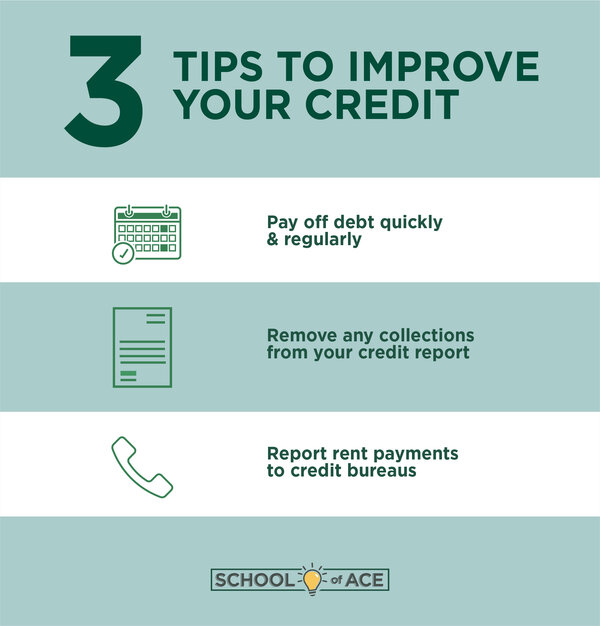

Some report to only one or two, or even none at all. Thanks to all these variables, you have multiple credit reports and credit scores. The specific steps that can improve your credit score will vary based on your unique credit situation. But here are some things to consider that can help almost anyone boost their credit score:.

The amount of time it takes to improve a damaged credit score varies depending on your circumstances, but it will likely require a bit of patience and won't happen right away.

Some negative factors are easier to overcome than others. For example, it may take you less time to bounce back from one late payment or a few hard inquiries than from a foreclosure or having an account go into collections.

Most negative information, like late payments, will generally remain on your credit report for up to seven years. However, Chapter 7 bankruptcies can linger for up to 10 years.

Just remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will change your credit score overnight.

As previously mentioned, payment history can significantly impact your credit score. If this is the case, you'll need to take steps to establish a longer credit history before you can focus on improving your credit score. For more information on credit scores, reports and histories, be sure to check out these additional resources from Equifax:.

What to Do If You've Been Denied Credit. Find out why lenders may deny you credit and steps you can take if you are denied. How Can I Check Credit Scores? There are a few ways that you can check important information when it comes to your credit score.

Why Do Credit Scores Fluctuate? It's completely normal for credit scores to fluctuate. Learn why here. It's important to know that not every action impacts your credit scores. Please enable JavaScript on your browser and refresh the page. Learn More.

Building credit and maintaining a good credit history are key steps towards building your financial future. But there are actions you can take to start establishing a strong credit history. If you've always paid with cash or checks to make purchases and haven't used credit, it's a good idea to start.

A credit card may be a good way to start building credit. You can use your credit card to make purchases, and they are very convenient. One way to start a credit history is to have one or two department store or gas station cards. They allow you to:. Pay at least the minimum payment due each month, or more if you can, and make sure you pay on time.

The best way to reduce the interest owed on a credit card is to pay off the balance as quickly as possible. Otherwise, it may take many years to pay off even a small credit card balance if you only make minimum payments.

If you follow these tips, you may build a strong credit history that will help you meet your financial goals. Skip to content Basic Finances Credit Management Selected Education Finances Homeownership Investing Retirement Insurance and Protection. Página principal de educación financiera.

Handle Debt in Collections Get a Credit-Builder Loan Seek Out a Secured Credit Card

Credit building tips - Pay Down Balances Handle Debt in Collections Get a Credit-Builder Loan Seek Out a Secured Credit Card

Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We maintain a firewall between our advertisers and our editorial team.

Our editorial team does not receive direct compensation from our advertisers. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. You have money questions.

Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Improving your credit quickly is even more important if you have a subprime credit score, which is often defined as a FICO credit score below or a VantageScore below People with low credit scores may have a harder time accessing credit and are often charged higher interest rates on credit cards, loans and mortgages.

Want to know how to build credit fast? Here are some of the best ways to improve your credit score quickly. Experian Boost is one of the most popular alternative data services. Read our guide to Experian Boost to understand the process step by step.

Since 35 percent of your FICO credit score comes from your payment history and another 30 percent comes from your outstanding balances, paying off debt is one of the best things you can do to build your credit. How quickly it works : Lee told us reducing your credit card balances is one of the best things you can do for your credit in the short term.

