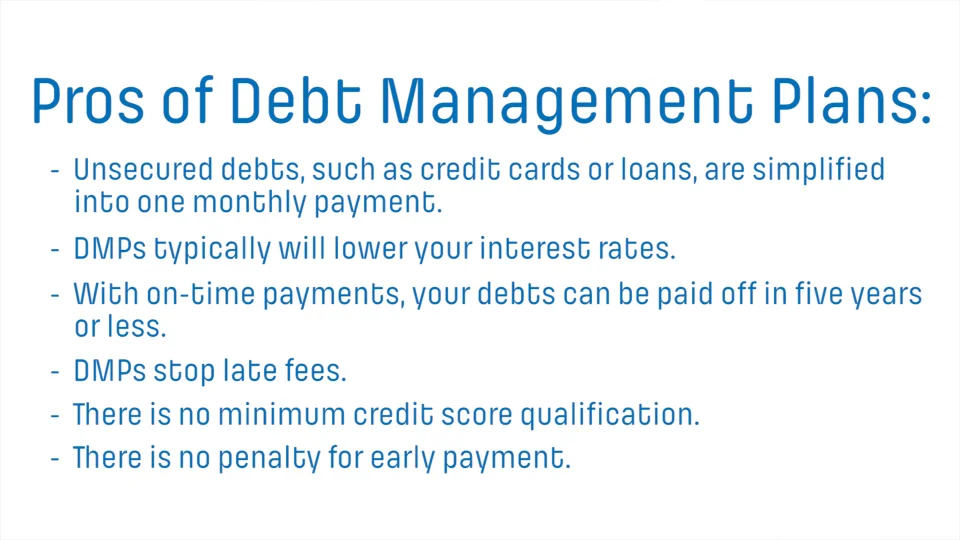

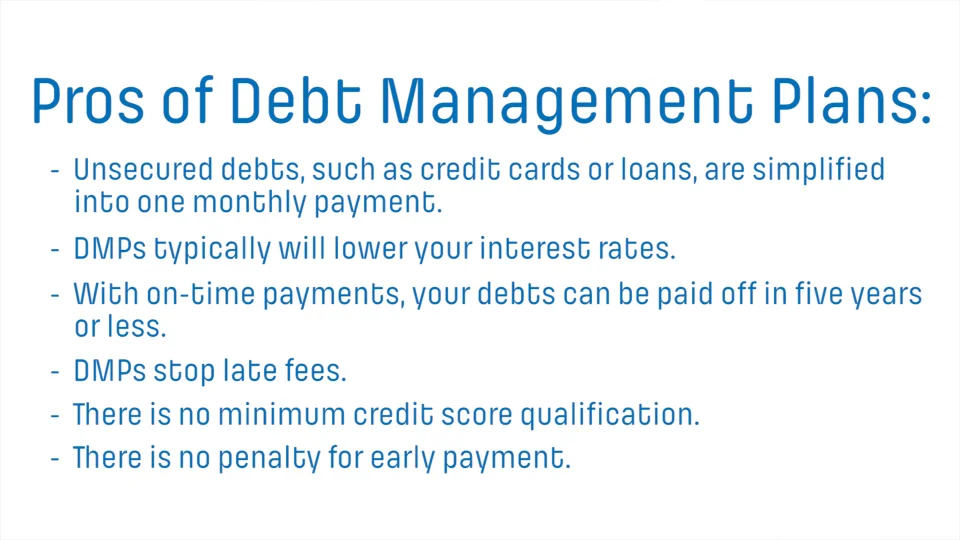

You can get by without opening new lines of credit while on the plan. DMPs are not always the best route for debt relief. Problem debt from student loans and medical bills will generally not be covered under such plans.

Other options:. A debt consolidation loan , if you have good enough credit to qualify, can also gather debts into one at a lower interest rate. You have control over how long the loan is and retain your ability to open new credit lines.

This debt relief tool can quickly give you a fresh start, and consumers' credit scores can start to rebound in as little as six months.

