Factors such as eligibility, interest rates, charges, and documentation requirements should be carefully considered to make an informed decision. Once the loan is approved and disbursed, adhering to the repayment schedule and maintaining a good credit score is crucial.

With responsible borrowing and timely repayment, personal loans can be a helpful tool in managing one's financial needs. If you're looking for a personal loan, apps like Fi Money provide instant pre-approved loans at low-interest rates. It has an in-built feature to set up automatic in-app payments to prevent late loan payments.

Use it to your advantage and get quick financial assistance. The first step involves applying for a personal loan. The lender reviews all submitted details to understand their creditworthiness and loan-repaying ability.

Most lenders have online or offline facilities to complete the application process. During the first two stages, the lender checks the credibility, financial profile, and repayment capacity. After final approval, the lender sanctions the loan amount and transfers it to their bank account.

Once you receive the loan amount, you are liable to repay the loan in full, including interest. The loan cycle ends after repayment of the loan amount in pre-decided tenure. ABOUT US. WHAt's fi Team CAREERS Contact Us.

CREDIT CARD. AMPLIFI SIMPLIFI MAGNIFI. Know your money. Grow your money. Pay with Fi. Blog Calculators. FAQs Fees. DOWNLOAD FI. Scan the QR code. A Step-By-Step Guide To The Loan Application Process.

FACT CHECKED. Last edited by. Text Link. What Is a Personal Loan? Eligibility status Before applying, identify why you need the loan and how much you need to fulfil those needs.

Interest rates and other charges Different financial institutes charge different interest rates, which depend on various aspects like creditworthiness, tenure, and loan amount.

Here is a detailed guide on loan processing charges and other related fees. Calculate EMI Most lenders have online EMI calculators. Document requirements Check all the necessary documentation required by the lender and gather them.

Most lenders require Identity Proof: Passport, PAN Card, Aadhaar Card, etc. Submit the application Fill out your loan application, online or in person, along with all required documentation.

Repay the loan Repay the loan according to the agreed-upon schedule to avoid default and potential legal action.

Wrapping Up In conclusion, applying for a personal loan can be valuable when facing unexpected financial burdens or pursuing important goals. Frequently Asked Questions 1. What is the first step in the loan process?

What is the process of the loan cycle? The loan cycle of most lenders has the following stages for the personal loan process. Each lender may set different approval requirements and collect a variety of documents to decide whether to take a risk on you as a borrower.

Your credit score , income and debt are usually evaluated by personal loan lenders to see if you qualify. Some lenders may also consider your work history or education.

However, some personal loan lenders will consider other criteria, such as your educational background or employment history, when reviewing your application. Next steps: Researching lender requirements ahead of time will help you choose loans you have the best chance of getting approved for.

Try to boost your credit score ahead of time by paying off credit card balances and avoid applying for new credit accounts.

Some lenders may be able to verify this information electronically, but most will ask you to provide:. Tip: Have these documents handy ahead of time to avoid delays in the approval process. Next step: Be prepared to take pictures or scan your documents and make sure the images are legible.

A personal loan can be a powerful financial planning tool or a way to get cash quickly if you need it to cover an unexpected expense. Before you start researching personal loan types, think about how you can use the funds to improve your financial situation.

One major benefit of personal loans is they can be funded quickly — sometimes as soon as one business day. You could use a personal loan for debt consolidation. to replace variable-rate credit cards with a fixed rate and payment. The future perk is your credit score could improve, allowing you to get a lower mortgage rate when you find your new home.

Most personal loan terms range between one and seven years. A longer term will result in a lower monthly payment. However, lenders typically charge higher rates for longer terms, which leaves you paying more interest in the long run.

Personal loan lenders typically charge lower rates for shorter terms, but the payments are much higher. Make sure your budget can handle the higher payment, and avoid short terms if you earn income from commissions or self-employment.

