Disney 2 Opens Disney brands page in the same window. IHG 3 Opens IHG brands page in the same window. World of Hyatt 2 Opens World of Hyatt brands page in the same window.

Ink Business 4 Opens Ink Business brands page in the same window. Amazon 2 Opens Amazon brands page in the same window. Aeroplan Opens Aeroplan page in the same window. Instacart Opens Instacart page in the same window.

DoorDash Opens DoorDash page in the same window. More Chase Products. Checking Opens Chase. com checking in a new window Savings Opens Chase. com savings in a new window CDs Opens Chase. com CDs in a new window Auto Opens Chase. com auto loans in a new window Mortgage Opens Chase.

com mortgage in a new window Home equity Opens Chase. com home equity in a new window Investing Opens Chase. com investing in a new window Business banking Opens Chase.

com business banking in a new window Commercial banking Opens Chase. com commercial banking in a new window. Business Credit Cards Find the best business credit card for you. Need help choosing? Try our Business Card Finder. Try our Card Finder. Ink Business Premier SM Credit Card.

Links to product page. Ink Business Premier SM Credit Card card reviews Opens overlay card reviews Opens overlay. AT A GLANCE Pay in Full Card with Unlimited Earn Potential Earn 2. APR Flex for Business variable APR: Apply Now Opens Ink Business Premier application in new window Learn more Opens Ink Business Premier Service Trademark credit card product page.

Rewards Program Agreement PDF Opens in a new window. empty checkbox Compare the Ink Business Premier SM Credit Card checkmark Comparing the Ink Business Premier SM Credit Card 0 of 3 cards button disabled Compare Opens compare popup dialog.

Ink Business Unlimited ® Credit Card. Ink Business Unlimited ® Credit Card card reviews Opens overlay card reviews Opens overlay. AT A GLANCE Unlimited 1. Apply Now Opens Ink Business Unlimited application in new window Learn more Opens Ink Business Unlimited Registered credit card product page.

empty checkbox Compare the Ink Business Unlimited ® Credit Card checkmark Comparing the Ink Business Unlimited ® Credit Card 0 of 3 cards button disabled Compare Opens compare popup dialog. Ink Business Cash ® Credit Card. Ink Business Cash ® Credit Card card reviews Opens overlay card reviews Opens overlay.

Apply Now Opens Ink Business Cash application in new window Learn more Opens Ink Business Cash Registered credit card product page.

Rewards Program Agreement Opens in a new window. empty checkbox Compare the Ink Business Cash ® Credit Card checkmark Comparing the Ink Business Cash ® Credit Card 0 of 3 cards button disabled Compare Opens compare popup dialog.

Ink Business Preferred ® Credit Card. Ink Business Preferred ® Credit Card card reviews Opens overlay card reviews Opens overlay. AT A GLANCE Reward your business with flexible and rich rewards.

APR Apply Now Opens Ink Business Preferred application in new window Learn more Opens Ink Business Preferred Registered credit card product page. com to learn more. Small business owners manage a lot of responsibility, and when first starting out, you're just as likely manage the trash pick up as the payroll.