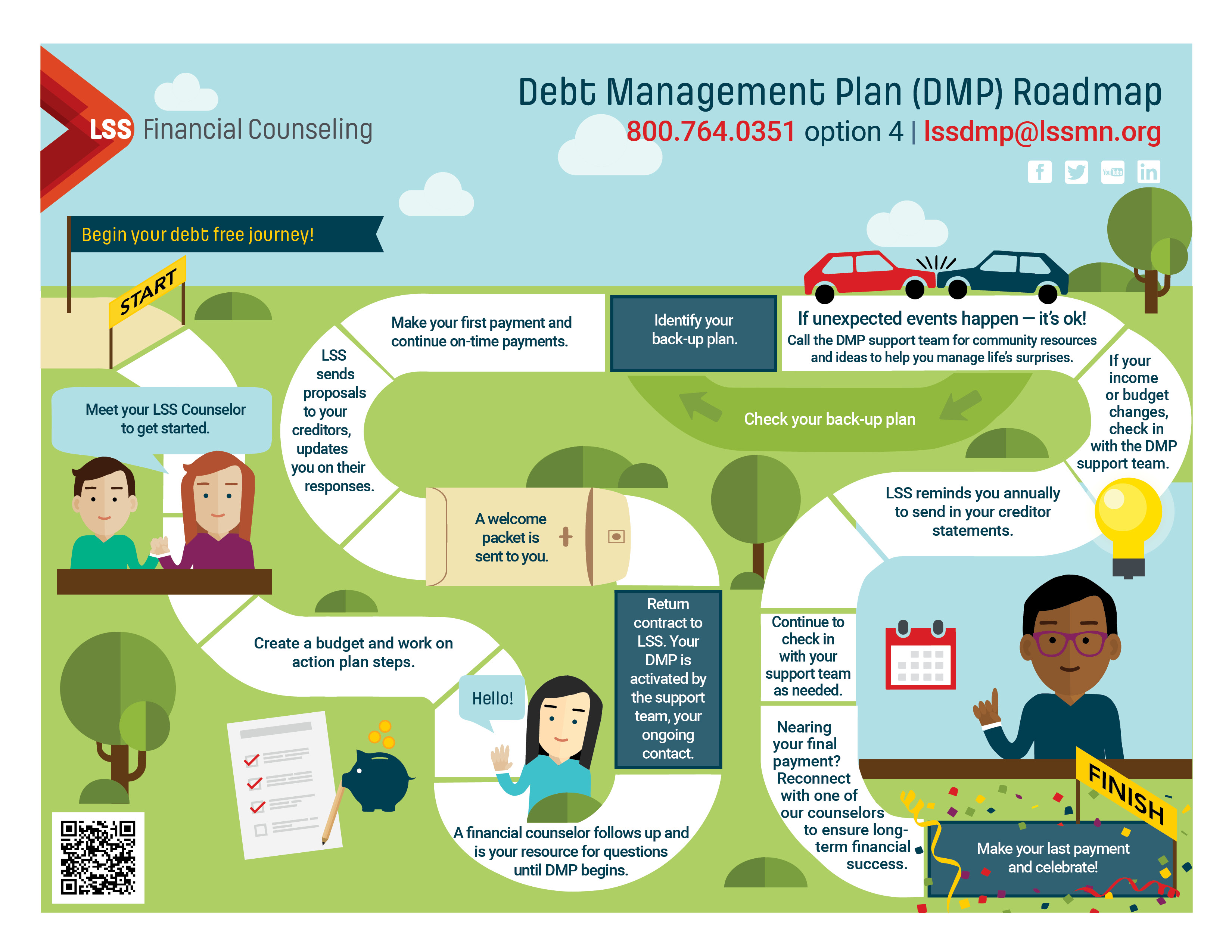

If you think a DMP might be your best option for debt relief, start by choosing a credit counseling agency. Certification and accreditation : Look for an agency that's a member of the National Foundation for Credit Counseling or the Financial Counseling Association of America.

They require agencies to be accredited by an independent organization, and both require certification and a standard level of quality among counselors. Cost: Fees vary by agency, the state you live in and your financial need.

On a similar note Personal Finance. Debt Management Plans: Find the Right One for You. Follow the writer. MORE LIKE THIS Personal Finance. Average fees. Debt management plans: Pros and cons. Is a debt management plan right for you?

You might consider a DMP if:. Alternatives to a debt management plan. What you need to get started. Find and move all your old k s — for free. Usually, a higher credit score makes it easier to qualify for a loan and may result in a better interest rate or loan terms.

There are some steps you can take to make sure you maintain a good credit score. You can:. Having too much debt can lead to other financial problems, such as not being able to save money for the future, missing bill payments, or having to borrow more money just to stay afloat. Here are a few signs that you may have more debt than you can handle:.

