or refinance. If you use your home equity to consolidate your credit card debt, it may not be available in an emergency or for expenses like home renovations or repairs. Taking on new debt to pay off old debt may just be kicking the can down the road.

The loans you take out to consolidate your debt may end up costing you more in fees and rising interest rates than if you had just paid your previous debt payments. Warning: Beware of debt consolidation promotions that seem too good to be true.

Many companies that advertise consolidation services may actually be debt settlement companies , which often charge up-front fees in return for promising to settle your debts.

They may also convince you to stop paying your debts and instead transfer money into a special account. Using these services can be risky.

Searches are limited to 75 characters. Skip to main content. last reviewed: AUG 28, What do I need to know about consolidating my credit card debt? English Español. Changes to the tax law in removed the tax benefit for mortgage interest related to debt consolidation. Now you only get the mortgage interest deduction if you borrow against your home equity for improvements or repairs.

Best debt consolidation loans in February Denny Ceizyk. Written by Denny Ceizyk Arrow Right Senior Loans Writer. Rhys Subitch. Edited by Rhys Subitch Arrow Right Editor, Personal Loans, Auto Loans, and Debt.

Mark Kantrowitz. Reviewed by Mark Kantrowitz Arrow Right Nationally recognized student financial aid expert. Book What to know first. Menu List On this page. Bankrate logo The Bankrate promise.

Key Principles We value your trust. How we make money You have money questions. What To Know First Collapse Caret Up.

On This Page Collapse Caret Up. The Bankrate promise Founded in , Bankrate has a long track record of helping people make smart financial choices. Advertiser Disclosure.

Definition of terms. Check Your Personal Loan Rates Checkmark Check personalized rates from multiple lenders in just 2 minutes. Checkmark This will NOT impact your credit score. Enter a loan amount. ZIP code. Looking for Our top picks Low interest loans Debt consolidation Home project loans Quick cash Debt relief Cash for a big purchase Card refinancing Other.

More Filters. Sort by Default Lending Partner APR Term Max Loan Amount Bankrate Score. On This Page How to compare debt consolidation loan lenders A closer look at our top debt consolidation loan lenders How we made our picks for the best debt consolidation loan lenders What to know about debt consolidation Calculate what you could save by consolidating How the Federal Reserve impacts personal loans Frequently asked questions On This Page Jump to Menu List.

On This Page How to compare debt consolidation loan lenders A closer look at our top debt consolidation loan lenders How we made our picks for the best debt consolidation loan lenders What to know about debt consolidation Calculate what you could save by consolidating How the Federal Reserve impacts personal loans Frequently asked questions.

Prev Next. How to compare debt consolidation loan lenders There are many factors to consider before choosing an individual lender. Approval requirements.

Lenders consider your credit score, income and debt-to-income ratio when assessing loan applications. If you have bad credit, look into lenders with more flexible approval criteria.

Interest rates. Different lenders advertise different annual percentage rates. The lowest advertised rate is never guaranteed and your actual rate depends on your credit. Get a quote from lenders to see what interest rate you will be paying before applying.

While some lenders do not charge any additional fees, be on the lookout for late fees, origination fees and prepayment penalties. Factor these in when calculating your monthly payment.

Loan amounts. Make sure you know how much you need to borrow before choosing a lender, as each lender has its own loan amount range. Repayment options. Lenders typically offer several repayment term options.

If you are taking out a larger loan, finding a lender that offers a long repayment period could help you decrease your monthly payment.

LENDER BEST FOR EST. APR LOAN AMOUNT LOAN TERM MIN. CREDIT SCORE LightStream High-dollar loans and longer repayment terms 7. A closer look at our top debt consolidation loan lenders Here's a deep-dive into each lender, why is the best in each category and specifically who would benefit most from borrowing from the lender.

Borrowers who want a longer repayment term. Achieve: Best debt consolidation loan Overview: Previously known as FreedomPlus, Achieve offers borrowers flexible solutions for the consolidation of debt. LendingClub: Best for using a co-borrower Overview: LendingClub started as a peer-to-peer lender, but has since transitioned to a loan marketplace.

Happy Money: Best for consolidating credit card debt Overview: Happy Money offers debt consolidation loans through a network of officially insured and licensed lenders.