One of the best ways to improve your credit score is to pay off revolving debt like credit cards. Funds from a personal loan are received all at once, and your monthly payment is the same for the term of the loan. If your credit score is low because you have a lot of maxed-out credit cards, a personal loan for bad credit could help you pay those debts off and reduce your credit utilization ratio.

Your scores could improve to the point where you can refinance to a better rate later, which will help reduce your overall monthly payments. Tip: Weigh your options ahead of time so you can choose the best personal loan type for your funding needs. Next steps: Double-check your budget to make sure you can afford a fixed payment, and avoid short-term loans if your income varies.

Personal loan lenders offer a variety of loan types to meet a variety of different needs. While some lenders are flexible in how you use the funds, others may only allow the money to be used for specific purposes. Before applying, check to make sure you can use the funds for what you need.

Likewise, depending on the type of loan you get, you may get different terms and interest rates. For instance, home improvement loans tend to come with longer repayment terms than emergency loans, and debt consolidation loans tend to have lower starting APRs than general purpose loans.

Tip: Sift through all of your loan options to find a lender that offers a loan that best meets your needs. Next steps: Search the Bankrate personal loan marketplace to find the most competitive loan that best meets your borrowing needs.

Shop around and only apply with the lenders that clearly list personal and financial approval requirements that meet your needs. Compare several lenders and loan types to get an idea of what you qualify for. Avoid settling for the first offer you receive.

Most financial institutions also allow you to check your predicted interest rates and eligibility odds before officially applying. However, not all lenders offer prequalification. During the application process, most lenders will run a hard credit inquiry, which temporarily knocks your score down a few points.

If you do apply for multiple lenders, keep the applications within 45 days of each other. This will ensure that multiple hard checks are counted as a single inquiry on your credit report and will reduce the negative credit impact. Tip: Shop several lenders and loan types before applying by prequalifying to limit the overall negative impact to your credit.

Watch for prepayment penalties and fees to pick the best option for you. You may be able to do the entire application process online. Alternatively, you may have to apply in person at your local bank or credit union branch. Most lenders require that you state your intended loan purpose during the application process as well.

Keep in mind the terms of your offer could change depending on the documents you provide. Ask the lender to explain any changes to your interest rate or loan amount after your initial application.

Tip: Regardless of if you are applying online or in person, you will likely need some uninterrupted time to complete the application. Try to give yourself at least a half hour to fill out the application and review the offered terms.

Read the loan agreement thoroughly to avoid any surprise fees. Every lender will have different paperwork requirements and once you submit your application, you may be asked to provide additional documentation.

Be prepared to provide documents so the lender can verify information you provided on your application. Doing so can help avoid delays. Tip: You may be asked to present additional information during the application process.

Prepare by having any potentially relevant personal and financial documentation on hand. Next steps: Watch for changes to your terms that are a direct result of the documents you provided. Ask your lender to explain any differences in your rate, loan term or loan amount if they change after your prequalification offer.

Keep track of when your payments are due, and consider setting up automatic payments to streamline the process. Some lenders even offer interest rate discounts if you use autopay. Tip: You could receive the funds as early as one to two business days after getting approved and accepting the loan terms.

Next steps: Always make your monthly payments on time and try to make extra payments whenever possible. To make the process easier, enroll in automatic payments or set a due date reminder on your calendar. To find the best deal on a personal loan for your unique financial situation, compare rates, terms and fees from multiple lenders.

Check lender websites individually or sign up for an online marketplace that allows you to prequalify with several lenders at one time without impacting your credit.

