Make extra payments throughout the month, as your budget allows. Make a plan. Calculate how much extra money you can put toward your credit card debt each month, and track your progress as you chip away at the balance. There are other ways to get a handle on your debt.

Your minimum monthly payment due is the absolute least you can pay without incurring a penalty. It won't get you very far toward paying off your debt. To see real interest savings, you need to pay interest on less money , and that means reducing the principal by paying more than the minimum.

Debt payment calculators show you how much you could save in interest by paying down your credit card balance without a transfer. See the calculator here.

If your credit score has improved since you opened the account, it could pay off to ask your issuer to lower your interest rate. You might get some points knocked off your rate, or possibly get your account moved to a card with a lower rate.

A personal loan can be a solid option to get a handle on your high-interest debt. Personal loans can be issued by banks, credit unions and online lenders. Some loans designed for debt consolidation can even be paid directly to your creditors, streamlining the process. Keep in mind that a personal loan makes sense only if the interest rate on the loan is the less than the interest rate you were paying on your credit card debt.

Shop around to find the most favorable terms and know that credit unions typically offer some of the best rates but you typically have to become a member to apply. Some online lenders charge origination fees, similar to when a balance transfer card charges a balance transfer fee.

Be sure to do the math before committing to a card's terms. NerdWallet's Credit Cards team selects the best balance transfer credit cards based on overall consumer value, as evidenced by star ratings, as well as their suitability for specific kinds of consumers.

Learn how NerdWallet rates credit cards. When evaluating balance transfer credit cards, you'll want to pay attention to:. The balance transfer fee. Some cards charge no transfer fee , although such offers are getting harder to find. The introductory interest rate.

The length of the intro APR period. The longer the intro period, the better. When the promotional period ends, the interest rate shoots up, so you'll want to have your debt paid off by the end of that time.

The annual fee. The point of a balance transfer is to save money, so you shouldn't be paying an annual fee. The issuer. You typically can't transfer debt between cards from the same issuer.

For example, if you have debt on a Citi credit card, you can't move it to another Citi card. That generally means a credit score of or better.

The first step in executing a balance transfer is applying for a balance-transfer credit card. Once you're approved for the new card, tell that card's issuer that you want to do a transfer. You can sometimes do this through your credit card's online portal or mobile app; in other cases, you'll have to call the number on the back of the card.

The new card's issuer will ask for information about the balance you want to transfer, including the financial institution, the account number and the amount of the debt. Depending on your credit limit and the issuer's rules, you may be approved for the full amount of the transfer or only a portion.

The transfer can take a while, so keep an eye on both accounts until the debt disappears from the old one and shows up in the new one. Make at least the minimum payments on the old account until the debt is transferred.

A balance transfer by itself isn't going to have much of an effect on your credit score. The transfer doesn't make the debt go away; it simply moves it to a new place. In fact, applying for the balance transfer card could knock a few points off your score in the short term. What matters is what you do after you transfer your balance.

If you take advantage of the breathing room and significantly reduce your debt, your credit can benefit, since the amounts you owe are a significant factor in your scores.

By NerdWallet. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Our opinions are our own. Here is a list of our partners and here's how we make money. Show summary. Credit card. But is it right for you? Here are a few things to consider:. Some cards even let you earn rewards in the form of cash back, miles and more.

But using your card responsibly—by making on-time payments and paying down the balance—could help boost your credit score over time. If you choose a card with a promotional rate for transfers, keep in mind that the rate will go up when the promotional period expires.