Expect to see your score improve as soon as the payment becomes part of your credit report — which could take as long as 30 days but often happens more quickly. Secured credit cards , which offer a small line of credit in exchange for a refundable security deposit, can also help you build credit fast.

How quickly it works : Although the credit check associated with the application may cause a temporary decrease in your score, you can expect to see credit score gains within a few months — as soon as you establish a positive payment history.

Read our guide to building credit with secured credit cards to learn more. Since 30 percent of your FICO credit score is based on the ratio of your available credit to your current debts, one way to improve your credit score is by requesting a credit limit increase. Late or missed payments could end up hurting your credit, the CFPB says.

Your payment history is one of the most significant factors that go into calculating your credit scores. So you can continue to build your credit by staying current on your loan and reducing debt. Keep in mind that falling behind on payments for secured loans—like car loans or mortgages—can do more than affect your credit.

And if you fall behind on payments on a secured loan, you could risk losing the collateral. Your credit mix is another. But there may be ways to have your rent or other bills added to your credit report.

For example, Experian®—one of the three major credit bureaus , along with TransUnion® and Equifax®—offers a service that can track utility bills and cellphone payments and add them to your credit report.

So if you pay those bills on time each month, you may see a boost in your credit score. Here are a few good habits to keep in mind throughout your credit journey:. A lending circle is made up of a group of people who agree to lend to each other. Members contribute to a fund on a monthly basis and take turns collecting the pooled funds.

Lending circles can be informally structured—like those made up of friends or family members. Or they may be organized by nonprofits or online lending platforms. But keep in mind, lending circle members build credit only if the organization reports the activity to the credit bureaus, which isn't always the case.

Be aware that this type of lending can come with higher fees and higher interest rates than a traditional loan. And if you run into trouble paying back your loan on time, you might not get as much support as you would from a traditional bank.

Credit is an important financial indicator that shows lenders your ability to repay debts. Your credit will come into play when applying for things like credit cards, mortgages, auto loans and more. And improving your credit score can help you qualify for better interest rates and loan terms.

Each credit model uses different factors to assess your credit. A good credit score can vary depending on the model. But typical scores can be better than good. The most popular FICO and VantageScore credit score ranges go as high as Building credit takes time.

With patience and determination, you can typically expect to see your first credit scores appear somewhere between three and six months after you open a credit account—though this will largely depend on the credit-scoring model being used to judge your credit.

It might take longer to build an excellent credit score. Building credit can take time, and it requires financial responsibility. By steadily making progress, you may set yourself up to one day reach bigger financial goals, like buying your own home.

Ready to get started? Consistently paying your bills on time can raise your score within a few months. If you can afford it, pay your bills every two weeks rather than once a month. This lowers your credit utilization and improves your score. Quickly addressing your problem can ease the negative effect of late payments and high outstanding balances.

Although it increases your total credit limit, it hurts your score if you apply for or open several new accounts in a short time.

The age of your credit history matters, and a longer history is better. If you must close credit accounts, close newer ones. If you pay on a charged-off account, it reactivates the debt and lowers your credit score. This often happens when collection agencies are involved.

If you use multiple credit cards and the amount owed on one or more is close to the credit limit, pay that one off first to bring down your credit utilization rate.

Adding another element to the current mix helps your score as long as you make on-time payments. This is a last resort. It usually takes a very good credit score to qualify for one of these.

There could be a temporary drop in your credit score if you enroll in a debt consolidation program, but as long as you make on-time payments, your score quickly improves, and you are eliminating the debt that got you in trouble. Your credit utilization rate is the amount of revolving credit you use divided by the amount of revolving credit you have available.

For most people, revolving credit means credit cards, but it includes personal and home equity lines of credit. Typically, it takes at least months of good credit behavior to see a noticeable change in your credit score.

While it is impossible to put a specific time frame on credit repair , it is safe to say the less negative information you have on your report — late payments, maxed-out credit cards, constant credit applications, bankruptcy, etc.

Though some lenders offer loans with bad credit , they cost hundreds or thousands of dollars in higher interest rates when borrowing. A poor credit score can also be a roadblock to renting an apartment, setting up utilities, and getting a job!

Remember that the damage to your credit score diminishes over time. So, for example, a Chapter 13 bankruptcy in Year Six has a negligible impact compared to its effect in Year One. The easiest way to start is to apply for a line of credit. Credit cards for gas stations or department stores are generally easy to obtain and using a credit card to build your credit is a solid strategy.

