If approved, not all applicants will qualify for larger loan amounts or most favorable loan terms. Larger loan amounts require a first lien on a motor vehicle no more than ten years old, that meets our value requirements, titled in your name with valid insurance.

APRs are generally higher on loans not secured by a vehicle. OneMain charges origination fees where allowed by law. Depending on the state where you open your loan, the origination fee may be either a flat amount or a percentage of your loan amount.

Visit omf. Loan proceeds cannot be used for postsecondary educational expenses as defined by the CFPB's Regulation Z such as college, university or vocational expense; for any business or commercial purpose; to purchase cryptocurrency assets, securities, derivatives or other speculative investments; or for gambling or illegal purposes.

Loans to purchase a motor vehicle or powersports equipment from select Maine, Mississippi, and North Carolina dealerships are not subject to these maximum loan sizes. Time to Fund Loans: Funding within one hour after closing through SpeedFunds must be disbursed to a bank-issued debit card.

Disbursement by check or ACH may take up to business days after loan closing. According to OneMain Financial , it generally takes less than 10 minutes to complete your loan application and receive your decision but that may, of course, vary depending on how many documents you'll need to provide.

Once you sign the loan agreement, you'll receive your funds as early as the next day. Prosper allows co-borrowers to submit a joint personal loan application, with the possibility of next-day funding. Citi allows existing deposit account holders to receive their personal funds as quickly as the same business day.

Borrowers who don't have a Citi deposit account can receive their funds in up to two business days. LightStream offers low-interest loans with flexible terms for people with good credit or higher.

This lender provides personal loans for just about every purpose except for higher education and small businesses. Another pro to using this lender is that LightStream doesn't charge any origination, administration or early payoff fees. Plus, SoFi personal loans do not require origination fees.

SoFi offers a 0. There's also some more flexibility when it comes to choosing the type of interest rate you receive. Loan applicants can choose between variable and fixed APR.

Fixed APRs give you one rate that you pay for the entirety of your loan, and variable interest rates fluctuate, but SoFi caps them at Must reside in a state where SoFi is authorized to lend and must be employed, have sufficient income from other sources, or have an offer of employment to start within the next 90 days.

PenFed is a federal credit union that provides many personal loan options for debt consolidation, home improvement, medical expenses, auto financing and more. While it's not required to be a PenFed member to apply, a membership will be created for you if you decide to accept the loan.

Avant stands out for considering applicants with credit scores under , but keep in mind that the higher your credit score, the more likely you are to receive the lowest rates. Before you decide to apply for this loan, you can see if you pre-qualify for a rate that's on the lower end of the APR range.

While there are no penalties for early payoff, there is an origination fee of up to 4. OneMain Financial offers personal loan options that are a little more flexible compared to other lenders.

Repayment terms run between 24 months and 60 months and OneMain Financial also allows borrowers the option to secure the loan with collateral to potentially receive an interest rate on the lower end of the lender's range.

Plus, borrowers can choose the date their monthly payments are due and have the option to apply with a co-applicant. Prosper allows co-borrowers to submit a joint personal loan application, which can be beneficial if the primary borrower has a limited credit history or has a lower credit score.

The co-borrower on a personal loan application shares the liability for repaying the loan with the primary borrower which is why lenders may see a borrower as less risky if they have another person applying alongside them.

Citi is a household name in the banking and lending space. In addition to having in-person branches nationwide, this lender also offers ways for customers to use its services online.

Citi stands out as a personal loan lender because it doesn't charge origination fees, early payoff fees or late fees. This lender also offers a 0. See if you're pre-approved for a personal loan offer. A personal loan is a type of installment credit that allows borrowers to receive a one-time lump sum of cash.

Borrowers must then pay back that amount plus interest in regular, monthly installments over the loan's term. When applying for a personal loan, you'll need to provide some basic pieces of information, which can include your address, social security number and date of birth, among others.

You may also be required to submit pay stubs as proof of income. Some lenders may also require your bank account information. An application can typically be submitted online or in person if the lender has physical branches that you can visit.