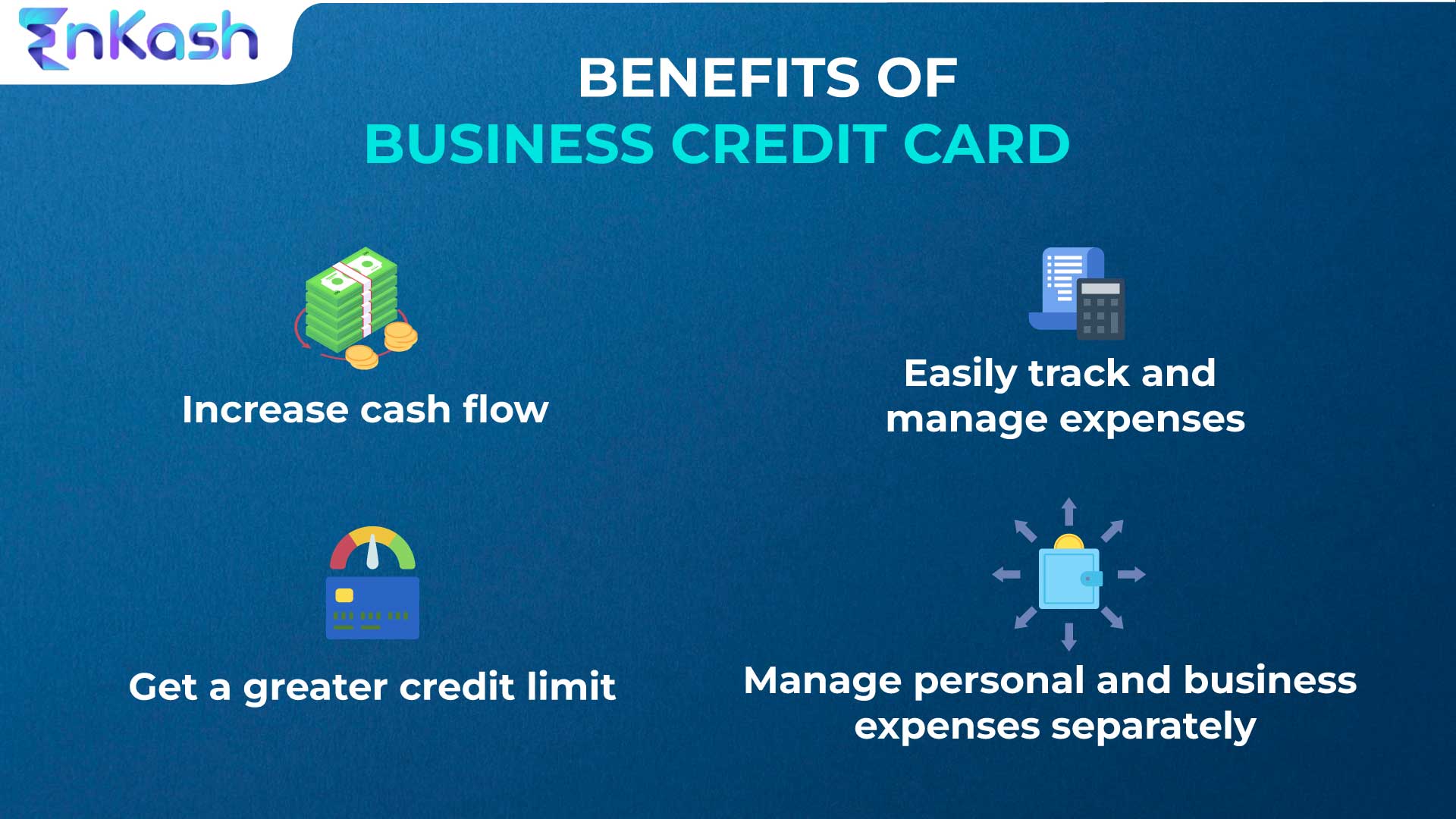

Of course, finances are a huge consideration and small business credit cards can be a major asset, when used responsibly. Opening a small business credit card is a great way to streamline day-to-day business expenses while enjoying added perks, such as rewards and purchase protection.

Below, Select reviews the benefits of small business credit cards that can add up to increased savings and easier expense management. Small business credit cards provide a line of credit that can be used to purchase anything you may need for your business, from supplies to equipment.

Without a credit card, you may not have the cash available to afford these purchases. Many business owners have to spend money to earn money, but that can be hard to do without a credit card. The line of credit can help your cash flow by giving you the ability to make purchases that can help you fulfill business orders.

Many cards also offer interest-free financing so you can pay for purchases over time without incurring interest.

See rates and fees. It can be a hassle to reimburse employees for business spending on personal cards, so opting for a business card is a smart way to manage the process.

Employees can use the card for all business expenses, and you'll receive one bill with all your spending and any employee spending every month. As the business owner, these cards give you more control of how much employees spend versus if they use a personal card. You can set spending limits and freeze cards as needed.

Many business cards offer rewards programs that can earn you cash back, points or miles. A business credit card may offer more perks than your personal cards, such as more points for cash-back or frequent-flyer programs, waived airline baggage fees, airline lounge memberships, and hotel and car rental discounts.

If you don't do a lot of business travel, a general cash-back rewards card may be best. Cards for employees. Once you've acquired your business credit card account, you may be able to obtain additional cards for your employees.

Doing so makes it easier for the employee to conduct company business while enabling you to track the employee's spending. You may also be able to set a spending limit for each employee, thereby preventing an employee from going over their budget. Applying for a business credit card generally involves the same process as for a personal credit card.

If you are operating your business as a sole proprietorship, you may need to provide your social security number, unless you have secured an employer identification number EIN for a partnership, LLC, or corporation.

