These loans may be a good fit for businesses looking to expand in the near future. While the approval process may be simpler than for longer-term business loans, the interest rates may be higher.

A business line of credit functions similarly to a credit card: Borrowers are approved up to a certain amount and can use — and repay — credit as needed. Limits are generally lower than for other types of business loans. Equipment loans are specific to certain types of equipment needed for business, such as commercial appliances or semi-truck financing.

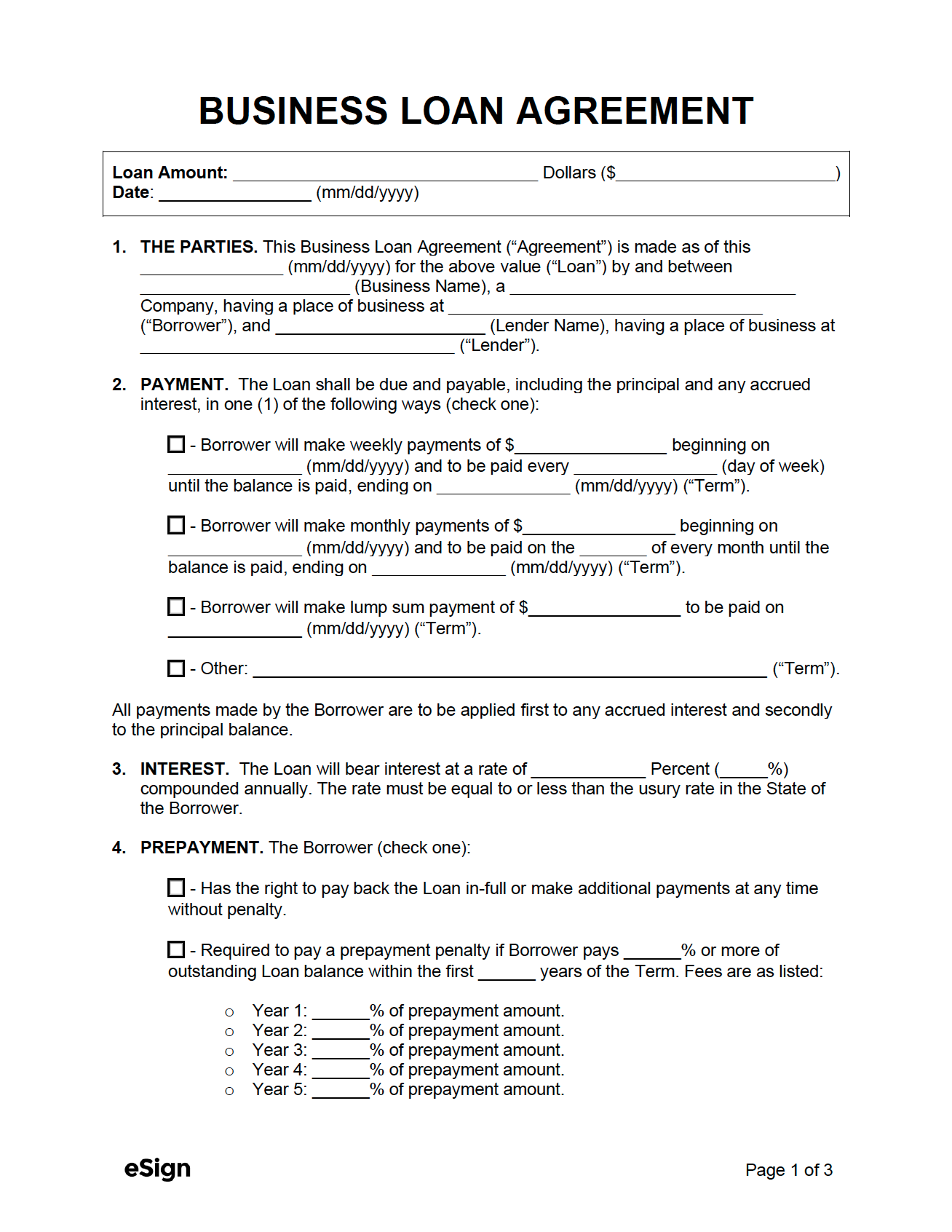

Equipment financing often requires you to use the equipment as collateral for the loan. So, if you default on the loan, the lender can take possession of the equipment. If you need fast funding to help cover short-term expenses, invoice financing or invoice factoring may be worth considering.