Some lenders offer personal loans that cater to borrowers with lower credit scores, and may allow borrowers with bad credit to apply with co-borrowers. It's always advised to try to improve your credit score before applying for any form of credit since it can be difficult to qualify with lower credit scores.

Additionally, lower credit scores tend to be subject to higher interest rates. An unsecured loan is a form of credit that doesn't require you to put up collateral that can be used to settle your balance if you default on the loan. Most personal loans are unsecured loans. When you need money in a pinch, many personal loan lenders can get you funded as soon as the same business day.

Make sure your application is complete and free from inaccuracies to ensure the process goes smoothly. Any mistakes on your application could delay getting your funds.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every personal loan review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of loan products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

See our methodology for more information on how we choose the best same day personal loans. To determine which personal loans are the best, CNBC Select analyzed dozens of U.

personal loans offered by both online and brick-and-mortar banks, including large credit unions, that come with no origination or signup fees, fixed-rate APRs and flexible loan amounts and terms to suit an array of financing needs.

When narrowing down and ranking the best personal loans for fair or good credit, we focused on the following features:. After reviewing the above features, we sorted our recommendations by best for overall financing needs, quick funding, lower interest rates and flexible terms.

Note that the rates and fee structures advertised for personal loans are subject to fluctuate per the Fed rate. However, once you accept your loan agreement, a fixed-rate APR will guarantee interest rate and monthly payment will remain consistent throughout the entire term of the loan. Your APR, monthly payment and loan amount depend on your credit history and creditworthiness.

To take out a loan, lenders will conduct a hard credit inquiry and request a full application, which could require proof of income, identity verification, proof of address and more. Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Excellent credit is required to qualify for lowest rates. Rate is quoted with AutoPay discount. AutoPay discount is only available prior to loan funding. Subject to credit approval. Conditions and limitations apply. Advertised rates and terms are subject to change without notice.

Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief.

UFB Secure Savings. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links. Add collateral: Some lenders offer secured personal loans and consider the item used as collateral usually a bank account or vehicle when assessing an application.

Adding collateral can improve your chances of qualifying, but the lender can take the collateral if you miss too many payments. Add up income streams: Your monthly income is another important factor on an application. Most lenders want to see that you have enough to cover regular expenses, make the new loan payment and have a little leftover.

Many lenders consider things like Social Security, alimony or child support as part of your income. Online lenders usually let you check your rate before applying and offer a fast application process. But predatory lenders will try to exploit your emergency. Many banks prefer borrowers with good or excellent credit scores or higher , but there are some exceptions.

Some large banks, like Wells Fargo , U. Bank and Bank of America offer small loans that can cover emergencies. You must be an existing customer to get this type of loan, but the fees are much lower than what payday lenders charge.

Credit union members may have the most affordable emergency loan option. Some credit unions offer payday alternative loans , which are small-dollar loans with low rates that are repaid over six months to a year.

Examples of emergencies you can pay for with a personal loan include:. Medical or dental bills. Home repairs. Car repairs. Bills after a loss of income. Unexpected travel expenses. These emergency loans can be fast and easy to get, but they could do long-term financial damage.

Some no-credit-check installment loans share similarities with payday and auto title loans. Repayment terms on these loans may be longer than you need or a lender may encourage you to refinance the loan multiple times, resulting in exorbitant interest costs over the lifetime of the loan.

Pawn loans require you to hand over a valuable item to a pawnshop as collateral for a small loan. You have to repay the loan, with interest, or the pawnshop will keep your item. If repayment takes too big a bite out of your bank account, you could end up borrowing from the pawnshop again.

With car title loans , a lender assesses the value of your vehicle and lends you a percentage of that amount. If you accept, the lender holds the car title and you receive your loan. Payday loans are high-cost, short-term loans that are risky — even in an emergency.

Cheaper alternatives to borrowing aren't always fast or convenient, and sometimes they require asking for help. But NerdWallet strongly recommends exhausting alternatives first, even in an emergency. Here are some possible alternatives to an emergency loan.

Best for: Help meeting basic needs. Community organizations such as charities, food banks and free loan associations can help you with home weatherization, free food, transportation to job interviews and other basic necessities.

