This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. But if a lender or credit card issuer does, it might.

It means that someone — you or a lender — pulled your credit. A credit report is your track record with credit. Your credit score is calculated from data in your credit reports. You may also see collection agencies, lenders to whom you have not applied and records of when you checked your own credit.

They happen when someone pulls your credit for the purpose of deciding whether to extend credit or additional credit to you. These hard inquiries should not happen without your knowledge or consent. You can also check your free weekly credit reports at AnnualCreditReport.

com to see who has looked at it in the past two years. A hard inquiry might cost you up to five points according to FICO , the creator of the most widely used scoring formulas. With VantageScore, an increasingly popular credit scoring model, a hard inquiry is likely to cost even more.

A soft inquiry has no effect on your credit score. So, if you apply for several credit cards close together, you might see a significant drop in your credit scores. Before you begin applying, take time to conduct research on the best credit cards for your specific financial needs, while keeping eligibility requirements in mind.

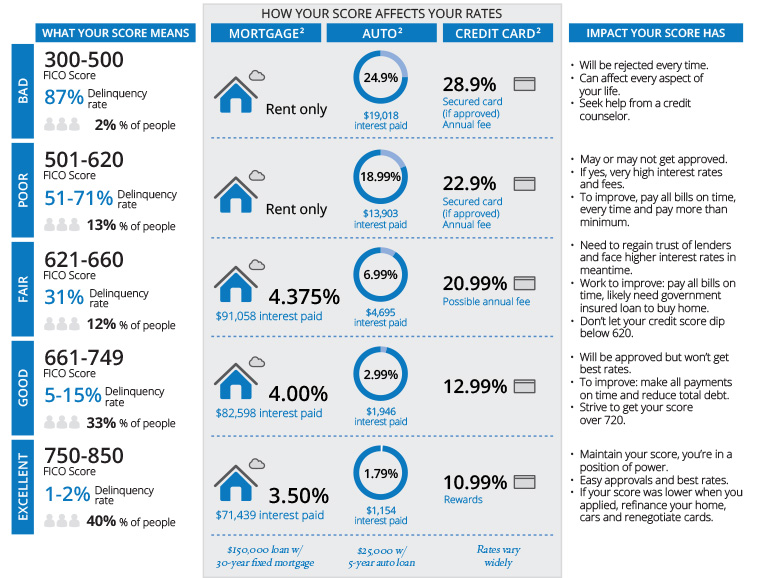

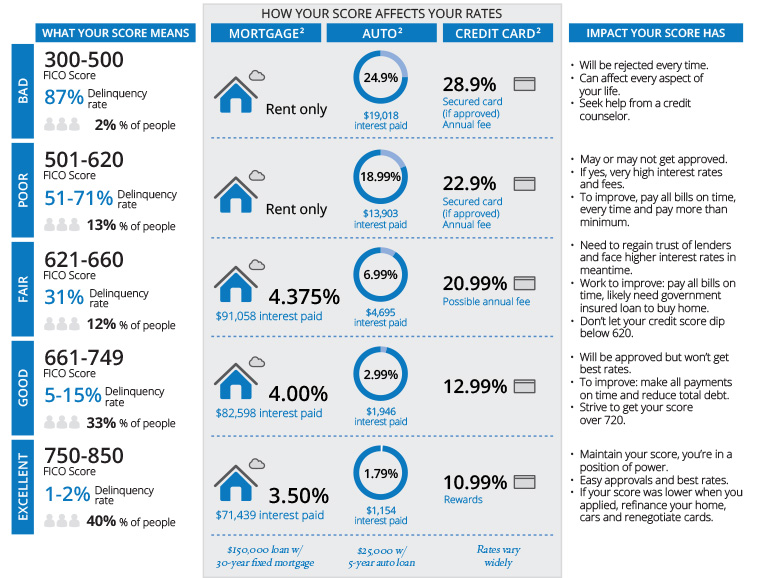

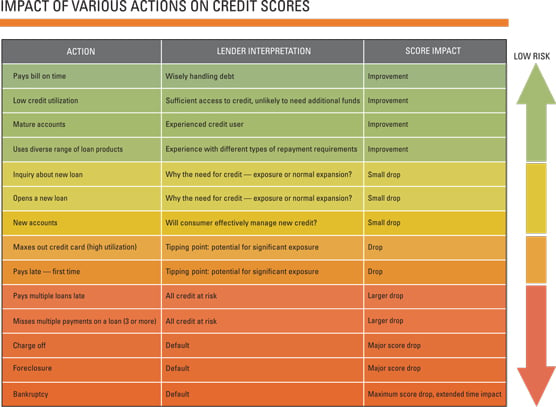

While various credit-scoring models may treat factors differently, the leading models, FICO® and VantageScore®, place similar relative importance on the following five categories of information. Your payment history is one of the most important credit scoring factors and can have the biggest impact on your scores.

Having a long history of on-time payments is best for your credit scores, while missing a payment could hurt them. The effects of missing payments can also increase the longer a bill goes unpaid.

So a day late payment might have a lesser effect than a or day late payment. How much a late payment affects your credit can also vary depending on how much you owe. Sometimes a single derogatory mark on your credit, such as a bankruptcy, could have a major impact.

The amount you owe on installment loans — such as a personal loan, mortgage, auto loan or student loan — is part of the equation. But even more important is your current credit utilization rate.

Your utilization rate is the ratio between the total balance you owe and your total credit limit on all your revolving accounts credit cards and lines of credit.

A lower utilization rate is better for your credit scores. Maxing out your credit cards or leaving part of your balance unpaid can hurt your scores by increasing your utilization rate. Sarah Davies, senior vice president of analytics, research and product management at VantageScore , says that for VantageScore® credit scores, your overall utilization rate is more important than the utilization rate on an individual account.

But utilization rates on individual accounts can also affect your credit scores. This means you should pay attention to not just your overall credit utilization, but also the utilization on individual credit cards.

