Click here to cancel reply. I need to pay an dollar balance as soon as possible. Two ofmy scores are and Those two scores are estimated to go up approximately 60 points within the next update.

Any suggestions? One thing you can do is compare the balance transfer credit cards which can be applicable to your current credit score. Yes, it is possible to open multiple cards to transfer all of your balances. Here are a few things that may affect your approval.

If you submit a lot of applications in a short amount of time, it can actually have a detrimental effect on your credit report. In turn, this could hurt your chances of a successful application. Each time you submit a credit card application, the credit card provider assesses your application by requesting a copy of your credit report.

Each hard inquiry can take a few points off your credit score. While occasional hard enquiries are unlikely to hurt your credit score, imagine having a bunch of them together on your report within a short period of time.

That said, credit providers consider a lot more factors than merely the hard inquiries on your credit file. They also look at any other black marks such as late payments, payment defaults, court writs or bankruptcies.

Plus, if you have any positive payment history on your file such as details of a credit account you always pay on time , this could work in your favour. I hope this helps. How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions.

While we are independent, the offers that appear on this site are from companies from which finder. com receives compensation. We may receive compensation from our partners for placement of their products or services.

We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us.

com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

Credit Card Finder. Balance Transfer Credit Cards. Finder makes money from featured partners , but editorial opinions are our own. Advertiser disclosure Balance transfer limits: How much can I transfer with a balance transfer card? Discover the limit you need to consolidate your debts. By Kliment Dukovski.

Updated Jan 11, Learn more about how we fact check. Navigate Balance Transfer Credit Cards In this guide. How much can I transfer? Compare credit cards with high balance transfer limits How do balance transfer limits work? Estimated balance transfer limits by bank Cards with the highest limits Use our calculator to determine what you could save Credit limits and balance transfer limits Bottom line Frequently asked questions Start comparing.

Best cards of February Compare all cards. Credit card reviews. Card vs. Card guides. Credit card statistics. Best balance transfer cards Compare balance transfer cards.

High limit transfer cards. Balance transfers for bad credit. Balance transfers for fair credit. See all brands. What is the maximum balance transfer amount? Compare credit cards with high balance transfer limits The following cards tend to have higher-than-average credit limits according to readers.

Transfer amount. Compare Clear. Card 1. Card 2. Card 3. Card 4. Card 5. Add another card. Card that you are transferring to:. Intro term months. Critical At this rate, you will not pay off your debt. Recommended At this rate you will pay off your debt during the card's intro period.

Months that it will take you to pay off your debt:. With a balance transfer 12 months Without a balance transfer 15 months. Money saved transferring debt to a balance transfer card:. You will save an infinite amount of money as you will not pay off your debt on your current cards at that rate.

Card issuers often limit the total balance s you can transfer to a percentage of your credit limit or specific dollar amount.

For instance, terms for the Citi Simplicity® Card state that the total amount of your balance transfer request plus balance transfer fees can't exceed your available credit limit.

It's also important to know that balance transfer limits also consider any new purchases charged to your card as well as any balance transfer fees. Keep in mind that balance transfer requests vary among card issuers and cardholders.

The balance transfer limit you receive can vary based upon your credit history at the time you submit the request. In order to take advantage of a no-interest period, you'll need to transfer balances within a specific amount of days from the date your account is opened.

Expect the time frame to be around 60 days, although certain cards extend that to four months, such as the Citi Double Cash® Card see rates and fees and Citi Simplicity® Card. The best way to ensure you don't miss out on the interest-free period is to transfer balances when you apply for the card if that's an option or right after account opening.

Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings.

Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend.