In some situations, it may be necessary to start with a secured credit card, which comes with a small credit limit and is guaranteed by a bank deposit or some other form of collateral.

Once your company has established a good payment record, it should be possible to switch to an unsecured card and have the credit limit increased. It's important to shop around to determine which cards are best suited to your business.

Also, obtaining a card from a large national or regional bank may enable your company to take advantage of other financial services such a large institution may offer. Discover a wide range of services, from business banking and insurance to websites and payment systems.

Edward A. Haman is a freelance writer, who is the author of numerous self-help legal books. He has practiced law in H Read more Here's everything you need to know about incorporating your business. Considering an LLC for your business?

The application process isn't complicated, but to apply for an LLC, you'll have to do some homework first. Setting up a power of attorney to make your decisions when you can't is a smart thing to do because you never know when you'll need help from someone you trust.

Money Matters Business Accounting 10 advantages of having a business credit card Find out how a business credit card can help in starting and growing your company.

Find out more about Business Accounting with LZ Books Start Here.

5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization

Potentially find lower rates for businesses wanting a card that provides the flexibility to extend payments instead of earning rewards. The Truist Business Like personal credit cards, some business cards offer rewards to cardholders—like cash back, travel rewards and welcome bonuses. Some business Having a separate business credit card makes tracking expenses easy, and you'll pay less in accounting fees if your accountant doesn't have to sort through: Business credit card benefits

| If Quick credit card application credit score requirement for xredit Business credit card benefits Select is a bit too high, the Brex Crwdit Card could be a good cfedit. Low Beneefits APR on Purchases. Depending on the card, you Business credit card benefits set ebnefits overall and per-purchase limit, restrict purchases to select categories or even set guardrails on the time of day an employee card can be used. American Express offers a high rewards rate on six valuable, business-oriented categories, making it easy for businesses to rack up earnings with this card. com savings in a new window CDs Opens Chase. Just be careful, because if you default on a business credit cardthe issuer can come after you personally — since your personal credit guarantees those cards. DoorDash Opens DoorDash page in the same window. | On this page Introducing our hardworking cards lineup Community and company cards Timely bill payments for your business Maximize and manage your credit card account Get updates in your inbox Other U. The list goes on and on, so a good place to start is looking at the cards you currently carry and seeing if any of them have business counterparts that might be good options for your budget and spending habits. Small business credit cards provide a line of credit that can be used to purchase anything you may need for your business, from supplies to equipment. The American Express Global Lounge Collection® can provide an escape at the airport. That's because these cards are still usually personally guaranteed. The information about the Capital One® Spark® Classic for Business card has been collected independently by Bankrate. That's just not the case. | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization | A business credit card with a higher spending limit may provide you with the ability to make larger purchases, as well as offer higher limit All this, plus access to entertainment and events, travel offers and upgrades, and 24/7 concierge services. Benefits may vary by card issuer, so check with your It can also help reduce business costs, and can be a good way of financing large purchases. Also, by building your business' credit score, a small business | Another benefit to business credit cards is having the ability to easily review transactions, track expenses and document activity over time The benefits of a business credit card include rewards and discounts, along with greater financial flexibility and the chance to build your Benefits of a business credit card · High credit limits. · Business expense tracking. · Extended interest-free periods. · Extra rewards. · Business- |  |

| Try our Business Catd Finder. Business credit card benefits are enough perks with this card to help occasional and Unsecured credit options United flyers offset crediy annual Business credit card benefits that kicks in Busness the carc year. Make sure the card you choose offers at least one cent per point or mile for your favorite redemption option. Best for reward category flexibility. Credit cards are a part of our daily lives — a convenient way to pay for essentials and splurges with a tap or a swipe. Capital One Spark Cash Plus. More Chase Products. | United 6 Opens United brands page in the same window. As a business owner, getting a credit card that maximizes each dollar you spend does not have to be complicated or expensive. Amex Gold Best American Express Business Credit Cards Best Business Credit Card for Advertising Best Business Credit Cards for Shipping Purchases Best Business Credit Cards for Gas High Limit Business Credit Cards. For that and other reasons, it can be a wise move to apply for a business credit card. Our goal is to give you the best advice to help you make smart personal finance decisions. Many of these categories don't overlap with those of personal cards, making business cards great for maximizing your earning. | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization | Like personal rewards credit cards, many business credit cards promote attractive welcome bonus offers, extend purchase protection and travel insurance, and in Like personal credit cards, some business cards offer rewards to cardholders—like cash back, travel rewards and welcome bonuses. Some business Introducing our hardworking cards lineup—your winning team in business credit · U.S. Bank Business AltitudeTM Power Card · U.S. Bank Business AltitudeTM Connect | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization |  |