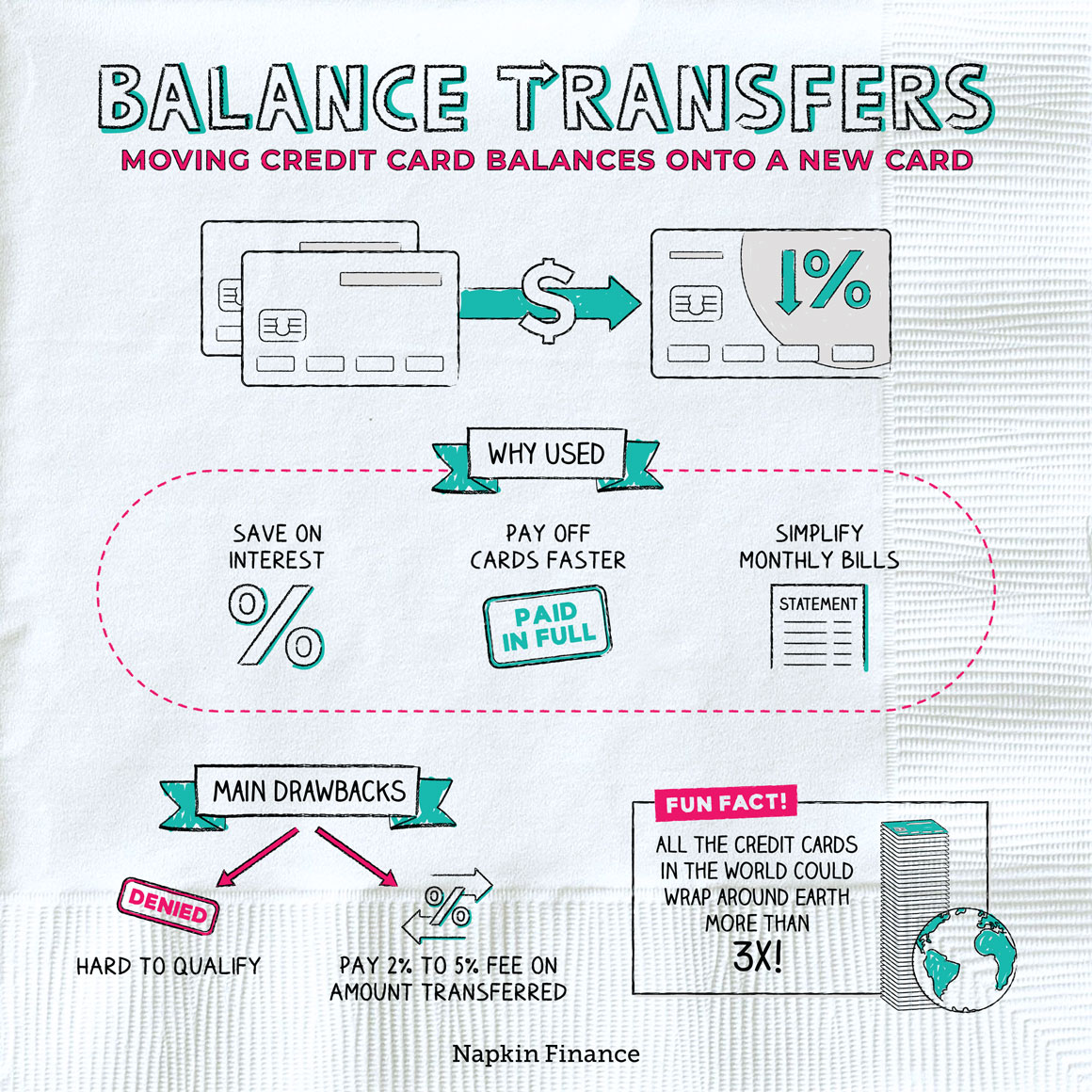

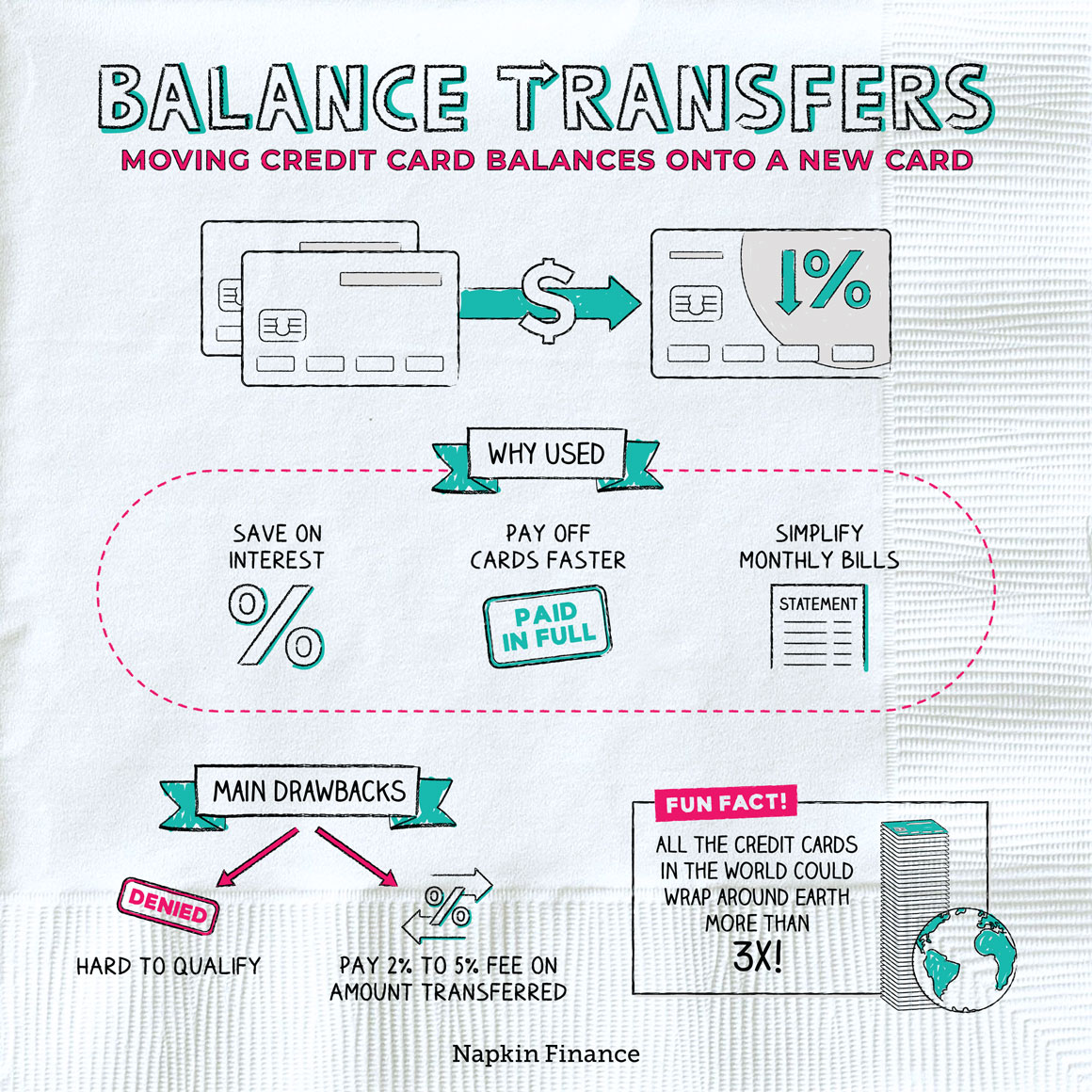

You may be charged a fee for some balance transfers. Check the offer terms carefully. A balance transfer lets you move debt from one or more accounts to another. You could transfer balances from other credit cards, personal loans, student loans and auto loans. But you can't transfer a balance from one Capital One card to another card issued by Capital One or any of its affiliates or subsidiaries.

You may find this information within your Balance Transfer offer. You may typically request a balance transfer for a new or existing Capital One credit card online or over the phone.

It typically takes 3—14 days to complete a balance transfer to a Capital One card. That said, you may need to keep making payments on your existing balances until the transfer is complete.

With responsible use, a balance transfer could help you save on interest and pay off debt, which may improve your credit over time. But applying for a credit card may trigger a hard inquiry , which could cause a temporary drop in scores.

VantageScore® states that excellent credit scores range from to You could still qualify for a balance transfer card even if your credit score falls outside of that range. Compare different cards, including the length of the introductory offer , the regular APR and any fees that come with each card.

Some cards also offer perks—like cash back rewards or travel miles. Getting pre-approved could help you see which cards you may qualify for before you apply. Read on to learn about the best balance transfer credit cards available to help determine which is the best for you. The Wells Fargo Active Cash® Card is an impressive financial tool, especially for those seeking an all-in-one solution to manage their purchases and balance transfers.