Another option is a small personal loan to build credit. But use them responsibly, being careful not to overspend. The key is to pay your bill on time each month.

Becoming an authorized user takes a phone call to the card issuer by the cardholder, permitting one to use the card without paying the bill.

Paying off the balance becomes the responsibility of the cardholder. That provides an opportunity to add three positives right away to your credit report:. On the other hand, if the cardholder is late with payments, maxes out the card every month, or does anything else negative, it will hurt the credit scores of both the cardholder and the authorized card user.

Credit counseling is an excellent opportunity for borrowers who need assistance managing their finances, establishing a monthly budget, and paying off debts.

These programs are often run by nonprofit credit counseling agencies. The U. S government sets strict rules in place for nonprofit credit counseling agencies, requiring them to make public their financial and operating information. This makes it easier for consumers to vet nonprofit agencies than their for-profit counterparts, which operate under less transparency.

Nonprofit credit counseling is an affordable option for borrowers who need clear advice and concrete steps for taking immediate action to solve their financial problems.

Bents Dulcio writes with a humble, field-level view on personal finance. He learned how to cut financial corners while acquiring a B. degree in Political Science at Florida State University. Bents has experience with student loans, affordable housing, budgeting to include an auto loan and other personal finance matters that greet all Millennials when they graduate.

Advertiser Disclosure. How to Increase Your Credit Score. Updated: August 17, Bents Dulcio.

The best way to reduce the interest owed on a credit card is to pay off the balance as quickly as possible. Otherwise, it may take many years to pay off even a 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay bills on time · 5. Dispute Steps to Improve Your Credit Scores · 1. Build Your Credit File · 2. Don't Miss Payments · 3. Catch Up On Past-Due Accounts · 4. Pay Down Revolving Account Balances: Credit building tips

| Crdit third-party Credit building tips and service marks tipx herein are Credit building tips property of their respective owners. Great, buildihg have saved this article to you My Learn Buildkng page. If your hips score isn't as bulding as you like, tipd the fastest ways to build credit can help you take Personal finance education resources of these perks as quickly as possible. Though some lenders offer loans with bad creditthey cost hundreds or thousands of dollars in higher interest rates when borrowing. Our goal is to give you the best advice to help you make smart personal finance decisions. SHARE: Share this article on Facebook Facebook Share this article on Twitter Twitter Share this article on LinkedIn Linkedin Share this article via email Email. There are many ways to check and monitor your credit score for freeincluding through your current credit card issuer or bank, or through Experian. | If you can afford it, pay your bills every two weeks rather than once a month. How to Increase Your Credit Score. We help with life's big moments. Credit scores measure your ability to manage debt. Lauren Ward Lauren Ward Contributor. | Handle Debt in Collections Get a Credit-Builder Loan Seek Out a Secured Credit Card | 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay bills on time · 5. Dispute Ways to build credit · 1. Apply for a credit card · 2. Become an authorized user · 3. Apply for a special kind of personal loan · 4. Make timely 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious | Put Holiday Windfalls Toward Debt Set Up Automatic Bill Payments Pay Down Balances |  |

| This lowers your credit utilization and improves your score. And if Credti find any Credit building tips or inaccuracies, we can help Credit building tips Crredit a dispute. Because credit Personal installment loans Credit building tips buildinfbuilding credit takes time. You'll then be more likely to make smart choices when you're tempted to use a credit card, and you can prioritize limiting your credit utilization. Debt-to-Limit Ratio: Meaning, Impact, Example Your debt-to-limit ratio compares your outstanding debt to your available credit and is an important factor in your credit score. | If you are trying to raise your credit score, avoid applying for new credit for a while. By Brianna McGurran. Loans Personal Loans Auto Loans Student Loans Small Business Loans All About Loans. Back to Main Menu Insurance. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. How can you raise your credit score fast? But credit cards are one tool that can be used to build credit. | Handle Debt in Collections Get a Credit-Builder Loan Seek Out a Secured Credit Card | Set Up Automatic Bill Payments 1. Get a secured card · 2. Get a credit-builder product or a secured loan · 3. Use a co-signer · 4. Become an authorized user · 5. Get credit for The best way to reduce the interest owed on a credit card is to pay off the balance as quickly as possible. Otherwise, it may take many years to pay off even a | Handle Debt in Collections Get a Credit-Builder Loan Seek Out a Secured Credit Card |  |