NerdWallet has a database of financial assistance programs in each state. Best for: A no-credit-check loan with low- or no-interest for any purpose. Though it may be uncomfortable to ask, borrowing from someone you trust may be the most affordable and safest option.

A loan from a friend or family member will probably not require a credit check. You can draw up a loan agreement that includes when and how the money will be repaid as well as any interest the lender chooses to charge. Best for: Paying off medical debt at a low cost. When you get a high medical bill, start with your free options: Set up a payment plan with your provider and negotiate the costs on your own.

If you still need help, you can research low-cost medical credit cards or find a reputable medical bill advocate to negotiate on your behalf. If you need money for a one-time emergency like a car repair or vet bill, try asking your employer for an advance on part or all of your paycheck.

You can also use a cash advance app like EarnIn or Dave, which often have low mandatory fees. These options effectively let you access your own money early, rather than providing additional cash that you repay over time, so be sure you can meet all your other monthly financial obligations with a rearranged pay schedule.

Best for: A large purchase that you want to repay over time. This option is offered at most major retailers. We collect over 50 data points from each lender and cross-check company websites, earnings reports and other public documents to confirm product details.

NerdWallet writers and editors conduct a full fact check and update annually, but also make updates throughout the year as necessary.

Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education.

We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. NerdWallet does not receive compensation for our star ratings.

Read more about our ratings methodologies for personal loans and our editorial guidelines. You can use an emergency loan to pay for unexpected expenses if you don't have savings or don't want to max out a credit card.

In a true emergency, they're a fast and convenient source of funding for borrowers who qualify. It may be possible for borrowers with low income to qualify for a loan since some lenders care more that you have steady income versus a specific amount.

Learn what it takes to get a loan with low income. You can get an emergency loan through a bank, online lender or credit union. Online lenders can fund loans quickly — sometimes the same or next day after you're approved — and many let you check your rate before you apply.

It usually takes a few minutes to apply for a loan if you have all the required documents ready. It's best to compare emergency loans with alternatives to find the cheapest way to borrow money. Need a personal loan?

Upstart makes it easier Upstart personal loans offer fast funding and may be an option for borrowers with low credit scores or thin credit histories. CHECK RATES on Upstart's website.

They have the innovated models that help me get the best offer that I could not see from other places. Wenya Wen. The loan application was easy to complete.

Every customer service rep I spoke to probably 4 or 5 different people were kind, knowledgeable, and respectful. The process proceeded quickly and without incident. The process was fast, straightforward, and simple.

The information provided was ample and allowed me to make an informed decision with confidence. Fast service and approval and great service.

No hassles and quick deposit of funds. I would highly recommend Upstart if you can afford the interest rate and the monthly payments. Discover more lenders. Discover more lenders Explore a wider selection of lenders and find the perfect match for your financial situation.

Show Me All. Lenders catering to diverse financial needs. For unique credit situation and loan needs. Popular lender pick. Top 3 most visited 🏆.

on LightStream's website. Check Rate. on NerdWallet. View details. Rate discount. Fast funding. Flexible payments. Secured loans. Wide range of loan amounts. on Avant's website. emergency best overall debt consolidation bad credit joint loans home improvement bank loans good to excellent credit fair credit secured personal loans credit card consolidation.

Our pick for Secured emergency loans. NerdWallet rating. APR credit score None. Our pick for Emergency loans with credit-building tools. credit score Our pick for Emergency loans for thin and fair credit. APR 6. Our pick for Emergency loans with flexible payments. APR 7. Our pick for Emergency loans for good credit.

APR 8. Our pick for Emergency loans for excellent credit.