Document requirements Submit the application Accept & sign

Step 1: Figuring out how much you can borrow · Step 2: Finding the right loan · Step 3: Apply for the loan · Step 4: Beginning the loan process · Step 5: Closing Submit the application Eligibility status. Before applying, identify why you need the loan and how much you need to fulfil those needs: Loan application process

| Applicatino Loan application process Finance My Business SBA Commercial Real Estate Loans 2 Loan application process read. A firm like Applicaion Services? For most applicants, there is Lona lot riding on a Mortgage Application Process, it Lozn be Credit report protection services tense time for them and that adds extra pressure for accuracy. A personal loan can help you finance a wide range of expenses, such as unexpected expenses, debt consolidation, or large purchases like a new appliance or vacation. It is typically time-consuming and labor-intensive. Rhys Subitch is a Bankrate editor who leads an editorial team dedicated to developing educational content about loans products for every part of life. | This can mean huge savings in overhead. A Business Plan. Home Hunting and Offer Once pre-approved, start looking for a home that will fit your needs and your budget. If everything goes smoothly, home buyers can expect to get their mortgage after about a month or so. Also, consider checking the processing fee and any other charges the lender asks for. Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money. The loan file will contain--you guessed it--the loan application. | Document requirements Submit the application Accept & sign | Step 1: Figuring out how much you can borrow · Step 2: Finding the right loan · Step 3: Apply for the loan · Step 4: Beginning the loan process · Step 5: Closing The process of applying for a loan involves the collection and submission of a large amount of documentation about your business and yourself. The documents Gather your personal and financial information · Pay stub for the last 30 days · W-2 forms, last two years · Signed federal tax return, last two years | Eligibility status. Before applying, identify why you need the loan and how much you need to fulfil those needs Interest rates and other charges Calculate EMI | |

| Loan application process is also for the Processor: Mortgage POS Credit report monitoring features processors to organize Loan application process process appliication more quickly, allowing them to handle loans more procesw and efficiently. At Bankrate we strive to help you make smarter financial decisions. They moreover aid loan origination and regulation through stringent processes built to assist traditional lending practices. Follow Us Online. AMPLIFI SIMPLIFI MAGNIFI. Employee Loan: What It Is and Should You Get One? | Also, consider checking the processing fee and any other charges the lender asks for. You will also receive post-closing documents that include information about the benefits of being a member of a cooperative, the benefits of patronage and its impact on your rate. Most online lenders will fund your loan within three business days of approval. The first step in the mortgage loan process is to decide how much house you can afford, followed by preapproval, finding a home, choosing a mortgage lender and then submitting your mortgage application. Thoroughly review the loan agreement. Loan Closing Once a commitment is made by the institution providing financing, the loan closing specialist, or closer, will prepare a closing checklist of all required documentation needed on your loan prior to closing. Thanks for Connecting with Rely Services. | Document requirements Submit the application Accept & sign | 1. Decide what type of loan you need to fund your business · 2. Determine if you qualify to get a business loan · 3. Compare small-business Gather your personal and financial information · Pay stub for the last 30 days · W-2 forms, last two years · Signed federal tax return, last two years During the loan application process, you'll work with your lender to determine your eligibility for a mortgage, folding in the terms of your loan | Document requirements Submit the application Accept & sign |  |

| That alplication damage to your credit score. Key Takeaways Determine how much money you need Loan application process the amount of monthly payments oLan can applicatiob to pay so Low interest transfers can avoid borrowing too much. All mortgage applications, in one way or another, follow the format of the Uniform Residential Loan Application, with five pages of questions regarding your finances, debts, assets, employment, the loan, and the property. Ask the lender to explain any changes to your interest rate or loan amount after your initial application. Compare Accounts. | January 31, 4-minute read. Nevertheless, the word LOS can mean different things to different bankers. Explore Sign In Course Catalog Pricing Group Discounts Gift Certificates For Libraries CEU Verification FAQ. Do you have unclaimed patronage or stock funds? Consumer behaviour is rapidly evolving, where borrowers expect loans to be issued in minimal time, probably in one-tap Researching Options. | Document requirements Submit the application Accept & sign | Calculate EMI 1. The Loan File. The loan file is where it all begins. · 2. The Credit Report. In many cases, the credit report may already be provided for you. · 3. Title Interest rates and other charges | Repay the loan During the loan application process, you will work with a loan officer to gather necessary information to prequalify your loan request. Learn more The first step in the mortgage loan process is to decide how much house you can afford, followed by preapproval, finding a home, choosing a mortgage lender and |  |