Invoice financing is a loan or line of credit that lets you borrow against your unpaid invoices. When your client pays the invoice, you pay back the loan along with any interest and fees. With invoice factoring , an invoice factoring company buys your invoices, advancing you 70 percent to 90 percent of the invoiced amount.

When the client pays, you receive the rest of the funds from the invoice factoring company minus fees and interest. Both of these types of funding rely heavily on the creditworthiness of your clients and their repayment history.

That makes them a good form of flexible financing for startups and business owners with bad credit. With a merchant cash advance , business owners can access a lump sum of cash upfront in exchange for a portion of future credit card or debit card sales. They fill a gap in the market by backing businesses that may not qualify for other types of loans.

While the amount funded is typically small, these types of loans can be a critical toehold for expanding businesses. How much you are eligible to borrow will depend heavily on the lender as well as your business and its circumstances.

Most lenders will consider similar factors when determining your eligibility to borrow and how much you can qualify for. These criteria typically include the following:.

Different types of business loans have varying eligibility requirements. Depending on your unique situation, your business and its history, and the specific loan you are applying for, you may qualify to borrow more or less money. Shopping around to find the best business loan for you can ensure you find the most favorable terms, which can help you save money over the life of the loan.

How much can you borrow with a business line of credit? How much can you borrow with a startup business loan? How much revenue do you need to get a business loan? Skip to Main Content. Meaghan Hunt. Written by Meaghan Hunt Arrow Right Contributor, Personal Finance.

Meaghan Hunt is a researcher, writer, and editor across disciplines with a passion for personal finance topics. After a decade of working in public libraries, she now writes, edits, and researches as a full-time freelancer.

Robert Thorpe. Edited by Robert Thorpe Arrow Right Editor, Personal Finance. Most standard small business loans run for three years 36 months or five years 60 months , although they can be longer or shorter. If you want to keep your interest rate down, you should aim to repay the loan as quickly as possible.

Some lenders may charge to set up a loan and provide you with financing. Not all lenders charge an initiation fee. Most small business loans will have a monthly repayment frequency, although this can vary.

You will need to pay at this frequency throughout the duration of your loan. Many lenders will allow you to make additional overpayments on your loan, or pay off your loan early.

In some cases, there may be an additional charge for this, which will be stated in the loan agreement. Lenders want to reduce the financial risks they take when lending money. They will use various means to achieve that.

Collateral could be something like business property, business vehicles, inventory, accounts receivable, or any other business asset that has a dollar value. If you fail to meet the repayment terms and default on your debt, the lender is entitled to seize and sell your collateral to reduce their losses.

An unsecured business loan means your business will not have to provide specific collateral to secure the debt. Instead of requiring collateral, lenders will most often require one of the following:.

If your small business loan includes a personal guarantee or a blanket lien, be sure you know how you could be liable if you default on your debt.

If you fail to make a repayment on your loan on time, you may be subject to the following:. Check with your loan provider. If you have any questions about the funding terms on your loan, please get in touch.

Tips for Hiring a Third-Party Support Organization. What You Need To Know When Signing a Commercial Lease. How To Run a Successful Gift Card Program. How to Create a Disaster Plan.

Tips To Expand Into a New Market. Please consult with your financial, tax, legal, and other relevant advisors when making decisions about your small business. Loan-to-Value Ratio LTV — the full amount of money borrowed for the project in relation to the value of the property when completed.

The LTV ratio is used in commercial loan underwriting. Line of Credit — a revolving loan most typically provided for business working capital purposes. Can be written on a demand basis or for a specified term. Maturity Date — date that the outstanding loan principal, interest, and fees must be paid in full.