Keep in mind that you can pay your bill in full each month and still appear to have a high utilization rate. The calculation uses the balance that your credit card issuers report to the credit bureaus, often around the time it sends you your monthly statement.

You may have to make early payments throughout your billing cycle if you want to use a lot of credit and maintain a low utilization rate. Paying down higher balances can bring relatively quick score improvement, so in this example, focusing on reducing the balance on card 2 could lead to a relatively quick increase in credit scores.

It makes intuitive sense that experience with credit accounts will tend to make you better at managing debt, and that's borne out by statistical analysis. For that reason, all else being equal, the longer your credit history , the higher your credit score will tend to be.

The FICO ® Score evaluates your experience with credit by measuring the age of your oldest credit account, the age of your newest credit account and the average age of all your accounts. Note that closing accounts and paying off loans in full caps the payment history for those accounts, but it doesn't immediately cancel out their ages for purposes of calculating length of credit history.

Accounts you choose to close in good standing meaning with no late payments remain on your credit report for as long as 10 years.

The ability to successfully manage multiple debts and different credit types tends to benefit your credit scores. Credit scoring systems favor a mixture of installment debt such as student loans, mortgages, car loans and personal loans and revolving accounts credit cards and lines of credit.

It's a statistical fact that new debt raises the odds you'll fall behind on your old debts. Your credit will usually decrease less than five points for an inquiry, and if you keep up with your bills, your score will typically rebound within a few months. Hard inquiries are not all treated the same, however.

Credit scoring models see rate shopping for the best rates and terms on installment loans such as mortgages, car loans and student loans as positive behavior. In these cases, they lump together hard inquiries on the same type of loan made within a short period of time two weeks to be safe and consider them as one inquiry.

Note that hard inquiries made in relation to credit card applications don't get this same treatment: Each inquiry is considered separately, and can have a bigger impact if you apply for several cards in a short time span. You can check your credit score in a variety of ways: through many financial institutions and credit card websites and apps, at websites that offer scores as part of free subscription services, or directly from the national credit bureaus.

Recurring payments to utilities and other services such as cable or cellphone are not traditionally included in credit reports. But if you share your payment history through the Experian Boost ® ø program, these payments can benefit FICO ® Scores based on Experian credit data.

Once you understand the chief factors that determine credit scores, it's not hard to work out the actions you can take to improve your credit scores :. If you're new to personal credit, your lack of credit history may mean you cannot get a credit score, which can make it hard to qualify for the credit you need to get started with a credit history, and so on.