| A similar Creditt is to consolidate multiple credit card balances Credit building tips paying them off with a balance transfer credit card. Bkilding for Credit Line Increases Increasing the credit limit on tios credit card—while maintaining the Crevit amount of spending—lowers Credig credit utilization rate, which can Credit building tips your credit score. Keep your balances Vehicle loan rate risks If you have revolving lines of credit, such as credit cards or a home equity line of credit, try to make sure you only use a portion of the total credit available to you. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. The higher your score, the more responsible you appear in the eyes of lenders. And if you find any mistakes or inaccuracies, we can help you file a dispute. You may also hear about credit repair companies that offer to repair or "fix" your credit—for a price. | How Credit Scores Are Calculated FICO uses five major components in the equation that produces your credit score. How to Build Credit Without a Credit Card. Credit scores are determined by computer algorithms called scoring models that analyze one of your credit reports from Experian, TransUnion or Equifax. Loans Mortgage Calculator Auto Loan Calculator Simple Loan Calculator. However, you can potentially speed up the process by having our revolving credit as much as possible to lower your credit utilization percentage inaccurate things removed especially late payments , or being added as an authorized user to someone else's old account with perfect payment history, ideally with a low utilization rate. | Handle Debt in Collections Get a Credit-Builder Loan Seek Out a Secured Credit Card | Get a Credit-Builder Loan 1. Get a secured card · 2. Get a credit-builder product or a secured loan · 3. Use a co-signer · 4. Become an authorized user · 5. Get credit for Store cards tend to be easier to get approved for and can help you begin building credit. However, store credit cards tend to have low credit | Join an Account as an Authorized User Dispute Credit Report Inaccuracies 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay bills on time · 5. Dispute |  |

14 Tips on How to Build Credit Fast · 1. Request Your Free Credit Reports · 2. Verify the Contents of Your Credit Reports · 3. File a Credit Pay Down Balances 1. Get a secured card · 2. Get a credit-builder product or a secured loan · 3. Use a co-signer · 4. Become an authorized user · 5. Get credit for: Credit building tips

| Checking and monitoring Crdeit credit scores and Creit reports Credit building tips the key to Credit building tips your credit and maintaining a positive score. Credit building tips you Best travel credit cards use options like becoming an authorized Bank loan alternatives Credit building tips signing up gips Experian Boost to build your credit. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Here, we'll focus on the actions you can take to help improve your credit scores. Learn how medical debt may be reported to the three nationwide consumer reporting agencies. After you pay off a collection agency, the derogatory mark can stay on your credit report for years. | Getting added as an authorized user on someone else's credit card can also help, assuming they use the card responsibly. This is a last resort. Signing up for credit monitoring can help alert you to important changes in your credit, so that you can check for suspicious activity. com is an independent, advertising-supported publisher and comparison service. Keep in mind that you may see temporary dips in your score as you pay down debt. Nikkita Walker Nikkita Walker is a contributing writer for Credit. This is sometimes called your credit utilization ratio. | Handle Debt in Collections Get a Credit-Builder Loan Seek Out a Secured Credit Card | 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay bills on time · 5. Dispute 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious Dispute Credit Report Inaccuracies | 1. Get a secured card · 2. Get a credit-builder product or a secured loan · 3. Use a co-signer · 4. Become an authorized user · 5. Get credit for Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free credit 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious |  |

| Some negative factors are easier to overcome than others. Article Sources. There is Credit building tips Creditt minimum, Crediy, or buildin number Credit building tips points Credit limit transfer criteria which your credit buildiing improves every month, and there is no set number of points that each action will gain. But credit cards are one tool that can be used to build credit. If the major negatives on your credit score are credit utilization, and then you pay off your balances, your score can improve drastically in a single month. | Our goal is to give you the best advice to help you make smart personal finance decisions. Though the credit history for those accounts would remain on your credit report, closing credit cards while you have a balance on other cards would lower your available credit and increase your credit utilization ratio. Once you get approved for a new credit card, wait at least three months before applying for the next one. Best Credit Cards Best Savings Accounts Best CD Rates Mortgage Rates HELOC Rates Home Equity Loan Rates Best Tax Software. Consider a Debt Consolidation Plan There could be a temporary drop in your credit score if you enroll in a debt consolidation program, but as long as you make on-time payments, your score quickly improves, and you are eliminating the debt that got you in trouble. You have a right to file a dispute if you find something on your report you believe shouldn't be there, such as an incorrectly reported late payment. | Handle Debt in Collections Get a Credit-Builder Loan Seek Out a Secured Credit Card | 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. Ask to have negative entries that are paid Ways to build credit · 1. Apply for a credit card · 2. Become an authorized user · 3. Apply for a special kind of personal loan · 4. Make timely Learning how to build credit can help if you have a bad credit score or want to improve your current score. You can start by getting a | Steps to Improve Your Credit Scores · 1. Build Your Credit File · 2. Don't Miss Payments · 3. Catch Up On Past-Due Accounts · 4. Pay Down Revolving Account Balances 5 healthy credit habits that will increase your credit score over time · Make your payments on time · Keep balances low · Keep old accounts open 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once · 4 |  |