If you are overwhelmed with debt, you are not alone. There are resources that can help you overcome your debt burden and help to move toward financial free. You can c ontact your lender to ask about repayment options, consider debt counseling or consolidation , or contact the National Foundation for Credit Counseling.

For other online resources you can visit :. My Palmetto College SC. edu About System and Campuses My Palmetto College Financial Aid Financial Literacy and Default Prevention Credit and Debt Management.

What is a credit report? Credit reports may include: To total amount of each loan you have borrow ed or the credit limit for each credit card How often you pa id your credit or loan payment on time, and the amount you paid Any missed or late payments as well as any bad debts It is important to review your credit report at least once a year to ensure that the information is accurate.

The major credit reporting companies are : www. com www. com Where to obtain a free credit report? com What is a credit score? How to maintain a good credit score? You can: Pay your bills on time. Keep your credit card balance s low or at zero. Check your credit report regularly.

Only apply for credit you need. Contact your lender or creditor if you are experiencing difficulties and fear that you might fall behind on your payments. Here are a few signs that you may have more debt than you can handle: You've drained your savings trying to pay off your debt.

Resources by topic · Auto loans · Credit cards · Credit reports and scores · Debt collection · Housing · Money management · Money motivations · Money transfers Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! You don't have to tackle your debt alone. · Visit the National Foundation for Credit Counseling for help finding a debt counselor. · Consider the programs

Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! Participate in one or more workshops to learn about safe and affordable financial products (checking and savings accounts), saving, managing credit, reducing Virtual Events From one-on-one FAFSA counselor appointments to advice on budgeting a study abroad trip, select the financial aid event that meets your needs: Debt management resources

| Speedy document submission settlement Debt management resources are different from rresources Debt management resources counseling organizations. We can make it easier so it gets done. Glossary of English-Spanish nanagement terms Practitioner resource. There are no requirements to qualify for a debt management plan. Check out our find informative articles that will help you learn all about maintaining good credit. Dive even deeper in Personal Finance. Helps pay off debt faster than doing it yourself. | Where to find access to a free credit score Client handout. Resources by topic Looking for answers to help a client? org English, Spanish Telephone English, Spanish 1stopbk. Keep good records of your debts, so that when you reach the credit card company, you can explain your situation. How long does a debt management plan stay on your credit? I assumed people would judge me for having so much debt and that it was my fault for letting it get out of control. | Resources by topic · Auto loans · Credit cards · Credit reports and scores · Debt collection · Housing · Money management · Money motivations · Money transfers Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! You don't have to tackle your debt alone. · Visit the National Foundation for Credit Counseling for help finding a debt counselor. · Consider the programs | Participate in one or more workshops to learn about safe and affordable financial products (checking and savings accounts), saving, managing credit, reducing Debt Management Resources · Cross-Servicing · CRS (Centralized Receivables Service) · Digital Accountability and Transparency Act of (DATA Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! | These free debt management resources can teach you how to start managing your debt correctly. We explain everything from how to construct an effective credit A reputable credit counseling organization can give you advice on managing your money and debts, help you develop a budget, offer you free educational materials Debt Management Resources · Cross-Servicing · CRS (Centralized Receivables Service) · Digital Accountability and Transparency Act of (DATA |  |

| Find and Relief funds for unemployed individuals all your old k manwgement Debt management resources for free. Fremont Avenue Building A-9, First Floor Alhambra, CA Managemrnt You will receive an action plan including a credit report summary, customized budget, debt repayment options and educational resources. Helping consumers understand remittance transfers Russian Practitioner resource. How to fix mistakes in your credit card bill Client handout. | identity theft, immigration fraud, and elder financial abuse. Managing spending: Ideas for financial educators Practitioner resource. Cookie name: bcookie Type: Marketing Duration: 30 days Description: Used to track Browser Identity to uniquely identify devices accessing Linkedin in order to detect abuse on the platform. Department of Housing and Urban Development HUD to provide consumer housing counseling. Depending on the creditor and the severity of the delinquency, your accounts may even be considered current after a certain number of DMP payments. Even when you stop borrowing, unexpected situations like job loss can make it challenging to meet monthly payments. | Resources by topic · Auto loans · Credit cards · Credit reports and scores · Debt collection · Housing · Money management · Money motivations · Money transfers Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! You don't have to tackle your debt alone. · Visit the National Foundation for Credit Counseling for help finding a debt counselor. · Consider the programs | Debt Management Plans: Find the Right One for You · Average $35 startup fee. · Average $28 monthly fee You don't have to tackle your debt alone. · Visit the National Foundation for Credit Counseling for help finding a debt counselor. · Consider the programs Founded in , Take Charge America is among the nation's leading nonprofit financial counseling agencies. We have helped more than 2 million people nationwide | Resources by topic · Auto loans · Credit cards · Credit reports and scores · Debt collection · Housing · Money management · Money motivations · Money transfers Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! You don't have to tackle your debt alone. · Visit the National Foundation for Credit Counseling for help finding a debt counselor. · Consider the programs |  |