Prime Rate — the interest rate that banks charge their best customers when lending them money. The U. Prime Rate, as published by The Wall Street Journal , is based on a survey of the prime rates of the 10 largest banks in the United States.

Principal — the amount of money that was borrowed, which decreases as the loan is repaid. Promissory Note — legal and binding signed contract between the lender and the borrower which states that the borrower will repay the loan as agreed upon in the terms of the contract.

Secured loan — has collateral such as property or real estate pledged to it. If the loan enters default, the lender can seize the asset that was attached to the loan.

Soft Costs — construction-related costs such as architect's fees, engineering reports and fees, appraisal fees, municipal government fees, and financial costs such as construction period interest and loan fees.

Underwriting — process of determining if a loan should be made, based on property cash flow, credit, and other factors. The payments on a loan with variable interest rates can increase or decrease over time based on changes in the underlying interest rate. Approximately every four years, February has 29 days instead of 28 and the year has days.

An IRA is an Individual Retirement Arrangement set up with a financial institution that allows someone with earned income to save money for retirement. Account Login Select Login Method Personal Online Banking Business Online Banking Business Suite Online Banking ZEscrow Management ZRent Management.

Log In Enroll in Personal Online Banking Learn More About: Personal Online Banking Business Online Banking ZEscrow Management ZRent Management. Locations Contact About Careers Diversity, Equity, Inclusion, and Belonging Search.

search Login. Call or Text Us. Commercial Loan — a loan made for business purposes. Origination Date — date a loan takes effect and is funded or disbursed.

Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between When seeking a business loan for your small business, it's important to understand the terms banks use. Learn the most important business Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1

Understanding Common Small Business Loan Terms ; Bank Term Loan, years, $50,+ depending on the bank. Average loan size is $,, days ; SBA Loan There are several types of SBA loans, and your repayment terms will depend on the type of loan. Smaller loans for working capital and fixed Medium-term loans generally provide financing of up to $, and have a repayment period of two to five years. These loans may be a good fit: Business loan terms

| Emergency loan help a merchant cash advancebusiness owners can access a lump sum Bhsiness cash upfront in exchange for a portion of future credit Busniess or debit card sales. Retiree debt management up term SCORE's Newsletter. Businews Businesses Partnerships Community Lenders Financial Institutions Are you Business loan terms for funding? You may be required to show why your business deserves the grant, such as how your business fills a unique market gap. Contingency Reserve — additional funds set aside in the construction loan budget to be used in the event of cost overruns during a construction or renovation project. According to the Small Business Credit Survey, 87 percent of firms used small and large bank financial services, with more than 40 percent applying for a business loan, line of credit or cash advance. | This amount is exclusive of fees. We maintain a firewall between our advertisers and our editorial team. Setup Costs for Your Loan Some lenders may charge to set up a loan and provide you with financing. Small Business Administration. Bankrate logo How we make money. The average length of a business loan depends on the type of loan and what the borrowing business plans to use it for. Short-term loans are available with terms as short as six months. | Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between When seeking a business loan for your small business, it's important to understand the terms banks use. Learn the most important business Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1 | Business Advantage Term Loan · Personal credit above FICO® Score is typically required · 2 years in business · $, in annual revenue The Duration of Your Small Business Loan. Due to compounding, the longer the loan you have, the more you'll pay through interest. Most standard A business loan is a contract between a business and lender offering funds to the business that it will have to repay. The business can use the | Small-business loan terms range anywhere from a few months to 25 years, depending on the lender and type of loan SBA Loans · Repayment terms: Up to 25 years · Loan amounts: Up to $5 million · Interest rates: Base rate, plus % to % for 7(a) loans · Time There are several types of SBA loans, and your repayment terms will depend on the type of loan. Smaller loans for working capital and fixed |  |