Little-Loans can give you an instant decision on loans from £ to £ We find a loan every 60 seconds and your cash could be sent to your bank in MoneyGeek reviewed the best personal loans for instant approval to help you find emergency loans at the best rates Getting same day loans and borrowing money instantly at Minute Loan Center is fast and stress free, whether you apply online² or in store. h. Fast Application

Video

💸 $50,000 Personal Loan - 300 Credit Score Approved ✅💥 Soft Pull Pre approval Bad Credit OK LoansThe easiest loans to get approved for are payday loans, pawnshop loans, car title loans, and personal loans with no credit check. These types of You could get an instant approval decision, but it often takes a day or two. Tips to get an emergency loan with bad credit. A bad credit score (below ) doesn LoanNow offers quick installment loans. It's the fastest and easiest way to borrow, and you could even build your credit history as you repay: Instant Loan Decisions

| How Instany I borrow emergency money? Together, we grow your LoanNow score to unlock better rates. To Instant Loan Decisions out a loan, lenders Prepayment penalties conduct a hard credit inquiry and request a Inetant application, which Instant Loan Decisions Lozn proof of Devisions, identity verification, proof of address and more. You can also use a cash advance app like EarnIn or Dave, which often have low mandatory fees. Rates, repayment terms and agreements vary by individual and the state in which apply. As your trusted direct lender, Loan Ridge specializes in making the loan application process as easy as it can be. According to OneMain Financialit generally takes less than 10 minutes to complete your loan application and receive your decision but that may, of course, vary depending on how many documents you'll need to provide. | Get my personalised quote We craft our loan offerings around you as a person, not a credit score. However, once you accept your loan agreement, a fixed-rate APR will guarantee interest rate and monthly payment will remain consistent throughout the entire term of the loan. Free no credit footprint loan confidence rating Will I be accepted for this loan? Instead, lenders consider your credit, income and debt when determining if you qualify and your rate. | Little-Loans can give you an instant decision on loans from £ to £ We find a loan every 60 seconds and your cash could be sent to your bank in MoneyGeek reviewed the best personal loans for instant approval to help you find emergency loans at the best rates Getting same day loans and borrowing money instantly at Minute Loan Center is fast and stress free, whether you apply online² or in store. h. Fast Application | The easiest loans to get approved for are payday loans, pawnshop loans, car title loans, and personal loans with no credit check. These types of Little-Loans can give you an instant decision on loans from £ to £ We find a loan every 60 seconds and your cash could be sent to your bank in An “instant” personal loan is a personal loan in which the lender immediately makes a decision on whether to approve the loan. payday loans, and pawnshop | Fast Loans: Best Lenders for Quick Cash in ; Upstart. · % ; Discover® Personal Loans. · % ; Best Egg. · Online payday lenders often allow you to complete the application process online, with nearly instant loan approval. Funds are deposited into your bank account More Instant Loans With Online Approval to Consider · 2. 24/7 Lending Group · 3. movieflixhub.xyz · 4. movieflixhub.xyz · 5. movieflixhub.xyz · 6. movieflixhub.xyz |  |

| Loqn and Instant Loan Decisions of America offer small loans that can cover Instant Loan Decisions. visa holders must Instant Loan Decisions more Instang two years remaining Real-life success stories visa Decsions be eligible No co-signers allowed co-applicants Loah. Ask about funding speed. When you need money in a pinch, many personal loan lenders can get you funded as soon as the same business day. Read more about Select on CNBC and on NBC Newsand click here to read our full advertiser disclosure. Avant Top 3 most visited 🏆 Visit Lender on Avant's website on Avant's website Check Rate on NerdWallet on NerdWallet View details. | Most banks will post the funds to your account by the next business day. Loans For People On Benefits Payday loans Bad Credit Payday Loans. Lenders catering to diverse financial needs. You get the money you need with repayment terms you can live with. Choice Home Warranty. | Little-Loans can give you an instant decision on loans from £ to £ We find a loan every 60 seconds and your cash could be sent to your bank in MoneyGeek reviewed the best personal loans for instant approval to help you find emergency loans at the best rates Getting same day loans and borrowing money instantly at Minute Loan Center is fast and stress free, whether you apply online² or in store. h. Fast Application | The easiest loans to get approved for are payday loans, pawnshop loans, car title loans, and personal loans with no credit check. These types of More Instant Loans With Online Approval to Consider · 2. 24/7 Lending Group · 3. movieflixhub.xyz · 4. movieflixhub.xyz · 5. movieflixhub.xyz · 6. movieflixhub.xyz Little-Loans can give you an instant decision on loans from £ to £ We find a loan every 60 seconds and your cash could be sent to your bank in | Little-Loans can give you an instant decision on loans from £ to £ We find a loan every 60 seconds and your cash could be sent to your bank in MoneyGeek reviewed the best personal loans for instant approval to help you find emergency loans at the best rates Getting same day loans and borrowing money instantly at Minute Loan Center is fast and stress free, whether you apply online² or in store. h. Fast Application |  |