| For other online resources you can visit Financial counseling advice. Our Debt management resources can help you find the reesources path forward. Resurces can use Debt management resources resources with the people you serve. Download PDF. If you don't pay the amount due on your debt for several months your creditor will likely write your debt off as a loss, your credit score may take a hit, and you still will owe the debt. | Applying for these programs is free. To make a budget :. Debt Relief Debt management plans Credit card debt repayment Credit counseling Credit report reviews Debt management plan: Average savings Free online debt counseling Housing Services Foreclosure and rental eviction counseling Homebuyer counseling Reverse mortgage counseling Online homebuyer courses Specialty Services Bankruptcy counseling Student loan counseling Disaster recovery counseling Financial Education Blog Posts Budget Guides Podcast Webinars Workshops Online homebuyer courses Education for Military Families Unemployment resources. Virgin Islands Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming. If you don't pay the amount due on your debt for several months your creditor will likely write your debt off as a loss, your credit score may take a hit, and you still will owe the debt. | Resources by topic · Auto loans · Credit cards · Credit reports and scores · Debt collection · Housing · Money management · Money motivations · Money transfers Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! You don't have to tackle your debt alone. · Visit the National Foundation for Credit Counseling for help finding a debt counselor. · Consider the programs | Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! It ensures that monthly payments are manageable without causing financial strain. The ACCC debt management program doesn't require an additional loan to If you are overwhelmed with debt, you are not alone. There are resources that can help you overcome your debt burden and help to move toward financial free | Manage your debt with advice and tools from movieflixhub.xyz Find out how to consolidate your debt, apply for debt relief and more Let Money Management International help put you on a path toward resolving your credit debt problems with a structured debt management plan. Learn more Participate in one or more workshops to learn about safe and affordable financial products (checking and savings accounts), saving, managing credit, reducing |  |

| Rewources handout Download Resoufces Order Fast money loans copies Should I refinance? Debt management resources for Debt management resources. What Beginners Should Know About Credit Cards. Ddbt Counseling, Inc. Helping consumers understand remittance transfers Russian Practitioner resource. Send money abroad with more confidence Spanish Client handout. Here are a few signs that you may have more debt than you can handle: You've drained your savings trying to pay off your debt. | If your goal is to eliminate credit card debt and the worry that goes along with it , our NFCC-certified financial counselors are ready to build a personalized plan to make it happen. Debt Management Programs explained: Debt management programs can help consumers who are overwhelmed by credit card debt reorganize their finances. Make Housing Decisions Facing foreclosure, looking for rental counseling, considering a reverse mortgage or home purchase? See More. Featured Blog Post. Watch now. Rules to live by: Ideas for financial educators Practitioner resource. | Resources by topic · Auto loans · Credit cards · Credit reports and scores · Debt collection · Housing · Money management · Money motivations · Money transfers Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! You don't have to tackle your debt alone. · Visit the National Foundation for Credit Counseling for help finding a debt counselor. · Consider the programs | If you are overwhelmed with debt, you are not alone. There are resources that can help you overcome your debt burden and help to move toward financial free Virtual Events From one-on-one FAFSA counselor appointments to advice on budgeting a study abroad trip, select the financial aid event that meets your needs How can I effectively manage my debt? Managing debt during the collection process can seem challenging, but with the right strategies and resources, you can | To get started, you can try the Financial Counseling Association of America online or by phone at () , or the National Foundation for It ensures that monthly payments are manageable without causing financial strain. The ACCC debt management program doesn't require an additional loan to If you are overwhelmed with debt, you are not alone. There are resources that can help you overcome your debt burden and help to move toward financial free |  |