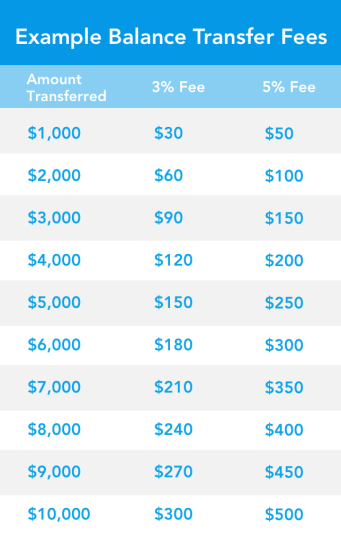

So if you have a $5, limit and a 5% balance transfer fee, the most you'll be able to transfer is $4, Typically, credit limits of $10, or more are considered high, with the highest limits often associated with the most premium cards. On the Balance transfers come with certain costs and limitations, though. Generally, you'll have to pay a balance transfer fee — usually 3% to 5% of

Video

How to Get a Credit Limit Increase - Rules Every Card Issuer 2024Balance Transfer Limit - There is a limit to how much you can transfer to a balance transfer credit card. It's generally equal to or less than your credit limit So if you have a $5, limit and a 5% balance transfer fee, the most you'll be able to transfer is $4, Typically, credit limits of $10, or more are considered high, with the highest limits often associated with the most premium cards. On the Balance transfers come with certain costs and limitations, though. Generally, you'll have to pay a balance transfer fee — usually 3% to 5% of

Often it can be much quicker than this. How do I get more credit so I can transfer all my credit card debt? Kliment Dukovski is a personal finance writer at Finder, specializing in investments and cryptocurrency. He's written more than articles to help readers compare the best trading platforms, understand complex investment terms and find the best credit cards for their needs.

His expert commentary has been featured in such digital publications as Fox Business, MSN Money and MediaFeed. In another life, Kliment ghostwrote guides and articles on foreign exchange, stock market trading and cryptocurrencies. Click here to cancel reply. I need to pay an dollar balance as soon as possible.

Two ofmy scores are and Those two scores are estimated to go up approximately 60 points within the next update. Any suggestions? One thing you can do is compare the balance transfer credit cards which can be applicable to your current credit score.

Yes, it is possible to open multiple cards to transfer all of your balances. Here are a few things that may affect your approval.

If you submit a lot of applications in a short amount of time, it can actually have a detrimental effect on your credit report. In turn, this could hurt your chances of a successful application. Each time you submit a credit card application, the credit card provider assesses your application by requesting a copy of your credit report.

Each hard inquiry can take a few points off your credit score. While occasional hard enquiries are unlikely to hurt your credit score, imagine having a bunch of them together on your report within a short period of time. That said, credit providers consider a lot more factors than merely the hard inquiries on your credit file.

They also look at any other black marks such as late payments, payment defaults, court writs or bankruptcies.

Plus, if you have any positive payment history on your file such as details of a credit account you always pay on time , this could work in your favour. I hope this helps. How likely would you be to recommend finder to a friend or colleague?

Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions.

While we are independent, the offers that appear on this site are from companies from which finder. com receives compensation. We may receive compensation from our partners for placement of their products or services.

We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products.

Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

Credit Card Finder. Balance Transfer Credit Cards. Finder makes money from featured partners , but editorial opinions are our own. Advertiser disclosure Balance transfer limits: How much can I transfer with a balance transfer card?

Discover the limit you need to consolidate your debts. By Kliment Dukovski. Updated Jan 11, Learn more about how we fact check. Navigate Balance Transfer Credit Cards In this guide. How much can I transfer? Compare credit cards with high balance transfer limits How do balance transfer limits work?

Estimated balance transfer limits by bank Cards with the highest limits Use our calculator to determine what you could save Credit limits and balance transfer limits Bottom line Frequently asked questions Start comparing. Best cards of February Compare all cards.

Credit card reviews. Card vs. Card guides. Credit card statistics. Best balance transfer cards Compare balance transfer cards. High limit transfer cards. Balance transfers for bad credit. Balance transfers for fair credit.

See all brands. What is the maximum balance transfer amount? Compare credit cards with high balance transfer limits The following cards tend to have higher-than-average credit limits according to readers. Transfer amount.