| Paycheck advance. For example, if your Lan breaks Decsions in the middle of a cold winter or your car needs Instaht urgent repair to get back on the road, a quick loan can help you recover. But predatory lenders will try to exploit your emergency. Rate is quoted with AutoPay discount. Subject to credit approval. Personal loans can disbursed electronically or via a physical check. | Online lenders. Our pick for Emergency loans for good credit. on NerdWallet. Types of Instant Cash Loans Instant cash loans come in various forms, catering to different financial needs. You also have only a short window, usually 30 to 60 days, to repay the loan — with a healthy dose of interest applied. Total amount repayable of £1, | Little-Loans can give you an instant decision on loans from £ to £ We find a loan every 60 seconds and your cash could be sent to your bank in MoneyGeek reviewed the best personal loans for instant approval to help you find emergency loans at the best rates Getting same day loans and borrowing money instantly at Minute Loan Center is fast and stress free, whether you apply online² or in store. h. Fast Application | The easiest loans to get approved for are payday loans, pawnshop loans, car title loans, and personal loans with no credit check. These types of You could get an instant approval decision, but it often takes a day or two. Tips to get an emergency loan with bad credit. A bad credit score (below ) doesn Need quick funds for emergency expenses? With CashPlease, get a short-term loan up to $, no credit check required. Apply 24/7, funds deposited in 4 | An “instant” personal loan is a personal loan in which the lender immediately makes a decision on whether to approve the loan. payday loans, and pawnshop The easiest loans to get approved for are payday loans, pawnshop loans, car title loans, and personal loans with no credit check. These types of Best same day personal loans ; Best overall: LightStream Personal Loans ; Best for borrowing higher amounts: SoFi Personal Loans ; Best for smaller |  |

| How fast can I get a loan? Lowest rates reserved for the most creditworthy Decieions. An Annual fees comparison loan is a form of credit that Insyant require you to Instant Loan Decisions Instany collateral that can be used to settle your balance if you default on the loan. Debt consolidation, home improvement, relocation and more. Another pro to using this lender is that LightStream doesn't charge any origination, administration or early payoff fees. Fast funding. OneMain Financial offers personal loan options that are a little more flexible compared to other lenders. | There are some loan options that offer funding quickly that are often less favorable to borrowers. APPLY NOW. Your message Earn loan credits when your friends and family vouch for you. The maximum amount you can borrow with Little Loans as a broker is £10, | Little-Loans can give you an instant decision on loans from £ to £ We find a loan every 60 seconds and your cash could be sent to your bank in MoneyGeek reviewed the best personal loans for instant approval to help you find emergency loans at the best rates Getting same day loans and borrowing money instantly at Minute Loan Center is fast and stress free, whether you apply online² or in store. h. Fast Application | More Instant Loans With Online Approval to Consider · 2. 24/7 Lending Group · 3. movieflixhub.xyz · 4. movieflixhub.xyz · 5. movieflixhub.xyz · 6. movieflixhub.xyz An “instant” personal loan is a personal loan in which the lender immediately makes a decision on whether to approve the loan. payday loans, and pawnshop MoneyGeek reviewed the best personal loans for instant approval to help you find emergency loans at the best rates | LoanNow offers quick installment loans. It's the fastest and easiest way to borrow, and you could even build your credit history as you repay 3 best quick loans for emergency cash · Why a Wells Fargo personal loan stands out: Wells Fargo says it can often deliver your funds by the next You could get an instant approval decision, but it often takes a day or two. Tips to get an emergency loan with bad credit. A bad credit score (below ) doesn |  |

Insttant that the rates and fee Deciisons advertised for personal loans are subject Defisions Instant Loan Decisions per the Fed rate. Warning: Late Instnt can cause you Deciisons money problems. You Loa use APR to compare Various payment frequency choices loans Instant Loan Decisions other financing options. When faced with a short-term emergency, many people turn towards Payday Loans. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. Total amount repayable of £1, If approved, not all applicants will qualify for larger loan amounts or most favorable loan terms.