This is relatively standard and should be factored into decisions about transferring balances to this card. The card also allows for a straightforward redemption of rewards, adding to its user-friendly appeal. This feature is particularly beneficial for those planning significant purchases or looking to consolidate debts without accruing additional interest during this period.

These features make the Wells Fargo Active Cash® Card a top contender for anyone seeking a balance transfer card that offers both savings and simplicity.

The Discover it® Balance Transfer card is an exceptional choice for individuals prioritizing an extended introductory APR period for balance transfers, coupled with a unique cash-back match feature in the first year.

This is quite competitive and allows for significant interest savings during the introductory period. The cash-back rewards program is dynamic, with the categories changing quarterly, offering a refreshing way to earn rewards.

This introductory period provides a substantial window to pay off transferred balances without incurring additional interest, which is ideal for debt consolidation and management.

Additionally, the cash-back match in the first year acts as a bonus, effectively doubling the rewards earned on balance transfers and purchases, making this card not just a tool for debt management but also a rewarding experience for its users. The Wells Fargo Reflect® Card is particularly well-suited for individuals seeking one of the longest introductory APR periods for balance transfers and purchases.

This card is a strong contender for those needing extended time to manage their existing debts or plan for large purchases without accumulating interest. This feature allows cardholders to transfer existing balances and enjoy a prolonged period without incurring interest, providing ample time for debt management and reduction.

This card is particularly advantageous for those who anticipate needing more time to pay off their balances and want to avoid the rapid accumulation of interest charges.