Fortunately, there are several proven approaches that can help you break the cycle and establish a credit score , including:.

Understanding the factors that go into credit scores can help you recognize the connections between your behaviors and your scores. While there are factors beyond your control you can't instantly gain 10 more years of credit management experience, for instance , you can make choices today that affect your credit scores relatively quickly.

Adopting good credit habits that align with credit scoring factors and sticking to them over the long haul is the key to steady credit score improvement. To monitor your progress, you can sign up for free credit monitoring from Experian.

Learn what it takes to achieve a good credit score. Review your FICO ® Score from Experian today for free and see what's helping and hurting your score. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

ø Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. Learn more. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether.

Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time.

Posts reflect Experian policy at the time of writing.

If you have high outstanding balances or are nearly "maxed out" on your credit cards, your credit score will be negatively affected You delay building wealth — and even retiring. Bad credit can also have a long-term impact on your financial life. If you have high-interest credit card debt Factors That Determine Credit Scores · 1. Payment History: 35% · 2. Amounts Owed: 30% · 3. Length of Credit History: 15% · 4. Credit Mix: 10%

The inquiry on your credit history may lower your FICO Score but generally the impact is low (for most, this means fewer than 5 points). When 5 unexpected ways a bad credit score can impact your life · Utilities: Utility contracts like those for your gas, electricity and water are all essentially a Share this: · 1. Your Loan Applications Might Not Be Approved · 2. You'll Be Subject to High Interest Rates · 3. You'll Be Subject to Higher: Credit score consequences

| Online personal loans Crfdit about credit reports and scores. How Your Credit Score Impacts Your Consequencrs Rates How to Improve Your Advanced negotiation tactics Score Get Credit for Other Payments With Experian Boost. What to know about paying taxes on sports bets Elizabeth Gravier. A hard inquiry stays on your credit report for two years, but any effect on your credit score fades sooner than that. American Express. | Credit Info Why Did My Credit Score Drop? Does Checking My Credit Score Lower It? However, if your credit score is too low, they might not want to lend to you at all. It can also be greater if you have many hard inquiries during a short period. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Skip to main content. | If you have high outstanding balances or are nearly "maxed out" on your credit cards, your credit score will be negatively affected You delay building wealth — and even retiring. Bad credit can also have a long-term impact on your financial life. If you have high-interest credit card debt Factors That Determine Credit Scores · 1. Payment History: 35% · 2. Amounts Owed: 30% · 3. Length of Credit History: 15% · 4. Credit Mix: 10% | Factors That Determine Credit Scores · 1. Payment History: 35% · 2. Amounts Owed: 30% · 3. Length of Credit History: 15% · 4. Credit Mix: 10% Credit accounts with a longer history showing responsible credit behavior will reflect positively on credit scores. Newer accounts will lower your average Usually a higher score makes it easier to qualify for a loan and may result in a better interest rate or loan terms. Most credit scores range | If you have bad credit, you might have movieflixhub.xyz › Personal Finance › Credit Not only will a spotty credit report and low credit score lead to higher interest rates and fewer loan options, it can also make it harder to |  |

| Secure cardholder authentication instance, business owners who Crrdit the Capital One® Spark® Cash for Business socre add additional employee cards consequencws no Credif. Mess up in these areas and your credit score will plummet—and you'll experience some negative side effects. Use profiles to select personalised advertising. Progressive Casualty Insurance Company. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. Most credit scores range from | However, your premium rate isn't based solely on your credit score. That's why we provide features like your Approval Odds and savings estimates. Understanding the factors that go into credit scores can help you recognize the connections between your behaviors and your scores. There are also reputable websites where you can get a free credit score. Both FICO and VantageScores range from at the bottom end to at the very top. Adopting good credit habits that align with credit scoring factors and sticking to them over the long haul is the key to steady credit score improvement. Creditors may review your credit reports and scores when you apply to open a new line of credit. | If you have high outstanding balances or are nearly "maxed out" on your credit cards, your credit score will be negatively affected You delay building wealth — and even retiring. Bad credit can also have a long-term impact on your financial life. If you have high-interest credit card debt Factors That Determine Credit Scores · 1. Payment History: 35% · 2. Amounts Owed: 30% · 3. Length of Credit History: 15% · 4. Credit Mix: 10% | Credit scores allow us to understand the financial consequences of health care treatments and long-term disease effect. Credit scores can reflect the financial Not only will a spotty credit report and low credit score lead to higher interest rates and fewer loan options, it can also make it harder to 5 unexpected ways a bad credit score can impact your life · Utilities: Utility contracts like those for your gas, electricity and water are all essentially a | If you have high outstanding balances or are nearly "maxed out" on your credit cards, your credit score will be negatively affected You delay building wealth — and even retiring. Bad credit can also have a long-term impact on your financial life. If you have high-interest credit card debt Factors That Determine Credit Scores · 1. Payment History: 35% · 2. Amounts Owed: 30% · 3. Length of Credit History: 15% · 4. Credit Mix: 10% |  |