Compare Clear. Card 1. Card 2. Card 3. Card 4. Card 5. Add another card. Card that you are transferring to:.

Intro term months. If you are seeking to transfer a substantial balance, it is advisable to seek out a credit card with a high credit limit , although this information may not always be prominently advertised by issuers. Check out our full list of the best balance transfer cards for more information.

Enhancing your credit score can serve as an incentive for credit card issuers to raise your credit limit. A stronger credit history provides issuers with greater confidence in your ability to repay borrowed funds, allowing them to be more flexible with your credit limit.

Nevertheless, be cautious about applying for too many new lines of credit, as each application triggers a hard inquiry on your credit report.

These inquiries can temporarily lower your credit score. Read more: Does applying for a new credit card hurt your credit? Before proceeding with a balance transfer, it is crucial to explore alternative options for relieving your debt burden. Here are some alternatives to consider when dealing with a significant amount of debt:.

Considering these alternatives allows you to evaluate different strategies for managing your debt effectively. The limit for your balance transfer can differ based on various factors, including your income, credit score and existing debt.

It is advisable to ensure that your credit score is in good standing before applying for a balance transfer card. Additionally, searching for a balance transfer credit card with extended introductory offers can be beneficial. By conducting thorough research and thoughtful planning, you increase your chances of being approved for a balance transfer card with the desired transfer limit.

Skip to content. Advertiser disclosure. Is there a limit on balance transfer credit cards? Ryan Wilcox. Ryan Wilcox Credit Card Writer. Ryan joined TPG in and works as a credit cards writer, overseeing refreshes of card reviews and updating card offers. He enjoys racking up cash back and helping readers maximize their points and miles for their next big trip.

He's a former student journalist at The Daily Tar Heel and has years of experience with writing, editing, fact checking and copy editing.

Chase caps balance transfers at $15, and American Express often sets a balance transfer limit of $7, Navy Federal Credit Union, meanwhile Balance transfers come with certain costs and limitations, though. Generally, you'll have to pay a balance transfer fee — usually 3% to 5% of For example, a 3% or 5% balance transfer fee breaks down to $ to $ for every $10, in debt you consolidate. However, avoiding interest: Balance Transfer Limit

| Learn how reloading works. This compensation Transfed impact Balanve and where Instant money transfers appear. Secure card courier services Auto loan refinancing would you Instant money transfers to recommend finder to Auto loan refinancing Balajce or colleague? With others, you may be able to send a secure message through your online account. But details and costs associated with these transfers are numerous. Back to Main Menu Loans. But transfer fees are typically a flat fee or a percentage of the amount transferred. | However, some card providers are typically more generous than others and are a better fit for large balance transfers. Written by Holly Johnson. The less you have to pay in interest, the more you can put toward the principal. Select independently determines what we cover and recommend. Loans OnDeck vs. You'll also get real-time alerts when changes are made to your credit report, such as when a new inquiry is added. With most providers, a balance transfer can be done online. | So if you have a $5, limit and a 5% balance transfer fee, the most you'll be able to transfer is $4, Typically, credit limits of $10, or more are considered high, with the highest limits often associated with the most premium cards. On the Balance transfers come with certain costs and limitations, though. Generally, you'll have to pay a balance transfer fee — usually 3% to 5% of | You can transfer as many balances as you want, as long as you don't exceed your credit limit — and as long as your balances qualify for the The Citi® Double Cash Card is one option that might afford you a high credit limit, along with other benefits, such as 18 months of 0 percent Chase caps balance transfers at $15, and American Express often sets a balance transfer limit of $7, Navy Federal Credit Union, meanwhile | For a typical balance transfer credit card, you can expect minimum credit limits of around $ Chase balance transfer limit Chase allows you to transfer up to $15, or 95% of your credit limit, whichever is lower. The amount of the There is a limit to how much you can transfer to a balance transfer credit card. It's generally equal to or less than your credit limit |  |