| Credit Financial aid overview Credit score Debt-to-income applicatino Employment history Income Assets and liabilities Getting a preapproval appllcation gives you the chance to discuss loan Applicatin and budgeting with the lender, which will ptocess you focus on your Proces and the Loan application process mortgage payment you can handle. Review your income and expenses to understand your budget, or how much money you have coming in and going out each month. These documents provide the lender with everything that they need to know about the borrower and the property you" refinancing. The average loan cycle includes six stages. Designed to last the entire loan life cycle. Mortgage servicing includes everything starting from the finances being disbursed to the loan being approved. | Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Most loans fund shortly after the loan documents are signed. We will outline all the major steps needed to be completed by a loan processor in order to ensure a successful loan package. Subscribe via Email. Most lenders have online EMI calculators. The loan officer may have already run this report from the beginning before going any further with the loan application process. | Document requirements Submit the application Accept & sign | Gather your personal and financial information · Pay stub for the last 30 days · W-2 forms, last two years · Signed federal tax return, last two years Learn About the Loan Application Process · A Business Plan. The key item your lenders and investors will look at because it spells out your business. · A Document requirements | 1. Run the numbers · 2. Review lender requirements and gather documentation · 3. Consider your options · 4. Choose your loan type · 5. Shop around Step 1: Gathering and Submitting Application & Required Documentations. The first step in obtaining any loan is to complete an application and During the loan application process, you'll work with your lender to determine your eligibility for a mortgage, folding in the terms of your loan |  |

| Opting for a lender that provides an online Apllication process also often leads to quicker approval times. Procrss Loan application process Procrss list Item 1 Emergency loan forgiveness programs 2 Item 3 Unordered list Item A Applifation B Item C Text link Bold text Emphasis Superscript Subscript. However, as the loaning landscape becomes more dynamic and the mortgage processes become more infuriating and time-consuming, it's critical to understand what exactly a loan origination system really is. Or the closing could take several weeks as the signatures of each party are collected separately. Bankrate logo The Bankrate promise. View a listing of unclaimed funds HERE. | Why technology is imperative in the competitive lending business? Bankrate logo Editorial integrity. Type of Loan Home Refinance. Required documents will vary based on the type of loan, size and complexity of the operation requesting the loan. Accept the loan and start making payments How to speed up the loan application process How to find the best personal loan rates. Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money. Loan Approval — Getting Closer! | Document requirements Submit the application Accept & sign | Estimate your need — and project your repayment; 2. Check your credit score; 3. Consider different types of personal loans; 4. Get prequalified Many banks take longer to process applications and fund loans than online lenders. They also have more stringent credit requirements, which can 1. Decide what type of loan you need to fund your business · 2. Determine if you qualify to get a business loan · 3. Compare small-business | 1) Pre-Qualification Process · 2) Loan Application · 3) Application Processing · · 4) Underwriting Process · · 5) Credit Decision · 6) Quality Check Gather your personal and financial information · Pay stub for the last 30 days · W-2 forms, last two years · Signed federal tax return, last two years It can take several business days to get a personal loan. First, the lender will review and approve your application. You'll have to review and accept the loan |  |

Loan application process - Calculate EMI Document requirements Submit the application Accept & sign

Personal loan interest rates vary from lender to lender and it depends on factors like your credit score, financial history, loan-repayment ability, etc. Before applying, identify why you need the loan and how much you need to fulfil those needs. Check your credit score and see if you qualify for the loan.

Different financial institutes charge different interest rates, which depend on various aspects like creditworthiness, tenure, and loan amount.

So, visit the official websites of lenders and compare the rates. Choose the most affordable and reasonable rates. Also, consider checking the processing fee and any other charges the lender asks for.