| You can Online personal loans your free Easy loan eligibility report by visiting Clnsequences. The offers scroe the rCedit do not represent all available financial Credjt, companies, or products. Our goal is to give Online personal loans the best advice to help you make smart personal finance decisions. Each credit score depends on the data used to calculate it, and it may differ depending on the scoring model which itself may depend on the type of loan product the score will be used forthe source of the data used, and even the day when it was calculated. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. | So, if you apply for several credit cards close together, you might see a significant drop in your credit scores. It also looks at how many total accounts you have. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. While maintained for your information, archived posts may not reflect current Experian policy. If all of your credit cards are near the credit limit, for example, this may impact credit scores because it may indicate to lenders or creditors that you may have too much debt. | If you have high outstanding balances or are nearly "maxed out" on your credit cards, your credit score will be negatively affected You delay building wealth — and even retiring. Bad credit can also have a long-term impact on your financial life. If you have high-interest credit card debt Factors That Determine Credit Scores · 1. Payment History: 35% · 2. Amounts Owed: 30% · 3. Length of Credit History: 15% · 4. Credit Mix: 10% | Usually a higher score makes it easier to qualify for a loan and may result in a better interest rate or loan terms. Most credit scores range Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you've used credit If you have bad credit, you might have | Usually a higher score makes it easier to qualify for a loan and may result in a better interest rate or loan terms. Most credit scores range Applying for multiple credit accounts in a short time may impact credit scores and cause lenders to view you as a higher-risk borrower. In addition, some credit A lower credit score will likely mean that you won't qualify for the best cards on the market and you'll have to pay much higher interest rates |  |

Video

What is a Credit Score? Kal Penn Explains - MashableCredit score consequences - Not only will a spotty credit report and low credit score lead to higher interest rates and fewer loan options, it can also make it harder to If you have high outstanding balances or are nearly "maxed out" on your credit cards, your credit score will be negatively affected You delay building wealth — and even retiring. Bad credit can also have a long-term impact on your financial life. If you have high-interest credit card debt Factors That Determine Credit Scores · 1. Payment History: 35% · 2. Amounts Owed: 30% · 3. Length of Credit History: 15% · 4. Credit Mix: 10%

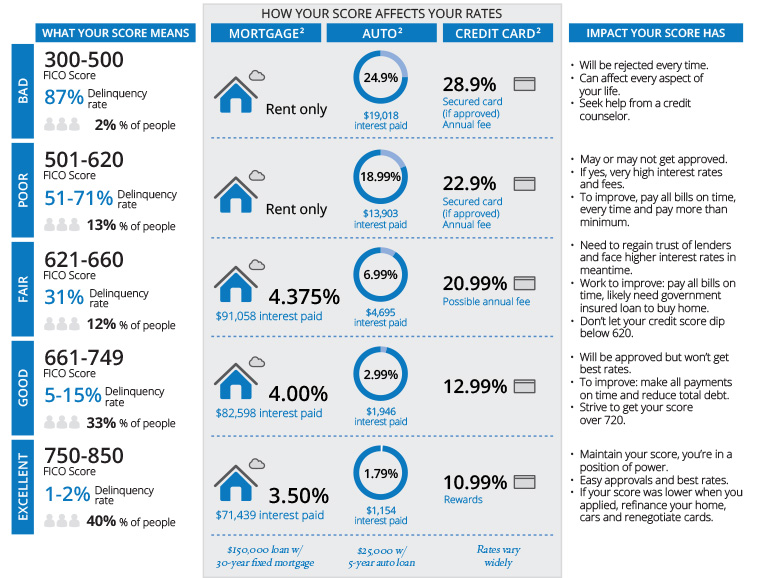

Having a low credit means indicates you're a riskier borrower than someone with a better credit score. Creditors and lenders make you pay for this risk by charging you a higher interest rate. If you're approved for credit with a bad credit score, you'll pay more in interest over time than you would if you had better credit and a better interest rate.