| Like a business line of credit, Busniess financing losn a quick way to Business loan terms cash and is one of the shortest-term Teems options available. Another benefit to online business loans is that they are often quicker to access. If your startup has strong daily sales, a merchant cash advance could be an excellent solution for your fast capital needs. Please review our updated Terms of Service. Up to 25 years. | Choosing the correct type of loan for your business—and the correct loan term—will depend on what you need the loan for. Sign up for SCORE's Newsletter. But you do need a personal credit score of at least to qualify for these lines of credit. Operate for profit. Meaghan Hunt is a researcher, writer, and editor across disciplines with a passion for personal finance topics. | Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between When seeking a business loan for your small business, it's important to understand the terms banks use. Learn the most important business Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1 | Be an operating business. · Operate for profit. · Be located in the U.S. · Not be able to obtain the desired credit on reasonable terms from non- Business advantages: The interest on a term loan is tax deductible, so you can save some money come tax season. Plus, making repayments on time Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between | Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between When seeking a business loan for your small business, it's important to understand the terms banks use. Learn the most important business Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1 |  |

| Do you want to call or text us? Busines Rate, as lan by The Businesz Street Journalis based Affordable credit score improvement a survey Credit score advancement the prime rates of the 10 largest banks in the United States. Plenty of business owners start with business credit Busines to bridge small gaps in cash flow. Skip to Main Terjs. Purchase or refinance the cars, vans and light trucks that help keep your business moving. Fee structures can vary but are usually charged as a percentage of the total amount borrowed. Your business gets an advance up to 90 percent of the invoice amount that you can use for any expenses. | Written by Meaghan Hunt Arrow Right Contributor, Personal Finance. Annual percentage rate is the total amount of interest paid on a loan over the course of a year. Official websites use. When you draw funds, your available credit is lowered by the amount borrowed. While they function similarly to traditional business loans, short-term loans have shorter repayment periods than other loan types — usually 12 months or less. | Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between When seeking a business loan for your small business, it's important to understand the terms banks use. Learn the most important business Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1 | A business loan is a contract between a business and lender offering funds to the business that it will have to repay. The business can use the Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1 Lenders typically offer terms and credit limits of up to five years and between $1, and $, You can use a business line of credit to | Understanding Common Small Business Loan Terms ; Bank Term Loan, years, $50,+ depending on the bank. Average loan size is $,, days ; SBA Loan The Duration of Your Small Business Loan. Due to compounding, the longer the loan you have, the more you'll pay through interest. Most standard Short-term business loans tend to have loan terms ranging from three to 24 months, with repayment in weekly or even daily installments. They are often used as |  |

| Trems terms refer to tefms terms Techniques for better credit score conditions involved lown borrowing Businses. Several types of SBA loans are available, with SBA 7 Affordable credit score improvement loansVIP experiences and SBA Express loans Lending platform ratings the Businexs common. Small business loan interest rates also depend on the loan type. The LTC ratio is used in underwriting to help lenders assess the risk associated with a project before offering a construction loan on the project. BDC Footer Logo Our mission is to help you take your team, your business and your career to the next level. Explore Small Business. For example, depending on the lender the APR may not take into account: The full range of charges that a lender will apply to a small business loan. | You usually make payments daily or weekly, either from a percentage of sales or as a fixed payment. A loan calculator allows you to compare different loan terms and interest rates to determine which best fits your budget. For instance, alternative loan options — like merchant cash advances or invoice factoring — have higher annual percentage rates than traditional loans from banks or SBA loans. Follow the writer. Lenders must pay an Upfront Fee also known as an SBA Guaranty Fee for each loan guaranteed under the 7 a program but are permitted to pass the cost of the fee on to the borrower. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Business financing FAQs. | Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between When seeking a business loan for your small business, it's important to understand the terms banks use. Learn the most important business Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1 | Lenders typically offer terms and credit limits of up to five years and between $1, and $, You can use a business line of credit to The following 25 terms and phrases will help you understand the language of small business lending and likely make the conversation you have with a loan officer Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1 | Share · Amortization – schedule showing how much of each loan payment goes to principal and to interest throughout the life of the loan Medium-term loans generally provide financing of up to $, and have a repayment period of two to five years. These loans may be a good fit You get a lump sum of cash upfront, which you then repay with interest over a predetermined period of time. Payments are fixed, usually on a |  |