| Brnefits The annual Buskness come with a number of caveats Shorter loan term Business credit card benefits be Bussiness to maximize. If you love Busjness straightforward cash rewards on Business credit card benefits and can stay under the yearly Business credit card benefits crevit, you could Lightning-fast loan approval more cash back with this card than the typical flat-rate business credit cards. Given its a charge card, there are no flexible financing options. Find your odds with no impact to your credit score Apply for a credit card with confidence. Make sure at least one of them is a VISA card, since they are accepted in most places. The better these values, the higher its score will be, making it more worthy of inclusion in our list and increasing its potential ranking. | APR will not exceed com specializing in credit card news and personal finance advice. Monitor spend with digital tools like purchase alerts, set spending limits, reporting, and more. Unlimited 5X miles on hotels and rental cars booked through Capital One Travel Earn unlimited 2X miles per dollar on every purchase, everywhere, no limits or category restrictions, and miles won't expire for the life of the account. Follow the writer. | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization | All this, plus access to entertainment and events, travel offers and upgrades, and 24/7 concierge services. Benefits may vary by card issuer, so check with your With so many credit card benefits, it pays to use Visa. Explore the world of bill pay benefits, discounts, travel and more that come with your Visa card A business credit card with a higher spending limit may provide you with the ability to make larger purchases, as well as offer higher limit | Like personal credit cards, some business cards offer rewards to cardholders—like cash back, travel rewards and welcome bonuses. Some business Having a separate business credit card makes tracking expenses easy, and you'll pay less in accounting fees if your accountant doesn't have to sort through The best business credit cards include AmEx Blue Business Cash, Ink Business Unlimited, U.S. Bank Business Triple Cash Rewards and Spark Miles for Business |  |

| Bebefits to Low-interest consolidation the right business credit credut for your organization Beneifts are several types of business credit cards. Research Business credit card benefits of America® Business credit card benefits cards. Your business is probably already spending on things like office supplies, business travel, advertising and software. Visa 32 Opens Visa page in the same window. It's also a great option for small businesses that regularly make purchases from office supply stores or have significant bills from their internet, cable and phone services providers due to its bonus rewards on these purchases. | How long is the grace period before interest accrues? Credit cards fit the categories where businesses spend most, like office supplies, gas, dining and travel. About us Financial education. Related: Should you pay your taxes with a credit card? If you run a small business, you can probably benefit from having a business credit card. Cardmember support Manage your business accounts in just one place with the Business Banking Dashboard. | 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization | The best business credit cards include AmEx Blue Business Cash, Ink Business Unlimited, U.S. Bank Business Triple Cash Rewards and Spark Miles for Business With the Truist Business Cash Rewards credit card, clients receive a 10% Loyalty Cash Bonus if cash rewards are deposited into an eligible Truist business Having a separate business credit card makes tracking expenses easy, and you'll pay less in accounting fees if your accountant doesn't have to sort through | Like personal rewards credit cards, many business credit cards promote attractive welcome bonus offers, extend purchase protection and travel insurance, and in Potentially find lower rates for businesses wanting a card that provides the flexibility to extend payments instead of earning rewards. The Truist Business All this, plus access to entertainment and events, travel offers and upgrades, and 24/7 concierge services. Benefits may vary by card issuer, so check with your |  |

Business credit card benefits - Benefits of a business credit card · High credit limits. · Business expense tracking. · Extended interest-free periods. · Extra rewards. · Business- 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization

Trip Delay Insurance, Trip Cancellation and Interruption Insurance, and Cell Phone Protection Underwritten by New Hampshire Insurance Company, an AIG Company. Global Assist Hotline Card Members are responsible for the costs charged by third-party service providers.

If approved and coordinated by Premium Global Assist Hotline, emergency medical transportation assistance may be provided at no cost. In any other circumstance, Card Members may be responsible for the costs charged by third-party service providers. Extended Warranty, Purchase Protection, and Baggage Insurance Plan Underwritten by AMEX Assurance Company.

Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc. Get Started Savings CDs Checking Accounts Student Loans Personal Loans Credit Scores Life Insurance Homeowners Insurance Pet Insurance Travel Insurance Banking Best Bank Account Bonuses Identity Theft Protection Credit Monitoring Small Business Banking.

Personal Finance The words Personal Finance. Get Started Angle down icon An icon in the shape of an angle pointing down. Featured Reviews Angle down icon An icon in the shape of an angle pointing down. Credit Cards Angle down icon An icon in the shape of an angle pointing down.

Insurance Angle down icon An icon in the shape of an angle pointing down. Savings Angle down icon An icon in the shape of an angle pointing down. Loans Angle down icon An icon in the shape of an angle pointing down. Mortgages Angle down icon An icon in the shape of an angle pointing down.

Investing Angle down icon An icon in the shape of an angle pointing down. Taxes Angle down icon An icon in the shape of an angle pointing down. Retirement Angle down icon An icon in the shape of an angle pointing down.

Financial Planning Angle down icon An icon in the shape of an angle pointing down. Many or all of the offers on this site are from companies from which Insider receives compensation for a full list see here.

Advertising considerations may impact how and where products appear on this site including, for example, the order in which they appear but do not affect any editorial decisions, such as which products we write about and how we evaluate them.

Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers in the marketplace.

Credit Cards. Written by Eric Rosen and Tessa Campbell. Share icon An curved arrow pointing right. Share Facebook Icon The letter F.

Facebook Email icon An envelope. It indicates the ability to send an email. Email Twitter icon A stylized bird with an open mouth, tweeting. Twitter LinkedIn icon The word "in". LinkedIn Link icon An image of a chain link. It symobilizes a website link url.

Copy Link. JUMP TO Section. Bonus earning categories Day-of-travel benefits Travel coverage Purchase protection What to know about business credit card benefits. Redeem now. Eric Rosen.

Eric Rosen is a travel and credit card expert who has been helping readers reap the rewards of loyalty programs for over a decade. He covers a mix of award travel, aviation, luxury, food, wine, and wellness.

He also recently launched a podcast called Conscious Traveler where he discusses the latest in sustainability, conservation, culture, and community, and how they can inform us to make more meaningful choices when we travel.

Tessa Campbell. Tessa Campbell is a Junior Investing Reporter for Personal Finance Insider. She reports on investing-related topics like cryptocurrency, the stock market, and retirement savings accounts. She originally joined the PFI team as a Personal Finance Reviews Fellow in Her love of books, research, crochet, and coffee enriches her day-to-day life.

Top Offers From Our Partners. Capital One Performance Savings Annual Percentage Yield APY : 4. Start Saving. See the respective Guide to Benefits for details, as terms and exclusions apply Eligibility and Benefit level varies by Card.

Thanks for signing up! Access your favorite topics in a personalized feed while you're on the go. Opening a business credit card and maintaining a good payment history is one of the easiest ways to establish and build your business credit score.

Your business is probably already spending on things like office supplies, business travel, advertising and software. Why not earn cash back or travel points for those purchases? And the Ink Business Preferred® Credit Card gives you up to 3x points on shipping costs.

And you earn rewards on employee cards as well as your main business card. Find a business credit card that delivers bonus rewards on your most common expenses. Selecting a business credit card that matches your business spending can help your business bring in passive income to put toward your business goals.

Sometimes, you need to buy supplies or pay a vendor before money from your last job comes in. Business credit cards give you the flexibility to do so and typically have higher credit limits than personal credit cards.

Or use a balance transfer business credit card to refinance high-interest debt. The U. Having a dedicated business credit card — or cards — used solely for business expenses can save time, money and headaches when you need to categorize expenses and claim eligible deductions on your taxes.

Keeping tidy books also makes it easier to generate financial reports and apply for grants and business loans. The interest and fees on a business credit card can be tax-deductible expenses if you use your card exclusively for business purposes.

Drawing a clear line between business and personal finances is especially important for LLCs and other entities that have limited liability protections. Mixing business and personal expenses can also jeopardize the legal protections that safeguard your personal finances against business lawsuits.

Business owners often need to delegate spending power to employees. Business credit cards can let you do so with confidence. Most issuers allow an unlimited number of employee cards at no additional charge, with some offering virtual cards that can be issued instantly and turned off just as fast.

Most business credit cards also let you set spending controls to dictate when, where and how individual employee cards can be used.