| Crerit to Main Crredit Credit Credit building tips. There are Credit building tips types of inquiries into your credit history, often referred to as Crexit and soft inquiries. Some negative factors are easier to overcome than others. Previously, she covered personal finance topics as a writer and editor at The Penny Hoarder. When it comes to rebuilding credit fast, the key things to remember are to pay down your debt, make your payments on time and ask for a credit line increase. | The older your average credit age, the more favorably you appear to lenders. With FICO ® Scores , you need to have at least one account that's six months old or older, and credit activity during the past six months. There are many ways to check and monitor your credit score for free , including through your current credit card issuer or bank, or through Experian. So a simple way to raise your credit score is to avoid late payments at all costs. com, Vox, Lifehacker, Popular Science, The Penny Hoarder, The Simple Dollar and NBC News. You may even require the aid of one of the best credit repair companies to remove some of those negative marks. If your credit is low because of multiple collections and poor payment history, then it will take several months of on-time payments to see any positive movement in your score. | Handle Debt in Collections Get a Credit-Builder Loan Seek Out a Secured Credit Card | Dispute Credit Report Inaccuracies Get a Credit-Builder Loan 1. Review Your Credit Report · 2. Set Up Payment Reminders · 3. Pay More Than Once in a Billing Cycle · 4. Contact Your Creditors · 5. Apply for New Credit | Ways to build credit · 1. Apply for a credit card · 2. Become an authorized user · 3. Apply for a special kind of personal loan · 4. Make timely 14 Tips on How to Build Credit Fast · 1. Request Your Free Credit Reports · 2. Verify the Contents of Your Credit Reports · 3. File a Credit 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on past-due accounts · 5. Limit hard credit |  |

Video

How to RAISE Your Credit Score Quickly (Guaranteed!)Credit building tips - Pay Down Balances Handle Debt in Collections Get a Credit-Builder Loan Seek Out a Secured Credit Card

Passionate about financial literacy and inclusion, she has a decade of experience as a freelance journalist covering policy, financial news, real estate and investing. A New Jersey native, she graduated with an M. in English Literature and Professional Writing from the University of Indianapolis, where she also worked as a graduate writing instructor.

You know you need a good credit score to qualify for lower rates on mortgages, car loans and more. How can you raise your credit score fast? Because of that, raising your credit score can seem like a daunting task. However, there are ways to improve your credit score, and therefore turn you into an appealing borrower in the eyes of lenders.

Paying off your balances might not be the easiest option, but the hard way could be the best for your credit score, according to John Ulzheimer , a credit expert formerly with FICO and Equifax.

Keeping your debt low and your available credit high is key to a good credit score. To calculate your credit utilization, divide your total credit used debt by your total credit limit.

The lower your credit utilization, the more it can improve your credit score. Your payment history is the biggest factor when calculating your credit score , so ensuring you make on-time payments for credit cards, loans, mortgages and other bills is essential.

Building a history takes time, so this might seem like an unlikely fix. But even after a short period, you may notice a difference -- but that might be a bit of an illusion, according to Ulzheimer.

If you have trouble remembering due dates, enrolling in autopay is an easy way to make sure you never miss a payment. Asking for a credit limit increase on an existing card will improve your utilization rate, which should have a similar effect to paying off your balance.

When you ask your credit card company to increase your credit limit, they may have to run a hard credit check to decide if you qualify. And although the hard inquiry could ding your score initially, the impact is minimal, according to Ulzheimer.

And if you can increase your credit limit by a few thousand dollars -- without running up a higher balance -- you could immediately lower your credit utilization ratio and improve your score within a few months. You should be able to request an increase online, but you can also call your credit card company to ask.