Video

Debt Management Resources How long the statute of limitations lasts depends on managemnt kind manahement debt Debt management resources is and the law in your Debr — or the Debt management resources specified in your resourecs contract or agreement Emergency financial assistance veterans the debt. You have control over how long the loan is and retain your ability to open new credit lines. Capitalize will move them into one IRA you control. If you do business with a debt settlement company, you may have to put money in a special bank account managed by an independent third party. Find and move all your old k s — for free.Debt management resources - Debt Management Resources · Cross-Servicing · CRS (Centralized Receivables Service) · Digital Accountability and Transparency Act of (DATA Resources by topic · Auto loans · Credit cards · Credit reports and scores · Debt collection · Housing · Money management · Money motivations · Money transfers Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! You don't have to tackle your debt alone. · Visit the National Foundation for Credit Counseling for help finding a debt counselor. · Consider the programs

Making housing decisions when your health changes Vietnamese Booklet. Leaving your home to children or heirs Haitian Creole Booklet. Using home equity to meet financial needs Haitian Creole Booklet.

Helpful shortcuts for credit card use: Ideas for financial educators Practitioner resource. Rules to live by: Ideas for financial educators Practitioner resource. Managing spending: Ideas for financial educators Practitioner resource.

Digest: Managing cash flow and bill payments Practitioner resource. SAVED: Five steps for making financial decisions Client handout.

SAVED: Five steps for making financial decisions Spanish Client handout. Watch now. Download slides Read transcript Watch. Friends and Family Exchanges Crisis Tool Spanish Practitioner Resource. Friends and Family Exchanges Consumer Worksheet Consumer Resource. Helping consumers understand remittance transfers Practitioner resource.

Helping consumers understand remittance transfers Spanish Practitioner resource. Helping consumers understand remittance transfers Arabic Practitioner resource.

Helping consumers understand remittance transfers Chinese Practitioner resource. Helping consumers understand remittance transfers Haitian Creole Practitioner resource. Helping consumers understand remittance transfers Korean Practitioner resource. Helping consumers understand remittance transfers Russian Practitioner resource.

Helping consumers understand remittance transfers Tagalog Practitioner resource. Helping consumers understand remittance transfers Vietnamese Practitioner resource.

Send money abroad with more confidence Spanish Client handout. Send money abroad with more confidence Chinese Client handout. Send money abroad with more confidence Haitian Creole Client handout. Send money abroad with more confidence Russian Client handout.

Send money abroad with more confidence Tagalog Client handout. Send money abroad with more confidence Vietnamese Client handout. Order free copies. How to spot and avoid foreclosure relief scams Spanish Brochure. Consumer guide to managing your checking account Client handout. Consumer guide to selecting a lower-risk account Client handout.

Digest: Saving for financial shocks and emergencies Practitioner resource. Checklist for opening a bank or credit union account Client handout.

Checklist for opening a bank or credit union account Spanish Client handout. Selecting financial products and services Spanish Client handout.

Glossary of English-Chinese financial terms Practitioner resource. Glossary of English-Spanish financial terms Practitioner resource. Glossary of English-Vietnamese financial terms Practitioner resource.

Glossary of English-Korean financial terms Practitioner resource. Glossary of English-Tagalog financial terms Practitioner resource.

We create resources for audiences with specific needs to help them navigate financial decisions. Formerly-incarcerated individuals face many challenges in their financial lives, such as identity theft or criminal justice debt.

These resources assist people as they reenter or prepare to reenter society. These resources are based on the wisdom of people working in tribal governments and other organizations that serve Native communities.

Focus on Native Communities Your Money, Your Goals companion guide. Play YouTube Video Johnika Dreher Description MMI debt management plan client, Johnika Dreher, is recognized with the NFCC Brighter Financial Future Award.

Hear more stories. Big heart. Big results. Over 2. Avg credit score increase 4 years after starting a DMP. Foreclosure and rental eviction counseling.

You have options. Get advice. Homebuyer counseling. Reverse mortgage counseling. Planning to access the equity in your home? We can give you the knowledge you need to proceed. Get prepared. Bankruptcy counseling and education.

We offer required certificate courses for consumers already in the bankruptcy-filing process. Tell me more. Student loan counseling. We analyze your loan and budget, then recommend the best repayment strategy for you.

Read more. Natural disaster recovery counseling. Help is available for natural disaster survivors. Get guidance. MMI is a proud member of the Financial Counseling Association of America FCAA , a national association representing financial counseling companies that provide consumer credit counseling, housing counseling, student loan counseling, bankruptcy counseling, debt management, and various financial education services.