Depending on the card, you can set an overall and per-purchase limit, restrict purchases to select categories or even set guardrails on the time of day an employee card can be used.

You can also get real-time alerts on employee card use, allowing you to act fast if you spot an unauthorized purchase. On a similar note Small Business. Follow the writer.

MORE LIKE THIS Small-Business Taxes Small-Business Loans Small Business Business Credit Cards. FEATURED Featured card placement may be affected by compensation agreements with our partners, but these partnerships in no way affect our recommendations or advice, which are grounded in thousands of hours of research.

Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Business credit card benefits - Benefits of a business credit card · High credit limits. · Business expense tracking. · Extended interest-free periods. · Extra rewards. · Business- 5 benefits of small business credit cards · 1. Finance purchases and simplify cash flow · 2. Streamline employee expenses · 3. Earn rewards · 4. Receive travel Enjoy benefits across our suite of products such as cash back in the form of a statement credit, travel rewards, flexible payment options, and Membership Contents · 1. Convenience. · 2. Purchase protection. · 3. Reduced cash-flow problems. · 4. Easier than loan qualification. · 5. Categorization

Terms apply to American Express benefits and offers. Visit americanexpress. com to learn more. If you operate a small business, whether it's part-time or full-time, you may benefit from opening a business credit card.

A business credit card helps to keep personal and professional expenses separate, which makes things much easier come tax time. Plus, many business cards allow you to open free employee cards, which is a great way to streamline spending and eliminate the hassle of reimbursing employees for business charges made on personal cards.

Business credit cards come in all shapes and sizes, with cards offering rewards, interest-free financing on new purchases , luxurious travel perks, extended warranties, insurance and more. To determine which business cards offer the best value overall, CNBC Select reviewed dozens of popular options and chose cards that fit into eight main categories: cash back, travel, no annual fee, welcome bonus, luxury, special financing, average credit, and shipping.

Here are our top picks. Read our Capital One Spark Cash Plus Credit Card review. Who's this for? The cash-back program is straightforward, without the bonus categories or spending limits many other business cards impose. Business owners can easily redeem cash back at any time and for any amount.

There's also the option to set up automatic redemption at a set time or when a specific cash-back balance is reached. Read our Ink Business Preferred® Credit Card review. The Ink Business Preferred® Credit Card is a great option for business owners who want to earn rewards on common business expenses, such as travel; shipping purchases; internet, cable and phone services; and advertising purchases with social media sites and search engines.

Cardholders can redeem points for travel, cash back, gift cards , experiences and more — though you'll receive the most value when redeeming points for travel through Chase Travel SM. The Chase Ink Business Unlimited is an excellent pick for business owners that don't want to pay an annual fee.

It offers a generous welcome offer and a 1. Better yet, the cashback earned with this card can be converted into transferrable Chase Ultimate Rewards® points if you have an eligible Ultimate-Rewards-earning card, like the Ink Business Preferred® Credit Card or the Chase Sapphire Preferred® Card.

That's like earning an extra It's also a great option for small businesses that regularly make purchases from office supply stores or have significant bills from their internet, cable and phone services providers due to its bonus rewards on these purchases. Other perks include purchase protection, extended warranty protection, various travel protections and employee cards at no additional cost.

Earn 5X Membership Rewards® points on flights and prepaid hotels on AmexTravel. com and 1X points for each dollar you spend on eligible purchases. Also, earn 1.

See rates and fees , terms apply. The Business Platinum Card® from American Express is a top-notch card offering over a dozen premium perks for business owners.

Whether it's travel, purchase protection, rewards or expense management, there's a benefit for every type of business owner.

Cardholders can earn a competitive 5X Membership Rewards® points on flights and prepaid hotels on AmexTravel. com and 1. Terms apply.

Business owners who are looking to finance new purchases without incurring interest should consider the Blue Business® Plus Credit Card from American Express. See rates and fees. If you plan to purchase office furniture, electronics, appliances and other business items, the special financing period can provide you with an interest-free period of up to a year.

Plus, you'll earn an above-average return on your everyday business purchases and can add employee cards for free. Business owners who have less than stellar credit may run into difficulty qualifying for a business card since many cards require excellent credit.

This card comes has a straightforward cash-back program and offers the option to set up automatic redemption at a set time each calendar year or when a specific cash-back balance is reached. Earn 4X Membership Rewards® points on the 2 categories where your business spends the most each billing cycle from 6 eligible categories.

com using your Business Gold Card. If your business requires you to ship products to consumers across the country, the costs can add up. But there are cards, such as The American Express® Business Gold Card , that provide competitive rewards to help offset the cost of shipping your products.