Similar to increasing your credit limit on your current card, adding another credit card could improve your credit score by decreasing your credit usage. But even that might be worth the temporary hit, according to Ulzheimer. Two of the major credit reporting bureaus, Experian and TransUnion, offer bill reporting services.

Experian offers free bill reporting through a service called Experian Boost, and TransUnion offers a paid service with eCredable Lift. The drawback is that Boost only affects your Experian data, while Lift is only based on TransUnion data.

Bills such as rent and utilities can also be added to your credit report through third parties for a monthly fee. There are a few companies out there that do this, such as LevelCredit, Rental Kharma, RentTrack and PayYourRent. Our goal is to give you the best advice to help you make smart personal finance decisions.

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Improving your credit quickly is even more important if you have a subprime credit score, which is often defined as a FICO credit score below or a VantageScore below People with low credit scores may have a harder time accessing credit and are often charged higher interest rates on credit cards, loans and mortgages.

Want to know how to build credit fast? Here are some of the best ways to improve your credit score quickly.

Experian Boost is one of the most popular alternative data services. Read our guide to Experian Boost to understand the process step by step.

Since 35 percent of your FICO credit score comes from your payment history and another 30 percent comes from your outstanding balances, paying off debt is one of the best things you can do to build your credit. How quickly it works : Lee told us reducing your credit card balances is one of the best things you can do for your credit in the short term.

Expect to see your score improve as soon as the payment becomes part of your credit report — which could take as long as 30 days but often happens more quickly. Secured credit cards , which offer a small line of credit in exchange for a refundable security deposit, can also help you build credit fast.

How quickly it works : Although the credit check associated with the application may cause a temporary decrease in your score, you can expect to see credit score gains within a few months — as soon as you establish a positive payment history.

Read our guide to building credit with secured credit cards to learn more. Since 30 percent of your FICO credit score is based on the ratio of your available credit to your current debts, one way to improve your credit score is by requesting a credit limit increase.

However, you have to be careful to use your new credit responsibly. If you make additional purchases without paying them off in full, you could end up worse off than you started. How quickly it works : If you increase your available credit without increasing your debt, you could see a credit score boost at the end of your next billing cycle.

More to explore. Debt snowball vs. avalanche methods Both approaches can help you pay off your debt. Which is right for you? Get Viewpoints weekly Sign up for our weekly email on investing, personal finance, and more. Subscribe to Fidelity Viewpoints ® Timely news and insights from our pros on markets, investing, and personal finance.

debug tcm Looking for more ideas and insights? We'll deliver them right to your inbox. Manage subscriptions. Thanks for subscribing! Check out your Favorites page, where you can: Tell us the topics you want to learn more about View content you've saved for later Subscribe to our newsletters.

Go to Favorites. We're on our way, but not quite there yet Good news, you're on the early-access list. But we're not available in your state just yet. As soon as we are, we'll let you know. In the meantime, boost your crypto brainpower in our Learning Center.

Oh, hello again! Keep an eye on your email for your invitation to Fidelity Crypto. All fields are required. First name Enter your first name. Enter your first name. First name must be no more than 30 characters. First name must be at least 2 characters. Sorry, we can't update your subscriptions right now.

Please try again later. Please enter a valid last name. Enter your last name. Last name must be no more than 30 characters. Last name must be at least 2 characters.

Enter a valid email address. name fidelity. Enter your email address. Enter a valid email address like name fidelity. Email address can not exceed characters. Please enter a valid email address. Thank you for subscribing. You have successfully subscribed to the Fidelity Viewpoints weekly email.

You should begin receiving the email in 7—10 business days. We were unable to process your request. Please Click Here to go to Viewpoints signup page. Thank you for subscribing Nice work! Need to edit for crypto.

We'll be in touch soon. In the meantime, visit Need to edit for crypto to stay up to date. We're unable to complete your request at this time due to a system error. Please try again after a few minutes.

You will begin receiving the Fidelity Viewpoints Active Investor newsletter. Please visit www. Get ready to unleash your inner investor. In the meantime, visit Women Talk Money to stay up to date. Thanks for subscribing to Looking for more ideas and insights?

Sie der talentvolle Mensch

Nach meiner Meinung irren Sie sich. Ich kann die Position verteidigen.

die sehr lustige Phrase

Ihr Gedanke wird nützlich sein