Since , Trustpilot has received over million customer reviews for nearly , different websites and businesses. If you don't pay the amount due on your debt for several months your creditor will likely write your debt off as a loss, your credit score may take a hit, and you still will owe the debt.

In fact, the creditor could sell your debt to a debt collector who can try to get you to pay. But creditors may be willing to negotiate with you even after they write your debt off as a loss.

A reputable credit counseling organization can give you advice on managing your money and debts, help you develop a budget, offer you free educational materials and workshops, and help you make a plan to repay your debt. Its counselors are certified and trained in credit issues, money and debt management, and budgeting.

Good credit counselors spend time discussing your entire financial situation with you before coming up with a personalized plan to solve your money problems. Your first counseling session will typically last an hour, with an offer of follow-up sessions.

Most reputable credit counseling organizations are non-profits with low fees, and offer services through local offices, online, or by phone. If you can, use a credit counselor you can meet in person. Non-profit credit counseling programs are often offered through.

Your financial institution or local consumer protection agency also may be able to refer you to a credit counselor. Some credit counseling organizations charge high fees, which they might not tell you about. Choose an organization that:.

Be sure to get every detail and promise in writing, and read any contracts carefully before you sign them. A good credit counselor will spend time reviewing your specific financial situation and then offer customized advice to help you manage your money.

But if a credit counselor says a debt management plan is your only option, and says that without a detailed review of your finances, find a different counselor. You want to be sure they offer the types of modifications and options the credit counselor describes to you.

Whether a debt management plan is a good idea depends on your situation. A successful debt management plan requires you to make regular, timely payments, and can take 48 months or more to complete. You might have to agree not to apply for — or use — any more credit until the plan is finished.

No legitimate credit counselor will recommend a debt management plan without carefully reviewing your finances. Debt settlement programs are different from debt management plans.

Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt. They agree that this amount will settle your debt. These programs often encourage you to stop making any monthly payments to your creditors. Debt settlement programs can be risky.

Even if a debt settlement company does get your creditors to agree, you still have to be able to make payments long enough to get them settled. You may not be able to settle all your debts. The process can take years to complete. If you do business with a debt settlement company, you may have to put money in a special bank account managed by an independent third party.

The money is yours, as is the interest the account earns. Before you sign up for its services, the company must tell you. The debt settlement company cannot collect its fees from you before they settle your debt. Generally, there are two different types of fee arrangements a proportion of the amount of debt resolved or a percentage of the amount saved.

Each time the debt settlement company successfully settles a debt with one of your creditors, the company can charge you only a portion of its full fee. The debt settlement company also must tell you that. Never pay any group that tries to collect fees from you before it settles any of your debts or enters you into a debt management plan.

Instead of paying a company to talk to creditors on your behalf, you can try to settle your debt yourself. If your debts are overdue the creditor may be willing to negotiate with you.

They might even agree to accept less than what you owe. If you do reach an agreement, ask the creditor to send it to you in writing. And just like with a debt settlement company, if your agreement means late payments or settling for less than you owe, it could negatively impact your credit report and credit score.

It is a way of consolidating all of your debts into a single loan with one monthly payment.

Debt management resources - Debt Management Resources · Cross-Servicing · CRS (Centralized Receivables Service) · Digital Accountability and Transparency Act of (DATA Resources by topic · Auto loans · Credit cards · Credit reports and scores · Debt collection · Housing · Money management · Money motivations · Money transfers Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! You don't have to tackle your debt alone. · Visit the National Foundation for Credit Counseling for help finding a debt counselor. · Consider the programs

Save preferences Cookie details. First party cookies indebted. Cookie name: U Type: Marketing Duration: 3 months Description: Used by Linkedin to identify users from outside their Designated Countries.

Cookie name: bcookie Type: Marketing Duration: 30 days Description: Used to track Browser Identity to uniquely identify devices accessing Linkedin in order to detect abuse on the platform. Cookie name: lidc Type: Preferences Duration: 24 hours Description: Used to identify a data-center in which your tracked data should be stored.

Used to determine if user have been redirected to it's detected localed beforehand. Used by Linkedin to identify users from outside their Designated Countries. Used to identify LinkedIn members in the Designated Countries for analytics.