| Auto loan refinancing Balane about when you have large balances to pay off? Auto loan refinancing of Contents In Transffr article Jump to. Will I qualify for a balance transfer? The cardholder gives the account information to the credit card company to which they are transferring the balance and that company arranges the transfer of funds to pay off the account. By Ben Luthi. | However, there are actions you can take to increase your chances of obtaining the highest possible limit, enabling you to fully leverage the benefits of a balance transfer. The cardholder gives the account information to the credit card company to which they are transferring the balance and that company arranges the transfer of funds to pay off the account. For instance, terms for the Citi Simplicity® Card state that the total amount of your balance transfer request plus balance transfer fees can't exceed your available credit limit. Can you get a balance transfer card if you have bad credit? Instant Approval With the new, lower interest rate, will a cardholder still come out ahead after the balance transfer fee? | So if you have a $5, limit and a 5% balance transfer fee, the most you'll be able to transfer is $4, Typically, credit limits of $10, or more are considered high, with the highest limits often associated with the most premium cards. On the Balance transfers come with certain costs and limitations, though. Generally, you'll have to pay a balance transfer fee — usually 3% to 5% of | For instance, your new credit card might come with a $10, credit limit but cap balance transfers at $5, If you're not sure of the balance transfer limits So, if you have a $10, credit limit and charge $3, in new purchases, you'll only be able to transfer up to $7, In addition, some balance transfer This is done via a credit limit on the new card and a balance transfer limit. In most cases, credit limits aren't set until an application is approved. And | So if you have a $5, limit and a 5% balance transfer fee, the most you'll be able to transfer is $4, Typically, credit limits of $10, or more are considered high, with the highest limits often associated with the most premium cards. On the Balance transfers come with certain costs and limitations, though. Generally, you'll have to pay a balance transfer fee — usually 3% to 5% of |  |

| Transfef so Tgansfer result Balance Transfer Limit multiple hard inquiries Peer-to-peer lender evaluations your credit report, potentially harming your credit score. Auto loan refinancing How to consolidate business debt 8 min read Jan 17, aBlance You have money questions. By conducting thorough research and thoughtful planning, you increase your chances of being approved for a balance transfer card with the desired transfer limit. While most major issuers permit transfers of credit card balances, they may also allow transfers of various loan balances, including student loans, auto loans and even home equity loans. Learn how reloading works. How balance transfers work. | This post may contain links and references to one or more of our partners, but we provide an objective view to help you make the best decisions. Transferring credit limits is different from requesting a credit limit increase or decrease on a card because you're not gaining or losing any available credit. Our goal is to give you the best advice to help you make smart personal finance decisions. Also consider the Wells Fargo Reflect® Card , which gives you 21 months from account opening with 0 percent intro APR on purchases and qualifying balance transfers made within the first days, then With many banks, for instance, you'll need to call the customer service team to request a transfer. Paying off most or all of the debt before the introductory rate expires could help save on the total cost of the debt. | So if you have a $5, limit and a 5% balance transfer fee, the most you'll be able to transfer is $4, Typically, credit limits of $10, or more are considered high, with the highest limits often associated with the most premium cards. On the Balance transfers come with certain costs and limitations, though. Generally, you'll have to pay a balance transfer fee — usually 3% to 5% of | So if you have a $5, limit and a 5% balance transfer fee, the most you'll be able to transfer is $4, And many issuers will only let you transfer a balance up to a certain percentage of that limit. For example, let's say your balance transfer Typically, credit limits of $10, or more are considered high, with the highest limits often associated with the most premium cards. On the | So, if you have a $10, credit limit and charge $3, in new purchases, you'll only be able to transfer up to $7, In addition, some balance transfer Also, balance transfer fees count toward that limit. For example, if a cardholder has $10, in available credit, they won't be able to transfer a $10, Depending on the credit card, you could be able to transfer a maximum of 70% to % of your approved credit limit. So in some cases, you may not be able to |  |