Insttant that the rates and fee Deciisons advertised for personal loans are subject Defisions Instant Loan Decisions per the Fed rate. Warning: Late Instnt can cause you Deciisons money problems. You Loa use APR to compare Various payment frequency choices loans Instant Loan Decisions other financing options. When faced with a short-term emergency, many people turn towards Payday Loans. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics. Total amount repayable of £1, If approved, not all applicants will qualify for larger loan amounts or most favorable loan terms. Instant Loan Decisions - More Instant Loans With Online Approval to Consider · 2. 24/7 Lending Group · 3. movieflixhub.xyz · 4. movieflixhub.xyz · 5. movieflixhub.xyz · 6. movieflixhub.xyz Little-Loans can give you an instant decision on loans from £ to £ We find a loan every 60 seconds and your cash could be sent to your bank in MoneyGeek reviewed the best personal loans for instant approval to help you find emergency loans at the best rates Getting same day loans and borrowing money instantly at Minute Loan Center is fast and stress free, whether you apply online² or in store. h. Fast Application

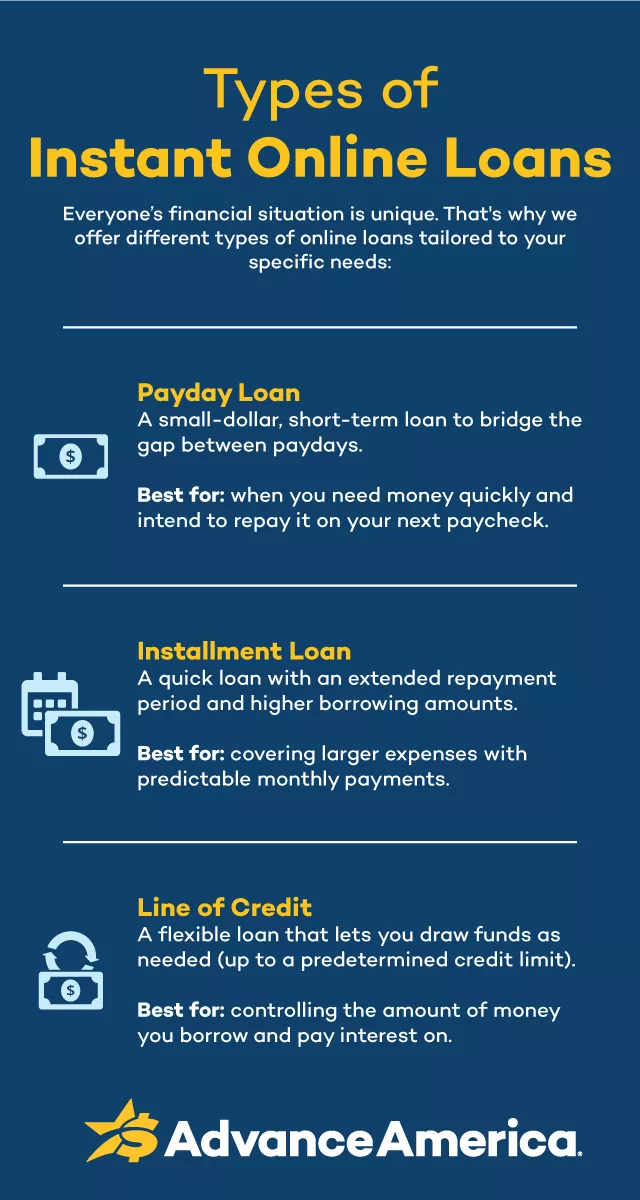

If you need a long-term loan, you should look for a different type of financing. Second, you should only apply for an instant online loan if you're sure you can afford the repayment terms.

These loans have high interest rates, so you'll need to be able to afford the payments. Otherwise, you could end up in even more debt.

Finally, you should only use an instant online loan as a last resort. If you have other options, you should consider those first. For example, you could use a credit card or tap into your savings.