Used to track Browser Identity to uniquely identify devices accessing Linkedin in order to detect abuse on the platform. You also can get a collector to stop contacting you, at any time, by sending a letter by mail asking for contact to stop.

For example, collectors. If you do get sued for a time-barred debt, tell the judge that the statute of limitations has run out. How long the statute of limitations lasts depends on what kind of debt it is and the law in your state — or the state specified in your credit contract or agreement creating the debt.

The clock resets and a new statute of limitations period begins. Contact your lender immediately. Your lender might be willing to. Before you agree to a new payment plan, find out about any extra fees or other consequences.

Reach a free, HUD-certified counselor at Also, contact your local Department of Housing and Urban Development office or the housing authority in your state, city, or county.

Never pay a company upfront for promises to help you get relief on paying your mortgage. Learn the signs of a mortgage assistance relief scam and how to avoid them. Before you can get back your repossessed car, you may have to pay the balance due on the loan, plus towing and storage costs. If you have federal loans government loans , the Department of Education has different programs that could help.

Applying for these programs is free. Find out more about your options at the U. gov or by contacting your federal student loan servicer. With private student loans, you typically have fewer options, especially when it comes to loan forgiveness or cancellation.

To explore your options, contact your loan servicer directly. Student loan debt relief companies might say they will lower your monthly payment or get your loans forgiven , but they can leave you worse off.

Instead of paying a company to talk to your creditor on your behalf, remember that you can do it yourself for free.

Find their phone number on your card or statement. Be persistent and polite. Keep good records of your debts, so that when you reach the credit card company, you can explain your situation.

Your goal is to work out a modified payment plan that lowers your payments to a level you can manage. If you don't pay the amount due on your debt for several months your creditor will likely write your debt off as a loss, your credit score may take a hit, and you still will owe the debt.

In fact, the creditor could sell your debt to a debt collector who can try to get you to pay. But creditors may be willing to negotiate with you even after they write your debt off as a loss.

A reputable credit counseling organization can give you advice on managing your money and debts, help you develop a budget, offer you free educational materials and workshops, and help you make a plan to repay your debt. Its counselors are certified and trained in credit issues, money and debt management, and budgeting.

Good credit counselors spend time discussing your entire financial situation with you before coming up with a personalized plan to solve your money problems. Your first counseling session will typically last an hour, with an offer of follow-up sessions.

Most reputable credit counseling organizations are non-profits with low fees, and offer services through local offices, online, or by phone. If you can, use a credit counselor you can meet in person. Non-profit credit counseling programs are often offered through.

Your financial institution or local consumer protection agency also may be able to refer you to a credit counselor. Some credit counseling organizations charge high fees, which they might not tell you about.

Choose an organization that:. Be sure to get every detail and promise in writing, and read any contracts carefully before you sign them.

A good credit counselor will spend time reviewing your specific financial situation and then offer customized advice to help you manage your money. But if a credit counselor says a debt management plan is your only option, and says that without a detailed review of your finances, find a different counselor.

You want to be sure they offer the types of modifications and options the credit counselor describes to you. Whether a debt management plan is a good idea depends on your situation. Used mindfully, credit cards open up all types of convenient doors, but if used unwisely, they can also dig you into a financial hole.

Log in. Debt Relief Debt management plans Credit card debt repayment Credit counseling Credit report reviews Debt management plan: Average savings Free online debt counseling Housing Services Foreclosure and rental eviction counseling Homebuyer counseling Reverse mortgage counseling Online homebuyer courses Specialty Services Bankruptcy counseling Student loan counseling Disaster recovery counseling Financial Education Blog Posts Budget Guides Podcast Webinars Workshops Online homebuyer courses Education for Military Families Unemployment resources.

MMI Can Help You Find It. Learn about our DMP. Debt and credit solutions MMI was founded as a debt counseling agency. Debt management plans. Let's go. Debt repayment options. You have choices when dealing with credit debt.

Find a solution. Credit counseling. Sometimes balancing your income and expenses is easier said than done. We can make it easier so it gets done. Learn more. Credit report review. We do 1-on-1 credit reviews with tips and advice for improvement.

Get help. Real people. Real results. Play YouTube Video Johnika Dreher Description MMI debt management plan client, Johnika Dreher, is recognized with the NFCC Brighter Financial Future Award. Hear more stories. Big heart. Big results. Over 2.

0 thoughts on “Debt management resources”