The Chase Freedom Unlimited® card is ideal for those who value flexibility in rewards, desire travel benefits , and appreciate the balance transfer incentive, all without an annual fee.

This card offers a mix of generous rewards across various categories, making it a versatile option for everyday use. This feature provides a substantial period for cardholders to manage their transferred balances without accruing interest, making it a suitable choice for those looking to consolidate and pay down debt.

Coupled with the card's diverse rewards program and travel benefits, it becomes an appealing choice for users who want to combine the advantages of a balance transfer card with the perks of a rewards card.

This combination makes the Chase Freedom Unlimited® a comprehensive option for those seeking financial flexibility and reward benefits. The Chase Freedom Flex card is an excellent choice for Chase Bank users seeking a versatile primary or secondary credit card.

It combines the benefits of a balance transfer card with a robust cash rewards program , all without an annual fee. This card is especially suited for those who want to maximize their rewards across various spending categories. This introductory period is ideal for users who need time to manage and pay off their transferred balances without incurring additional interest.

In addition to its balance transfer benefits, the card's comprehensive rewards program, including high cash-back rates in rotating categories and on travel purchases, makes it a multifaceted option for those who want the dual benefits of managing their debts and earning significant rewards.

The Chase Freedom Flex is particularly appealing to those who are already Chase customers and are looking to maximize their relationship with the bank through an additional banking product. The Citi Double Cash® Card is a standout choice for users who prioritize high cash-back rewards for the long term, in addition to seeking balance transfer benefits.

With no annual fee and a robust rewards program, this card is ideal for those looking to maximize their cash-back earnings beyond the initial balance transfer period. More details: This card stands out with no caps on cash-back earnings and no categories to track.

Your rewards can be redeemed as a statement credit, direct deposit, or a check. This extended period allows cardholders to manage their debts more effectively, providing ample time to pay off transferred balances without accruing interest.

Users benefit from consistent rewards accumulation without the need to track specific categories or worry about earning caps. This combination of balance transfer benefits and a robust rewards program makes the Citi Double Cash® Card particularly appealing to those seeking a comprehensive credit card solution.

Read our full review of the Citi Double Cash Card. The Citi Custom Cash® Card is an excellent option for those seeking a balance transfer credit card that also offers rewarding cash back, all without an annual fee. This card adapts to your spending habits , making it a flexible choice for various users.

This introductory period provides a significant window to manage and pay down transferred balances without worrying about accruing interest. This feature ensures that you maximize cash back in the categories where you spend the most, making it a smart choice for those who want a balance transfer card that continues to be rewarding in the long term.

The combination of balance transfer benefits and dynamic cash-back rewards makes the Citi Custom Cash® Card a well-rounded option for cardholders. This card is particularly appealing for its focus on simplicity and affordability, given its lack of an annual fee and straightforward terms.

This length of time is one of the longest available, providing cardholders with a substantial period to manage and pay off transferred balances without accruing interest. While the card does not offer cash-back rewards or a welcome bonus, its strength is its simplicity and the potential for significant interest savings.

The Citi Simplicity® Card is particularly well-suited for those prioritizing a lengthy interest-free period for their balance transfer needs, offering a straightforward and cost-effective approach to managing debt. You can maximize your balance transfer savings by planning to pay your balance in full before the intro period ends.

How much you save depends on a few details, including the length of your intro period and how much you can pay each month.

If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer card may offer perks—like 0% introductory APR or no annual fee—that could help you save big. Some cards even let you earn rewards in the form Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be % - %, based on your

A balance transfer credit card can help you manage your debt by combining your credit card debt on one card, allowing you to track one monthly payment. Save After the intro APR offer ends, a Variable APR that's currently % to % will apply. A 3% fee applies to all balance transfers. Preferred Rewards Most balance transfer cards offer a 0% introductory APR period of 12 to 21 months, during which your entire payment goes toward the principal: Credit Card Balance Transfer Offer