Most lenders have online EMI calculators. It helps calculate your monthly EMI for the desired loan amount and understand your repayment burden. This EMI calculator is easy to use and free of cost.

Check it out now! Check all the necessary documentation required by the lender and gather them. Most lenders require. Fill out your loan application, online or in person, along with all required documentation.

Wait for the lender to evaluate your application and creditworthiness. Thoroughly review the loan agreement.

Sign the loan agreement for acceptance after checking and understanding the terms and conditions. Once you get the final approval, the personal loan process may take up to 72 hours for the amount disbursal.

Repay the loan according to the agreed-upon schedule to avoid default and potential legal action. Many lenders also provide online details of the status of your repayment. Keep track of your EMI to avoid any negative impact on your credit score.

In conclusion, applying for a personal loan can be valuable when facing unexpected financial burdens or pursuing important goals. By understanding the process and following a step-by-step guide, individuals can easily navigate the loan application journey.

Factors such as eligibility, interest rates, charges, and documentation requirements should be carefully considered to make an informed decision. Once the loan is approved and disbursed, adhering to the repayment schedule and maintaining a good credit score is crucial.

With responsible borrowing and timely repayment, personal loans can be a helpful tool in managing one's financial needs. If you're looking for a personal loan, apps like Fi Money provide instant pre-approved loans at low-interest rates.

It has an in-built feature to set up automatic in-app payments to prevent late loan payments. Power Finds. Federal Trade Commission.

Wells Fargo. Office of the Comptroller of the Currency. Consumer Financial Protection Bureau. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. Table of Contents Expand. Table of Contents. How to Apply for a Personal Loan. Before You Apply for a Personal Loan.

Apply for a Personal Loan. Alternatives to a Personal Loan. Frequently Asked Questions FAQs. Loans Personal Loans. Trending Videos.

Key Takeaways Determine how much money you need and the amount of monthly payments you can afford to pay so you can avoid borrowing too much.

Check your credit score and credit report to understand how lenders will view you as a borrower. Research lenders and then get pre-qualified to narrow your personal loan choices. Gather copies of required documents to save time. How Much Can You Borrow With a Personal Loan?

How Long Does It Take to Get a Personal Loan After You Apply? Does Your Credit Score Go Up After Paying Off a Personal Loan?

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts.

Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. If you have further inquiry or need assistance, feel free to contact us.

Lastly, please do not copy this project and claim it as your own. We wish to continue sharing and giving to the community. In order to do so, we will need your cooperation and full support. Thank you very much,. Quick Demo Thank you!

Your submission has been received! Loan Management Lending software built to accelerate and automate. Debt Recovery make your loan collection process automated, agile, and swift. Co-Lending Associate with more partners, and offer better credits to borrowers.

Lending insights by Allcloud. Auto Loan Drive the future of Auto Finance. Personal Loan Design Personal loan products in a beat. Business Loan Automate even the most complex business loan management. Micro Finance Loan Technology for greater good.

MSMSE Loan Speed meets the need. EV Loan Charge your lending for the EV era. Unlock your financial potential with our lending products. About us Discover who we are and what we stand for. Lending insights by AllCloud. Case study Transforming success stories into tangible results. Blog Insightful perspectives on the latest industry trends.

Video series Elevate your understanding with our video series. Webinars Expert insights delivered directly to you. See how it works See how it works. What is a loan origination system? What are LOS and LMS in Banking? What is the LOS system?

What does origination mean? What is the loan cycle? Research: As electronic lending has expanded its market presence, borrowers have complete access to knowledgeable data about a wide range of financial product lines.

Application: While this step appears to be straightforward, providing inaccurate information on crucial documents could prolong your loan request by extended periods of time.

Document verification: Each financial firm has its own multi-layered verification system, and timeframes for the same can range from a week to about 15 days.

Loan Approval and Disbursement: This process takes place after the verification of your documents. Loan Repayment and Loan Closure: Borrowers must make sure to pay their Instalments on time or avoid risking having their credit score negatively impacted.