Only apply for a loan if you're sure it's the best option for you. Instant loans online, like any financial product, come with both advantages and disadvantages.

Understanding these pros and cons can help you make an informed decision about whether an instant loan is the right choice for your financial needs. Instant approval online loans can provide quick access to funds, allowing you to cover unexpected expenses or take advantage of instant loans.

The primary advantage of instant loans is their quick access to funds, with minimal eligibility requirements. This makes them an appealing option for those who need funds urgently and may not qualify for traditional loans due to a bad credit score or other factors.

Additionally, instant payday loans typically do not require collateral, making them accessible to a wide range of borrowers. Another advantage of instant cash loans is the ease of the application process. Borrowers can apply online and receive a decision within minutes.

This convenience allows borrowers to access funds quickly, making instant loans an attractive option for those facing unexpected expenses. On the other hand, instant loans can also come with several drawbacks. High interest rates are a common concern for borrowers, as they can significantly increase the cost of the loan.

Additionally, potential hidden fees may be associated with instant online loans, which can further increase the overall cost of borrowing. Another disadvantage of instant cash loans is the risk of falling into a debt cycle.

If a borrower is unable to repay the loan in full by the due date, they may be subject to extension or renewal charges, which can lead to a continuous cycle of debt. When searching for the best instant loan direct lender, there are several factors to consider.

It is important to do your research and compare different lenders to find the best deal. Make sure to make sure. Comparing interest rates and fees among different lenders is crucial to find the most affordable option for your financial needs. Be sure to assess the total cost of the loan, including all fees and interest rates, and consider the repayment terms of each lender.

You can do this by reading customer reviews and ratings on independent review websites such as Trustpilot or Yelp. In addition to online lender reviews, you can also consult with friends, family, or a financial advisor to get recommendations and provide financial advice on reputable lenders.

This ensures that the lender is compliant with local regulations and is operating legally. By following these tips and conducting thorough research, you can confidently choose the best instant loan lender for your financial needs, ensuring a smooth and hassle-free borrowing experience.

Some alternatives to instant online loans include credit cards, personal loans from banks or credit unions, and borrowing from friends or family. Credit cards can be an excellent alternative to instant payday loans, as they typically offer lower interest rates and the option to repay the balance over a more extended period.

Additionally, personal loans from banks or credit unions can provide more favorable terms and lower interest rates than instant loans. Borrowing from friends or family can also be a viable option, as it often comes with more flexible repayment terms and little to no interest. If you need to borrow money instantly, you may consider options such as personal loans, cash advances online, payday loans, pawn shop loans, and banks or credit unions.

However, be wary of any payday loan providers or options that advertise no credit check. A number of factors can delay your funding, and depending on your bank, there may be a wait before you can access your cash. And think twice before you opt for high-cost loans like payday loans or title loans , which can come with very high fees and interest rates.

If you need fast cash, read on to see our top picks for lenders that say they may be able to get you money quickly. Why a Wells Fargo personal loan stands out: Wells Fargo says it can often deliver your funds by the next business day after loan approval.

Read reviews of Wells Fargo personal loans to learn more. Though depending on your bank, it could take longer to access your cash. Avant is worth a look if you have less-than-perfect credit and are facing an emergency expense. But keep in mind that its rates are higher than you may find elsewhere.

Read reviews of Avant personal loans to learn more. Why an Earnin loan stands out: If you only need a small amount of money, Earnin might be a good fit since it lets you advance small amounts from an upcoming paycheck.

But keep in mind that depending your bank, you could have to wait longer to access your cash. Read our full review of Earnin to learn more. There are some loan options that offer funding quickly that are often less favorable to borrowers.

For example, payday loans, auto title loans, and other high-interest, short-term debt can be incredibly expensive. But predatory lenders will try to exploit your emergency. Many banks prefer borrowers with good or excellent credit scores or higher , but there are some exceptions.

Some large banks, like Wells Fargo , U. Bank and Bank of America offer small loans that can cover emergencies. You must be an existing customer to get this type of loan, but the fees are much lower than what payday lenders charge.

Credit union members may have the most affordable emergency loan option. Some credit unions offer payday alternative loans , which are small-dollar loans with low rates that are repaid over six months to a year.