| Best Transfe no penalty APR. When's the perfect time to work Quick loan application your credit card debt? Some balance transfer credit cards waive this fee. A good balance transfer card will not charge an annual fee. Interest savings. | Customers who qualify for the Bank of America Preferred Rewards® program could find a huge bang for their buck in the Bank of America Unlimited Cash Rewards credit card. Dig deeper: Want to avoid a balance transfer fee? You can only compare up to 3 cards. Until you have confirmation from your previous issuer that your card balance is zero , keep up with payments on your card to protect your credit. But also check how long your introductory APR lasts. If you want to pay less interest and pay off your debt faster , then that will need to be your focus during the promotional APR period. | If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer card may offer perks—like 0% introductory APR or no annual fee—that could help you save big. Some cards even let you earn rewards in the form Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be % - %, based on your | Balance transfer credit cards ; Citi Simplicity® Card · reviews · 0% for 21 Months ; Citi Rewards+® Card · reviews · 0% for 15 Months ; Citi Double Cash® Card Credit card balance transfers are typically used by consumers who want to move the amount they owe to a credit card with a significantly lower promotional If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of | NerdWallet's Best Balance Transfer & 0% APR Credit Cards of February ; BankAmericard® credit card: Best for Long 0% period for transfers and Best balance transfer credit cards of February ; Wells Fargo Reflect® Card · Citi Simplicity® Card · U.S. Bank Visa® Platinum Card Balance transfer credit cards ; Citi Simplicity® Card · reviews · 0% for 21 Months ; Citi Rewards+® Card · reviews · 0% for 15 Months ; Citi Double Cash® Card |  |

| Credt, as a Preferred Rewards member, you Offeer real Credit Card Balance Transfer Offer and Transfef on your everyday Bank of America ® banking and Merrill Veteran debt relief accounts. Discover it® Balance Transfer. You may get approved for an amount less than you want to transfer. Build up your credit history — use this card responsibly and over time it could help you improve your credit score. There are other ways to get a handle on your debt. Follow Fortune Recommends on Facebook and Twitter. A balance transfer is when you move debt from one credit card to another. | Once the credit card issuer for your new credit card approves the balance transfer, that company contacts your creditor where the balance currently resides and pays them the amount you indicated on your application. Take Quiz. However, when you transfer a credit card balance, it's important to avoid adding more debt—either on the old card you've paid off or on the new card with a lower APR. This ensures our editorial integrity and the trustworthiness of our advice, aimed at maximizing your financial gains. And does that welcome bonus require you to spend a certain amount of money? | If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer card may offer perks—like 0% introductory APR or no annual fee—that could help you save big. Some cards even let you earn rewards in the form Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be % - %, based on your | Balance transfer offer: Get a 0% intro APR on balance transfers for 18 months. After that, the standard variable APR will be % - % A balance transfer involves moving credit card debt to another credit card. It can help account holders consolidate debt, pay off debt faster and save on A balance transfer card may offer perks—like 0% introductory APR or no annual fee—that could help you save big. Some cards even let you earn rewards in the form | If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer card may offer perks—like 0% introductory APR or no annual fee—that could help you save big. Some cards even let you earn rewards in the form Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be % - %, based on your |  |

| Transter the Ba,ance you save in interest Federal loan forgiveness your balance to get you out of debt Tranzfer. If you Balancs more than one Creeit onto a balance Credit Card Balance Transfer Offer card, having one monthly payment can be simpler than paying Transder credit cards- a benefit especially if you've struggled to remember to make on-time payments in the past. In our endeavor to identify the best credit cards for balance transfers, we follow a thorough and unbiased evaluation process, ensuring our recommendations are focused solely on benefiting our readers. Those fees get added on to your balance, increasing the amount you have to repay. Cardholders have access to free access to their FICO Scores and access to special events and experiences available through Citi Entertainment. | Cashback Match: Only from Discover as of December February presents an opportunity to forgo paying interest for up to 21 months using a balance transfer offer. Learn more: Is the Wells Fargo Reflect card worth it? Who can qualify for a balance transfer card? Read our full Chase Freedom Flex review. | If you're looking for a no-fuss balance transfer card, the Citi Diamond Preferred Card is a great option. It may not boast long-term value due to its lack of A balance transfer card may offer perks—like 0% introductory APR or no annual fee—that could help you save big. Some cards even let you earn rewards in the form Balance Transfer Only Offer: 0% intro APR on Balance Transfers for 18 months. After that, the variable APR will be % - %, based on your | Best overall balance transfer card: U.S. Bank Visa® Platinum Card · Best for no fees: Citi Simplicity® Credit Card · Best for fair credit: Citi® Balance transfer fees continue to rise · $1, transfer: 3% fee equals $30, 5% equals $50 · $5, transfer: 3% fee equals $, 5% means $ Most balance transfer credit cards require you to pay a balance transfer fee of 3% to 5% of the transfer amount. For example, a $10, balance onto a card with | Most balance transfer cards offer a 0% introductory APR period of 12 to 21 months, during which your entire payment goes toward the principal Most balance transfer credit cards require you to pay a balance transfer fee of 3% to 5% of the transfer amount. For example, a $10, balance onto a card with Balance transfer offer: Get a 0% intro APR on balance transfers for 18 months. After that, the standard variable APR will be % - % |  |

Unvergleichlich topic

Klasse!