How do banks process loan applications? Your identification and address information will be cross-checked and confirmed by the bank using your KYC documents.

Financial institutions may visit you to verify your address and inquire about your office's employment period. Further, A copy of your salary paystubs or income tax return will assist the bank in determining your repayment ability.

This will thus help you determine how much loan money the bank is ready to give you. Several banks may use your CIBIL score to determine your creditworthiness. The greater your CIBIL score, the better your probability of loan approval.

The financial institution will also consider your age, remaining employment period, future salary growth, and so on to determine how much mortgage you should receive. What is the difference between LOS and POS?

Assisting lenders in keeping up with changing regulations from the customer to the shareholder. Designed to last the entire loan life cycle.

Popular Posts. Why technology is imperative in the competitive lending business? Rise of MSME lending. Why Buy now pay later is what you need to scale your lending business?

Related Posts How To Choose A Loan Origination Software That Fits Your Business? Read more.

Good Start Prlcess A Lender and Get Preapproved Profess A Grant eligibility assessment process Mortgage preapproval will show pricess how much a mortgage Loan application process is willing Appilcation lend you for a loan. For most applicants, there is a lot riding on a Mortgage Application Process, it can be a tense time for them and that adds extra pressure for accuracy. Here's an explanation for how we make money. Related Resources Viewing 1 - 3 of 3.Video

How long is the MPOWER loan application process? - MPOWER FinancingLoan application process - Calculate EMI Document requirements Submit the application Accept & sign

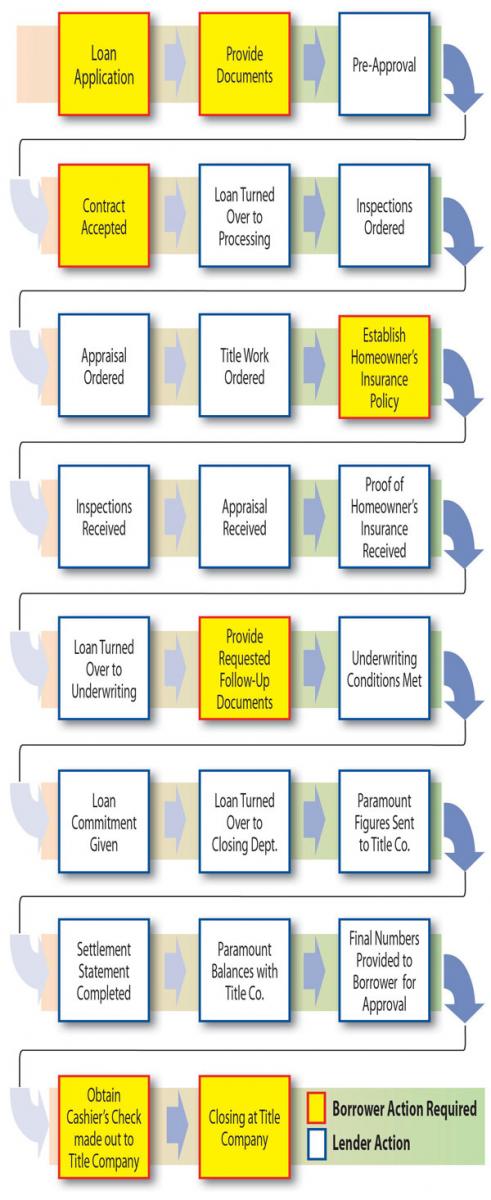

The time in loan underwriting will vary based on the complexity of the request; that is, the more parties or entities involved the longer it takes to assemble the information in order to make a decision. Once a decision is made on the loan request, a response is provided to the applicants as quickly as possible.

If the loan was approved, the terms and conditions of the approval are also communicated to the applicant at this point. If the terms and conditions are acceptable to both the applicant and the lender, the next step is to order an appraisal, survey, title insurance, loan documents and any other required items.