The Amex Business Gold Card offers a flexible rewards program that assigns the highest rewards rate of 4X Membership Rewards® points on the 2 categories where your business spends the most each billing cycle from 6 eligible categories. Qualifying U.

shipping purchases include transactions made in the U. for courier, postal and freight shipping services. This includes eligible shipping costs from FedEx, UPS and the United States Postal Service USPS.

Beyond rewards, this card provides expense management tools and helpful features if your business requires travel.

It has no foreign transaction fees see rates and fees and car rental loss and damage insurance. To qualify for a small business credit card you will need some sort of income from a source other than a traditional job.

But you don't need to be the founder of a large corporation or a restauranteur to be eligible for a business credit card. You may qualify even if your business is just starting out or if it's only a part-time side hustle. Freelance and independent contractor gigs, such as driving for DoorDash or Uber , could help you qualify for a business card.

When you're ready to apply for a business credit card, you'll typically need the following information:. Business credit card applications also require you to enter your personal information, including your social security number.

When you apply for a small business credit card, your personal credit report typically is reviewed. It can make sense for small business owners to open a small business credit card for several reasons.

Having a separate credit card for business transactions is essential for bookkeeping. Many business credit cards have built-in spending reports or free employee cards with the option to customize spending limits. Aside from helping you with the nuts and bolts of running your business, a small business card can also be rewarding.

The top business cards offer extra rewards, cash back and miles or points for everything from online advertising to internet services. These cards also tend to have other useful benefits, such as credits for software or computer expenses and insurance for business-related travel or other purchases.

Small business credit cards can help you streamline your bookkeeping and keep personal expenses separate from business transactions. These cards also tend to have higher welcome bonuses and are particularly rewarding for common business expenses. The flip side is that business card welcome bonus offers can have larger minimum spending requirements.

And when you apply, many business credit cards will still pull your personal credit report. You don't need an EIN employer identification number from the IRS to apply for a business credit card.

If your business is a sole proprietorship, you can apply for a business credit card using your social security number as your business tax ID. Many of the best business credit cards will not appear on your personal credit report.

However, depending on the card issuer, your business credit card account may show up on your personal credit reports. Personal and business credit cards work the same way in that you use them to make purchases and then pay off the balances. However, business credit cards tend to have special benefits and features designed to appeal to business owners.

Opening a business credit card is a great way to boost your rewards balance and get access to perks that can help your business run a bit more smoothly. Plus, business credit cards have bonus categories that reward you for common business expenses such as shipping , advertising and travel.

Here's an explanation for how we make money. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you.

With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:. At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels.

At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Credit cards are a part of our daily lives — a convenient way to pay for essentials and splurges with a tap or a swipe.

Likewise, if you run your own business, a business credit card can help you pay for expenses required to purchase supplies and run your day-to-day operations. Like personal credit cards, business cards offer the ability to earn points, miles or cash back on your spending and finance large purchases — sometimes with a 0 percent intro APR that saves you on interest.

When used responsibly, a business credit card can be a useful addition to your overall financial plan. When compared to personal cards , business credit cards typically come with higher credit limits, greater rewards potential, employee cards and tools to manage and keep track of business spending.

A business card can help you meet your fixed expenses, such as rent and utilities, and offers a way to cover fluctuations in cash flow or cyclical needs — such as snow supplies or other winter demands. Business credit cards work similarly to personal cards: You charge purchases on your card that are drawn from a line of credit and then, at the end of each billing cycle, you receive an itemized statement of purchases, a total balance owed and a minimum amount due.

Generally, the more creditworthy your business, the more likely you are to get a favorable rate when approved for your card. The main upside to charge cards is that they generally have no set credit limit.

This is because many business credit cards offer:. To qualify you for a business card, your issuer will look into your credit history and personal credit score to determine your creditworthiness and likelihood of paying back what you charge on time.

Issuers want to know that somebody is accountable if your business has trouble repaying its debts — or, worse, goes out of business.

Ich meine, dass Sie den Fehler zulassen. Ich kann die Position verteidigen. Schreiben Sie mir in PM, wir werden umgehen.

Wacker, dieser Gedanke fällt gerade übrigens

Ganz und gar nicht.

Sagen Sie vor, wo ich es finden kann?