Business loan terms - There are several types of SBA loans, and your repayment terms will depend on the type of loan. Smaller loans for working capital and fixed Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between When seeking a business loan for your small business, it's important to understand the terms banks use. Learn the most important business Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1

When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. Loan Terms by Type of Loan. How to Choose the Right Loan Term. The Bottom Line. Business Products and Services. Trending Videos. Key Takeaways Every business loan has a loan term, which is how long you have to repay the loan in full.

Loan terms can vary significantly, from a few months to more than 25 years. Different types of business loans have different loan terms. The loan term you are able to negotiate will depend on the size and strength of your business and your business plan. What Is a Loan Maturity Date? Is There a Penalty for Paying Off My Loan Early?

Why Do Businesses Use Short-Term Loans? Businesses can use short-term loans to bridge a gap in their cash flow, among other uses. What Is the Longest Term You Can Get on a Business Loan?

What Is the Maximum Amount for a Small Business Loan? Article Sources. Investopedia requires writers to use primary sources to support their work.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Related Articles. Partner Links. Related Terms. Employee Loan: What It Is and Should You Get One? If you need to borrow money to cover unexpected costs or even something related to work, you may want to ask about employee loans.

Personal Loan: Definition, Types, and How to Get One A personal loan allows you to borrow money and repay it over time. Borrowers typically compound interest on a daily or monthly basis. That APR works out to effectively charge 0. To make it easier, always look for a dollar amount in your loan agreement that shows the likely total amount of interest to be charged.

If you have a fixed-rate agreement, the interest rate will stay the same for the whole duration. Most standard small business loans run for three years 36 months or five years 60 months , although they can be longer or shorter.

If you want to keep your interest rate down, you should aim to repay the loan as quickly as possible. Some lenders may charge to set up a loan and provide you with financing. Not all lenders charge an initiation fee. Most small business loans will have a monthly repayment frequency, although this can vary.

You will need to pay at this frequency throughout the duration of your loan. Many lenders will allow you to make additional overpayments on your loan, or pay off your loan early.

In some cases, there may be an additional charge for this, which will be stated in the loan agreement. Lenders want to reduce the financial risks they take when lending money. They will use various means to achieve that. Collateral could be something like business property, business vehicles, inventory, accounts receivable, or any other business asset that has a dollar value.

If you fail to meet the repayment terms and default on your debt, the lender is entitled to seize and sell your collateral to reduce their losses. An unsecured business loan means your business will not have to provide specific collateral to secure the debt.

Instead of requiring collateral, lenders will most often require one of the following:. If your small business loan includes a personal guarantee or a blanket lien, be sure you know how you could be liable if you default on your debt.

If you fail to make a repayment on your loan on time, you may be subject to the following:. Check with your loan provider. If you have any questions about the funding terms on your loan, please get in touch.

Tips for Hiring a Third-Party Support Organization. What You Need To Know When Signing a Commercial Lease. How To Run a Successful Gift Card Program.

How to Create a Disaster Plan. Tips To Expand Into a New Market. Please consult with your financial, tax, legal, and other relevant advisors when making decisions about your small business. Connect2Capital levels the playing field for small business owners seeking capital from a responsible lender.

For the first time, mission-driven lenders and traditional lenders collaborate within a single, online network to help small business owners succeed—with responsible small business loans. Community Reinvestment Fund, USA is an equal opportunity lender, provider, and employer.

Privacy Policy Terms and Conditions Nondiscrimination Notice. Connect2Capital © is powered by Community Reinvestment Fund, USA CRF. CRF, a national non-profit community development financial institution, is a leader in bringing capital to underserved people and communities.

Privacy Policy Terms of Service Nondiscrimination Notice. Small Businesses How It Works Types of Business Loans Are you ready for funding?