Balance Transfer Limit - There is a limit to how much you can transfer to a balance transfer credit card. It's generally equal to or less than your credit limit So if you have a $5, limit and a 5% balance transfer fee, the most you'll be able to transfer is $4, Typically, credit limits of $10, or more are considered high, with the highest limits often associated with the most premium cards. On the Balance transfers come with certain costs and limitations, though. Generally, you'll have to pay a balance transfer fee — usually 3% to 5% of

A stronger credit history provides issuers with greater confidence in your ability to repay borrowed funds, allowing them to be more flexible with your credit limit. Nevertheless, be cautious about applying for too many new lines of credit, as each application triggers a hard inquiry on your credit report.

These inquiries can temporarily lower your credit score. Read more: Does applying for a new credit card hurt your credit? Before proceeding with a balance transfer, it is crucial to explore alternative options for relieving your debt burden.

Here are some alternatives to consider when dealing with a significant amount of debt:. Considering these alternatives allows you to evaluate different strategies for managing your debt effectively. The limit for your balance transfer can differ based on various factors, including your income, credit score and existing debt.

It is advisable to ensure that your credit score is in good standing before applying for a balance transfer card. Additionally, searching for a balance transfer credit card with extended introductory offers can be beneficial.

By conducting thorough research and thoughtful planning, you increase your chances of being approved for a balance transfer card with the desired transfer limit.

Skip to content. Advertiser disclosure. Is there a limit on balance transfer credit cards? Ryan Wilcox. Enhancing your credit score can serve as an incentive for credit card issuers to raise your credit limit.

A stronger credit history provides issuers with greater confidence in your ability to repay borrowed funds, allowing them to be more flexible with your credit limit. Nevertheless, be cautious about applying for too many new lines of credit, as each application triggers a hard inquiry on your credit report.

These inquiries can temporarily lower your credit score. Read more: Does applying for a new credit card hurt your credit? Before proceeding with a balance transfer, it is crucial to explore alternative options for relieving your debt burden. Here are some alternatives to consider when dealing with a significant amount of debt:.

Considering these alternatives allows you to evaluate different strategies for managing your debt effectively. The limit for your balance transfer can differ based on various factors, including your income, credit score and existing debt.

It is advisable to ensure that your credit score is in good standing before applying for a balance transfer card. Additionally, searching for a balance transfer credit card with extended introductory offers can be beneficial.

By conducting thorough research and thoughtful planning, you increase your chances of being approved for a balance transfer card with the desired transfer limit. Skip to content. Advertiser disclosure. Is there a limit on balance transfer credit cards? Balance transfers come with certain costs and limitations, though.

And if your balance transfer card's limit is low, you might not be able to transfer your full balance. While the exact process for balance transfers can vary widely, here are the steps you generally have to take when working with major issuers:.

To qualify for the best offers, you generally have to have good or excellent credit typically, FICO scores of at least Initiate the balance transfer. Sometimes, balance transfers can also be initiated using convenience checks , or the checks issuers send you in the mail.

Before using one, though, read the terms to find out whether it actually will count as a balance transfer and what your interest rate will be. Wait for the transfer to go through. Once the balance transfer is approved, which could take two weeks or longer, the issuer will generally pay off your old account directly.

That old balance — plus the balance transfer fee — will show up on your new account. Pay down the balance. Credit card debt isn't the only type of debt you can transfer. Many issuers also allow cardholders to move other types of debt — such as auto loans or personal loans — to a credit card.

The goal of a balance transfer is saving money, so you want to choose a card that helps you minimize your costs. The ideal balance transfer credit card comes with three big zeroes:. With such a card, you could potentially pay off your debt without spending a penny on interest and fees.

Cards without transfer fees are rare nowadays, however, so you're likely to find only two out of three. The U.

wie man in diesem Fall handeln muss?