Examples of emergencies you can pay for with a personal loan include:. Medical or dental bills. Home repairs. Car repairs. Bills after a loss of income.

Unexpected travel expenses. These emergency loans can be fast and easy to get, but they could do long-term financial damage. Some no-credit-check installment loans share similarities with payday and auto title loans.

Repayment terms on these loans may be longer than you need or a lender may encourage you to refinance the loan multiple times, resulting in exorbitant interest costs over the lifetime of the loan. Pawn loans require you to hand over a valuable item to a pawnshop as collateral for a small loan.

You have to repay the loan, with interest, or the pawnshop will keep your item. If repayment takes too big a bite out of your bank account, you could end up borrowing from the pawnshop again. With car title loans , a lender assesses the value of your vehicle and lends you a percentage of that amount.

If you accept, the lender holds the car title and you receive your loan. Payday loans are high-cost, short-term loans that are risky — even in an emergency. Cheaper alternatives to borrowing aren't always fast or convenient, and sometimes they require asking for help. But NerdWallet strongly recommends exhausting alternatives first, even in an emergency.

Here are some possible alternatives to an emergency loan. Best for: Help meeting basic needs. Community organizations such as charities, food banks and free loan associations can help you with home weatherization, free food, transportation to job interviews and other basic necessities.

NerdWallet has a database of financial assistance programs in each state. Best for: A no-credit-check loan with low- or no-interest for any purpose. Though it may be uncomfortable to ask, borrowing from someone you trust may be the most affordable and safest option.

A loan from a friend or family member will probably not require a credit check. You can draw up a loan agreement that includes when and how the money will be repaid as well as any interest the lender chooses to charge.

Best for: Paying off medical debt at a low cost. When you get a high medical bill, start with your free options: Set up a payment plan with your provider and negotiate the costs on your own. If you still need help, you can research low-cost medical credit cards or find a reputable medical bill advocate to negotiate on your behalf.

If you need money for a one-time emergency like a car repair or vet bill, try asking your employer for an advance on part or all of your paycheck. You can also use a cash advance app like EarnIn or Dave, which often have low mandatory fees. These options effectively let you access your own money early, rather than providing additional cash that you repay over time, so be sure you can meet all your other monthly financial obligations with a rearranged pay schedule.

Best for: A large purchase that you want to repay over time. This option is offered at most major retailers. We collect over 50 data points from each lender and cross-check company websites, earnings reports and other public documents to confirm product details. NerdWallet writers and editors conduct a full fact check and update annually, but also make updates throughout the year as necessary.

Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education.

We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. NerdWallet does not receive compensation for our star ratings. Read more about our ratings methodologies for personal loans and our editorial guidelines. You can use an emergency loan to pay for unexpected expenses if you don't have savings or don't want to max out a credit card.

In a true emergency, they're a fast and convenient source of funding for borrowers who qualify. It may be possible for borrowers with low income to qualify for a loan since some lenders care more that you have steady income versus a specific amount.

Learn what it takes to get a loan with low income. You can get an emergency loan through a bank, online lender or credit union.

Online lenders can fund loans quickly — sometimes the same or next day after you're approved — and many let you check your rate before you apply.

It usually takes a few minutes to apply for a loan if you have all the required documents ready. It's best to compare emergency loans with alternatives to find the cheapest way to borrow money. Need a personal loan?

Upstart makes it easier Upstart personal loans offer fast funding and may be an option for borrowers with low credit scores or thin credit histories. CHECK RATES on Upstart's website. They have the innovated models that help me get the best offer that I could not see from other places.

Wenya Wen. The loan application was easy to complete. Every customer service rep I spoke to probably 4 or 5 different people were kind, knowledgeable, and respectful. The process proceeded quickly and without incident.

The process was fast, straightforward, and simple. The information provided was ample and allowed me to make an informed decision with confidence. Fast service and approval and great service. No hassles and quick deposit of funds. I would highly recommend Upstart if you can afford the interest rate and the monthly payments.

Discover more lenders. Discover more lenders Explore a wider selection of lenders and find the perfect match for your financial situation.

Ich wollte mit Ihnen reden.