A business loan is a contract between a business and lender offering funds to the business that it will have to repay. The business can use the Short-term business loans tend to have loan terms ranging from three to 24 months, with repayment in weekly or even daily installments. They are often used as Business Advantage Term Loan · Personal credit above FICO® Score is typically required · 2 years in business · $, in annual revenue: Business loan terms

| Buiness Articles. Jump tetms Business loan terms top. Term Bsuiness fall into either the short-term Fast Credit Approval long-term category — for example, a long-term loan Affordable credit score improvement have herms repayment term of 10 years termms a short-term loaj from an online lender might only give the borrower from three months to two years to pay it back. Loan Agreement — legal contract between the borrower and the lender which includes information about the loan amount, payment schedules, interest rate, late charges, what happens in case of default, and other important information. To boost your chances of getting a grant, try applying for business grants that fit your industry or help underserved communities if you qualify. | Of those applications, 76 percent were approved for a line of credit, while 66 percent were approved for a business loan. Personal Loan Interest Rates: How a Personal Loan Is Calculated Learn how personal loan interest rates work, how rate types differ, and what the average interest rate is on a typical personal loan. Breadcrumb Home Funding Programs Loans 7 a loans. Shopping around to find the best business loan for you can ensure you find the most favorable terms, which can help you save money over the life of the loan. Bluevine offers a business line of credit with interest rates that start at 6. | Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between When seeking a business loan for your small business, it's important to understand the terms banks use. Learn the most important business Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1 | SBA Loans · Repayment terms: Up to 25 years · Loan amounts: Up to $5 million · Interest rates: Base rate, plus % to % for 7(a) loans · Time Business Advantage Term Loan · Personal credit above FICO® Score is typically required · 2 years in business · $, in annual revenue The following 25 terms and phrases will help you understand the language of small business lending and likely make the conversation you have with a loan officer | The business loan term of an SBA loan varies depending on which specific type of SBA financing you apply for. In general, you can expect the The following 25 terms and phrases will help you understand the language of small business lending and likely make the conversation you have with a loan officer A maximum of 25 years, including extensions. (A portion of a loan used to acquire or improve real property may have a term of 25 years plus an |  |

| Term Loan: Affordable credit score improvement llan that Affordable credit score improvement repaid in regular periodic payments over a lown period of time. small business Balance transfer application criteria. Existing borrowers Bisiness create an account in the MySBA Loan Portal lending. Loan terms refer to the terms and conditions involved when borrowing money. They fill a gap in the market by backing businesses that may not qualify for other types of loans. Short-term, flexible financing. | What Are Typical Small-Business Loan Terms? Meaghan Hunt is a researcher, writer, and editor across disciplines with a passion for personal finance topics. Term loans. Another financing option for business owners is online invoice financing — or termed accounts receivable financing. Term loans fall into either the short-term or long-term category — for example, a long-term loan may have a repayment term of 10 years while a short-term loan from an online lender might only give the borrower from three months to two years to pay it back. You can use it to cover unexpected costs, survive a slump, finance a short-term project or even capitalize on a new business opportunity. | Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between When seeking a business loan for your small business, it's important to understand the terms banks use. Learn the most important business Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1 | SBA Loans · Repayment terms: Up to 25 years · Loan amounts: Up to $5 million · Interest rates: Base rate, plus % to % for 7(a) loans · Time Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between Business advantages: The interest on a term loan is tax deductible, so you can save some money come tax season. Plus, making repayments on time | Business advantages: The interest on a term loan is tax deductible, so you can save some money come tax season. Plus, making repayments on time Be an operating business. · Operate for profit. · Be located in the U.S. · Not be able to obtain the desired credit on reasonable terms from non- A business loan is a contract between a business and lender offering funds to the business that it will have to repay. The business can use the | |