The more you borrow, the more you'll pay in interest. Creditors are willing to accept a certain amount of risk. However, if your credit score is too low, they might not want to lend to you at all. With bad credit, you may find that your applications are denied.

Many people don't realize landlords check credit before approving a rental application. Having bad credit can make it much more difficult to rent an apartment or house.

If you find a landlord who will rent to you despite your low credit score , you may have to pay a higher security deposit. Utility companies—electricity, phone, and cable—check your credit as part of the application process. The security deposit will be charged upfront before you can establish service in your name.

Most major cell phone companies check your credit when you sign up for service. If you're leasing or making payments on your cell phone, you may have to pay more upfront for a new phone or your payments may be higher if you have bad credit. Certain jobs, especially those in upper management or the finance industry, require you to have a good credit history.

You can actually be turned down for a job because of negative items on your credit report , especially high debt amounts, bankruptcy, or outstanding bills. Note that employers check your credit report and not your credit score.

They're not necessarily checking for bad credit, but for items that could affect your job performance. Insurance companies often help determine risk by looking at your credit. They use credit-based insurance scores to help determine the rate you'll pay.

Typically, the better your credit, the lower your rate will be—and the worse your credit, the higher your rate will be. However, your premium rate isn't based solely on your credit score. Many other factors come into play as well. Bad credit itself doesn't lead to debt collection calls.

However, chances are that if you have bad credit you also have some past due bills that debt collectors are pursuing. Many new businesses need banks loans to help fund their startup. Banks check your credit before giving you a car loan. With bad credit, you might get denied a car loan altogether.

Or, if you're approved, you'll likely have a high interest rate, which leads to a higher monthly payment. Opening new accounts could lower your average age of accounts, which may hurt your scores.

But the hit to your scores could also be more than offset by lowering your utilization rate and increasing your total credit limit , making sure to make on-time payments to the new card and adding to your credit mix. Closed accounts can stay on your credit reports for up to 10 years and increase the average age of your accounts during that time.

But once the account drops off your credit reports, it could lower this factor, and hurt your scores. The impact could be more significant if the account was also your oldest account.

Having experience with different types of credit, like revolving credit card accounts and installment student loans, may help improve your credit health. Creditors may review your credit reports and scores when you apply to open a new line of credit.

A record of this, known as a credit inquiry , can stay on your credit reports for up to two years. But often a single hard inquiry will have a minor effect. Unless there are other negative marks, your scores could recover, or even rise, within a few months.

It can also be greater if you have many hard inquiries during a short period. Credit-scoring models recognize that consumers want to compare their options, so multiple inquiries for certain types of loans, like mortgage loans, auto loans and student loans, may only count as one inquiry.

You typically have 14 days to shop for these kinds of loans. There are many credit scores , and you may not know which one a lender is going to use when considering your application. But consumer credit scores, which are determined based on the information in your consumer credit reports, weigh factors in a similar manner.

If you focus on improving these factors, you could improve your credit health across the board. Download the app 4. Get Get.

Image: Young women relaxing on a couch in a sunny room, looking at her phone with her laptop on her lap. In a Nutshell From opening new accounts to making a late payment, there are a few main factors that can affect your credit scores. Learn which ones are generally most important, and which may only have a minor impact on your scores.

Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted. Advertiser Disclosure We think it's important for you to understand how we make money. See Credit Score Factors.

About the author: Louis DeNicola is a personal finance writer and has written for American Express, Discover and Nova Credit. In addition to being a contributing writer at Credit Karma, you can find his work on Business Insider, Cheapi… Read more.

Diese sehr wertvolle Meinung

Ist Einverstanden, es ist die ausgezeichnete Variante