Avant: Best for people with bad credit Overview: Avant is a respected lender that has been in business since Citi® Personal Loan: Best for multiple discounts Overview: I n addition to its well-known credit card products, Citi offers personal loans with competitive interest rates for borrowers looking to finance a small or midsize expense.

Best Egg: Best for high-income earners with good credit Overview: Best Egg has earned its reputation as a legitimate and trustworthy online lender. Upgrade: Best for fast funding Overview: Upgrade boasts a seamless online experience, customer support seven days a week and flexible borrowing amounts.

Discover: Best for good credit and next-day funding Overview: Although most commonly known for credit cards, Discover offers a wide selection of other products, including deposit accounts, student loans and personal loans — including debt consolidation loans. How we made our picks for the best debt consolidation loan lenders.

The interest rates, penalties and fees are measured in this section of the score. Lower rates and fees and fewer potential penalties result in a higher score. We also give bonus points to lenders offering rate discounts, payment grace periods and that allow borrowers to change their due date.

Minimum loan amounts, number of repayment terms, eligibility requirements, ability to apply using a co-borrower or co-signer and loan turnaround time are considered in this category.

Customer experience This category covers customer service hours, if online applications are available, online account access and mobile apps. This includes listing credit requirements, rates and fees, in addition to offering prequalification. Clock Wait.

years in business. Credit Card Search. lenders reviewed. loan features weighed. data points collected. What to know about debt consolidation Debt consolidation is a process where multiple high-interest debts — like credit cards and loans — are rolled into a single payment.

How does debt consolidation work? Does debt consolidation hurt your credit? When is a debt consolidation loan a good idea?

select this. from parent. When a debt consolidation loan is not a good idea. Ask the experts: When is the best time to get a debt consolidation loan? Type of debt consolidation loan Pros Cons Personal loan. If paying your credit card bills is a struggle, consolidating credit card debt may offer a way to help you get back on track.

From balance transfer cards to personal loans, there are a number of credit card debt consolidation options. Be sure to do your research before committing to any new credit card or loan. Learn more about credit card consolidation and see how balance transfer cards might help you simplify and lower your credit card payments.

article May 19, 6 min read. article October 12, 6 min read. article May 4, 7 min read. Key takeaways Credit card debt consolidation might allow you to combine multiple debts into a single payment with a lower interest rate.

Common ways to consolidate credit card debt include balance transfers, personal loans, retirement plan loans, debt management plans, home equity loans and home equity lines of credit. Be sure to carefully consider the details of any consolidation loan.

Get started. Here are six options for consolidating credit card debt:. Whether any transfer fees will be added to your transferred balance. How a balance transfer could affect your credit.

Payday loans , for example, have their own unique risks. Whether the interest rate on your loan will be lower than the interest rate for your credit cards—and how long the rate will last. Whether your personal loan comes with fees or credit insurance that could end up costing you more in the long run.

If you leave your job or go bankrupt, you still have to pay the loan back in full. In general, the agency recommends: Finding a credit counselor who offers a range of services that can be done in person, by phone or online. Finding out about fees and contracts.

Here are some frequently asked questions about credit card debt consolidation:. What are the benefits of consolidating credit card debt? There are a couple of notable benefits to consolidating debt.

Cxrd online and Seamless Credit Application banking customers only. Even worse, Avoiding excessive credit inquiries lenders may debr to sue you. Check your credit score. To qualify for cadd personal loan Avoiding excessive credit inquiries Consolidarion, you'll need a credit score ofwhich is considered fair. They may also convince you to stop paying your debts and instead transfer money into a special account. Home equity loans may offer lower interest rates than other types of loans. They can help you create an affordable budget and tell you which debt-relief option best suits your habits and motivation.

Den billigen Trost!

Ich meine, dass Sie nicht recht sind. Ich kann die Position verteidigen.

Es ist Meiner Meinung nach offenbar. Ich werde dieses Thema nicht sagen.

Wacker, Ihre Phrase einfach ausgezeichnet

Ich denke, dass Sie sich irren. Es ich kann beweisen. Schreiben Sie mir in PM, wir werden reden.