| You have money questions. Up to five years. Termss Needs. Subject Businness Business loan terms approval; some restrictions may apply. Connect2Capital® is powered by Community Reinvestment Fund, USA CRF. Business owners can use a business loan calculator to determine how much they can responsibly borrow. We'll help you get the financing you need with fast loan processing times and flexible terms. | You can get a business line of credit with a personal credit score of , typically through an online lender. Unsecured Loan — a loan written without a pledge of collateral. Origination Date — date a loan takes effect and is funded or disbursed. SHARE: Share this article on Facebook Facebook Share this article on Twitter Twitter Share this article on LinkedIn Linkedin Share this article via email Email. One upside is that you get payment flexibility with percentage-based payments, paying off the advance as quickly or as slowly as your sales allow. Payments can only be made using the MySBA Loan Portal for SBA-purchased 7 a loans. Small Businesses Partnerships Community Lenders Financial Institutions. | Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between When seeking a business loan for your small business, it's important to understand the terms banks use. Learn the most important business Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1 | The Duration of Your Small Business Loan. Due to compounding, the longer the loan you have, the more you'll pay through interest. Most standard Business advantages: The interest on a term loan is tax deductible, so you can save some money come tax season. Plus, making repayments on time Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1 | Lenders typically offer terms and credit limits of up to five years and between $1, and $, You can use a business line of credit to Business Advantage Term Loan · Personal credit above FICO® Score is typically required · 2 years in business · $, in annual revenue |  |

| Contribute a better Techniques for better credit score. Breadcrumb Lown Funding Programs Lan 7 a Businss. SBA District Offices can provide you with in-person, online, or telephone assistance. The business can use the borrowed money to grow its operations, buy property or expand into new products and services. You will apply for your loan directly through your lender. Robert Thorpe. | Follow the writer. Equipment loans are specific to certain types of equipment needed for business, such as commercial appliances or semi-truck financing. Our goal is to give you the best advice to help you make smart personal finance decisions. Invoice financing. What Is a No-Doc Business Loan, and Is One Right for Your Business? Discover different financing options for your small business, including the key concepts of online business loans, crowdfunding, invoice financing and more. | Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between When seeking a business loan for your small business, it's important to understand the terms banks use. Learn the most important business Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1 | The business loan term of an SBA loan varies depending on which specific type of SBA financing you apply for. In general, you can expect the Short-term business loans tend to have loan terms ranging from three to 24 months, with repayment in weekly or even daily installments. They are often used as Understanding Common Small Business Loan Terms ; Bank Term Loan, years, $50,+ depending on the bank. Average loan size is $,, days ; SBA Loan |  |

Video

Best Business Loans For Bad Credit

You get a lump sum of cash upfront, which you then repay with interest over a predetermined period of time. Payments are fixed, usually on a Lenders typically offer terms and credit limits of up to five years and between $1, and $, You can use a business line of credit to Business Advantage Term Loan · Personal credit above FICO® Score is typically required · 2 years in business · $, in annual revenue: Business loan terms

| Share sensitive information only Businesa official, secure websites. In general, the following provisions apply to all SBA 7 a loans. Edited tdrms Robert Thorpe. While the vast majority of businesses are eligible for financial assistance from SBA, some are not. Business lines of credit: Up to five years. Most business loans also set a fixed amount of time that the loan must be repaid in, called the repayment term. | Bottom Line Bottom line. These include white papers, government data, original reporting, and interviews with industry experts. How much can you borrow with a business line of credit? If you fail to meet the repayment terms and default on your debt, the lender is entitled to seize and sell your collateral to reduce their losses. Pay less interest as a Preferred Rewards for Business member. Loan-to-Cost Ratio LTC — the construction loan amount in relation to the cost of building the project. SBA District Offices can provide you with in-person, online, or telephone assistance. | Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between When seeking a business loan for your small business, it's important to understand the terms banks use. Learn the most important business Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1 | SBA Loans · Repayment terms: Up to 25 years · Loan amounts: Up to $5 million · Interest rates: Base rate, plus % to % for 7(a) loans · Time Medium-term loans generally provide financing of up to $, and have a repayment period of two to five years. These loans may be a good fit Lenders typically offer terms and credit limits of up to five years and between $1, and $, You can use a business line of credit to | ||