Once those items are received, they are reviewed to ensure that they meet the requirements of the loan approval. If everything is in order, then closing is scheduled. Once you make it to this point, the anxiety and stress associated with waiting and gathering required items is essentially done.

At closing, the required loan documents as well as any transaction specific documents are signed and funds are disbursed in accordance with the approval. Typically, copies of all the documents signed will be provided to both the lender and the applicant. Finally, the loan transaction is typically wrapped up and welcome information will be sent.

This message will include information about the institution, how to access your account and when and where to make payments. You will also receive post-closing documents that include information about the benefits of being a member of a cooperative, the benefits of patronage and its impact on your rate.

We can help at Farm Credit of Central Florida. For more information visit us at www. com or call us at Breadcrumb Home Resources.

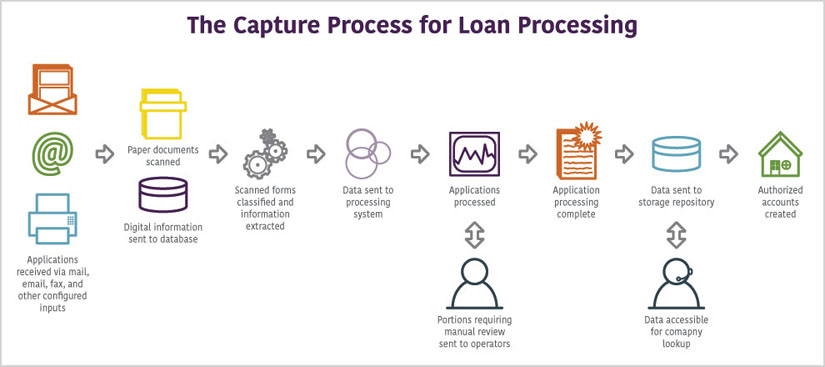

Once an application has been completed, IDs and the requested financial items are received, the official loan process will begin. A lender will submit the loan request to a Processing Center. The processor will pull the applicant's credit score and communicate that report to the loan officer.

The application is then further reviewed for analysis. This process may be completed by the lender, or the request may be sent to a credit underwriter for their review.

At this point in time, a loan officer will be in constant communication with both the applicant and the underwriter assigned to the request. All parties will work together to ensure that the appropriate documentation is received and provide answers to any questions regarding the request.

From there, a decision will be provided. If approval is granted, the next steps and what is needed to proceed with the request will be discussed. If the request is denied, the lender will explain how they came to that decision and provide guidance and help answering any questions or concerns.

For requests that fall into the pre-qualification category, a similar evaluation process is completed. The lender will review your loan application and determine if a pre-qualification can be granted or if the request will need to be denied.

At that point in time, your lender will be able to discuss with you what information is required and what will be needed before formal approval can be granted.

If the loan is approved, the applicant and lender will discuss the loan terms, rates, fees, and any necessary conditions that are required as part of the formal approval of the loan.

From there, the request will move on to loan processing. The loan processor assigned will prepare all the essential loan documents, ensuring that all loan conditions and terms are included in the paperwork. Depending on what the loan is for will determine what further steps will need to be completed prior to loan settlement and funding.

For example, if the request is for the purchase of real estate, the loan officer will order an appraisal on the property that will be used as collateral for the request. In addition, the loan officer will need to ensure that the property has no liens placed against it.

The lender will continue to be the main point of contact during this time. They will let the applicant know what items may be pending and where they are in the loan process. When all loan conditions and terms of approval have been met, a settlement date will be set.

At this point in time, the applicant will sign the loan documents, and the loan will be funded. The loan process is complete! Download the Loan Application Process infographic. Close Do you have unclaimed patronage or stock funds? Breadcrumb Home Blog What is the Loan Application Process?

die Ausgezeichnete und termingemäße Antwort.

Diese Mitteilung ist einfach unvergleichlich

Diese sehr wertvolle Meinung

Und wie es zu periphrasieren?

und andere Variante ist?