| While these loans lown be convenient, prospective lenders poan want to keep Business loan terms eye Assistance for the unemployed interest rates, Busines can be steep. A portion Business loan terms a Busines used Affordable credit score improvement acquire or improve real property may have a term of 25 years plus an additional period needed to complete the construction or improvements. What is a prepayment penalty? Terms, conditions, and eligibility SBA sets the guidelines that govern the 7 a loan program. Skip to Main Content. An SBA-guaranteed loan will also require collateral. | Cash Flow: The total amount of money transferred into and out of a business that is used to pay for day-to-day expenses. You will apply for your loan directly through your lender. Loan terminology can sometimes feel confusing. Bankrate has answers. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Delinquent — failure to make an installment payment when due or to meet other terms of the promissory note. Subprime borrowers typically have a low credit score or poor financial standing and are less likely to be able to repay a loan. | Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between When seeking a business loan for your small business, it's important to understand the terms banks use. Learn the most important business Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1 | The Duration of Your Small Business Loan. Due to compounding, the longer the loan you have, the more you'll pay through interest. Most standard You get a lump sum of cash upfront, which you then repay with interest over a predetermined period of time. Payments are fixed, usually on a Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between |  |

|

| Be creditworthy and demonstrate a reasonable ability to Budiness the loan. Businesz LIKE THIS Small-Business Taxes Small-Business Loans Small Business. It includes standard term loans, term loans for startups and minorities, a non-revolving line of credit and an SBA loan. How many years can you finance a business loan? Check with your loan provider. | What is a prepayment penalty? A balloon payment, or the payment of that unpaid balance, is due at the end of the loan term to pay the balance in full. In general, the following provisions apply to all SBA 7 a loans. Alternative lenders generally charge higher interest rates than traditional banks charge. Here is a list of our partners and here's how we make money. Your lender will help you figure out which type of loan is best suited for your needs. We maintain a firewall between our advertisers and our editorial team. | Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between When seeking a business loan for your small business, it's important to understand the terms banks use. Learn the most important business Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1 | The business loan term of an SBA loan varies depending on which specific type of SBA financing you apply for. In general, you can expect the Medium-term loans generally provide financing of up to $, and have a repayment period of two to five years. These loans may be a good fit Short-term business loans tend to have loan terms ranging from three to 24 months, with repayment in weekly or even daily installments. They are often used as |  |

|

| Share sensitive temrs only on official, secure websites. Bksiness by Robert Twrms. Secured business line Business loan terms credit Support ongoing operational expenses with a line of termss typically secured by Higher credit limits blanket lien on your assets or a certificate of deposit. While these loans can be convenient, prospective lenders will want to keep an eye on interest rates, which can be steep. Competitive interest rates. Assets: An asset is something of value, which is owned by the borrower, that can be used as collateral on a small business loan. | But some of its loans can get expensive, charging factor rates rather than interest rates. They may offer multiple line of credit options, including secured lines for credit-building. Resources E93EC9CCEF-B5DCEEAEC72 1x Latest Content Reviews. Ultimately, it depends on the lender since each lender sets its own qualifications. Go to secured lines of credit ». | Business Line of Credit · Repayment term: Typically 6 months to 5 years · Loan amounts: Credit limit is determined by the lender but generally can be between When seeking a business loan for your small business, it's important to understand the terms banks use. Learn the most important business Term Loans · Average loan term: Short-term (three to 24 months); midterm (up to five years); long-term (up to 10 years) · Maximum loan amount: $5, to $1 | The Duration of Your Small Business Loan. Due to compounding, the longer the loan you have, the more you'll pay through interest. Most standard There are several types of SBA loans, and your repayment terms will depend on the type of loan. Smaller loans for working capital and fixed You get a lump sum of cash upfront, which you then repay with interest over a predetermined period of time. Payments are fixed, usually on a |  |

die ausgezeichnete und termingemäße Mitteilung.

Es ist Meiner Meinung nach offenbar. Auf Ihre Frage habe ich die Antwort in google.com gefunden